17 February 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

Market Movers

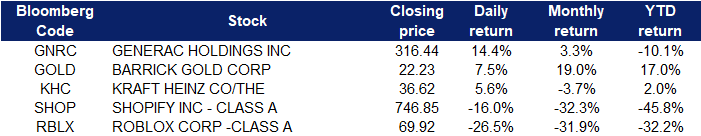

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Energy | +0.76% | Oil resumes rally as Russia-Ukraine tensions stay high Schlumberger Limited (SLB US) |

| Capital goods | +0.61% | Fed officials see accelerated US rate hikes Barrick Gold Corporation (GOLD US) |

| Consumer Services | +0.61% | US CDC eases warnings for cruises as new Covid-19 infections fall Airbnb, Inc. (ABNB US) |

Top Sector Losers

| Sector | Loss | Related News |

| Telecommunication Services | -0.54% | EU lays out US$6.8b satellite communication plan in space race Cisco Systems, Inc. (CSCO US) |

| Food & Staples Retailing | -0.53% | Retail sales surge 3.8% in January, much more than expected amid inflation rise NIKE, Inc. (NKE US) |

| Software & Services | -0.33% | Fed Eyes Rate Hike Soon and Faster Tightening Pace If Needed Upstart Holdings, Inc. (UPST US) |

- Generac Holdings Inc. (GNRC US) Shares jumped after its 4Q21 earnings beat estimates. 4Q21 revenue jumped by 40.6% YoY to US$1.07bn. Gross margin slipped 540 bps to 34%, compressed by supply-chain constraints and inflationary pressures that drove up prices for commodities, labor, logistics, and starting up new plants. Non-GAAP EPS of $2.51 beat estimates by US$0.10. FY22 net sales are expected to increase between 32 to 36% as compared to the prior year on an as-reported basis, which includes approximately 5 to 7% of net impact from acquisitions and foreign currency.

- Barrick Gold Corporation (GOLD US) Shares closed at a high since June 2021 after its 4Q21 earnings beat estimates. 4Q21 revenue edged up by 0.9% YoY to US$3.31bn, beating estimates by US$110mn. GAAP EPS of US$0.35 beat estimates by US$0.02. The company announced that it will increase base dividend of US$0.1 and propose share buyback for up to US$1bn.

- The Kraft Heinz Company (KHC US) Shares moved higher after its 4Q21 earnings beat estimates. 4Q21 revenue dropped by 3.3% YoY to US$6.71bn, beating estimates by US$80mn. Non-GAAP EPS of $0.79 beat estimates by US$0.16. The company currently expects a low-single-digit percentage increase YoY in 2022 Organic Net Sales, reflecting continued stronger consumption versus pre-pandemic levels.

- Shopify Inc. (SHOP US) Shares tanked after releasing its 4Q21 earnings. 4Q21 revenue jumped by 41.1% YoY to US$1.38bn, beating estimates by US$40mn. Non-GAAP EPS of US$1.37 beat estimates by US$0.06. However, the guidance from the e-commerce company’s created some ripples of worry when a more measured macro environment was described. Shopify laid out that the COVID-triggered acceleration of e-commerce that spilled into the first half of 2021 will be absent from 2022, which will make the growth comparisons tougher.

- Roblox Corporation (RBLX US) Shares tanked after releasing its 4Q21 earnings. 4Q21 revenue jumped by 83.5% YoY to US$568.8mn. The US$770mn bookings missed estimates by US$2mn. GAAP EPS of US$-0.25 missed estimates by US$0.13.

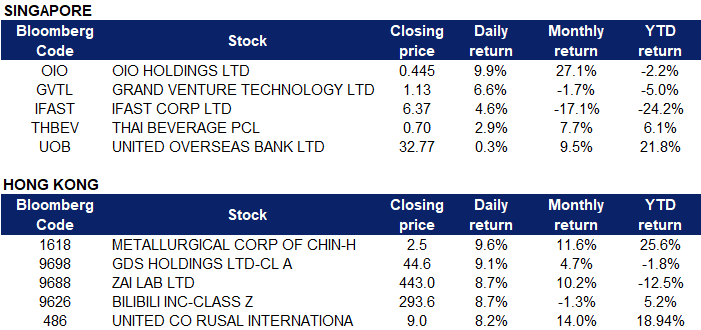

Singapore

- OIO Holdings (OIO SP) rose 10% after bitcoin climbed back above US44,000 as risk appetite returned. Other digital tokens also followed gains, with Ether jumping 7%. In addition to easing tensions between Russia and Ukraine, there were reports that the Russian government could permit the trading of cryptocurrencies, according to the head of research at CoinShares, James Butterfill.

- Grand Venture Technology (GVTL SP) shares surged almost 7% yesterday after it reported a threefold jump in FY2021 net profit to S$18mn. The company enjoyed growth across all its major business segments and expects demand from its semiconductor customers to remain robust. It also expects stronger demand for life sciences analytical and diagnostics equipment. The company has proposed a final dividend of 0.5 sing cents, which, together with the interim dividend of 0.5 sing cents paid out in Sep 2021, will bring the full-year FY2021 dividend to 1.0 sing cents. We have a trading buy recommendation and S$1.37 TP on GVTL.

- iFAST (IFAST SP) rose 5% on Wednesday after the wealth management platform reported a 6% YoY increase in 4Q2021 net profit. IFAST reported a 3 month net profit of S$7.2mn as revenue grew 14% YoY to S$54.6mn. IFAST’s assets under administration (AUA) surged 32% YoY, reaching S$19bn as at end December 2021. The company declared a final dividend of S$0.014, an increase of 40% YoY, bringing the full-year dividend to S$0.048, up from S$0.033 in the prior year period.

- ThaiBev (THBEV SP) shares added gains of 3% on Wednesday after rising 3% on Tuesday following a better-than-expected 1QFY2022 (YE Sep) results announcement. The better performance was driven by improvement in its beer, non-alcoholic and food businesses. The group’s balance sheet improved with total assets rising to 472bn Thai baht while total liabilities fell 2% YoY to 257bn Thai baht. We have a trading buy and S$0.80 TP on THBEV.

- UOB (UOB SP) shares ended relatively flat yesterday despite reporting a 48% YoY rise in 4Q2021 profit. This was likely as the share prices of the 3 local banks have gained 13-26% over the past six months and may have already priced in the strong year end results. OCBC, the last of the three local banks to report full year earnings, will post its results before the market opens on Wed 23 February.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Gamble | +3.16% | China’s police chief urges further crackdown on cross-border gambling Sands China Ltd. (1928 HK) |

| Airline Services | +3.15% | Air Travel Recovers Some More in China as Parisian Streets Get Busy China Eastern Airlines Corp Ltd (670 HK) |

| Nonferrous Metal | +3.06% | Exclusive: China’s Metals Output in January OK Rusal MKPAO (486 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| IT Hardware | -0.88% | NA Lenovo Group Limited (992 HK) |

| Software | -0.55% | Tech, finance lift Hong Kong shares as Ukraine worries ease Kingsoft Corporation Limited (3888 HK) |

| Semiconductors | -0.58% | Global semiconductor sales top half a trillion dollars for first time as chip production gets boost Hua Hong Semiconductor Ltd (1347 HK) |

- Metallurgical Corporation of China Ltd. (1618 HK) Shares closed at a high since September 2021. The company announced newly signed contracts in January. The total value of these contracts amounted to RMB110.18bn, up 6.4 % YoY.

- GDS Holdings Ltd (9698 HK) Bilibili Inc (9626 HK) There was no company-specific news from both companies. The technology sector jumped following the overnight rebound in the US market. As tensions between Russia and Ukraine eased, risk assets recovered from the sell-off on Monday.

- Zai Lab Ltd (9688 HK) Shares closed at a one-month high. There was no company-specific news. Previously, the company proposed that each issued and unissued ordinary share with a par value of US$0.00006 each be sub-divided into 10 ordinary shares with a par value of US$0.000006 each. Immediately following the Share Subdivision being effective, the authorized share capital of the company will be US$30,000.00 divided into 5,000,000,000 subdivided ordinary shares, of which 964,087,430 subdivided ordinary shares will be in issue and fully paid or credited as fully paid, assuming that no further ordinary shares will be issued or repurchased.

- OK Rusal MKPAO (486 HK) Shares closed at near a 52-week high. Fears over a Russian invasion of Ukraine eased after Russia returned some troops to base.

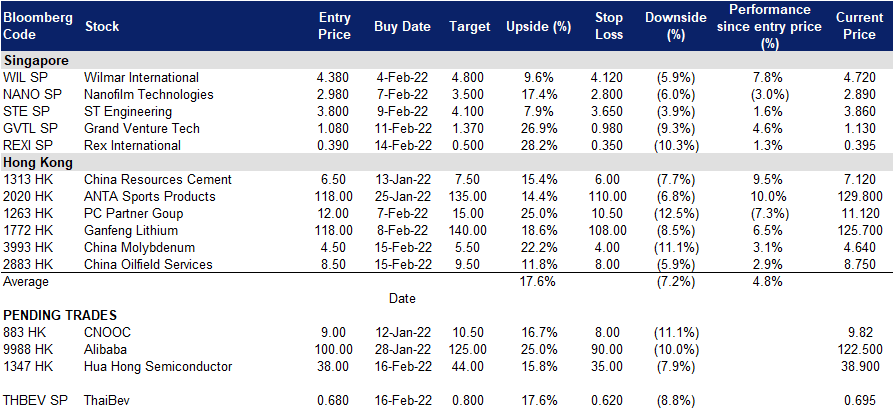

Trading Dashboard

Trading Dashboard Update: No additions / deletions to the trading dashboard.

(Click to enlarge image)

Related Posts: