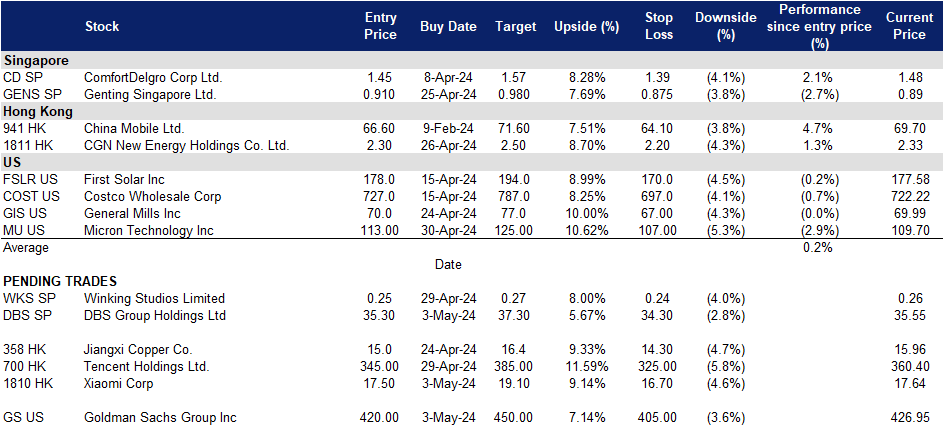

3 May 2024: DBS Group Holdings Ltd. (DBS SP), Xiaomi Corp. (1810 HK), Goldman Sachs Group Inc (GS US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

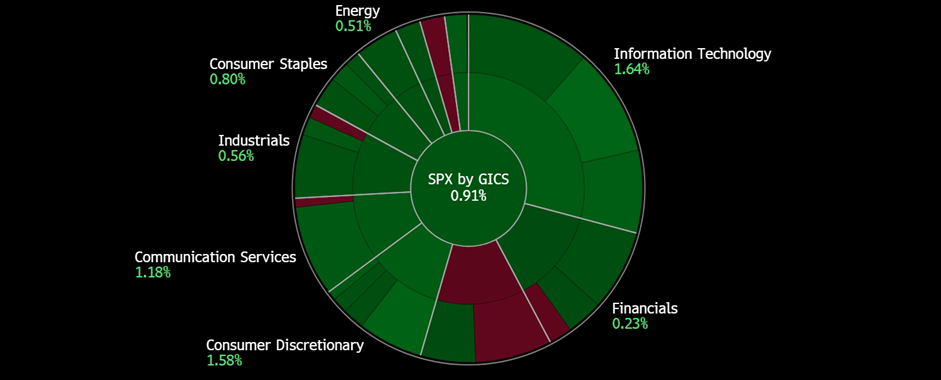

United States

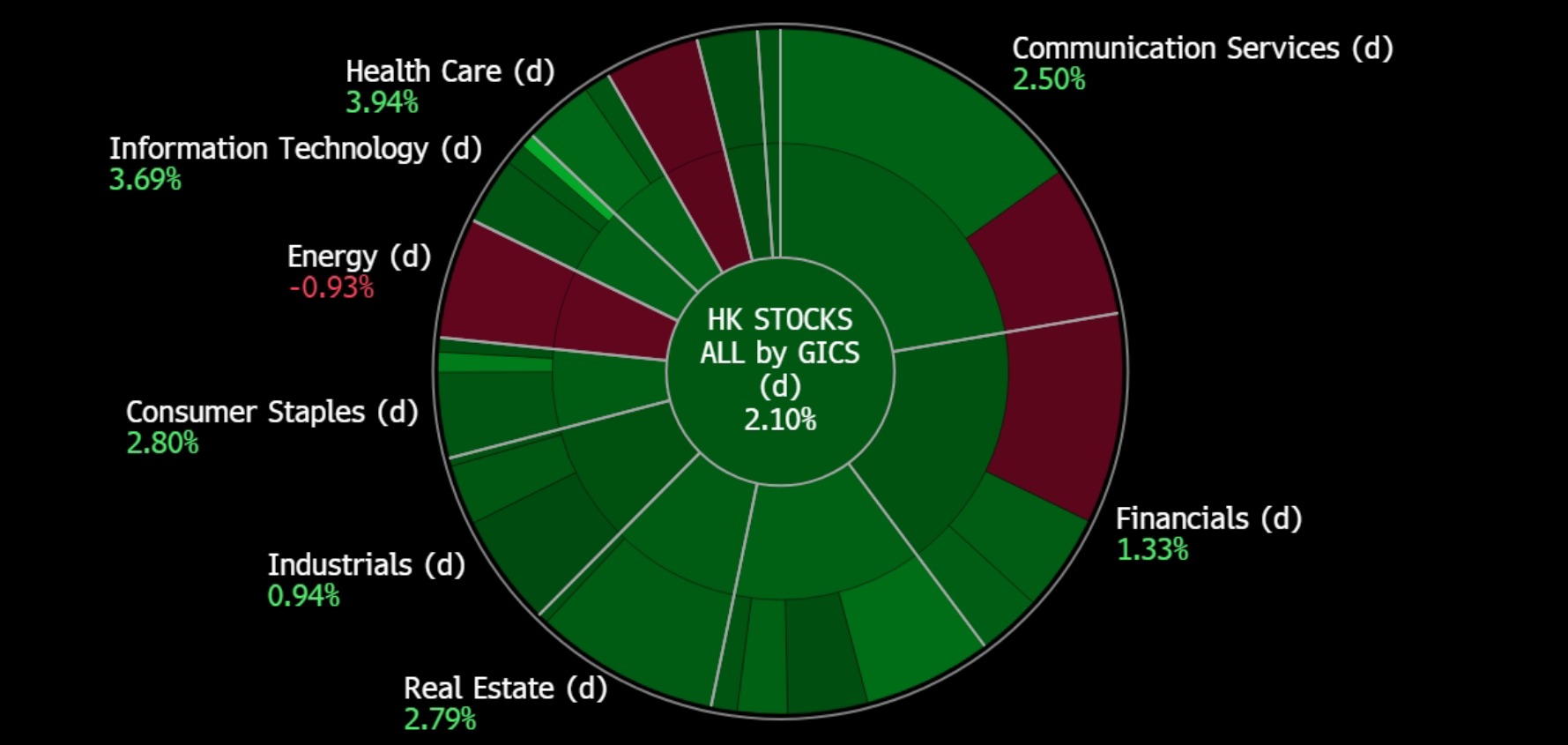

Hong Kong

DBS Group Holdings Ltd. (DBS SP): Increase shareholders returns

- BUY Entry – 35.30 Target– 37.30 Stop Loss – 34.30

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Increasing business momentum. DBS just announced its results exceeding the market expectations. Loans grew and both fee income and treasury customer sales reached new highs, showcasing the strength and momentum of the company’s business. ROE reached a record high of 19.4% compared to 18.6% a year ago, and the net interest margin edged up to 2.14%, compared to 2.12% a year ago.The company remains optimistic that total income and earnings will be better than previously guided and the company would be able to deliver another year of strong shareholder returns.

- Bonus share issuance. DBS paid out its Q4 final dividend amounting to 54 Singapore cents per share on 19 April. DBS also issued one bonus share for every 10 shares held on 30 April and these shares will qualify for dividends from 1Q24. The increase in dividend payout and issuance of bonus shares is to increase capital returns to its shareholders.

- Expectations of monetary policy to remain unchanged. The Monetary Authority of Singapore (MAS) is expected to maintain its current monetary policy in the upcoming review. Despite inflation showing some volatility, core inflation remains above the central bank’s target. MAS may consider easing monetary settings in the second half of the year if inflation stabilizes. While inflation in Singapore remains elevated, forecasts suggest moderation throughout the year. Global central banks are cautiously adjusting interest rates, and MAS is likely to follow suit gradually, balancing growth and inflation concerns. Analysts suggest MAS may not rush to relax policy, considering Singapore’s role as a bellwether for global growth and the ongoing export-driven economic recovery. Policy easing, if any, is anticipated in October at the earliest, with MAS managing monetary policy through adjustments to the Singapore dollar’s exchange rate against its main trading partners. With the monetary policy expected to remain unchanged, DBS will continue to benefit from the high net interest margins for the coming quarters, allowing it to maintain its FY23 net interest income levels.

- New sustainability initiative. On 3 April, DBS Bank and Enterprise Singapore launched a program to support local companies in becoming more sustainable. The initiative offers training, guidance, and financing options to SMEs and mid-cap companies, with around 100 expected to join the first cohort. Companies will receive support from sustainability specialists and can choose basic or intermediate training levels. By the end of the program, participating firms should have a clear sustainability action plan. Enterprise Singapore will finance 70% of eligible activities per company until March 2026. The initiative aims to help businesses future-proof themselves, cut costs, and meet the growing demand for sustainability.

- 1Q24 results review. 1Q24 total income rose by 12.6% YoY to S$5.56bn, compared to S$4.94bn in 1Q23. Net profit increased 15.0% YoY to S$2.96bn in 1Q24, compared to S$2.57bn in 1Q23. Basic EPS rose to S$4.57 in 1Q24 compared to S$3.65 in 1Q23.

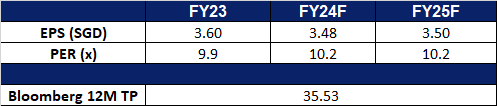

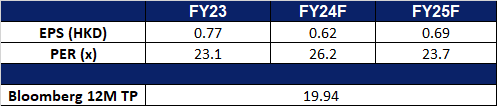

- Market Consensus

(Source: Bloomberg)

Winking Studios Limited (WKS SP): Exponential growth trend

- RE-ITERATE BUY Entry – 0.25 Target– 0.27 Stop Loss – 0.24

- Winking Studios Limited operates as a game art outsourcing studio. The Company provides complete end-to-end art outsourcing and game development services across various platforms for the video games industry. Winking Studios serves customers worldwide.

- Inorganic growth strategy. Winking Studios Limited embarked on an inorganic growth strategy to bolster its sales volume. This initiative culminated in the full acquisition of On Point Creative Co., Ltd. on 1 April 2024. Aligned with the company’s expansion objectives, this strategic move not only secures two additional global game publishers as clients but also promises to amplify its top-line growth trajectory.

- Continued organic growth. Winking Studios remains committed to sustaining organic growth alongside its acquisition endeavours. In addition to expanding its client base through the acquisition of smaller art outsourcing studios, the company has bolstered its internal business development team. This team is dedicated to securing sales from key markets such as Japan and the United States, further diversifying its geographic reach. Furthermore, Winking has demonstrated consistent workforce expansion, with an annual double-digit growth rate. This strategic increase in manpower positions the company to tackle larger and more extensive projects from various publishers, driving sustained growth and market competitiveness.

- Placement announcement. On 10 April, Winking Studios unveiled plans to raise up to S$27 million through a placement of new shares priced at 25 cents each. The initiative entails the issuance of up to 108 million shares, with Acer Group, the company’s largest shareholder, committing to subscribe to at least 64.8 million new shares valued at S$16.2 million. In the event of unsubscribed shares, Acer Group will absorb the remaining placement shares. If fully subscribed, Winking Studios’ share base will expand by over a third to 387.7 million shares. This strategic placement aims to bolster the company’s financial capacity to pursue acquisitions, alliances, and joint ventures, thereby augmenting its market share and customer base. Additionally, a portion of the raised funds will be allocated towards enhancing its AI capabilities.

- Acquisition spree. On 1 April 2024, Winking Studios Limited successfully completed the acquisition of 100% ownership of On Point Creative Co., Ltd (OPC). Established in Taipei in 2018, OPC enriches the group with extensive expertise in art production services spanning from 2D design and animation to 3D production and advertising promotion. The integration of OPC is poised to infuse Winking Studios with fresh creativity and vitality, potentially revolutionizing game art outsourcing technology on the global stage. This strategic acquisition marks the commencement of Winking Studios’ expansion journey, leveraging the flexibility and convenience of the Singapore Exchange to pursue further impactful acquisitions aimed at enhancing the brand’s global reputation and influence. Additionally, on 8 April, Winking Studios announced that it plans to acquire assets and services from Pixelline Production, a Malaysian art and animation outsourcing company, solidifying its commitment to strategic growth.

- FY23 earnings. Revenue rose to US$29.3mn in FY23, rising 19.5% YoY, compared to a revenue of US$24.5mn in FY22, driven primarily by heightened contributions from its art outsourcing and game development segments. The company’s net profit rose to USS$1.78mn in FY23, +71.6% YoY, compared to USS$1.04mn in FY22. EPS rose from US$0.005 in FY22 to US$0.007 in FY23.

- We have fundamental coverage with a BUY recommendation and a fully-diluted TP of S$0.34. Please read the full report here.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Strengthening market position

- BUY Entry – 17.5 Target –19.1 Stop Loss – 16.7

- Xiaomi Corp is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Strong Smartphone sales. In 1Q24, Xiaomi maintained its position as the world’s third-largest smartphone vendor by shipments. With 40.7 million smartphone units shipped, Xiaomi held a 14% market share, trailing behind Samsung, which shipped 60 million units (20% market share), and Apple, which shipped 48.7 million units (16% market share). Xiaomi’s impressive performance was propelled by robust shipments of its latest models in the Middle East, Africa, and Latin America markets. Additionally, the company’s strategic focus on technological advancements, such as its HyperOS technology aimed at integrating multiple systems into a single ecosystem, has contributed to its strong market performance and efforts to capture a larger market share.

- Better turnarounds on EV business. Xiaomi has ventured into the electric vehicle (EV) market with the launch of its new EV car. The sales of the new EV SU7 surpassed expectations, bringing the company closer to breaking even, despite offering it at a lower price point compared to Tesla’s Model 3. Xiaomi now aims to deliver 100,000 units of its new EV this year, targeting an estimated gross profit margin of approximately 5% to 10% for its auto business. This outlook is reinforced by cost reductions from suppliers. Moreover, Xiaomi is currently engaging in discussions with supply chain partners to explore ways to increase production capacity and further streamline costs to support its EV venture.

- Further Integration of new operating system. Xiaomi has been focusing on extending its new operating system, the Xiaomi HyperOS to more Xiaomi and Redmi devices and products. HyperOS is expected to power not only smartphones but also smart home devices and even electric vehicles like the new Xiaomi SU7. With the launch of the new Xiaomi SU7 EV, customers can expects to gain a seamless experience in a new smart ecosystem between the EV and their phones. Under the new HyperOS operating system, the company has also been releasing several products, such as a ceiling fan as well as clothes dryer. This shift into a new operating system also marks a strategic move of the company’s vision into creating a seamless smart ecosystem, “Human x Car x Home”. This ecosystem is bound to entice consumers to purchase Xiaomi’s other products as well.

- FY23 earnings. Revenue fell by 3.2% YoY to RMB271.0bn in FY23, compared to RMB280.0bn in FY22. Net profit rose by 598.2% to RMB7.5bn in FY23, compared to RMB2.50bn in FY22. Basic earnings per share rose to RMB0.70 in FY23, compared RMB0.10 in FY22.

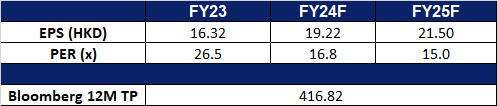

- Market consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): More game launches

- RE-ITERATE BUY Entry – 345 Target – 385 Stop Loss – 325

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added (VAS) services, online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- New game launch. Tencent has announced the long-awaited release date of May 21 for its highly anticipated “Dungeon and Fighter” mobile game, marking the culmination of seven years of development. This mobile adaptation is based on the immensely popular “Dungeon and Fighter: Origin” computer game, originally developed by the Korean company Nexon, which stands as one of the world’s most profitable computer games. Although Tencent initially secured government approval for the game’s release in 2017, this approval was later revoked. However, the company successfully obtained a new license for the game in February of last year.

- More games approved in China. The Chinese National Press and Publication Administration disclosed the approval data for domestic online games in April, with a total of 95 games receiving approval. Previously, the number of approved domestic game versions had surpassed 100 for three consecutive months, and for two consecutive months (January and February 2024), it exceeded 110. In the first four months of this year, the total number of approved domestic game versions reached 428. The approval of an increasing number of new games underscores the ongoing recovery of China’s gaming market.

- Partnership with Toyota Motor. Tencent has recently revealed its plans to forge a strategic partnership with Toyota Motor, focusing on collaboration in artificial intelligence, cloud computing, and big data for electric vehicles marketed by the Japanese automaker in China. Toyota aims to collaborate with Tencent specifically on in-car software, which is pivotal for the advancement of next-generation vehicles, in a bid to expedite its progress in the automotive sector. Leveraging its extensive social networking service with over 1 billion users, Tencent is venturing into the automotive industry, anticipating substantial growth opportunities in this market.

- FY23 earnings. Revenue rose by 9.82% YoY to RMB609.0bn in FY23, compared to RMB554.6bn in FY22. Net profit fell by 37.4% to RMB118.0bn in FY23, compared to RMB188.7bn in FY22. Basic earnings per share rose to RMB16.7 in FY23, compared RMB12.1 in FY22.

- Market consensus.

(Source: Bloomberg)

Goldman Sachs Group Inc (GS US): Net interest margins to remain elevated

- Entry – 420 Target – 450 Stop Loss – 405

- The Goldman Sachs Group, Inc., a bank holding company, is a global investment banking and securities firm specializing in investment banking, trading and principal investments, asset management and securities services. The Company provides services to corporations, financial institutions, governments, and high-net worth individuals.

- Rates unchanged. In May, the US Federal Reserve maintained interest rates and hinted at potential future reductions, but expressed concern over recent disappointing inflation readings, suggesting that rate cuts might be delayed. Fed Chair Jerome Powell emphasized the need for sustained progress in inflation towards the 2% target, indicating a cautious approach to rate adjustments. While Powell’s remarks were less hawkish than expected, investors remained uncertain about the timing of rate cuts, with some speculation that cuts could begin in September. The Fed also announced a reduction in the pace of balance sheet shrinking to ensure adequate reserves in the financial system. Despite relatively weak GDP growth in the first quarter, Powell highlighted strong job gains and low unemployment, dismissing concerns of stagflation. With interest rates expected to remain unchanged, banks like Goldman Sachs will benefit from continued high net interest margin.

- Lead private credit debt deal. Goldman Sachs spearheaded a significant private credit debt deal, raising €1.5bn for SumUp, a leading global FinTech firm. This financing will be utilized to restructure existing debt and drive SumUp’s international growth initiatives, particularly in bolstering support for merchants and expanding product offerings. The oversubscribed round underscores investor faith in SumUp’s established business model and highlights the prowess of Goldman Sachs’ deal team. Notable new investors AllianceBernstein, Apollo Global Management, and Deutsche Bank AG joined existing backers such as BlackRock and Temasek in supporting SumUp’s mission.

- Success in going back to its roots. Goldman Sachs exceeded Wall Street expectations with a 28% rise in profit in the first quarter, driven by a resurgence in underwriting, deals, and bond trading. The bank’s earnings showed strong performance in investment banking, indicating a rebound after recent challenges. Its CEO expressed optimism about the reopening of capital markets and highlighted the growing interest in initial public offerings and debt underwriting. The bank’s focus on AI-related advisory services and a shift away from consumer banking garnered investor confidence. Additionally, robust investment banking fees and record revenue from asset and wealth management contributed to the positive outcome. Goldman Sachs remains committed to its strategic shifts, prioritizing its core businesses and anticipates continued growth as it bolsters its position in capital markets.

- 1Q24 earnings review. Revenue rose by 16.3% YoY to US$14.21bn, beating estimates by US$1.28bn. GAAP EPS was US$11.58, beating estimates by US$2.90. The company declared a quarterly dividend of US$2.75 per share, in line with the previous dividend.

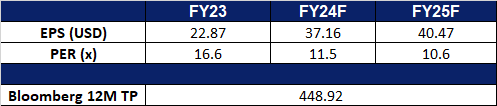

- Market consensus.

Micron Technology Inc (MU US): A dip-buying opportunity

- RE-ITERATE BUY Entry – 113 Target – 125 Stop Loss – 107

- Micron Technology, Inc., through its subsidiaries, manufactures and markets dynamic random access memory chips (DRAMs), static random access memory chips (SRAMs), flash memory, semiconductor components, and memory modules.

- Big tech AI gains. Recent big tech firms, Microsoft and Google, recent quarterly results exceeded expectations, driven by increased revenue from cloud computing, particularly fuelled by the growing use of artificial intelligence (AI) services. The competition between these tech giants in the AI space continues to intensify, with both leveraging AI to drive growth in their cloud computing units. Rising demand for cloud infrastructure from corporate clients is seen as a positive sign for the industry’s stability and growth potential, which bodes well for Micron Technology amid the AI boom. Micron is poised to gain as AI tech relies on high-bandwidth memory that the company produces.

- Benefitting from CHIPS act. Micron Technology is poised to receive over US$13bn in government funding and loans to establish memory chip factories in New York and Idaho, aligning with the Biden administration’s strategy to relocate supply chains from Asia. The funding package comprises US$6.1bn in direct funding and up to US$7.5bn in loans under the 2022 Chips Act. Micron intends to channel up to US$125bn into both states over the next two decades. With its latest memory chips integrated into Nvidia’s GPUs and Apple’s smartphones, Micron is pivotal in the tech landscape. The administration targets a 20% share of leading-edge chips produced in the US by 2030, aiming to reduce dependency on China. Micron’s history includes challenges in China, such as sanctions from the Cyberspace Administration. This investment underscores efforts to bolster American industry and diminish reliance on China. Moreover, Micron stands to benefit from investment tax credits and state incentives, with New York offering US$5.5bn. As the fourth chipmaker to secure funding under the program, Micron joins Intel, Taiwan Semiconductor Manufacturing, and Samsung. The initiative is forecasted to generate over 70,000 jobs, encompassing direct construction and manufacturing roles. Micron plans to adopt renewable energy across its facilities and invest in workforce training and childcare amenities, aligning with the increasing demands of artificial intelligence and fostering high-tech job creation in the US.

- 2Q24 earnings review. Revenue rose by 57.7% YoY to US$5.82bn, beating estimates by US$470mn. Non-GAAP EPS was US$0.42, beating estimates by US$0.66. In 3Q24, sales are expected to be within a range of US$6.4bn to US$6.8bn and earnings of between US$0.38 and US$0.52 per share, excluding one-time items.

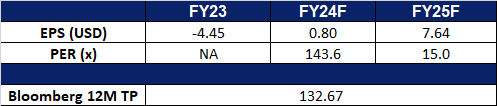

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Haier Smart Home Co. Ltd. (6690 HK) at HK$28.7. Add Micron Technology Inc (MU US) at US$113. Cut loss on Coinbase Global Inc (COIN US) at US$205.