27 March 2025: Investment Product Ideas

Vanguard FTSE Europe ETF (VGK US)

- Investing in European Equities. This ETF tracks equities across 16 European countries, with the largest weightings in the United Kingdom, France, Switzerland, and Germany. It is well-suited for investors seeking exposure to developed European economies.

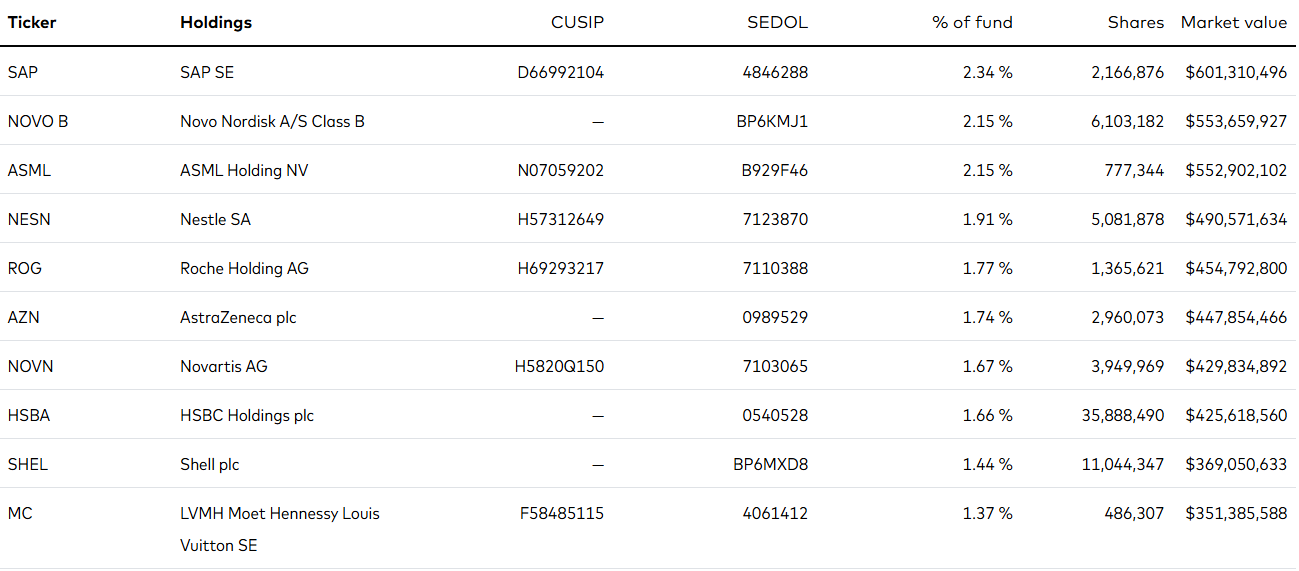

- Broad Holdings Exposure. This ETF holds over 1,200 constituents, with a strong tilt toward large-cap stocks, while mid and small cap allocations are relatively limited. The top five holdings include SAP, Novo Nordisk, ASML Holding, Nestlé, and Roche Holding. The top ten positions collectively account for approximately 18.53% of the portfolio.

- Low Expense Ratio. This ETF has an expense ratio of 0.06% which is among the lower levels in its category Its cost efficiency makes it an attractive option for investors seeking to minimize investment expenses.

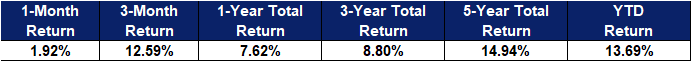

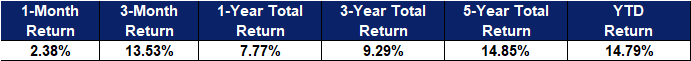

Fund Name (Ticker) | Vanguard FTSE Europe ETF (VGK US) |

Description | Vanguard FTSE Europe ETF is an exchange-traded fund incorporated in the USA. The ETF seeks to track the performance of the FTSE Developed Europe All Cap Index, which measures the investment return of stocks issued by companies located in the major markets of Europe. The ETF weights the holdings using a market capitalization methodology. |

Asset Class | Equity |

30-Day Average Volume (as of 25 Mar) | 5,155,993 |

Net Assets of Fund (as of 25 Mar) | $21,898,937,000 |

12-Month Yield (as of 25 Mar) | 3.07% |

P/E Ratio (as of 25 Mar) | 18.451x |

P/B Ratio (as of 25 Mar) | 2.079x |

Expense Ratio (Annual) | 0.06% |

Top Holdings

(as of 28 February 2025)

(Source: Bloomberg)

- Investing in developed European economies. This ETF holds stocks from more than a dozen developed European economies and is suitable for investors who want to reduce the volatility associated with their U.S. large-cap stock positions and diversify their exposure to stocks in the European region.

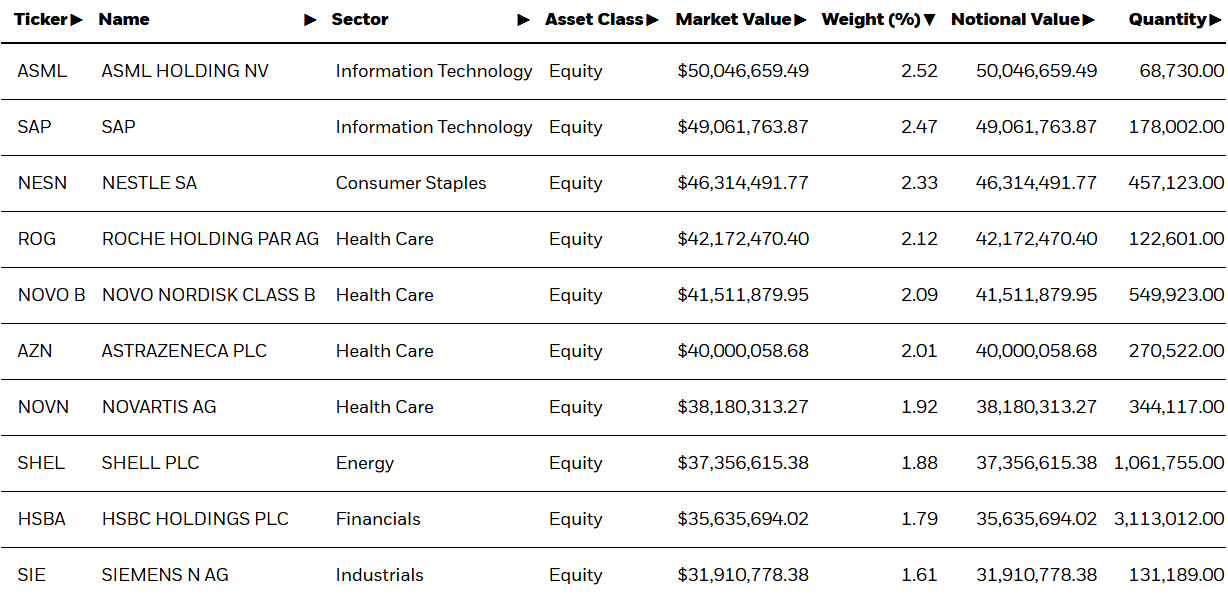

- Holding large-cap stocks. The ETF tracks the Standard & Poor’s Europe 350 Index and mainly holds large-cap stocks, including ASML Holdings, SAP, Nestle, Novo Nordisk and Roche Holding AG. The top ten holdings account for about 20.72%.

- Diversification of investment industries. The ETF portfolio covers multiple industries such as finance, pharmaceuticals, oil and gas exploration, defense, food, semiconductors, communications and media, avoiding excessive concentration in a single industry.

Fund Name (Ticker) | iShares Europe ETF (IEV US) |

Description | iShares Europe ETF is an exchange-traded fund incorporated in the USA. The Fund seeks investment results that correspond to the performance of the S&P Europe 350 Index. |

Asset Class | Equity |

30-Day Average Volume (as of 24 Mar) | 560,474 |

Net Assets of Fund (as of 25 Mar) | $2,000,750,934 |

12-Month Yield (as of 25 Mar) | 2.70% |

P/E Ratio (as of 24 Mar) | 17.53x |

P/B Ratio (as of 24 Mar) | 2.12x |

Expense Ratio (Annual) | 0.61% |

Top 10 Holdings

(as of 24 March 2025)

(Source: Bloomberg)