KGI DAILY TRADING IDEAS – 10 March 2021

IPO Watch

Coupang (CPNG US): Increased IPO price range to US$32-34/share

- We wrote up on CPNG at the start of the week, in which we saw US$35/share as an achievable price for its first day of trading.

- With the increased initial IPO price range to US$32-34, private market sentiment remains strong for tech and e-commerce stocks, despite NASDAQ’s correction in the past 2 weeks.

- We now see 6x Price/Sales (US$42/share) as the next reference point for CPNG, should market sentiment turn for the better on tech stocks. Given the wide Price/Sales gap between the various e-commerce stocks, we see potential for 10x Price/Sales (US$70/share) on the first trading day.

- CPNG starts trading tomorrow, 11 March.

Roblox (RBLX US): Reference price at US$45/share

- We covered RBLX almost 2 months ago where we state the US$45/share price as being too expensive.

- If the sector rotation out of tech were to continue this week, we recommend accumulation of RBLX around the US$15-30/share range, about 10x to 20x Price/Sales.

- RBLX starts trading tomorrow, 11 March.

US Trading Ideas

Ebang International Holdings (EBON US): Crypto is back up

- BUY Entry – 5.01 Target – 7.99 Stop Loss – 4.01

- EBON is a China-based blockchain technology company which mines Bitcoin and supplies mining machines for other miners.

- EBON rode to a high of 13.7 as a follow-up crypto stock play to Riot (RIOT US) and Marathon Patent Group (MARA US), which all rode Bitcoin’s initial rise to US$50,000. However, while RIOT and MARA have held on to at least 40% of their share price gains, EBON has fell back to its initial trading range.

- As Bitcoin consolidates and makes a return to the US$50,000 range, we see potential for EBON to gain back at least 40%. EBON has recently announced plans to mine Litecoin and Dogecoin, with plans to open a cryptocurrency exchange. Additional news from EBON can catalyse another upswing for the stock.

Target (TGT US): How about a new US$1,400 fridge?

- BUY Entry – 180 (BUY STOP) Target – 192.5 Stop Loss – 171

- TGT is the US’s 2nd discount chain store behind Walmart (WMT US), operating over 1,800 Target Stores across the US.

- RSI has bottomed out below 30 on 4th March and TGT, together with the Vaneck Vectors Retail ETF (RTH US) have posted a rally since.

- We pick TGT over RTH and other discount stores as TGT is positioned towards consumer discretionary goods, which we expect to see stronger spending from the recovering economy.

HK Trading Ideas

China National Building Material Co Ltd (3323 HK): Prepare for infrastructure expansion

- BUY Entry – 9.3 Target – 11.5 Stop Loss – 8.3

- China National Building Material Company Limited manufactures cement products. The company produces silica cement, commodity concrete, cement clinkers, and other products. China National Building Material also produces glass fibres, composite materials, and other products.

- The company recently announced the restructuring plan of its cement business. Its subsidiary, Xinjiang Tianshan Cement (000877 CH) will issue shares to the company and purchase the cement assets. The acquisition is valued at 1.5x price-to-book ratio.

- Market expects more restructuring plans of its engineering and new materials business in the near term, and profitability and debt burden to improve as a result.

- Market consensus of net profit growth in FY21 and FY22 are 17.22%YoY and 0.86% YoY, which implies forward PERs of 4.6x and 4.5x. Current PER is 5.5x. Bloomberg consensus average 12-month target price is HK$14.45.

Hainan Meilan International Airport Company Limited (357 HK): Shop till you drop

- RE-ITERATE BUY Entry – 31 Target – 48 Stop Loss – 25

- The company operates through aeronautical businesses and non-aeronautical businesses. Its aeronautical businesses include the provision of terminal facilities, ground handling services and passenger services. Its non-aeronautical businesses include the leasing of commercial and retail spaces at Meilan Airport, airport-related businesses franchising, advertising spaces leasing, car parking businesses, cargo handling and the sales of consumable goods.

- Hainan had adopted the new offshore duty-free shopping policy since July 2020. In 2H20, the duty-free sales increased by 87.4% YoY. Duty-free sales per capita increased by 74.4% YoY in 2020.

- The operational data jumped substantially during Chinese New Year holiday in February. Passenger throughput, aircraft movement, and cargo throughput surged by 209% YoY to 1.2mn persons, 114% YoY to 9,809 units, and 107% YoY to 19,270 tonnes respectively.

- The catalyst is the commencement of operations of Terminal 2, expected around mid-2021. Total duty-free shopping area will reach 24,000 square meters (current T1 shopping area: 15,000 sqm), making it China’s largest duty-free shop.

- Market consensus of net profit growth in FY21 and FY22 are 67.35%YoY and 32.1% YoY, which implies forward PERs of 21.8x and 16.5x. Current PER is 35.3x.

SG Trading Ideas

Nanofilm Technologies (NANO SP): Tech-nical rebound? Buying the dip and sleeping well at night

- BUY Entry – 4.65 Target – 5.50 Stop Loss – 4.25

- NANO provides advanced coating solutions to products such as smartphones, smartwatches, computers and automotive.

- The recent sell-off among technology-related stocks has presented bargains among our watchlist. However, we caution against broad based buy-the-dip strategy and selectively buy companies with actual earnings and growth, to help mitigate losses should sector rotation into value/cyclical stocks accelerate.

- NANO recently posted a full-year FY2020 earnings beat as earnings jumped 61% YoY to S$58mn, driven by higher revenues from its advanced materials and nanofabrication business units.

- Management was positive on future prospects as it continues to strengthen its value proposition through potential mergers & acquisitions or strategic partnerships across the value chain. Furthermore, the group’s expansion plans are gaining traction; its second plant in Shanghai commenced operations last month.

- NANO currently trades at 37/30/25x FY21/22/23E P/E, a premium to Singapore-listed peers who are trading at mid-teens, which we believe is justified by the company’s double-digit sales growth and proprietary technologies . While not a direct comparison in terms of business profile, Venture Corp (VMS SP) trades at 16/15/13x P/E but with 5-7% sales growth (2022-2023) and single-digit EPS growth.

- We also think that NANO has a high possibility of joining the STI and therefore attrace fund inflows.

SATS (SATS SP): The joy of travelling once again

- BUY Entry – 4.25 Target – 5.10 Stop Loss – 3.90

- SATS is a air transport recovery play as more countries begin opening up by 2H 2021. It also benefits from its cold storage capabilities that include 18 cold rooms and 4 temperature zones to store Covid-19 vaccines.

- As SATS controls almost 80% of Changi’s ground handling and catering services, any positive news related to air travel – for example air travel bubbles – between Singapore and other countries are likely to provide upside catalysts to its share price.

- The travel sector is expected to gather pace in 2H 2021 and going into 2022 as the pace of global vaccination accelerates.

- Fundamentally, SATS is in an enviable position among global air travel-related stocks due to its strong balance sheet, with enough cash (S$122mn net cash position as at end 3QFY2021) to help it survive this challenging period.

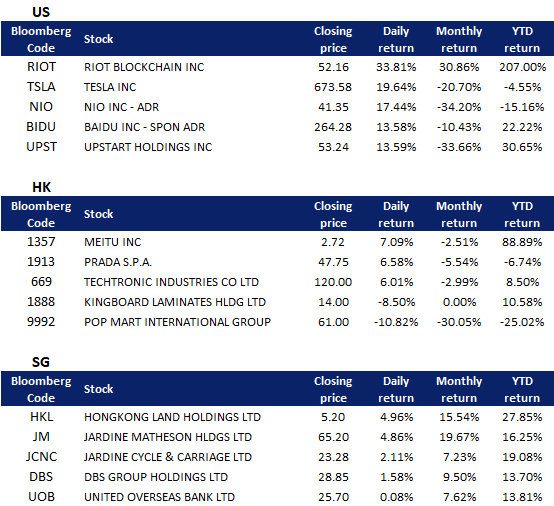

Market Movers – What’s Hot

United States

- All major indices gained on Tuesday, with NASDAQ staging a strong 4% rebound after a 10% correction since the mid February peak. S&P was up 1.4% while Dow Jones eked a 0.1% gain.

- Tesla (TSLA US) reversed all losses from the previous 4 days of trading, leading a strong rebound of other EV stocks such as Li Auto (+8.2%), Nio (+17.4%) and Blink Charging (+20%).

- A reversal occurred in energy and financial stocks, losing steam on Tuesday. Select Sector Energy ETF (XLE US) -1.8% after climbing over 35% since February from rising oil prices, while Select Sector Financial ETF (XLF US) -0.9% after gaining close to 20% since February.

Earnings Watch: AMC (10 Mar), Oracle (10 Mar), JD.com (11 Mar), DocuSign (11 Mar)

Hong Kong

- Meitu (1357 HK), the company announced that it bought US$40mn worth of Bitcoin and Ethereum previously, making it the first HKEX-listed company buying cryptocurrencies.

- Prada (1913 HK), CICC raised the TP to HK$52 from HK$42 and maintained an OVERWEIGHT rating. It is expected that EBIT in FY20 will turn positive. The sales growth was driven by the new series of fashion launched by the co-creative director Raf Simons.

- Techtronic Industries (669 HK), Nomura raised TP to HK$156 from HK$112 and reiterated an OVERWEIGHT rating. 2H20 performance improved, as net profit grew by 42% YoY due to its online marketing strategy and new products. Net profits are expected to grow by 8% YoY and 13% YoY in FY21 and FY22.

- Kingboard Laminates (1888 HK), the company was involved in a civil action case where the suppliers sued one of its subsidiaries based in Shanghai.

- Pop Mart (9992 HK), the company continued to be sold off as the valuations are still relatively high.

Singapore

- The Jardine Group of companies continued to dominate trading activity yesterday following the announcement that it was going to consolidate its holdings into a simplified company structure. Shares of Hongkong Land (HKL SP), Jardine Matheson (JM SP) were among the biggest gainers among the large-caps. The Jardine-linked companies are now the best performing STI constituents in 2021, with Jardine Strategic surging 32% YTD, Hongkong Land gaining 26% YTD and Jardine C&C higher by 19% YTD.

- Singapore Banks continued to advance yesterday along with global peers as higher interest rates lend a boost. However, we think banks may start to consolidate around these levels given the outperformance YTD. The three local banks are among the best performing in the STI for the year, gaining 14% to 17% YTD.

- Industrial REITs underperformed the overall market after JPMorgan earlier this week issued a contrarian UNDERWEIGHT on Singapore industrial REITs. The investment bank expects Industrials REITs to be vulnerable to the recent steepening of the yield curve as it offered a lower yield and distribution per unit (DPU) growth compared to other sectors. A steeper yield curve has historically led to a 16% decline in S-REITs. REITs such as Keppel DC REIT (KDCREIT SP), Frasers Logistics & Commercial Trust (FLT SP) and MapletreeLogistics Trust (MLT SP) closed lower by between 1% and 3% yesterday.

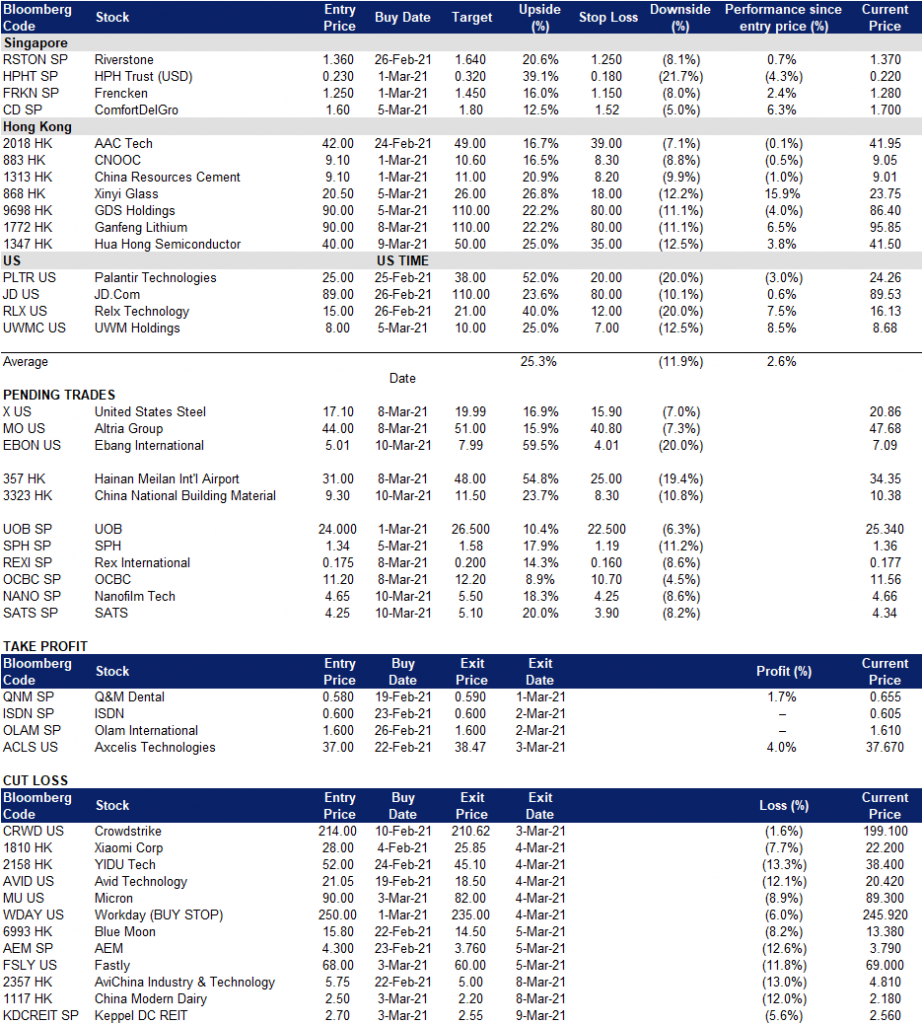

Trading Dashboard