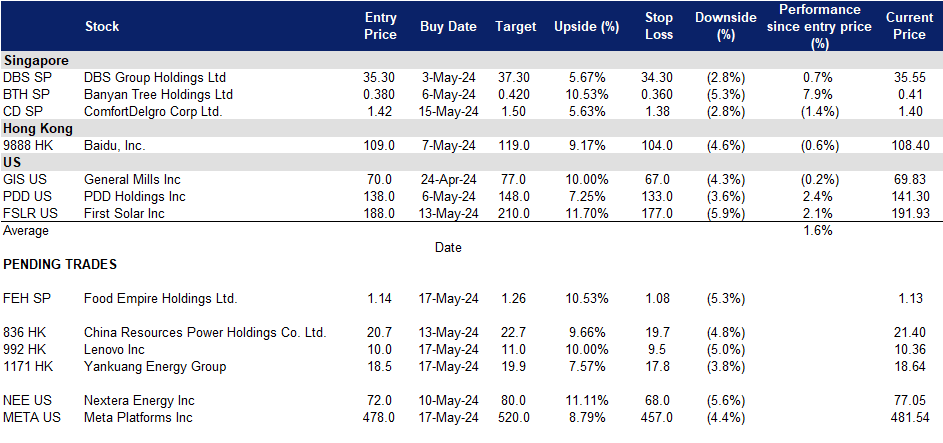

17 May 2024: Food Empire Holdings Ltd. (FEH SP), Yankuang Energy Group Co. Ltd. (1171 HK), Meta Platforms Inc (META US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

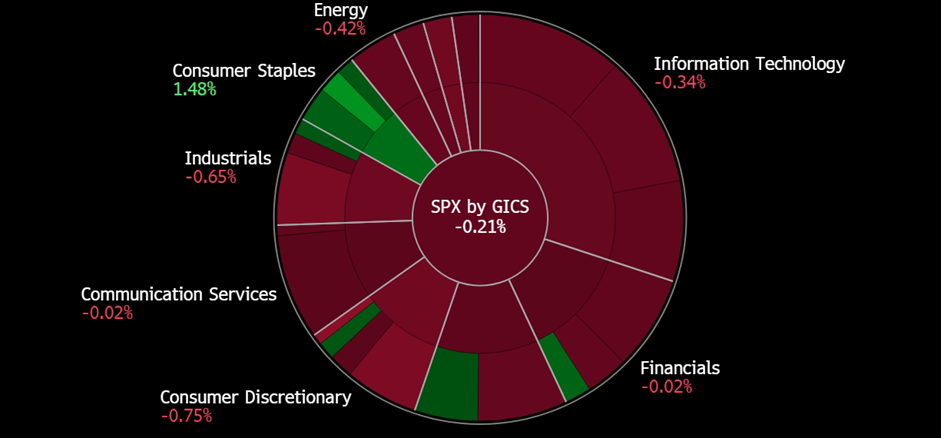

United States

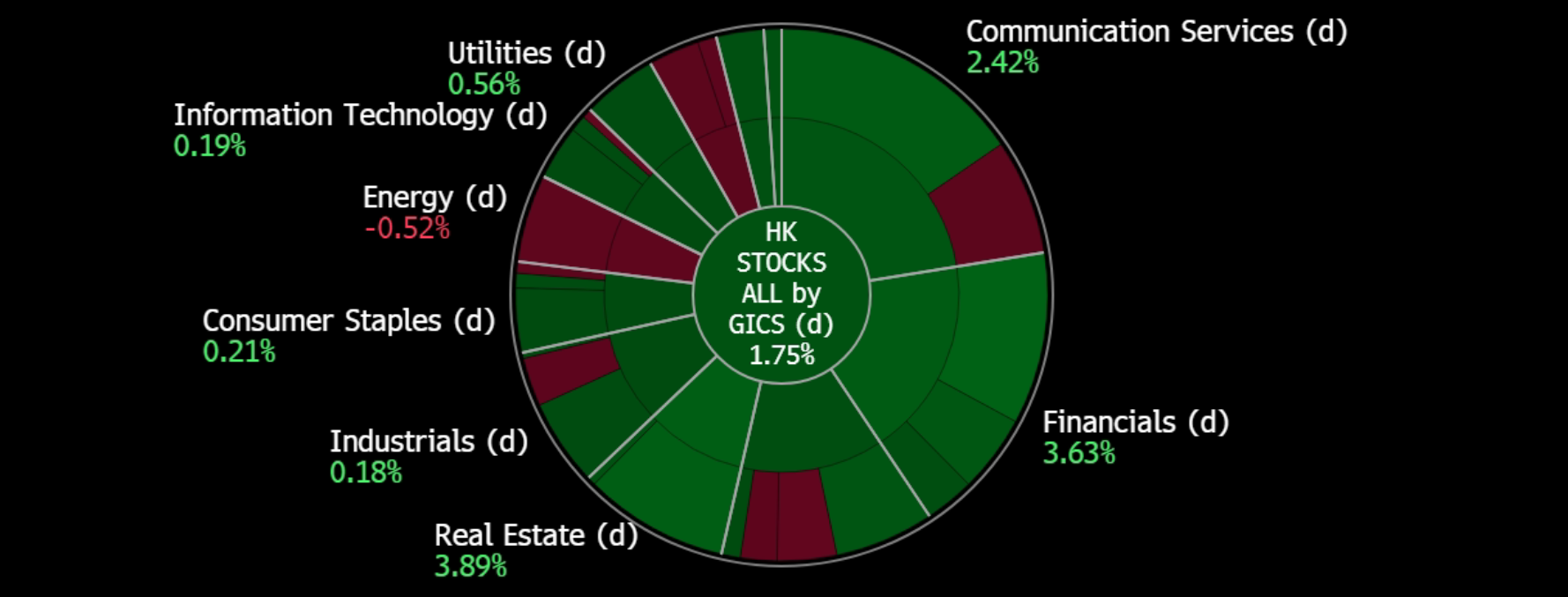

Hong Kong

Food Empire Holdings Ltd. (FEH SP): Higher capacity to drive growth

- BUY Entry – 1.14 Target– 1.26 Stop Loss – 1.08

- Food Empire Holdings (Food Empire) is a multinational food and beverage manufacturing and distribution group headquartered in Singapore. Food Empire’s products are sold in over 60 countries, spanning North Asia, Eastern Europe, South-East Asia, Central Asia, the Middle East, and North America. The Group has 23 offices worldwide and operates 8 manufacturing facilities located in 5 countries.

- Increased capacity in Malaysia to enhance revenue. The group got the final approval from the Malaysian government for its non-dairy creamer expansion in Malaysia and commenced commercial production on 1st April. The ramp-up of capacity aims to boost non-dairy creamer sales to external parties in the region and is expected to improve revenue performance from 2Q24 onwards. The Group expects the added capacity to reach full utilisation over the next 2 to 3 years.

- Strong growth across all key markets. Food Empire Holdings saw a sustained increase in sales across all its core markets in 1Q24, showcasing a resilient consumer demand. Demand for the company’s products remained strong, seeing volume growth YoY, especially in the Southeast Asia and South Asia regions. The group continues to reap the benefits of its brand-building efforts in Vietnam, increasing its market share across the Vietnamese market. Demand for the group’s products in South Asia also remains strong amidst a coffee consumption boom in the region. Sales growth in the company’s Ukraine, Kazakhstan, and CIS markets also reported double-digit growth after FX losses. While the company reported a 3.2% YoY increase in its business in Russia, the company’s business in Russia achieved a top-line revenue increase of 27.4% in local currency terms, showcasing continued strong demand for the company’s products.

- Increased capacity in Malaysia to enhance revenue. The group got the final approval from the Malaysian government for its non-dairy creamer expansion in Malaysia and commenced commercial production on 1st April. The ramp-up of capacity aims to boost non-dairy creamer sales to external parties in the region and is expected to improve revenue performance from 2Q24 onwards. The Group expects the added capacity to reach full utilisation over the next 2 to 3 years.

- 1Q24 Business Updates. Food Empire reported higher revenue of US$117.5mn for 1Q24, up 14.5% YoY, compared to US$102.6mn in 1Q23, led by strong growth in its South-East Asia and South Asia market, which saw a growth of 35.3% and 33.0% respectively. The company saw revenue growth across its other key markets, showcasing resilience in consumer demand amidst ongoing geopolitical tensions worldwide, in a high interest rate environment.

- We have fundamental coverage with a BUY recommendation and a TP of S$1.35. Please read the full report here.

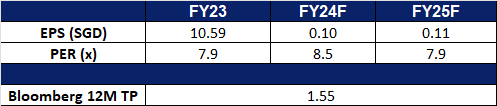

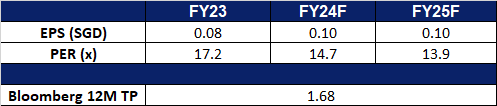

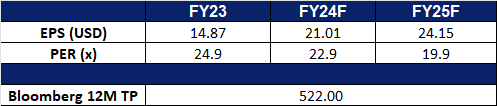

- Market Consensus

(Source: Bloomberg)

ComfortDelGro (CD SP): Improving locally

- RE-ITERATE BUY Entry – 1.42 Target– 1.50 Stop Loss – 1.38

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

- Tourism support. Chinese tourists flocked back to Singapore during China’s recent May Day holiday, with a significant increase in flight and hotel bookings reported by travel agencies. The removal of visa requirements and ongoing mutual visa exemption between Singapore and China have contributed to Singapore’s attractiveness as a tourist destination. Despite the recovery in visitor arrivals from China, first-quarter figures still lag behind pre-pandemic levels. Efforts by the Singapore Tourism Board (STB) to attract Chinese tourists include collaborations with celebrities and influencers, along with promotional events such as live-stream countdowns to concerts. Travel operators in Singapore noted a surge in bookings from Chinese tourists during the Labour Day holiday, with preferences for small-group travel and customized itineraries. These efforts to support tourism demand would, in turn, benefit the transportation sector in Singapore.

- Enhancing reliability and expanding its customer base. Gojek and ComfortDelGro Taxi began their partnership on 23 April, allowing rides not taken by drivers on one platform to be dispatched to the other’s platform. This collaboration aims to improve reliability by leveraging a larger combined driver pool. In the first phase which began on 29 April, Gojek rides not accepted by drivers will be transferred to ComfortDelGro’s platform, benefiting both drivers and commuters. The second phase, where Gojek receives untaken rides from ComfortDelGro, has no specific timeline yet. The partnership also involves exploring collaboration in areas like electric vehicles, insurance, driver training, and vehicle maintenance. As a result of this collaboration, drivers in ComfortDelGro’s two-shift taxi system will have access to a larger customer base in the initial phase and ComfortDelGro will be able to improve its reliability by leveraging a larger pool of drivers in the second phase.

- Green loan for decarbonisation. On 22 April, it was announced that ComfortDelGro secured a S$100mn green loan from DBS to purchase 135 electric buses for its UK subsidiary, Metroline. The buses, comprising double-deck and single-deck models, will replace internal combustion engine-powered ones, aiming to save 9,900 tonnes of CO2 emissions annually. This initiative aligns with CDG’s goal to transition 50% of its global bus fleet to cleaner energy vehicles by 2030 and 100% by 2050, displaying the company’s commitment to sustainability.

- FY23 results review. Revenue rose 2.6% YoY to S$3.88bn from S$3.78bn; normalised PATMI increased 26.6% YoY to S$180.5mn in FY23 from S$142.6mn in FY22. FY23 earnings per share was S$0.0833, up 4.3% YoY from S$0.0799. FY23 total dividend amounted to 6.66 sing cents per share.

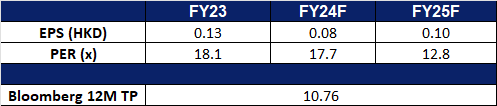

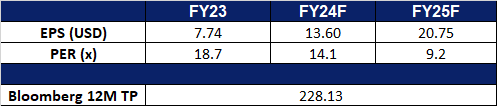

- Market Consensus

(Source: Bloomberg)

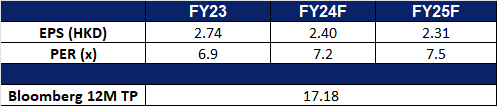

Yankuang Energy Group Co. Ltd. (1171 HK): Seasonal tailwinds

- BUY Entry – 18.50 Target 19.90 Stop Loss – 17.80

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- Increasing electricity demand and upcoming summer season. In 2024, China is projected to generate 9.96tn kilowatt hours (kWh) of power, as per the National Energy Administration, reflecting a growth rate of 5.3%. The International Energy Agency predicts a 5.1% rise in electricity demand, while the China Electricity Council anticipates a 6% increase, surpassing GDP forecasts. Additionally, the upcoming summer season is expected to further boost electricity demand as consumers turn to air conditioning to escape the rising temperatures. This expectation of higher electric demand is likely to translate into a higher demand for coal for power generation.

- Increasing coal stockpiles ahead of the summer season. Since the start of 2024, China has been steadily increasing its stockpile of coal. For the period from January to April, China’s coal imports amounted to 161.2mn mt, increasing 13.1% YoY. Just recently in April, China imported 45.3mn mt of coal, up 9.4% MoM and up 11.2% YoY. Strong levels of coal import highlight a continued strong demand for thermal coal, which will benefit Yankuang Energy Group.

- Plan to Buy Majority Stake in German Underground Mining Equipment Maker. Yankuang Energy recently announced plans to enhance its global market growth by acquiring a controlling stake in a German underground mining equipment manufacturer for approximately $34.9mn. This acquisition aims to expand Yankuang Energy’s mining equipment business, allowing the company to independently produce various equipment, including underground mining and auxiliary transport devices, thereby reducing equipment purchasing costs. Additionally, the deal will enable Yankuang Energy to leverage SMT Scharf’s service networks in multiple countries, strengthening its international market position in related businesses.

- 1Q24 earnings. Revenue fell 20.76% YoY to RMB39.6bn in 1Q24, compared with RMB50.bn in 1Q23. Net profit fell 41.85% to RMB3.76bn in 1Q24, compared to RMB6.46bn in 1Q23. Basic earnings per share was RMB0.51in 1Q24, compared to RMB0.86 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Lenovo Inc. (992 HK): High expectations for AI PC

- RE-ITERATE BUY Entry – 10.0 Target –11.0 Stop Loss – 9.50

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Launch of ThinkPad P1 Gen 7 and other AI PCs. Lenovo has recently unveiled a lineup of AI-powered laptops, highlighted by the ThinkPad P1 Gen 7, which boasts a unique blend of workstation expertise, high AI performance, and exceptional portability. These advanced AI technologies embedded in the laptops promise to revolutionize professionals’ interaction with AI workflows. Featuring the latest CPUs, NPUs, and GPUs from Intel and Nvidia, the ThinkPad P1 Gen 7 delivers unparalleled power and efficiency to tackle demanding AI tasks effectively. Moreover, it stands as the world’s inaugural mobile workstation to integrate LPDDR5x LPCAMM2 memory, a collaboration between Micron and Lenovo, providing one of the swiftest and most energy-efficient modular memory solutions for PCs.

- Increasing partnerships to increase AI portfolio. Lenovo has forged strategic alliances with leading U.S. chip companies like Intel Corp and Qualcomm Inc. to pioneer AI-powered PCs, catering to the escalating need for intelligent productivity solutions. The latest AI PC lineup from Lenovo introduces an AI assistant named “Xiao Tian,” driven by Alibaba’s Tongyi Qianwen model. Additionally, Lenovo has previously disclosed a partnership with Baidu to integrate Baidu’s advanced generative AI technology into its smartphones. These collaborations with key industry players position Lenovo at the forefront of AI innovation, enhancing value propositions for customers and consequently driving demand for its AI PC series.

- PC demand recovery. PC demand has shown signs of recovery and is expected to continue recovering in 2024, after a demand slump in 2023. The worldwide traditional PC market returned to growth during 1Q24 with 59.8mn shipments, growing 1.5% YoY, according to preliminary results from the International Data Corporation (IDC). AI technology is also expected to propel the global PC market in 2024, with increasing demand for PCs equipped with new AI technologies. Furthermore, suppliers are also gearing up more for replacement demand, where many consumers are expected to replace their PCs, accessories, and peripherals after more than 2 years of usage since the digital boom during the Covid-19 pandemic.

- 3Q24 results. Revenue rose by 2.97% YoY to US$15.7bn in 3Q24, compared to US$15.3bn in 3Q23. Net profit fell by 22.8% YoY to US$337mn in 3Q24, compared to US$437mn in 3Q23. Basic EPS fell to US2.81cents in 3Q24, compared to US3.65cents in 3Q23.

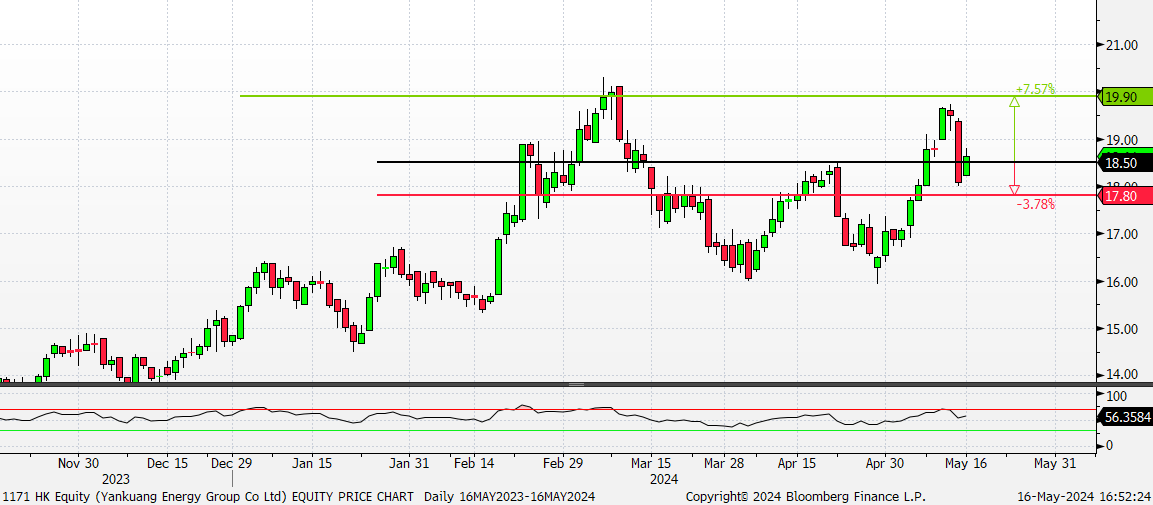

- Market consensus.

(Source: Bloomberg)

Meta Platforms Inc (META US): Prices bouncing back

- Entry – 478 Target –520 Stop Loss – 457

- Meta Platforms, Inc. operates as a social technology company. The Company builds applications and technologies that help people connect, find communities, and grow businesses. Meta Platform is also involved in advertisements, augmented, and virtual reality.

- US CPI trending downwards. US core consumer prices, which exclude volatile items such as food and energy, rose by 0.3% from the previous month in April of 2024, slowing from 0.4% increases in March and February, and in line with market expectations. From the previous year, core inflation slowed to 3.6% from 3.8% in the earlier month. Retail sales in the US were unchanged MoM in April 2024, following a downwardly revised 0.6% gain in March and defying market forecasts of 0.4% rise, suggesting consumer spending has slightly eased. The recent decrease in inflation data has given investors renewed hope that the US Federal Reserve will lower borrowing costs in September. Lowering interest rates will support the borrowing needs of technologically advanced companies like Meta for their expansion and research and development efforts.

- Discontinuation of Workplace. Meta Platforms is discontinuing Workplace, the enterprise version of Facebook, over the next two years. They plan to help existing customers transition to Zoom Video Communications’s Workvivo product. The company will focus on building AI and metaverse technologies and continue to focus on workplace-related products in the metaverse. The Workplace will continue to exist internally at Meta for company employees, even after it is shut down in August 2025. Customers will have access to their data until the end of May 2026. This will enable the company to dedicate fewer resources to its Workplace business and focus on developing its AI-related products, which will result in a decrease in manpower and operational costs.

- Integrating AI into our daily lives. In April, Meta launched its Meta AI chatbot on social media platforms such as Instagram, Facebook, Messenger, and WhatsApp. This chatbot is capable of generating text, answering questions, creating images, and more using real-time information from Google and Bing to provide responses. Additionally, Meta has expanded its AI chatbot to WhatsApp’s web version, enabling users to generate images through the chatbot. All images created using the chatbot are watermarked for authenticity. While the chatbot is still improving and may not be 100% accurate, users can create unique and engaging images to share on their various social media platforms. This integration of the AI chatbot into social media allows current users to access generative AI without the need to download another application, which may help ensure continued reliance on Meta’s applications. Meta has been enhancing its ad-buying products with AI tools to drive earnings growth and integrating more AI features into its social media platforms, such as chat assistants. Nevertheless, it may take some time before Meta realizes any new revenue streams from its AI endeavours.

- 1Q24 earnings review. Revenue rose by 27.3% YoY to US$36.46n, beatings estimates by US$240mn. GAAP EPS was US$4.71, beating estimates by US$0.39. For 2Q24, it expects to deliver revenue between US$36.5bn to US$39.0bn. FY24 revenue guidance projects capital expenditures to be in the range of US$35bn to US$40bn, increased from a prior range of US$30bn to US$37bn. Meta expects total expenses of between US$96bn and US$99bn, tightening its previous forecast range of US$94bn to US$99bn.

- Market consensus

(Source: Bloomberg)

First Solar Inc (FSLR US): Potential tailwinds from tariffs

- RE-ITERATE Entry – 188 Target –210 Stop Loss – 177

- First Solar, Inc. designs and manufactures solar modules. The Company uses a thin film semiconductor technology to manufacture electricity-producing solar modules.

- Potential tariff on China’s photovoltaic products. The Biden administration is expected to impose new tariffs on China’s products from three industries including semiconductor, electric vehicle, and solar. The US photovoltaic products will benefit from a new round of tariff as China’s import prices will become unattractively low. Futhermore, Europe could follow the US once the tariff is imposed.

- Data center electricity demand is expected to double by 2026. According to the International Energy Agency’s Power Report 2024, global electricity demand for data centers, cryptocurrency, and artificial intelligence is expected to nearly double by 2026, reaching 620 to 1,050 terawatt-hours (TWh), slightly above the base case of 800 TWh and up from 460 TWh in 2022.

- Solar demand is set to surge. Solar panel installations in the United States are projected to increase significantly in the coming years to meet soaring electricity demand, particularly driven by data centers, electric vehicles, and heating/cooling systems. Solar is one of the fastest-growing energy sources in the US, and is expected to expand substantially despite facing challenges such as permitting delays and rising capital costs. To meet the growing demand, solar companies plan to ramp up manufacturing capacity, buoyed by tax incentives in President Biden’s Inflation Reduction Act.

- 1Q24 earnings review. Revenue rose by 44.8% YoY to US$794mn, beatings estimates by US$7.19mn. GAAP EPS was US$2.20, beating estimates by US$0.22. FY24 revenue guidance projects net revenue of US$4.4bn to US$4.6bn, above the market consensus of US$4.51bn. EPS of US$13 to US$14, versus the market consensus of US$13.60. Sales orders are expected to be 78.3 GW.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Micron Technology Inc. (MU US) at US$125.0 and Tencent Holdings Ltd (700 HK) at HK$400. Add ComfortDelgro (CD SP) at S$1.42 and First Solar (FSLR US) at US$188.0. Cut loss on ComfortDelgro (CD SP) at S$1.39.