KGI Daily Trading Ideas – 19 January 2021

IPO Watch

US: Roblox (RBLX US)

Tentative trading date is on 20th January 2021. Read our write-up here.

US: Relx Technology (RLX US)

Tentative trading date is on 21st January 2021. Read our write-up here.

HK: Kuaishou

Trading date is on 5th February 2021.

Kuaishou is Chinese video-sharing mobile app developed by Beijing Kuaishou Technology Co., Ltd, with a particularly strong user base among users outside of China’s Tier 1 cities. Outside Mainland China, it has also gained considerable popularity in other markets, topping the Google Play and Apple App Store’s “Most Downloaded” lists in eight countries. In India, this app is known as Snack Video. It is often referred to as “Kwai” in overseas markets. Its main competitor is Douyin, which is known as TikTok outside of China.

US Trading Ideas

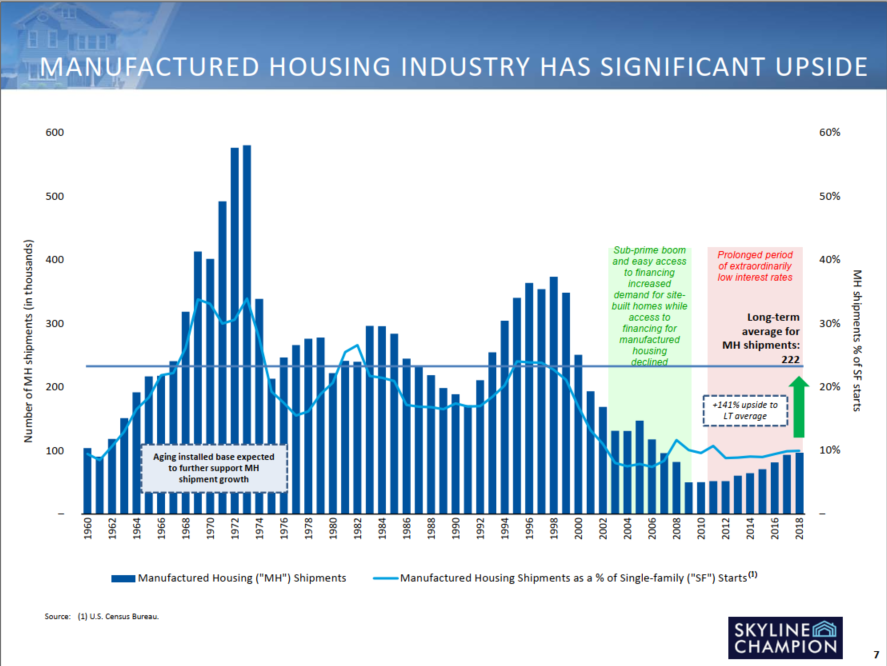

Skyline Champion Corp (SKY US): Upward momentum for homebuilders

- BUY Skyline (SKY US) Entry – 31.8 Target 37.8 Stop Loss – 28.8

- Skyline Champion is one of the largest manufactured housing builders in the US.

- The US homebuilding industry is expected to see solid growth in 2021 as more US millennials, the largest generation, enters the homebuying age, fueled by low borrowing costs and the ability to live in the suburbs, enabled by Work-From-Home initiatives.

- Given Skyline’s business recovery in COVID-19, we expect further tailwinds for the company in 2021, with the upcoming fiscal stimulus.

Palantir (PLTR US): Price consolidation; pre-earnings breakout likely

- BUY Palantir (PLTR US) Entry – 28 (BUY STOP) Target 36 Stop Loss – 24

- Palantir is an American software company specialising in big data analytics, co-founded by Paypal co-founder Peter Thiel back in 2003.

- Palantir’s business model is fairly unique with almost half of the customer base being government agencies, a low customer base with fairly high spending per customer, and much lower growth rates than most newly listed tech firms such as the likes of Snowflake (SNOW US), Datadog (DDOG US) or Zoom (ZM US). The market has favoured Palantir’s business, and share price has more than tripled since the IPO offer price of US$7.25.

- Since reaching an all-time high of US$33.5 on 27 November, we see Palantir trading in a tighter range with an uptrend since 2021. A breakout can bring Palantir back to past highs.

HK Trading Ideas

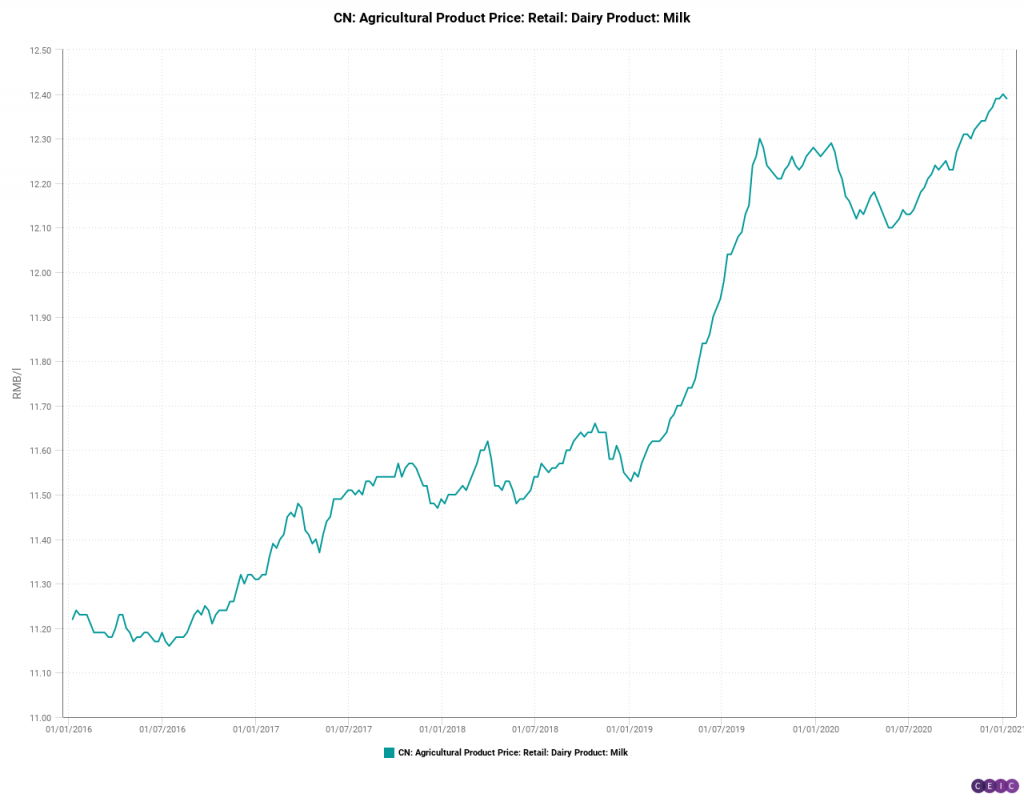

China Modern Dairy Holdings Ltd (1117 HK): Milking more profits

- BUY China Modern Dairy Entry – 2.65 Target – 3.5 Stop Loss – 2.2

- China Modern Dairy Holdings Ltd. is an industrialized agricultural company. The Company operates dairy farms and produces raw milk in China. China Modern Dairy Holdings Ltd focuses on large-scale industrialized free-stall dairy farming.

- The company just announced a positive profit alert that its FY20 net profit will be more than RMB700mn (including a one-off disposal gain of RMB72mn) with a growth of more than 100% YoY.

- Raw milk demand in China is estimated to be 450mn tonnes in 2020 and projected to grow to 500mn in 5 years. Domestic production of raw milk is estimated to be 33mn tonnes in 2020 and projected to grow to 35mn tonnes in 5 years time. Hence, demand growth will outpace supply growth.

- China Modern Dairy’s raw milk production is expected to be 1.6mn tonnes in 2020. The company sets a goal to achieve 3.6mn tonnes of raw milk production by 2025, equivalent to a CAGR of 17%. Besides, the company has also benefited from the uprising milk price.

BUY Xiaomi Corp (1810 HK): Buy-the-dip opportunity

- RE-ITERATE Xiaomi Corp Entry – 28 Target – 35.9 Stop Loss – 25

- The company is engaged in the research, development and sales of smartphones, Internet of things and lifestyle products, the provision of Internet services, and investment business.

- The recent headwinds of being blacklisted by the US Defence Department is expected to be temporary. Foreign investors will comply to gradually liquidate their stakes in the company. However, the fundamentals are still sound, while Chinese investors will likely take stakes from foreign funds who will be selling.

- For investors who are at paper losses, we recommend to adopt an average down strategy to lower your entry costs.

SG Trading Ideas

VALUETRONICS (VALUE SP): Value for money

- BUY VALUE Entry – 0.680 Target – 0.830 Stop Loss – 0.595

- We expect VALUE’s two main businesses, which accounts for an equal share of total revenues, to pick up momentum this year.

- Its Consumer Electronics (CE) segment should see a boost from its biggest customer, Signify NV (LIGHT NA), as demand for Internet of Things (IoT) devices drives growth.

- Meanwhile, its Industrial and Commercial Electronics (ICE) business is riding on recovering automotive demand as the global economy rebounds and vehicle electrification gears up.

- VALUE is an excellent M&A play as well for international companies who wish to diversify outside of China and establish a manufacturing presence in Southeast Asia. The company’s Vietnam campus would likely be completed within the next two years.

- Furthermore, the company could also embark on M&A to grow inorganically given its cash hoard that makes up 60-70% of its market cap. Overall, VALUE offers a good short-term trading opportunity, as well as a long-term value play given its >5% dividend yield and fortress-like balance sheet.

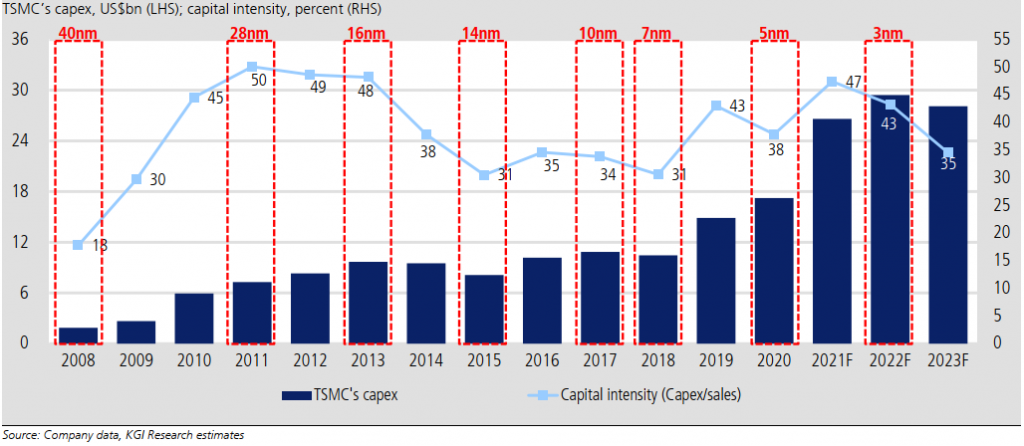

UMS Holdings (UMSH SP): Let’s get cyclical

- BUY UMSH Entry – 1.17 Target – 1.35 Stop Loss – 1.08

- Semicap equipment makers are set to expand this year following the stronger-than-expected capex guidance by industry leader TSMC (2330 TW/TSM US). TSMC substantially raised its 2021 capex guidance by a substantial 54% YoY to US$25-28bn, showing a strong conviction of its growth outlook and advanced node in 7nm, 5nm and 3nm.

- The current upcycle in the semiconductor industry is driven by infrastructure investments, 5G base station and smartphone penetration, auto recovery/electric vehicles and the growth of the cloud. Global foundry revenue is forecasted to expand by 6% YoY, according to estimates by TrendForce, after growing a blistering 24% YoY in 2020.

- We think a key catalyst would be if Intel were to announce outsourcing chip manufacturing to TSM. Intel will announce its results this Friday, as well as potentially news of its manufacturing plans.

- While we have a fundamental fair value S$1.22 (read report here) on UMS, we believe the positive sentiment in the sector due to the recent wave of privatisations could accelerate trading interest and volumes.

Market Movers – What’s Hot

United States

- No market movers as the US observed Martin Luther King Jr. Day on Monday

Hong Kong

- Evergrande Property Services Group Ltd (6666 HK) +26.22%, closing at a new high of HK$15.5 since IPO. The company released its internal 2021 key performance indicator, which included aims to increase property management area by 360mn square meters and grow net profit by 50% YoY.

- Kingdee International Software Group Co. (0268 HK) +13.93%, closing at a new high of HK$31.9. Citi Group reiterated OVERWEIGHT rating with an unchanged TP of HK$35. Last Friday, the company announced a profit warning for FY20. Revenue from cloud service business is expected to increase by 43% to 48% YoY. Net loss will be in the range of RMB250mn to RMB350mn (FY19 net profit: RMB372.58mn).

- Hua Hong Semiconductor Ltd (1347 HK) +13.72%, closing at HK$46. Founder Securities reiterated OVERWEIGHT rating with a TP of HK$58.2. It expects 4Q20 earnings to beat expectations, and that the strong demand for power semiconductors and CMOS image sensors will last till 4Q21.

Singapore

- Singapore tech-manufacturing stocks are piping hot following the recent privatisation offers for companies in the sector such as Hi-P International (HIP SP), Sunningdale Tech (SUNN SP) and CEI (CEI SP).

- Among Monday’s biggest winners in the sector were ISDN (ISDN SP) +17.5%, closing at S$0.74, Fu Yu (FUYU SP) +10.7% to close at S$0.31 and Grand Venture (GVT SP) +16.7% to close at a record high of S$0.525.

- DBS Group Research highlights companies such as Fu Yu and Valuetronics (VALUE SP) as potential M&A and privatisation candidates.

- Olam (OLAL SP) +8.3% to S$1.69 as it plays catch up with other commodity firms who have rallied on the back of surging prices.

- Jiutian Chemical (JIUC SP) +5.0% to close at S$0.105 as CGS-CIMB initiated coverage on the stock with an add recommendation and a target price of S$0.145 vs its current share price of S$0.10, implying a potential upside of 45%.

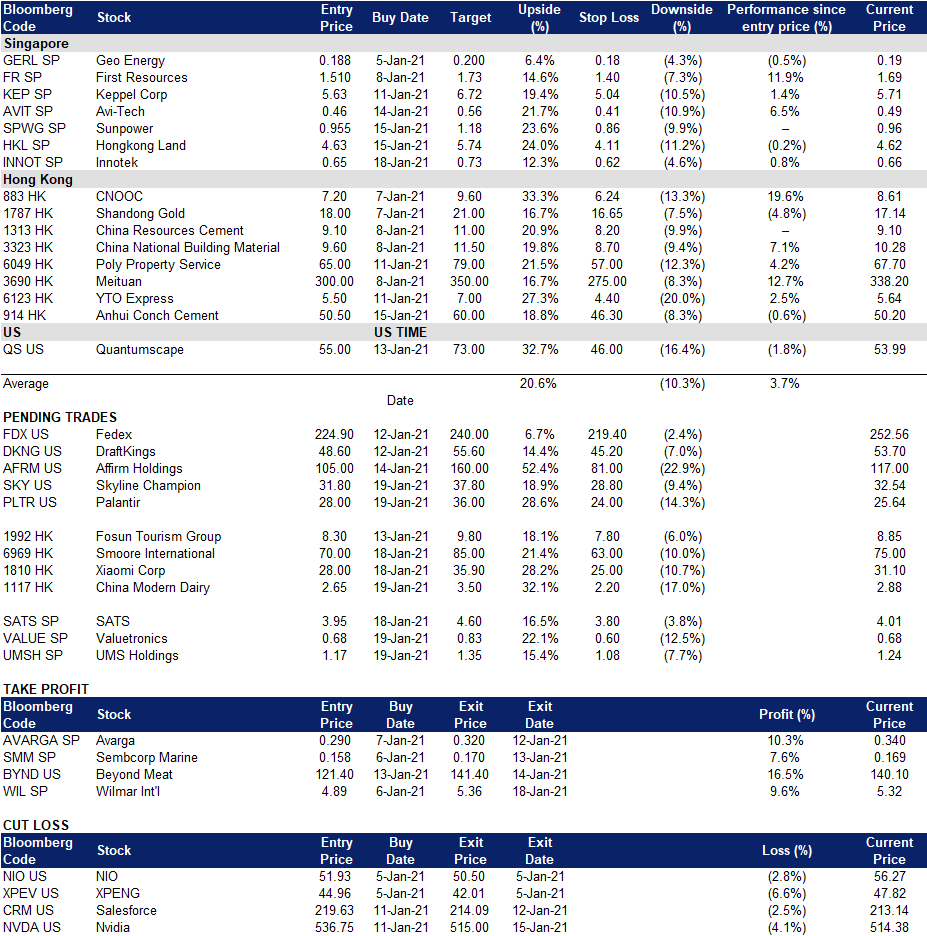

Trading Dashboard