22 February 2023: Singapore Airlines Ltd. (SIA SP), Yankuang Energy Group Co Ltd (1171 HK), Cloudflare Inc. (NET US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

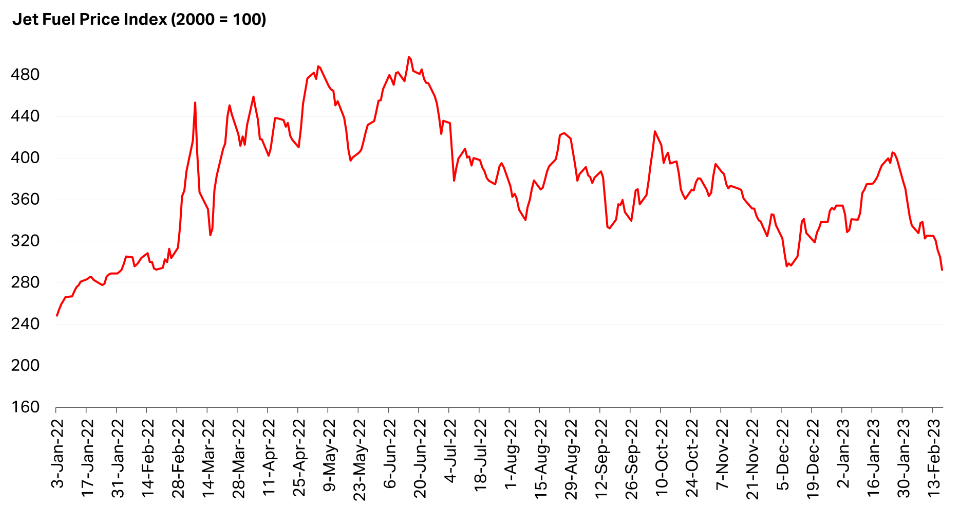

Singapore Airlines Ltd. (SIA SP): A new fleet under its wings

- RE-ITERATE BUY Entry 5.70 – Target – 5.90 Stop Loss – 5.60

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

- New aircraft fleets. Singapore Airline subsidiary Scoot recently announced that they recently signed a letter to lease 9 new Embraer E190-E2 aircrafts, being the 1st operator to fly the type in the Southeast Asia’s region. Deliveries of the aircraft would take place from 2024 through 2025. This adds a new aircraft type to Scoot’s fleet, which currently consists of 32 Airbus A320, as well as 19 Boeing 787s. This expansion of its fleet’s showcase the airline’s confidence in the growing demand for air travel and better match their capabilities and capacity to capture this growing demand.

- Post-Covid boom. Last year, there were about 6.3 million visitors arriving in Singapore, a YoY increase of 1,810.5%. China lifted its overseas travelling restrictions in early January 2023, and Singapore is expected to see a spike in Chinese tourist influx this year. In January 2023, there were 931,500 visitors (up 1,529.3% YoY) in Singapore. According to a recent market survey from travel agents in China, Southeast Asian countries are among the top cross-border travelling preferences after a three-year lockdown.

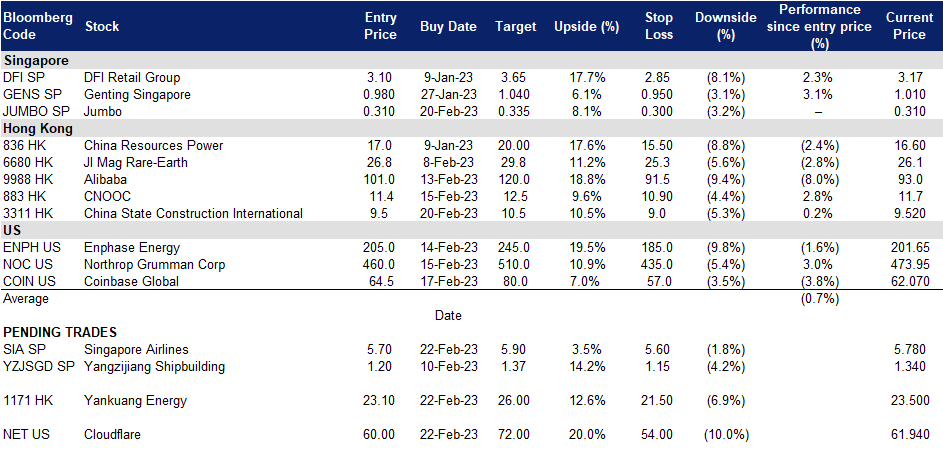

- Jet fuel prices fall. Due to concerns over a slowdown of global economic growth and recession, international oil prices have been trending downward since mid-2022. Accordingly, prices of crude oil derivatives fall, benefiting airline companies as part of operating costs drops.

Jet Fuel Price Index

(Source: IATA, S&P Global)

(Source: IATA, S&P Global)

- 1H23 results review. In1H23 (YE March), net profit arrived at S$927mn, recovering from an S$837mn loss during 1H22, resulting from the sharp revival in travel demand after economies reopened their borders. SIA and Scoot carried 11.4mn passengers during 1H23, a 13-fold jump from 1H22.

- Updated market consensus of the EPS in FY23/24 is S$0.592/S$0.397 respectively, which translates to 9.8x/14.6x forward PE. Bloomberg consensus average 12-month target price is S$5.73.

(Source: Bloomberg)

Jumbo Group Ltd. (42R SP): Year of recovery

Jumbo Group Ltd. (42R SP): Year of recovery

- RE-ITERATE Entry – 0.310 Target – 0.335 Stop Loss – 0.300

- Jumbo Group Ltd is a seafood restaurant group offering multiple dining concepts catering to all types of consumers. The Company offers restaurants in Singapore, China, and Japan.

- China’s re-opening play. China just recently announcement the re-opening of it borders to international visitors. Domestic and International tourists are expected to rise in the coming quarters. China is one of Jumbo Group key markets, and has 3 brands with 10 outlets located in China. The rise in international travel to China would definitely drive revenue for the company.

- Increase in tourism level in SG. With international borders re-opening, Singapore has become a global hot spot for tourists again. Singapore’s international visitor arrivals rose to 931,530 in January, setting a new record since the onset of the pandemic. Singapore’s tourism recovery is expected to reach back to pre-Covid level by 2024. Jumbo Group would be able to tap on this recovery as more tourists in Singapore would drive more revenue for the Group from its Singapore restaurants.

- Company Outlook. The company’s outlook is positive, as they are seeing an increase in consumer demand in its key market as more and more countries emerge from the pandemic and see a rise in tourism level. The harsh macroeconomic environment might pose some challenges due to high inflation and interest rates impacting consumer demand, but this is bound for a turnaround in the 2nd half of FY 23. This suggests that the company’s performance is likely to continue to improve in the near future.

- Updated market consensus of the EPS in FY23/24 is S$0.013/S$0.017 respectively. Bloomberg consensus average 12-month target price is S$0.35.

(Source: Bloomberg)

(Source: Bloomberg)

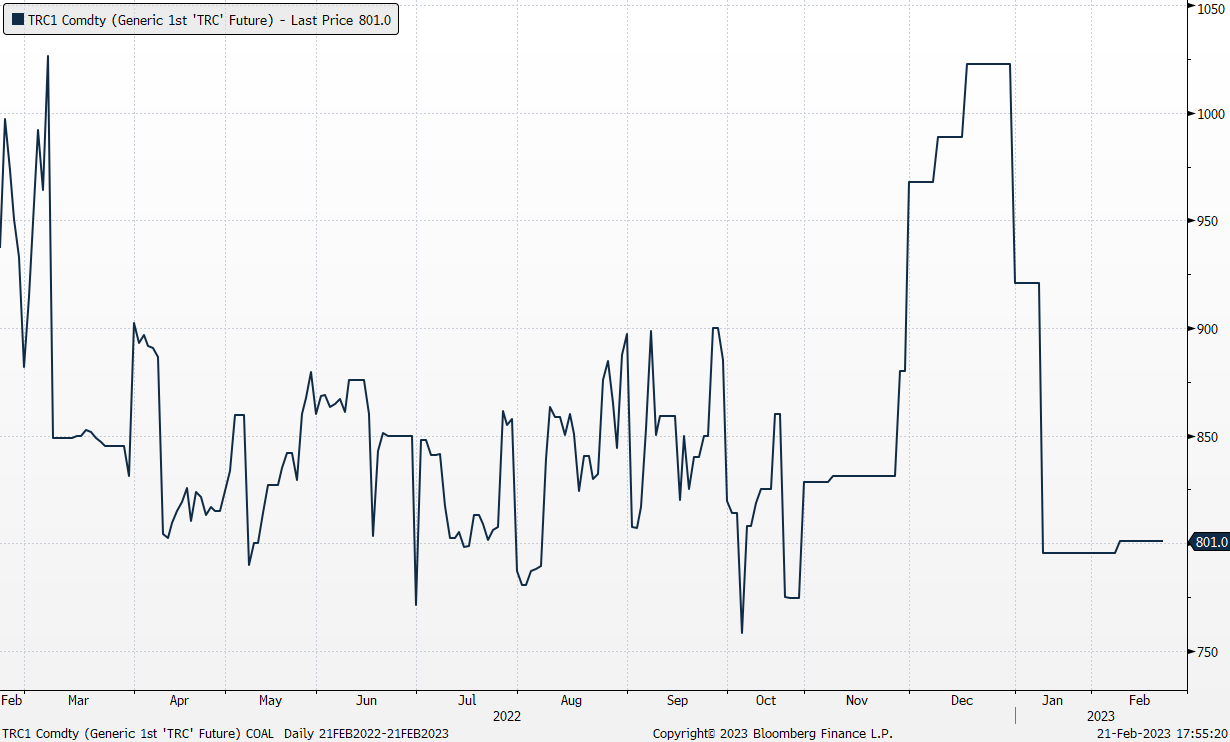

Yankuang Energy Group Co Ltd (1171 HK): Expecting a seasonal rebound

- BUY Entry – 23.1 Target – 26.0 Stop Loss – 21.5

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

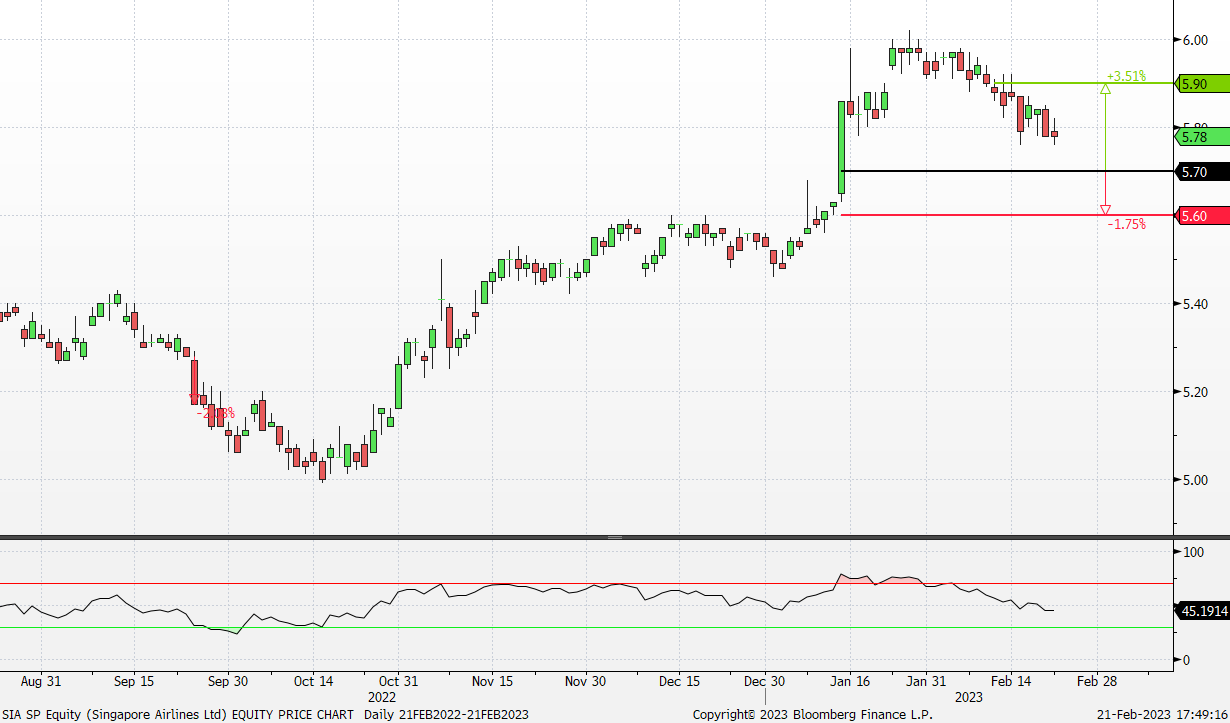

- Coal prices. Coking coal rebounded to a three-month high at RMB1,958/MT, driven by seasonal replenishment of inventory and recovery of smelting activities. Basic metals such as aluminium, copper, and steel had a good start in 2023 as China was reviving infrastructure expansion and bailing out the property market. On the other hand, thermal coal prices remained flat at RMB800/MT. Power plants are about to replenish thermal coal inventories in March/April, and hence, prices are expected to rebound seasonally.

China coking coal price performance

(Source: Bloomberg)

(Source: Bloomberg)

China thermal coal price performance

(Source: Bloomberg)

(Source: Bloomberg)

- Seasonality. Based on the last 15-year track record, Yankuang performs well during March/April which is the coal re-stocking period.

Monthly returns over the past 15 years

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 estimated earnings. The company expects to realise a net profit attributable to the shareholders of about RMB30,800 mn, an increase of about RMB14,500 mn or approximately 89% YoY, from RMB16,259 mn in FY21.

- The updated market consensus of the EPS growth in FY23/24 is -7.7%/-6.1% YoY respectively, which translates to2x/3.4x forward PE. Current PER is 3.2x. FY23F/24F dividend yield is 17.5%/16.75% respectively. Bloomberg consensus average 12-month target price is HK$26.94.

(Source: Bloomberg)

China State Construction International Holdings Ltd (3311 HK): Infrastructure expansion to uphold the economic recovery

China State Construction International Holdings Ltd (3311 HK): Infrastructure expansion to uphold the economic recovery

- RE-ITERATE BUY Entry – 9.5 Target – 10.5 Stop Loss – 9.0

- China State Construction International Holdings Limited is an investment holding company principally engaged in construction contracts business. The Company is also engaged in infrastructure project investments, facade contracting business and infrastructure operation. The Company operates its business through four segments: Hong Kong, Mainland China, Macau and Overseas. Through its subsidiaries, the Company is also engaged in building construction, civil and foundation engineering works.

- Improving infrastructure. Following the relaxation of COVID-19 controls in December, the Chinese government has shifted focus to infrastructure investments to stimulate economic growth. Infrastructure projects across China have resumed after the Spring Festival holidays, with major projects totaling $7.4 billion already underway. The National Development and Reform Commission has approved 109 fixed-asset investment projects worth a combined 1.48 trillion yuan, covering transportation, energy, and water conservancy. In 2022, China’s fixed-asset investment increased by 5.1%, with infrastructure and manufacturing investments increasing by 9.4% and 9.1%, respectively. Experts predict that infrastructure investments will continue to play a leading role in boosting economic growth in 2023.

- Investment in digital infrastructure and technology. China is expected to see an increase in investment in 5G communications, distributed electricity grids, and computing power this year. Shenzhen, also known as China’s Silicon Valley, plans to add 10,000 5G base stations as part of its infrastructure expansion plan, which is in line with the Chinese government’s efforts to advance 5G infrastructure development in the country. Shenzhen aims to become the top city in mainland China in terms of internet speed by bolstering internet connectivity and digital economic activity in the city. Meanwhile, Henan province, which is home to the world’s largest iPhone factory, is investing $7.39 billion in a digital infrastructure expansion program to move its industries up the value chain. The program focuses on the development of advanced computing, satellite communications, integrated circuits, artificial intelligence, digital platforms, and 5G, following the State Council’s commitment to enhance China’s digital economy.

- Hong Kong’s need for public housing. The Hong Kong government plans to spend HK$26 billion on building temporary apartments in eight land plots to reduce the wait times for public housing. The light public housing units will be built using modular construction and will be between 13-31 square meters. The aim is to cut the waiting period for public housing to 4.5 years from 5.6 years. The government has rolled out a similar initiative called transitional housing.

- 3Q22 earnings. Revenue rose 38.9% YoY to HK$73,411,573,000, from HK$52,835,893,000 in 2021. The Group recorded an accumulated new contract value of approximately HK$125.74bn and a backlog of approximately HK$299.18bn.

- The updated market consensus of the EPS growth in FY22/23 is 15.8%/14.2% YoY respectively, which translates to 6.1x/5.3x forward PE. Current PER is 6.4x. FY23F/24F dividend yield is 4.9%/5.7% respectively. Bloomberg consensus average 12-month target price is HK$12.63.

Cloudflare Inc (NET US): A ChatGPT-themed stock

- BUY Entry – 60.0 Target – 72.0 Stop Loss – 54.0

- Cloudflare, Inc. designs and develops software solutions. The Company offers platform for load balancing, video streaming, security, analysis, and domain registration. Cloudflare serves customers worldwide.

- ChatGPT hype. The revolutionary applition ChatGPT led to a new wave of artificial intelligence hype. The developer of ChatGPT, Open AI is one of Cloudflare’s customers. One third of the Fortune 500 companies also subscribe Cloudflare’s services.

- Growing demand for internet security. As more and more businesses and individuals shift their operations online, the need for robust internet security solutions is only going to increase. Cloudflare’s suite of security products, such as DDoS protection and web application firewalls, are in high demand and the company has been able to capitalize on this growing market.

- Diversified product offerings. In addition to its security products, Cloudflare also offers a range of other services, such as content delivery network (CDN) and domain name system (DNS) services. This diversification makes Cloudflare less reliant on any single product or service and gives the company multiple revenue streams.

- 4Q22 earnings review. Revenue jumped by 41.9% YoY to US$274.7mn. Non-GAAP gross profit was US$212.5mn, and GPM was 77.4%. Non-GAAP EPS arrived at US$0.06.

- The updated market consensus of the EPS growth in FY23/24 is 28.0%/49.5%, respectively, which translates to 388.3x/258.8x forward PE. Current PER is 388.3x. Bloomberg consensus average 12-month target price is US$69.54.

Coinbase Global Inc (COIN US): Fly to the moon

- RE-ITERATE BUY Entry – 64.5 Target – 80.0 Stop Loss – 57.0

- Coinbase Global Inc provides financial solutions. The company offers a platform to buy and sell cryptocurrencies, serving clients worldwide.

- Rebound of Crypto. BTC, which is the largest cryptocurrency, has gained momentum by increasing 26% in January. It has successfully rebounded from the collapse of FTX, surpassing the $20,000 level, and is set to have its best month since August 2021. Recently, BTC has surged past the $24.7K mark, which marks a 6-month high. Additionally, the increased mining difficulty of Bitcoin’s network provides investors with a positive outlook regarding the network’s fundamentals.

- SEC ruling. The Securities and Exchange Commission (SEC) proposed heightened requirements for businesses that safeguard assets for fund managers, a move that could further squeeze crypto platforms as the industry comes under pressure from regulators.

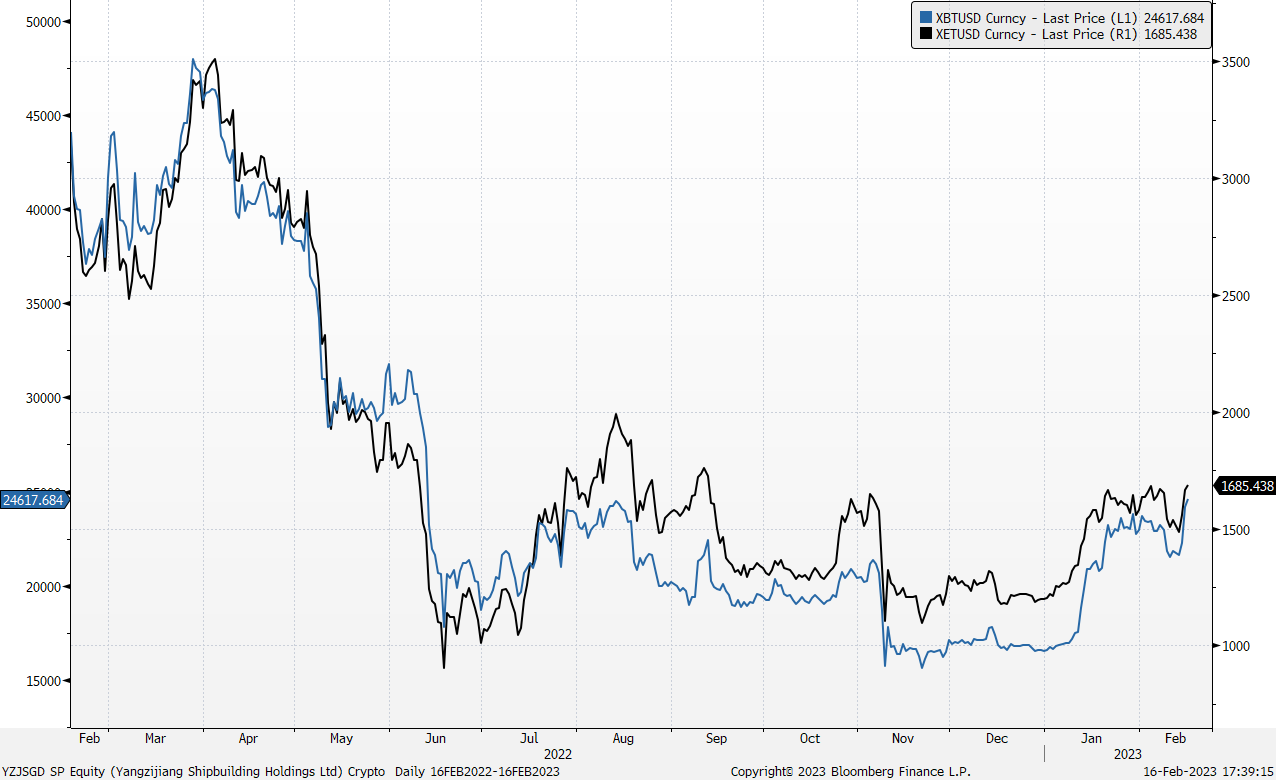

Bitcoin & Ethereum Chart Price Chart:

- Short squeeze incoming. With a short interest ratio of 2.15 and a short percentage float of 25.44%, this could result in a short squeeze in COIN.

Coinbase short interest

- The updated market consensus of the EPS in FY23/24 is -US$4.43/US$1.88, respectively. Current PER is 421.87x. Bloomberg consensus average 12-month target price is US$58.23.

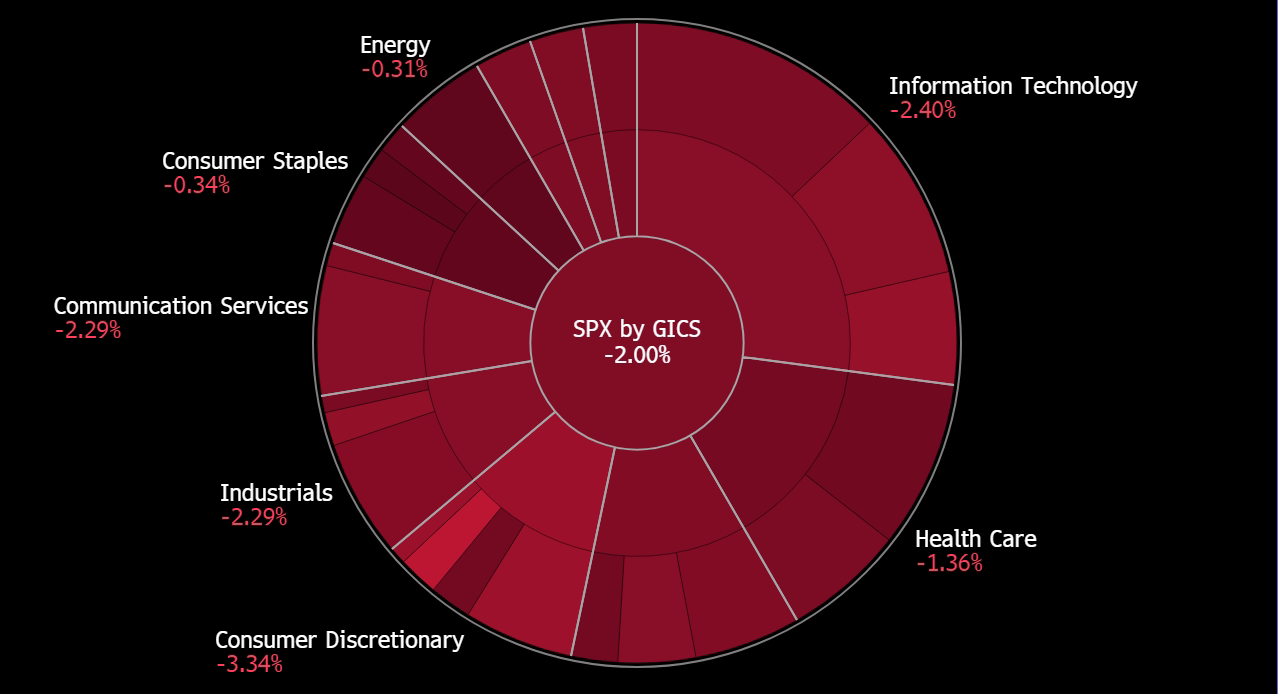

United States

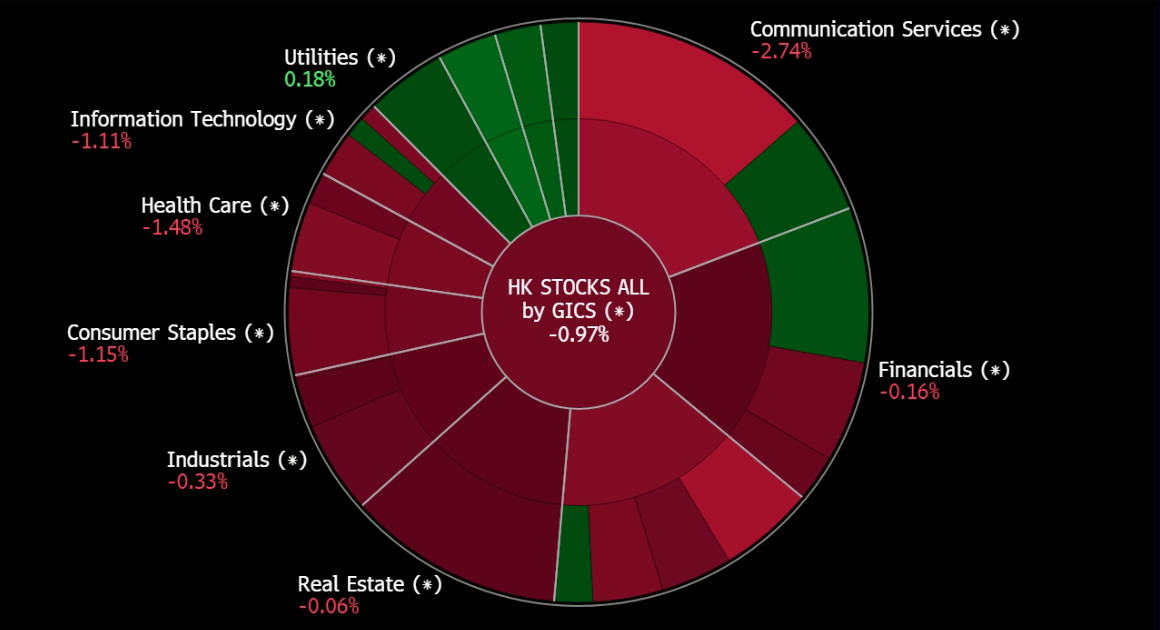

Hong Kong

Trading Dashboard Update: Add Jumbo (42R SP) at S$0.31 and China State Construction (3311 HK) at HK$9.5.