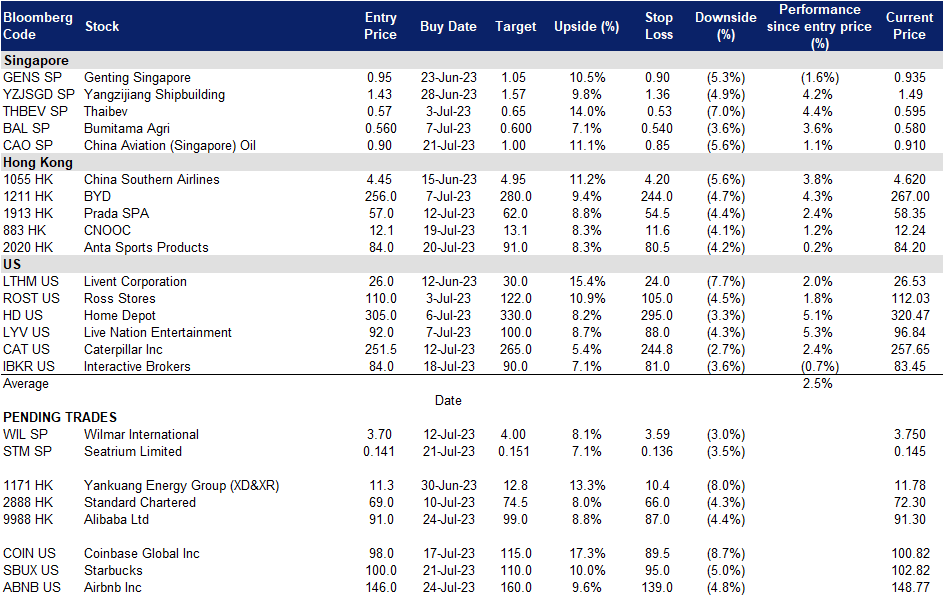

24 July 2023: ThaiBev (THBEV SP), Alibaba Ltd. (9988 HK), Airbnb Inc (ABNB US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

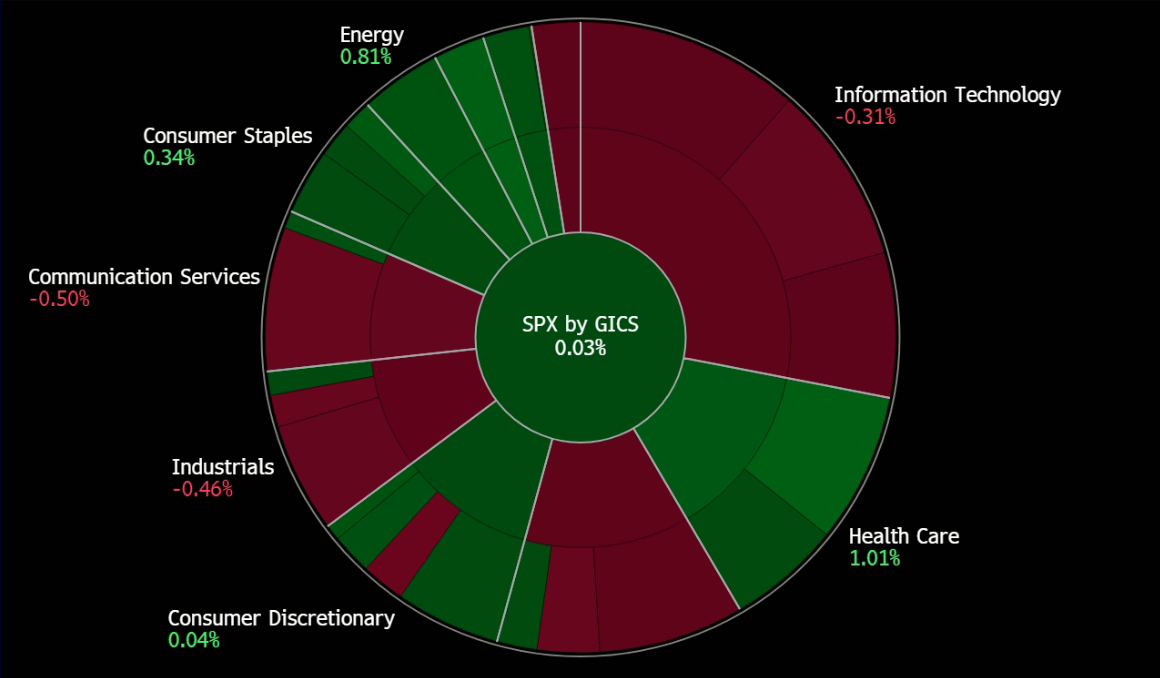

United States

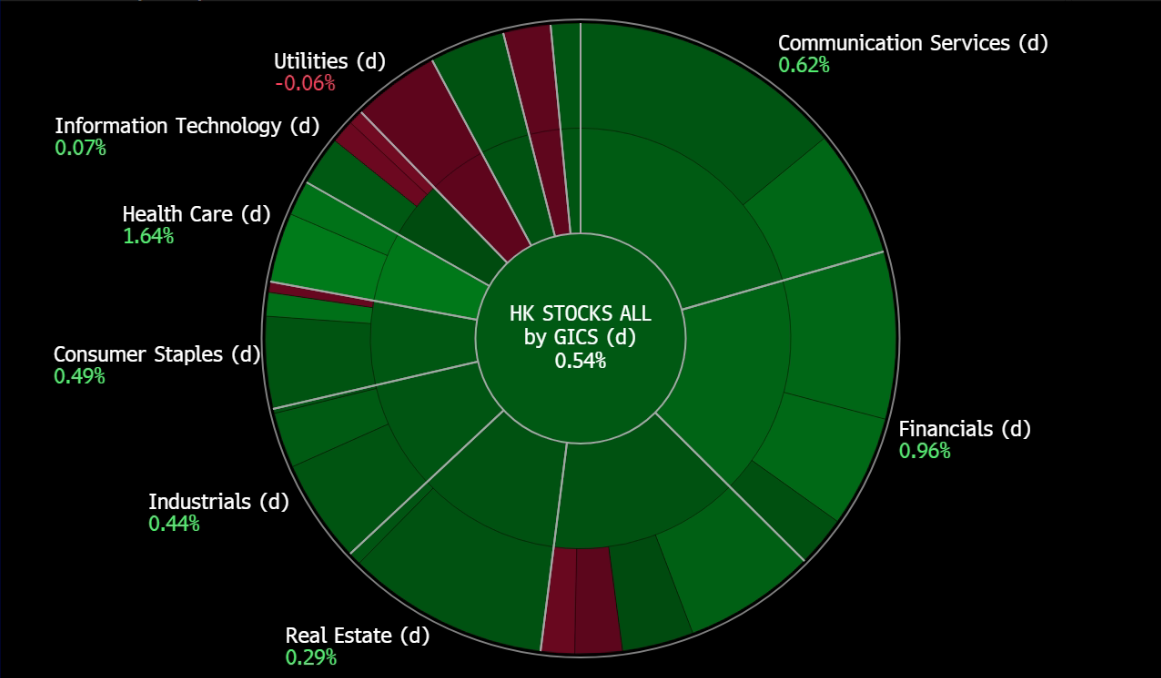

Hong Kong

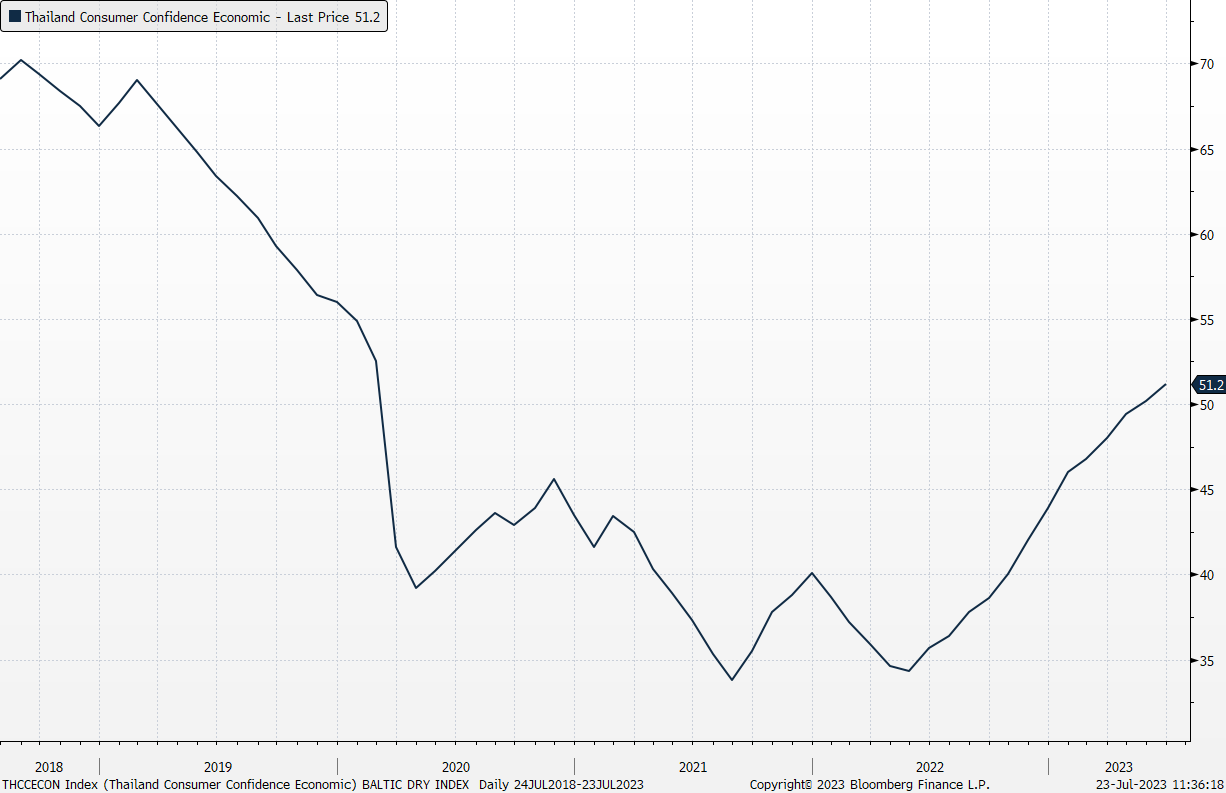

ThaiBev (THBEV SP): Recovering consumer confidence

- RE-ITERATE BUY Entry 0.57 – Target – 0.65 Stop Loss – 0.53

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- Improving consumer confidence. According to the latest consumer confidence survey, the index recovered to the highest level since the COVID outbreak, reaching 50.2 in May. The promising recovery was driven by the growth in tourism and the demand for industrial and agricultural goods.

Thailand Consumer Confidence Economic Index

(Source: Bloomberg)

- Potential liquor industry disruption. Winning the most seats in the Thailand general election in 2023, the Move Forward Party opposed the existing strict liquor law which is viewed as preserving a duopoly by suppressing microbreweries and distilleries. Boon Rawd Brewery and ThaiBev, makers of Singha and Chang respectively, hold a combined 93% of the local beer market. Though it is possible for the new government to ease the production curb, the dominance of the two giants will remain unchanged in the near term as their economy of scale can maintain stable profit margins amidst a high inflation environment.

- 2Q23 earnings review. Revenue grew mildly by 2% YoY to 67.4bn THB. Gross profit margin was 30.3%, up 0.06 ppts YoY. PATMI grew mildly by 3% YoY to 7.4bn THB. Net margin was 10.9%, up 0.01 ppts YoY.

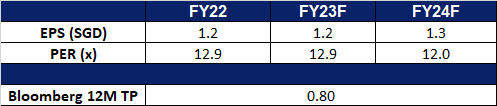

- Market consensus.

(Source: Bloomberg)

Seatrium Limited (STM SP): More bullets to fire

Seatrium Limited (STM SP): More bullets to fire

- RE-ITERATE BUY Entry 0.141 – Target – 0.151 Stop Loss – 0.136

- Seatrium Limited provides offshore and marine engineering solutions. It operates through two segments: Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding; and Ship Chartering.

- Green trade finance facility. The company secured a green trade finance facility from OCBC bank with a total amount of EUR720mn (S$1.04bn). The facility will be particularly utilized for the company’s offshore renewable projects and decarbonisation. The latest renewables and green solutions projects account for about 39% of the total net order book which increased to S$20bn in 1Q23.

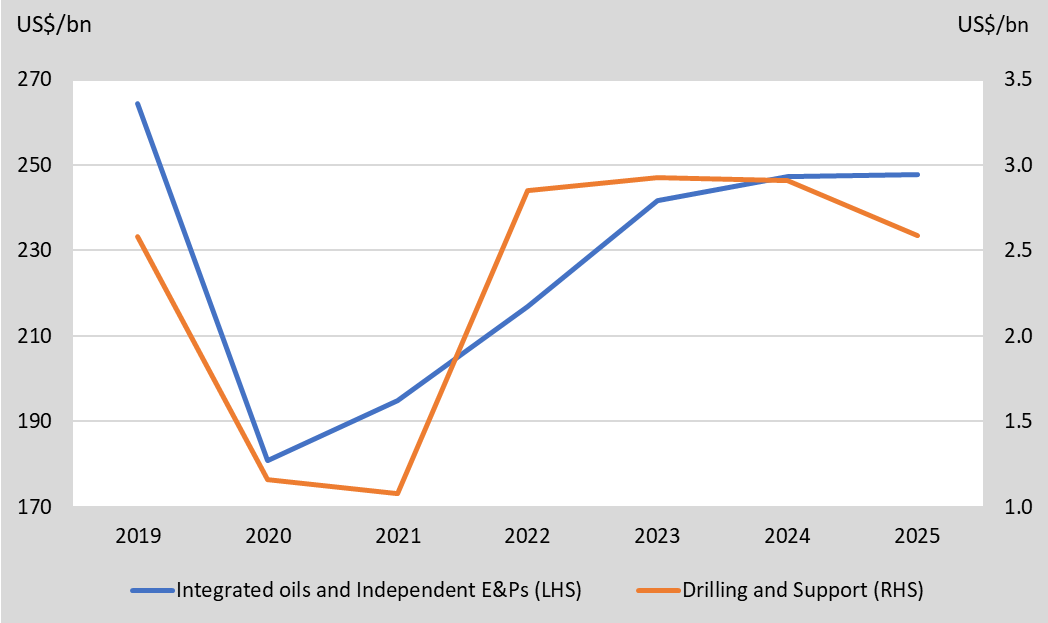

- Expecting mild growth in the upstream oil and gas capex. Though oil prices have topped out since July 2022 as global economic growth slows down, especially China’s recovery tumbles, the oil and gas upstream spending continues. Oil majors accelerated to explore and develop oil resources outside Russia after the sanction. Hence, there still be mild growth in the upstream capex during 2023/2024.

Global upstream oil and gas capex

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 results review. Revenue rose 4.6% YoY to S$1,947mn from S$1,862mn the prior year. Net loss declined by 78.0% YoY to -S$261mn from -S$1,171mn in FY21. With positive EBITDA for 2H22, the FY22 EBITDA was -S$7mn a 99% decrease YoY from the previous -S$1,028mn. The company will release 1H23 results on July 28th.

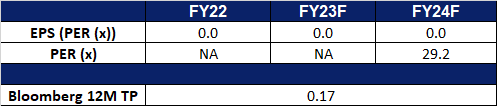

- Market consensus.

(Source: Bloomberg)

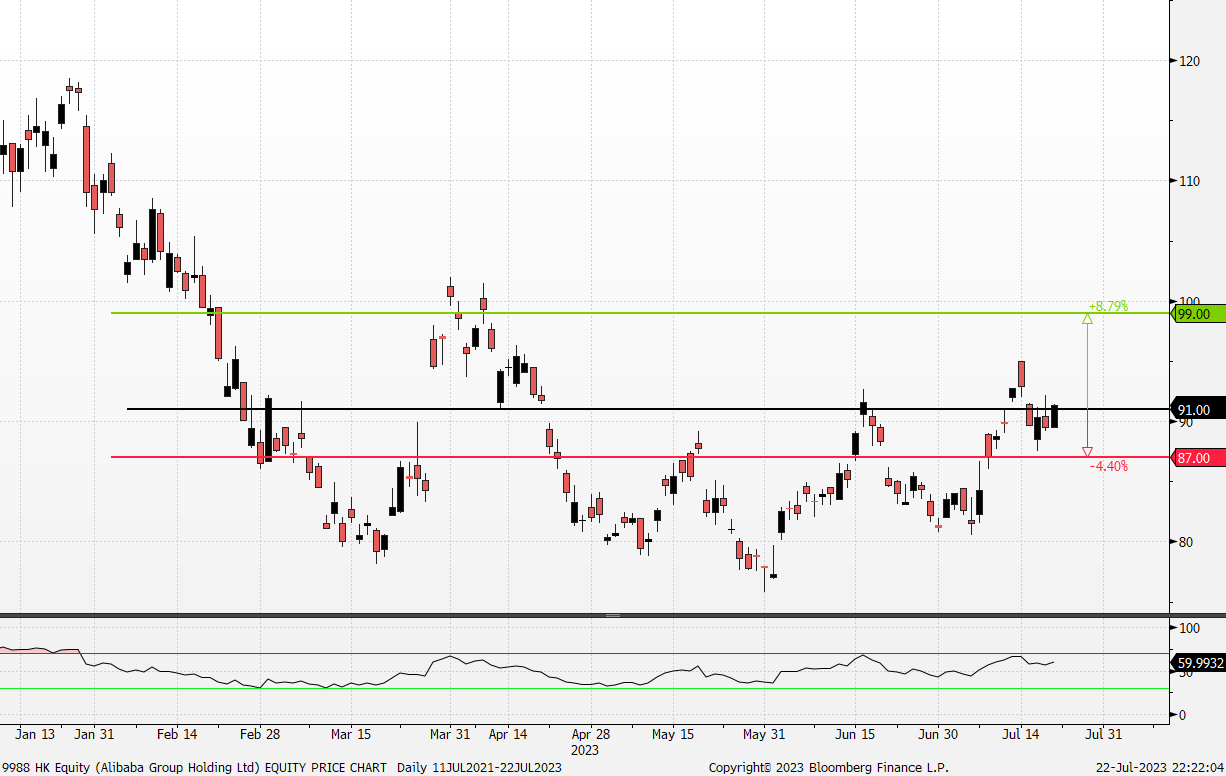

Alibaba Ltd. (9988 HK): Expecting more stimulus from the Politburo meeting

- BUY Entry – 91.0 Target – 99.0 Stop Loss – 87.0

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- Expected economic stimulus to boost domestic consumption. China’s ongoing economic recovery is encountering challenges due to inadequate demand, sluggish momentum, and low confidence. In anticipation of the month-end politburo meeting in China, there are high expectations for a substantial economic stimulus that emphasizes domestic consumption. The market foresees a shift towards more positive policies by increasing investment in infrastructure, implementing targeted support for consumption, and further easing property regulations. Additionally, the Commerce Ministry of China recently unveiled an 11-point plan aimed at bolstering domestic consumption of household consumer goods and services.

- Supply Chain Establishment. Cainiao Group, Alibaba’s logistics arm, is set to speed up global logistics network development and expand its presence in Europe, North America, and Southeast Asia with more local warehousing and distribution centers. In the coming decade, Cainiao aims to establish a leading global smart logistics network, covering domestic, cross-border, and overseas logistics, including last-mile deliveries and logistics technology. To achieve this, they are collaborating with AliExpress to offer a global delivery service that guarantees cross-border parcel delivery within five working days, 30% faster than the industry standard. The company has already expanded its global logistics infrastructure with 18 overseas distribution centers, warehouses, and self-operated distribution and pickup facilities.

- Driving growth in Asia. Alibaba has made a recent announcement about investing an extra $845.44 million in Lazada, the Southeast Asian e-commerce unit. This move is part of Alibaba’s strategy to strengthen its presence in the fiercely competitive region. Lazada aims to increase its current user base of 160 million in countries like Singapore, Indonesia, Thailand, and Malaysia to an impressive 300 million by the year 2030. This expansion plan will enable Lazada to gain a competitive edge against rivals like Shopee and Tiktok Shop in the Southeast Asian market.

- FY22 earnings. Revenue rose to RMB208.2bn, up 2.03% YoY. Net profit was RMB 23.5bn, compared to a net loss of RMB13.3 during the same period. Non-GAAP diluted earnings per share was RMB1.34, an increase of 35% YoY.

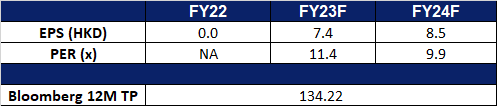

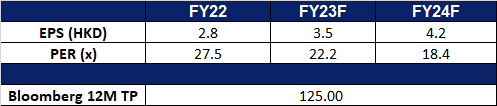

- Market Consensus.

(Source: Bloomberg)

Anta Sports Products Ltd. (2020 HK): Dual stimuli

Anta Sports Products Ltd. (2020 HK): Dual stimuli

- RE-ITERATE BUY Entry – 84.0 Target – 91.0 Stop Loss – 80.5

- ANTA Sports Products Limited is principally engaged in the manufacture and trading of sporting goods, including footwear, apparel and accessories in the Mainland China. The Company focuses on sportswear market in China with a brand portfolio, including ANTA, ANTA KIDS, FILA, FILA KIDS and NBA. Through its subsidiaries, the Company is also engaged in the manufacture of shoe sole. The Company’s subsidiaries include Anta Enterprise Group Limited, Motive Force Sports Products Limited and REEDO Sports Products Limited

- Expected economic stimulus to boost domestic consumption. China’s continued economic recovery is still faced with insufficient demand, weak momentum, and weak confidence. The market expects a big economic stimulus with a focus on domestic consumption at China’s upcoming month-end politburo meeting, expecting policies to turn more positive by boosting infrastructure investment, rolling out some targeted consumption support, and easing property policies further. China’s Commerce Ministry also recently announced an 11-point plan to boost the domestic consumption of household consumer goods and services.

- Upcoming Asian Games. The Asian Games, initially delayed due to the rapid spread of COVID-19 in and around Hangzhou, China, have been rescheduled for September 23 to October 8, 2023. With athletes and spectators from across Asia converging in China to participate in or witness the event, the upcoming Asian Games are expected to have a positive impact on the sales of sports products. The heightened exposure that Anta, a sports brand, will gain from this sporting event is likely to considerably boost the sales of its products.

- New Partnership. Anta has recently entered into a 5-year partnership agreement with Kyrie Irving and is set to launch a new product line in the first quarter of 2024. Additionally, both parties will collaborate on the Anta x Kyrie youth basketball training camp in China, aiming to promote the sport and its culture through charitable initiatives. This partnership with Irving signifies a significant advancement in Anta’s international expansion efforts. By introducing their exclusive product line and leveraging Irving’s influential status, Anta is strategically positioning itself to expand its presence in the global market.

- FY22 earnings. Revenue rose to RMB53.7bn, up 8.8% YoY. Net profit fell 1.7% YoY to RMB7.59bn. Net Profit Margin fell by 2.0% to 14.0%, as a result of higher expenses.Diluted EPS is at RMB2.82, down from RMB2.87 in FY21.

- Market Consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): Travel still in demand

- BUY Entry – 146 Target – 160 Stop Loss – 139

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- Air travel demand. The travel industry is experiencing a sustained high demand as people eagerly resume travel after the pandemic, with major airlines anticipating demand to surpass pre-pandemic levels and remain robust throughout FY23. While Airbnb is just one of many accommodation options available to travellers, it stands to benefit from the rising travel demand. The increasing popularity of travel and Airbnb’s unique marketplace can lead to its growth in the short term. However, the company’s long-term success will depend on its ability to compete with other accommodation options and manage factors like rental costs and economic conditions. Nonetheless, the ongoing high travel demand is likely to positively impact Airbnb’s revenue and profit in the near future.

- 1Q23 earnings review. Revenue grew by 20.5% YoY to US$1.82bn, beating estimates by US$30mn. 1Q23 GAAP EPS was US$0.18, beating estimates by US$0.08. Gross booking value grew by 19% YoY to US$20.4bn. Nights and experiences booked grew by 19% YOY to 121.1mn. Average daily rates remained flat YoY at US$168. 2Q23 revenue is expected to between US$2.35bn to US$2.45bn. The consensus revenue estimate is US$2.42bn.

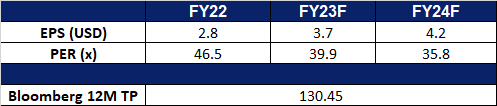

- Market consensus.

(Source: Bloomberg)

Starbucks Corp (SBUX US): BLACKPINK in your drink

Starbucks Corp (SBUX US): BLACKPINK in your drink

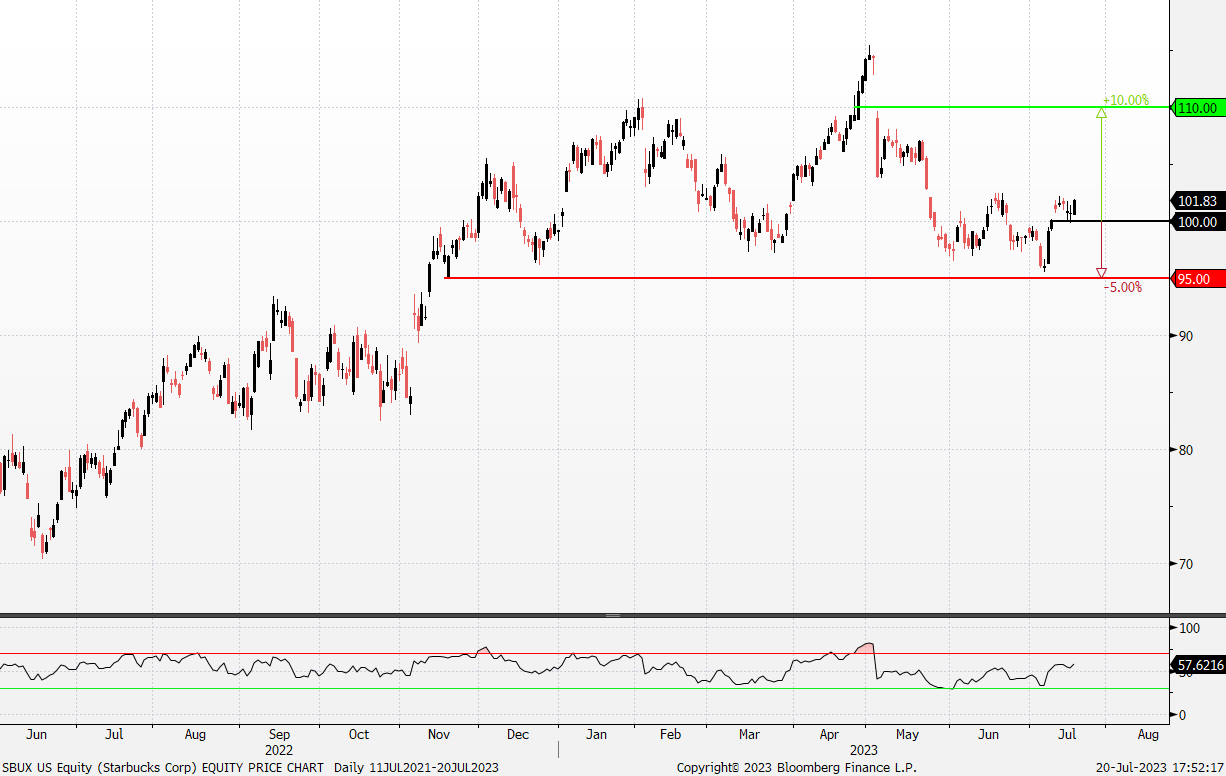

- RE-ITERATE BUY Entry – 100 Target – 110 Stop Loss – 95

- Starbucks Corporation is the premier roaster, marketer, and retailer of specialty coffee. The Company offers packaged and single-serve coffees and teas, beverage-related ingredients, and ready-to-drink beverages, as well as produces and sells bottled coffee drinks and a line of ice creams. Starbucks serves customers worldwide.

- Partnership with BLACKPINK. Starbucks recently unveiled an exclusive fan experience, exclusive to the Asia Pacific region, commencing on 25 July, featuring a BLACKPINK-themed Frappuccino and limited-edition merch collection. This collaboration with one of today’s biggest icons resonates with Starbucks’ dedication to uplifting customers and fans through meaningful connections, creating an unforgettable Starbucks Experience. The accompanying limited-edition merch collection boasts 11 drinkware styles and six lifestyle accessories in a striking pink and black color palette. The partnership, available at select Starbucks locations across Hong Kong, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan, Thailand, and Vietnam, aims to attract BLACKPINK fans, affectionately known as “Blinks,” capitalizing on the K-pop frenzy to potentially boost sales. Notably, this collaboration marks the first regional-scale partnership and menu item development for Starbucks, signifying their confidence in this collaboration with global icons.

- Expansion opportunity. Intense competition among global coffee chains like Starbucks and Costa, and local players such as Luckin Coffee and Manner Coffee, has driven a proliferation of coffee shops across countries, leading to a significant surge in coffee consumption. This trend is further fuelled by the growing demand for coffee makers and beans sourced internationally. Capitalising on immense growth prospects, Starbucks identifies substantial opportunities for expansion in China, where coffee consumption is on the rise due to increasing affluence and population. With rising coffee consumption in cities and a sizable middle-income consumer group, China remains a pivotal market for the coffee industry. Both global and domestic coffee chains are prioritising human connections, optimising performance, and investing in digital capabilities and innovation. In this pursuit, they are allocating more resources and manpower to penetrate smaller cities in China, aiming to tap into a larger consumer base while benefiting from lower costs in terms of management, labor, and rent compared to major cities. This strategic move enables large on-premise coffee brands to thrive and consolidate their presence in China’s rapidly evolving coffee landscape.

- Strength in its branding. Starbucks is poised to leverage the ongoing growth of the coffee industry and favorable customer preferences, ensuring continued success. Moreover, the company’s strong position is evident in its capacity to navigate potential economic downturns effectively. This resilience is attributed to its loyal membership program and a customer base that boasts relative affluence. These factors collectively fortify Starbucks’ market standing and reinforce its ability to thrive even in challenging economic conditions.

- 2Q23 earnings review. Revenue rose 14.5% YoY to $8.7bn, beating estimates by $270mn. Non-GAAP earnings per share was $0.74, $0.09 above expectations.

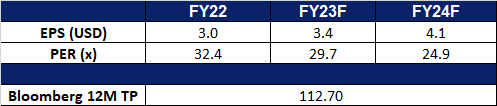

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Comfort Delgro (CD SP) at S$1.25.