KGI DAILY TRADING IDEAS – 21 July 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

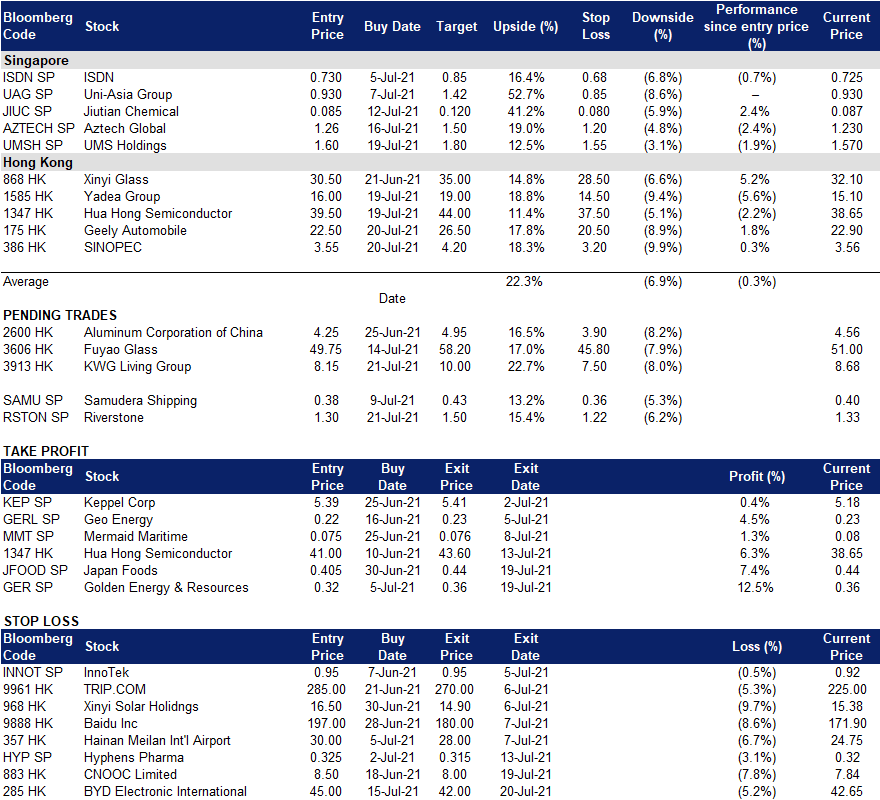

Riverstone Holdings (RSTON SP): Looking past the pandemic

- BUY Entry – 1.30 Target – 1.50 Stop Loss – 1.22

- Riverstone Holdings Limited produces, sells, and distributes clean-room products for use in highly controlled and critical environments. The company’s products include nitrite and natural rubber gloves and clean-room packaging materials and finger cots, as well as face masks, face pouches, hoods, caps, jumpsuits, and swabs.

- Looking past the pandemic. While the pandemic-induced demand for gloves in 2020 helped push Riverstone’s share price to a high of S$2.35 (80% higher than its current share price of S$1.33), the company’s business outlook is likely to be driven by production of cleanroom products, which are more sustainable and typically command higher margins. These products are primarily used in semiconductor, pharmaceuticals, biotech, life science, aerospace and military applications.

- Consensus estimates are still overall bullish despite recent downgrades. There are 4 BUYS / 2 HOLDS / 0 SELL, and a 12m TP of S$1.62 (+22% upside potential), despite recent downgrades by Nomura (Neutral TPS$1.37) and RHB (Neutral TP$1.30). FY2021 EPS is forecasted to surge 118% YoY before declining around 50% YoY in FY2022, with the decline largely attributed to the unsustainably high base of FY2021. Riverstone currently trades at 4x / 8x FY2021 / FY2022 PE, which is an attractive valuation.

Jiutian Chemical (JIUC SP): Fantastic chemistry

- RE-ITERATE BUY Entry – 0.085 Target – 0.120 Stop Loss – 0.080

- Jiutian is the second largest Dimethylformamide (DMF) producer in China, with a total annual capacity of 150,000 tons of DMF and methylamine (MA). Both these chemicals are important ingredients in industries as diverse as consumer goods, petrochemicals, electronics, pharmaceuticals and fertilisers. In addition, it now produces chemicals for fast growing sectors such as batteries that are used in electric vehicles.

- China’s economy has benefited from supply disruptions in the rest of the world. We see this trend continuing this year and may surprise on the upside given the unprecedented amount of fiscal and monetary stimulus around the world.

- Robust prices. Prices of DMF, its main product, remain resilient. DMF prices rose above RMB 12,000 per tonne last week, 22% higher than our RMB 9,800 forecast for 2021.

- Outperform with fundamental TP of S$0.145. Given the buoyant DMF prices, we maintain our Outperform recommendation and TP of S$0.145 which we published in our initiation report on 17 May 2021.

- Earnings watch and catalyst. The company is likely to report its first half earnings in the second week of August.

HONG KONG

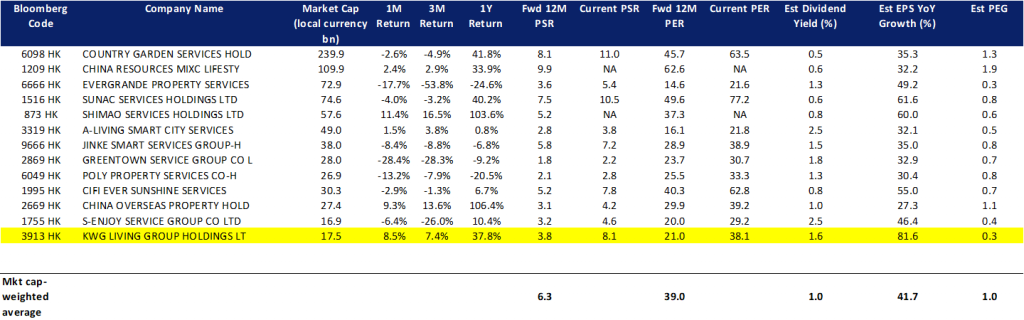

KWG Living Group Holdings Ltd (3913 HK): Fundamental intact but just a weak sentiment

- Buy Entry – 8.15 Target – 10 Stop Loss – 7.50

- KWG Living Group Holdings Ltd is a holding company engaged in provision of property management services. The company operates two segments. The Residential Property Management Services segment provides pre-sale management services, property management services, community value-added services and public space value-added services. The Commercial Property Management and Operational Services segment provides pre-sale management services, commercial property management services, commercial operation services and other value-added services.

- Counter-inflation remains the main investment theme for investors this year, and property management services are viewed as an indirect hedge against rate hikes. The sector has positive investment attributes such as low capex, net cash positions, and stable dividend payout. All these are in line with the value sectors that investors are currently looking out for.

- The company has a relatively attractive valuation compared to peers in the property management sector. Its forward 12M PEG is the lowest among its peers, and the estimated dividend yield is decent compared to peers.

- Market consensus of net profit growth in FY21 and FY22 are 61.1% YoY and 43.7% YoY, which implies forward PERs of 21.0x and 13.0x. Current PER is 38.1x. Bloomberg consensus average 12-month target price is HK$12.48.

Fuyao Glass Industry Group Co Ltd (3606 HK): Speed Bump on the resumption of uptrend

- Reiterate Buy Entry – 49.75 Target – 58.2 Stop Loss – 45.8

- Fuyao Glass Industry Group Co Ltd is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The company distributes its products within domestic markets and to overseas markets.

- Impacted by shortage of automobile chips, the automobile production recovery has slowed down even as demand for passenger vehicles continue to rise. Automobile glass is one of the parts in a vehicle, and hence, its sales are highly correlated to the auto production volume.

- As the automobile sector started to recover, the price performance of this counter is relatively lagging. The production issues of the auto sector will be mitigated in 2H21, which will favor the turnaround of the stock.

Key financials highlight:

| (RMB mn) | 1Q21 | 1Q10 | YoY change |

| Revenue | 5,706.0 | 4,170.5 | 36.8% |

| Gross profit | 2,316.4 | 1,436.6 | 61.2% |

| GPM (%) | 36.8 | 34.4 | 2.4 ppt |

| Net profit | 850.5 | 451.0 | 88.6% |

| NPM (%) | 14.9 | 10.8 | 4.1 ppt |

Updated market consensus of the estimated growth of net profit in FY21 and FY22 are 51.7% and 23.8% respectively, which translates to 27.0x and 21.9x forward PE. The current PE is 41.3x. Bloomberg consensus average 12-month target price is HK$55.23.

Market Movers

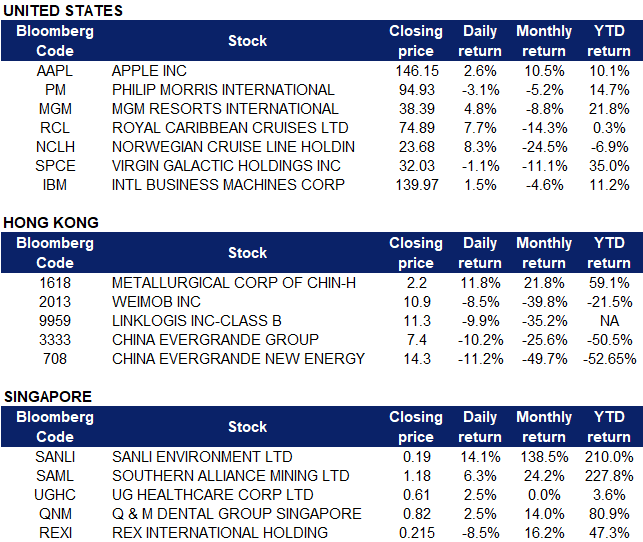

United States

- Apple (AAPL US). The tech giant’s shares rose 2.6% on Tuesday. UBS hiked its target price for Apple ahead of next week’s fiscal 3Q earnings report from $155 to $166 and maintains a BUY rating, citing stronger iPhone and Mac sales despite supply chain headwinds.

- Phillip Morris International (PM US) shares dipped 3.1% on Tuesday. The cigarette manufacturer reported $7.59 billion in quarterly revenue while analysts were looking for an EPS of $1.55 on revenue of $7.67 billion. Its smoke-free products accounted for 29% of net revenue in the quarter, while IQOS, its “reduced-risk” heated-tobacco device had more than 20 million users at the end of the quarter. Cigarette shipment volumes went up 3.2%, while heated tobacco shipment volume was up more than 30%. Phillip Morris said it now expects to earn between $5.76 and $5.86 a share for the full year, down from a prior range of $5.93-$6.03.

- Travel and leisure stocks rebounded strongly on Tuesday after worries of a spreading COVID-19 variant shook the market on Monday. Hotel and casino company MGM Resorts (MGM US) achieved a 4.8% gain; Royal Carribean (RCL US) rose 7.7%; and Norwegian Cruise Line (NCLH US) closed 8.3% higher. There wasn’t a clear reason for the bounce back, but analysts said “the rebound reflected ideas the previous selloff was overdone and may have been exacerbated by seasonal factors”.

- Virgin Galactic (SPCE US). Shares of the company fell after Amazon’s Jeff Bezos completed its first crewed flight on the New Shepard, made by Galactic’s rival space company Blue Origin. This comes nine days after Virgin Galactic founder Richard Branson completed its inaugural flight earlier this month.

- IBM (IBM US) stocks jumped, after the enterprise technology and services provider announced second-quarter earnings after market close on Tuesday, which topped estimates and showed its best revenue growth in three years. IBM reported adjusted earnings of $2.33 a share on revenue of $18.7 billion.

Singapore

- Sanli Environment Limited (SANLI SP) Shares continued to rise by 14.1% on Monday to hit a 52-week high after last Friday’s surge of 129.6%. There was no company specific news on Monday. Sanli announced on 15 July that it had won a S$72.67mn PUB contract for new disinfection systems at Johor River Waterworks. With the award of the contract, the group now has an order book of S$329.8mn which is expected to be completed by early 2026. Barring any unforeseen circumstances, the contract is expected to have a positive impact on the net tangible assets and earnings per share of the group for the financial year ending 31 March 22. Sanli’s Q2 earnings is expected to be announced on 28 July.

- Southern Alliance Mining Limited (SAML SP) Shares rose by 6.3% Monday and reached a one-month high. Most recent news was on 16 July where the company announced that it has established a joint venture with DYMM for exploration work for gold and any other mineral or deposits and/or mining activities at the Tenggaroh mine in Johor. Investors could also have a positive outlook on Southern Alliance’s current business, which includes selling iron ore to customers mainly located in Malaysia and China, as iron prices continued to pick up from the dip in end May and recovering to US$222.50 as of 16 July, almost near the all-time high of US$232 in mid-May.

- UG Healthcare Corporation Limited (UGHC SP) Shares rose by 2.5% on Monday. Even though the company announced last week that its manufacturing operations were temporarily halted in compliance with Malaysia’s Enhanced Movement Control Order (EMCO) from July 9 to July 22 in Seremban, investors could have a positive outlook on the company given that Covid-19 cases have been on the rise recently. Mixed analyst reactions were highlighted by The Edge last week, with CGS-CIMB maintaining its ADD call for UG Healthcare with a TP of S$1.20. On the other hand, RHB has kept its NEUTRAL rating for UG Healthcare but with a lower TP of S$0.57, down from S$0.61 previously.

- Q&M Dental Group Singapore Limited (QNM SP) Shares rose by 2.5% after it was highlighted by The Edge last Friday that Q&M was part of Maybank Kim Eng’s 10 highlighted companies that the research firm is optimistic about with regard to growth prospects for 2021-2022F, driven by rising demand catalysed by the pandemic reopening and new opportunities. The research firm also stated that Q&M was expanding its Covid-19 PCR testing segment, while aggressively opening new clinics in Singapore and Malaysia. We have an Outperform rating and a TP of S$0.91 on Q&M.

- Rex International Limited (REXI SP) There was no company specific news on Monday, however, shares dipped by 8.5% following last week’s rally which pushed Rex’s share price to an all-time high of S$0.235. This may likely be due to investors taking profit as oil prices dropped this week. Both Brent and WTI crude prices dropped towards US$66-68 a barrel this week after OPEC+ group of producers overcame internal divisions and agreed to boost oil output.

- Trading Dashboard Update: Add UMS Holdings (UMSH SP) at S$1.60. Take profit on Golden Energy & Resources (GER SP) at S$0.36 and Japan Foods (JFOODS SP) at S$0.435.

Hong Kong

- Metallurgical Corp of China Ltd (1618 HK). Both A-shares and H-shares closed at a 4-month high as Guotai Junan Securities released their latest report, stating that market investors have neglected its diversification strategy, and hence, its share price has not factored in the contribution from the photovoltaic, wind, and waste power businesses. Total value of new contracts signed in 1H21 grew by 32% YoY to RMB615.1bn.

- Weimob Inc (2013 HK). Shares closed at a YTD low, back to its December 2020 level. There was no company specific news. Weak sentiment remained in the overall SaaS sector due to a short report on Linklogis (9959 HK).

- Linklogis Inc (9959 HK). Shares plunged before trading was halted at noon. Short-seller Valiant Varriors wrote in a Tuesday report that the share price of the mainland company is overestimated, saying that it hid tens of billions of bridging loans and related transactions with huge financial risks. The price-earning ratio should not exceed 10 – 12 times, said the report, adding that the share price should be lower than HK$1.19 based on calculations.

- China Evergrande Group (3333 HK), China Evergrande New Energy Vehicle Group Limited (708 HK) Shares of Evergrande Group and related entities continued to plunge as long-simmering doubts about Evergrande’s financial health intensified this week after the company had a US$20 million bank deposit frozen by a local court and was hit with a property sales ban by a city government, alleging it had failed to set aside enough funds in escrow accounts. The city later removed the ban, providing some relief to Evergrande’s stock, but investors remain worried that the developer was not selling properties and other assets fast enough to repay its US$301 billion mountain of liabilities.

- Trading dashboard: Geely Automobile (175 HK) was added at HK$22.5, SINOPEC (386 HK) was added at HK$3.55, BYD Electronic International (285 HK) was cut loss at HK$42.

Trading Dashboard

Related Posts: