29 April 2024: Winking Studios Limited (WKS SP), Tencent Holdings Ltd. (700 HK), Micron Technology Inc (MU US)

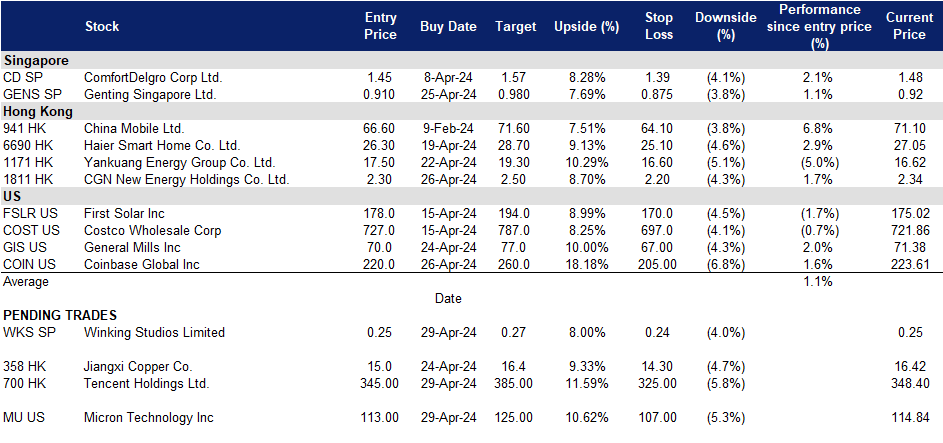

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

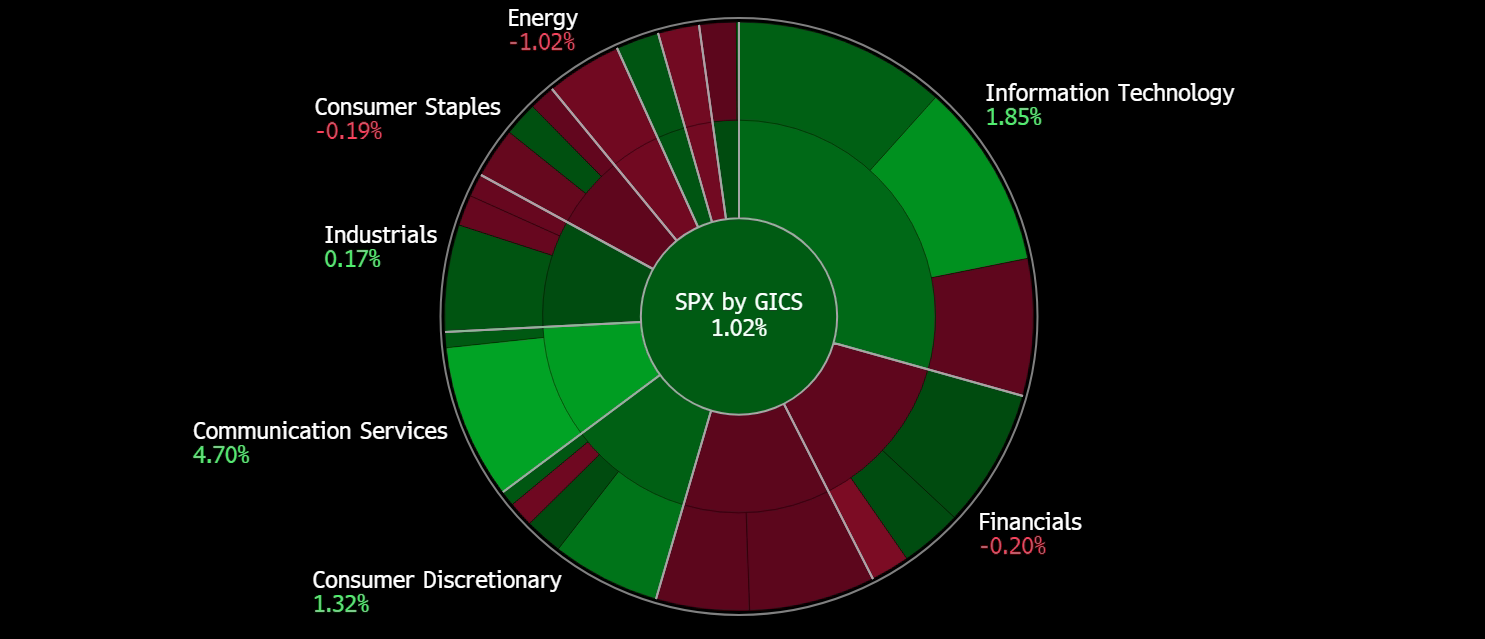

United States

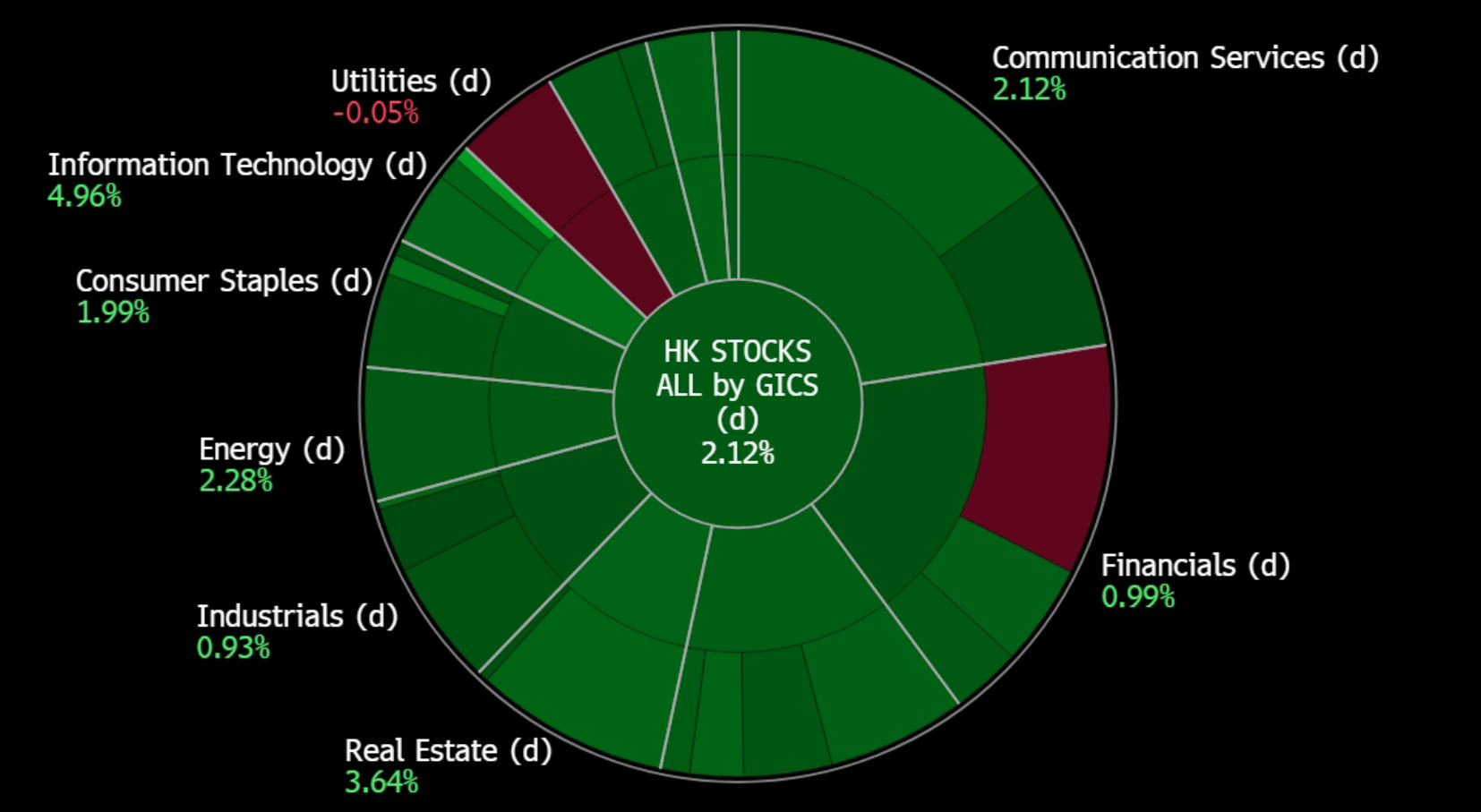

Hong Kong

Winking Studios Limited (WKS SP): Exponential growth trend

- BUY Entry – 0.25 Target– 0.27 Stop Loss – 0.24

- Winking Studios Limited operates as a game art outsourcing studio. The Company provides complete end-to-end art outsourcing and game development services across various platforms for the video games industry. Winking Studios serves customers worldwide.

- Inorganic growth strategy. Winking Studios Limited embarked on an inorganic growth strategy to bolster its sales volume. This initiative culminated in the full acquisition of On Point Creative Co., Ltd. on 1 April 2024. Aligned with the company’s expansion objectives, this strategic move not only secures two additional global game publishers as clients but also promises to amplify its top-line growth trajectory.

- Continued organic growth. Winking Studios remains committed to sustaining organic growth alongside its acquisition endeavours. In addition to expanding its client base through the acquisition of smaller art outsourcing studios, the company has bolstered its internal business development team. This team is dedicated to securing sales from key markets such as Japan and the United States, further diversifying its geographic reach. Furthermore, Winking has demonstrated consistent workforce expansion, with an annual double-digit growth rate. This strategic increase in manpower positions the company to tackle larger and more extensive projects from various publishers, driving sustained growth and market competitiveness.

- Placement announcement. On 10 April, Winking Studios unveiled plans to raise up to S$27 million through a placement of new shares priced at 25 cents each. The initiative entails the issuance of up to 108 million shares, with Acer Group, the company’s largest shareholder, committing to subscribe to at least 64.8 million new shares valued at S$16.2 million. In the event of unsubscribed shares, Acer Group will absorb the remaining placement shares. If fully subscribed, Winking Studios’ share base will expand by over a third to 387.7 million shares. This strategic placement aims to bolster the company’s financial capacity to pursue acquisitions, alliances, and joint ventures, thereby augmenting its market share and customer base. Additionally, a portion of the raised funds will be allocated towards enhancing its AI capabilities.

- Acquisition spree. On 1 April 2024, Winking Studios Limited successfully completed the acquisition of 100% ownership of On Point Creative Co., Ltd (OPC). Established in Taipei in 2018, OPC enriches the group with extensive expertise in art production services spanning from 2D design and animation to 3D production and advertising promotion. The integration of OPC is poised to infuse Winking Studios with fresh creativity and vitality, potentially revolutionizing game art outsourcing technology on the global stage. This strategic acquisition marks the commencement of Winking Studios’ expansion journey, leveraging the flexibility and convenience of the Singapore Exchange to pursue further impactful acquisitions aimed at enhancing the brand’s global reputation and influence. Additionally, on 8 April, Winking Studios announced that it plans to acquire assets and services from Pixelline Production, a Malaysian art and animation outsourcing company, solidifying its commitment to strategic growth.

- FY23 earnings. Revenue rose to US$29.3mn in FY23, rising 19.5% YoY, compared to a revenue of US$24.5mn in FY22, driven primarily by heightened contributions from its art outsourcing and game development segments. The company’s net profit rose to USS$1.78mn in FY23, +71.6% YoY, compared to USS$1.04mn in FY22. EPS rose from US$0.005 in FY22 to US$0.007 in FY23.

- We have fundamental coverage with a BUY recommendation and a fully-diluted TP of S$0.34. Please read the full report here.

(Source: Bloomberg)

Genting Singapore Ltd. (GENS SP): Expectations of strong results

- RE-ITERATE BUY Entry – 0.910 Target– 0.980 Stop Loss – 0.875

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- Expectations of good results. Marina Bay Sands (MBS) recently released good results, delivering record levels of financial and operating performance for 1Q24, with profits surging 51.5% YoY. Las Vegas Sands, the parent company of MBS, expects MBS’ new suite product and elevated service offerings to help drive additional growth for the company as airlift capacity continues to improve and travel and tourism spending in Asia continues to advance. The positive results reflect the strength of the hospitality and entertainment industry and bring about positive expectations towards Genting Singapore’s results.

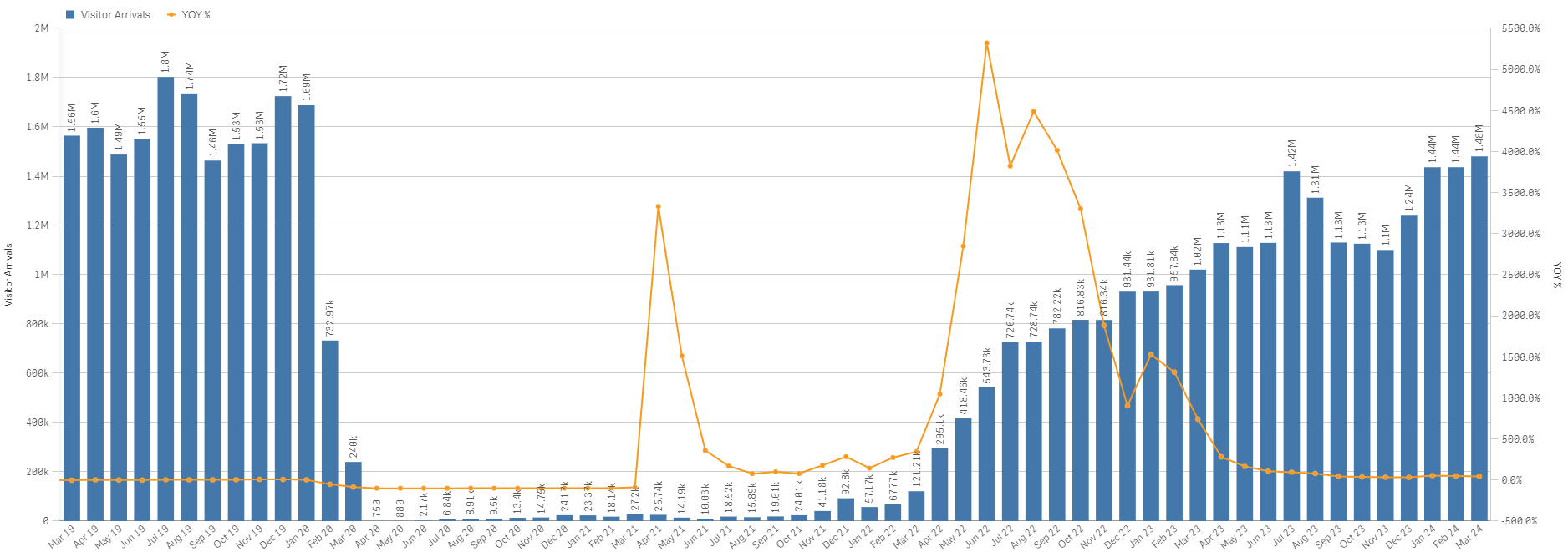

- Continued strength in International Tourist Arrivals. The Singapore Tourism Board projects continued tourism recovery in 2024, anticipating 15-16mn visitor arrivals and tourism receipts of S$26-27.5bn. Although pre-pandemic arrival numbers are not expected, tourist spending is anticipated to nearly match 2019 levels. In March, Singapore welcomed 1.48mn visitors, (+45.1% YoY), reaching a record high level since the onset of the COVID-19 pandemic. The surge is credited to improved flight connectivity, factors like the mutual visa-free travel arrangement with China, and ongoing efforts to attract diverse visitors. The sector’s resilience is underscored by 2023’s strong performance, characterized by longer stays, expanded hotel capacity, and successful event hosting. STB’s strategy focuses on enhancing visitor experiences and prolonging stays to attract higher-spending tourists, prioritizing quality over quantity. This approach aligns with Singapore’s reputation for premium experiences and top-notch connectivity. Despite potential economic challenges, an emphasis on value-added experiences could help to sustain tourist spending, even if arrival numbers do not rebound to pre-pandemic levels until 2025.

Singapore monthly visitor arrivals trend – Jan 2019 to Mar 2024

(Source: Singapore Tourism Analytics Network)

- RWS expansion on track. On 2 March, the Hard Rock Hotel Singapore at Resorts World Sentosa will close to undergo renovations for the complex’s planned expansion. The 360-room hotel will receive a complete overhaul. This aligns with Genting Singapore’s previously announced plans to invest around S$6.8bn to revamp and enlarge the resort, which includes the development of a new luxury hotel and waterfront complex with 700 hotel rooms. Other ongoing projects include the transformation of The Forum shopping area, the development of a new Minion Land attraction, and the rebranding of SEA Aquarium to the Singapore Oceanarium, all of which are expected to partially open in early 2025.

- FY23 earnings. Revenue rose to S$2.42bn in FY23, rising 40.1% YoY, compared to a revenue of S$1.73bn in FY22. The company’s net profit rose to S$611.6mn in FY23, +79.8% YoY, compared to S$340.1mn in FY22. Basic EPS rose to 5.07Scents in FY23, compared to 2.82Scents in FY22. Its gaming revenue rose 34% YoY to S$1.65bn and its non-gaming revenue jumped 58.6% YoY to S$758.2mn.

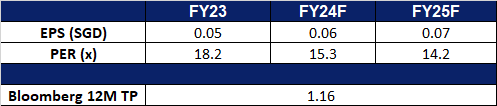

- Market Consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): More game launches

- BUY Entry – 345 Target – 385 Stop Loss – 325

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added (VAS) services, online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- New game launch. Tencent has announced the long-awaited release date of May 21 for its highly anticipated “Dungeon and Fighter” mobile game, marking the culmination of seven years of development. This mobile adaptation is based on the immensely popular “Dungeon and Fighter: Origin” computer game, originally developed by the Korean company Nexon, which stands as one of the world’s most profitable computer games. Although Tencent initially secured government approval for the game’s release in 2017, this approval was later revoked. However, the company successfully obtained a new license for the game in February of last year.

- More games approved in China. The Chinese National Press and Publication Administration disclosed the approval data for domestic online games in April, with a total of 95 games receiving approval. Previously, the number of approved domestic game versions had surpassed 100 for three consecutive months, and for two consecutive months (January and February 2024), it exceeded 110. In the first four months of this year, the total number of approved domestic game versions reached 428. The approval of an increasing number of new games underscores the ongoing recovery of China’s gaming market.

- Partnership with Toyota Motor. Tencent has recently revealed its plans to forge a strategic partnership with Toyota Motor, focusing on collaboration in artificial intelligence, cloud computing, and big data for electric vehicles marketed by the Japanese automaker in China. Toyota aims to collaborate with Tencent specifically on in-car software, which is pivotal for the advancement of next-generation vehicles, in a bid to expedite its progress in the automotive sector. Leveraging its extensive social networking service with over 1 billion users, Tencent is venturing into the automotive industry, anticipating substantial growth opportunities in this market.

- FY23 earnings. Revenue rose by 9.82% YoY to RMB609.0bn in FY23, compared to RMB554.6bn in FY22. Net profit fell by 37.4% to RMB118.0bn in FY23, compared to RMB188.7bn in FY22. Basic earnings per share rose to RMB16.7 in FY23, compared RMB12.1 in FY22.

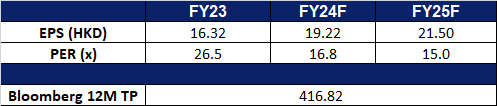

- Market consensus.

(Source: Bloomberg)

CGN New Energy Holdings Co. Ltd. (1811 HK): Tightening of carbon market

- RE-ITERATE BUY Entry – 2.30 Target – 2.50 Stop Loss – 2.20

- CGN New Energy Holdings Co Ltd is a company principally engaged in the operation of power plants. The Company operates its business through three segments. The Power Plants in Korea segment is engaged in the generation and supply of electricity. The Power Plants in the PRC segment is engaged in the generation and supply of electricity. The Management Companies segment is engaged in the provision of management services to power plants operated by CGN and its subsidiaries. The Company mainly operates wind, solar, gas-fired, coalfired, oil-fired, hydro, Cogen, fuel cell and biomass projects, which are in operation in the PRC and Korea power markets.

- Higher carbon prices driven by a tighter carbon market. China recently unveiled intentions to tighten regulations within its national carbon market, aiming to compel major polluters to reduce emissions, marking a significant stride towards fortifying a system that has thus far offered minimal support for climate mitigation efforts. These measures are poised to escalate demand for renewable energy and accelerate the decline of inefficient coal-fired power plants. The anticipation of fewer emission permits, coupled with plans to permit new participants in the market, has driven carbon prices to surpass 100 yuan, a milestone reached for the first time since the market’s inception in mid-2021. Consequently, this elevates the cost of carbon emissions for numerous producers, potentially incentivizing them to transition towards renewable energy sources.

China Carbon Prices

(Source: Bloomberg)

- Accelerating investments into green technology. During the annual National People’s Congress in March, Premier Li Keqiang unveiled plans to expedite investment in clean-energy initiatives. The objective is to cultivate a “new trio” of industries – namely, solar panels, electric vehicles (EVs), and lithium batteries – to serve as drivers of economic advancement, supplanting the “old trio” comprised of clothing, furniture, and appliances. China’s decision to intensify expenditure could propel this transformative shift forward, contributing to the realization of long-term climate objectives by advancing the timeline for reaching the peak in fossil fuel consumption and reducing greenhouse gas emissions. The heightened investment in green technology is poised to benefit entities involved in green energy provision, such as CGN New Energy Holdings.

- Transition to renewables. China has committed to achieving climate neutrality by 2060, marking a significant endeavor that is reshaping its energy landscape on a global scale. The country is leading the charge in renewable energy investments, resulting in a transformation of its power generation mix. According to a report by consulting firm DNV, the proportion of renewables in China’s total electricity generation is projected to surge from 30% at present to 55% by 2035 and further to 88% by 2050. This report underscores China’s substantial strides towards its objective of reducing net emissions to zero, envisioning a fivefold increase in renewables capacity by 2050. Consequently, China aims to reduce its share of global CO2 emissions from 33% to 22% by the same year, demonstrating a concerted effort towards environmental sustainability and climate mitigation.

- FY23 earnings. Revenue fell 9.76% YoY to US$2.19bn in FY23, compared to US$2.43bn in FY22. Net profit rose 30.4% to US$179.6mn in FY23, compared to US$214.4mn in FY22. Basic earnings per share rose to 6.24 US Cents in FY23, compared 4.55 US Cents in FY22.

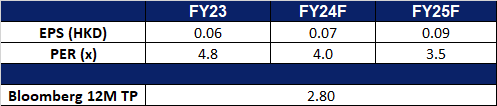

- Market consensus.

(Source: Bloomberg)

Micron Technology Inc (MU US): A dip-buying opportunity

- BUY Entry – 113 Target – 125 Stop Loss – 107

- Micron Technology, Inc., through its subsidiaries, manufactures and markets dynamic random access memory chips (DRAMs), static random access memory chips (SRAMs), flash memory, semiconductor components, and memory modules.

- Big tech AI gains. Recent big tech firms, Microsoft and Google, recent quarterly results exceeded expectations, driven by increased revenue from cloud computing, particularly fuelled by the growing use of artificial intelligence (AI) services. The competition between these tech giants in the AI space continues to intensify, with both leveraging AI to drive growth in their cloud computing units. Rising demand for cloud infrastructure from corporate clients is seen as a positive sign for the industry’s stability and growth potential, which bodes well for Micron Technology amid the AI boom. Micron is poised to gain as AI tech relies on high-bandwidth memory that the company produces.

- Benefitting from CHIPS act. Micron Technology is poised to receive over US$13bn in government funding and loans to establish memory chip factories in New York and Idaho, aligning with the Biden administration’s strategy to relocate supply chains from Asia. The funding package comprises US$6.1bn in direct funding and up to US$7.5bn in loans under the 2022 Chips Act. Micron intends to channel up to US$125bn into both states over the next two decades. With its latest memory chips integrated into Nvidia’s GPUs and Apple’s smartphones, Micron is pivotal in the tech landscape. The administration targets a 20% share of leading-edge chips produced in the US by 2030, aiming to reduce dependency on China. Micron’s history includes challenges in China, such as sanctions from the Cyberspace Administration. This investment underscores efforts to bolster American industry and diminish reliance on China. Moreover, Micron stands to benefit from investment tax credits and state incentives, with New York offering US$5.5bn. As the fourth chipmaker to secure funding under the program, Micron joins Intel, Taiwan Semiconductor Manufacturing, and Samsung. The initiative is forecasted to generate over 70,000 jobs, encompassing direct construction and manufacturing roles. Micron plans to adopt renewable energy across its facilities and invest in workforce training and childcare amenities, aligning with the increasing demands of artificial intelligence and fostering high-tech job creation in the US.

- 2Q24 earnings review. Revenue rose by 57.7% YoY to US$5.82bn, beating estimates by US$470mn. Non-GAAP EPS was US$0.42, beating estimates by US$0.66. In 3Q24, sales are expected to be within a range of US$6.4bn to US$6.8bn and earnings of between US$0.38 and US$0.52 per share, excluding one-time items.

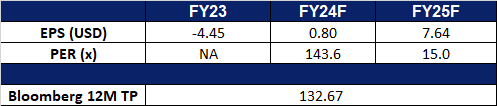

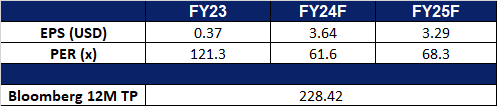

- Market consensus.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Expect a post-halving rally

- RE-ITERATE BUY Entry – 220 Target – 260 Stop Loss – 205

- Coinbase Global Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers consumers a primary financial account in the crypto economy; and a marketplace that provides institutional investors with a liquidity pool for trading crypto assets. It also provides technology and services that enable developers to build crypto products and securely accept crypto assets as payment.

- Bitcoin halving. Bitcoin’s mining reward was cut in half on 20 April 2024. This event, known as the halving, reduces the rate at which new Bitcoins are created. As a result, the supply of Bitcoin will decrease after the halving date. Historically, these halving events have been followed by 18-month bull market cycles for Bitcoin. The previous halvings occurred on 9 July 2016 and 11 May 2020.

- Market Outlook. Risky assets, such as stocks, have recently experienced a sell-off. This can be attributed to two factors: weaker-than-expected expectations for interest rate cuts and rising risk aversion due to geopolitical tensions. However, past trends suggest that these geopolitical events have a short-term impact, and risky assets typically recover quickly. While the market does not expect rate cuts as soon as initially anticipated, it is still expected to continue shaping economic activity in the next two years.

Bitcoin chart

(Source: Bloomberg)

- 4Q23 earnings review. Revenue rose by 51.6% YoY to US$954mn, beating estimates by US$135mn. GAAP EPS was US$1.04, beating estimates by US$0.01. Looking ahead, the company projects subscription and service revenue for 1Q24 to be between US$410mn and US$408mn, exceeding the consensus estimate of US$307mn.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Coinbase (COIN US) at US$220.