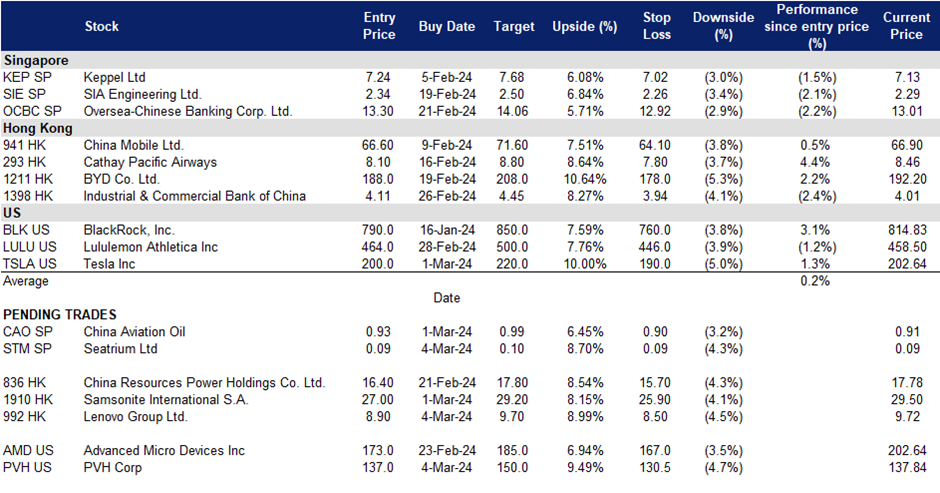

4 March 2024: Seatrium Ltd. (STM SP), Lenovo Group Ltd. (992 HK), PVH Corp (PVH US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

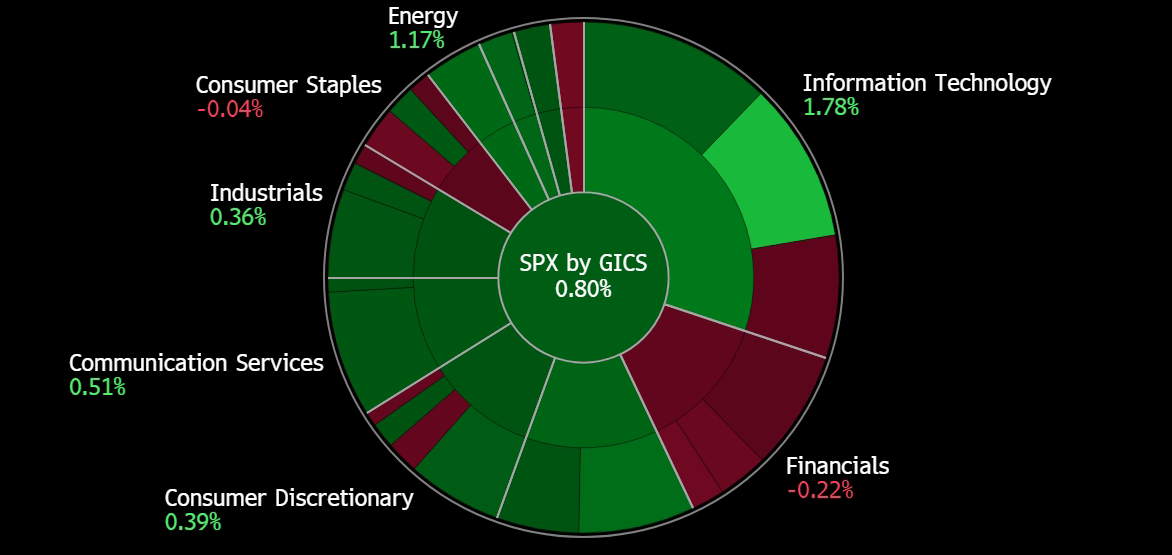

United States

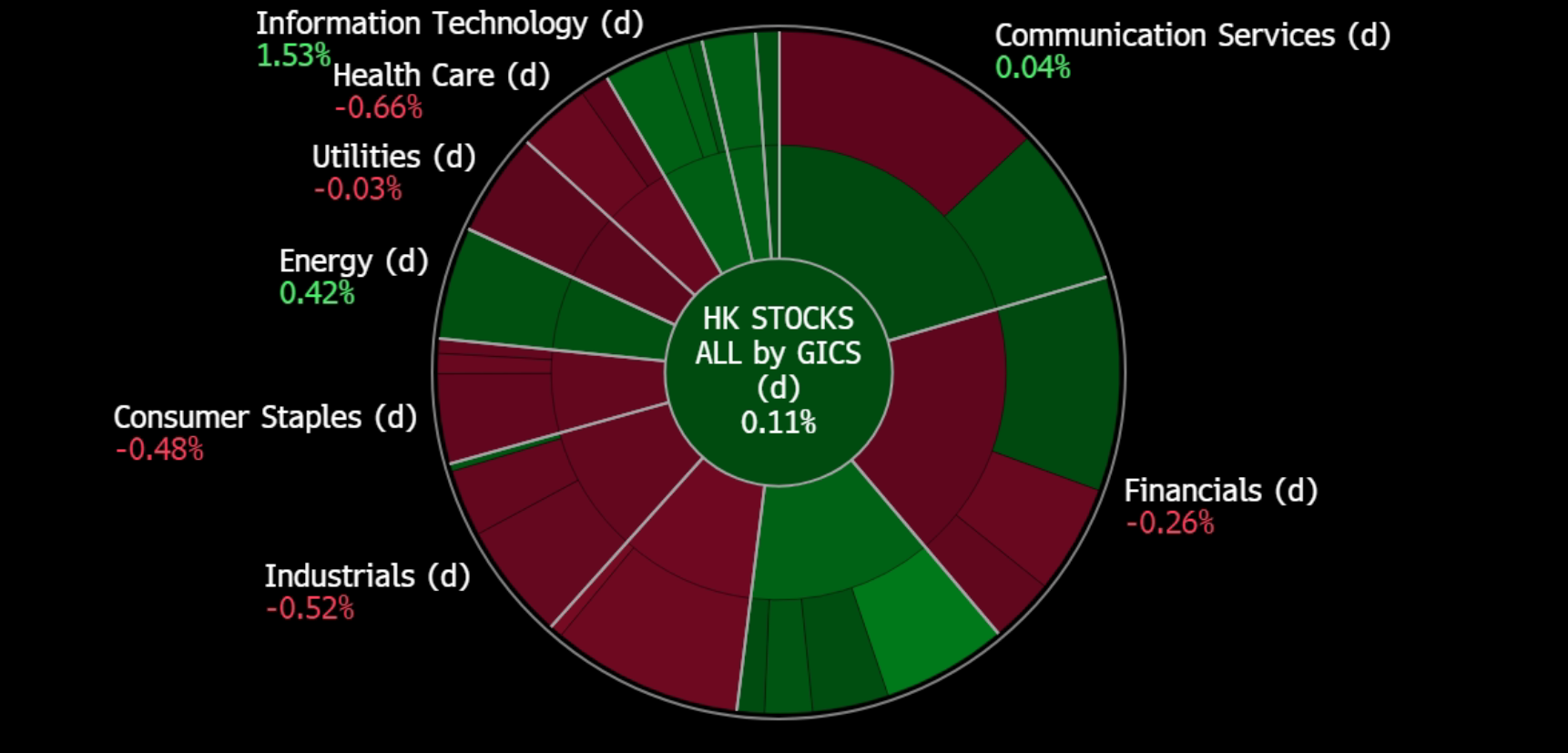

Hong Kong

Seatrium Ltd. (STM SP): Improving fundamentals

- Entry – 0.092 Target– 0.100 Stop Loss – 0.088

- Seatrium Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Seatrium serves customers worldwide.

- Bottom lines weighed down by one-off costs. Seatrium reported a significant net loss of S$1.68bn for the second half of its 2023 financial year, marking a substantial increase from the previous year’s loss of S$118.3mn. Additionally, Seatrium has reached in-principle settlement agreements with Brazilian authorities regarding the “Operation Car Wash” probe, involving a settlement payment of 670.7mn Brazilian real and a provision of S$82.4mn for indemnity to Keppel Corporation. Seatrium’s CEO sees these agreements as pivotal for the company’s transformation. Despite the net loss, Seatrium’s revenue surged by over 400% in the second half of 2023, reaching S$4.4bn. Its full-year revenue was S$7.3bn, with strong order wins totalling S$4.5B and a net order book of S$16.2b. The company also secured over $3.5 in new loans and refinancing, including sustainability-linked facilities, leading to an improved net gearing ratio of 0.12 times.

- Planned share consolidation. Seatrium’s recently announced of a 20:1 share consolidation exercise alongside its full-year earnings for 2023 which is not expected to fundamentally alter the stock but may deter speculative trading. This plan is currently still pending shareholder approval. The consolidation aims to enhance market interest stabilize the stock and reduce volatility rather than introduce substantial changes to its underlying value, which would be beneficial for shareholders.

- Orders incoming. Seatrium Limited is set to begin work on the third 2-gigawatt (GW) High Voltage Direct Current (HVDC) electrical transmission system for TenneT TSO B.V. in the Netherlands starting I June 2024. Under a five-year Framework Cooperation Agreement, Seatrium will supply three HVDC systems for offshore wind farm projects, totaling 6GW. The company’s responsibilities include engineering, procurement, construction, transportation, installation, and commissioning of the 2GW HVDC Offshore Converter Platform, supporting TenneT’s sustainability target of installing 40GW of offshore wind energy. Collaboration with consortium partner GE Vernova’s Grid Solutions is integral to the project. Seatrium’s ongoing work on five HVDC offshore Converter Platforms cements its position in supporting the energy transition. With offshore wind playing a vital role in global climate goals, Europe’s wind installed capacity is expected to rise significantly by 2030. Seatrium has a strong track record in delivering complex offshore renewables projects for international grid operators and energy players. Additionally, the company secured a S$400mn committed Green Revolving Loan Facility from UOB. Commercial discussions are ongoing for Petrobras’ two floating production storage and offloading vessels, with Seatrium poised to potentially secure an orders.

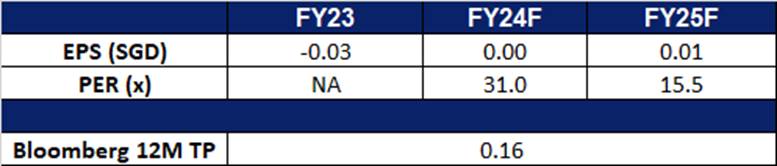

- FY23 results review. FY23 revenue rose by 208% to S$7.3bn, compared to S$1.9bn in FY22. Net loss rose by more than tenfold to S$1.68bn, compared to S$118.3mn in FY23.

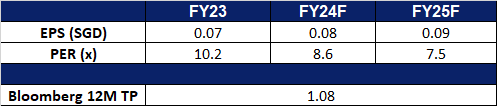

- Market Consensus.

(Source: Bloomberg)

China Aviation Oil Corp. Ltd. (CAO SP): Increasing Flights

China Aviation Oil Corp. Ltd. (CAO SP): Increasing Flights

- RE-ITERATE Entry – 0.93 Target– 0.99 Stop Loss – 0.90

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, petrochemical products, including physical and paper swaps, and futures trading.

- More flights between China and the US. The U.S. Department of Transportation has announced that Chinese passenger airlines will be permitted to increase their weekly round-trip U.S. flights to 50, effective March 31, up from the existing limit of 35. This approval is a significant stride toward further normalizing the U.S.-China market, especially in anticipation of the Summer 2024 traffic season, as stated by the US Department of Transportation. Last month, China simplified visa applications for U.S. tourists, reducing the required documents, likely leading to increased travel demand between China and the U.S. This expected rise in flight activities is anticipated to benefit China Aviation Oil.

- Record Travel Demand. Official data reveals that China experienced more than 7.2 billion inter-regional trips from January 26 to February 27, spanning the initial 33 days of the Spring Festival travel rush. This period, recognized as the world’s largest annual migration, drew massive crowds to tourist attractions nationwide. Minister of Transport Li Xiaopeng reported record-breaking Civil Aviation Passenger traffic, road traffic, and railway passenger traffic. The air travel sector alone saw over 18 million passenger trips during the holiday, reaching a daily average of 2.25 million, marking a new record. Additionally, domestic tourism spending surged by 47.3% to 632.7 billion yuan ($87.96 billion) compared to the same holiday period in 2023.

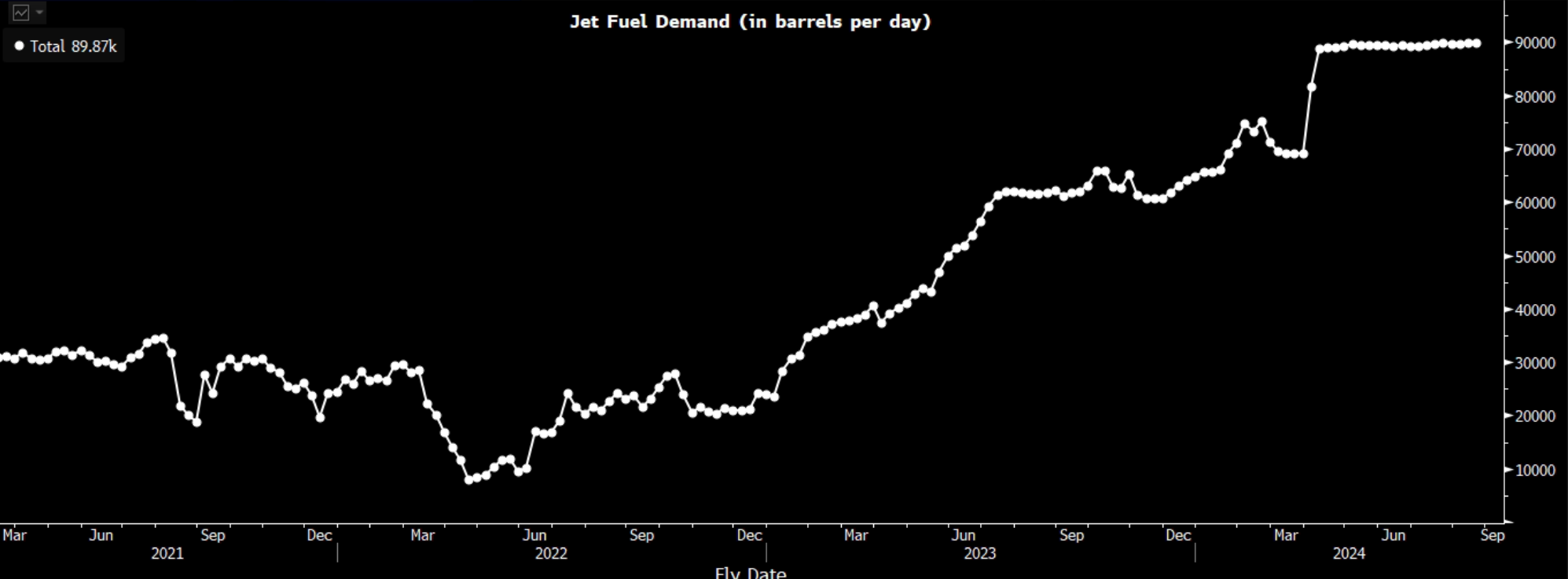

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- Improved air travel. China’s international air travel market is poised for further recovery, as the Civil Aviation Administration of China (CAAC) foresees weekly flights reaching 80% of pre-COVID levels by the close of 2024. The regulator envisions an increase in weekly international passenger flights from over 4,600 to 6,000 by year-end, a substantial rise from the less than 500 recorded at the start of 2023. Emphasizing a commitment to enhance international connectivity and the global standing of major airports, the CAAC aims to transform Beijing, Shanghai, and Guangzhou into world-class aviation hubs by 2050. Deputy Administrator of CAAC, Han Jun, states a focus on boosting intercontinental connectivity and global influence. The CAAC projects a robust recovery, forecasting 690 million passenger trips in 2024, an 11% increase from 2023. Additionally, the regulatory body plans to expand traffic rights with Belt and Road nations and deepen cooperation with regions such as Central Asia, the Middle East, and Africa.

- FY23 results review. FY23 revenue fell by 12.36% to US$14.43bn, compared to US$16.46bn in FY22. Net profit rose by 75.90% YoY to US$58.37mn, compared to US$33.19mn in FY23. Basic EPS rose by 75.48% to US6.84 cents in FY23, compared to US3.90 cents in FY22.

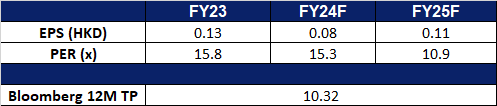

- Market Consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Expect an AI PC Boom

- BUY Entry – 8.90 Target – 9.70 Stop Loss – 8.50

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Unveiling suite of AI portfolio. Lenovo recently presented its cutting-edge portfolio of purpose-built AI devices, software, and infrastructure solutions at the highly anticipated Mobile World Congress (MWC) 2024 in Spain. Going beyond innovation, Lenovo introduced proof-of-concept devices that push the boundaries of traditional form factors. The global service provider unveiled the future of hybrid AI, driving multi-device, software, and service offerings for increased personalization, collaboration, and efficiency. A standout in their new lineup is the Lenovo ThinkBook Transparent Display Laptop, featuring a groundbreaking 17.3-inch Micro-LED transparent display. With a borderless screen, transparent keyboard area, and a seemingly floating footpad design, it effortlessly embodies high-tech simplicity, enhancing the overall user experience. Through the power of Artificial Intelligence Generated Content (AIGC), the transparent screen opens new avenues for work collaboration and efficiency by enabling interaction with physical objects and overlaying digital information to create unique user-generated content. Its transparency allows it to integrate seamlessly within its environment, highlighting AI’s potential within the PC market.

- PC demand recovery. PC demand has shown signs of recovery and is expected to continue recovering in 2024, after a demand slump in 2023. 4Q23 saw a continued recovery for the PC market, which ended the year with a 20% and 24% year-over-year gain in GPU and CPU shipments respectively, according to Jon Peddie Research. PC recovery is also boosted by the boom in AI technology, which increases the demand for PCs equipped with new AI technologies. Furthermore, suppliers are also gearing up more for replacement demand, where many consumers are expected to replace their PCs, accessories, and peripherals after more than 2 years of usage since the digital boom during the Covid-19 pandemic.

- Partnership with Baidu. Lenovo has recently revealed a collaboration with Baidu to integrate Baidu’s generative artificial intelligence (AI) technology into Lenovo’s smartphones. This strategic partnership aims to apply Baidu’s AI model practically. The global trend of selling smartphones featuring generative AI capabilities, including services like chatbots and real-time translation, gained popularity in late 2022 following the launch of ChatGPT. This collaboration presents a mutual benefit for both companies, allowing Lenovo to leverage the AI space to enhance the promotion of their smartphones.

- 3Q24 results. Revenue rose by 2.97% YoY to US$15.7bn in 3Q24, compared to US$15.3bn in 3Q23. Net profit fell by 22.8% YoY to US$337mn in 3Q24, compared to US$437mn in 3Q23. Basic EPS fell to US2.81cents in 3Q24, compared to US3.65cents in 3Q23.

- Market consensus.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Potential Privatisation

- RE-ITERATE BUY Entry – 27.0 Target – 29.2 Stop Loss – 25.9

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Takeover Interest. Samsonite is currently weighing options including going private after holding talks with a group of suitors, according to a report, which added that some private equity firms are considering acquiring the company and relisting it in another market at a higher valuation. Shares in Samsonite surged as much as 14% on Feb 27, the most since August 2022. Its market value surged to a current level of around HK$38 billion. The company is currently trading at 10.75x p/e ratio, compared to an industry p/e ratio of 12.04x, making Samsonite undervalued compared to its peers.

- Demand for travelling stays strong. The global demand for travel remains robust as 2023 concludes, evident in strong results from numerous hospitality and travel companies, underscoring the ongoing resilience of the travel industry. Although expectations suggest a moderation in travel demand, it is anticipated to persist at a strong level, projecting that flight activities will surpass pre-COVID levels by the close of 2024. In Asia, travel activities exhibit signs of a robust recovery, with China achieving a record number of trips during the Lunar New Year festivities, whereas the recovery of travel activities in the U.S. is progressing at a slower pace. The upcoming Sakura season is also poised to further stimulate global travel demand.

- Strong Brand Partnership. Samsonite recently announced a partnership with USA Gymnastics in preparation for the 2024 Summer Olympics. This collaboration involves supplying USAG athletes with the sleek and secure Proxis suitcases as they travel within the United States for training camps and internationally for competitions this year. The Proxis suitcase collection features a stylish design, secure siding, and TSA-approved locks, with a Roxkin outer shell – Samsonite’s proprietary shock-absorbent and damage-resistant material, ensuring lightweight durability. Additionally, the suitcases are equipped with a built-in USB port for convenient phone charging, enhancing connectivity during trips. Beyond supporting USA Gymnastics, this partnership indirectly promotes Samsonite’s brand name and underscores the premium quality of its luggage offerings.

- 3Q23 results. Net sales improved to US$957.7mn, up 21.1% YoY, compared to US$790.9mn in 3Q22. Net profit rose to US$123.2mn in 3Q23, up 88.3% YoY, compared to US$65.4mn in 3Q22. Adjusted Basic EPS was US$0.087 in 3Q23, compared to US$0.045 in 3Q22.

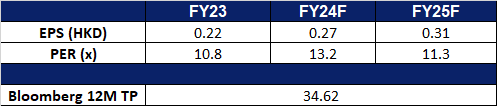

- Market consensus.

(Source: Bloomberg)

PVH Corp (PVH US): Making a comeback

- BUY Entry – 137.0 Target – 150.0 Stop Loss – 130.5

- PVH Corp. operates as a clothing and apparel accessories company. The Company designs, manufactures, and markets men’s, women’s, and children’s apparel, footwear, and accessories. PVH offers products such as dresses, shirts, sportswear, neckwear, and footwear.

- Revitalising the company. In the third quarter, PVH’s remarkable performance was driven by the strength of its iconic brands, Calvin Klein and Tommy Hilfiger, and the disciplined execution of the PVH+ Plan, revitalizing the company amidst challenging macroeconomic conditions. Despite facing headwinds, particularly in Europe, the company achieved revenue growth in line with guidance, expanded gross margins, and exceeded bottom-line expectations. There was also robust growth in the direct-to-consumer business, offsetting challenges in wholesale, and significant progress in driving profitability through increased EBIT margin. The company reaffirmed its commitment to long-term growth, emphasizing the importance of executing the PVH+ Plan across all regions and channels. Furthermore, strategic initiatives such as selling heritage brands and strengthening the management team underscore the company’s focus on its core brands and sustainable growth. Moving forward, we remain optimistic about PVH’s growth prospects, buoyed by the strong performance witnessed during Q3 and the ongoing execution of its growth strategy.

- Going according to plan. The PVH+ plan is seamlessly progressing as evidenced by recent high-profile brand campaigns featuring celebrities like Jennie Kim, Kendall Jenner, and Jungkook. Jennie Kim and Jungkook’s collaborations with Calvin Klein, alongside Kendall Jenner’s presence in Tommy Hilfiger’s spring campaign, highlight PVH Corp.’s strategic focus on product excellence and consumer engagement. These partnerships underscore the company’s commitment to modernizing classic American style and tapping into diverse global audiences, thereby driving brand visibility and growth across its portfolio. Additionally, Tommy Hilfiger’s recent partnership with F1 Academy, the women’s racing championship, further solidifies PVH Corp.’s dedication to promoting diversity and breaking barriers in traditionally male-dominated fields, reinforcing its position as a forward-thinking industry leader and further enhances the brand’s image and engagement with a global audience.

- 3Q23 earnings review. Revenue rose by 3.5% YoY to US$2.363bn, missing estimates by US$50mn. Non-GAAP EPS was US$2.90, beating estimates by $0.16. For FY23, revenue is projected to increase approximately 1% as compared to 2022, EPS GAAP about US$9.75 and Non-GAAP basis about $10.45 vs consensus of $10.35.

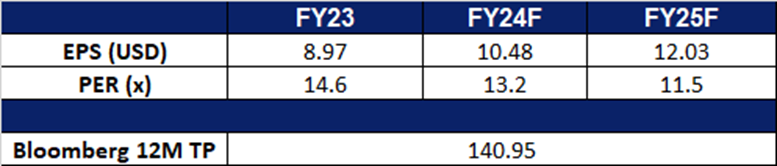

- Market consensus.

(Source: Bloomberg)

Tesla Inc (TSLA US): Excitement for roadster

- RE-ITERATE BUY Entry – 200 Target – 220 Stop Loss – 190

- Tesla Inc. operates as a multinational automotive and clean energy company. The Company designs and manufactures electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla owns its sales and service network and sells electric power train components to other automobile manufacturers.

- Unveiling the Roadster. Tesla CEO Elon Musk announced plans to ship the Roadster electric sports car next, promising it to be unparalleled in its design and performance. He hinted at revolutionary features, including reaching 60 miles per hour in less than a second. Despite Musk’s grandiose promises, Tesla has yet to deliver on the Roadster, with its production design set to be completed and unveiled by the end of this year. Originally announced in 2017 and delayed due to supply chain issues, the Roadster aims to debut after multiple postponements, including one in 2021 and another in 2023. If Tesla follows through on its announcement to release the Roadster for purchase, it will position the company to compete directly with its Chinese EV rival, BYD. BYD recently unveiled its latest electric supercar, the U6, slated for customer delivery this summer. The Roadster’s highly anticipated release is expected to significantly boost Tesla’s sales revenue.

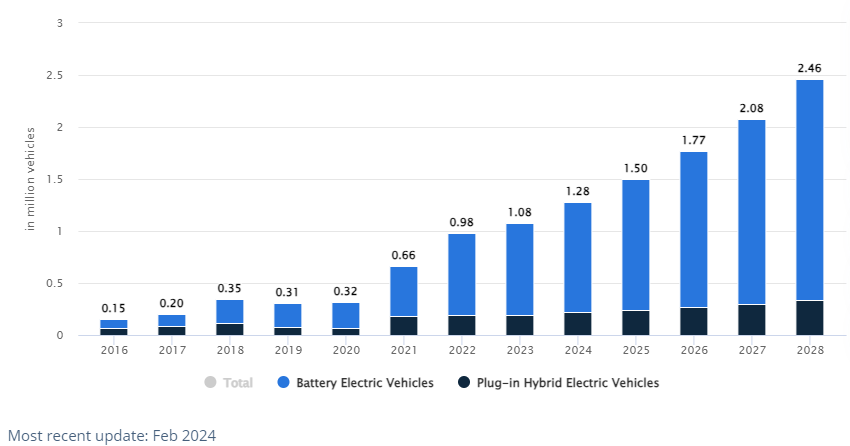

Projected electric vehicle unit sales in the United States 2024 to 2028

(Source: Statista Market Insights)

- Ongoing US EV transition plan. The Biden administration plans to ease proposed yearly requirements through 2030 to cut tailpipe emissions and increase electric vehicle (EV) sales. The Environmental Protection Agency (EPA) proposed a 56% reduction in new vehicle emissions by 2032, with automakers aiming for EVs to constitute 60% of new vehicle production by 2030. However, under the revised regulation, the pace of emissions requirements will slow, resulting in EVs accounting for less than 60% of total vehicles produced by 2030. Automakers and the United Auto Workers (UAW) had urged for a more gradual increase in stringency, citing concerns about EV technology costs and charging infrastructure development. The Alliance for Automotive Innovation (AAI) also called for more achievable requirements, suggesting 40 to 50% electric, plug-in electric, and fuel vehicles by 2030. The EPA’s proposal is still under review, with discussions ongoing between the government, automakers, and stakeholders.

- 4Q23 earnings review. Revenue rose by 3.5% YoY to US$25.17bn, missing estimates by US$590mn. Non-GAAP EPS was US$0.71 miss estimates by $0.03. In FY24, Tesla expects vehicle volume growth to be notably lower than in FY23 as the company is working toward launching its new next-generation vehicle in Texas.

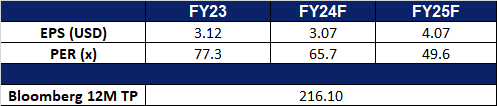

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take Profit on Dollar General Corp. (DG US) at US$149.5. Add Tesla Inc. (TSLA US) at US$200.