25 May 2023: Wealth Product Ideas

|

Fund Name (Ticker) |

JPM Japan Equity A (acc) – JPY (LU0235639324) |

|

Description |

To provide long-term capital growth by investing primarily in Japanese companies. |

|

Asset Class |

Asset |

|

Inception Date |

16/11/1988 |

|

30-Day Average Volume |

N.A. |

|

Net Assets of Fund (as of 23 May) |

JPY 289.96B |

|

12-Month Trailing Yield |

N.A. |

|

P/E Ratio (as of 23 May) |

22.350 |

|

P/B Ratio |

N.A. |

|

Management Fees |

1.5% |

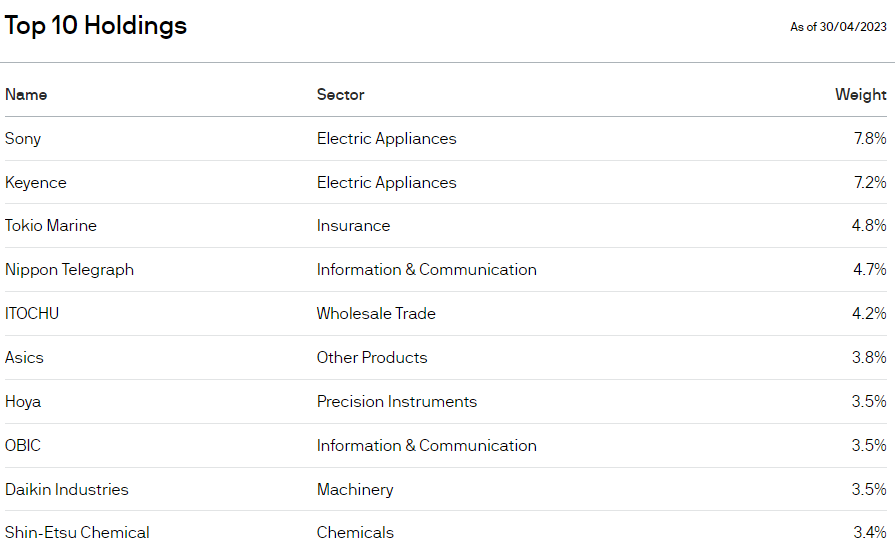

Top 10 Holdings (as of 30 April 2023)

(as of 30 April 2023)

BUY Entry –1,680 Target – 1,800 Stop Loss – 1,620

- Japan’s economy recovering after the lifting of Covid restrictions.

- Services PMI rose to a record high of 56.3 in May 2023 from 55.4 in April, showing further expansion in the service sector for the ninth consecutive month.

- Tourist arrivals have continued their upward trend, rising from 1,817,500 in March 2023 to 1,949,100 in April.

- 1Q23 GDP grew 0.4% QoQ and 1.3% YoY. GDP expanded at an annualized rate of 1.6% in 1Q23, and inflation rose to 3.5% in April.

- Nikkei Index hit a 33-year high on Tuesday (22 May 2023), up over 20% YTD.

- During the recent Berkshire’s AGM, Warren Buffett believed that Japanese stocks were bargains and considered increasing stakes in the Japanese market

- Currently, Berkshire’s Japanese market holdings are worth about US$15bn, compared to the $6bn when he entered positions three years ago .

- Berkshire has raised its stakes on five Japanese stocks from about 5% in 2020 to around 7.4% across the board now.

- JPY is viewed as one of the safe-haven currencies

- JPY depreciates against USD, however, it will eventually revert back to its previous levels when Japan economy recovers while US economy enters a recession, potentially returning investors with Japan market exposures FX gains.

Source: Bloomberg

|

Fund Name (Ticker) |

Schroder International Selection Fund Global Gold (LU1223082279) |

|

Description |

The fund aims to provide capital growth in excess of the FTSE Gold Mines Index after fees have been deducted over a three to five-year period by investing in equities of companies in the gold industry. |

|

Asset Class |

Equity |

|

Inception Date |

29/06/2016 |

|

Net Assets of Fund (as of 23 May) |

US$505.12M |

|

12-Month Trailing Yield |

N.A. |

|

P/E Ratio |

N.A. |

|

P/B Ratio (as of 23 May) |

1.246 |

|

Management Fees |

0.75% |

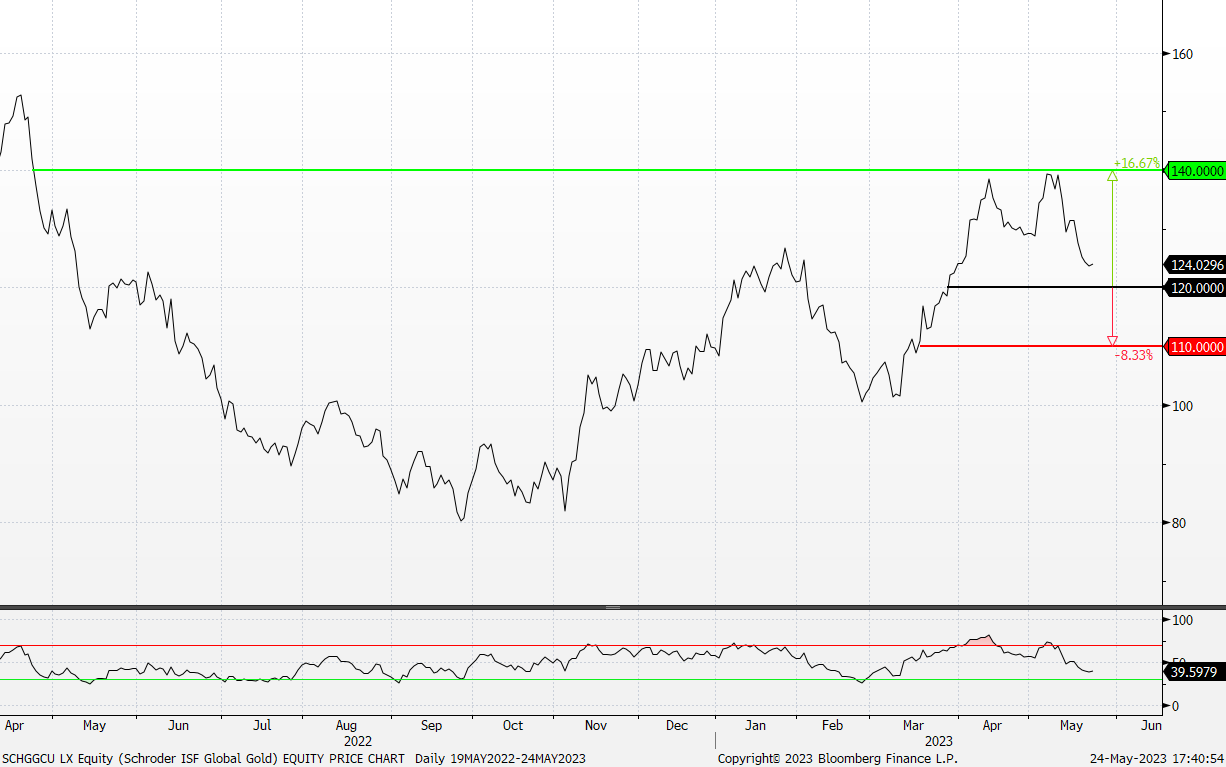

Top 10 Holdings

(as of 30 April 2023)

- BUY Entry –120 Target – 140 Stop Loss – 110

- Debt ceiling agreement

- The uncertainty surrounding the debt ceiling is likely to lead to rising market volatility as investors are concerned about the potential for a government default.

- Should a government default occur, it would lead to turmoil in the fixed-income and equity markets and the US dollars.

- Gold is seen as a hedge against market downturns.

- Peak rate expectations

- Amidst a high inflation rate environment, interest rates are also being priced up in an attempt to cool down the inflationary pressures.

- The current interest rates set by the Federal Reserves now stand at 5.25%, close to its previous high since 2008.

- U.S. interest-rate futures show that markets are expecting the Fed funds rate to peak just above 5.5% by June, compared with expectations of a peak below 5%. Market also expects around 1-2 more small rate hikes left from the federal reserve.