27 January 2023: Frencken Group Ltd. (FRKN SP), CMOC GROUP LTD (3993 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Frencken Group Ltd. (FRKN SP): Sales Surge from China’s re-opening

- Entry – 1.10 Target – 1.20 Stop Loss – 1.05

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial and semiconductor industries.

- Re-opening of China’s Economy. The re-opening of China’s economy is bound to drive the demand for semiconductors and technology-related software, alongside the price cuts for consumer goods such as automobiles and smartphones. Trade restrictions between U.S. and China also drive the demand for semiconductor from other parts of the world, and Frencken Group Limited stands to benefit from this increase in demand for semiconductor following China’s reopening of its economy.

- Geographically well-diversified. Frencken has multiple design centres and manufacturing sites spanning Asia, Europe and the USA. Their global footprint and local expertise enhance the value that they are able to bring to customers by facilitating seamless engagement leading to faster time-to-market and faster time-to-profit.

- Near-term weak demand challenges but see long-term strong demand. Outlook for the semiconductor and machines remains bleak in the near term with recessionary fears and interest rate hikes. However, the industry sees a 2H 2023 recovery with technology being more and more in long-term demand. Analysts also see China reopening fully by the end of 2023, which would bring up the demand within the semiconductors and technology industry.

- Updated market consensus of the EPS growth in FY23/24 is 12.77%/5.66% YoY respectively, which translates to 8.57x/8.14x forward PE. The current PER is 9.17x. Bloomberg consensus average 12-month target price is S$1.07.

(Source: Bloomberg)

Genting Singapore Ltd (GENS SP): Tourism recovery

Genting Singapore Ltd (GENS SP): Tourism recovery

- RE-ITERATE Entry – 0.98 Target – 1.04 Stop Loss – 0.95

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index. The principal activities of Genting Singapore and its subsidiaries are in developing, managing and operating integrated resort destinations including gaming, hospitality, MICE, leisure and entertainment facilities.

- Arrivals to double. With Singapore’s tourism arrival figures expected to double from 6.3mn in 2022 to an estimated 13mn in 2023, mainly due to increasing travel demand from South-East Asia, Genting Singapore’s 2023 revenue is likely to see exponential growth in the new year. This revenue boost will likely translate to higher profits, which can then be used to continue fueling their expansion effort.

- RWS 2.0 expansion progress. RWS 2.0 project is on-going as planned, with both the construction of Minion Land at USS and, additions and upgrades to infrastructure facilities running smoothly. This expansion marks a shift in the company’s focus towards the affluent market. In 1Q23, it expects its remade Festive Hotel, turned boutique-style accomodation to reopen.

- Gross gaming revenue (GGR) recovery. Singapore’s GGR has been predicted to recover to more than 70% of pre-pandemic levels in 2023, boosted by China tourist arrivals. Pre-pandemic wise, GGR can usually be correlated to China tourist arrivals, with higher tourist arrivals leading to a higher GGR for Singapore. Therefore, with tourist arrival numbers from China recovering to near pre-pandemic levels, it is expected that GGR may make a similar recovery as well.

- Updated market consensus of the EPS growth in FY23/24 is 59.6%/10.1% YoY respectively, which translates to 20.5x/18.6x forward PE. Current PER is 64.5x. Bloomberg consensus average 12-month target price is S$0.98.

(Source: Bloomberg)

CMOC GROUP LTD (3993 HK): High demand for metals

- BUY Entry – 4.25 Target – 4.80 Stop Loss – 3.98

- CMOC Group Ltd, formerly China Molybdenum Co Ltd, is a China-based company mainly engaged in the mining, smelting, processing and trading of molybdenum, tungsten, copper and other metals. The Company operates through six segments. The Molybdenum and Tungsten Related Products segment is engaged in the mining of molybdenum and tungsten ore. The Copper and Gold Related Products segment is engaged in the mining of copper and gold. The Niobium and Phosphate Related Products segment is mainly engaged in the production of niobium and phosphate fertilizers. The Copper and Cobalt Related Products segment is engaged in the production of copper and cobalt. The Metals Trading segment is principally engaged in the sales of metals. The Other segment is mainly engaged in mining support business.

- Copper prices are rising. Copper prices have risen globally due to supply disruptions caused by mine disruptions and reduced capital expenditure on mining firmss. Additionally, China’s economy reopening has further increased the demand for copper, as China is responsible for about half of global copper consumption.

- Demand for copper and cobalt. Copper has high conductivity, making it ideal for use in electrical wires. The market for both renewable energy and electricl vehicles is expanding, leading to more copper for wiring to connect various sources of renewable energy, such as wind and solar farms. In addition to the growing interest in renewable energy, electric vehicle production is rising as well, with EVs using about double the amount of copper needed to make traditional vehicles. Cobalt has recently gained popularity due to its role in battery technologies, with the lithium-ion batteries, mostly known for usage in EVs, accounting for more than 50% of the demand for cobalt.

- Copper futures seasonality. Copper performs the best in February in a year based on the last 15-year’s track record.

- 3Q22 earnings review. 3Q22 operating revenue fell by 2.5% YoY to RMB40.7bn. 9M22 operating revenue grew by 4.7% YoY to RMB132.5bn. Net profit attributable to shareholders of the company increased by 49.1% YoY to RMB5.3bn.

- The updated market consensus of the EPS growth in FY22/23 is 60.6%/7.5% YoY respectively, which translates to 12.12x/11.28x forward PE. The current PER is 11.74x. Bloomberg consensus average 12-month target price is HK$5.24.

(Source: Bloomberg)

Jiangxi Copper Company Limited (358 HK): A good start in 2023

Jiangxi Copper Company Limited (358 HK): A good start in 2023

- RE-ITERATE BUY Entry – 13.5 Target – 15.0 Stop Loss – 12.8

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- China bailing out the property market. The People’s Bank of China and the China Banking and Insurance Regulatory Commission jointly issued a notice to financial institutions laying out plans to ensure the “stable and healthy development” of the property sector in December. The notice includes 16 measures that range from addressing the liquidity crisis faced by developers to loosening down-payment requirements for homebuyers. Meanwhile, developers’ outstanding bank loans and trust borrowings due within the next six months can be extended for a year, while repayment on their bonds can also be extended or swapped through negotiations. The authorities also told the nation’s second-tier banks to dole out another RMB 400bn (US$56bn) of financing for the property sector in the final two months of 2022.

- Copper prices rallied and the dollar index fell. Copper futures closed at US$413.6/pound, last June’s level, and the dollar index pulled back to 102.4. China has released supportive policies for the property market, and the construction activities will widely resume after Chinese New Year. On the other hand, China is expected to continue its infrastructure expansion, especially the renewable energy segment. Both catalysts are tailwinds for the commodities market as both positive pricing and demand factors are expected to uphold the near-term recovery of the metal market.

- Copper futures seasonality. Copper performs the best in February in a year based on the last 15-year’s track record.

- 3Q22 earnings review. 3Q22 operating revenue grew by 2.2% YoY to RMB112.9bn. Net profit attributable to shareholders of the company dropped by 13.8% YoY to RMB1.3bn. 9M22 operating revenue grew by 9.2% YoY to RMB368.2bn. Net profit attributable to shareholders of the company increased by 4.9% YoY to RMB4.8bn.

- The updated market consensus of the EPS growth in FY23/24 is -16.6%/23.7% YoY respectively, which translates to 9.1x/7.4x forward PE. The current PER is 7.1x. Bloomberg consensus average 12-month target price is HK$12.6.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Consumer Durables | +4.39% | Tesla Slashes Prices Up To 20 Percent, Sending Shockwaves Through EV Industry Tesla, Inc. (TSLA US) |

| Energy Minerals | +2.57% | Oil settles up 2% on strong US data, China reopening Exxon Mobil Corp.(XOM US) |

| Technology Services | +2.28% | Microsoft’s AI push has some analysts raving about the stock even after lackluster earnings Microsoft Corp.(MSFT US) |

Top Sector Losers

| Sector | Loss | Related News |

| Consumer Non-Durables | -0.61% | UK Regulators To Probe Consumer Goods’ ‘Green’ Claims Procter & Gamble Company(PG US) |

| Health Technology | -0.14% | Johnson & Johnson teams up with Walmart, CareSource to boost resources for black mothers Johnson & Johnson (JNJ US) |

| Transportation | -0.06% | UPS Driver Put on Unpaid Leave Faces Uphill Accommodation Battle United Parcel Service, Inc.(UPS US) |

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Electronic Component |

+4.33% |

Hong Kong stocks hit 9-month high on lunar new year rush Sunny Optical Technology Group Co Ltd (2382 HK) |

|

Environmental Energy Material |

+4.24% | Xinyi Solar Holdings (0968 HK) |

|

Automobiles & Components |

+2.95% |

BYD Co Ltd (1211 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Gamble |

-0.86% |

No juice in casino stocks for Citic, UOB as Macau’s economic makeover, valuations blunt upside Sands China Ltd (1928 HK) |

|

Alcoholic Drinks & Tobacco |

-0.70% | Chinese New Year: Increased shopping and dining helping businesses during holiday Budweiser APAC (1876 HK) |

|

Investments & Assets Management |

-0.58% |

Exodus of Wealthy Chinese Accelerates With End of Covid Zero ESR Group Ltd (1821 HK) |

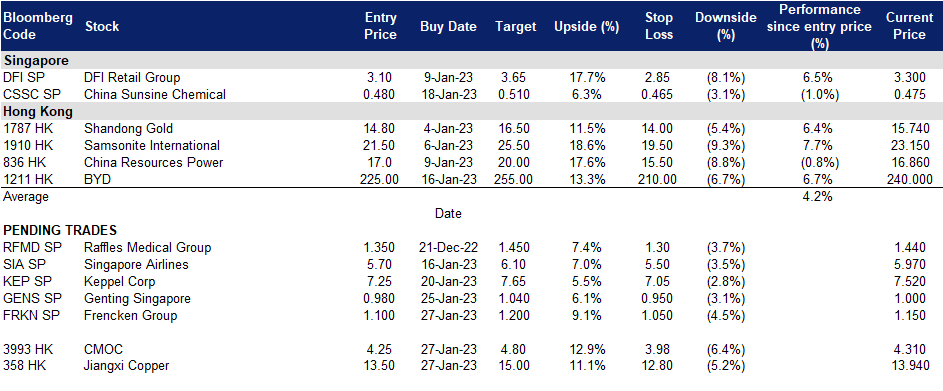

Trading Dashboard Update: No stock additions/deletions.