KGI Daily Trading Ideas – 18 January 2021

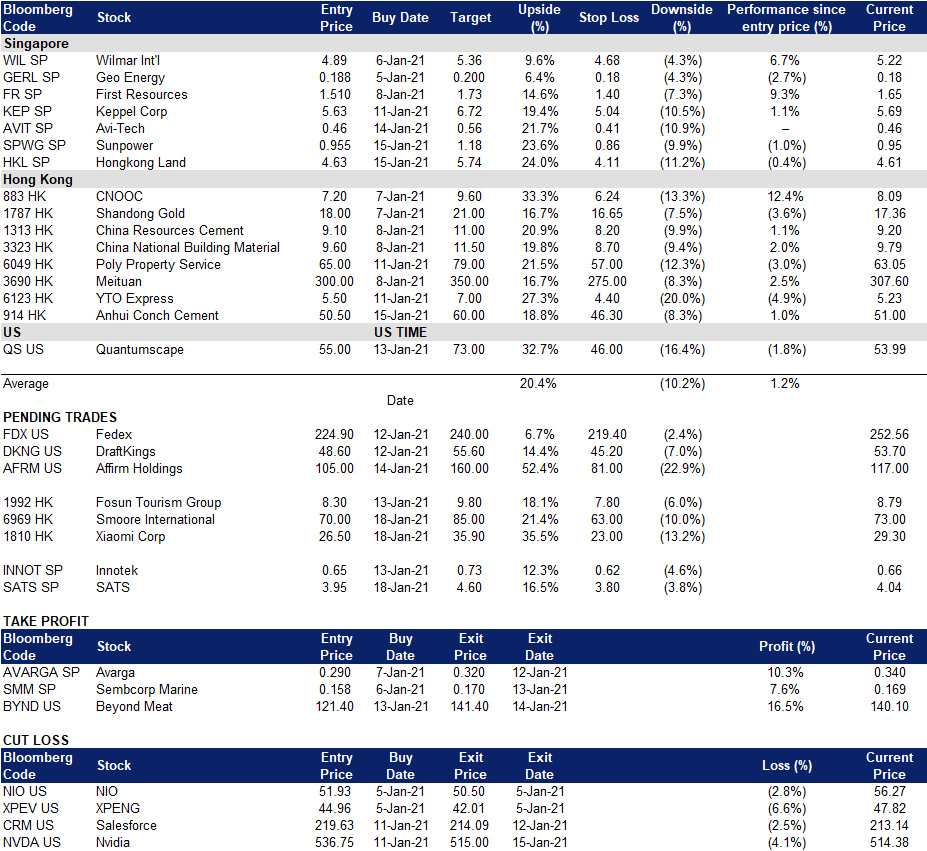

Trading Dashboard

IPO Watch

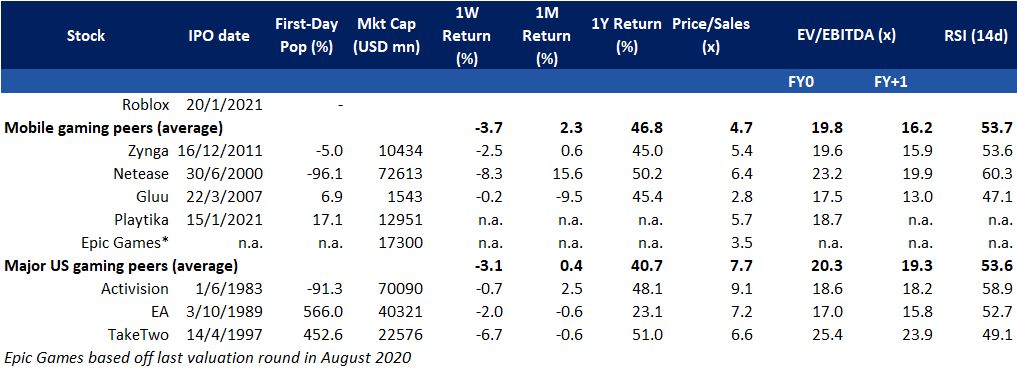

Roblox (RBLX US) – Is there any money left on the table?

- Roblox is an online game platform that allows users to program and/or play games created by other users.

- Since 2017, kids under 13 have spent more time on Roblox than other forms of online entertainment such as Youtube, Tiktok, Netflix or Facebook. More than half the user base is under 13 years of age, and an estimated 75% of US/Canadian kids have played Roblox, making Roblox the effective king of the attention economy for kids.

- While various other game platforms exist, Roblox was able to grow steadily as they took steps to incentivise creators, similar to social media platforms. Roblox’s freemium model also enables continuous monetisation of their user base.

- Roblox is planning to directly list this week (est. 20th January), after raising capital from private equity at US$29.5bn market cap valuation, translating to US$45/share. This is ~3.7x more than the initial IPO market valuation of about US$8bn, with a 37.6x Price/FY20 annualised sales multiple.

- While we think the hot IPO market can support further upside, we find the valuation to be too expensive, which requires Roblox to continue growing and operating flawlessly for the next couple of years. We think US$20-30 could be a more acceptable range to buy into the company.

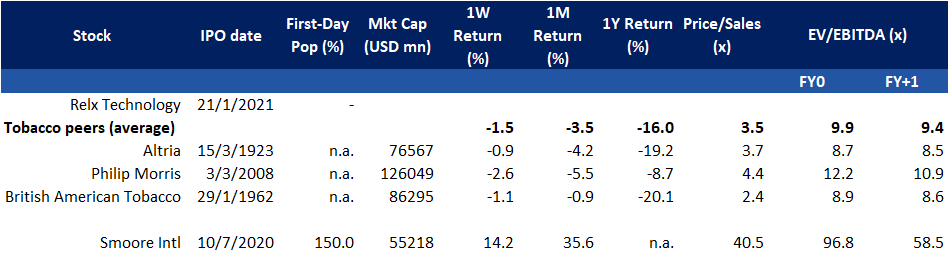

Relx Technology (RLX US) – Largest e-cigarette maker in the largest market

- Relx Technology is the largest developer of closed system e-vapor smoking products in China, holding ~63% of China’s market share.

- China is ~27% of a US$850 billion global tobacco market, yet has the most tobacco users and fairly low e-vapor penetration at 1.2% in 2019, according to CIC.

- RLX is expected to see explosive growth as the Chinese e-vapor market is forecasted to grow at 65.9% CAGR from 2019 to 2023.

- Being the first pure-play e-cigarette company to be publicly listed, we expect strong investor interest. The revised prospectus indicates a US$14bn market cap at US$8-10/share, which translates to a 32x P/FY20 annualised sales. However, if RLX can grow at CIC’s forecast range, the company can reach US$2bn sales in 2023, a 5x growth from FY20. If e-vapor penetration is faster than expected, the company has the potential to grow 10x or more in the next 4 years.

- Given that the Altria-Juul deal valued Juul at 19x Price/Sales when Juul had US$2bn of revenue, we think a similar valuation could be the blue-sky scenario for RLX, if investors are willing to discount short-term performance. We expect the IPO to perform well on its debut.

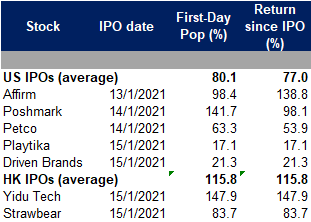

IPO Performance Recap

IPO reviews – Blockbuster IPOs with blockbuster debuts

- The second week of 2021 saw various big name US IPOs and one big name HK IPO perform well, carrying forward the strong IPO performance from last year.

- Affirm, Poshmark, Petco, Playtika and Driven Brands all priced above their IPO range and saw strong first day trading.

- Other IPOs that did well include NASCAR video game maker Motorsport Games (MSGM US), Chinese chemicals maker Qilian International (QLI US), and Chinese drama series producer and distributor Strawbear Entertainment (2125 HK).

Playtika (PLTK US) – The smallest pop amongst the popular IPOs

- Playtika opened trading at US$33.4, hitting an intraday high of US$36.06 but closing at US$31.62, slightly above our US$13bn market cap estimate and up 17% from IPO price.

- With the coronavirus situation in the US still fairly dire, we expect COVID plays such as Playtika to continue growth in 2021. We expect Playtika’s trading range to be 17-20x EV/FY21F adjusted EBITDA (US$29.8 – US$35.1).

Yidu Tech (2158 HK) – Skyrocketing debut

- The stock opened at HK$58.25 (day’s low) and closed at HK$65.2 (up 148.7% from the IPO pricing of HK$26.3) with an intraday high of HK$69.8.

- The company’s market cap was HK$58bn at Friday’s closing price. Based on FY20 revenue, the current price-to-sales ratio (PSR) is at 105.4x.

- Compared to the SaaS peers, we think the current valuation is relatively high and recommend to start to build positions if its PSR falls back to 80x, equivalent to a price of HK$52.

- The company offers healthcare solutions built on big data and artificial intelligence (AI) technologies. It serves and partners with key healthcare industry participants, including hospitals, pharmaceutical, biotech and medical device companies, research institutions, insurance companies, doctors and patients, as well as regulators and policy makers.

Strawbear Entertainment Group (2125 HK) – Superb performance in the winter of entertainment industry

- The stock opened at HK$7 and closed at HK$10.8 (up 83.7% from the IPO pricing of HK$5.88) with an intraday high of HK$11.36 and low of HK$6.1.

- The company’s market cap was HK$7.1bn at Friday’s closing price. Based on annualised 1H20 net profit, the current price-to-earning ratio (PER) is at 60.3x.

- Compared to profitable peers with similar market cap, the company’s valuation is relatively high as the average peers PER ranges from 40x to 50x. We recommend to start building positions if its PER falls back to 50x, equivalent to a price of HK$8.5.

- The company is an investment holding company principally involved in the production, distribution and licensing of broadcasting rights of television and web series.

Market Movers – What’s Hot

Global/Macro

- WTI crude oil prices dropped 2.9% on Friday, closing at $52.04/bbl, as the prospects of further lockdowns in Germany and France amid rising COVID-19 deaths coupled with fiscal uncertainty in the US weighed on global sentiment. Also, China reported the highest number of daily coronavirus cases in more than 10 months on Friday and capped a week that resulted in more than 28 million people under lockdown.

- The dollar index jumped around 0.7% to 90.78 on Friday, the strongest level since December 13th, amid a general increase in risk-aversion as rising coronavirus cases threaten the economic recovery. Concerns over the passage in Congress of Joe Biden’s $1.9 trillion coronavirus relief plan also weighed in investors’ mood.

United States

- Tilray (TLRY US) +6.14%, closing at US$19.70 after analyst upgrades on Aphria (APHA US), another cannabis company that is looking to merge with Tilray. Tilray and other cannabis companies have gained at least 10% for the week as the Democratic senate victory fuels hopes for further legalisation of marijuana in the US.

- Wells Fargo (WFC US) -7.80%, closing at US$32.04 after reporting weaker than expected revenues, despite exceeding analysts’ EPS expectations. The correction has largely wiped out share price gains for the week as investors were bidding up share prices in hopes of strong earnings results.

- 3D Systems Corp (DDD US) -11.75%, closing at US$28.25 after JP Morgan downgraded the stock with a target price of US$18. 3D printing stocks have surged for 2 weeks, and DDD is currently +169.6% YTD.

- EARNINGS: Plenty of financial services companies report this week, with Charles Schwab, Bank of America and Goldman Sachs on Tuesday, Morgan Stanley and BNY Mellon on Wednesday. Tech companies to watch for include Netflix (Tuesday), ASML (Wednesday), Intel and IBM (Thursday).

Hong Kong

- Guangzhou Automobile Group Co Ltd (2238 HK) +19.49%, closing at HK$9.38. The company announced that the graphene battery, its new battery technology, provides 1000km cruising power, can be 80%-charged in 8 minutes and will be mass produced in September this year.

- Evergrande Property Services Group Ltd (6666 HK) +10.04%, closing at HK$12.28. The parent company China Evergrande Group (3333 HK) purchased 93.1mn shares at an average price of HK$9.89 (Total value of transaction: HK$921mn).

- Postal Savings Bank of China (1658 HK) +10.03%, closing at a record high of HK$5.27. Driven by better than expected 4Q20 results of China Merchants Bank (3968 HK) and Industrial Bank China (601166 CH), China banking sector outperformed the market on Friday as investors were upbeat on the recovering profits of banks.

- Xiaomi Corp (1810 HK) -10.26%, closing at HK$29.3. The company was added in the US Defence Department’s blacklist.Under an executive order signed by Trump in November 2020, U.S. investors will have to unwind stakes in any company on the Defense Department list by Nov. 11, 2021.

Singapore

- iFAST (IFAST SP) +6.7% to close at another record-high of S$4.57 as expectations remains high for it to win the project to digitise Hong Kong’s pension system. Assets Under Administration (AUA) surged 45% YoY to S$14.5bn as at end 2020, contributed mainly by fund inflows into Singapore. iFAST’s stock price has surged 327% over the past 52-weeks to make it one of the best performing stocks in Singapore.

- REITs were the main movers last week in Singapore as funds continued to flow into income-generating stocks. Among the largest gainers among the S-REITs for the week were Keppel REIT (KREIT SP) +4.4% WoW to S$1.18, Keppel DC REIT (KDCREIT SP) +4.4% WoW to S$2.85, Frasers L&C Trust (FLT SP) +6.9% WoW to S$1.56 and Lendlease REIT (LREIT SP) +5.8% WoW to S$0.82.

US Trading Ideas

There is no trading in the US Equities Market later tonight as the country observes Martin Luther King Jr. day.

We will resume with our trading ideas for US stocks tomorrow (19 January 2021).

HK Trading Ideas

Smoore International Holdings Ltd (6969 HK): Vaping to get high

- BUY Smoore International Entry – 70 Target – 85 Stop Loss – 63

- The Company is mainly engaged in the research, design, manufacture and sales of vaping devices and components and self-branded advanced personal vaporizers (APV). Its APV brands include Vaporesso, Renova and Revenant Vape. The Company mainly operates its businesses in the United States, Mainland China, Hong Kong, Japan, Switzerland and the United Kingdom, among others. Smoore is the world largest vaporizer supplier.

- As of FY19, the company reported a 10-fold increase of FY16 revenue and 20-fold surge of FY16 net profit. The market penetration rate remains low at 16.5%, thus providing more headroom to capture higher growth in the next couple of years.

- The catalyst is the upcoming IPO of e-cigarette company, RLX Technology (RLX US). There are only a few pure listed vaporizer companies currently. We believe RLX’s IPO will attract more fund flows into this niche market.

- The stock price performance is on a healthily bullish uptrend.

BUY Xiaomi Corp (1810 HK): Buy-the-dip opportunity

- BUY Xiaomi Corp Entry – 26.5 Target – 35.9 Stop Loss – 23

- The company is engaged in the research, development and sales of smartphones, Internet of things and lifestyle products, the provision of Internet services, and investment business.

- The recent headwinds of being blacklisted by the US Defence Department is expected to be temporary. Foreign investors will comply to gradually liquidate their stakes in the company. However, the fundamentals are still sound, while Chinese investors will likely take stakes from foreign funds who will be selling.

- For investors who are at paper losses, we recommend to adopt an average down strategy to lower your entry costs.

SG Trading Ideas

SATS (SATS SP): Looking forward to pent up travel demand

- BUY Entry – 3.95 Target – 4.60 Stop Loss – 3.80

- SATS is a primarily air transport recovery play as more countries begin opening up by 2H 2021. It also benefits from its cold storage capabilities that include 18 cold rooms and 4 temperature zones to store Covid-19 vaccines.

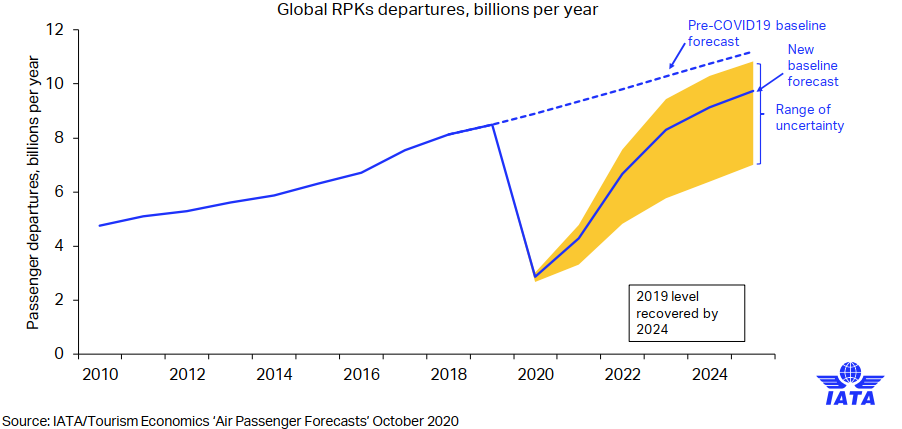

- While IATA expects air travel (as defined by worldwide passenger kilometers flown) to recover back to 2019 levels only by 2024, recovery is forecasted to gather pace in 2H 2021 and going into 2022.

- As SATS controls almost 80% of Changi’s ground handling and catering services, any positive news related to air travel – for example air travel bubbles – between Singapore and other countries are likely to provide upside catalysts to its share price.

- Fundamentally, SATS is in an enviable position among global air travel-related stocks due to its strong balance sheet, with enough cash (>S$800mn) to help it survive this challenging period.

Hongkong Land (HKL SP): An undervalued stock getting more attention

- RE-ITERATE HKL Entry – 4.63 Target – 5.74 Stop Loss – 4.11

- HKL is the largest landlord in Central, Hong Kong. While recent commercial transactions in Hong Kong represented a drop of 15-30% compared to the sellers’ asking prices, HKL’s cheap valuations are simply too cheap to ignore, trading at a steep 70% discount to its book value.

- Given the upcycle in global economic growth led by China, we believe the worst is over for the company.

8 thoughts on “KGI Daily Trading Ideas – 18 January 2021”

Comments are closed.