26 April 2024: Genting Singapore Ltd. (GENS SP), CGN New Energy Holdings Co. Ltd. (1811 HK), Coinbase Global Inc (COIN US)

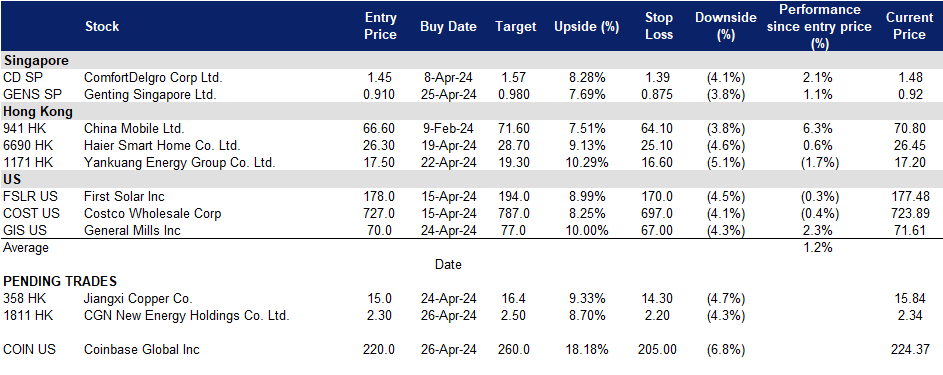

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

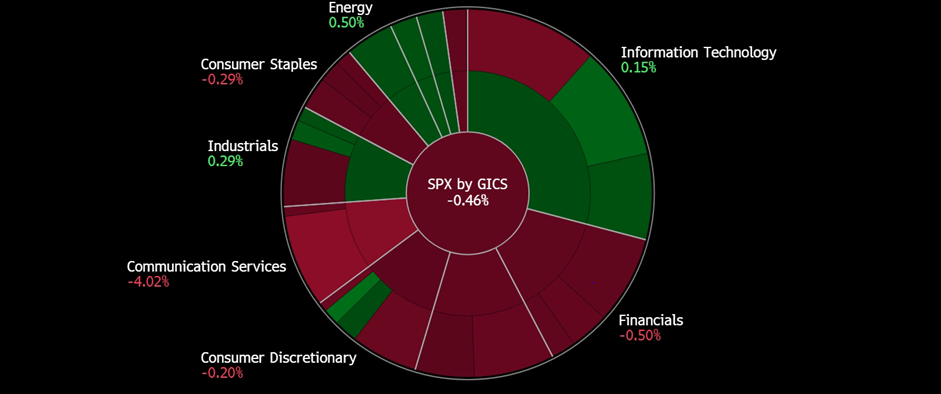

United States

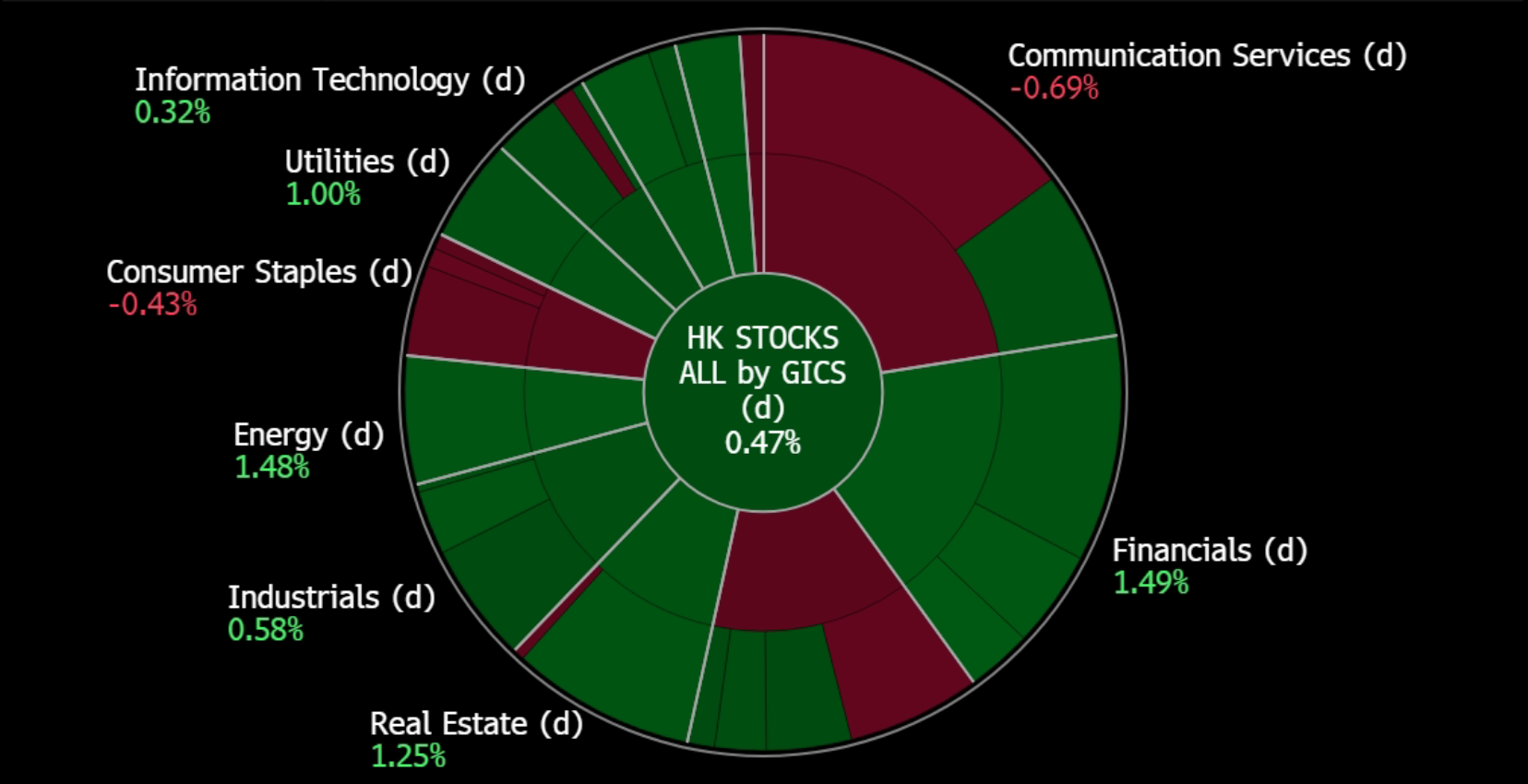

Hong Kong

Genting Singapore Ltd. (GENS SP): Expectations of strong results

- RE-ITERATE BUY Entry – 0.910 Target– 0.980 Stop Loss – 0.875

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- Expectations of good results. Marina Bay Sands (MBS) recently released good results, delivering record levels of financial and operating performance for 1Q24, with profits surging 51.5% YoY. Las Vegas Sands, the parent company of MBS, expects MBS’ new suite product and elevated service offerings to help drive additional growth for the company as airlift capacity continues to improve and travel and tourism spending in Asia continues to advance. The positive results reflect the strength of the hospitality and entertainment industry and bring about positive expectations towards Genting Singapore’s results.

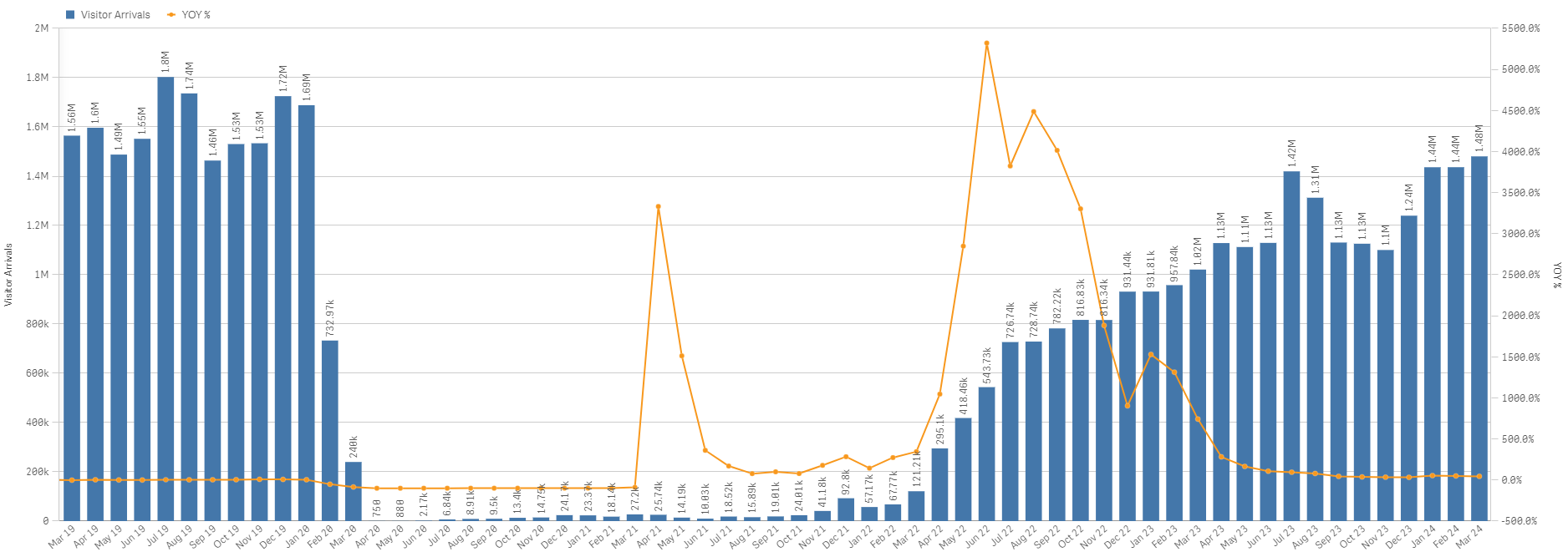

- Continued strength in International Tourist Arrivals. The Singapore Tourism Board projects continued tourism recovery in 2024, anticipating 15-16mn visitor arrivals and tourism receipts of S$26-27.5bn. Although pre-pandemic arrival numbers are not expected, tourist spending is anticipated to nearly match 2019 levels. In March, Singapore welcomed 1.48mn visitors, (+45.1% YoY), reaching a record high level since the onset of the COVID-19 pandemic. The surge is credited to improved flight connectivity, factors like the mutual visa-free travel arrangement with China, and ongoing efforts to attract diverse visitors. The sector’s resilience is underscored by 2023’s strong performance, characterized by longer stays, expanded hotel capacity, and successful event hosting. STB’s strategy focuses on enhancing visitor experiences and prolonging stays to attract higher-spending tourists, prioritizing quality over quantity. This approach aligns with Singapore’s reputation for premium experiences and top-notch connectivity. Despite potential economic challenges, an emphasis on value-added experiences could help to sustain tourist spending, even if arrival numbers do not rebound to pre-pandemic levels until 2025.

Singapore monthly visitor arrivals trend – Jan 2019 to Mar 2024

(Source: Singapore Tourism Analytics Network)

- RWS expansion on track. On 2 March, the Hard Rock Hotel Singapore at Resorts World Sentosa will close to undergo renovations for the complex’s planned expansion. The 360-room hotel will receive a complete overhaul. This aligns with Genting Singapore’s previously announced plans to invest around S$6.8bn to revamp and enlarge the resort, which includes the development of a new luxury hotel and waterfront complex with 700 hotel rooms. Other ongoing projects include the transformation of The Forum shopping area, the development of a new Minion Land attraction, and the rebranding of SEA Aquarium to the Singapore Oceanarium, all of which are expected to partially open in early 2025.

- FY23 earnings. Revenue rose to S$2.42bn in FY23, rising 40.1% YoY, compared to a revenue of S$1.73bn in FY22. The company’s net profit rose to S$611.6mn in FY23, +79.8% YoY, compared to S$340.1mn in FY22. Basic EPS rose to 5.07Scents in FY23, compared to 2.82Scents in FY22. Its gaming revenue rose 34% YoY to S$1.65bn and its non-gaming revenue jumped 58.6% YoY to S$758.2mn.

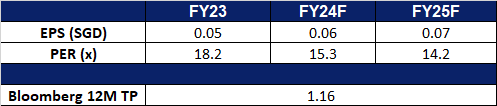

- Market Consensus.

(Source: Bloomberg)

ComfortDelGro Corp Ltd (CD SP): Upbeat overseas expansion

- RE-ITERATE Entry – 1.45 Target– 1.57 Stop Loss – 1.39

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

- Regulatory changes in Singapore. The Land Transport Authority (LTA) is introducing new standards for taxi and ride-hailing operators to enhance service reliability and reduce operational costs. Operators must notify LTA, passengers, and drivers within an hour of any incidents affecting service provision. Taxi operators will see lower operating costs through changes like extending the lifespan of non-electric cabs and reducing inspection frequency for newer taxis. Regulatory tweaks aim to balance the regulatory burden between taxis and private-hire cars. While concerns over driver earnings persist, the proposed changes aim to stabilize the transport sector and maintain a balance between taxis and private-hire cars. These new standards will bolster ComfortDelGro’s efforts to enhance its Taxi & Private Hire segment in Singapore, aligning with the increasing demand for personal transportation services.

- Secured contracts in Manchester. Metroline Limited, a subsidiary of ComfortDelGro, has secured contracts valued at £422mn to operate four public-bus franchises in the UK for five years. Awarded by the Greater Manchester Combined Authority, the contracts include options for two one-year extensions. Metroline will operate 232 services with 420 buses and over 1,350 employees, doubling its services and representing a 30% increase over its London portfolio. ComfortDelGro’s track record positions it well to fulfill these contracts, according to its managing director Cheng Siak Kian. This move aligns with ComfortDelGro’s strategy to strengthen its core public transportation businesses and solidify its reputation as a leading multi-modal transport operator.

- Acquisition of A2B. Shareholders of Australian taxi network operator A2B voted overwhelmingly in favour of ComfortDelGro’s acquisition, with 97.7% of votes cast supporting the deal. ComfortDelGro proposed to acquire all shares in A2B Australia for A$1.45 per share, totaling A$165.1 million. The transaction is expected to be finalized in April 2024 pending court approval. Upon completion, A2B’s 8,000-vehicle network will complement ComfortDelGro’s global taxi fleet of 21,300 vehicles. ComfortDelGro’s managing director sees A2B as a strategic fit to expand the company’s point-to-point offerings and strengthen its presence in the Australian market. This acquisition aligns with ComfortDelGro’s strategy to grow and defend its core transport businesses, which contributed to a 4.2% revenue increase and a 76.5% net profit growth in H2 FY2023. Additionally, ComfortDelGro has been expanding its global presence through acquisitions and joint ventures, such as the recent acquisition of CMAC Group and securing contracts for metro lines in Paris and Stockholm.

- FY23 results review. FY23 revenue rose by 2.6% YoY to S$3,880.3mn, compared to S$3,780.8mn in FY22. Net profit inclined 4.3% YoY to S$180.5mn, compared to S$173.1mn in FY22. FY23 earnings would have risen 26.6% YoY, excluding the one-off gain of S$30.5mn from its sale of its Alperton property in London in FY22. The taxi and private hire business had a 59.5% YoY jump in operating profit to S$106.7mn in FY23. Basic EPS rose to S$8.33 in FY23 compared to S$7.99 in FY22. FY23 total dividend amounted to 6.66 sing cents per share.

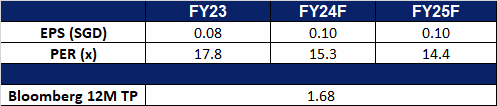

- Market Consensus

CGN New Energy Holdings Co. Ltd. (1811 HK): Tightening of carbon market

- BUY Entry – 2.30 Target – 2.50 Stop Loss – 2.20

- CGN New Energy Holdings Co Ltd is a company principally engaged in the operation of power plants. The Company operates its business through three segments. The Power Plants in Korea segment is engaged in the generation and supply of electricity. The Power Plants in the PRC segment is engaged in the generation and supply of electricity. The Management Companies segment is engaged in the provision of management services to power plants operated by CGN and its subsidiaries. The Company mainly operates wind, solar, gas-fired, coalfired, oil-fired, hydro, Cogen, fuel cell and biomass projects, which are in operation in the PRC and Korea power markets.

- Higher carbon prices driven by a tighter carbon market. China recently unveiled intentions to tighten regulations within its national carbon market, aiming to compel major polluters to reduce emissions, marking a significant stride towards fortifying a system that has thus far offered minimal support for climate mitigation efforts. These measures are poised to escalate demand for renewable energy and accelerate the decline of inefficient coal-fired power plants. The anticipation of fewer emission permits, coupled with plans to permit new participants in the market, has driven carbon prices to surpass 100 yuan, a milestone reached for the first time since the market’s inception in mid-2021. Consequently, this elevates the cost of carbon emissions for numerous producers, potentially incentivizing them to transition towards renewable energy sources.

China Carbon Prices

(Source: Bloomberg)

- Accelerating investments into green technology. During the annual National People’s Congress in March, Premier Li Keqiang unveiled plans to expedite investment in clean-energy initiatives. The objective is to cultivate a “new trio” of industries – namely, solar panels, electric vehicles (EVs), and lithium batteries – to serve as drivers of economic advancement, supplanting the “old trio” comprised of clothing, furniture, and appliances. China’s decision to intensify expenditure could propel this transformative shift forward, contributing to the realization of long-term climate objectives by advancing the timeline for reaching the peak in fossil fuel consumption and reducing greenhouse gas emissions. The heightened investment in green technology is poised to benefit entities involved in green energy provision, such as CGN New Energy Holdings.

- Transition to renewables. China has committed to achieving climate neutrality by 2060, marking a significant endeavor that is reshaping its energy landscape on a global scale. The country is leading the charge in renewable energy investments, resulting in a transformation of its power generation mix. According to a report by consulting firm DNV, the proportion of renewables in China’s total electricity generation is projected to surge from 30% at present to 55% by 2035 and further to 88% by 2050. This report underscores China’s substantial strides towards its objective of reducing net emissions to zero, envisioning a fivefold increase in renewables capacity by 2050. Consequently, China aims to reduce its share of global CO2 emissions from 33% to 22% by the same year, demonstrating a concerted effort towards environmental sustainability and climate mitigation.

- FY23 earnings. Revenue fell 9.76% YoY to US$2.19bn in FY23, compared to US$2.43bn in FY22. Net profit rose 30.4% to US$179.6mn in FY23, compared to US$214.4mn in FY22. Basic earnings per share rose to 6.24 US Cents in FY23, compared 4.55 US Cents in FY22.

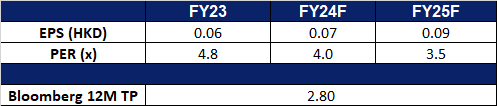

- Market consensus.

(Source: Bloomberg)

Jiangxi Copper Co. Ltd. (358 HK): Copper price surge

- RE-ITERATE BUY Entry – 15.0 Target – 16.4 Stop Loss – 14.3

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- Copper price rally. Copper futures surged to above US$4.4 per pound in April, the highest in nearly two years, as concerns of low supply were met with signs of traction in demand. Satellite data showed that copper smelters in China, the world’s top producer of refined copper decreased activity levels to act, in line with pledges that their output could fall up to 10% this year. The moves mark a response to the low supply of copper ore for Chinese smelters, magnifying the sector’s overcapacity to drive smelting fees to their lowest in years. On the demand side, improving demand from China drove imports of unwrought copper to surge by 16% to 474,000 tonnes in March, aligning with strong manufacturing PMIs for the period and suggesting that factories may be gaining some traction following prolonged pessimism. The spike in copper prices will benefit Jiangxi Copper’s revenue.

China Shanghai copper spot price (RMB/tonne)

(Source: Bloomberg)

- Increasing global demand for Copper. Despite facing global supply challenges, the demand for copper continues to thrive, driven by factors such as the energy transition and advancements in technologies like artificial intelligence (AI). This persistent demand suggests a bullish trajectory for the versatile metal, projected to endure for the next three years. As data centers evolve to support AI servers, the need for copper is anticipated to remain robust. Additionally, the global shift toward electric vehicles (EVs) adds another layer of demand for copper, as EVs require four times as much copper as traditional combustion-engine vehicles.

- FY23 earnings. Revenue rose 8.74% YoY to RMB521.9bn in FY23, compared to RMB480.0bn in FY22. Net profit attributed to company shareholders rose 8.53% to RMB6.51bn in FY23, compared to RMB6.00bn in FY22. Basic earnings per share rose to RMB1.88 in FY23, compared RMB1.73 in FY22.

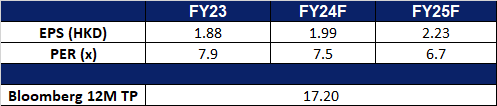

- Market consensus.

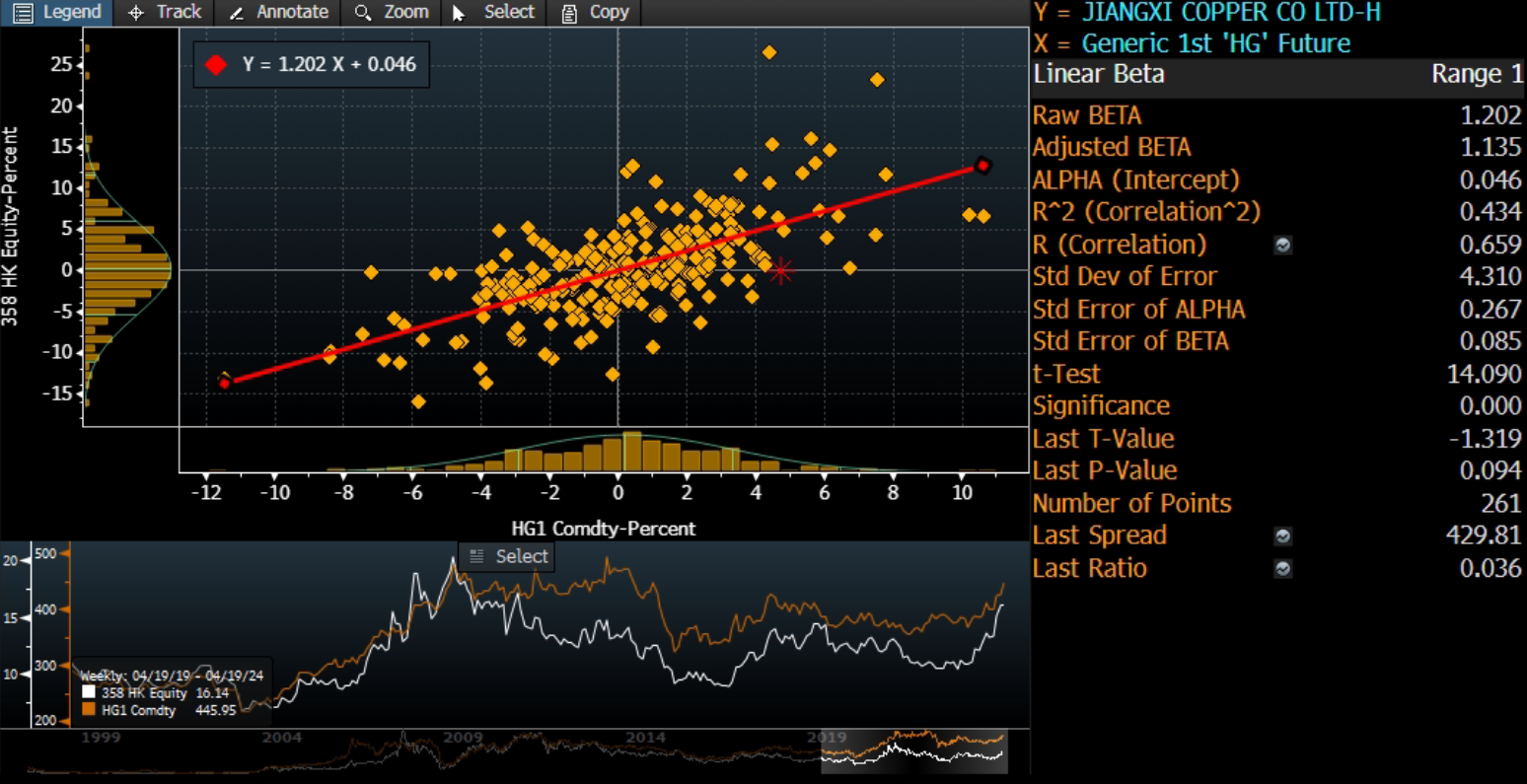

Share price and copper price (US$/lb) correlation

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Expect a post-halving rally

- BUY Entry – 220 Target – 260 Stop Loss – 205

- Coinbase Global Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers consumers a primary financial account in the crypto economy; and a marketplace that provides institutional investors with a liquidity pool for trading crypto assets. It also provides technology and services that enable developers to build crypto products and securely accept crypto assets as payment.

- Bitcoin halving. Bitcoin’s mining reward was cut in half on 20 April 2024. This event, known as the halving, reduces the rate at which new Bitcoins are created. As a result, the supply of Bitcoin will decrease after the halving date. Historically, these halving events have been followed by 18-month bull market cycles for Bitcoin. The previous halvings occurred on 9 July 2016 and 11 May 2020.

- Market Outlook. Risky assets, such as stocks, have recently experienced a sell-off. This can be attributed to two factors: weaker-than-expected expectations for interest rate cuts and rising risk aversion due to geopolitical tensions. However, past trends suggest that these geopolitical events have a short-term impact, and risky assets typically recover quickly. While the market does not expect rate cuts as soon as initially anticipated, it is still expected to continue shaping economic activity in the next two years.

Bitcoin chart

(Source: Bloomberg)

- 4Q23 earnings review. Revenue rose by 51.6% YoY to US$954mn, beating estimates by US$135mn. GAAP EPS was US$1.04, beating estimates by US$0.01. Looking ahead, the company projects subscription and service revenue for 1Q24 to be between US$410mn and US$408mn, exceeding the consensus estimate of US$307mn.

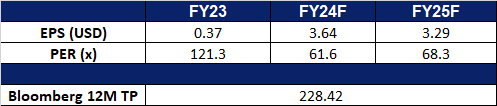

- Market consensus.

(Source: Bloomberg)

General Mills, Inc. (GIS US): Inflation rebounding

- RE-ITERATE BUY Entry – 70.0 Target – 77.0 Stop Loss – 67.0

- General Mills, Inc. operates as a food company. The Company manufactures and markets branded processed consumer foods sold through retail stores. General Mills serves customers worldwide.

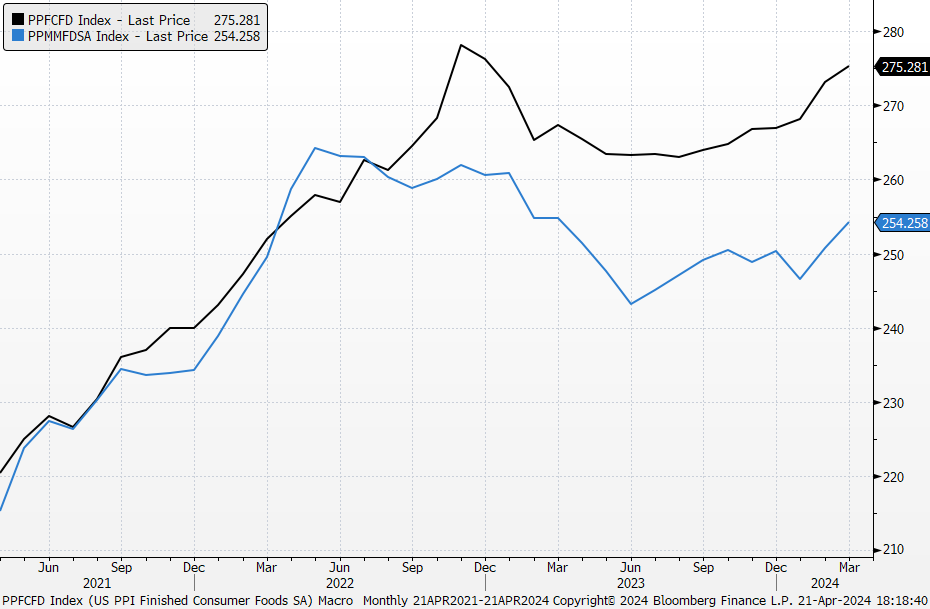

- Inflation rebounding. US March inflation data such as CPI and PPI showed that inflation rebounded. The price performances of several key commodities have signalled that inflation is returning. Brent/copper/aluminium rises more than 20%/16%/17% YTD respectively. Regarding agricultural products, coca and coffee rally sharply while the rest remain at lows. However, soybean and wheat recently rebounded from 52-week lows. Both materials for food manufacturing and finished consumer food PPIs indicate that uptrends are resuming. Accordingly, the packaged food sector is expected to bottom out after a one-year downturn.

- Geopolitical tensions escalating. Recent Israel and Iran conflicts reinforced the risk-averse sentiment. The uncertainty of whether both countries set up new rounds of retaliation will continue to rattle the market in the short term. Consumer staples as a defensive sector saw inflows accordingly.

US PPI – Materials for food manufacturing (black) and finished consumer food (blue)

(Source: Bloomberg)

- 3Q23 earnings review. Revenue dipped by 1.0% YoY to US$5.1bn, beating estimates by US$130mn. Non-GAAP EPS was US$1.17, beating estimates by US$0.12. FY24 guidance is that the organic net sales are expected to range between down 1% and flat. Adjusted operating profit and adjusted diluted EPS are each expected to increase 4% to 5% in constant currency.

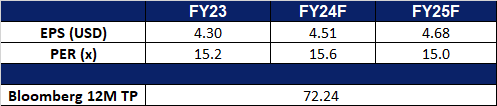

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add General Mills Inc. (GIS) at US$70.0 and Genting Singapore Ltd. at S$0.910. Cut loss on Frencken Group Ltd. (FRKN SP) at S$1.45.