KGI DAILY MARKET MOVERS – 11 March 2021

Hang Seng Tech Index Futures

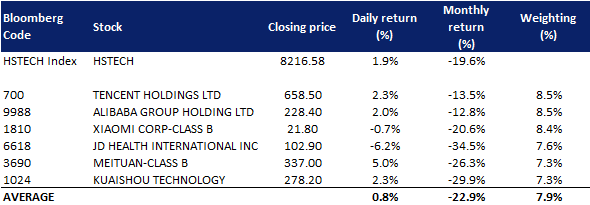

Momentum trades and technology stocks recently bore the brunt of the sell-off as investors grappled with higher interest rates and tighter domestic policy in China. The Hang Seng Tech Index (HSTECH) – launched in mid 2020 and tracks the 30 largest technology companies listed in Hong Kong – has declined almost 20% from last month.

The Hang Seng TECH Index Futures and Options are the first exchange-traded derivatives contracts to track the Index, providing investors with a new tool to manage risks in their exposures to Hong Kong-listed technology companies.

Traders and investors can use the HSTECH Futures to hedge their holdings of the large-cap Chinese technology companies such as Tencent, Alibaba and Meituan.

The table below shows the monthly returns for HSTECH Futures against the top six holdings in the index.

IPO Performance Review

Roblox (RBLX US): Up 54% from reference price, closing at US$69.5

- RBLX listed on the NYSE with an opening price of US$64.5, peaking close to US$75 before closing at US$69.5 for the day, up 54% from its US$45 reference price.

- At US$69.5, RBLX has a market value of US$45.3bn, based on 652mn shares outstanding. This implies a 30.2x forward Price/Sales multiple, based on the company’s own forecast of US$1.5bn sales in 2021.

- RBLX’s first day performance surprised to the upside given the lacklustre performance of the IPO market in the past 2 weeks.

- While RBLX’s story is unique in which the business can be interpreted as a hybrid of social media and gaming, we think valuations have surpassed even the frothiest of stocks in both these trending sectors.

- We continue to recommend RBLX at safer valuations of 15-20x forward Price/Sales (US$34.5 – 46).

Coupang (CPNG US): IPO Pricing of US$35/share

- We wrote up on CPNG at the start of the week, in which we saw US$35/share as an achievable price for its first day of trading.

- Private market sentiment continues to remain strong in which the IPO price has now reached US$35, indicating an initial market value of about US$60 bn.

- We now see 6x Price/Sales (US$42/share) as the next reference point for CPNG. Given the wide Price/Sales gap between the various e-commerce stocks, we see potential for 10x Price/Sales (US$70/share) on the first trading day.

- CPNG starts trading today, 11 March.

Market Movers – What’s Hot

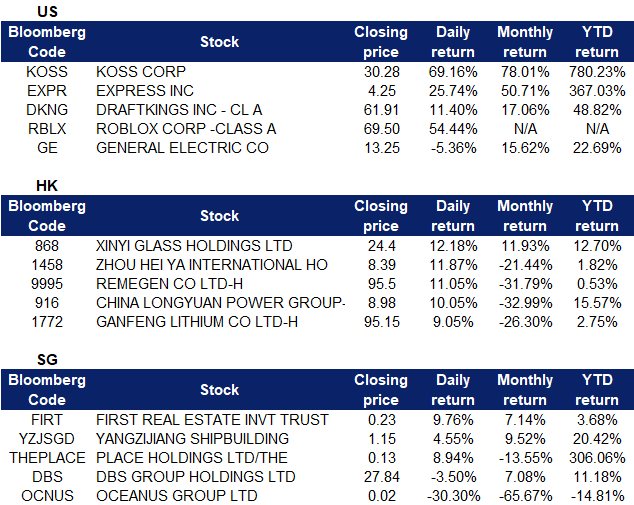

United States

- Markets rose for a second consecutive day, with the Dow at an all-time high after climbing 1.5%, S&P500 +0.6% while NASDAQ closed less than 0.1% lower after gaining up to 1.6% earlier in the day.

- Reddit stocks such as Gamestop (GME US), AMC (AMC US), Express (EXPR US) and Koss (KOSS US) saw another volatile day of trading, with most stocks ending higher for the day despite strong synchronised sell-downs between 12pm to 1pm US time.

- Draftkings (DKNG US) saw double digit gains despite minimal movement in tech and momentum stocks yesterday, 2 days after its investor day presentation on 9th March that led to multiple analyst upgrades. Consensus target price is now US$72-73, up from US$61-62 a month ago.

- General Electric (GE US). The recent news to divest GE Capital aviation services and potential reverse stock split was not welcomed by markets, sending share prices downwards despite broad market recovery in cyclical and old-economy stocks.

- Trading Dashboard Update: Added Target (TGT US) at US$180.

Earnings Watch: JD.com (11 Mar), DocuSign (11 Mar)

Hong Kong

- Xinyi Glass (868 HK). The share was trading higher due to management increasing holdings. The average prices that management purchased ranged from HK$20 to HK$ 22.5.

- Zhou Hei Ya International (1458 HK). CLSA upgraded TP to HK$13.5 from HK$12 and maintained an OVERWEIGHT rating. The company announced a profit warning that net profit in FY20 dropped 65% YoY due mainly to the COVID-19 lockdown measures. Since net profit in 1H20 dropped 69% YoY, profitability recovered in 2H20.

- Remegen (9995 HK). It is expected that National Medical Products Administration will approved its Telitacicept, a novel recombinant TACI-Fc (transmembrane activator and calcium modulator and cyclophilin ligand interactor) fusion protein, for the treatment of systemic lupus erythematosus (SLE).

- China Longyuan Power (916 HK). Citigroup upgraded TP to HK$9.8 and rating from UNDERWEIGHT to OVERWEIGHT. The National Energy Administration proposed a substitution plan of new project development rights for power tariff subsidies. The current price had already reflected the market concerns. It is expected the authority to issue details of the plan.

- Ganfeng Lithium (1772 HK). The shares are trading higher due to the technical rebound of the EV sector.

Singapore

- Yangzijiang (YZJSGD SP) was the best performing STI constituent yesterday following the announcement last Friday that it had secured new shipbuilding contracts worth a total of US$1.7bn for 31 vessels. The vessels are scheduled for delivery between 2022 to 2023. The company has secured a total of 60 shipbuilding contracts worth US$3.0bn year-to-date, and is likely to reach its historical peak of US$5.0bn orders that it won in 2007. Yangzijiang currently offers an attractive dividend yield of 4-5% for FY2021-2023 and trades at only 6-8x forward PEs. Consensus has a target price of S$1.41 vs its current price of S$1.15.

- The Place Holdings (THEPLACE SP). The company, which deals with cultural tourism, property management and media platform in China, has proposed a share consolidation of every five existing issued shares into one share. The company stated that the consolidation will help facilitate future corporate actions; it is currently engaging in various discussions on opportunities and projects. The company has been among the best performing stock in Singapore, surging almost 500% over 3 months and almost 1000% over the last 6 month.

- Oceanus (OCNUS SP) continued to see heavy selling yesterday on rotational play out of penny caps and into blue-chip names. The stock has lost 67% over the last two weeks after it reached a peak of 7.8 Sing cents.

- Stocks moving this morning: Yangzijiang (YZJSGD), Genting (GENS SP), Thaibev (THBEV SP), HPH Trust (HPHT SP), UMS (UMSH SP) and Frencken (FRKN SP) are up between 2-4% in early morning trade today.

Trading Dashboard Update: Added Rex International (REXI SP) at S$0.175

Trading Dashboard