KGI DAILY TRADING IDEAS – 11 August 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

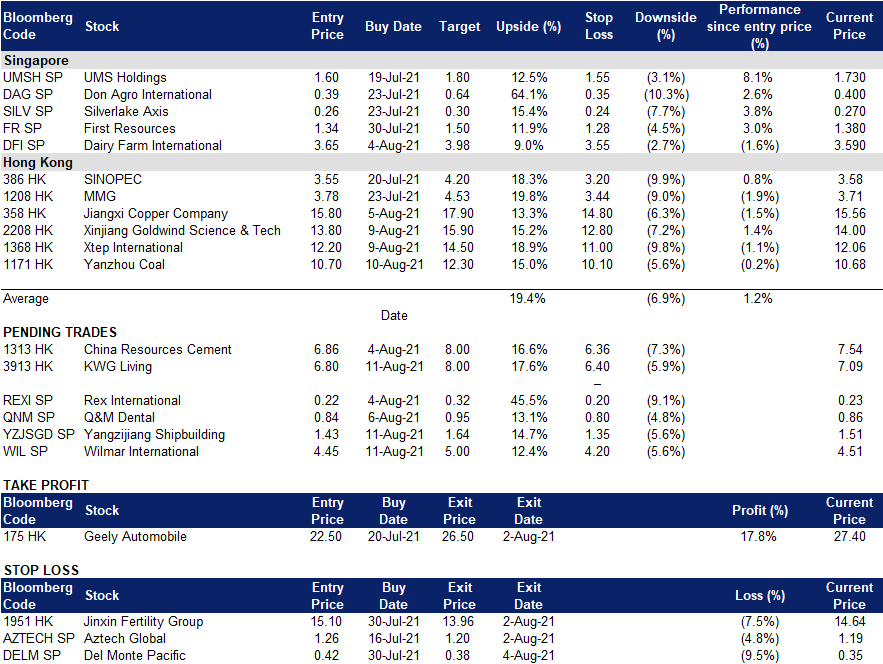

Wilmar International (WIL SP): Time to buy the dip

- BUY Entry – 4.45 Target – 5.00 Stop Loss – 4.20

- Wilmar is ranked among the largest listed companies by market cap (S$28bn market cap as of 10 Aug) on SGX. The company’s business activities include oil palm cultivation, oilseed crushing, edible oils refining, sugar milling and refining, manufacturing of consumer products, specialty fats, oleochemicals, biodiesel and fertilisers as well as flour and rice milling.

- Down from the peak. Shares of Wimar have declined almost 20% from the 5-year peak of S$5.57 reached in February 2021. This rally and subsequent decline was driven by the IPO of its China subsidiary, Yihai Kerry Arawana (YKA), on the ChiNext board of the Shenzhen Stock Exchange.

- Another IPO to serve as a catalyst. Wilmar’s 50% JV with Adani Group in India has filed a draft red herring prospectus with the Securities & Exchange Board of India in relation to the proposed IPO for listing on the BSE and NSE. The proposed listing will raise around US$600mn via the issuance of new shares.

- Robust palm oil prices. Despite the recent decline in palm oil prices, they remain near all-time highs, driven by robust demand from India and China. It is consensus view that stockpiles are likely to remain low in China, thus supporting prices. Meanwhile, labour shortages may pose downside risk to supply in the second half of 2021.

- Bullish consensus forecast. There are 13 BUYS / 1 HOLD / 0 SELL and an average 12m TP of S$6.17. Wilmar currently trades at 13x and 12x FY2021 and FY2021 P/E, driven by 6-7% EPS growth in the next two years. Dividend yield is a decent 3-4%.

Palm oil prices (5 years)

Yangzijiang Shipbuilding (YZJSGD SP): Busy as a bee

- RE-ITERATE BUY Entry – 1.50 Target – 1.72 Stop Loss – 1.40

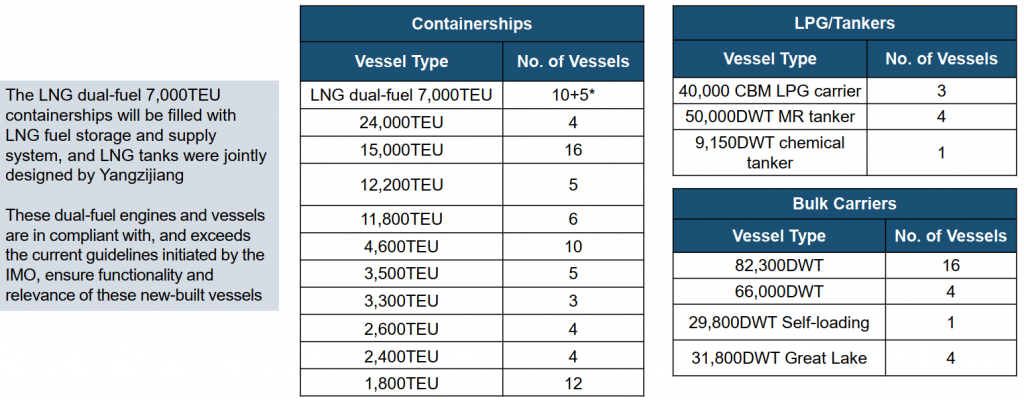

- Yangzijiang is China’s largest private shipbuilder. The company builds a broad range of commercial vessels including containerships, bulk carriers and LNG vessels. Yangzijiang has been at the forefront of shipbuilding in China, receiving its first ever 24,000 TEU containership order in December 2020, the largest containership currently operating in the world.

- 2Q2021 results a beat. Yangzijiang last week reported a 39% surge in its 1H2021 earnings to RMB1.64bn on the back of higher gross profit margin of 26% vs 24% in the prior year period. Earnings were helped by other income and reversal of impairment losses which totaled around RMB0.5bn in 1H2021.

- Very busy year. The company had a record high order win of US$6.7bn year-to-date, buoyed by favourable market sentiments and the group’s reputation and capabilities in shipbuilding. As of yesterday, the group had a record net orderbook of S$8.7bn for a total of 167 vessels. As a testament to its advanced shipbuilding capabilities, the group won 3 units of 40,000 CBM LPG vessels and 10+5 units of LNG dual-fuel 7,000 TEU containerships.

- Bullish consensus forecasts. There are 7 BUYS / 1 HOLD / 1 SELL and a 12m TP of S$1.80 (+25% upside). Valuations are attractive at 10x and 8x FY2021 and FY2022 P/E respectively. Dividend yield is decent at 3-4% per year from 2021 to 2023, backed by a rock-solid cash balance of almost RMB10bn (end 2Q21).

Yangzijiang’s orderbook as of 5 August 2021

HONG KONG

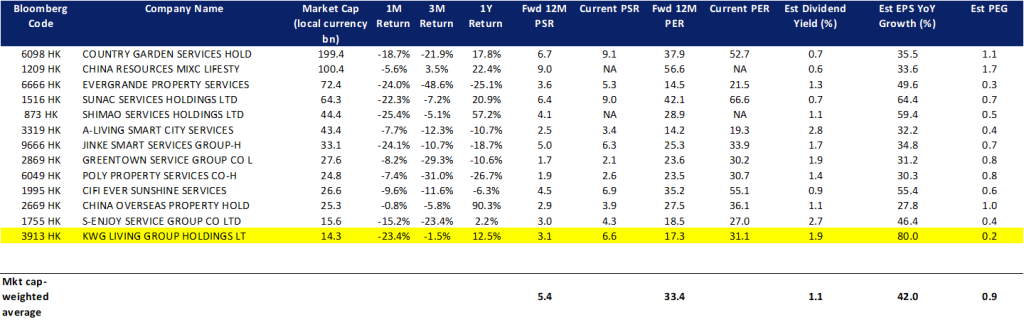

KWG Living Group Holdings Ltd (3913 HK): Fundamentals intact but just impacted by weak sentiment

- Buy Entry – 6.8 Target – 8.0 Stop Loss – 6.4

- KWG Living Group Holdings Ltd is a holding company engaged in provision of property management services. The company operates two segments. The Residential Property Management Services segment provides pre-sale management services, property management services, community value-added services and public space value-added services. The Commercial Property Management and Operational Services segment provides pre-sale management services, commercial property management services, commercial operation services and other value-added services.

- Counter-inflation remains the main investment theme for investors this year, and property management services are viewed as an indirect hedge against rate hikes. The sector has positive investment attributes such as low capex, net cash positions, and stable dividend payout. All these are in line with the value sectors that investors are currently looking out for.

- The company has a relatively attractive valuation compared to peers in the property management sector. Its forward 12M PEG is the lowest among its peers, and the estimated dividend yield is decent compared to peers.

- Market consensus of net profit growth in FY21 and FY22 are 61.1% YoY and 43.7% YoY, which implies forward PERs of 21.0x and 13.0x. Current PER is 38.1x. Bloomberg consensus average 12-month target price is HK$12.48.

Yanzhou Coal (1171 HK): Green light to expand production

- Buy Entry – 10.70 Target – 12.30 Stop Loss – 10.10

- Yanzhou Coal Mining Company Limited is a coal producer in China and Australia, which is primarily engaged in the mining, washing, processing and distribution of coal through railway transportation. The company offers a range of coal products and other mixed coal products, including thermal coal, semi-hard coking coal, semi-soft coking coal, pulverized coal injection (PCI) coal and other mixed coal products.

- China restarting coal mines. Last Thursday, China’s authorities authorised more coal mines to restart production amid surging power demand. Operations will restart for a year at 15 coal mines across the northern provinces including Shanxi and Xinjiang region, which is an addition to the restarting of 38 coal mines in Inner Mongolia in the prior week period.

- Strong demand for coal driving record high prices. The decision to restart the coal mines were driven primarily by strong demand as a result of the extreme summer heat and a rebound in industrial output. China’s thermal coal prices have jumped by around 36% year-to-date, hitting a record in May. Officials have warned that coal prices are expected to stay elevated due to China’s power shortage that is poised to worsen.

- Bloomberg consensus. Yanzhou Coal currently trades at 4x FY 2021-2023 P/E and at 0.7x FY2021 P/B while offering a 14-16% ROE per annum over the next three years. Bloomberg consensus average 12-month target price is HK$11.39.

Zhengzhou Thermal Coal Futures

Market Movers

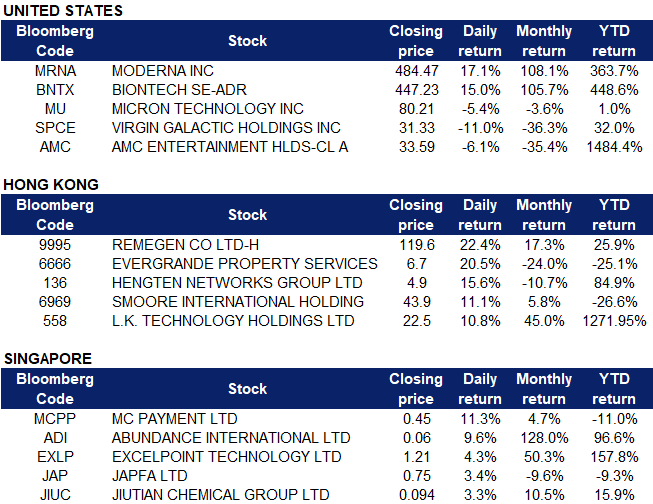

United States

- Moderna (MRNA US) stocks slipped 5.72% on Tuesday after Bank of America analyst Geoff Meacham wrote that the stock’s valuation had gone “from unreasonable to ridiculous”, reiterating with an underperform rating and a target price of $115, 75% below the stock’s current price.

- BioNTech (BNTX US) stocks were down 6.87% after studies of over 50,000 patients in the Mayo Clinic Health System showed that rival Moderna’s vaccine might be more effective against the delta variant of the COVID-19 virus. The vaccine developed together with Pfizer stood at only 42% effectiveness during July, according to the study, compared to 76% for Moderna.

- Micron Technology (MU US) shares dropped for a second day, falling 5.4% after a report that the order-filling time for chip makers now exceeds 20 weeks by Susquehanna Financial Group was released, as reported by Bloomberg. The order-filling time is the period from ordering a semiconductor to receiving it, and the current gap is at the highest in four years.

- Virgin Galactic (SPCE US). The space tourism company saw its shares plunge 11% after it was confirmed in a Wall Street Journal article that Virgin Galactic will raise ticket prices for rides to $450,000 a seat, twice of what was initially advertised.

- AMC Entertainment (AMC US) fell 6% after reporting a quarterly loss of 71 cents per share, 20 cents a share below analyst expectations. The movie theatre chain reported revenue of $444.7 million, beating analyst estimates of $382.1 million. AMC also announced that it will begin accepting cryptocurrencies at U.S. locations this year.

Singapore

- MC Payment Limited (MCPP SP) shares rose by 11.3%, boosted by higher-than-average trading volumes in the later-half of the trading session. There was no company specific news yesterday. However, share price could have risen due to the overall positive sentiment on digital payment providers. KPMG reported in The Business Times that payment companies have enjoyed the top spot in investors’ wallets globally, also clocking in the highest in deal value (US$19 bn in 1H21) by far among all other fintech segments. Finance solutions embedded into retail apps and ecosystem platforms, as well as the “buy now, pay later” sub-sector, have attracted significant investor interest. On the whole, KPMG projects “very robust” fintech investment trends in “most regions” of the world, although in view of increased numbers of digital transactions, cyber-security solutions will also come up on the radar of investors.

- Abundance International Limited (STRTR SP) shares continued to rise from last Friday and closed at a 52-week high yesterday. Investors are likely buying ahead of the company’s earnings results expected to be released on 13 August. Abundance International announced a positive profit alert on 21 July, where the group is expected to report a profitable 1H21 as compared to a loss-making 1H20. This is mainly driven by a significantly better performance from the company’s subsidiary, Orient-Sale Chemicals which is in the chemical trading business, coupled with its other subsidiaries in China and Japan. Additional catalysts include a significant fair value gain from the company’s investment of shares in the capital of Jiangsu Sopo Chemical Co., Ltd.a and a significant reduction in non-cash interest expense on zero coupon bonds. Read the full announcement here.

- Excelpoint Holdings Limited (EXLP SP) shares continued to rise from last Friday and closed at a 12-year high yesterday. The company announced its 1H21 results on 5 August, Thursday and reported an increase in revenue of 45.3%, from US$510mn in 1H20 to US$740.9mn in 1H21, while net profit surged by an outstanding 483.8% to US$12mn. The company’s CEO, Mr Albert Phuay, commented that despite the challenges posed by the pandemic, the group achieved a good set of results with record revenue and improved margins for the first half of the year. He also had a positive outlook on the company moving forward, contributed by the strong demand coming from the accelerated adoption of technologies for automation and intelligence in the consumer, commercial and industrial sectors. The company will continue to see a rising need for semiconductor chips and solutions. Read the full results here.

- Japfa Limited (JAP SP) Shares rose by 3.4% yesterday even though there was no company specific news. Most recent news was on 3 August when analysts cut their target prices for Japfa following the release of 1HFY2021 ended June results on July 29. UOB Kay Hian downgraded the stock to HOLD given the company’s uncertain outlook, especially for its Indonesia poultry and Vietnam swine segments, due to the worsening Covid-19 situation. Shares have declined continuously since reaching a 1-year peak in April, reaching a YTD low of S$0.725 on 6 August. The rise in share price yesterday could be due to a technical rebound after the RSI dropped below 30.

- Jiutian Chemical Group Limited (JIUC SP) shares rose by 3.3% yesterday and closed at a one-month high after the company provided a positive profit guidance last Friday. The company expects to report a significant increase in consolidated net profit compared to the corresponding prior year period. The higher profit is mainly due to an increase in average selling price and sales volume of DMF and methylamine. The company is due to report its 6M2021 results before 14 August. Jiutian’s peers, Abundance International and China Sunsine, also posted positive profit guidance news on 21 July and 30 July respectively. Abundance International is expected to report a profitable 1H21 as compared to a loss-making 1H20, whereas China Sunsine is expected to report a substantial increase in consolidated net profit in 1H21 as compared to 1H20, due to an increase in both average selling price and sales volume. Read the profit guidance posted by Abundance International and China Sunsine.

Hong Kong

- RemeGen Co Ltd (9995 HK) The company entered an exclusive worldwide license agreement with Seagen Inc. to develop and commercialize disitamab vedotin. Pursuant to the license agreement, among other things, Seagen is granted an exclusive license, to develop and commercialize disitamab vedotin, an anti-HER2 antibody-drug conjugate in countries of the world other than the countries retained as the RemeGen Territory. The RemeGen Territory includes Greater China and all other countries in Asia other than Japan and Singapore. Pursuant to the License Agreement and subject to the terms and conditions thereof, the company shall receive an upfront payment of US$200 million and up to US$2.4 billion in milestone payments.

- Evergrande Property Services Group Ltd (6666 HK), HengTen Networks Group Ltd (136 HK). Media previously reported that several large state-owned and private companies planned to inject capital into the company, as well as into China Evergrande New Energy Vehicle Group (708 HK).

- Smoore International Holdings Ltd (6969 HK). Citic Securities maintained an OVERWEIGHT rating and a TP of HK$74 as it views Smoore as the market leader with a robust tie with existing customers in the e-cigarette sector. Furthermore, it is difficult to find substitutes for Smoore’s products.

- LK Technology Holdings Ltd (558 HK). Shares closed at an all-time high. There was no company-specific news. Previously, Daiwa initiated with a BUY rating and a TP of HK$26. The company is Tesla’s exclusive Giga Press machine sole provider. If other automobile manufacturers were to adopt Tesla’s manufacturing technique, LK Technology would benefit. Meanwhile, Tesla’s acceleration in launching new models will drive more demand for Giga Press machines.

- Trading Dashboard: Add Yanzhou Coal (1171 HK) at HK$10.70.

Trading Dashboard

Related Posts: