KGI Daily Trading Ideas – 12 January 2021

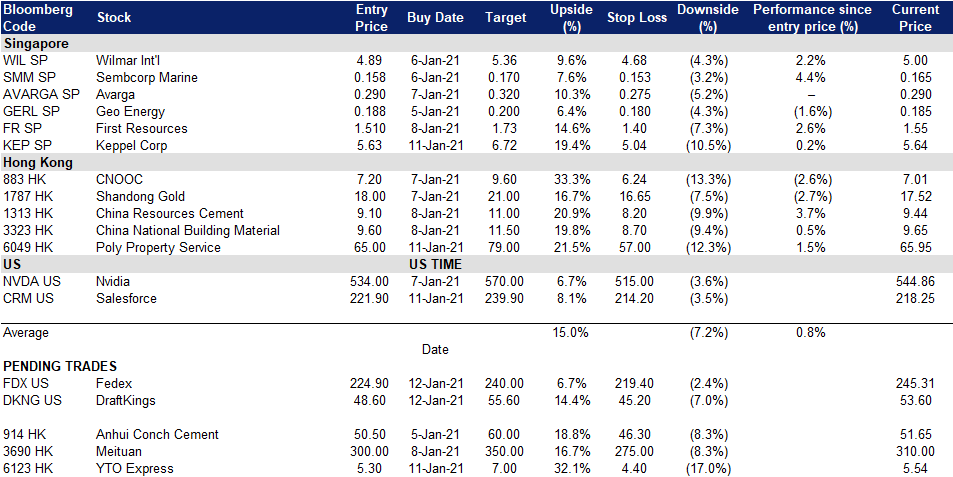

Trading Dashboard

IPO Watch

- Affirm Holdings is expected to trade Wednesday, 13 January 2021. Prior IPO pricing range was US$33-38.

- Yesterday, it raised the IPO range to US$41-44, implying that it will raise as much as US$1.08 billion if priced at the high end.

- Given the rise in IPO range, we are more certain that Affirm will see a pop in first day trading. We think a doubling of share price on first day trading is a strong possibility. Read our short write-up on 8 January here.

Market Movers – What’s Hot

Global/Macro

Big US banks will kick off the corporate earnings season with JPMorgan (JPM US), Citigroup (C US) and Wells Fargo (WFC US) posting their fourth-quarter results this Friday (15 Jan). As the global economy emerges from the recession in 2020, investors will be paying more attention to cyclical stocks such as financials, industrials, energy and commodities.

United States

- Twitter (TWR US) -6.41% after announcing a permanent ban on U.S. President Donald Trump’s account.

- Nio (NIO US) -4.8% in AH after the company proposed US$650mn in senior notes due 2026 and US$650mn in convertible senior notes due 2027.

- Tesla (TSLA) -7.8% after 11 consecutive trading days in the green. Tesla remains the 5th biggest company in the US by market cap.

Hong Kong

- Fuyao Glass Industry Group Co Ltd (3606 HK) +14.08%, closing at a record high of HK$52.25. The company proposed to issue and place not more than 101,126,240 additional H Shares. The issue price of the issuance shall not be less than 80% of the average closing price of the first five trading days prior to the date on which the placing or subscription price is determined. Part of the proceeds will be used to expand the photovoltaic glass market.

- BYD Company (1211 HK) +6.66%, closing at HK$256.2, setting another record high. Citi Group raised its TP to HK$339 from HK$276.1, maintaining OVERWEIGHT rating. The company launched three new auto models with applications of DM-i super hybrid technology.

- Haidilao International Holding Ltd (6862 HK) -7.55%, closing at HK$63.02. Some shareholders executed a 75mn shares placement at prices ranging from HK$62.2 to HK$64.2. Total transaction amount was about HK$4.716bn.

Singapore

- iFAST (IFAST SP) +8.6% closing at S$3.79, almost back to where it was trading before it announced that it did not win the coveted digital banking license in Singapore. We think the strength in its share price reflects optimism over its other projects, particularly the joint bid with Hong Kong’s PCCW to digitise and centralise the territory’s pension system.

- Palm oil companies Golden Agri (CGR SP) +8.1% and First Resources (FR SP) +5.4% as investors rotate away from industry-leader Wilmar International (+8% YTD).

US Trading Ideas

FedEx (FDX US): Strong pullback but numbers intact

- BUY Fedex (FDX US): Entry – 224.90 Target – 240 Stop Loss – 219.40.

- Fedex is one of the world’s largest express transportation company, offering global cargo shipping and delivery services.

- Fedex’s share price has been steadily retreating after reaching an all-time high in December, fuelled by e-commerce tailwinds.

- We see the 200 EMA as a safe entry point for a technical rebound, should the shares continue declining.

DraftKings (DKNG US): Twin beneficiaries to continue the updraft

- BUY DraftKings Inc (DKNG US) Entry – 48.6 Target 55.6 Stop Loss – 45.2

- DraftKings is one of the largest US fantasy sports contest and sports betting operator.

- The legalisation of online sports betting, as well as COVID-19 pandemic in the US, has driven DraftKings’ share price up 5x since March 2020 lows.

- Currently, 20 states have a form of legalised sports betting, with 6 more likely to legalise in 2021 and another 14 in 2022.

- New York lawmakers have recently filed for an online sports betting bill, while New York governor Andrew Cuomo has also recently spoke of his support for the motion.

HK Trading Ideas

Meituan (3690 HK): To deliver short-term outperformance

- RE-ITERATE BUY Meituan Entry – 300 Target – 350 Stop Loss – 275

- Meituan operates as a web-based shopping platform for locally sourced consumer products and retail services. The Company offers deals of the day by selling vouchers on local services and entertainment, dining, delivery, and other services. Meituan provides its services throughout China.

- The company announced that it is taking a 20% stake in Dossen International Group which runs more than 3,000 hotels in China and has 35mn registered paid members. The move marks Meituan’s entry into the hotel business.

- Among all the tech giants, Meituan has the least exposure to trade tensions and external geopolitical risks. With COVID infection cases rising in China, the market sentiment has gradually shifted preference back to some of the COVID plays.

- RSI shows positive upward momentum.

Anhui Conch Cement (914 HK): Rebound driven by Asia’s economic, urbanisation and population growth

- RE-ITERATE BUY Entry – 50.5 Target – 60.0 Stop Loss – 46.3

- The company is Asia’s largest cement producer. Share price weakness due to the reasons below. But we think share price has already priced in the headwinds, and we expect a rebound soon.

- The northern part of China is suffering from a serious haze problem this winter season and authorities are restricting the operation of infrastructure projects in several regions.

- Demand from the southern part of China has weakened due to more rainy days.

- 4Q20 cement price is expected to drop YoY but slightly trend up QoQ.

SG Trading Ideas

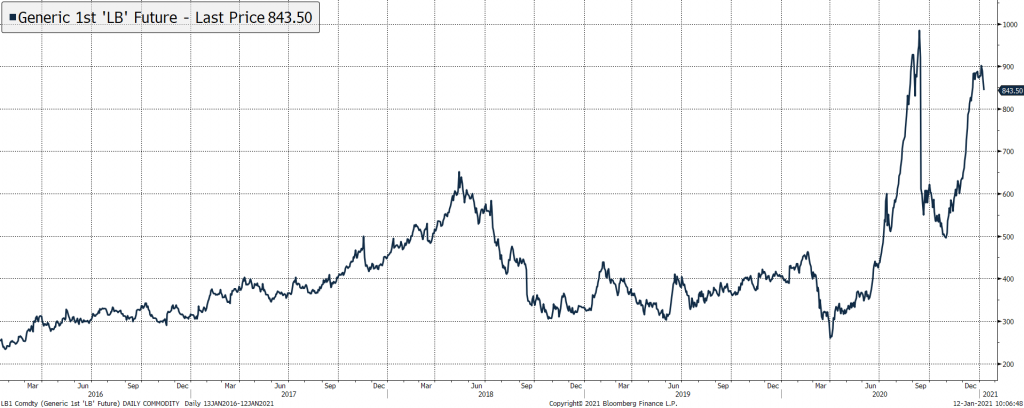

Avarga (AVARGA SP): Set to benefit from strong US housing demand and fiscal stimulus

- RE-ITERATE BUY AVARGA Entry – 0.29 Target – 0.32 Stop Loss – 0.275

- Avarga’s main business contributor, Taiga Building Products (TBL CN; 70.8%-owned by Avarga), runs a business of lumber and other building materials distribution in North America.

- TBL is benefiting from high lumber prices driven by strong housing starts in the US, as well as expectations of increased infrastructure stimulus that would lead to higher demand for building materials.

- AVARGA is a compelling short-term trade as its Canadian-listed TBL makes new multi-year highs. We have a fundamental fair value of S$0.43 on AVARGA.

Keppel Corp (KEP SP): The long-awaited strategic review of its O&M business finally set to conclude

- RE-ITERATE BUY KEP Entry – 5.62 Target – 6.72 Stop Loss – 5.04

- Last October, KEP announced a strategic review that involved the divestment of S$17.5bn worth of assets as part of its asset-light business model. The focus will likely be on its offshore & marine (O&M) segment, which management indicates could include both organic and inorganic options.

- As per management’s discussions back then, KEP is expected to announce the outcome of the strategic review of the O&M segment in the first week of February 2021 (100 days from 29 October 2020).

- We believe this could be a strong catalyst for the re-rating of KEP’s share price, similar to the outperformance of Sembcorp Industries (+98% share price appreciation from six months ago) after it divested Sembcorp Marine.

- KEP announces its 2020 full-year results on 28 January 2021.