8 March 2024: Food Empire Holdings Ltd. (FEH SP), China Resources Power Holdings Co. Ltd. (836 HK), Palantir Technologies Inc (PLTR US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

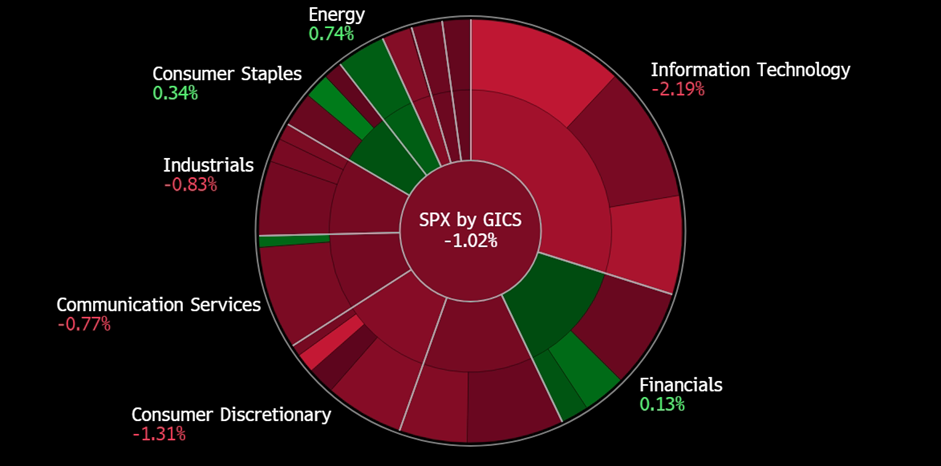

United States

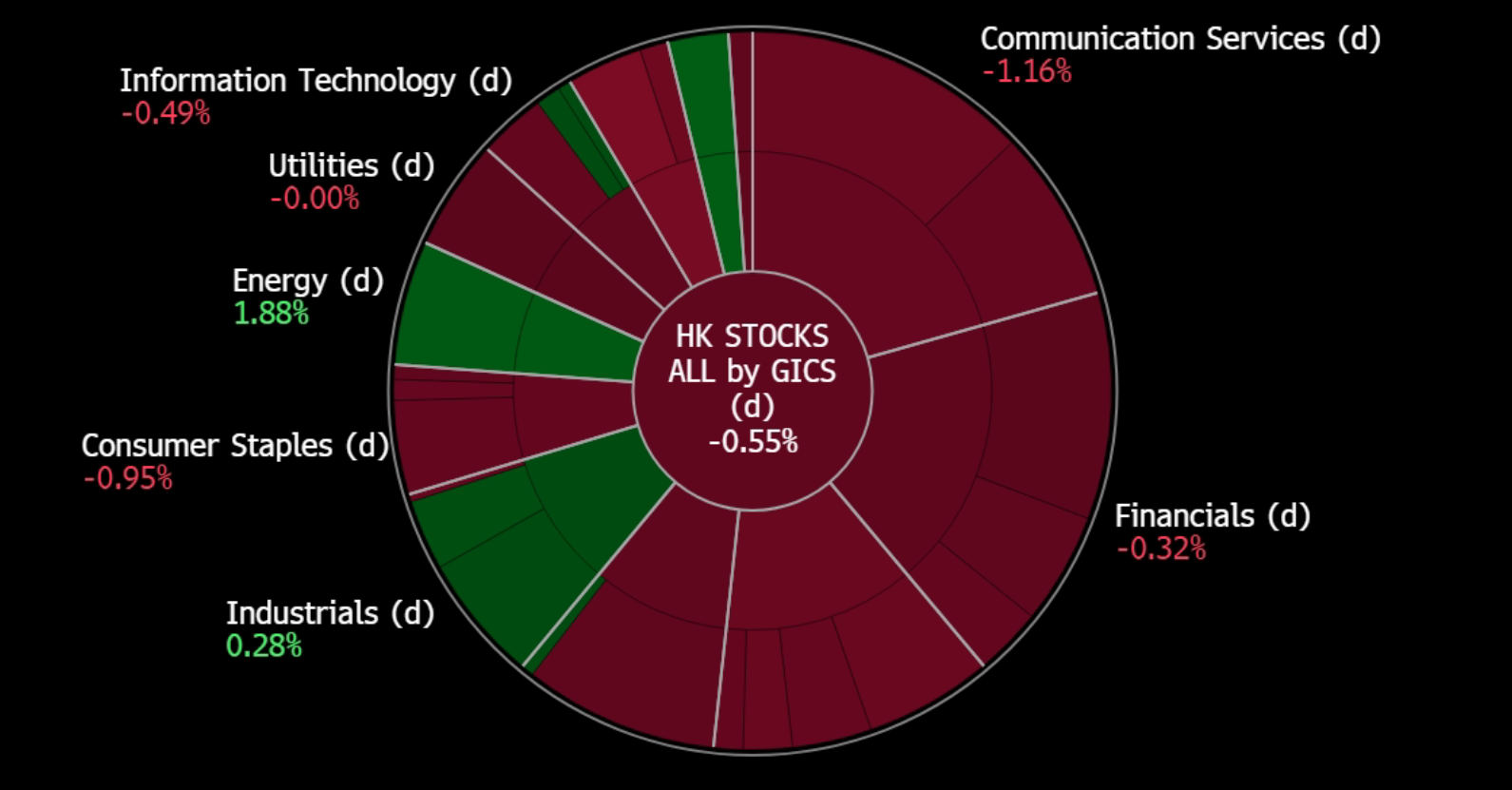

Hong Kong

Food Empire Holdings Ltd. (FEH SP): Soaring to new heights

- Entry – 1.38 Target– 1.50 Stop Loss – 1.32

- Food Empire Holdings (Food Empire) is a multinational food and beverage manufacturing and distribution group headquartered in Singapore. Food Empire’s products are sold in over 60 countries, spanning North Asia, Eastern Europe, South-East Asia, Central Asia, the Middle East, and North America. The Group has 23 offices worldwide and operates 8 manufacturing facilities located in 5 countries.

- Strong consumer demand. Consumer demand stays resilient across Food Empire Holdings’ key markets despite ongoing geopolitical tensions worldwide, alongside a high-interest rate environment. Demand for coffee and tea remained strong across company’s all key markets, seeing volume growth YoY, as well as an increase in sales YoY in local currencies. The expectation that interest rates have peaked and potential rate cuts on the horizon due to cooling inflation will likely enhance consumer sentiment, fuelling the demand for consumer goods. We expect to see further growth in FY24.

- Optimising product mix. The company still remains focused on optimising its product mix and reducing costs in 4Q23. For the full year, the company’s gross profit margin (GPM) rose to 33.2% in FY23, compared to 29.8% in FY22.

- Malaysia’s NDC plant to commence operation soon. The group has finalized its non-dairy creamer expansion in Malaysia, anticipating the commencement of commercial production in the next few months, pending final approval from the Malaysian government. This expansion aims to boost non-dairy creamer sales to external parties in the region. Marketing efforts have already commenced to identify potential customers, and the group foresees the plant reaching 30% to 40% capacity by year-end.

- FY23 financial results. The company reported a record revenue of US$425.7mn for FY23, up 6.9% YoY, due mainly to higher volume and higher pricing from all the group’s core markets. The company saw a significant increase in revenue in Ukraine, Kazakhstan, and CIS, and South Asia, attributed to higher contributions from the group’s coffee manufacturing plants in these markets. Gross profit also rose by 19.0% to US$141.5mn YoY, compared to US$118.8 in FY22. Net profit increased 25.3% YoY to US$56.5mn in FY23 compared to US$45.1mn in FY22, excluding a one-off gain of US$15.0 million from the disposal of non-core assets in FY22.

- Special dividend. The company declares a final FY23 dividend of 5 Scents per share and a surprise special dividend of 5 Scents per share, indicating a forward yield of 7.14%.

- We have fundamental coverage with a BUY recommendation and a TP of S$1.65. Please read the full report here.

(Source: Bloomberg)

Geo Energy Resources Ltd. (GERL SP): A good time to enter

Geo Energy Resources Ltd. (GERL SP): A good time to enter

- RE-ITERATE Entry – 0.35 Target– 0.39 Stop Loss – 0.33

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Dividend policy remained intact. Geo Energy’s FY23 results saw a 62% decline in net profit to US$62.7mn, reflecting the normalization of coal prices after a significant rise in FY22. Despite this decline, the company upheld its dividend policy by declaring a full-year dividend of S$0.02 per share, maintaining a total payout ratio of 33.7%. Production surpassed the initial target of 8Mt, reaching 8.4Mt, with the majority coming from the SDJ and TBR mines. The newly acquired TRA mine contributed 0.2Mt. While the reported net profit figure may be influenced by a one-off gain, the company demonstrated its commitment to shareholder value through its dividend policy.

- Production to rise. The acquisition of an 85% stake in the TRA mine significantly bolstered Geo Energy’s 2P reserves by over 275Mt. This expansion, combined with the mine’s low-ash, low-sulfur coal characteristics that command premium pricing, presents opportunities for increased production volume and potential revenue growth.

- FY23 results review. Revenue declined 33% YoY from US$733.5mn to US$489.0mn in FY23. This decline was due to the normalisation of coal prices, whereby the average ICI4 prices fell from US$86.06 in FY22 to US$70.46 in 1H23. 2H23 revenue also fell 32% YoY to US$249.2mn and net profit declined 40% YoY to US$34.7mn. Net profit tumbled 62% YoY to US$62.7mn from the previous year high of US$163.6mn. The net profit delivered was better than we anticipated due to a one-off gain on a bargain purchase line item. In 4Q23, Geo Energy proposed a final dividend of S$0.006 per share which results in a full-year dividend of S$0.02 per share. For FY23, the average ICI4 price fell to US$62.96 per tonne.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.72. Please read the full report here.

(Source: Bloomberg)

China Resources Power Holdings Co. Ltd. (836 HK): Increase coal use

- BUY Entry – 17.90 Target – 19.30 Stop Loss – 17.20

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Cold wave. China’s national observatory recently renewed an orange alert, the second-highest in the country’s four-tier weather warning system, for cold waves in various areas, forecasting plunging temperatures. The cold wave is set to bring a significant temperature decline to central and eastern China, progressing towards the east and south. In late February, northern China witnessed strong winds, widespread sandstorms, dramatic temperature drops, and rainy and snowy conditions. Temperatures in the north plummeted, with certain areas experiencing declines exceeding 20 degrees Celsius. Over the period, central and eastern China saw more widespread rainy, snowy, and freezing weather, coupled with noticeable temperature fluctuations. The cold wave is expected to drive increased electricity consumption as individuals opt to stay home, seeking warmth amid the freezing conditions across the period.

- Long-Term green power purchase agreement with Merck. China Resources Power has revealed its intention to engage in a long-term power purchase agreement with Merck. Under this agreement, Merck China will substantially enhance its utilization of green electricity in production and operations, aiming to achieve a 60% usage and reduce Scope 2 carbon emissions by 185,000 tonnes. This initiative aligns with Merck’s broader objective of raising its global procurement of electricity from renewable sources to 80% by 2030 and achieving climate neutrality by 2040. The ten-year power purchase agreement with Merck guarantees the life-cycle traceability of a total of 300 GWh of green power.

- Coal Prices. The decline in global coal prices is expected to have significant benefits for the company’s coal-fired power plants and gas-fired power plants. With prices at a 2-year low around of $130 per tonne, lower fuel costs for coal-fired power plants translate into improved profitability and a competitive advantage in the market. While China Resources Powers does have its own coal production plants, energy consumption during the current winter period typically skyrockets for China, this means that the company will be required to buy coal from other suppliers to further supplement its energy production and will therefore benefit from the lower prices. The declining prices also create opportunities for the company’s gas-fired power plants, as natural gas becomes a more cost-effective alternative. This diversification and cost advantage contribute to improved financial performance, market competitiveness, and the ability to offer competitive electricity prices to consumers. Overall, the decline in coal prices presents favourable conditions for the company’s power generation operations, enhancing profitability and sustainability.

Thermal Coal Price

(Source: Bloomberg)

- 1H23 earnings. Revenue rose 2.13% YoY to HK$51.5bn in 1H23, compared with HK$50.4bn in 1H22. Net profit rose 61.8% to HK$7,08bn in 1H23, compared to HK$4.37bn in 1H22. Basic earnings per share was HK$1.40 in 1H23, compared to HK$0.91 in 1H22.

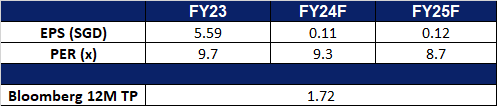

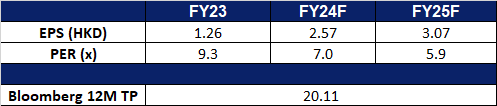

- Market consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Expect an AI PC Boom

- RE-ITERATE BUY Entry – 9.6 Target – 10.4 Stop Loss – 9.2

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Unveiling suite of AI portfolio. Lenovo recently presented its cutting-edge portfolio of purpose-built AI devices, software, and infrastructure solutions at the highly anticipated Mobile World Congress (MWC) 2024 in Spain. Going beyond innovation, Lenovo introduced proof-of-concept devices that push the boundaries of traditional form factors. The global service provider unveiled the future of hybrid AI, driving multi-device, software, and service offerings for increased personalization, collaboration, and efficiency. A standout in their new lineup is the Lenovo ThinkBook Transparent Display Laptop, featuring a groundbreaking 17.3-inch Micro-LED transparent display. With a borderless screen, transparent keyboard area, and a seemingly floating footpad design, it effortlessly embodies high-tech simplicity, enhancing the overall user experience. Through the power of Artificial Intelligence Generated Content (AIGC), the transparent screen opens new avenues for work collaboration and efficiency by enabling interaction with physical objects and overlaying digital information to create unique user-generated content. Its transparency allows it to integrate seamlessly within its environment, highlighting AI’s potential within the PC market.

- PC demand recovery. PC demand has shown signs of recovery and is expected to continue recovering in 2024, after a demand slump in 2023. 4Q23 saw a continued recovery for the PC market, which ended the year with a 20% and 24% year-over-year gain in GPU and CPU shipments respectively, according to Jon Peddie Research. PC recovery is also boosted by the boom in AI technology, which increases the demand for PCs equipped with new AI technologies. Furthermore, suppliers are also gearing up more for replacement demand, where many consumers are expected to replace their PCs, accessories, and peripherals after more than 2 years of usage since the digital boom during the Covid-19 pandemic.

- Partnership with Baidu. Lenovo has recently revealed a collaboration with Baidu to integrate Baidu’s generative artificial intelligence (AI) technology into Lenovo’s smartphones. This strategic partnership aims to apply Baidu’s AI model practically. The global trend of selling smartphones featuring generative AI capabilities, including services like chatbots and real-time translation, gained popularity in late 2022 following the launch of ChatGPT. This collaboration presents a mutual benefit for both companies, allowing Lenovo to leverage the AI space to enhance the promotion of their smartphones.

- 3Q24 results. Revenue rose by 2.97% YoY to US$15.7bn in 3Q24, compared to US$15.3bn in 3Q23. Net profit fell by 22.8% YoY to US$337mn in 3Q24, compared to US$437mn in 3Q23. Basic EPS fell to US2.81cents in 3Q24, compared to US3.65cents in 3Q23.

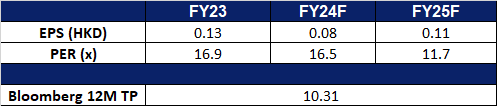

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): Backed by private and public sectors

- BUY Entry – 25.5 Target – 30.0 Stop Loss – 23.0

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Unveiled new customers at AIPCon. On 7 March, Palantir Technologies Inc. held AIPCon, which was accessible via livestreamed on YouTube, with over 60 customers who presented their work on Palantir’s Artificial Intelligence Platform (AIP) and introduced over 20 new customers and partners. Since the launch of AIP in mid-2023, nearly 850 AIP Bootcamps have been conducted globally, helping customers implement use cases swiftly. Its new customers and partners such as Lennar, General Mills, Lowe’s, Cone Health, CSX, OpenAI and many others led the AIP Bootcamps and shared their experiences at the event.

- Secured new contracts with US Army. On 6 March, Palantir Technologies Inc. announced that it had been awarded a US$178.4mn prime agreement by the Army Contracting Command – Aberdeen Proving Ground (ACC-APG) to develop and deliver the Tactical Intelligence Targeting Access Node (TITAN) ground station system. TITAN, the Army’s next-generation deep-sensing capability enabled by artificial intelligence and machine learning, aims to provide actionable targeting information for mission command and long-range precision fires. The system, designed to enhance the automation of target recognition and geolocation, will integrate systems and technologies from various partners including Northrop Grumman, Anduril Industries, and L3Harris Technologies. Palantir, as the prime contractor, will deliver both software and hardware components, leveraging innovative solutions to meet the Army’s modernization priorities. The award, facilitated through an Other Transaction Authority (OTA) agreement, underscores the changes AI is bringing about across various industries including the military.

- 4Q23 earnings review. Revenue rose by 19.6% YoY to US$608.35mn, beating estimates by US$5.55mn. Non-GAAP EPS was US$0.08, in-line with estimates. In 1Q24 it expects revenue to be between US$612mn- US$616mn and FY24 revenue to be between US$2.652bn- US$2.668bn.

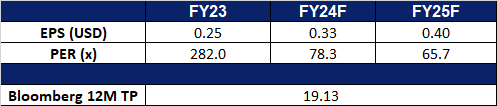

- Market consensus.

(Source: Bloomberg)

PVH Corp (PVH US): Making a comeback

- RE-ITERATE BUY Entry – 137.0 Target – 150.0 Stop Loss – 130.5

- PVH Corp. operates as a clothing and apparel accessories company. The Company designs, manufactures, and markets men’s, women’s, and children’s apparel, footwear, and accessories. PVH offers products such as dresses, shirts, sportswear, neckwear, and footwear.

- Revitalising the company. In the third quarter, PVH’s remarkable performance was driven by the strength of its iconic brands, Calvin Klein and Tommy Hilfiger, and the disciplined execution of the PVH+ Plan, revitalizing the company amidst challenging macroeconomic conditions. Despite facing headwinds, particularly in Europe, the company achieved revenue growth in line with guidance, expanded gross margins, and exceeded bottom-line expectations. There was also robust growth in the direct-to-consumer business, offsetting challenges in wholesale, and significant progress in driving profitability through increased EBIT margin. The company reaffirmed its commitment to long-term growth, emphasizing the importance of executing the PVH+ Plan across all regions and channels. Furthermore, strategic initiatives such as selling heritage brands and strengthening the management team underscore the company’s focus on its core brands and sustainable growth. Moving forward, we remain optimistic about PVH’s growth prospects, buoyed by the strong performance witnessed during Q3 and the ongoing execution of its growth strategy.

- Going according to plan. The PVH+ plan is seamlessly progressing as evidenced by recent high-profile brand campaigns featuring celebrities like Jennie Kim, Kendall Jenner, and Jungkook. Jennie Kim and Jungkook’s collaborations with Calvin Klein, alongside Kendall Jenner’s presence in Tommy Hilfiger’s spring campaign, highlight PVH Corp.’s strategic focus on product excellence and consumer engagement. These partnerships underscore the company’s commitment to modernizing classic American style and tapping into diverse global audiences, thereby driving brand visibility and growth across its portfolio. Additionally, Tommy Hilfiger’s recent partnership with F1 Academy, the women’s racing championship, further solidifies PVH Corp.’s dedication to promoting diversity and breaking barriers in traditionally male-dominated fields, reinforcing its position as a forward-thinking industry leader and further enhances the brand’s image and engagement with a global audience.

- 3Q23 earnings review. Revenue rose by 3.5% YoY to US$2.363bn, missing estimates by US$50mn. Non-GAAP EPS was US$2.90, beating estimates by $0.16. For FY23, revenue is projected to increase approximately 1% as compared to 2022, EPS GAAP about US$9.75 and Non-GAAP basis about $10.45 vs consensus of $10.35.

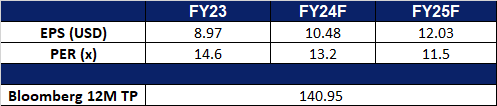

- Market consensus.

(Source: Bloomberg)

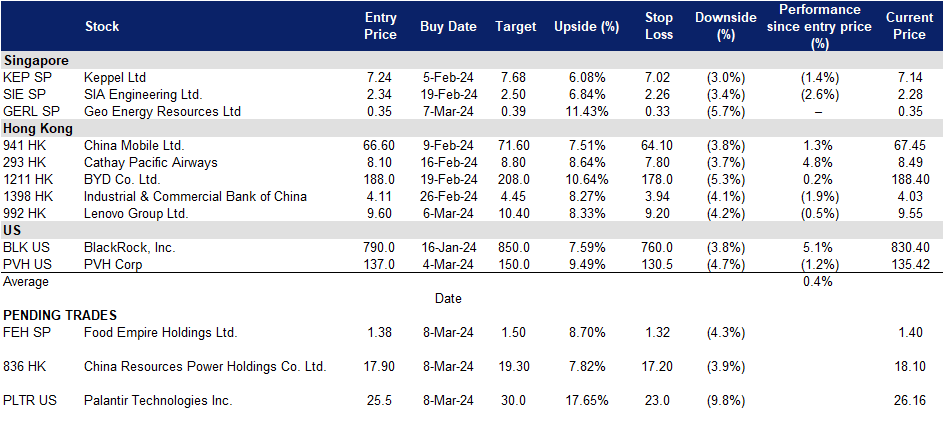

Trading Dashboard Update: Cut loss on Prada S.P.A (1913 HK) at HK$54.30 and Lululemon Athletica Inc. (LULU US) at US$446. Add Geo Energy Resources Ltd. (GERL SP) at S$0.35, Lenovo Group Ltd. (992 HK) at HK$9.60, and PVH Corp. (PVH US) at US$137.