KGI Daily Trading Ideas – 22 January 2021

IPO Watch

HK: Kuaishou

Trading starts 5th February 2021.

Kuaishou is Chinese video-sharing mobile app developed by Beijing Kuaishou Technology Co., Ltd, with a particularly strong user base among users outside of China’s Tier 1 cities. Outside Mainland China, it has also gained considerable popularity in other markets, topping the Google Play and Apple App Store’s “Most Downloaded” lists in eight countries. In India, this app is known as Snack Video. It is often referred to as “Kwai” in overseas markets. Its main competitor is Douyin, which is known as TikTok outside of China.

Relx Technology (RLX US) – IPO price range at US$12, above prior US$8-10 range

- New IPO price indicates ~US$18bn diluted market cap and 43.6x P/2020 annualised multiple.

- RLX is expected to trade tonight, 22nd January. We expect RLX to pop in its first day of trading. Read our write-up here.

Qualtrics (XM US) – IPO price range raised to US$22-26

- Qualtrics is an experience management platform that was acquired by SAP in 2019 for US$8bn prior to its IPO, and is now being spun out of the company.

- Initial IPO pricing was US$20-24. New IPO range indicates US$11.2 – 13.3bn initial market cap.

- Qualtrics is scheduled to IPO next week.

Ortho Clinical Diagnostics (OCDX US) – US$1.5bn IPO with initial price range at US$20-23

- OCDX is formerly a Johnson & Johnson diagnostics unit that was acquired by Carlyle for US$4bn back in 2014, providing in vitro diagnostic products.

- Initial IPO pricing is at US$20-23 for an initial market valuation of US$4.9bn at the midpoint of the price range.

- OCDX is scheduled to IPO next week.

IPO Performance Recap

MyTheresa (MYTE US) – First day pop of 19%

- MyTheresa opened trading near US$36 before ending the day at US$31, for a first day pop of 19%.

- At US$31, MYTE trades at 4.4x P/TTM Sales. We expect the trading range to be around 3x – 5x P/S (US$21 – US$32) and to accumulate at the lower end of the range.

Affirm Holdings (AFRM US): Steady pullback, catching the break

- REITERATE BUY Entry – 105 Target – 135 Stop Loss – 90

- Major IPO stocks have experienced a pullback, including Affirm’s, which has hit our entry price on Wednesday’s trading.

- Meanwhile, Afterpay (APT AU) has surged ~30% on the back of Affirm’s first day pop.

- We revise target price and stop loss to narrow the risk for the trade, but maintain that Affirm can reach Afterpay’s market valuation.

US Trading Ideas

Zillow Group (Z US): Estate tech market leader to rake in more gains

- BUY Entry – 141 Target – 180 Stop Loss – 122.5

- Zillow Group is the largest digital real estate platform in the US, boasting more than 200 million monthly unique users and close to US$3bn of sales.

- Zillow was able to grow 9M20 sales by 42% YoY, supported by low mortgage rates and suburban housing demand. Management has forecasted for further ramp-up of sales in 4Q20. With housing prices expected to continue climbing in 2021, Zillow is expected to benefit from increased fees from its core business of facilitating real estate agents, higher margins from their current inventory of homes, and more business activity in their newly formed mortgage business.

- The stock is attempting to break above US$150 and we recommend buying the pullback. (Note: Zillow has two classes of stock and we are recommending class C shares rather than class A)

Pinterest (PINS US): Facebook’s mishaps are in Pinterest’s interest

- RE-ITEREATE BUY Entry – 71 Target – 90 Stop Loss – 61

- Pinterest operates a hybrid social media/search engine internet platform, hosting over 400 million Monthly Active Users and TTM sales of US$1.4bn.

- Pinterest boasts a unique ad experience: while ads on other platforms are generally disruptive to the user experience, Pinterest’s targeted ads are helpful to the users whom are likely searching for inspiration prior to a purchase.

- We see Pinterest to have staying power in the digital advertisement space as attempts by Facebook (Hobbi) and Google (Google Keen) to replicate the Pinterest experience have been relatively unsuccessful.

- We see short term catalysts from the earnings call, while effective monetisation of international users will be the longer term catalyst to support the uptrend.

HK Trading Ideas

Razer Inc (1337 HK): Gearing up for a turnaround in 2021

- RE-ITERATE BUY Entry – 2.45 Target –2.9 Stop Loss – 2.15

- The company announced a profit alert for FY2020 that it expects to record breakeven profit or loss on a GAAP basis compared to US$83.5mn losses in FY2019. The overall revenue growth is expected to be at least 40% YoY. Profit margins were also improved due to higher contribution from Services business.

- Working from home (WFH) was widely adopted during COVID period, and it has become a new norm worldwide. Even though vaccination has begun amid rising infection cases, WFH will remain in the post-COVID era. Hence it will be an ongoing driver for Razer’s improving businesses.

- The stock is forming a support level at above HK$2. We believe this will be a bargain if the price pulls back due to some adverse market sentiment given that the company’s fundamentals remain sound.

Smoore International Holdings Ltd (6969 HK): Vaping to get high

- RE-ITERATE BUY Smoore International Entry – 75 Target – 90 Stop Loss – 65

- The Company is mainly engaged in the research, design, manufacture and sales of vaping devices and components and self-branded advanced personal vaporizers (APV). Its APV brands include Vaporesso, Renova and Revenant Vape. The Company mainly operates its businesses in the United States, Mainland China, Hong Kong, Japan, Switzerland and the United Kingdom, among others. Smoore is the world largest vaporizer supplier.

- As of FY19, the company reported a 10-fold increase of FY16 revenue and 20-fold surge of FY16 net profit. The market penetration rate remains low at 16.5%, thus providing more headroom to capture higher growth in the next couple of years.

- The catalyst is the upcoming IPO of e-cigarette company, RLX Technology (RLX US). There are only a few pure listed vaporizer companies currently. We believe RLX’s IPO will attract more fund flows into this niche market.

- The stock price performance is on a healthily bullish uptrend.

SG Trading Ideas

Avarga (AVARGA SP): Set to benefit from strong US housing demand and fiscal stimulus

- RE-ITERATE BUY Entry – 0.33 Target – 0.43 Stop Loss – 0.29

- Avarga’s main business contributor, Taiga Building Products (TBL CN; 70.8%-owned by Avarga), runs a business of lumber and other building materials distribution in North America.

- TBL is benefiting from high lumber prices driven by strong housing starts in the US, as well as expectations of increased infrastructure stimulus that would lead to higher demand for building materials.

- AVARGA is a compelling short-term trade as its Canadian-listed TBL makes new multi-year highs. We have a fundamental fair value of S$0.43 on AVARGA. Read our full report here.

Yanlord Land Group (YLLG SP): Primed for a rebound as peers in HK rally

- BUY Entry – 1.13 Target – 1.27 Stop Loss – 1.08

- YLLG is a leading property developer in China with a focus on the luxury residential market in Tier 1 and Tier 2 cities such as Chengdu and Nanjing.

- The company earlier this month announced that its total pre-sales from residential and commercial units and car parks for the full year 2020 amounted to around RMB 79 bn (S$16 bn) on contracted gross floor area (GFA) of 2.1mn sqm, representing a surge of 41% YoY and 14% YoY respectively.

- We currently have a fundamental OUTPERFORM rating on the stock with a target price of S$1.52. Meanwhile, we think YLLG offers a good short-term trading play following the rally of its peers listed in Hong Kong including Evergrande (3333 HK), Sunac (1918 HK) and China Vanke ( 2202 HK) .

Market Movers – What’s Hot

United States

- Intel (INTC US) +6.46% at US$62.46 after reporting earnings just minutes prior to market close, causing a substantial share price run up. While INTC beat 4Q20 expectations, 1Q21 forecast was lower on a year-on-year basis. INTC also announced plans to keep most of manufacturing in-house, sending INTC shares down in after-hours to around US$60 while also weakening TSMC’s (TSM US/2330 TT) share price.

- FuboTV (FUBO US) +17.74% closing at US$35.50 after David Einhorn’s Greenlight Capital revealed itself as a pre-IPO investor in the company and highlighted the bull case for FUBO and the sports betting scene.

- Paccar (PCAR US) +10.46% closing at US$98.74, reaching an all-time high. This comes two days after a strategic partnership with Aurora Innovation to improve PCAR’s autonomous vehicle platform.

Hong Kong

- Hua Hong Semiconductor Ltd (1347 HK) +8.53%, closing at a new high of HK$53.45. Founder Securities reiterated OVERWEIGHT rating with a TP of HK$58.2. It expects 4Q20 earnings to beat expectations, and that the strong demand for power semiconductors and CMOS image sensors will last till 4Q21.

- MicroPort Scientific Corporation (0853 HK) +8.08%, closing at a new high of HK$59.55. Previously, the proposed spin-off and separate listing of MicroPort CardioFlow Medtech Corporation,a subsidiary of the company has submitted the post hearing information pack to Hong Kong Exchange for public publication.

- China Youzan Ltd (8083HK) -7.04%, closing at a HK$3.7. The pullback was due to some profit-taking movements after 78.8% gains YTD.

Singapore

- CityDev (CIT SP) -2.2% in early morning trade today after the company announced that it will make material impairment loss on its investment in its 51%-owned Sincere Property, given the challenges facing China’s real estate market. So far, three directors in CityDev have resigned over concerns on its investment in Sincere Property.

- UMS (UMSH SP) +3.1% to close at S$1.34 as it catches up to semiconductor-related companies like Frencken Group (FRKN SP) and AEM (AEM SP).

- Singapore M&A activity continues to ramp up. Grand Venture Tech (GVTL SP) +53% YTD to S$0.53 after Singapore-based private equity firm Novo Tellus took a 29.6% stake in the company for S$30mn. Novo Tellus has been the PE fund behind many successful tech-related investments including AEM (AEM SP) and ISDN (ISDN SP).

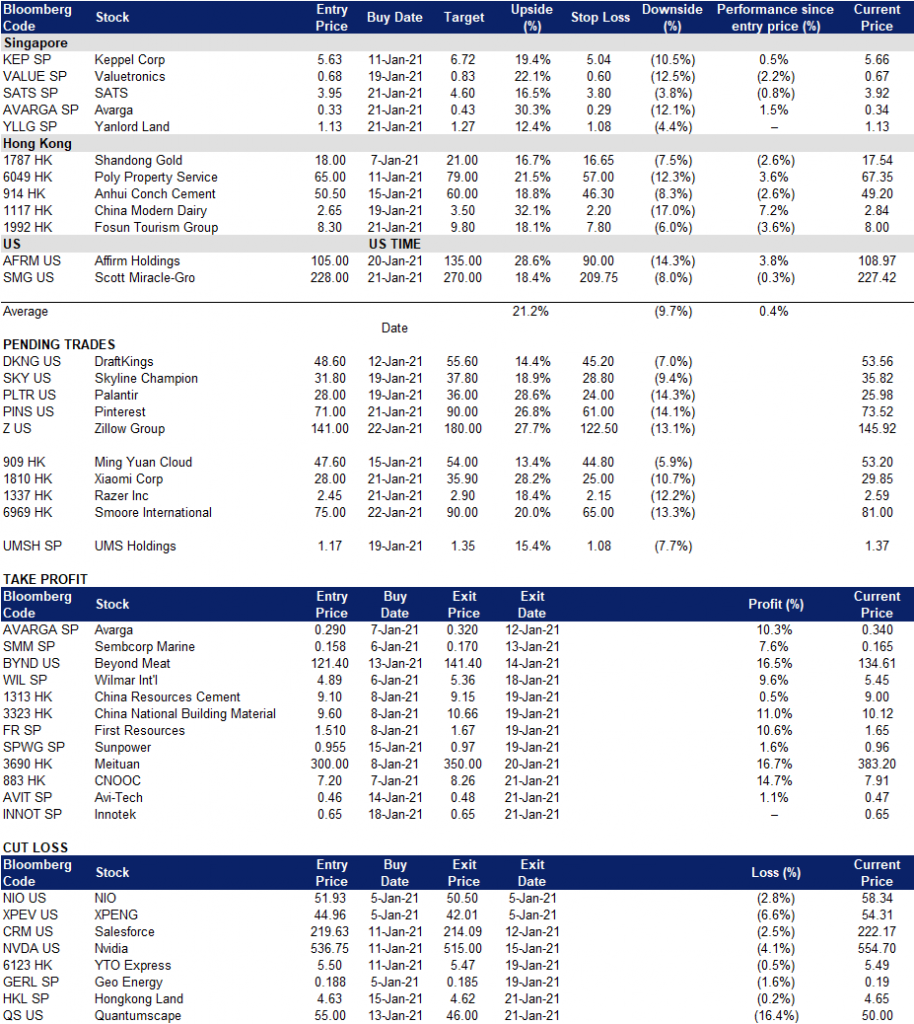

Trading Dashboard