KGI DAILY TRADING IDEAS – 24 May 2021

IPO Watch: FIGS | Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

IPO WATCH

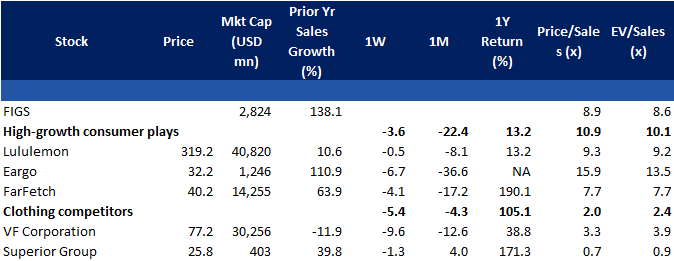

FIGS (FIGS US): Athleisure meets healthcare

- FIGS sells reusable medical attire, with scrubs as their core offering through a Direct-to-Consumer business model.

- In the past 3 years, FIGS has experienced accelerated growth, achieving US$263mn of sales in 2020 and booking their first annual profit. FIGS has managed to reach about 6% of US healthcare professionals and 2% of the healthcare apparel market share in the US.

- At the midpoint of the initial IPO range of US$16-19/share, FIGS has an initial(diluted) market cap of US$2.8bn(US$3.8bn). This translates to a 9x(12x) Price/Trailing Twelve Months Sales

- While we see double digit P/S multiples as justifiable from FIG’s sales growth rate, investors may be concerned about the long term difficulty of brand-building, or the potentially high dilution.

SINGAPORE

Uni-Asia Group (UAG SP): A strong V-shaped recovery

- BUY Entry – 0.66 Target –0.91 Stop Loss – 0.60

- UAG is an alternative investment company which owns and manages bulk carriers, invests in Hong Kong commercial offices and develops residential properties in Japan.

- The group derives around 65% of its revenues from charter income generated by its fleet of bulk carriers, and the remainder of revenue is from its property projects in HK and Japan. While its shipping business performed poorly in FY2020 due to weak charter rates and impairments, it had shown a V-shaped recovery in FY2021.

- Baltic Dry Index (BDI) highest in 10 years. The BDI has finally crossed the elusive 3,000 point mark, the highest in more than 10 years. The surge in the main sea freight index comes amid strong demand across all vessel segments. Order book for handysize bulk carriers is at near record lows of 4% of fleet capacity, while demand side is driven by increase in Chinese dry bulk imports from the Atlantic and also fueled by port congestion.

- More than a V-shaped recovery in charter rates. More specific to Uni-Asia’s fleet of handysize carriers, the Baltic Handysize Index has crossed the 1,000 mark, the first time since 2010. It recently corrected but is now back above 1,300 as demand remains firm. UAG managed to achieve an average charter rate of US$10k/day for its handysize vessels in 1Q2021, up from US$7,442/day in 1Q2020.

- Upgrade to Outperform. We upgrade UAG to OUTPERFORM and raise our TP to S$0.91, based on SOTP valuations. We raise the multiples for the shipping business to 0.5x FY2021F P/B from 0.2x FY2020F P/B previously while maintaining 0.5x FY2021F P/B for the HK and Japan property business. Balance sheet remains healthy as it continues to pare down debt, and we forecast dividends to recover to 3.5/3.0/3.0 Sing cents for FY2021/22/23F (40-48% payout ratio), an implied 5% yield.

Read our full report here.

CapitaLand (CAPL SP): Very limited downside from here

- BUY Entry – 3.55 Target – 3.80 Stop Loss – 3.46

- CapitaLand is one of Asia’s largest diversified real estate groups. It owns and manages a global portfolio worth about S$138bn as at 31 March 2021. The group’s assets include commercial, retail, business park, industrial & Logistics, integrated development, urban development, as well as lodging and residential. Its largest shareholder is Temasek Holdings with a 52% stake, and Blackrock who owns 4.8%.

- While recent covid-related restrictions have dealt a blow to Singapore property counters (CapitaLand -4% over last 1 month; CityDev -6%, Frasers Property -6%, GuocoLand -4%), CapitaLand’s recent sell-off could be a buying opportunity as we expect downside to be limited from current price level.

- CapitLand’s share price surged to a 52-week peak of S$4.01 after it announced the bid to privatise its property development arm, but recently dropped to a low of S$3.54. The company declared a S$0.09 dividend and went ex-div on 4 May, which partially explains the share price drop.

- Consensus estimates are overall bullish on CapitaLand. There are 13 BUYS / 2 HOLDS / 0 SELLS, and a 12-month average target price of S$4.18, or a potential upside of 17% from its current share price.

HONG KONG

Haier Smart Home (6690 HK): Upward price momentum starting

- Buy Entry – 30.5 Target – 34.2 Stop Loss – 28.8

- The company is a China-based company principally engaged in the research, development, manufacture and sales of household electrical appliances. The company’s main products include refrigerators/freezers, washing machines, air-conditioners, water heaters, kitchen appliances products, small home appliances and U-home smart home products. The company also provides customers with integrated smart home solutions. The company is also involved in channel integration service business, including logistics, as well as the distribution of home appliances and other products. It distributes its products in both domestic and overseas markets.

- Share price has been range bound between HK$28 and HK$34 since March. The main headwinds for the stock over the past quarter and at the moment are rising material costs such as copper and steel which leads to margin compression. As the home appliance market in China is a typical type of perfection competition in an economic term, even one of the market leaders like Haier is difficult to raise selling prices to pass the increase in costs to end customers. However, material prices will not sustain at high grounds for long, hence, we expect margin compression is temporary and profitability will be normalised in 3Q/4Q21.

- 1Q21 financial highlights:

| (RMB bn) | 1Q21 | 1Q20 | YoY change |

| Revenue | 54.8 | 43.1 | 27% |

| GPM (%) | 28.5 | 27.5 | 1 ppt |

| PATMI | 3.1 | 1.1 | 185.3% |

- Domestic home appliance sales grew by 40% YoY to RMB164bn. The ongoing catalysts for Haier are the internet of things, smart home, transformation of digitalisation and high-end brands development.

- Updated market consensus of the estimated growths of EPS in FY21 and FY22 are 2.51% and 23.05% respectively, which translates to 19.6x and 15.9x forward PE. The current PE is 20.1x. Bloomberg consensus average 12-month target price is HK$41.6.

Ping An Insurance (Group) Company of China, Ltd. (2318 HK): Stock price approaching a support level

- Re-iterate Buy Entry – 80.5 Target – 88.7 Stop Loss – 77.1

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Accumulated gross premium income periodic comparison:

| (RMB bn) | YTD April 2021 | YTD April 2020 | YoY change |

| Life insurance and health insurance | 215.0 | 224.7 | -4.3% |

| Property &Casualty Insurance | 87.6 | 96.5 | -9.2% |

| Total | 302.6 | 321.2 | -5.8% |

- Key financial and operating update as of 1Q21:

| 1Q21 | 1Q20 | YoY change | |

| Basic operating earnings per share (in RMB) | 2.21 | 2.03 | 8.9% |

| Net profit attributable to shareholders of the parent company (RMB bn) | 27.2 | 26.1 | 4.5% |

| Life & Health New Business Value (in RMB mn) | 19.0 | 16.5 | 15.4% |

| Retail customers (mn) | 220.6 | 218.4 | 1.0% |

| Internet users (mn) | 611.3 | 598. | 2.2% |

Updated market consensus of the estimated growth of net profit in FY21 and FY22 are 7.0% and 14.5% respectively, which translates to 7.8x and 6.8x forward PE. The current PE is 8.1x. The estimated respective dividend yield in FY21 and FY22 is 3.6% and 4.1% respectively. Bloomberg consensus average 12-month target price is HK$112.65.

Market Movers

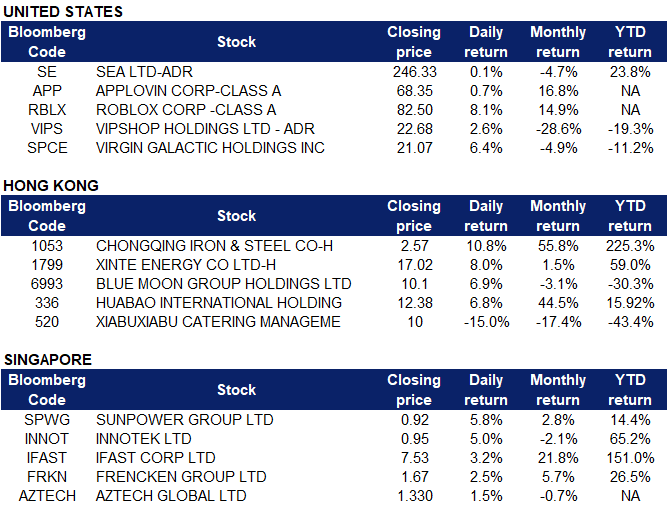

United States

- Sea Limited (SE US) climbed back near the US$250 level after reporting 1Q21 results. While sales increased 147% and gross profit more than doubled, adjusted EBITDA and EPS came in below consensus estimates. However, the overall gain for video gaming stocks in the week could have propelled Sea back up, as Garena’s Free Fire continues to book strong numbers for the company.

- Roblox (RBLX US) rallied to a new high, leading video gaming stocks upwards behind a return in tech sentiment, and a positive article in Wall Street Journal detailing how game habits formed in the pandemic could be difficult to break.

- AppLovin (APP US) rallied this week back near its IPO price after several insider purchases occurred at the start of the week. Around US$2.5mn of shares were bought by President/CFO Herald Chen and Director Vivas Eduardo at the start of the week.

- Vipshop Holdings (VIPS US) fell to a new recent low after reporting 1Q21 results where guidance was weaker than expected. Despite beating 1Q21 sales and EPS guidance, 2Q21 guidance of 20-25% sales growth is below consensus of around 25.5% growth.

- Virgin Galactic (SPCE US) flew up 30% for the week after confirming and successfully completing its third spaceflight.

Singapore

- InnoTek (INNOT SP) gained 11% for the week as it looks poised to leverage on China’s EV push. Last week, we upgraded our target price to S$1.12 and maintained an outperform recommendation. Read our full report here.

- Sunpower Group (SPWG SP) Shares rose 13% for the week. We currently have an outperform recommendation on Sunpower and a fundamental target price of S$1.45 (before dividend payout).

- iFAST (IFAST SP) ended the week 20% higher after Bloomberg earlier in the week published a write-up on the company. IFAST’s shares have gained more than 631% in the past 12 months and analysts remain bullish on the stock, with 5 BUY recommendations and an average 12-month target price of S$8.28.

- Frencken (FRKN SP) Shares surged 18% for the week, continuing the bullish momentum after beating 1Q2021 forecasts and on further analyst upgrades.

- Aztech Global (AZTECH SP) Ended the week 9% higher as investors rotated to technology-related laggards. We have a trading target price of S$1.50 on Aztech. Read our write-up on the company here.

- Nanofilm Technologies (NANO SP) Nanofilm managed to eke out 5% gains for the week, but still lagged that of its locally-listed peers. Street estimates are overall bullish on the stock with 7 BUYS / 0 HOLD / 0 SELL and a 12-month target price of S$5.90, or a potential 18% upside from the current price.

Hong Kong

- Chongqing Iron & Steel Co. Ltd. (1053 HK) There was no company specific news. Iron ore futures recovered on Thursday night. Shares could have some technical rebounds as iron ore and steel futures remained at high levels.

- Xinte Energy Co Ltd (1799 HK) Photovoltaic sector jumped as the National Energy Administration (NEA) announced China has ordered power transmission firms to connect a minimum of 90 gigawatts (GW) of wind and solar capacity to the grid this year. Meanwhile, NEA officially published the Notice on the development and construction of wind and PV power in 2021.

- Blue Moon Group Holdings Ltd (6993 HK) Daiwa Securities reiterated a BUY rating with an unchanged TP of HK$17.4.

- Huabao International Holdings Limited (336 HK) E-cigarette sector continued to perform well. According to market news, China Tobacco Yunnan Industrial will partner with Boulder International , Inc. to launch the first e-cigarette product GloFish. Assuming this is based on facts, investors would be more certain of the e-cigarette sector and of regulations as the state-owned company is also now engaged in it.

- Xiabuxiabu Catering Mgt Chn Hldgs Co Ltd (520 HK) The company announced it changed CEO as performance of certain sub-brands of the group did not meet the expectation of the board on Thursday.

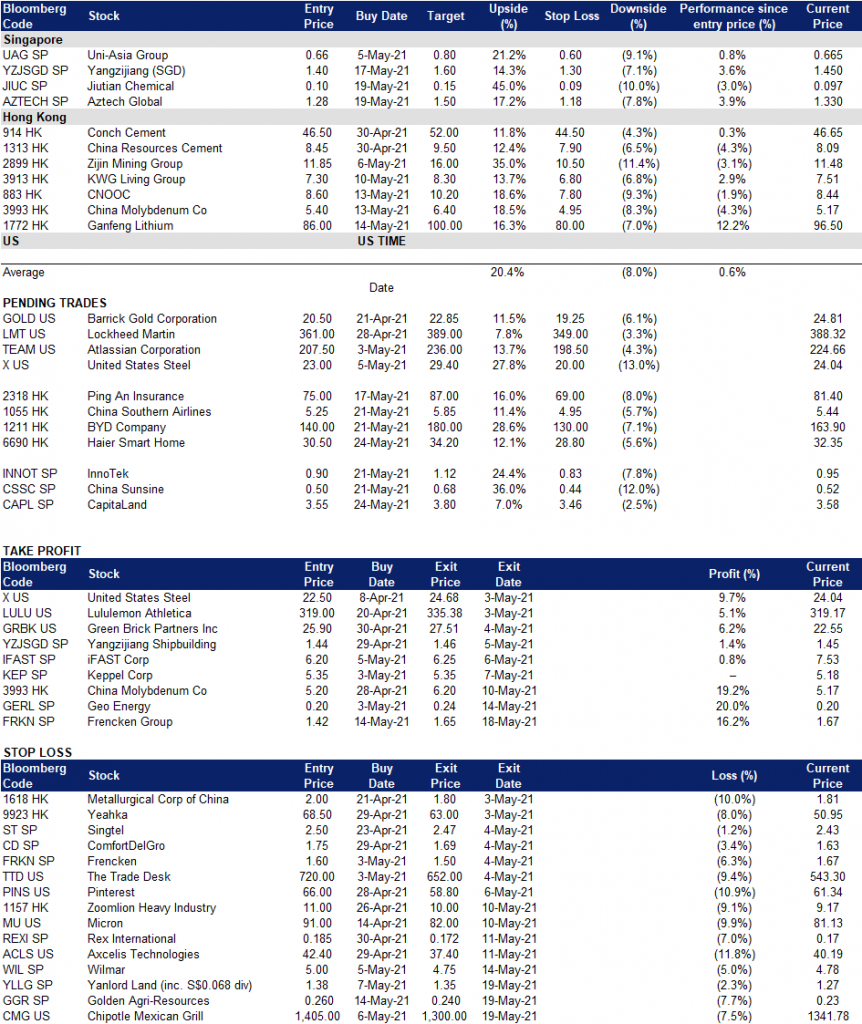

Trading Dashboard

Related Posts: