KGI Daily Trading Ideas – 20 January 2021

IPO Watch

Qualtrics (XM US) – IPO price range raised to US$22-26

- Qualtrics is an experience management platform that was acquired by SAP in 2019 for US$8bn prior to its IPO, and is now being spun out of the company.

- Initial IPO pricing was US$20-24. New IPO range indicates US$11.2 – 13.3bn initial market cap.

- Qualtrics is scheduled to IPO next week.

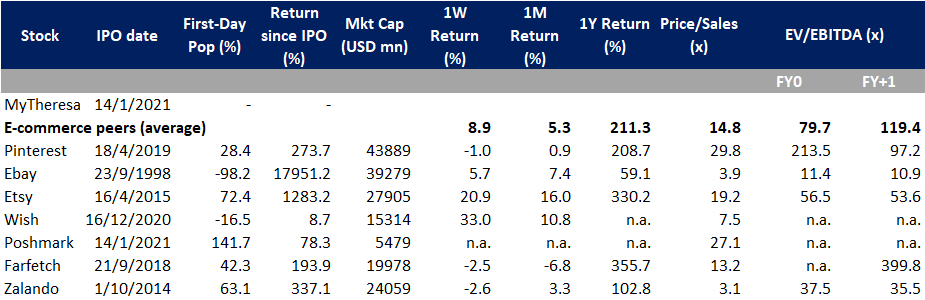

MyTheresa (MYTE US) – IPO price range raised to US$24-26

- MyTheresa is a Europe-based luxury fashion e-tailer boasting an average order value of €600 (US$725), one of the highest in the industry.

- Despite COVID-19, MyTheresa was able to grow its active customer base by 22% and sales by 19% versus its prior fiscal year ending June 2019. Quarterly results for September 2020 was also promising, with sales and profits at +17% YoY.

- MyTheresa looks to sell 16.6mn ADSs at US$24-26 price range, with an initial market cap of about US$2.2bn at the mid point of the price range. This is up 47% from prior IPO price range and roughly translates to 4.6x P/Sales.

- MyTheresa is expected to price tonight and trade on the NYSE on Thursday, 21st January.

Relx Technology (RLX US)

- Tentative IPO pricing date is on 20th January, and expected to trade on Thursday, 21st January. Read our write-up here.

Roblox (RBLX US)

- Revise trading date is in February, through a direct listing. Read our write-up here.

HK: Kuaishou

Trading starts 5th February 2021.

Kuaishou is Chinese video-sharing mobile app developed by Beijing Kuaishou Technology Co., Ltd, with a particularly strong user base among users outside of China’s Tier 1 cities. Outside Mainland China, it has also gained considerable popularity in other markets, topping the Google Play and Apple App Store’s “Most Downloaded” lists in eight countries. In India, this app is known as Snack Video. It is often referred to as “Kwai” in overseas markets. Its main competitor is Douyin, which is known as TikTok outside of China.

IPO Performance Recap

Yidu Tech (2158 HK) – Near our recommended entry price of HK$52

Compared to the SaaS peers, we think the current valuation is relatively high and recommend to start building positions if its Price-to-Sales (P/S) falls back to 80x, equivalent to a price of HK$52. Yidu Tech currently trades above HK$60, more than double its IPO price of HK$26.3.

US Trading Ideas

Palantir (PLTR US): Price consolidation; pre-earnings breakout likely

- RE-ITERATE BUY Palantir (PLTR US) Entry – 28 (BUY STOP) Target 36 Stop Loss – 24

- Palantir is an American software company specialising in big data analytics, co-founded by Paypal co-founder Peter Thiel back in 2003.

- Palantir’s business model is fairly unique with almost half of the customer base being government agencies, a low customer base with fairly high spending per customer, and much lower growth rates than most newly listed tech firms such as the likes of Snowflake (SNOW US), Datadog (DDOG US) or Zoom (ZM US). The market has favoured Palantir’s business, and share price has more than tripled since the IPO offer price of US$7.25.

- Since reaching an all-time high of US$33.5 on 27 November, we see Palantir trading in a tighter range with an uptrend since 2021. A breakout can bring Palantir back to past highs.

HK Trading Ideas

Ming Yuan Cloud Group Hld (909 HK): SaaS momentum remains strong

- RE-ITERATE BUY Ming Yuan Cloud Entry – 49.0 Target – 60.0 Stop Loss – 44.8

- Ming Yuan Cloud Group Holdings Limited develops software products. The Company provides enterprise resource planning, open platforms, software as a service products, platform as a service infrastructure products, and other products. Ming Yuan Cloud Group provides its services throughout China.

- The SaaS sector has been capturing investors’ attention recently, while Yidu Tech’s stellar IPO performance simply reinforces the positive sentiment in the sector.

- The stock has been consolidating at a range between high 40s and low 50s recently.

Xiaomi Corp (1810 HK): Buy-the-dip opportunity

- RE-ITERATE BUY Xiaomi Corp Entry – 29.0 Target – 35.9 Stop Loss – 27.5

- The company is engaged in the research, development and sales of smartphones, Internet of things and lifestyle products, the provision of Internet services, and investment business.

- The recent headwinds of being blacklisted by the US Defence Department is expected to be temporary. Foreign investors will comply to gradually liquidate their stakes in the company. However, the fundamentals are still sound, while Chinese investors will likely take stakes from foreign funds who will be selling.

- For investors who are at paper losses, we recommend to adopt an average down strategy to lower your entry costs.

SG Trading Ideas

VALUETRONICS (VALUE SP): Value for money

- BUY VALUE Entry – 0.680 Target – 0.830 Stop Loss – 0.595

- We expect VALUE’s two main businesses, which accounts for an equal share of total revenues, to pick up momentum this year.

- Its Consumer Electronics (CE) segment should see a boost from its biggest customer, Signify NV (LIGHT NA), as demand for Internet of Things (IoT) devices drives growth.

- Meanwhile, its Industrial and Commercial Electronics (ICE) business is riding on recovering automotive demand as the global economy rebounds and vehicle electrification gears up.

- VALUE is an excellent M&A play as well for international companies who wish diversify outside of China and establish a manufacturing presence in Southeast Asia. The company’s Vietnam campus would likely be completed within the next two years.

- Furthermore, the company could also embark on M&A to grow inorganically given its cash hoard that makes up 60-70% of its market cap. Overall, VALUE offers a good short-term trading opportunity, as well as a long-term value play given its >5% dividend yield and fortress-like balance sheet.

UMS Holdings (UMSH SP): Let’s get cyclical

- BUY UMSH Entry – 1.17 Target – 1.35 Stop Loss – 1.08

- Semicap equipment makers are set to expand this year following the stronger-than-expected capex guidance by industry leader TSMC (2330 TW/TSM US). TSMC raised its 2021 capex guidance by a substantial 54% YoY to US$25-28bn, showing a strong conviction of its growth outlook and advanced node in 7nm, 5nm and 3nm.

- The current upcycle in the semiconductor industry is driven by infrastructure investments, 5G base station and smartphone penetration, auto recovery/electric vehicles and the growth of the cloud. Global foundry revenue is forecasted to expand by 6% YoY, according to estimates by TrendForce, after growing a blistering 24% YoY in 2020.

- We think a key catalyst would be if Intel were to announce outsourcing chip manufacturing to TSMC. Intel will announce its results this Friday, as well as potentially news of its manufacturing plans.

- While we have a fundamental fair value S$1.22 (read report here) on UMS, we believe the positive sentiment in the sector due to the recent wave of privatisations could accelerate trading interest and volumes.

Market Movers – What’s Hot

Global/Macro

- Goldman Sachs Explores Entering Crypto Market, CoinDesk Reports. While Bitcoin hovered at around US$37,000 on Tuesday, crypto enthusiasts are chasing rallies in other coins like Ether, which is up almost 90% in 2021 compared to Bitcoin’s 27% advance year-to-date.

United States

- Coherent (COHR US) +29.65% closing at US$197.01 after agreeing to be acquired by Lumentum (LITE US), forming a laser and photonics giant in the industry.

- General Motors (GM US) +9.75% closing at US$54.84 upon Microsoft (MSFT US, +1.78%) partnership to accelerate plans to produce electric, self-driving cars.

- Xpeng Inc (XPEV US) +12.59% closing at US$53.84 after unveiling autonomous driving solution for its flagship P7 sedan.

Hong Kong

- BYD Electronic (International) Co Ltd (0285 HK) +15.83%, closing at a new high of HK$49.4. Market news said the company will become the foundry of Honor Mobile Phones, a brand spun off from Huawei Group. It is expected to produce more than 50mn pieces per year.

- China Evergrande Group (3333 HK) +15.68%, closing at HK$17.26. National Bureau of Statistics of China released 2020 full-year real estate sector data. Total value of residential property sales grew by 8.7% YoY to RMB17.4tn. Total sales area grew by 2.6% YoY to 17.6bn square meters. Total property investment grew by 7% YoY to RMB14.1tn.

- ANTA Sports Products Ltd (2020 HK) +9.43%, closing at a new high of HK$143.9. Previously, the company released 4Q20 operational updates. The respective retail sales growth under Anta brand, FILA brand, and other brands were low single-digit, 25%-30%, and 55%-60%.

- COSCO SHIPPING Holdings (1919 HK) -9.17%, closing at HK$9.9, likely due to profit taking which triggered the drop.

Singapore

- iFAST (IFAST SP) +4.1% to close at another record-high of S$4.86 as expectations remains high for it to win the project to digitise Hong Kong’s pension system. Assets Under Administration (AUA) surged 45% YoY to S$14.5bn as at end 2020, contributed mainly by fund inflows into Singapore. iFAST’s stock price has surged 354% over the past 52-weeks, making it one of Singapore’s best performing stock and raising its current market capitalisation to S$1.3bn.

- Sunningdale Tech (SUNN SP) +3.9% to close at S$1.62 after the privatisation offer from Koh Boon Hwee and Novo Tellus PE Fund 2 was raised to S$1.65.

- Nanofilm Technologies International (NANO SP) +3% in early morning trade today as Credit Suisse initiates coverage with an Outperform rating. The company is expected to see a big surge in profits driven by growth in its Chinese JV and growing smartphone market share of an undisclosed key customer.

Trading Dashboard