KGI Daily Market Movers – 16 February 2021

Cryptocurrency – Ethereum Futures

Ethereum (XETUSD/ETH): Joining the party

- Ethereum is now gaining more acceptance after the launch of the CME Ether futures contract on 8 February 2021, which aims to provide investors with a regulated market to gain exposure to the digital asset.

- In February 2021, Ethereum’s market capitalisation reached over US$200 million, more than eight times the value it had in the same period last year. However, Ethereum’s market capitalisation is still a tiny fraction of Bitcoin’s (BTC) US$900 billion market value.

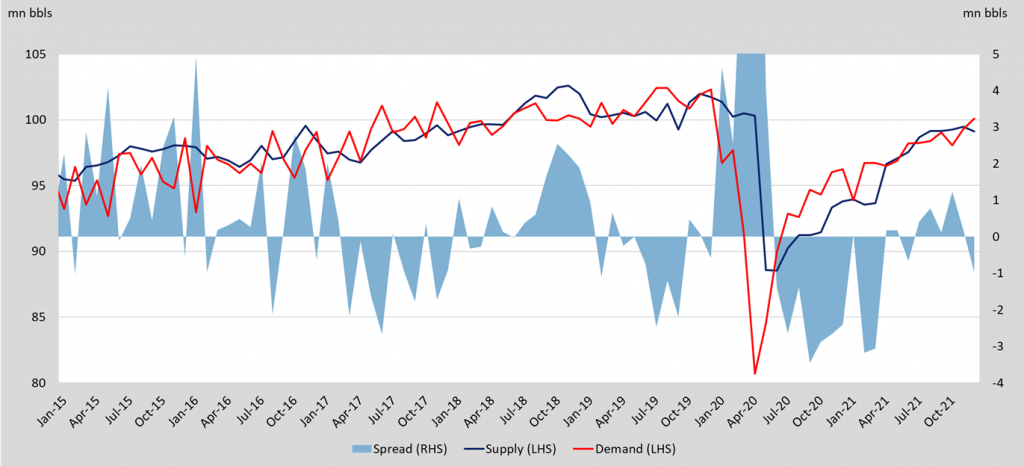

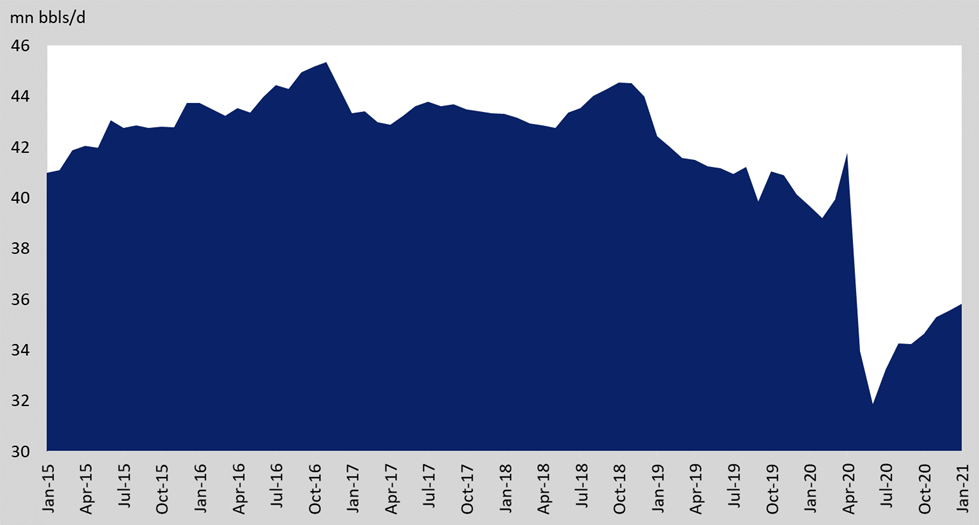

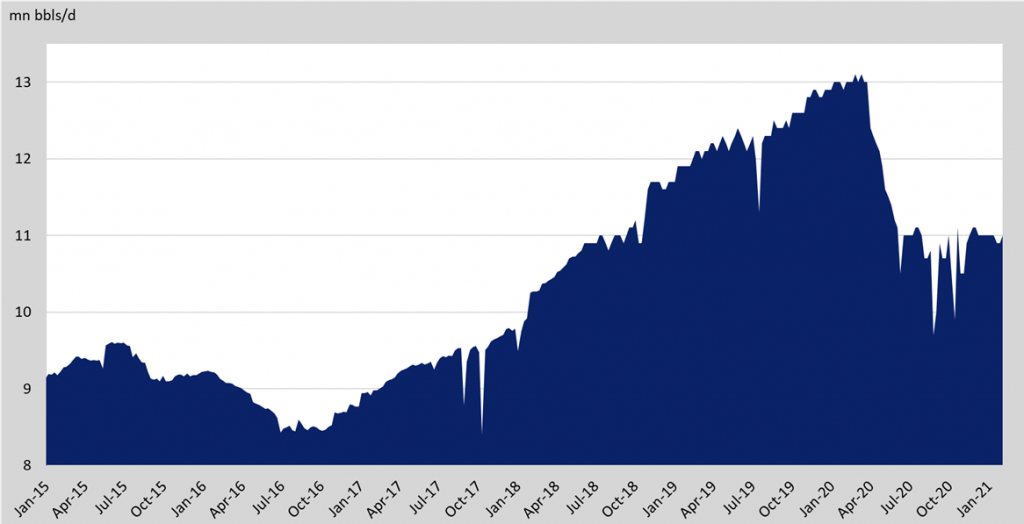

Commodities – Oil

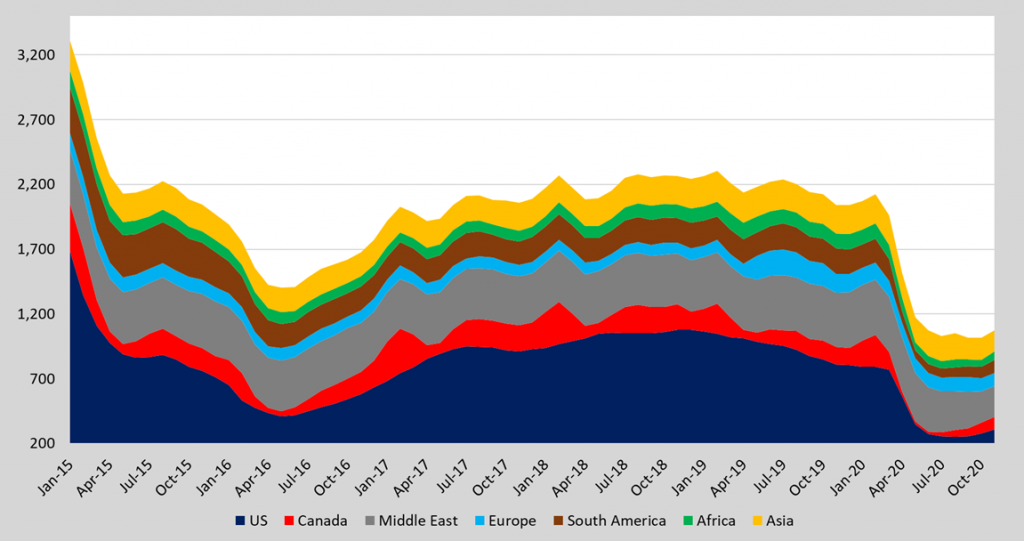

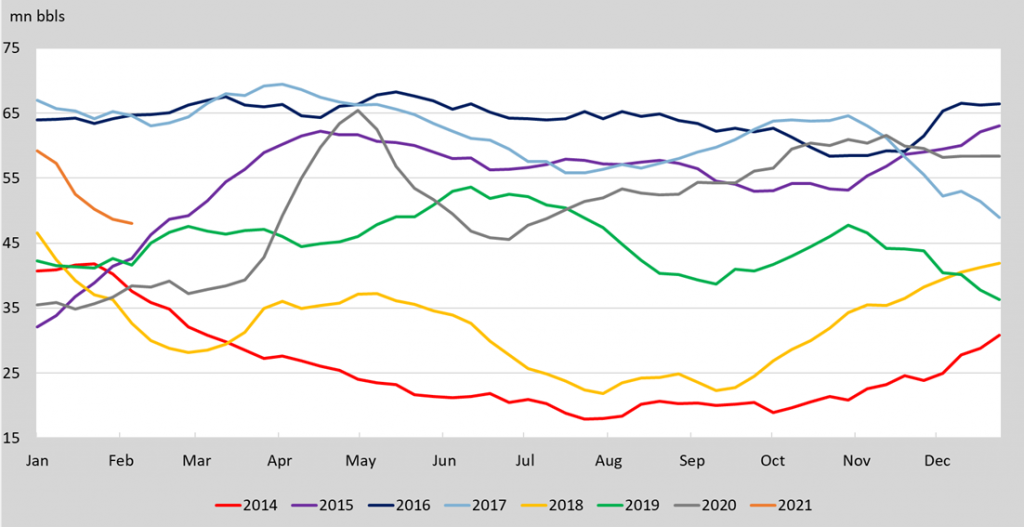

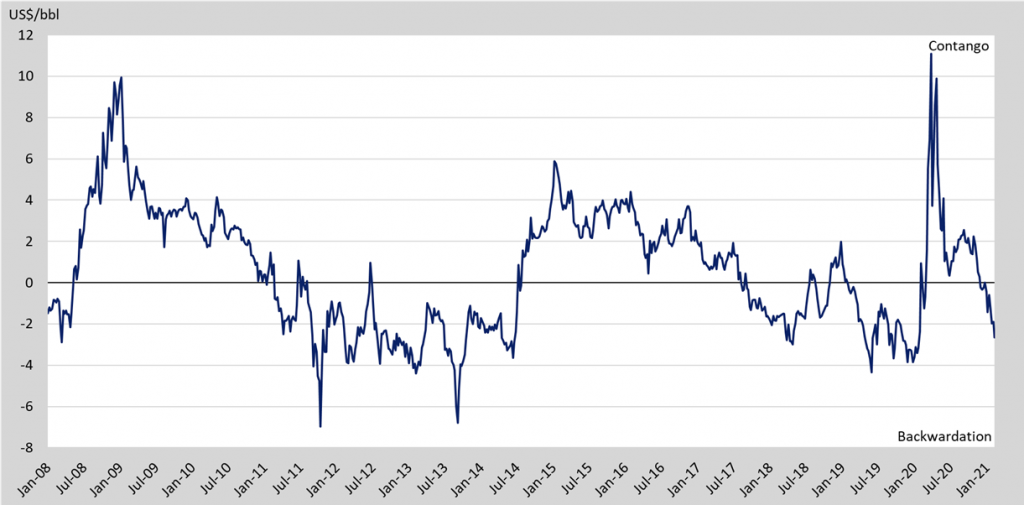

Crude oil is on fire now. WTI broke above US$60/bbl on 15th February, the highest since early January 2020. Meanwhile Brent broke above US$63/bbl the same day, the highest since late January 2020.However, the spread between the two oil price benchmarks has been narrowing due to more demand for WTI pushing prices higher. Owing to the current winter storm in the US that is impacting crude production and related refining operations, inventory level is declining substantially. In the nerm term, we expect WTI to further extend gains until the freezing climate improves in the US.

Products to trade: WTI Futures, Brent Futures, USO ETF

Market Movers – What’s Hot

- The US 10-year yield touched 1.25% for the first time since March 2020 on optimism for an improving economy and expectations of higher inflation. The US Federal Reserve has said it will tolerate inflation above its 2.0% target.

- BHP Group (BHP US), the world’s largest listed miner, announced its best 1H profit in 7 years and forecasts for record iron ore output, on the back of China’s demand.

United States

- The US market was closed last night in commemoration of Presidents’ Day. Trading resumes tonight at regular market hours.

- Earnings watch: Mon 15 Feb – BHP; Tue 16 Feb – CVS/ZTS/PLTR/AIG/OXY/SEDG/BYD

Hong Kong

- HK market was closed yesterday for the Chinese New Year Holidays. Trading resumes today.

Singapore

- AEM (AEM SP) +7.4% to S$4.62 after the company said that it received in-principle approval from SGX for the listing of new shares that will be utilised for the S$99.7mn buy-out of CEI. The potential for increased semiconductor capex in the US should also benefit Singapore-listed companies such as AEM, Frencken (FRKN SP) and UMS (UMSH SP).

- Raffles Medical (RFMD SP) +4.0% to S$1.03 after Canadian-based Global Alpha Capital Management last week increased its stake to 7.057% from 6.998%, translating to an increase of S$1.1mn worth of RFMD shares. RFMD is due to report its full-year FY2020 results before the market opens on Monday, 22 February 2021.

- Thomson Medical (TMG SP) +12.7% to S$0.089, posting its fifth consecutive day of gains. TMG is among Singapore’s best performing stock over the past week, having surged 82% over the last five trading days. The stellar performance comes after the group posted a net profit of S$8.1mn in 1H FY2021, a reversal from the S$1.9mn loss in 1H FY2020.

- Jiutian Chemical (JIUC SP) +6.7% to S$0.112 on firmer selling prices of its key products and ahead of its full-year results next week.

- Rex International (REXI SP) +6.4% to S$0.183 as the company rides on higher oil prices. REXI is the only oil-producing listed company in Singapore which is ramping up oil production this year. Meanwhile, oil prices extended gains to a 13-month high.

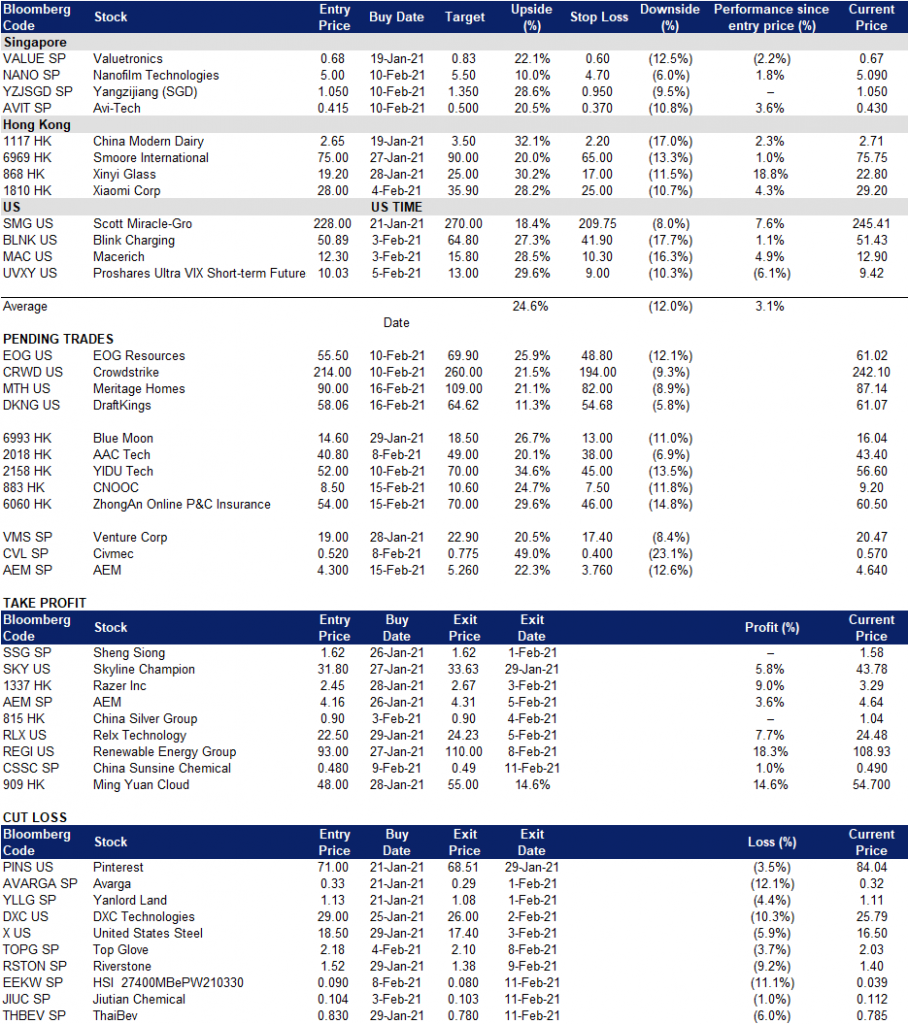

Trading Dashboard