22 June 2023: Wealth Product Ideas

| Fund Name (Ticker) | iShares Blockchain and Tech ETF (IBLC US) |

| Description | The iShares Blockchain and Tech ETF seeks to track the investment results of an index composed of U.S. and non-U.S. companies that are involved in the development, innovation, and utilization of blockchain and crypto technologies. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 20 Jun) | 4,720 |

| Net Assets of Fund (as of 20 Jun) | US$7,336,304 |

| 12-Month Trailing Yield (as of 28 Apr) | 0.49% |

| P/E Ratio (as of 16 Jun) | 11.20 |

| P/B Ratio (as of 16 Jun) | 1.60 |

| Management Fees (Annual) | 0.47% |

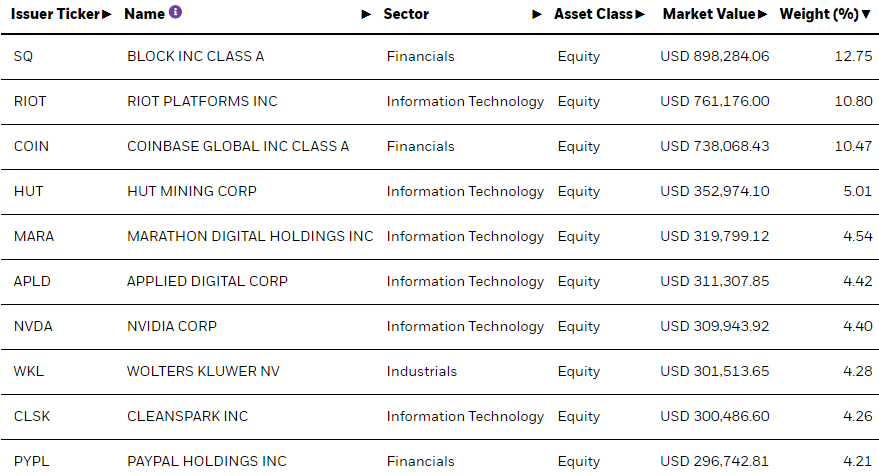

Top 10 Holdings

(as of 16 June 2023)

- BUY Entry –18 Target – 22 Stop Loss – 16

- Start of Bitcoin rally. The price of bitcoin climbed on Monday, with its price surging over 5% to reach $28,002.18, the highest level since early May. This increase was attributed to financial institutions showing support for Bitcoin, particularly BlackRock, the world’s largest asset manager, filing an application for a spot Bitcoin ETF in the U.S. This occurred in the same period as the Securities and Exchange Commission’s lawsuit against major crypto exchanges Binance and Coinbase, sparking speculation. The rally extended to other cryptocurrencies, with Ether rising 3.5%. Additionally, traditional incumbents are now seeing an opportunity to grab market share with the Citadel/Fidelity launch of EDX today and Deutsche Bank applying for a digital asset custody licence in Germany, potentially reshaping the digital asset landscape. Bitcoin’s recent climb and the BlackRock ETF application also influenced the ongoing legal battle between Grayscale Investments and the SEC regarding the conversion of the Grayscale Bitcoin Trust into an ETF. Other factors impacting the markets include the U.S. crackdown on crypto, macro forces such as the Federal Reserve’s stance on interest rate hikes, and potential economic stimulus in China.

- Launch of new crypto exchange. The launch of EDX Markets, a new crypto exchange backed by financial giants Charles Schwab, Fidelity Digital Assets, and Citadel Securities, supports the notion of long-term institutional interest in the crypto industry. EDX aims to cater to the needs of sophisticated financial institutions by providing a non-custodial exchange platform that allows trading of bitcoin, ether, litecoin, and bitcoin cash. By operating as a non-custodial exchange, EDX addresses concerns about the misuse of funds and regulatory uncertainties. The backing from prominent financial institutions like Charles Schwab and Fidelity signifies growing confidence in the potential of blockchain technology and crypto investing. This development instills optimism in investors, potentially reducing the reputational risks associated with crypto businesses. Bitcoin’s recent gains further highlight the positive sentiment, with a 69% increase in value this year.

- Application to offer a custody service for digital assets, in Germany. Deutsche Bank, a multinational investment bank valued at $1.4 trillion, is applying for a crypto custody license in Germany. It aims to offer a custody service for digital assets, including cryptocurrencies, in Germany. The bank is expanding its digital assets and custody business and has submitted its application to the Federal Financial Supervisory Authority (BaFin). This move is part of the bank’s strategy to increase fee income, aligning with similar efforts at its investment arm, DWS Group. Despite past skepticism towards digital assets, Deutsche Bank has been taking steps to gain a potential first-mover advantage in the industry, including collaborations with blockchain technology like Project DAMA (Digital Asset Management Access) to enhance the management and accessibility of digital assets.

(Source: Bloomberg)

| Fund Name (Ticker) | iShares India 50 ETF (INDY US) |

| Description | The iShares India 50 ETF seeks to track the investment results of an index composed of 50 of the largest Indian equities. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 20 June) | 39,218 |

| Net Assets of Fund (as of 20 June) | USD$599,593,481 |

| 12-Month Trailing Yield (as of 20 June) | 13.25% |

| P/E Ratio (as of 20 June) | 3.248 |

| P/B Ratio (as of 20 June) | 22.846 |

| Management Fees | 0.89% |

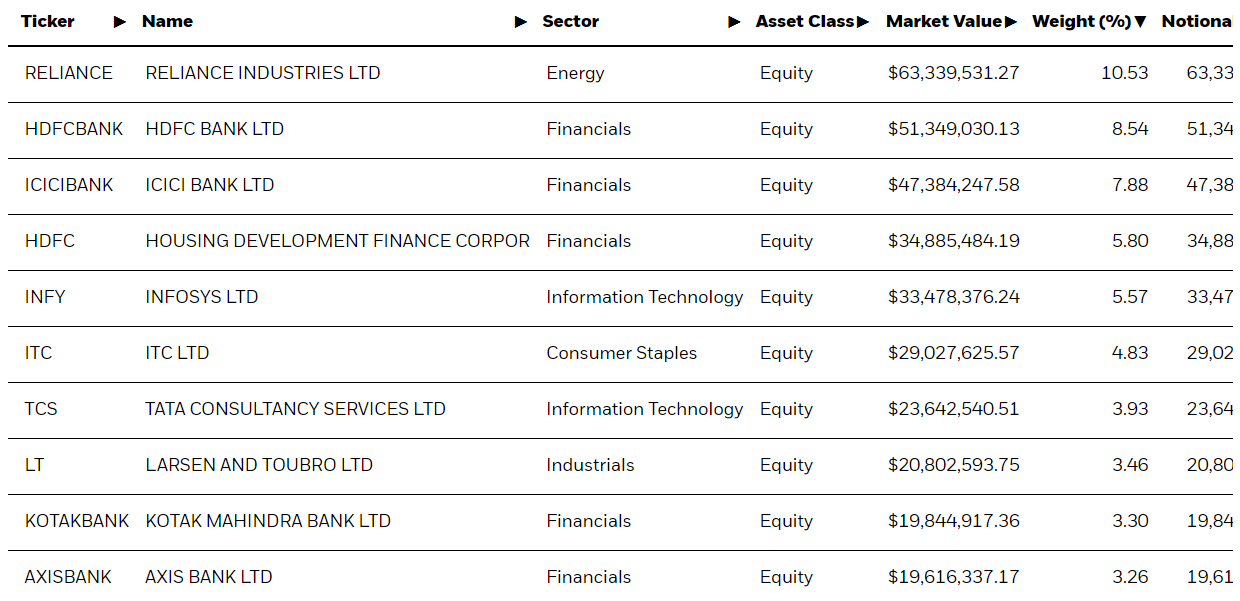

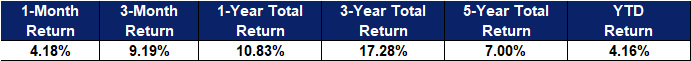

Top 10 Holdings

(as of 16 June 2023)

- BUY Entry – 44 Target – 48 Stop Loss – 42

- Deepening ties between India and US. In a recent development, Indian Prime Minister Narendra Modi embarked on a state visit to the United States, signifying a crucial milestone in the bilateral relationship between the two nations and paving the way for enhanced and diversified collaboration. This visit holds the potential for an expanded partnership, particularly in the defense industry and high-tech sectors, as India seeks to gain access to vital American technologies that are typically shared only with allied nations by Washington.

- Inflow of foreign funds into India’s market. Recently, India’s benchmark Sensex stock index achieved an all-time high, while the Nifty 50 made progress towards its highest point ever. These milestones were driven by continuous foreign investments in Indian equities, supported by the country’s robust macroeconomic performance. As of Friday, India’s market capitalization reached a substantial sum of US$3.4bn, securing the country’s position as the fourth-largest market globally in terms of value, according to data from QUICK FactSet. In the current financial year, foreign investors have injected a noteworthy sum of US$8.99bn into the market, marking a significant shift from their net selling position in the previous two fiscal years, which witnessed a record outflow of US$17.07bn in FY22. These developments can be attributed to India’s impressive economic growth, which gained momentum in the March quarter, alongside a decline in inflation to a 25-month low of 4.25% in May. These indicators reflect India’s status as one of the swiftest-growing emerging economies, and an improving investor’s confidence toward the India market.

- Supply chain allocation. Apple is increasing its investments in India and expanding production capacity, as evidenced by Foxconn’s US$700mn investment in a new plant. This suggests a potential shift in iPhone manufacturing from China. Amid deepening tensions between China and the US, there is a risk of China losing production capacity to countries like India and Vietnam. Similarly, Tesla has engaged in discussions with the Indian government about incentives for car and battery manufacturing, proposing the establishment of an electric vehicle factory in India.

(Source: Bloomberg)