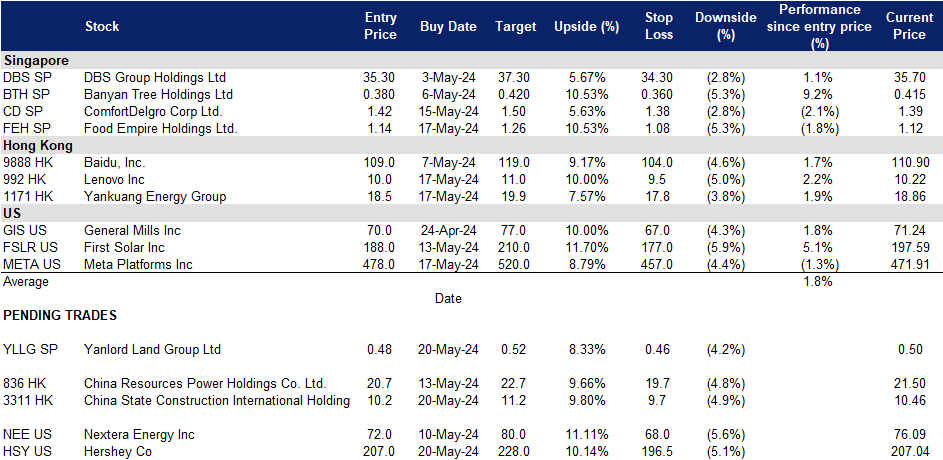

20 May 2024: Yanlord Land Group Ltd (YLLG SP), China State Construction International Holdings. (3311 HK), Hershey Co (HSY US)

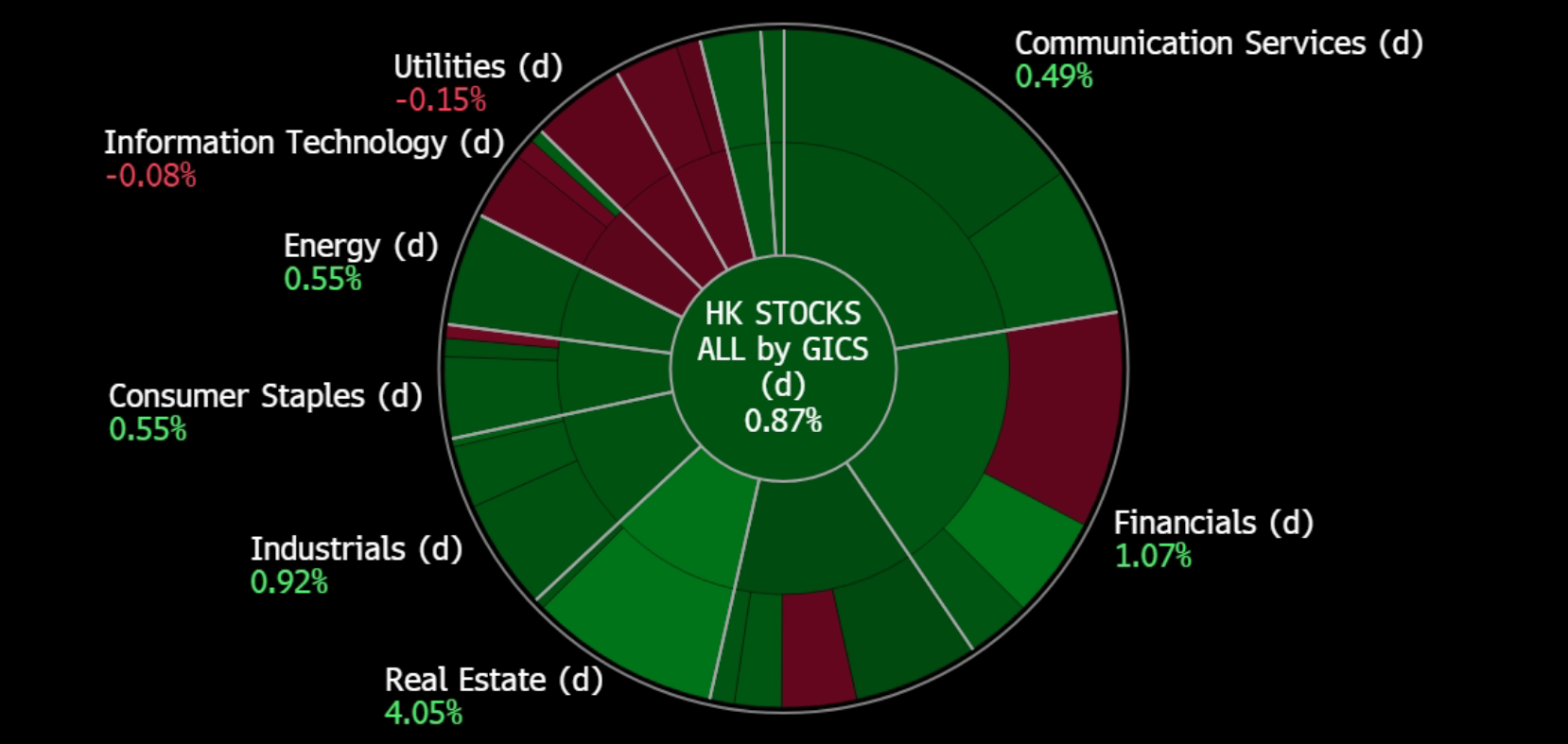

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Yanlord Land Group Ltd (YLLG SP): More Bail-out measures for property market

- BUY Entry – 0.48 Target– 0.52 Stop Loss – 0.46

- Yanlord Land Group Ltd is a real estate development company. The Company develops high-end residential property projects in the Peoples Republic of China.

- Rolling out new measures. China recently announced new measures to revive its struggling property industry after data showed housing prices have dropped nearly 10% since the beginning of the year. Local state-owned enterprises will be asked to purchase unsold homes from distressed developers at significant discounts using loans from state banks, with many of these homes to be converted into affordable housing. The government also emphasized the importance of advancing the “three big projects,” which include affordable housing, urban renovation, and public infrastructure development.

- Lending rates expected to be maintained or lowered. China is anticipated to maintain its benchmark lending rates steady on 20 May. However, there is increasing expectation for a cut in the mortgage reference rate to stimulate the housing market. The survey of 33 market watchers found that 82% expect the one-year and five-year Loan Prime Rates (LPRs) to remain unchanged. The one-year LPR, currently at 3.45%, is primarily used for new and outstanding loans, while the five-year LPR, serving as the mortgage reference rate, stands at 3.95% following a February cut. A minority of respondents predict potential cuts to the five-year LPR by 5 to 20 basis points. Despite industrial output exceeding forecasts, the property sector and weak retail sales continue to weigh on the economy. The central bank recently left a key policy rate unchanged due to a weak currency, complicating further monetary easing. Expectations for a mortgage rate cut are growing following measures aimed at rescuing the property market.

- Lowering requirements for purchase and lower mortgage rates. The People’s Bank of China announced the creation of a 300 billion yuan relending facility for affordable housing and further reductions in mortgage interest rates and down payment requirements. Effective Saturday, the interest rate for first-time housing provident fund loans under five years will be reduced by 0.25 percentage points to 2.35%, while the rate for loans over five years will decrease by 0.25 percentage points to 2.85%. Additionally, the minimum down payment for first homes will be lowered from 20% to 15% of the purchasing price, and for second homes, from 30% to 25%.

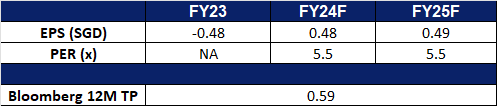

- FY23 financial results. Yanlord Land reported higher revenue of RMB43.4bn for FY23, up 51% YoY, compared to RMB28.7bn in FY22. Gross profit rose by 7% to RMB9.29bn, compared with RMB7.75bn in FY22. The company reported a net loss of RMB722mn for FY23, compared to a profit of RMB2.87bn in FY22. Basic earnings per share was -RMB0.4834 in FY23, compared to RMB0.7934 in FY22.

- Market Consensus

(Source: Bloomberg)

Food Empire Holdings Ltd. (FEH SP): Higher capacity to drive growth

- RE-ITERATE BUY Entry – 1.14 Target– 1.26 Stop Loss – 1.08

- Food Empire Holdings (Food Empire) is a multinational food and beverage manufacturing and distribution group headquartered in Singapore. Food Empire’s products are sold in over 60 countries, spanning North Asia, Eastern Europe, South-East Asia, Central Asia, the Middle East, and North America. The Group has 23 offices worldwide and operates 8 manufacturing facilities located in 5 countries.

- Increased capacity in Malaysia to enhance revenue. The group got the final approval from the Malaysian government for its non-dairy creamer expansion in Malaysia and commenced commercial production on 1st April. The ramp-up of capacity aims to boost non-dairy creamer sales to external parties in the region and is expected to improve revenue performance from 2Q24 onwards. The Group expects the added capacity to reach full utilisation over the next 2 to 3 years.

- Strong growth across all key markets. Food Empire Holdings saw a sustained increase in sales across all its core markets in 1Q24, showcasing a resilient consumer demand. Demand for the company’s products remained strong, seeing volume growth YoY, especially in the Southeast Asia and South Asia regions. The group continues to reap the benefits of its brand-building efforts in Vietnam, increasing its market share across the Vietnamese market. Demand for the group’s products in South Asia also remains strong amidst a coffee consumption boom in the region. Sales growth in the company’s Ukraine, Kazakhstan, and CIS markets also reported double-digit growth after FX losses. While the company reported a 3.2% YoY increase in its business in Russia, the company’s business in Russia achieved a top-line revenue increase of 27.4% in local currency terms, showcasing continued strong demand for the company’s products.

- Increased capacity in Malaysia to enhance revenue. The group got the final approval from the Malaysian government for its non-dairy creamer expansion in Malaysia and commenced commercial production on 1st April. The ramp-up of capacity aims to boost non-dairy creamer sales to external parties in the region and is expected to improve revenue performance from 2Q24 onwards. The Group expects the added capacity to reach full utilisation over the next 2 to 3 years.

- 1Q24 Business Updates. Food Empire reported higher revenue of US$117.5mn for 1Q24, up 14.5% YoY, compared to US$102.6mn in 1Q23, led by strong growth in its South-East Asia and South Asia market, which saw a growth of 35.3% and 33.0% respectively. The company saw revenue growth across its other key markets, showcasing resilience in consumer demand amidst ongoing geopolitical tensions worldwide, in a high interest rate environment.

- We have fundamental coverage with a BUY recommendation and a TP of S$1.35. Please read the full report here.

- Market Consensus

(Source: Bloomberg)

China State Construction International Holdings. (3311 HK): Property downtrend reversal

- BUY Entry – 10.20 Target 11.20 Stop Loss – 9.70

- China State Construction International Holdings Limited is an investment holding company principally engaged in construction contracts business. The Company is also engaged in infrastructure project investments, facade contracting business and infrastructure operation. The Company operates its business through four segments: Hong Kong, Mainland China, Macau and Overseas. Through its subsidiaries, the Company is also engaged in building construction, civil and foundation engineering works.

- Rolling out new measures. China recently announced new measures to revive its struggling property industry after data showed housing prices have dropped nearly 10% since the beginning of the year. Local state-owned enterprises will be asked to purchase unsold homes from distressed developers at significant discounts using loans from state banks, with many of these homes to be converted into affordable housing. The government also emphasized the importance of advancing the “three big projects,” which include affordable housing, urban renovation, and public infrastructure development.

- Lowering requirements for purchase and lower mortgage rates. The People’s Bank of China announced the creation of a 300 billion yuan relending facility for affordable housing and further reductions in mortgage interest rates and down payment requirements. Effective Saturday, the interest rate for first-time housing provident fund loans under five years will be reduced by 0.25 percentage points to 2.35%, while the rate for loans over five years will decrease by 0.25 percentage points to 2.85%. Additionally, the minimum down payment for first homes will be lowered from 20% to 15% of the purchasing price, and for second homes, from 30% to 25%.

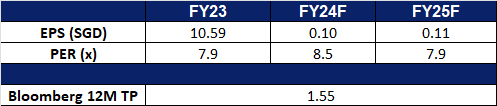

- FY23 earnings. Revenue increased 11.5% YoY to HK$113.7bn in FY23, compared with HK$102.0bn in FY22. Net profit rose 15.2% to HK$9.16bn in FY23, compared to HK$7.96bn in FY22. Basic earnings per share was HK$1.82 in FY23, compared to HK$1.58 in FY22.

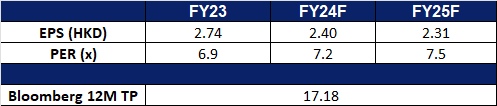

- Market consensus.

(Source: Bloomberg)

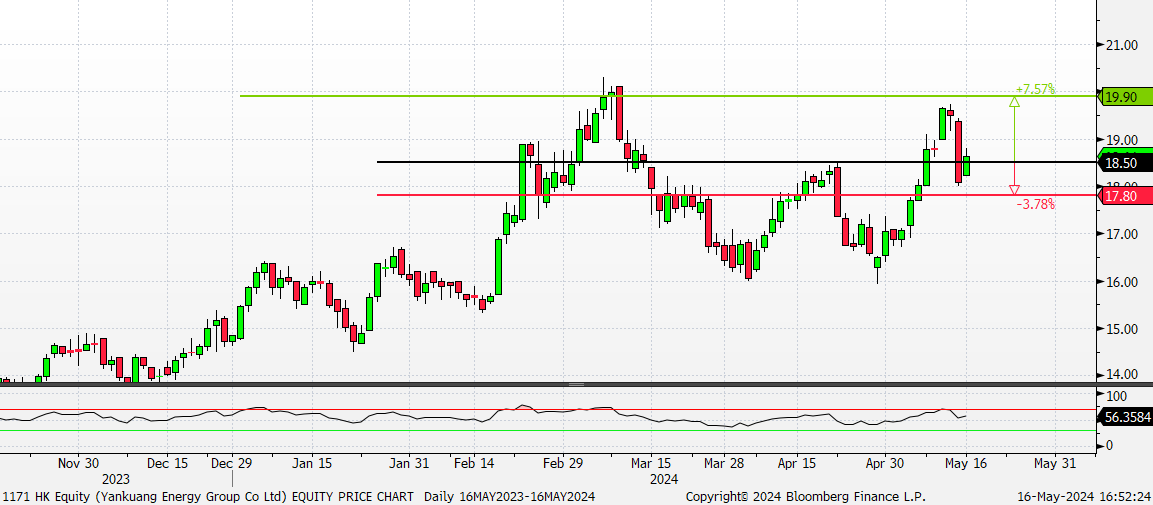

Yankuang Energy Group Co. Ltd. (1171 HK): Seasonal tailwinds

- RE-ITERATE BUY Entry – 18.50 Target 19.90 Stop Loss – 17.80

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- Increasing electricity demand and upcoming summer season. In 2024, China is projected to generate 9.96tn kilowatt hours (kWh) of power, as per the National Energy Administration, reflecting a growth rate of 5.3%. The International Energy Agency predicts a 5.1% rise in electricity demand, while the China Electricity Council anticipates a 6% increase, surpassing GDP forecasts. Additionally, the upcoming summer season is expected to further boost electricity demand as consumers turn to air conditioning to escape the rising temperatures. This expectation of higher electric demand is likely to translate into a higher demand for coal for power generation.

- Increasing coal stockpiles ahead of the summer season. Since the start of 2024, China has been steadily increasing its stockpile of coal. For the period from January to April, China’s coal imports amounted to 161.2mn mt, increasing 13.1% YoY. Just recently in April, China imported 45.3mn mt of coal, up 9.4% MoM and up 11.2% YoY. Strong levels of coal import highlight a continued strong demand for thermal coal, which will benefit Yankuang Energy Group.

- Plan to Buy Majority Stake in German Underground Mining Equipment Maker. Yankuang Energy recently announced plans to enhance its global market growth by acquiring a controlling stake in a German underground mining equipment manufacturer for approximately $34.9mn. This acquisition aims to expand Yankuang Energy’s mining equipment business, allowing the company to independently produce various equipment, including underground mining and auxiliary transport devices, thereby reducing equipment purchasing costs. Additionally, the deal will enable Yankuang Energy to leverage SMT Scharf’s service networks in multiple countries, strengthening its international market position in related businesses.

- 1Q24 earnings. Revenue fell 20.76% YoY to RMB39.6bn in 1Q24, compared with RMB50.bn in 1Q23. Net profit fell 41.85% to RMB3.76bn in 1Q24, compared to RMB6.46bn in 1Q23. Basic earnings per share was RMB0.51in 1Q24, compared to RMB0.86 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Hershey Co (HSY US): Decline in cocoa prices

- Entry – 207.0 Target –228.0 Stop Loss – 196.5

- The Hershey Company manufactures chocolate and sugar confectionery products. The Company’s principal products includes chocolate and sugar confectionery products, gum and mint refreshment products, and pantry items, such as baking ingredients, toppings, and beverages.

- Recent cocoa price decline. Cocoa prices have surged to nearly $10,000 per metric ton in March 2024, driven by a global shortage caused by climate change-induced droughts in West Africa, structural issues like underinvestment in cocoa farms, and increased investor speculation. This has led to higher costs for chocolate brands, many of which are passing these costs onto consumers, resulting in reduced demand and a shift towards other snacks. Some manufacturers are reducing product sizes or using less cocoa to cope. Cocoa prices dropped significantly to around US$7,277 per metric ton from record high of US$11,722 per metric ton earlier in the year, driven by a shortage of cocoa beans due to heavy rains and disease. This price decline was due to favourable climate changes which is expected to improve cocoa supply. Even though Hershey’s is largely covered on cocoa for the year, the decline in cocoa prices is beneficial for the company as will result in increased profit margins.

- New product varieties. Hershey recently showcased new products and retail strategies at the 2024 Sweets & Snacks Expo in Indianapolis, held from 14 May to 16 May, highlighting its expanding sweet and salty portfolio. New offerings include Reese’s Caramel Big Cup, Kit Kat Pink Lemonade, and Hershey’s Crunchy Waffle Cone Bars, among others. The company is also introducing Reese’s Medals for the Olympic Games. Hershey utilized augmented reality and image recognition to optimize merchandise placement and sales. With increasing foodservice demand, Hershey advises retailers to implement mobile ordering and foodservice features to enhance customer engagement. Effective merchandising at both assisted and self-checkout terminals is emphasized to maximize unplanned purchases and improve the shopping experience. Its new offerings cater to customer preferences, and the new flavours are likely to attract more customers to purchase these snacks.

- Delivered good results. Hershey exceeded Wall Street expectations for first-quarter sales and profit, driven by higher prices and steady consumer demand for its chocolates and candy. Despite raising prices to offset commodity costs, Hershey faced minimal resistance from customers, especially during holidays like Easter and Thanksgiving. Net sales rose 8.9% YoY to US$3.25bn, surpassing the expected US$3.11bn. Confectionary sales in North America, which makes up 80% of revenue, increased to US$2.70bn. Excluding items, earnings were US$3.07 per share, above the US$2.76 estimate. The company’s gross margin fell by 170 basis points to 44.9%.

- 1Q24 earnings review. Revenue rose by 8.7% YoY to US$3.25bn, beatings estimates by US$140mn. EPS was US$3.07, beating estimates by US$0.31. For 2Q24, it expects to deliver revenue between US$36.5bn to US$39.0bn. For FY24, Hershey expects net sales to increase by 2% to 3% versus estimated growth of 3.43% and adjusted earnings per share are expected to remain unchanged.

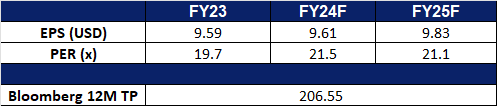

- Market consensus.

(Source: Bloomberg)

Meta Platforms Inc (META US): Prices bouncing back

- RE-ITERATE Entry – 478 Target –520 Stop Loss – 457

- Meta Platforms, Inc. operates as a social technology company. The Company builds applications and technologies that help people connect, find communities, and grow businesses. Meta Platform is also involved in advertisements, augmented, and virtual reality.

- US CPI trending downwards. US core consumer prices, which exclude volatile items such as food and energy, rose by 0.3% from the previous month in April of 2024, slowing from 0.4% increases in March and February, and in line with market expectations. From the previous year, core inflation slowed to 3.6% from 3.8% in the earlier month. Retail sales in the US were unchanged MoM in April 2024, following a downwardly revised 0.6% gain in March and defying market forecasts of 0.4% rise, suggesting consumer spending has slightly eased. The recent decrease in inflation data has given investors renewed hope that the US Federal Reserve will lower borrowing costs in September. Lowering interest rates will support the borrowing needs of technologically advanced companies like Meta for their expansion and research and development efforts.

- Discontinuation of Workplace. Meta Platforms is discontinuing Workplace, the enterprise version of Facebook, over the next two years. They plan to help existing customers transition to Zoom Video Communications’s Workvivo product. The company will focus on building AI and metaverse technologies and continue to focus on workplace-related products in the metaverse. The Workplace will continue to exist internally at Meta for company employees, even after it is shut down in August 2025. Customers will have access to their data until the end of May 2026. This will enable the company to dedicate fewer resources to its Workplace business and focus on developing its AI-related products, which will result in a decrease in manpower and operational costs.

- Integrating AI into our daily lives. In April, Meta launched its Meta AI chatbot on social media platforms such as Instagram, Facebook, Messenger, and WhatsApp. This chatbot is capable of generating text, answering questions, creating images, and more using real-time information from Google and Bing to provide responses. Additionally, Meta has expanded its AI chatbot to WhatsApp’s web version, enabling users to generate images through the chatbot. All images created using the chatbot are watermarked for authenticity. While the chatbot is still improving and may not be 100% accurate, users can create unique and engaging images to share on their various social media platforms. This integration of the AI chatbot into social media allows current users to access generative AI without the need to download another application, which may help ensure continued reliance on Meta’s applications. Meta has been enhancing its ad-buying products with AI tools to drive earnings growth and integrating more AI features into its social media platforms, such as chat assistants. Nevertheless, it may take some time before Meta realizes any new revenue streams from its AI endeavours.

- 1Q24 earnings review. Revenue rose by 27.3% YoY to US$36.46bn, beatings estimates by US$240mn. GAAP EPS was US$4.71, beating estimates by US$0.39. For 2Q24, it expects to deliver revenue between US$36.5bn to US$39.0bn. FY24 revenue guidance projects capital expenditures to be in the range of US$35bn to US$40bn, increased from a prior range of US$30bn to US$37bn. Meta expects total expenses of between US$96bn and US$99bn, tightening its previous forecast range of US$94bn to US$99bn.

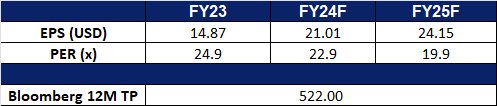

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on PDD Holdings Inc (PDD US) at US$148. Add Food Empire Holdings Ltd (FEH SP) at S$1.14, Lenovo Inc (992 HK) at HK$10, Yankuang Energy Group (1171 HK) at HK$18.5 and Meta Platforms Inc (META US) at US$478.