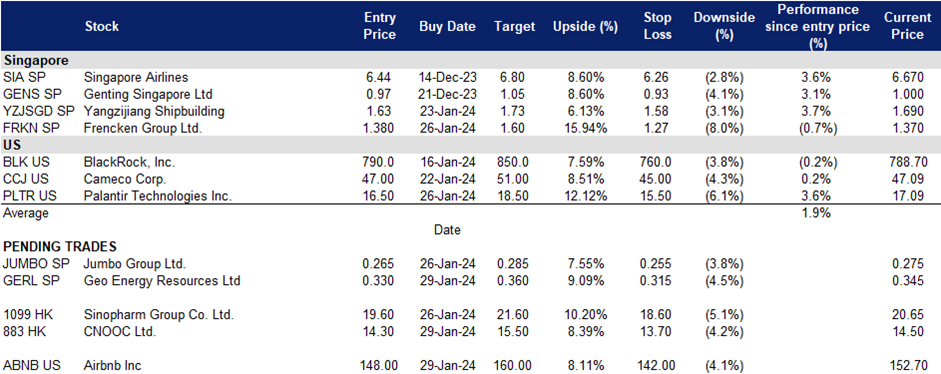

31 January 2024: Geo Energy Resources Ltd (GERL SP), CNOOC Ltd. (883 HK), Airbnb Inc (ABNB US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

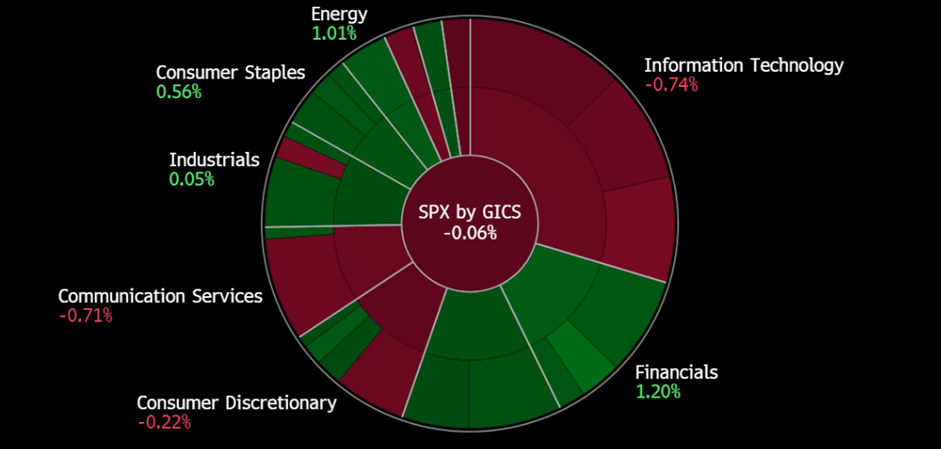

United States

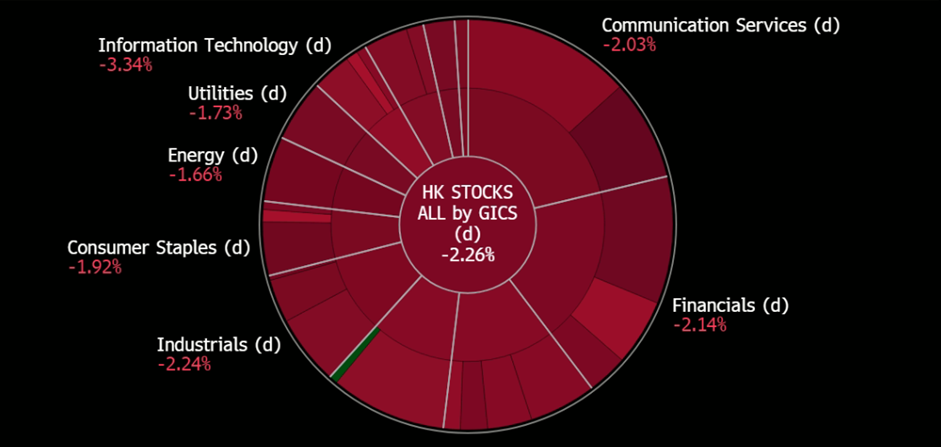

Hong Kong

Geo Energy Resources Ltd (GERL SP): Production to jump

- BUY Entry – 0.330 Target– 0.360 Stop Loss – 0.315

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Inorganic growth to expand sales volume. As of 31 December 2023, Geo Energy owns 73.11% of PT Golden Eagle Energy Tbk, listed on IDX, and it owns 85% of TRA mine. In December 2023, after the acquisition, TRA had its first export shipment of coal valued at around USD3.2mn based on the ASP of approximately USD58.98 per tonne, which was sold at a premium to the Indonesian Coal Index (ICI) price of USD58.05 per tonne at that time, indicating the favourable demand for TRA coal. TRA produces 3,800 kcal/kg gar coal and has 275Mt of 2P coal reserves, leading to a 262% increase in reserves after the acquisition.

- Long life of mine and low operating costs. Geo Energy obtains a strategic advantage stemming from the extensive lifespan and projected coal production of its mines, instilling confidence in long-term clients to engage in supply contracts with the company. Boasting over 351 million tonnes of thermal coal reserves, Geo Energy holds a prominent position in Indonesia. Additionally, its commendably low stripping ratio, approximately 4.8 for a large-scale coal operator, equips Geo Energy with resilience against cyclical fluctuations in volatile coal prices.

- Upbeat outlook after the acquisition. The recent EGM voting approved the acquisition of two promising companies, significantly expanding the group’s mining portfolio. The newly acquired mine boasts an estimated 275 million tonnes of reserves. Within 5-6 years, Geo Energy will scale up its production to up to 25 million tonnes from the current 8-10 million tonnes, implying a CAGR of 18.6%. The strategic move aligns with the robust demand for TRA coal, primarily fuelled by China and Korea. Despite challenges such as the Monsoon season impacting mining activities, the group anticipates sustained profitability, emphasizing the strategic imperative for acquiring additional mines.

- 3Q23 results review. 3Q23 revenue decreased by 33% YoY to US$111mn from US$164.7mn. Net profit fell 68% YoY to US$11.5mn from US$35.7mn. It attributed the lower revenue to lower sales volume and average selling price, noting that the average Indonesian Coal Index Price for 4,200 GAR coal fell to US$52.07 per tonne in Q3, from US$82.20 per tonne a year earlier. Coal sales declined from 2.4mn tonnes to 2.2mn tonnes.

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.80. Please read the full report here.

(Source: Bloomberg)

Jumbo Group Ltd (JUMBO SP): Welcome more Chinese

Jumbo Group Ltd (JUMBO SP): Welcome more Chinese

- RE-ITEREATE BUY Entry – 0.265 Target– 0.285 Stop Loss – 0.255

- Jumbo Group Ltd is a seafood restaurant group offering multiple dining concepts catering to all types of consumers. The Company offers restaurants in Singapore, China, and Japan.

- Mutual visa exemption. Starting on 9 February, Singapore and China will implement a 30-day visa-free arrangement, allowing ordinary passport holders from both countries to enter without a visa for up to 30 days. The agreement, signed on 25 January, aligns with the Chinese New Year holidays. China has similar comprehensive visa exemption arrangements with at least 22 countries, and this initiative aims to enhance travel between Singapore and China, particularly as the Chinese New Year falls on 10 February this year.

- Chinese tourism expected to rise. Despite weaker-than-expected consumer sentiment, analysts and survey data forecast a continued recovery of overseas travel by Chinese tourists in 2024. While China’s economic data suggests consumer caution, there is a notable rise in enthusiasm for travel and socializing in restaurants and bars. McKinsey predicts a shift from goods to services spending, contributing to the recovery of international travel. A forecast by Singapore-based China Trading Desk anticipates a 50% rise in international travel by Chinese tourists in 2024, reaching 62% of pre-pandemic levels. Singapore is expected to benefit from this tourism recovery, being the most popular destination among surveyed respondents. The impending 30-day mutual visa exemption arrangement between Singapore and China is seen as a positive development for boosting tourism. Jumbo is set to benefit from the increase in travellers and the shift to services spending.

- 2H23 results review. 2H23 revenue increased by 40.7% to S$92.8mn from S$66mn. Earnings rose 52% YoY to S$6.7mn from S$4.4mn due to a recovery in its sale of food and beverages sector. Cost of sales rose 46.5% to S$32.6mn, in tandem with revenue. In China, 2H23 revenue rose 15.3% to S$12.7mn due to the end of the country’s zero-Covid-19 policy in December 2022. In Taiwan, Jumbo’s top-line contributions rose 17.5% to S$1.9mn.

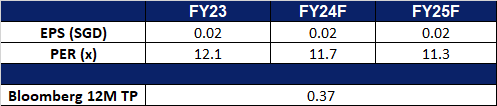

- Market Consensus.

(Source: Bloomberg)

CNOOC Ltd. (883 HK): 2024 Record Targets

- BUY Entry – 14.3 Target – 15.5 Stop Loss – 13.7

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Record 2024 Output and Capex Targets. CNOOC has recently increased its 2024 production target by approximately 8% to a record 700-720 million barrels of oil equivalent (BOE), accompanied by a surge in annual capital spending to unprecedented levels. Around 69% of the total output in 2024 is expected to stem from domestic production. New domestic production sources this year will include oilfields off China’s Bohai Bay, deep-sea natural gas operations in the South China Sea, and onshore coalbed methane projects. Additionally, the company anticipates robust production growth from the Mero-3 project in Brazil. In terms of Capital Expenditure, CNOOC’s 2024 budget ranges from 125 billion yuan ($17.43 billion) to 135 billion yuan, with exploration, development, and production accounting for approximately 16%, 63%, and 19% of the total, respectively.

- Commencement of production. CNOOC recently announced that its Mero2 Project has begun production. The project consists of 16 development wells which are planned to be commissioned, including 8 production wells and 8 injectors. The Floating Production Storage and Offloading (FPSO) used in the project also has a designed storage capacity of approximately 1.4million barrels, one of the largest FPSO in the world. This project is expected to bring an additional 180,000 barrels of crude oil per day for the company.

- Construction of underground oil reserve. CNOOC recently started construction in Ningbo, China, on its largest commercial underground oil reserve project. The oil reserve is designed with a capacity of 3 million cubic meters, encompassing crude oil caverns, along with surface crude oil storage, transportation, and other supporting facilities. The project would be receiving a total investment of around 3bn yuan and is scheduled to be completed by 2026. Upon completion, the oil reserve would provide a steady supply of crude oil to surrounding cities and provinces.

- 3Q23 earnings. Revenue rose by 5.48% YoY to RMB114.8bn in 3Q2023, compared to RMB108.8bn in 3Q22. Net profit fell 8.23% YoY to RMB33.4bn, compared to RMB36.4bn in 3Q22. Basic EPS fell by 7.78% YoY to RMB0.71, compared to RMB0.77 in 3Q22.

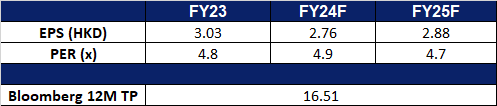

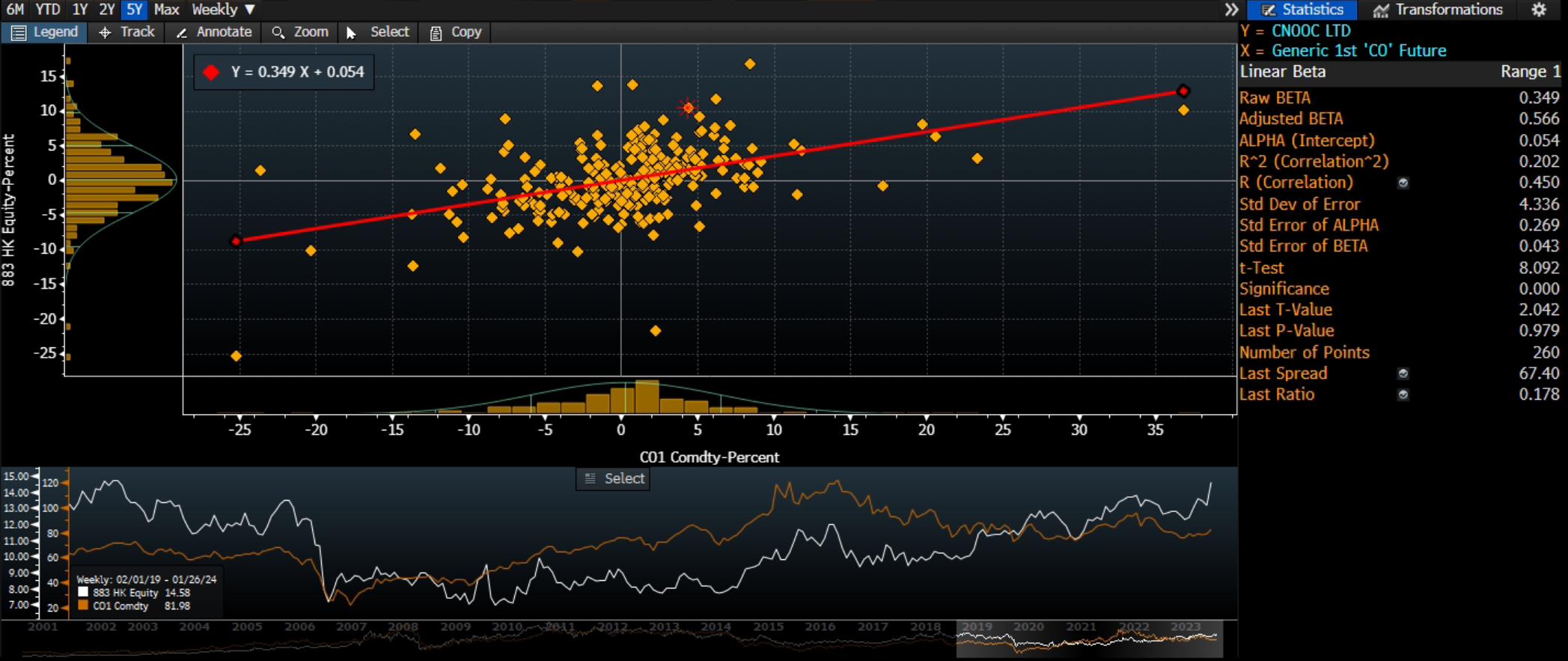

- Market consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Sinopharm Group Co. Ltd. (1099 HK): Flu season

- RE-ITEREATE BUY Entry – 19.6 Target – 21.6 Stop Loss – 18.6

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- Surge in flu cases. China has witnessed an increase in cases of acute infectious respiratory diseases since the onset of winter. According to JD Health, an online healthcare platform, sales of flu medication have experienced notable surges of 340% and 13%, respectively, in the initial 12 days of January when compared to figures from November and December. This heightened demand for respiratory disease medications in China has prompted major drug manufacturers to substantially ramp up their production. Industry experts anticipate a growing requirement for such remedies in the days ahead.

- Strategic Cooperations. Recently, the groundbreaking ceremony for the construction of the new Xinxiang Maternal and Child Health Hospital and Sinopharm Zhongyuan Children’s Hospital took place on the western side of Xinxiang Central Hospital’s east campus. This project marks a significant milestone in the ongoing medical reform collaboration between Sinopharm Group and the Xinxiang Municipal People’s Government, spanning over a decade. Sinopharm Group expresses its commitment to further deepen cooperation and engagement with the Xinxiang Municipal Party Committee and Municipal Government in the future. The company is dedicated to fulfilling the responsibilities of central enterprises, aiming to achieve even more fruitful and impactful collaborative outcomes.

- Increasing adoption of AI in healthcare technology. The influence of AI on healthcare is substantial, reshaping the delivery of medical services. The progress in healthcare technology through AI contributes to enhanced diagnostics, improving the efficiency and accuracy of treatments. Many companies are expected to embrace this trend in the near future. The ongoing development of AI in healthcare technology is likely to persist, driven by consumer preferences and the rise in chronic illnesses, particularly among a globally aging population, with China being a notable example.

- 9M23 earnings. Operating Revenue rose by 9.73% YoY to RMB445.9bn in 9M2023, compared to RMB406.4bn in 9M22. Net profit rose by 2.60% to RMB10.1bn in 9M2023, compared to RMB 9.81bn in 9M2022. Diluted EPS rose by 4.25% from RMB1.88 in 9M2022 to RMB1.96 in 9M2023.

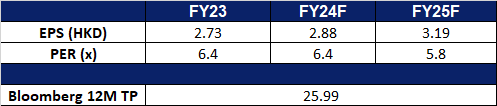

- Market consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): International growth prospects

- BUY Entry – 148 Target – 160 Stop Loss – 142

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- Cross-currency bookings. Airbnb is planning to increase the guest service fee for cross-currency bookings starting 1 April, adding up to 2% for guests paying in a different currency. This move, aimed at supporting the company’s international growth strategy, could potentially generate $200mn to $500mn in incremental profit in 2025. While there might be a high-single-digit impact on 2025 EBITDA if users shift to local currency payments, Airbnb views this adjustment as aligning its fees with industry practices and enhancing flexibility for new products, features, and policies.

- Establishment of a housing council. Airbnb established the Airbnb Housing Council in the United States, aiming to find “sensible, long-term” solutions to increase housing supply and collaborate with cities on the challenges of home sharing. Chaired by Stephanie Rawlings-Blake, former Mayor of Baltimore, the council will involve leading independent housing organizations to advise Airbnb on policies, initiatives, and partnerships for housing growth. The council will work on balancing the benefits of home sharing with community needs, addressing housing affordability challenges. Airbnb aims to leverage the council’s expertise to identify new policy ideas and initiatives in collaboration with communities, hosts, and guests.

- 3Q23 results. Revenue rose 18.1% YoY, to US$3.4bn. GAAP EPS beat estimates by US$4.53 at US$6.63. Expect nights booked growth to moderate in Q4 compared to Q3. For 4Q23, the company expects to deliver revenue of US$2.13bn to US$2.17bn, a YoY growth between 12% and 14%.

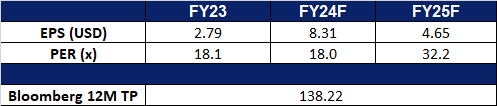

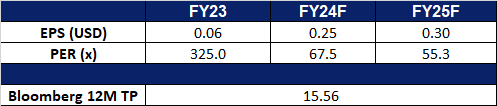

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): Lagging behind

- RE-ITEREATE BUY Entry – 16.5 Target – 18.5 Stop Loss – 15.5

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Good results expected. Palantir raised its guidance after strong Q3 earnings, with 33% YoY growth in US commercial revenue to $116 million, showcasing a shift from relying on government contracts. The company’s AI business is gaining traction, as seen in a 45% YoY increase in commercial customers and a robust 23% YoY growth in commercial revenue. The Artificial Intelligence Platform (AIP) has witnessed rapid adoption, with users nearly tripling in 3Q23, and Palantir plans to aggressively expand AIP to commercial customers through boot camps. The company’s redesigned go-to-market approach is accelerating commercial deal growth, with deal count and total contract value showing significant increases. The positive impact of AI is reflected in investors expectations for growth in revenue for the fourth quarter. Notably, the company’s third-quarter results mark its fourth-straight quarter of profitability, which makes it eligible for inclusion in the S&P 500.

- To catch up. The recent market surge in the S&P 500 and Nasdaq Composite, driven by strong results and guidance from major companies like Netflix and Taiwan Semiconductor. Small and mid-cap companies which belongs to the AI theme shall catch up the rally.

- 3Q23 earnings review. Revenue rose by 16.8% YoY to US$558mn, beating estimates by US$2.08mn. Non-GAAP EPS was US$0.07, beating estimates by US$0.01. It raised revenue guidance for FY23 to be between US$2.216bn – US$2.220bn vs. the consensus of US$2.21B.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Prada S.P.A (1913 HK) at HK$49.3.