10 May 2024: ComfortDelGro (CD SP), Lenovo Inc. (992 HK), Nextera Energy Inc (NEE US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

Hong Kong

ComfortDelGro (CD SP): Improving locally

- BUY Entry – 1.42 Target– 1.50 Stop Loss – 1.38

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

- Tourism support. Chinese tourists flocked back to Singapore during China’s recent May Day holiday, with a significant increase in flight and hotel bookings reported by travel agencies. The removal of visa requirements and ongoing mutual visa exemption between Singapore and China have contributed to Singapore’s attractiveness as a tourist destination. Despite the recovery in visitor arrivals from China, first-quarter figures still lag behind pre-pandemic levels. Efforts by the Singapore Tourism Board (STB) to attract Chinese tourists include collaborations with celebrities and influencers, along with promotional events such as live-stream countdowns to concerts. Travel operators in Singapore noted a surge in bookings from Chinese tourists during the Labour Day holiday, with preferences for small-group travel and customized itineraries. These efforts to support tourism demand would, in turn, benefit the transportation sector in Singapore.

- Enhancing reliability and expanding its customer base. Gojek and ComfortDelGro Taxi began their partnership on 23 April, allowing rides not taken by drivers on one platform to be dispatched to the other’s platform. This collaboration aims to improve reliability by leveraging a larger combined driver pool. In the first phase which began on 29 April, Gojek rides not accepted by drivers will be transferred to ComfortDelGro’s platform, benefiting both drivers and commuters. The second phase, where Gojek receives untaken rides from ComfortDelGro, has no specific timeline yet. The partnership also involves exploring collaboration in areas like electric vehicles, insurance, driver training, and vehicle maintenance. As a result of this collaboration, drivers in ComfortDelGro’s two-shift taxi system will have access to a larger customer base in the initial phase and ComfortDelGro will be able to improve its reliability by leveraging a larger pool of drivers in the second phase.

- Green loan for decarbonisation. On 22 April, it was announced that ComfortDelGro secured a S$100mn green loan from DBS to purchase 135 electric buses for its UK subsidiary, Metroline. The buses, comprising double-deck and single-deck models, will replace internal combustion engine-powered ones, aiming to save 9,900 tonnes of CO2 emissions annually. This initiative aligns with CDG’s goal to transition 50% of its global bus fleet to cleaner energy vehicles by 2030 and 100% by 2050, displaying the company’s commitment to sustainability.

- FY23 results review. Revenue rose 2.6% YoY to S$3.88bn from S$3.78bn; normalised PATMI increased 26.6% YoY to S$180.5mn in FY23 from S$142.6mn in FY22. FY23 earnings per share was S$0.0833, up 4.3% YoY from S$0.0799. FY23 total dividend amounted to 6.66 sing cents per share.

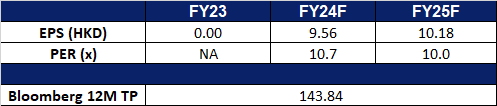

- Market Consensus

(Source: Bloomberg)

Banyan Tree Holdings Ltd (BTH SP): Growth in sustainability efforts

- RE-ITERATE BUY Entry – 0.38 Target– 0.42 Stop Loss – 0.36

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Secured new sustainable loan. Banyan Tree secured its first sustainability-linked loan worth S$70 million, led by Maybank, with support from the Bank of India and Hua Nan Commercial Bank. The loan reflects Banyan Tree’s commitment to responsible tourism and decarbonization, following its financial recovery from the pandemic. In FY23, the group saw a 23% increase in property sales from branded residences and extended-stay segments. Maybank emphasizes the need for timely and flexible financial solutions amid changing market conditions, highlighting its substantial mobilization in sustainable finance.

- Success in joint venture. Banyan Tree Residences Creston Hill, the inaugural luxury branded residences near Khao Yai National Park, celebrated the success of its presales phase valued at THB17bn. Managed by Banyan Tree in partnership with Creston Holding Ltd., the venture reflects a rising demand for upscale residences in Thailand. With presales surpassing THB1bn, its Managing Director anticipates increased interest with the unveiling of fully furnished display units. The project caters to the growing trend of luxury living amidst nature, appealing to permanent residents and holidaymakers. The strategic location, near the upcoming Motorway 6, enhances accessibility. The development offers 21 pool villas and 16 condominium buildings, designed to blend seamlessly with the serene landscape. Future phases will introduce additional villas and condominiums. Buyers benefit from Banyan Tree’s exclusive owner programme, “The Sanctuary Club,” granting privileges across global properties. Situated just 200km from Bangkok, Khao Yai offers diverse activities, making Creston Hill an ideal second home. The on-site sales gallery welcomes prospective buyers with exclusive promotions during the presales period.

- 30th anniversary new launches. Banyan Tree announced a robust pipeline of 19 new property openings. Under the new corporate brand umbrella, Banyan Group, the company expanded beyond its luxury offerings with brands like Angsana, Cassia, and Dhawa. New destinations include Japan, Saudi Arabia, Vietnam, and South Korea. Sustainability commitments include a 2030 Sustainability Roadmap aligned with UN targets. Laguna Lakelands in Phuket promises immersive living with nature-integrated development. New initiatives include Beyond, a digital companion for holistic experiences, and withBanyan, an experiential members program.

- Segmental split. Banyan Group previously announced plans to split its hotel and property development segments into separate companies to boost investor confidence. Chairman Ho Kwon Ping revealed the restructuring plan, aiming to simplify the company’s complex business model and unlock value. The move comes as the company’s stock performance lags, down 85% from its peak in 2007. The pandemic accelerated the need for restructuring, with a focus on selectively developing properties in Thailand and expanding hotel management globally. Despite recent losses due to COVID-19, the company anticipates growth, with plans to reach 100 hotels by year-end. The property development arm remains a unique strength, offering quicker returns compared to hotel ownership. Banyan’s residential projects aim to tap into strong demand for homes, positioning the company for future growth while maintaining a focus on its home market.

- FY23 results review. FY23 revenue inclined by 21% to S$327.9mn. Net profit rose significantly to S$31.7mn, compared to S$767,000 in FY22. FY23 operating profit more than doubled to S$90.1mn. It declared a final dividend of S$0.012 for FY23.

- Market Consensus

(Source: Bloomberg)

Lenovo Inc. (992 HK): High expectations for AI PC

- BUY Entry – 9.80 Target –10.60 Stop Loss – 9.40

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Launch of ThinkPad P1 Gen 7 and other AI PCs. Lenovo has recently unveiled a lineup of AI-powered laptops, highlighted by the ThinkPad P1 Gen 7, which boasts a unique blend of workstation expertise, high AI performance, and exceptional portability. These advanced AI technologies embedded in the laptops promise to revolutionize professionals’ interaction with AI workflows. Featuring the latest CPUs, NPUs, and GPUs from Intel and Nvidia, the ThinkPad P1 Gen 7 delivers unparalleled power and efficiency to tackle demanding AI tasks effectively. Moreover, it stands as the world’s inaugural mobile workstation to integrate LPDDR5x LPCAMM2 memory, a collaboration between Micron and Lenovo, providing one of the swiftest and most energy-efficient modular memory solutions for PCs.

- Increasing partnerships to increase AI portfolio. Lenovo has forged strategic alliances with leading U.S. chip companies like Intel Corp and Qualcomm Inc. to pioneer AI-powered PCs, catering to the escalating need for intelligent productivity solutions. The latest AI PC lineup from Lenovo introduces an AI assistant named “Xiao Tian,” driven by Alibaba’s Tongyi Qianwen model. Additionally, Lenovo has previously disclosed a partnership with Baidu to integrate Baidu’s advanced generative AI technology into its smartphones. These collaborations with key industry players position Lenovo at the forefront of AI innovation, enhancing value propositions for customers and consequently driving demand for its AI PC series.

- PC demand recovery. PC demand has shown signs of recovery and is expected to continue recovering in 2024, after a demand slump in 2023. The worldwide traditional PC market returned to growth during 1Q24 with 59.8mn shipments, growing 1.5% YoY, according to preliminary results from the International Data Corporation (IDC). AI technology is also expected to propel the global PC market in 2024, with increasing demand for PCs equipped with new AI technologies. Furthermore, suppliers are also gearing up more for replacement demand, where many consumers are expected to replace their PCs, accessories, and peripherals after more than 2 years of usage since the digital boom during the Covid-19 pandemic.

- 3Q24 results. Revenue rose by 2.97% YoY to US$15.7bn in 3Q24, compared to US$15.3bn in 3Q23. Net profit fell by 22.8% YoY to US$337mn in 3Q24, compared to US$437mn in 3Q23. Basic EPS fell to US2.81cents in 3Q24, compared to US3.65cents in 3Q23.

- Market consensus.

(Source: Bloomberg)

Baidu, Inc. (9888 HK): To benefit from a deal with Tesla

- RE-ITERATE BUY Entry – 109 Target –119 Stop Loss – 104

- Baidu Inc is a Chinese language Internet search provider. The Company offers a Chinese language search platform on its Baidu.com Website that enables users to find information online, including Webpages, news, images, documents and multimedia files, through links provided on its Website. The Company operates through two segments, Baidu Core segment and iQIYI segment. Baidu Core mainly provides search-based, feed-based, and other online marketing services, as well as products and services from the Company’s new artificial intelligence (AI) initiatives. Within Baidu Core, the Company’s product and services offerings are categorized as Mobile Ecosystem, Baidu AI Cloud and Intelligent Driving & Other Growth Initiatives. iQIYI is an online entertainment service provider that offers original, professionally produced and partner-generated content on its platform.

- Partnership with Tesla. Baidu has recently finalized an agreement with Tesla, granting the car manufacturer access to its mapping license for data collection on China’s public roads. This agreement marks the resolution of a key regulatory requirement for Tesla’s driver assistance system, known as Full Self Driving (FSD), to be introduced in China. Under the terms of the deal, Baidu will also supply its lane-level navigation system to Tesla. With the mapping service license in place, Tesla gains the legal authorization to deploy its FSD software on Chinese roads, allowing its vehicle fleets to collect data on road configurations, traffic signals, and surrounding infrastructure.

- 1st in AI patent application. Baidu maintains its top position in national rankings for artificial intelligence patent applications and authorizations, demonstrating its commitment to fostering technological innovation and advancing new productive forces. By the end of 2023, the company had submitted 19,308 AI-related patent applications and received 9,260 patents, securing its leading position among domestic tech firms for six consecutive years, as reported. Additionally, Baidu leads in patents for AI-powered large language models, with 869 applications and 317 patents granted in this field.

- Release of new AI tools. Baidu recently unveiled user-friendly AI tools enabling individuals without coding expertise to develop specialized generative AI-driven chatbots tailored for specific purposes. These chatbots can seamlessly integrate into websites, Baidu search results, and various online platforms. The basic Baidu tools are accessible for experimentation at no cost, subject to a usage threshold. Additionally, Baidu introduced three new iterations of its Ernie AI model – dubbed “Speed,” “Lite,” and “Tiny” – providing developers with selective access based on the complexity of their projects. These supplementary AI tools are poised to draw in a broader audience for Baidu. The company’s “Ernie bot,” has also amassed over 200mn users, with its application programming interface (API) being utilized 200mn times daily. Additionally, the chatbot has garnered 85,000 enterprise clients. In 4Q2023, Baidu generated significant revenue, totaling several hundred million yuan, by leveraging AI to enhance its advertising services and assist other companies in constructing their own models.

- FY23 earnings. Revenue increased by 8.8% YoY to RMB134.6bn in FY23, compared to RMB123.7bn in FY22. Non-GAAP Net income rose by 39.0% to RMB28.7bn in FY23, compared to RMB20.7bn in FY22. Non-GAAP diluted earnings per share rose to RMB80.85 in FY23, compared to RMB58.93 in FY22.

- Market consensus.

(Source: Bloomberg)

Nextera Energy Inc (NEE US): Foresee a power supply gap

- Entry – 72 Target – 80 Stop Loss – 68

- NextEra Energy, Inc. provides sustainable energy generation and distribution services. The Company generates electricity through wind, solar, and natural gas. Through its subsidiaries, NextEra Energy also operates multiple commercial nuclear power units.

- Electricity is the foundation of artificial intelligence. Since the beginning of this year, technology and chip giants have all discussed the gap in power supply in the wave of artificial intelligence. Even in the current environment of stubborn inflation and high interest rates, power companies are still actively increasing their investment in renewable energy power generation. The next few years will be the harvest period for the profit growth of power companies, and funds have been actively deployed in the power sector last year.

- Strong performance in both businesses. Nextera Energy operates two business segments, Florida Power & Light and NextEra Energy Resources. Nextera’s electric utility business, Florida Power & Light (FPL), generates most of its electricity from natural gas and added 100,000 more customers in the first quarter compared to the same quarter last year. FPL serves approximately 1.2 million customers with natural gas, propane, and electric service. This segment has benefited from Florida’s growing population and the presence of financial institutions and technology companies in the state. Additionally, Florida has historically been a popular destination for high-net-worth immigrants, further solidifying its customer base. NextEra Energy Resources (NEER) is Nextera Energy’s other business segment. This new energy segment focuses on developing and investing in renewable energy sources, such as nuclear, wind, solar, and energy storage. With ambitious growth plans, NEER aims to have an expected installed capacity of 12.1-14.6 gigawatts and 20.6-27.2 gigawatts in 2024 and 2025, respectively.

- 1Q24 earnings review. Revenue fell by 14.7% YoY to US$5.73bn, missing estimates by US$750mn. Non-GAAP EPS was US$0.91, beating estimates by US$0.13. In 2024, the company continues to expect adjusted earnings per share to be in the range of US$3.23 to US$3.43 vs US$3.40 consensus. For 2025 and 2026, it expects to grow 6% to 8%, off the 2024 adjusted earnings per share range, translating to a range of US3.45 to US$3.70 vs US$3.67 consensus for 2025 and US$3.63 to US$4.00 vs US$3.96 consensus for 2026.

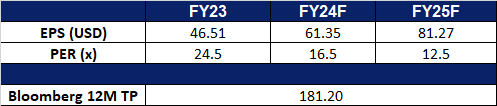

- Market consensus.

(Source: Bloomberg)

PDD Holdings Inc (PDD US): Temu staying on top

- RE-ITERATE Entry – 138 Target – 148 Stop Loss – 133

- PDD Holdings Inc. is a multinational commerce group that owns and operates a portfolio of businesses. The Company focuses on the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD Holdings has built a network of sourcing, logistics, and fulfilment capabilities for its underlying businesses.

- Government to increase support. The Communist Party’s Politburo announced plans to enhance support for China’s economy through prudent monetary and proactive fiscal policies, including adjustments to interest rates and bank reserve requirement ratios (RRR). While the economy showed faster-than-expected growth in the first quarter, it still faces challenges. The Politburo highlighted structural issues such as insufficient demand and risks in key sectors, emphasizing the need for flexible policy tools. China aims for around 5% economic growth in 2024, necessitating additional stimulus measures. The government plans to issue ultra-long-term special treasury bonds and accelerate the issuance of local government special bonds to maintain fiscal expenditure intensity. Additionally, reforms will be a focal point, aiming to address economic imbalances and promote a pro-market environment. Efforts to stabilize the housing market and optimize policy measures for new housing are also underway. The emphasis on developing “new productive forces” underscores the importance of innovation in driving economic growth. Investors will continue to be influenced by how the Chinese government implements policies to address its underlying economic issues, with the recently announced economic reforms and stimulus measures seen improving investor sentiment.

- Change in consumer patterns. Amidst rising inflation, American consumers are increasingly favoring the Chinese e-commerce platform Temu, which boasts a 17% market share in the US market. Temu, owned by PDD Holdings offers a wide range of products at competitive prices and is the top shopping app on Apple’s app store, surpassing giants like Amazon and Walmart. With orders shipped from China, Temu is now expanding its presence in the US by opening its marketplace to local warehouses, aiming to compete with Amazon’s fast delivery. This disruption in the US market from changing consumer preferences and economic challenges has ultimately benefitted Temu.

- Continued global growth. In the first quarter of 2024, Korean consumers’ direct purchases from China reached a new quarterly high of 938.4bn won (US$677mn), driven by the popularity of Chinese e-commerce platforms like Temu and AliExpress. This marked a 54% YoY increase and accounted for 57% of total direct purchases. Overall, online cross-border shopping reached 1.65tn won, with the United States and the European Union also significant contributors. Additionally, online shopping transactions within Korea reached a record high of 59.68tn won in the first quarter, driven by increased demand for travel, transportation services, and food items during the Lunar New Year holiday. Purchases made through mobile devices also saw a significant increase. Amid shifting global consumer preferences towards e-commerce and a preference for affordable goods, Temu has effectively expanded its customer base and is poised to capitalize on this persistent trend.

- Exceptional performance. PDD Holdings delivered better-than-expected earnings for the fourth quarter, driven by overseas expansion. Revenue reached 88.88bn yuan (US$12.4bn), up 123% YoY and surpassing analyst forecasts. Its Chairman and co-CEO highlighted 2023 as a pivotal year for the company’s development towards high-quality growth, with a commitment to improving consumer experiences and technology innovation in 2024. The company’s full-year revenue increased by 90% YoY to 247.64bn yuan, with plans to focus on supporting high-quality supply and enhancing service delivery. Despite challenges in China’s economy, PDD’s overseas platform Temu gained popularity among American consumers for its affordable products. While facing scrutiny from American authorities regarding supply chain practices, PDD continues to expand its logistics capabilities and increase spending on advertising and promotions. PDD’s executives emphasized the importance of rational consumption upgrades and announced plans to invest in technology and agriculture to continue to drive growth in 2024.

- 4Q23 earnings review. Revenue rose by 113.26% YoY to US$12.35bn, beating estimates by US$1.50bn. EPS was US$2.41, beating estimates by US$0.75. In 2024, the company will continue to ramp up its support for high-quality supply and enhance its ability to deliver good value and excellent service.

- Market consensus.

(Source: Bloomberg)

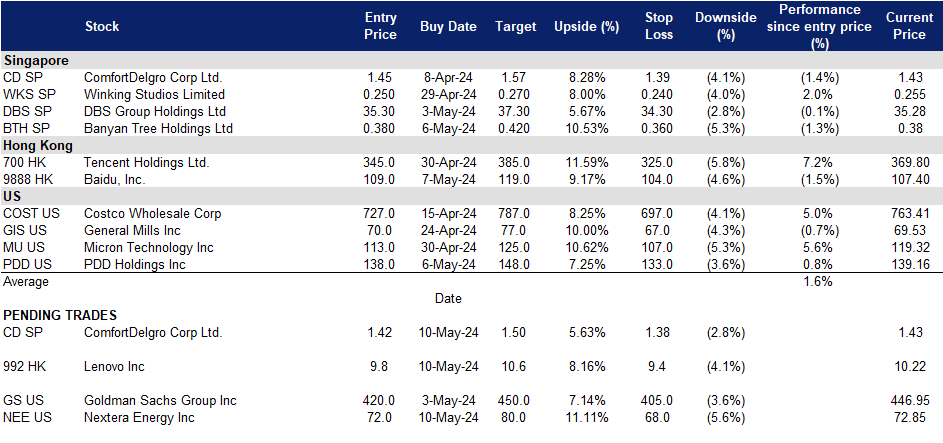

Trading Dashboard Update: Take profit on China Mobile Ltd (941 HK) at HK$70.40 and CGN New Energy Holdings Co. Ltd. (1811 HK) at HK$2.50. Add Winking Studios Limited (WKS SP) at S$0.25, DBS Group Holdings Ltd (DBS SP) at S$35.3 and Banyan Tree Holdings Ltd (BTH SP) at S$0.38. Cut loss on Genting Singapore Ltd (GENS SP) at S$0.875.