KGI DAILY TRADING IDEAS – 8 March 2021

IPO Watch

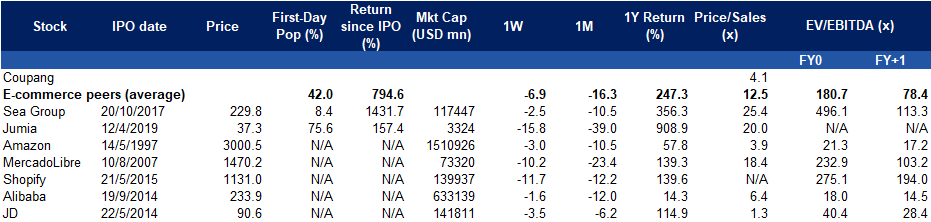

Coupang (CPNG US): More ways to participate in E-commerce’s rise

- CPNG is South Korea’s largest online retailer with around US$12bn of sales. More than half of South Korea have used Coupang’s app before, with 15mn active customers, about 30% of South Korea’s population.

- At 27%, South Korea boasts one of the highest e-commerce penetration rates, ahead of US and China. However, CPNG is still seeing YoY% growth rate that is ahead of Amazon’s and Alibaba’s respective e-commerce divisions.

- CPNG’s initial IPO price range is at US$27-30, which is around 4.1x Price/Sales at the mid-point of US$28.5. We see US$35/share (+23%) as a fairly achievable mark despite the recent weak market sentiment on tech stocks.

- CPNG is expected to start trading on Thursday, 11 March.

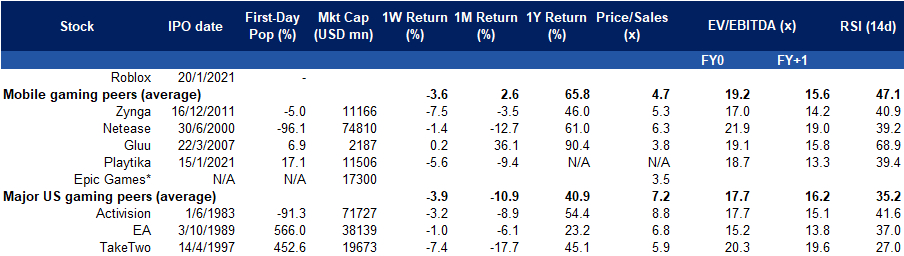

Roblox (RBLX US): Finally getting on the road

- We covered RBLX almost 2 months ago where we state the US$45/share price as being too expensive.

- After the recent rout of tech and momentum stocks, we believe it is even more likely that RBLX will see weak trading. Given that RBLX is doing a direct listing, there will be no support from investment banks to prop up the share price.

- If the sector rotation were to continue this week, we recommend accumulation of RBLX around the US$15-30/share range, about 10x to 20x Price/Sales.

- RBLX is expected to start trading on Thursday, 11 March.

US Trading Ideas

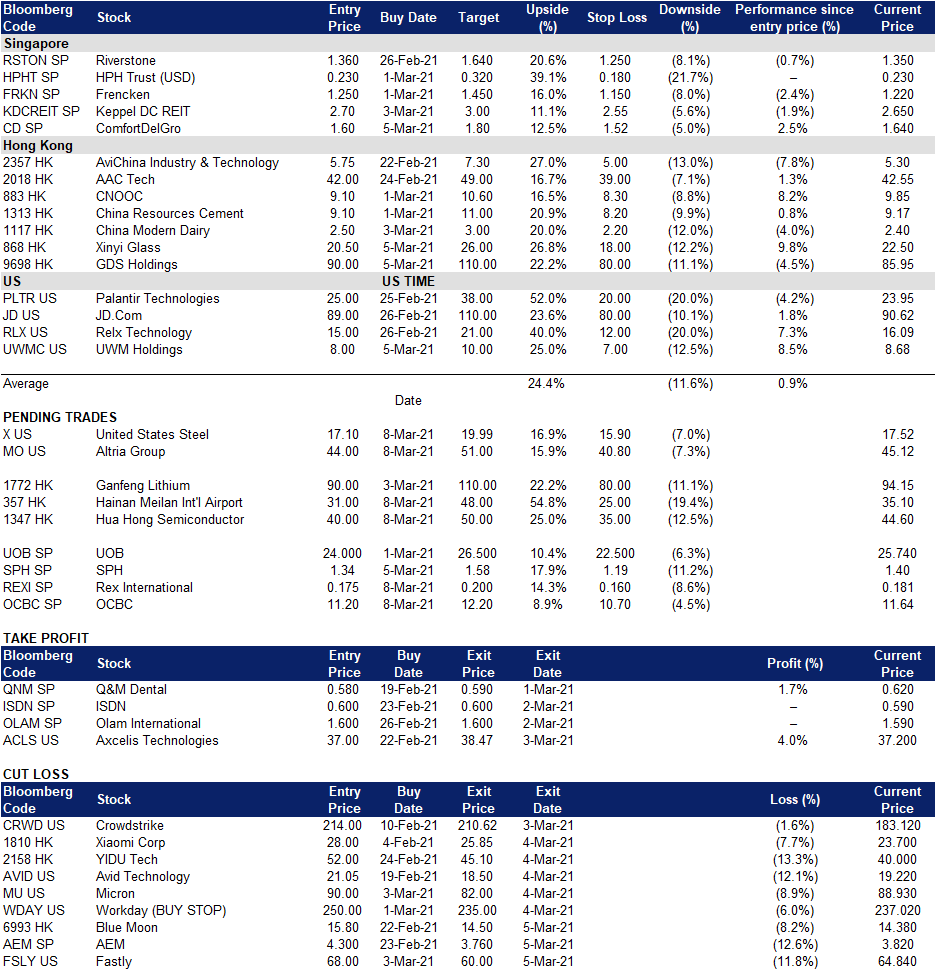

Altria Group (MO US): Enough dividends to withstand the selldown

- BUY Entry – 44 Target – 51 Stop Loss – 40.8

- MO is one of the world’s largest producers and marketers of tobacco and related products, owning a part of Philip Morris (PM US), Juul, and Cronos Group (CRON CN).

- Recent market volatility with regards to the rising 10-year bond yield has not stopped the upward momentum of MO, which has made a 6-month high on Friday.

- At 7+% dividend yield, we see little fundamental reason for current investors to bail ship even in the face of rising bond yields.

- Despite write-offs on Juul as a result of recent vape regulations in US and EU, we expect MO to continue to position itself in accordance to the changing demands of smokers. We expect the pre-COVID share price of MO to be an achievable target.

United States Steel Corp (X US): Steel your resolve

- BUY Entry – 17.1 Target – 19.99 Stop Loss – 15.9

- We re-pitched X on 19 February which was a profitable trade, closing above 19.99 on 25 February.

- Since then, the share price of X has whipsawed between 16 to 20, as the overall market fell. Meanwhile, iron ore prices have stayed flat at its all time high over the past 2 weeks

- We see potential in pitching X again for a profitable short term trade.

HK Trading Ideas

Hainan Meilan International Airport Company Limited (357 HK): Shopping at a discount

- BUY Entry – 31 Target – 48 Stop Loss – 25

- The company operates through aeronautical businesses and non-aeronautical businesses. Its aeronautical businesses include the provision of terminal facilities, ground handling services and passenger services. Its non-aeronautical businesses include the leasing of commercial and retail spaces at Meilan Airport, airport-related businesses franchising, advertising spaces leasing, car parking businesses, cargo handling and the sales of consumable goods.

- Hainan had adopted the new offshore duty-free shopping policy since July 2020. In 2H20, the duty-free sales increased by 87.4% YoY. Duty-free sales per capita increased by 74.4% YoY in 2020.

- The operational data jumped substantially during Chinese New Year holiday in February. Passenger throughput, aircraft movement, and cargo throughput surged by 209% YoY to 1.2mn persons, 114% YoY to 9,809 units, and 107% YoY to 19,270 tonnes respectively.

- The catalyst is the commencement of operations of Terminal 2, expected around mid-2021. Total duty-free shopping area will reach 24,000 square meters (current T1 shopping area: 15,000 sqm), making it China’s largest duty-free shop.

- Market consensus of net profit growth in FY21 and FY22 are 67.35%YoY and 32.1% YoY, which implies forward PERs of 21.8x and 16.5x. Current PER is 35.3x.

Hua Hong Semiconductor Ltd (1347 HK): A low-end chips play

- BUY Entry – 40 Target –50 Stop Loss – 35

- The company is an investment holding company engaged in production and sales of semiconductor wafers. The company produces 200mm and 300mm-wafers. Its products are applied in general microcontroller (MCU), Type-C interface chips, image stabilization chips, touch control chips, and smart meter controller chips. The products also serve Internet of Things (IoT), new energy vehicles, artificial intelligence and other markets.

- In early February, the company announced FY20 full year results. Revenue hit an all-time high of US$961.3mn with 3.1% YoY growth. GPM dropped 4.3ppts YoY to 26.3%. Net profit plunged by 78.5% YoY to US$33.3mn.

- The recent sell-down was due to NEC’s liquidation of 9,900mn shares at the prices ranging from HK$53.35 to HK$58.55. Meanwhile, its client StarPower Semiconductor (603290 CH) announced to expand its IGBT capacity, which raised concerns on the decline in orders from Hua Hong. However, the strong demand for IGBT will not affect the order book. The utilization of 8 inch foundry capacity remains full for Hua Hong this year.

- Market consensus of net profit growths in FY21 and FY22 are 39.1%YoY and 33.1% YoY, which implies forward PERs of 54.7x and 41.2x. Current PER is 76.6x.

SG Trading Ideas

OCBC (OCBC SP): Banking on higher interest rates and economic recovery

- BUY Entry – 11.20 Target – 12.20 Stop Loss – 10.70

- Banks are the primary beneficiary of rising interest rates and stronger economic growth prospects. With Singapore’s economy forecasted to grow by 4-6% in 2021, as per Singapore’s Ministry of Trade and Industry (MTI), credit costs and non-performing loans (NPL) are expected to be lower.

- OCBC has the highest CET-1 CAR among the three local banks. As at end-2020, its CET-1 CAR was at 15.2%, higher than its target range of 12.5-13.5% and that of the other banks such as DBS (13.9%) and UOB (14.7%). Thus, OCBC in well-positioned to normalise dividends going forward and embark on M&A activities.

- OCBC recently announced Helen Wong as its new group CEO, who will succeed Samuel Tsien on 15 April 2021. Her experience as HSBC’s Greater China Chief Executive sinec 2015 is likely to see OCBC expand faster in China.

- Current valuations are still attractive despite the runup in prices, with double-digit EPS growth in 2021 and 2022. Dividend yields are expected to recover to 4.0% in FY2021, 4.6% in FY2022 and 4.7% in FY2023, according to forecasts.

Rex International (REXI SP): The only oil-related pure play in town

- BUY Entry – 0.175 Target – 0.190 Stop Loss – 0.168

- REXI is an oil and gas exploration and production company with assets mainly in Oman and Norway. As one of Singapore’s only publicly listed oil producing company, its share price is highly correlated to the movement in oil prices.

- This is a pivotal year for REXI as the group ramps up production in Oman. Its Oman field started producing 9,000 barrels of oil last year and the company is in the process of upgrading its maximum processing capacity to handle up to 30,000 barrels per day.

- Last week, OPEC+ surprised markets by maintaining production for April 2021, which will be supportive of oil prices going into the second quarter. Brent and WTI are both higher by 35% year-to-date, with potential upside if Chinese refineries were to start buying again.

- REXI is a laggard play considering the outsized gains of US-listed Exploration and Production (E&P) companies such as Marathon Oil Corp (+95% YTD), Occidental Petroleum Corporation (+70% YTD) and Diamondback Energy (+76% YTD).

Market Movers – What’s Hot

United States

- All major groups in the S&P 500 finished on the higher side last Friday, led by energy as crude oil prices jumped to the highest in nearly two years. The 10-year Treasury yield, which had surged to 1.62% after US jobs numbers came in better than expected, dropped 6bp to close at 1.56%. The recent spike in yields has unsettled financial markets around the world, with high-flying tech companies bearing the brunt of the stock market rout as the Nasdaq continues to lag the major indices.

- Western Digital (WDC US) +7.2% to close at US$68.07, reversing Thursday’s -8.9% move and keeping WDC near its pre-COVID high.

- Tesla (TSLA US) -3.8% to close at US$597.95, for its first close below US$600 since 7th December, almost exactly 3 months later. TSLA is down more than 30% from its peak, and has dragged down related electric vehicle stocks such as NIO, Xpeng, and Blink Charging.

Earnings Watch: C3.AI (8 Mar), Oracle (10 Mar), JD.com (11 Mar), DocuSign (11 Mar)

Hong Kong

- The overall Hong Kong market remained soft as the US market continued to be sold off, and northbound fund flows exceeded southbound flows. The top sectors that plunged included:

- Basic metals: China Hongqiao Group Ltd (1378 HK) -9.45%, closing at HK$9.96. China Molybdenum Co Ltd (3993 HK) -9.36%, closing at HK$5.23. Aluminum Corp of China Ltd (2600 HK) -8.91%, closing at HK$3.58. Angang Steel Co Ltd (347 HK) -8.00%, closing at HK$3.91.

- Healthcare and Pharmaceuticals: Alibaba Health Information Technology Ltd (241 HK) -8.11%, closing at HK24.35. Remegen Co Ltd (9995 HK) -7.62%, closing at HK$95.15. Zai Lab Ltd (9688) -6.61%, closing at HK$1,018. JD Health International Inc (6618 HK) -5.08%, closing at HK$121.5.

- However, top sectors that outperformed due to a rising interest rate expectation and upbeat oil prices included:

- Banking: Agricultural Bank of China Ltd (1288 HK) +4.42%, closing at HK$3.07. Industrial & Commercial Bank of China Ltd (1398 HK) +3.6%, closing at HK$5.47. Postal Savings Bank of China Co Ltd (1658 HK) +2.33%, closing at HK$6.16. Bank of China Ltd (3988 HK) +2.16%, closing at HK$2.84.

- Oil and Gas: PetroChina Co Ltd (857 HK) +3.17%, closing at HK$2.93. CNOOC Ltd (883 HK) +2.42%, closing at HK$9.31. China Petroleum & Chemical Corp (386 HK) +1.15%, closing at HK$4.38.

Singapore

- Sector rotation continued last week as investors sold high-flying technology and penny cap plays, while buying sectors which would benefit from a stronger economy and higher interest rates. Banks and energy stocks tend to outperform in this environment.

- Price-to-book valuations for the three banks are back to pre-Covid levels, although we think they could continue to gain as the economic recovery takes hold. OCBC (OCBC SP) +4.6% WoW to close at S$11.49 and outperforming DBS (-3.9% WoW to close at S$27.69) and UOB (+3.1% WoW to S$25.45) for the week.

- Technology stocks closed mostly lower following the deep sell-off among US semiconductor stocks. UMS (UMSH SP) -7.8% WoW to close at S$1.06, AEM (AEM SP) -4.7% WoW to close at S$3.84 and Frencken (FRKN SP) -8.9% WoW to close at S$1.23.

- Profit taking among high-flying penny caps, with Oceanus (OCNUS SP) -39% WoW to close the week at S$0.043, but still sporting a 1333% gain over the past one year. Other losers included Thomson Medical (TMG SP) -9.2% WoW to close at S$0.108 and Medtecs (MED SP) -14.1% WoW to close at S$0.945.

Trading Dashboard

3 thoughts on “KGI DAILY TRADING IDEAS – 8 March 2021”

Comments are closed.