Technical Analysis – 9 February 2024

United States | Singapore | Hong Kong | Earnings

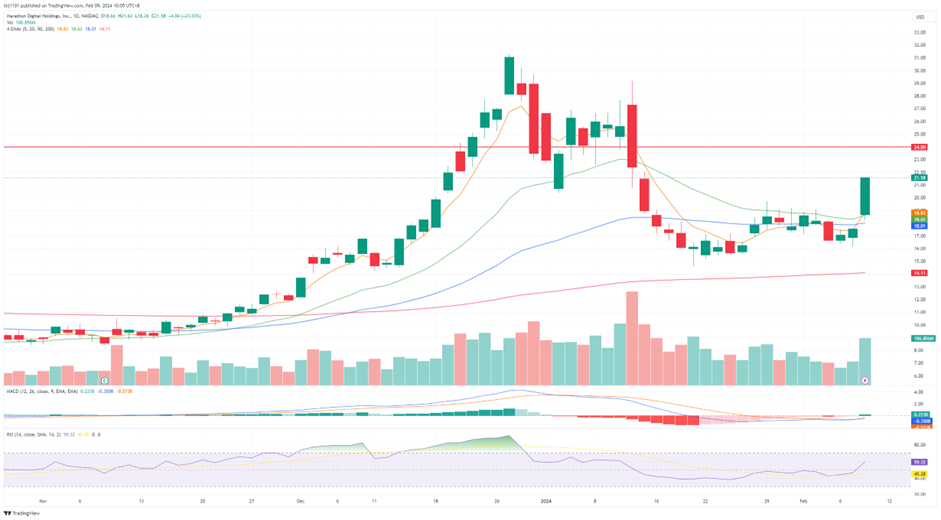

Marathon Digital Holdings, Inc. (MARA US)

●

● Shares closed higher above the 20dEMA with a surge in volume. 5dEMA just crossed the 20dEMA and 50dEMA.

● MACD just turned positive, RSI is constructive.

● Long – Entry 21.0, Target 24.0, Stop 19.5

Riot Platforms, Inc. (RIOT US)

● Shares closed higher above the 50dEMA with a surge in volume. 5dEMA is about to cross the 20dEMA and 200dEMA.

● MACD is positive, RSI is constructive.

● Long – Entry 12.5, Target 14.5, Stop 11.5

Geo Energy Resource Ltd. (GERL SP)

- Shares closed at a 52-week high with a surge in volume.

- MACD is positive, RSI is at an “overbought” level.

- Long – Entry 0.42, Target 0.46, Stop 0.40

HongKong Land Ltd. (HKL SP)

- Shares closed higher above the 20dEMA with constructive volume. 5dEMA is about to cross the 20dEMA.

- MACD is positive, RSI is constructive.

- Long – Entry 3.20, Target 3.40, Stop 3.10

Sands China Ltd (1928 HK)

- Shares closed at a one-month high above the 5dEMA. The 20dEMA is about to meet the 50dEMA.

- Both RSI and MACD are constructive.

- Long – Entry 22.4, Target 24.0, Stop 21.6

Wynn Macau Ltd (1128 HK)

- Shares closed at a three-month high above the 5dEMA with a jump in volume. The 20dEMA is about to meet the 50dEMA.

- Both MACD and RSI are constructive.

- Long – Entry 6.68, Target 7.24, Stop 6.40

Alibaba Group Holding Ltd (BABA)

- 3Q24 Revenue: $36.67B, +5% YoY, beat estimates by $270M

- 3Q24 Non-GAAP EPADS: US$2.67, beat estimates by US$0.03

- 4Q24 Guidance: No guidance was given.

- Comment: Alibaba delivered Q3 results beating revenue expectations. Despite a 69% YoY decline in its net income to 14.4bn yuan which was due to equity investments and impairments related to its video streaming service Youku and supermarket chain Sun Art, the company announced a US$25bn increase in its share buyback program showing confidence in the outlook for its business and cashflow. China’s difficult macroeconomic environment has dampened consumer demand, posing challenges for the company’s e-commerce and cloud computing divisions in China, and contributing to slower overall growth. Amidst the uncertainty in China, Alibaba’s focus is on reigniting growth in its core businesses, e-commerce and cloud computing. The company has undergone major restructuring and management changes, including the cancellation of the spin-off of its cloud computing business. Despite exploring separate financing options, Alibaba remains cautious due to current market conditions. 4Q24 recommended trading range: $70 to $82. Neutral Outlook.

阿里巴巴(BABA)

- 24财年第三季营收:366.7亿美元, 同比增幅5.0%,超预期2.7亿美元

- 24财年第三季Non-GAAP每股盈利:2.67美元,超预期0.03美元

- 24财年第四季指引:不提供指引。

- 短评:阿里巴巴公布的第三季度财报超出了收入预期。尽管由于股权投资和与视频流媒体服务优酷和连锁超市高鑫零售相关的减值,其净收入同比下降69%至144亿元人民币,但该公司宣布将其股票回购计划增加250亿美元,显示出对其业务和现金流前景的信心。中国艰难的宏观经济环境抑制了消费者需求,给该公司在中国的电子商务和云计算部门带来了挑战,并导致整体增长放缓。在中国的不确定性中,阿里巴巴的重点是重新点燃其核心业务——电子商务和云计算的增长。该公司经历了重大的重组和管理层变动,包括取消分拆其云计算业务。尽管阿里巴巴探索了不同的融资方案,但由于目前的市场状况,阿里巴巴仍持谨慎态度。 24财年第四季度建议交易区间:70美至82美元。中性前景。

- 4Q23 Revenue: $9.9B, +15.1% YoY, beat estimates by $140M

- 4Q23 GAAP EPS: $0.66, beat estimates by $0.49

- 1Q24 Guidance: Gross bookings of $37.0bn to $38.5bn. Adjusted EBITDA of $1.26bn to $1.34bn.

- Comment: Uber Technologies reported strong results for the holiday quarter, with forecasted quarterly core profit and gross bookings exceeding expectations. The company posted its first annual net profit since going public, driven by increased demand in ride-sharing and food delivery. Revenue and gross bookings for the October-December period exceeded Wall Street targets, with net profit nearly tripling thanks to a pre-tax benefit. Uber saw 34% growth in its core ride-share business, particularly in Latin America and Asia Pacific, and its delivery business revenue also increased. Uber plans to discuss capital allocation, potentially including buyback plans, at its upcoming investor day. The company expects adjusted earnings and gross bookings for the next quarter to surpass estimates. The upcoming investor day would be a good opportunity for investors to gain clarity on the company’s capital return plans in the coming quarters. 1Q24 recommended trading range: $70 to $80. Positive Outlook.

优步科技(UBER)

- 23财年第四季营收:99亿美元,同比增长15.1%,超预期1.4亿美元

- 23财年第四季GAAP每股盈利:0.66美元,超预期0.49美元

- 24财年第一季指引:总预订量为370亿至385亿美元。调整后EBITDA为12.6亿美元至13.4亿美元。

- 短评:优步科技公布了假日季度的强劲业绩,预计季度核心利润和总预订量超出预期。在拼车和外卖需求增加的推动下,该公司公布了上市以来的首次年度净利润。10月至12月期间的收入和总预订量超过了华尔街的目标,由于税前收益,净利润增长了近两倍。优步的核心拼车业务增长了34%,尤其是在拉丁美洲和亚太地区,其外卖业务收入也有所增长。优步计划在即将到来的投资者日上讨论资本配置,可能包括回购计划。该公司预计,下一季度调整后的收益和总预订量将超过预期。即将到来的投资者日将是投资者了解该公司未来几个季度资本回报计划的好机会。24财年第一季度建议交易区间:70美至80美元。积极前景。

PayPal Holdings Inc (PYPL)

- 4Q23 Revenue: $8.0B, +8.1% YoY, beat estimates by $130M

- 4Q23 Non-GAAP EPS: $1.48, beat estimates by $0.12

- FY24 Guidance: No revenue guidance provided. Expect adjusted earnings per share of $5.10.

- Comment: PayPal delivered results that beat analysts’ expectations due to the strong holiday shopping season but forecasted flat growth in adjusted profit for the current year. Unbranded businesses contributed to PayPal’s growth, which helped offset weakness in Venmo due to intensifying competition. The company’s newly appointed CEO outlined a strategic plan to drive profitable growth and ease pressure on the company’s shares. The 2024 profit forecast remains unchanged from the previous year at $5.10 per share, with adjustments including stock-based compensation expenses and a restructuring charge. While Q4 earnings exceeded expectations, concerns linger about competition from Apple and Google. PayPal plans to cut 2,500 jobs to streamline operations in a transition year focused on long-term success. As the company prioritizes strategic positioning for FY24, investors eye margin improvement for sustained success. 1Q24 recommended trading range: $55 to $65. Neutral Outlook.

PayPal(PYPL)

- 23财年第四季营收:80.0亿美元, 同比增幅8.1%,超预期1.3亿美元

- 23财年第四季Non-GAAP每股盈利:1.48美元,超预期0.12美元

- 24财年指引:不提供营收指引。预计调整后每股收益为5.10美元。

- 短评:由于假日购物季的强劲增长,PayPal的业绩超出了分析师的预期,但预计今年调整后的利润将持平。无品牌业务为PayPal的增长做出了贡献,这帮助抵消了Venmo因竞争加剧而出现的疲软。该公司新任命的首席执行官概述了一项战略计划,以推动盈利增长,缓解公司股价的压力。2024年的利润预测与去年持平,为每股5.10美元,调整包括股票薪酬费用和重组费用。尽管第四季度收益超出预期,但对来自苹果和谷歌竞争的担忧仍挥之不去。PayPal计划裁员2,500人,以简化运营,在过渡的一年里,专注于长期成功。由于该公司将2024财年的战略定位放在首位,投资者将利润率的提高视为持续成功的前提。24财年第一季度建议交易区间:55美至65美元。中性前景。

Walt Disney Co (DIS)

- 1Q24 Revenue: $23.5B, +4.0% YoY, miss estimates by $270M

- 1Q24 Non-GAAP EPS: $1.22, beat estimates by $0.18

- FY24 Guidance: Expect fiscal 2024 earnings per share of about $4.60.

- Comment: Walt Disney Co reported better than expected earnings, a result of the company’s cost-cutting efforts. The company mentioned that it is on pace to meet or exceed its goal of cutting costs by at least $7.5 billion by the end of fiscal 2024. While the company saw an increase in average revenue per use as a result of its price hikes, core subscribers shrank by 1.3mn over the quarter. The company recently announced that it will launch a new sports streaming venture among ESPN, Fox and Warner Bros. Discovery later this year, which is likely to drive more subscribers after its launch. The company has also crackdown on password sharing, as well as restructured and streamlined its business model. This is likely to push consumers to purchase their individual subscriptions in the long run, alongside better consumer sentiments and improving macroeconomic conditions. 2Q24 recommended trading range: $100 to $115. Positive Outlook.

迪士尼(DIS)

- 24财年第一季营收:235亿美元, 同比增幅4.0%,逊预期2.7亿

- 24财年第一季Non-GAAP每股盈利:1.22美元,超预期0.18美元

- 24财年指引:预计2024财年每股收益约为4.60美元。

- 短评:华特迪士尼公司公布的收益好于预期,这是该公司削减成本努力的结果。该公司提到,到2024财年末,该公司正按计划实现或超过其削减成本至少75亿美元的目标。虽然由于价格上涨,该公司的每次使用平均收入有所增加,但核心用户在本季度减少了130万。该公司最近宣布,将在今年晚些时候在ESPN、福克斯和华纳兄弟探索之间推出一个新的体育流媒体项目,该项目推出后可能会吸引更多的用户。该公司还打击了密码共享,并重组和精简了其商业模式。从长远来看,这可能会推动消费者购买个人订阅服务,同时消费者情绪也会好转,宏观经济状况也会改善。24财年第二季度建议交易区间:100美至115美元。积极前景。

ARM Holdings PLC (ARM)

- 3Q24 Revenue: $824M, +13.8% YoY, beat estimates by $61.01M

- 3Q24 Non-GAAP EPS: $0.29 beat estimates by $0.04

- 4Q24 Guidance: Revenue in the range of US$850mn – US$900mn, more than the average estimate of US$778 million compiled by Bloomberg. FY24 Guidance: Revenue will be US$3,105mn – US$3,205mn.

- Comment: The firm presented robust outcomes, capitalizing on the smartphone market rebound and the growing use of Arm-based chips in the server market, particularly influenced by generative AI. Rapid adoption of its Armv9 technology, coupled with higher ASP and increased market share in server segments driven by the surge in AI applications, contributed to the positive performance. Additionally, the revival in smartphone demand and the introduction of flagship Android devices are anticipated to further enhance royalty earnings. 4Q24 recommended trading range: $90 to $112. Positive Outlook.

ARM 控股 (ARM)

- 24财年第三季营收:8.24亿美元, 同比增幅13.8%,超预期6,100万美元

- 24财年第三季Non-GAAP每股盈利:0.29美元,超预期0.04美元

- 24财年第四季指引:营收在8.5亿至9.0亿美元之间,高于彭博社估计的7.78亿美元的平均水平。24财年指引:收入将为31.05亿至32.05亿美元。

- 短评:该公司展示了强劲的业绩,利用了智能手机市场的反弹和服务器市场越来越多地使用基于ARM的芯片,特别是受生成式人工智能的影响。其Armv9技术的迅速采用,加上更高的平均销售价格和人工智能应用激增推动的服务器市场份额的增加,促成了积极的表现。此外,智能手机需求的复苏和旗舰Android设备的推出预计将进一步提高版税收入。24财年第四季度建议交易区间:90美至112美元。积极前景。

Wynn Resorts Ltd (WYNN)

- 4Q23 Revenue: $1.84B, +84.0% YoY, beat estimates by $100M

- 4Q23 Non-GAAP EPS: $1.91 beat estimates by $0.75

- 1Q24 Guidance: No guidance provided.

- 4Q23 Dividend: The company declared a cash dividend of 24 cents per share, payable on Feb. 29 to shareholders of record as of Feb. 20.

- Comment: The company reported a stronger-than-expected result, with the company seeing continued momentum in 4Q23 driving record-adjusted property earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs (EBIDTAR). The company remains focused on delivering five-star hospitality, being one of the largest employers in the Las Vegas Strip in the U.S. Travel volumes in the US are expected to continue to recover gradually in 2024, alongside improving consumer sentiments. The construction of the company’s Wynn Al Marjan Island resort is also continuing and is likely to become a must-see tourism destination in the United Arab Emirates. The commencement of rate cuts in 2024 is also likely to benefit the company and boost tourism levels as well. 1Q24 recommended trading range: $97 to $112. Positive Outlook.

永利度假村(WYNN)

- 23财年第四季营收:18.4亿美元, 同比增幅84.0%,超预期1亿美元

- 23财年第四季Non-GAAP每股盈利:1.91美元,超预期0.75美元

- 24财年第一季指引:营收在8.5亿至9.0亿美元之间,高于彭博社估计的7.78亿美元的平均水平。

- 23财年第四季股息:该公司宣布,将于2月29日向截至2月20日登记在册的股东派发每股24美分的现金股息。

- 短评:该公司报告了强于预期的业绩,公司在第四季度继续保持增长势头,推动创纪录的调整后的利息、税项、折旧、摊销、重组或租金成本前的房地产收益(EBIDTAR)。该公司仍然专注于提供五星级的服务,是美国拉斯维加斯大道上最大的雇主之一,预计美国的旅游数量将在2024年继续逐步恢复,同时消费者情绪改善。该公司的永利阿尔马尔詹岛度假村的建设也在继续,很可能成为阿拉伯联合酋长国必去的旅游目的地。2024年开始的降息也可能使该公司受益,并提高旅游水平。24财年第一季度建议交易区间:97美至112美元。积极前景。