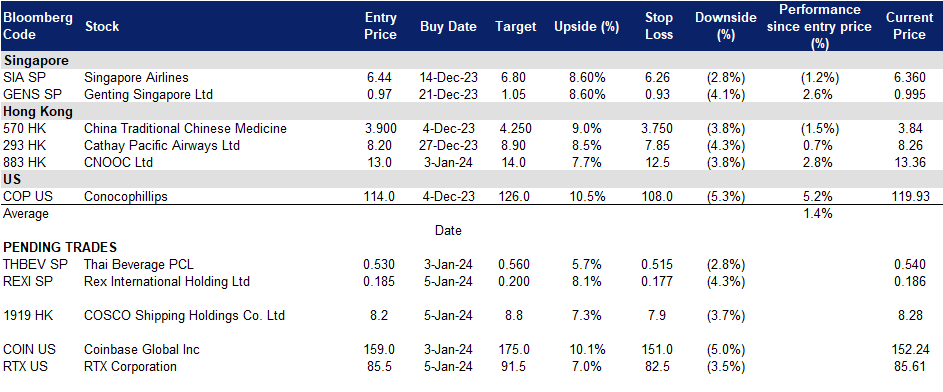

5 January 2024: Thai Beverage PCL (THBEV SP), CNOOC Ltd. (883 HK), Coinbase Global Inc (COIN US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

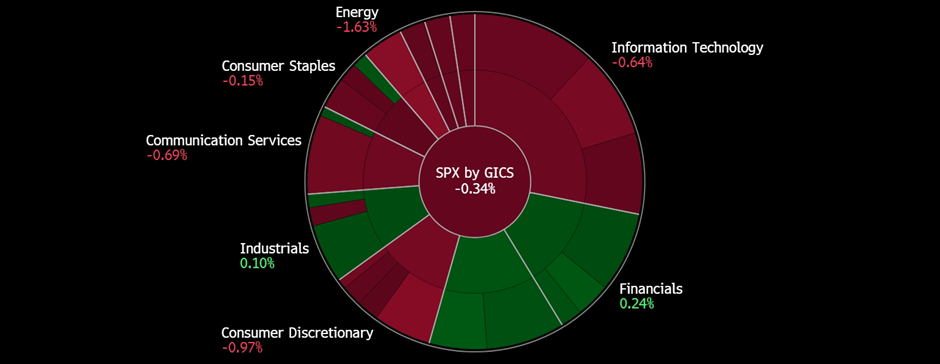

United States

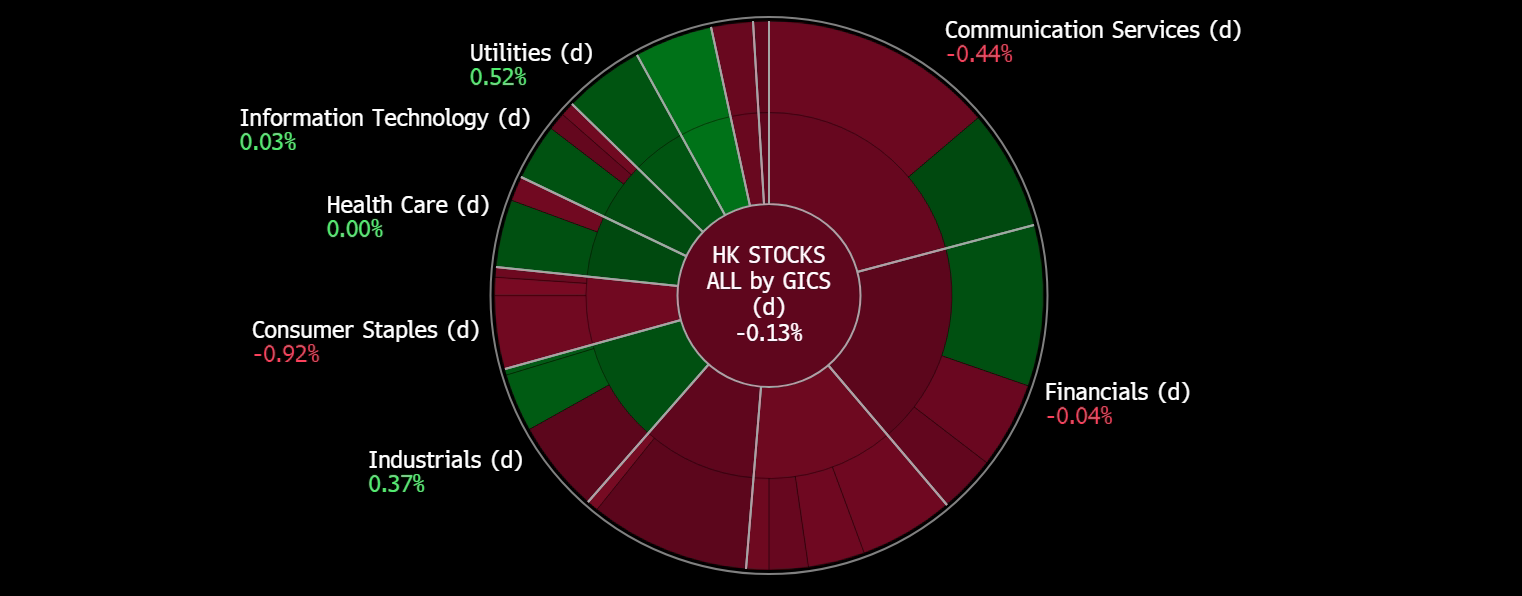

Hong Kong

Rex International Holding Ltd (REXI SP): Oil is rebounding

- Entry 0.185 – Target – 0.200 Stop Loss – 0.177

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Near-term favourable catalysts. Middle east tension escalated due to another attack on a merchant vessel in the Red Sea. US and its allies have vowed to protect shipping on the Suez Canal from any military assaults, and meanwhile Iranian warship entered Red Sea. The potential conflicts are expected to expand, and oil prices are fuelled by worrisome sentiment. On the other hand, OPEC+ announced that it would hold a Joint Minister Monitoring Committee meeting on February 1st. Market expects OPEC+ to release further measures to defend oil price from falling. The recent protest in Libya led to a shutdown of Sharara oilfield which is the country’s largest output source, pushing upward pressure on oil prices.

- Production sharing agreement. Rex International Holding’s joint venture subsidiary, Porto Novo Resources, has secured a production sharing contract for operatorship and a 76% working interest in an offshore block in Benin’s Sèmè Field. The subsidiary, Akrake Petroleum SA, aims to redevelop the Sèmè Field using Rex’s low-cost production system, incorporating a jack-up Mobile Production Unit and a Floating Storage Unit. The offshore Block 1 covers 551 sqkm, with plans to file a field development plan in 2024 to restart oil production in the area, utilizing geological expertise and operational know-how from teams in Norway and Oman.

- Completed acquisition. The board of directors from Rex announced that its subsidiary, Lime Petroleum AS’s, has completed the acquisition of a 17% interest in PL740 in the Norwegian North Sea on 29 December 2023. The OKEA-operated Brasse Field is expected to start commercial production in 2027.

- 1H23 earnings. The company revenue rose to US$106.92mn, a 7.5% YoY increase compared to US$99.45mn in 1H22. Revenue rose due to the increase in the volume of oil lifted and sold from the Yumna Field in Oman and the inclusion of oil liftings from the Yme Field in Norway. Adjusted EBITDA amounted to US$47.13mn in 1H23. The company’s net profit for the period was US$3.69mn, a 38.9% YoY decline from its previous net profit in 1H22 of US$6.04. Earnings per share were US$0.23 (S$0.31) cents compared to the previous US$0.37 (S$0.51) cents in 1H22.

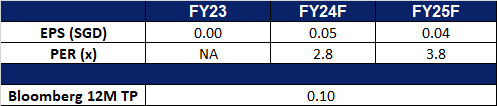

- Market Consensus.

(Source: Bloomberg)

Thai Beverage PCL (THBEV SP): Visa requirements waived

- RE-ITEREATE Entry 0.530 – Target – 0.560 Stop Loss – 0.515

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- Permanent visa-free between China and Thailand. Thailand and China will waive visa requirement starting in March 2024. In 2023, there were 28mn tourist arrivals in Thailand, and 3.5mn of which were from China. However, the numbers were still below pre-COVID levels: 11mn Chinese tourists out of total 39mn arrivals. The revenue from tourism was THB1.2tn (US$35bn) in 2023. There is room for further recovery in its tourism in FY24.

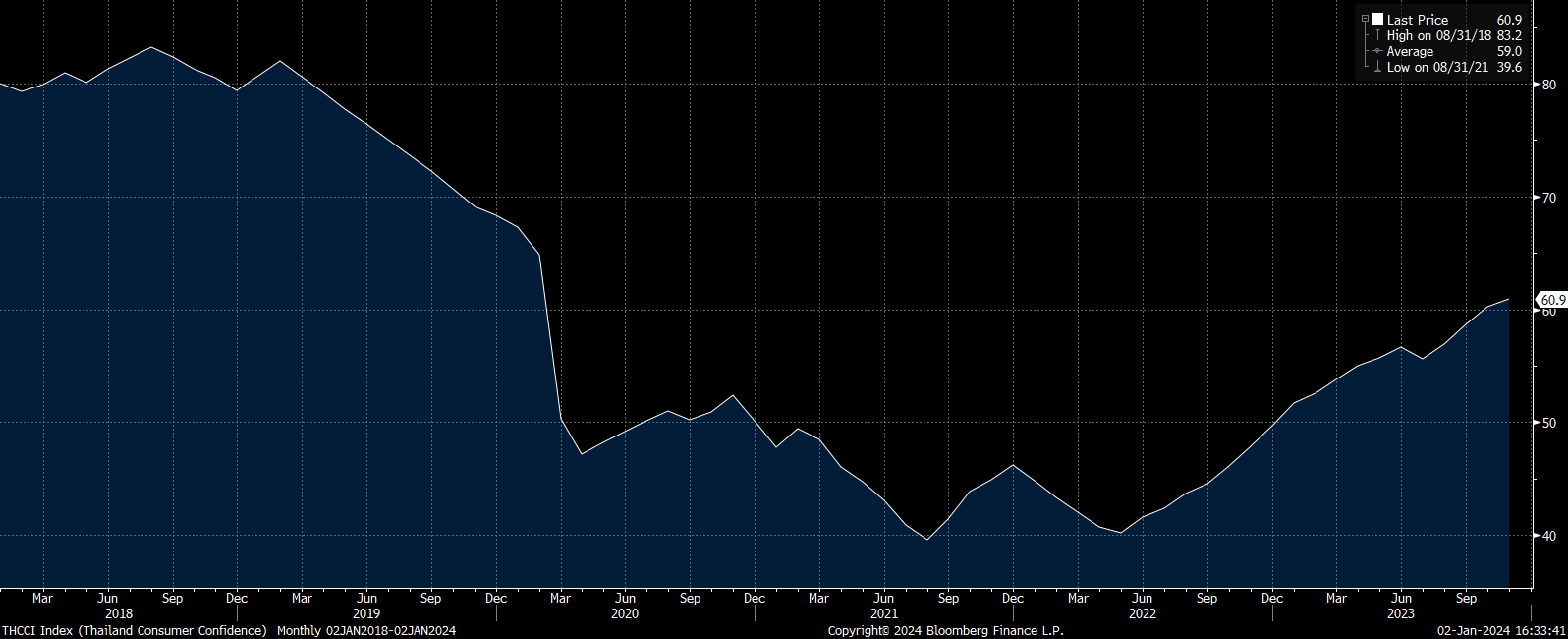

- Consumer confidence rebounding. The Thai consumer confidence index is expected to continue to improve alongside its economy, supported by government measures as well as the relaxation of tourism visa regulations. The index has been on a relatively consistent uptrend since May 2022 and currently sits at 60.9 in November.

Thailand Consumer Confidence Index

(Source: Bloomberg)

- Tax cuts approved. Thailand’s cabinet recently approved tax cuts on alcoholic beverages and entertainment venues to boost tourism. The tax reduction includes lowering taxes on wine from 10% to 5%, on spirits from 10% to zero, and halving excise tax on entertainment venues from 10% to 5%. These measures, which will expire at the end of 2024, aim to support the tourism sector, a key driver of Thailand’s economy, and offset tax revenue losses with additional tourist receipts. Thailand achieved its target of 28mn tourists in the previous year, generating 1.2tn baht, and is aiming for over 34mn tourist arrivals in 2024. The reduction in alcohol taxes is expected to benefit ThaiBev, as the lowered tax rates are likely to increase consumption of alcoholic beverages, aligning with the government’s efforts to stimulate tourism and economic activity.

- FY23 earnings. The company revenue rose to 279.1bn baht, a 3% YoY increase compared to 272.4bn baht in FY22. The company’s net profit for the period was 27.4bn, a 9% YoY decline from its previous net profit in FY22 of 30.1bn baht. Net profit for its spirits segment rose 3% to 22.1bn baht whereas, its beer segment’s net profit fell 38% to 2.4bn baht. Basic earnings per share were 1.09 baht compared to the previous 1.2 baht in FY22. It will also pay out a final dividend of 0.45 baht per share on 28 February 2024.

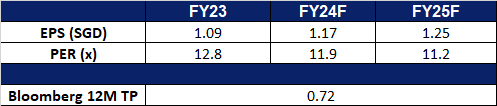

- Market Consensus.

(Source: Bloomberg)

COSCO Shipping Holdings Co. Ltd. (1919 HK): Sailing through a red sea

- BUY Entry – 8.20 Target – 8.80 Stop Loss – 7.90

- COSCO SHIPPING Holdings Co., Ltd., formerly China COSCO Holdings Company Limited, is an investment holding company principally engaged in container shipping and related businesses. The Company is engaged in container shipping, dry bulk shipping, the management and operation of container terminals, container leasing and the provision of logistics services. The Company operates its business through two segments. The Container Shipping segment is engaged in the transportation of goods across the Pacific, Asia and Europe, and other international routes. The Terminal Operation and Investment segment is engaged in the operation and management of ports. The Company is also involved in the management and leasing of containers.

- Higher freight costs from Red Sea attacks. Recent attacks on ships in the Red Sea has led to a surge in freight costs. Ships are forced to re-route around the Cape of Hope, adding 7-14 days to voyages and significantly increasing fuel consumption and resulting in delays in deliveries. This disruptions have resulted in a higher operating costs for shipping companies, which are often passed on to consumers in the form of surcharges and higher freight rates. The increased risk of attacks has driven up war risk insurance premiums for ships traveling through the Red Sea, and these additional costs are also factored into increased freight rates. Rates from Asia to North America’s East Coast have already risen by 55% to $3,900 per 40-foot container recently.

- Seasonality demand. Shipping demand saw a significant increase emerging from the winter holidays and is expected to remain strong as the New Year peak season arrives, attributed to consumers stocking up on Lunar New Year goods, and prepare for the upcoming festive season.

- New partnership with BP. To boost BP’s China operations, Cosco Shipping and the oil giant signed a landmark MoU, unveiling plans to deepen collaboration beyond traditional shipping. The agreement targets key areas like Castrol marine lubricants, hydrocarbon transportation, and offshore construction, while also exploring potential partnerships in methanol bunkering and offshore wind supply chains.

- 3Q23 earnings. Revenue fell by 59.61% YoY to RMB42.71bn in 3Q2023, compared to RMB105.76bn in 3Q22. Net profit fell 83.07% YoY to RMB5.51bn, compared to RMB32.46bn in 3Q22. Basic EPS fell by 83.17% YoY to RMB0.34, compared to RMB2.02 in 3Q22.

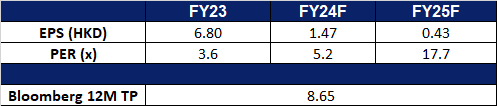

- Market consensus.

(Source: Bloomberg)

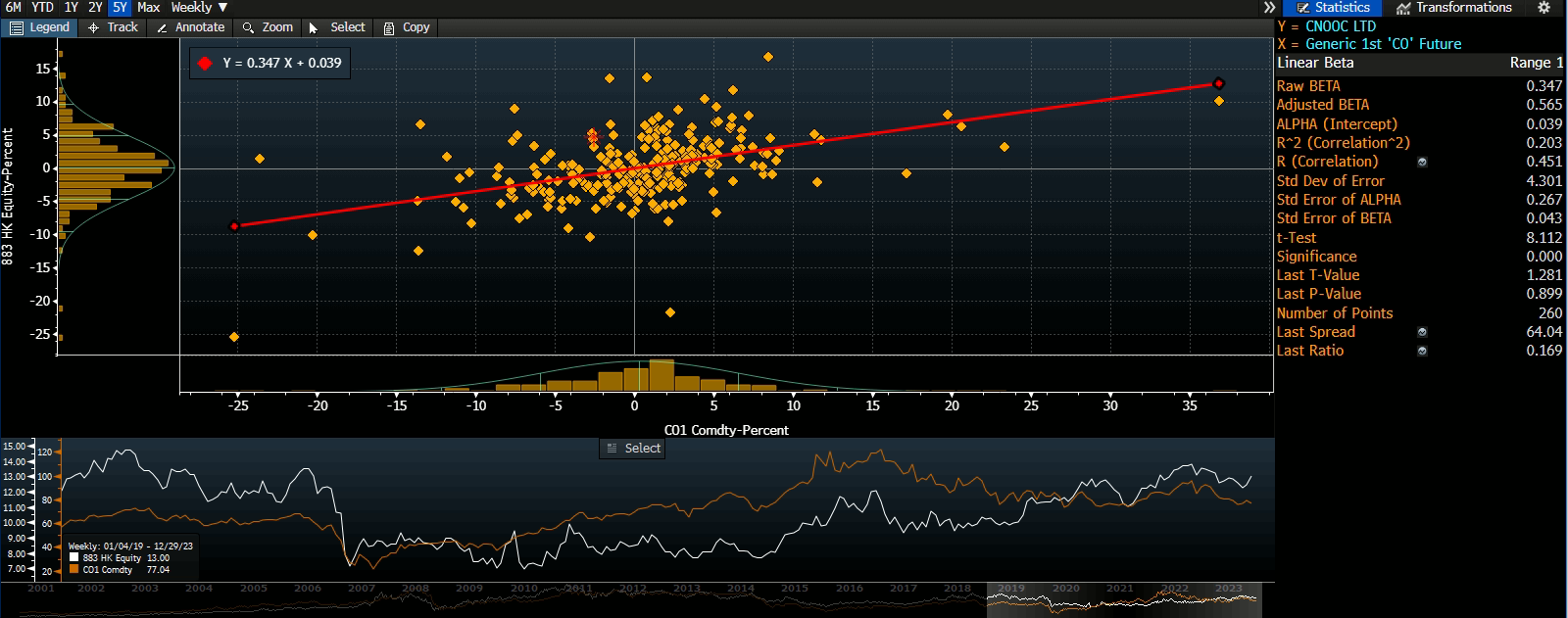

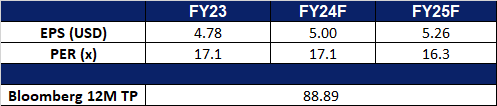

CNOOC Ltd. (883 HK): Focusing on Supply Chain

- RE-ITERATE BUY Entry – 13.0 Target – 14.0 Stop Loss – 12.5

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Commencement of production. CNOOC recently announced that its Mero2 Project has begun production. The project consists of 16 development wells which are planned to be commissioned, including 8 production wells and 8 injectors. The Floating Production Storage and Offloading (FPSO) used in the project also has a designed storage capacity of approximately 1.4million barrels, one of the largest FPSO in the world. This project is expected to bring an additional 180,000 barrels of crude oil per day for the company.

- Approval of license for LPG Facility. Uganda’s cabinet recently approved CNOOC to proceed with the construction of a Liquified Petroleum Gas (LPG) facility in the Kingfisher development area in Uganda. The facility will produce clean and affordable energy for the local market in the East African country, facilities the country’s transition to green energy.

- Construction of underground oil reserve. CNOOC recently started construction in Ningbo, China, on its largest commercial underground oil reserve project. The oil reserve is designed with a capacity of 3 million cubic meters, encompassing crude oil caverns, along with surface crude oil storage, transportation, and other supporting facilities. The project would be receiving a total investment of around 3 bn yuan and is scheduled to be completed by 2026. Upon completion, the oil reserve would provide a steady supply of crude oil to surrounding cities and provinces.

- 3Q23 earnings. Revenue rose by 5.48% YoY to RMB114.8bn in 3Q2023, compared to RMB108.8bn in 3Q22. Net profit fell 8.23% YoY to RMB33.4bn, compared to RMB36.4bn in 3Q22. Basic EPS fell by 7.78% YoY to RMB0.71, compared to RMB0.77 in 3Q22.

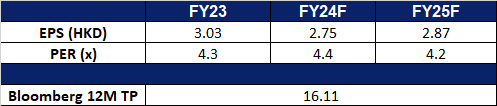

- Market consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

RTX Corp (RTX US): Tensions arising

- BUY Entry – 85.5 Target – 91.5 Stop Loss – 82.5

- RTX Corporation operates as an aerospace and defense company. The Company offers avionics systems, aviation systems, communications and navigation equipment, interior and exterior aircraft lighting, aircraft seating, environmental control systems, flight control systems, and engine components.

- Secured a US$345mn contract. Raytheon Technologies recently secured a modification contract worth US$344.6mn from the Air Force Life Cycle Management Center for the StormBreaker munition. The contract, expected to be completed by 30 August 2028, involves manufacturing the 10th lot of StormBreaker munitions, supplying additional components, and includes foreign military sales to Norway, Germany, Italy, and Finland. The geopolitical tensions globally have increased the demand for missile defense systems, benefiting RTX as a prominent US missile maker. The StormBreaker is a precision-guided winged munition, with its smart features for target detection in challenging conditions, contributing to RTX’s growth opportunities. The integration of StormBreaker on various aircraft platforms enhances the potential for more contract wins in the future.

- Rising geopolitical tensions. The demand for missiles is expected to increase due to geopolitical tensions, such as those between Russia and Ukraine, and ongoing hostilities in the Middle East. RTX is well-positioned to benefit from the tensions, given its extensive missile portfolio, including AIM-9X Sidewinder, SM-6, SM-3 interceptor, TOW missiles, among others. Furthermore, the most recent Red Sea attacks, which have disrupting global commerce has resulted in twelve nations, led by the United States, to issue a joint warning to Yemen’s Houthi rebels, urging them to cease their attacks. This has caused further chaos and uncertainty about the global economy and the freedom of navigation.

- 3Q23 results. Sales rose to US$13.5bn, down 21% YoY, due to a US$5.4bn charge relating to the disclosed Pratt powder metal matter. Adjusted sales rose 12% YoY to US$19.0bn. GAAP EPS was at a loss of US$0.68 whereas adjusted EPS was US$1.25 an increase of 3% YoY. Furthermore, the board of directors approved a US$10bn share repurchase program.

- Market consensus.

(Source: Bloomberg)

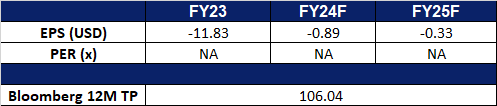

Coinbase Global Inc (COIN US): Spot Bitcoin ETF’s approval soon

- RE-ITERATE BUY Entry – 159 (Buy Stop) Target – 175 Stop Loss – 151

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- Bitcoin price surge. Bitcoin has been on an uptrend since mid-October 2023 and recently surpassed US$45,000, reaching a 21-month peak, driven by optimism surrounding the potential approval of exchange-traded fund (ETF) spot bitcoin funds. It gained 154% in FY23, marking its strongest performance since FY20. Investors are focused on the US Securities and Exchange Commission’s (SEC) approval of the spot bitcoin ETFs, with expectations for SEC’s decision on the ETF approval to be released between 5 and 10 January. Despite being below its record high of US$69,000 in November 2021, the recent positive sentiment is further supported by the anticipation of regulatory developments and expectations of interest rate cuts by major central banks.

- ETF filing updates. BlackRock and Valkyrie, applicants for a spot bitcoin ETF, have disclosed their authorised participants (AP). BlackRock has partnered with J.P. Morgan and Jane Street, while Valkyrie has named Jane Street and Cantor Fitzgerald as its AP. The filings were made on the last day for updates to the SEC.

- Bitcoin halving. Bitcoin prices have recently witnessed a surge to above $45,000, after being range bound between around $41,000 to $44,000 in December 2023, marking its highest value since April 2022. The periodic Bitcoin halving which leads to a slow-down in mining output is expected to be in April 2024. In other words, the supply of Bitcoin after the halving date will be less. Based on the previous two halvings, Bitcoin experienced bull cycles for 18 months (Previous two halving dates: 9 July 2016 and 11 May 2020). Notably, the upward momentum historically initiates 6 months before the halving date, suggesting that the current Bitcoin upcycle has commenced.

Bitcoin Halving

(Source: Bloomberg)

- Rate cuts expected. Investors are anticipating potential interest rate cuts in 2024 from the Federal Reserve. The Fed’s dovish tone in December 2023, forecasting 75 basis points in rate reductions for 2024, has led to an 86% chance of rate cuts in March, according to CME FedWatch.

- 3Q23 results. Revenue rose to US$674.15mn, up 14.2% YoY, beating expectations by US$20.6mn. GAAP EPS beat estimates by US$0.52 at -US$0.01.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add CNOOC Ltd. (883 HK) at HK$13.0.