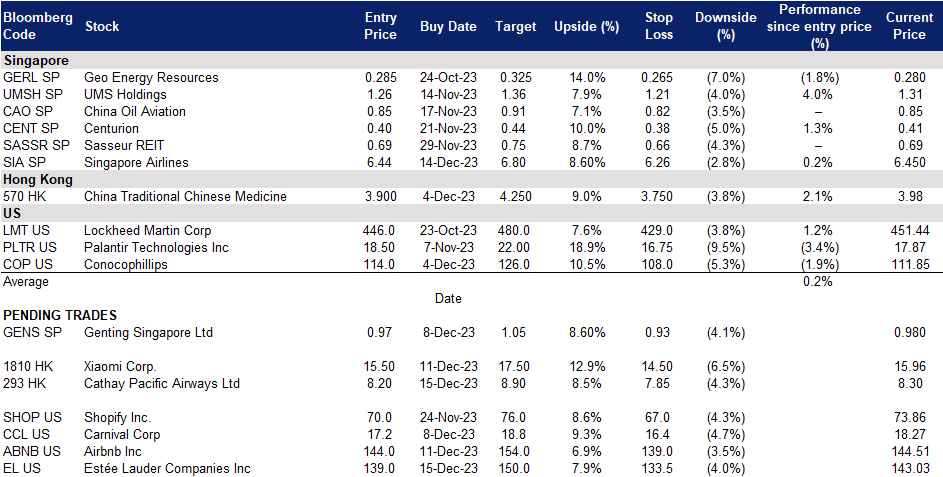

3 January 2024: Singapore Airlines Ltd. (SIA SP), Cathay Pacific Airways Ltd. (293 HK), Estée Lauder Companies Inc. (EL US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

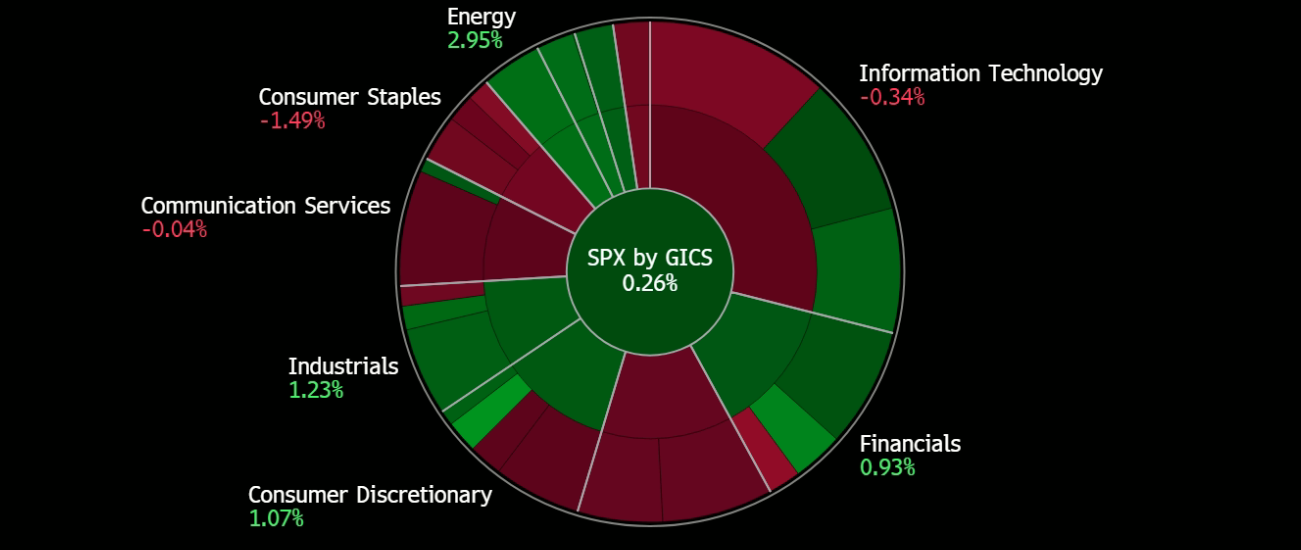

United States

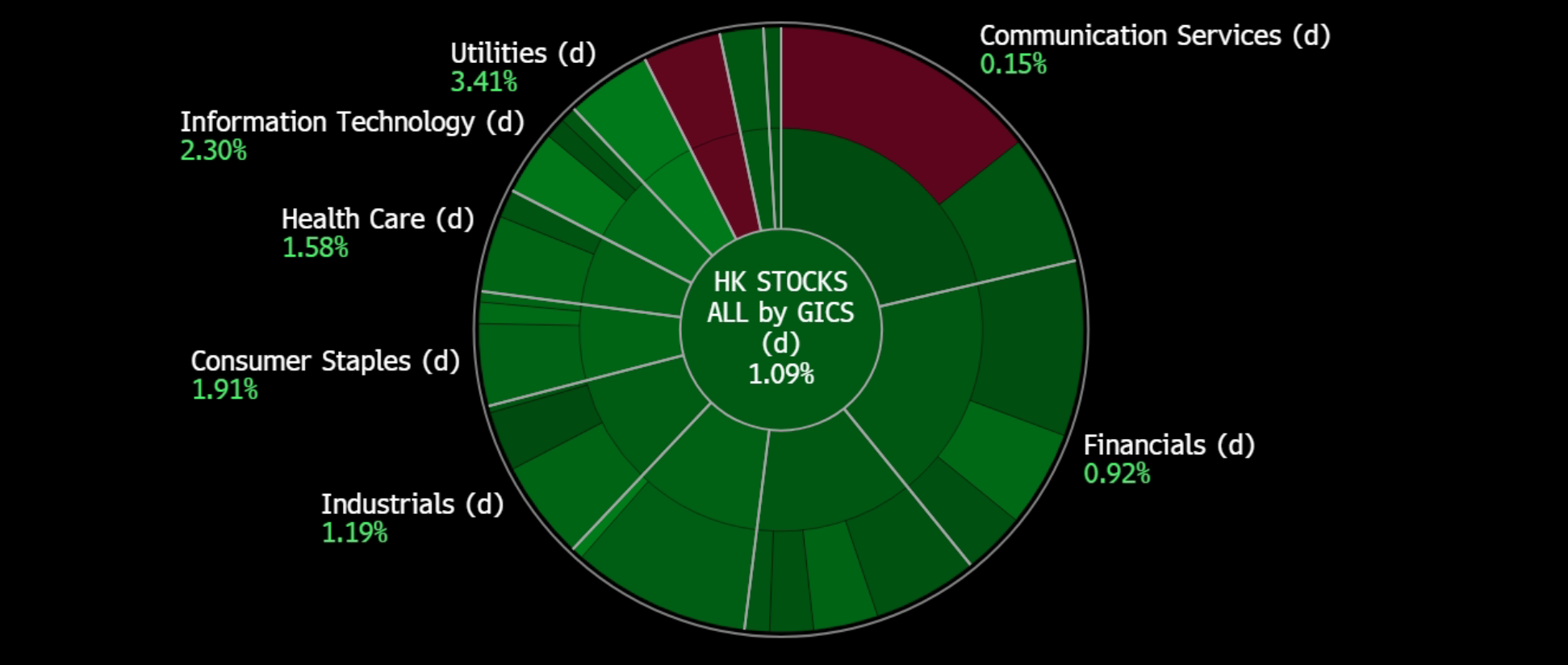

Hong Kong

Singapore Airlines Ltd. (SIA SP): Upbeat outlook in 2024

- RE-ITERATE Entry 6.44 – Target – 6.80 Stop Loss – 6.26

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

- Exceeded 2023 expectations. According to the International Air Transport Association (IATA), airline profitability in 2023 exceeded expectations, with revenues projected to reach US$896bn, US$93bn higher than anticipated. Expenses also rose to US$855bn, US$74bn above the previous forecast. This resulted in a net profit of US$23.3bn, significantly surpassing the June forecast of US$9.8bn. However, the net profit margin is just 2.6%, equating to an average of US$5.44 per passenger carried in 2023. The improvement was mainly driven by the passenger business, which saw a US$96bn increase in revenues. Cargo revenues slightly underperformed, reaching US$134.7bn instead of the expected US$142.3bn.

- Expected 2024 record highs. IATA anticipates a YoY increase in 2024 net profits, reaching US$25.7bn with a 2.7% net profit margin. Operating profits are projected at US$49.3bn. Record-breaking revenues of US$964bn are expected, with passenger revenues at US$717bn and cargo revenues at US$111bn, impacted by belly capacity growth. Despite challenges like rising fuel prices and supply chain issues, the industry’s recovery remains robust, emphasising resilience while acknowledging ongoing challenges and the need for regulatory improvements. Furthermore, the Airports Council International (ACI) has indicted strong passenger growth, positioning the industry for global passenger traffic recovery in 2024. According to a Skyscanner report, 87% of Singapore’s travellers plan equal or more trips abroad in 2024 than 2023, with 48% citing flight ticket costs as a significant factor. Travel demand is expected to stay high in the coming year.

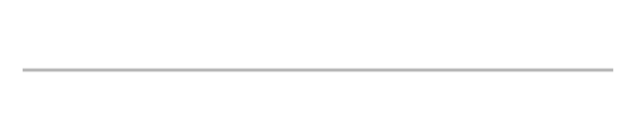

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Lower jet fuel prices. On the week ending 8 Dec, the global average jet fuel price dropped by 7.5% to US$105.30/bbl. Oil prices fell due to increased production in the US and other non-OPEC countries, along with reduced demand from China. Jet fuel prices in Europe continued to decline due to air traffic remaining below 90% of pre-pandemic levels. The US also experienced lower jet fuel prices due to a combination of decreased demand and increased refinery output. The lower jet fuel prices are benefiting airlines, improving their operating margins.

- A380 back in the lineup. Singapore Airlines has effectively reintroduced all its Airbus A380 aircraft into service, coinciding with the continued revival of air travel demand in Southeast Asia. Airlines in Southeast Asia aim for a 90% capacity rebound by the end of 2023 post-pandemic. This positions SIA to address the surge in travel demand and utilise these aircrafts with more seating capacity for its busier and longer-haul flights.

- 1H24 earnings. The company revenue rose to S$9,162mn, +8.9% YoY compared to 1H23. The company’s net profit for the period was S$1,441mn, a 55.4% increase YoY. SIA and Scoot carried 17.4mn passengers in 1H24, an increase of 52.3% YoY. Passenger traffic grew 38.0% from a year before, outpacing the capacity expansion of 29.0%. As a result, the Group passenger load factor (PLF) improved by 5.8 percentage points to 88.8%, the highest ever half-yearly PLF. SIA and Scoot achieved record PLFs of 88.0% and 91.3% respectively. The Company declared an interim dividend of 10 cents per share, amounting to S$297mn, for 1H24 which will be paid on 22 December 2023 for shareholders as of 7 December 2023.

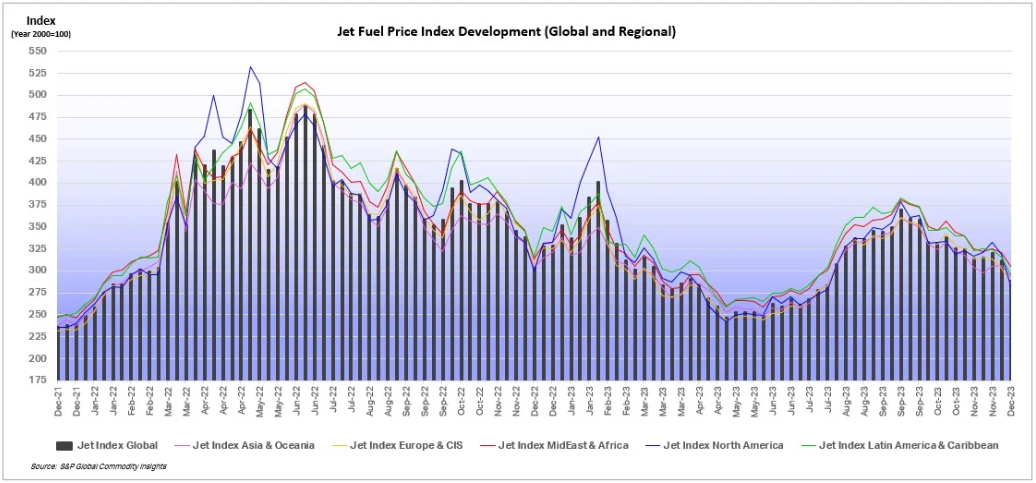

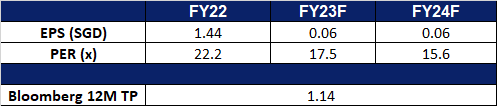

- Market Consensus.

(Source: Bloomberg)

Genting Singapore Ltd (GENS SP): China-Singapore mutual visa-free in 2024

Genting Singapore Ltd (GENS SP): China-Singapore mutual visa-free in 2024

- RE-ITERATE BUY Entry 0.97 – Target – 1.05 Stop Loss – 0.93

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- 30-day mutual visa-free between Singapore and China. During the 19th Joint Council for Bilateral Cooperation, Singapore and China achieve a 30-day mutual visa-free arrangement. The implementation is expected to be in early 2024. Accordingly, Chinese visitor arrivals are estimated to further increase. Hence, Singapore Resorts World Sentosa shall see improvements in its revenue streams in 2024.

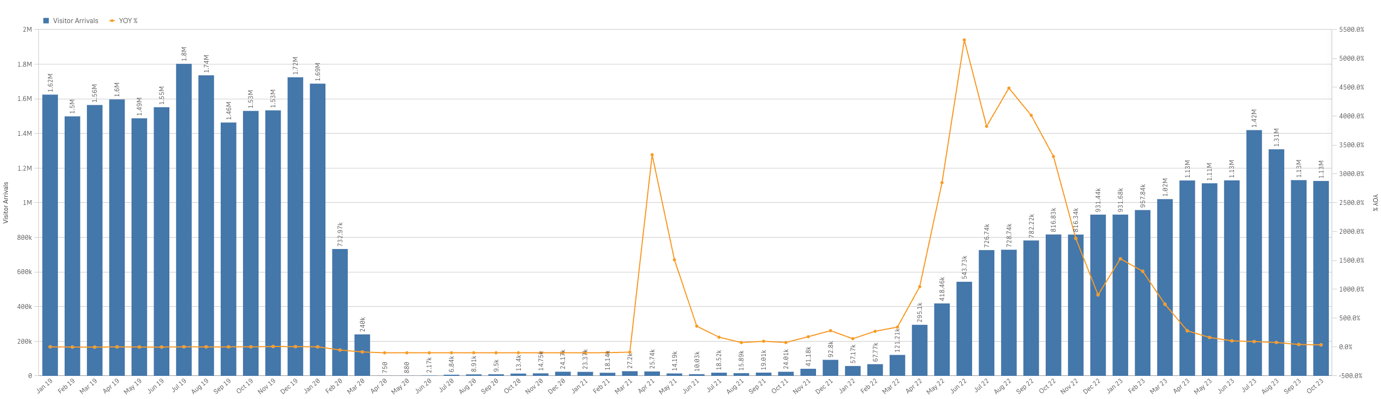

- Still has room for visitor arrivals to recover. Visitor arrivals to Singapore further improved in 2023. However, recent figures show that the number of visitors travelling to Singapore has flattened. Compared to the pre-CVOID level, tourism has not fully recovered. There is room for recovery as the average number of arrivals was above 1.5mn per month while the YTD number is around 1.1mn per month.

Singapore monthly visitor arrivals trend (2019-2023)

(Source: Singapore Tourism Analytics Network)

- Correlation between tourists and revenue. Genting Singapore reported a significant increase in net profit and revenue for 1H23. The company attributed this improved performance to an increase in foreign visitor arrivals to Singapore, despite challenges such as limited air capacity from certain regional countries and higher airfares affecting leisure travel. Resorts World Sentosa (RWS) saw a 37% growth in adjusted earnings in 2Q23, mainly due to a rebound in the non-gaming business, a strong VIP win rate, and a recovery in regional gaming activities. Gross gaming revenue also rose 3% on a hold-normalised basis, reaching $547.9mn. We anticipate continued growth in Genting’s revenue from the increase in visitor arrivals in 2H23 alongside its strong VIP gaming segment and keys added to its newly refurbished Ora Hotel.

- Project timeline. Genting Singapore previously mentioned that it aims to begin construction in FY24 after government approvals on the new Waterfront building, the Equarius Hotel extension and the Health and Wellness Centre.

- 1H23 earnings. The company revenue rose to S$1,080.4mn, +63% YoY compared to 1H22. The company’s net profit for the period was S$276.7mn, more than 3 times the net profit in 1H22 of S$84.4mn. Basic earnings per share were S$2.29 cents compared to the previous S$0.70 cents in 1H22. It also paid out an interim dividend of S$1.5cents on 22 September 2023.

- Market Consensus.

Cathay Pacific Airways Ltd. (293 HK): Capturing year-end demand

- BUY Entry – 8.20 Target – 8.90 Stop Loss – 7.85

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services, and commercial laundry operations.

- Partnership with Shinsegae. Cathay Pacific recently announced that from 2024 onwards, Cathay Pacific Airways users will be able to use their mileage points to shop at Shinsegae duty-free shops in South Korea. Shinsegae Duty-Free, one of Korea’s top three duty-free brands, plans to collaborate with the airline via a membership mileage partnership, to attract individual tourists to duty-free shops amid a shift from Chinese group tourists to diverse individual tourists, including those from Europe and Southeast Asia. This partnership is likely to increase customer loyalty for Cathay Pacific, as well as the number of customers for both companies.

- Expectations of a strong year-end travel demand. Cathay Pacific recently released its traffic figures for October 2023, carrying a total of 1,684,700 passengers in Oct 2023 (+320.2% YoY). The company expects year-end travelling demand to remain strong, and the company is on track to achieve its 2023 rebuild target. The company expects to operate 70% of our pre-pandemic passenger flights covering about 80 destinations, and projects that they will be back to 95% of pre-pandemic passenger numbers by the end of 2023. This highlights the strength in travel demand during the year-end holiday season.

- Increasing number of flights to capture travel demand. Cathay Pacific has gradually increased the number of flights across several destinations to capture the higher demand for travelling as the year-end holiday season arrives. Just over the last month, the airline carrier added more flights to cities like Brisbane, Sydney, as well as to Chinese Mainland.

- 1H23 earnings. Revenue rose 135.0% YoY to HK$43.6bn in 1H23, compared with with HK$18.6bn in 1H22. Net profit was HK$4.3bn in 1H23, compared to net loss of HK$5.0bn in 1H22. Basic earnings per share was 61.5 HK cents in 1H23, compared to -82.3 HK cents in 1H22.

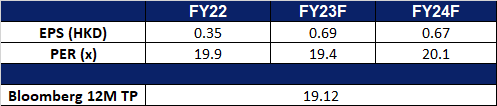

- Market consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): New products to lift the top line

- RE-ITERATE BUY Entry – 15.5 Target – 17.5 Stop Loss – 14.5

- XIAOMI CORPORATION is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Tapping into the EV market. As part of the company’s effort to create a seamless ecosystem, the company has engaged with several carmakers about possible partnerships to build EVs. The company has also recently secured approval from the National Development and Reform Commission (NDRC) to manufacture 100,00 vehicles annually, marking a major milestone for the company’s venture into EV manufacturing. Xiaomi’s founder, Lei Jun has also previously announced an investment of $10bn into the EV space over the next ten years, and aims to mass produce its first cars by 1H2024.

- Surging sales of Xiaomi 14 and 14Pro. Xiaomi just released it Xiaomi 14 and 14Pro last week, marking them as the world’s first smartphones powered by the Snapdragon 8 Gen 3 chipset. The Xiaomi 14 series broke the company’s previous year’s record on all its major Chinese online retail platforms, selling out within the first four hours of its initial sales. Consumers were attracted to the series 14 impressive design, the enhanced iteration of the Xiaomi 13 series, the incorporation of the Snapdragon 8 Gen 3 chipset, and the introduction of the all-new HyperOS user experience, alongside having a Leica-optimized Light Hunter 900 primary camera in addition to a unique Leica Summilux lens, providing a high-quality photography experience.

- Integration of new operating system. Xiaomi announced recently its new operating system, the Xiaomi HyperOS. This operating system is made available to consumers together with the sales of Xiaomi’s latest phone, the 14 series, as well as other latest wearables and TV sets in China on 31st Oct 23. This shift into a new operating system also marks a strategic move of the company’s vision into creating a seamless smart ecosystem, “Human x Car x Home”. This ecosystem is bound to entice consumers to purchase Xiaomi’s other products as well.

- 2Q23 earnings. Revenue fell 4.0% YoY to RMB67.4bn in 2Q23, compared with withRMB70.2bn in 2Q22. Adjusted Net profit was RMB5.14bn in 2Q23, increasing 147% YoY compared to RMB2.08bn in 2Q22. Basic earnings per share was RMB0.15 in 2Q23, compared to RMB0.06 in 2Q22.

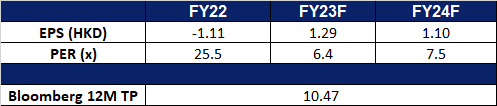

- Market consensus.

(Source: Bloomberg)

Estée Lauder Companies Inc (EL US): Bottoming out

- BUY Entry – 139.0 Target – 150.0 Stop Loss – 133.5

- The Estee Lauder Companies Inc. manufactures and markets a wide range of skin care, makeup, fragrance, and hair care products. The Company’s products are sold in countries and territories around the world.

- US retail sales increase. US retail sales rose by 0.3% MoM in November a turnaround compared to the 0.1% MoM decline seen in October. The incline can be attributed to increased consumer demand witnessed over the Black Friday, Cyber Monday weekend sales which took place in November. Furthermore, the Federal Reserve held its key interest rates steady for the third consecutive time and will be set to cut rates multiple times in the coming year. With inflation easing and future interest rate cuts, consumers will regain their confidence to spend.

- Exploring different marketing channels. Estée Lauder Companies decided to focus on its brands, Estée Lauder and The Ordinary to branch out into TikTok Shop, leveraging each brand’s distinct market position. The strategy involves livestreaming, short-form content, and affiliate links within user videos, aiming to enhance the consumer journey. While The Ordinary targets live streams as direct sales channels with viewer interaction, Estée Lauder adopts a more refined approach with professional hosts and a focus on engaging with comments. The affiliate program, involving over 200,000 sellers, enables content creators to earn commissions, emphasising TikTok Shop’s creator-led approach compared to Instagram Shop. This strategic market entry was in response to a challenging sales quarter, highlighting the company’s commitment to enhancing marketing strategies and exploring innovative approaches to tackle its decline in sales volume from the Asia travel retail and mainland China geographical segments.

- Hopping on new platforms. Kult App, a premium beauty mobile-commerce platform, has collaborated with Estée Lauder Companies to introduce six iconic brands, including Bobbi Brown, Too Faced, Smashbox, Clinique, Estée Lauder, and MAC to its platform. This partnership aims to cater to a broader audience, offering an exceptional selection of makeup and skincare products. These brands are now available for purchase on the Kult App, providing users with a personalised shopping experience through a Skin Analysis Test.

- 1Q24 results. Revenue fell 10.6% YoY, to US$3.52bn. Non-GAAP EPS beat estimates by US$0.31 at US$0.11. The company lowered its outlook to reflect the slower pace of recovery in net sales and margin as growth in overall prestige beauty in Asia travel retail and in mainland China decline alongside incremental external headwinds. In 2H24, the company expects to return to net sales growth and have progressive operating margin improvements due to improvement in the Asia travel retail business and mainland China. FY24 gross margin expansion is anticipated which will be primarily driven by strategic price increases, discount reductions and lower obsolescence charges.

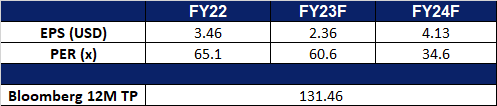

- Market consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): 2024 bookings to rise

- RE-ITERATE BUY Entry – 144 Target – 154 Stop Loss – 139

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- 2024 demand expected to grow. Skyscanner CEO anticipates a 10% to 15% growth in travel demand for 2024, especially in Asia, building on the post-COVID-19 “revenge travel” trend. The travel trends report for 2024 highlights cultural exploration as a priority for travellers, with cost considerations remaining crucial. Despite concerns about the high cost of living, travel demand has remained resilient throughout the year, showing promising signs for the industry’s outlook in 2024. The use of technology, such as artificial intelligence AI, is expected to enhance travel experiences and help users plan more unique and personalised trips. With higher demand for travel, Airbnb is sure to see an uptick in revenue for the next year.

- Benefitting from the Olympics. Paris is set to host the 2024 Summer Olympics, with nearly 10mn visitors expected. However, the surge in demand for lodging has led to a 519% and 829% increase in Airbnb and Vrbo rates, respectively. Short-term rental prices have already doubled, averaging $932 per night during the event. Hosts in France, the second-largest Airbnb market, are capitalising on the opportunity, with some moving in with family to rent out their properties. Airbnb CEO has encouraged Parisians to list their homes, aiming to keep prices reasonable. The company anticipates over half a million visitors using Airbnb during the games, generating €1bn in economic benefits for France.

- Potential regulation. Industry players in Malaysia are urging the government to regulate Airbnb swiftly as hotel prices are expected to rise by 30% due to an increase in the sales and services tax (SST) from 6% to 8% next year. The Malaysia Budget and Business Hotel Association (MyBHA) president argues that Airbnb poses a significant threat to the hotel industry’s survival, as Airbnb rates will not be affected by the tax hike since they are not registered as businesses. He claims that Airbnb operates illegally without business licenses and pays residential rates for utilities, giving them a competitive advantage. Airbnb’s public policy head for Southeast Asia, India, Hong Kong, and Taiwan, disputed these claims, stating that Airbnb complies with relevant tax laws and contributes significantly to Malaysia’s GDP and job creation. The increase in SST is expected to impact hotel prices, making Airbnb more appealing to cost-conscious travellers. Industry leaders emphasise the need for regulatory measures to address the challenges posed by Airbnb to the hotel sector and the broader tourism industry.

- 3Q23 results. Revenue rose 18.1% YoY, to US$3.4bn. GAAP EPS beat estimates by US$4.53 at US$6.63. Expect nights booked growth to moderate in Q4 compared to Q3. For 4Q23, the company expects to deliver revenue of US$2.13bn to US$2.17bn, a YoY growth between 12% and 14%.

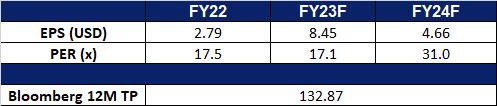

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Singapore Airlines (SIA SP) at S$6.44 and cut loss on Air China Ltd. (753 HK) at HK$4.95.