Technical Analysis – 7 December 2023

United States | Singapore | Hong Kong | Earnings

KB Home (KBH US)

- Shares closed at a high since 2007, above the 5wEMA.

- Both RSI and MACD are constructive.

- Long – Entry 55.2, Target 60.0, Stop 52.8

Lowe’s Companies Inc (LOW US)

- Shares closed above the 200dEMA with rising volume. The 20dEMA is about to cross the 50dEMA.

- RSI is constructive and MACD is positive.

- Long – Entry 207.9, Target 226.3, Stop 198.7

Raffles Medical Group Ltd (RFMD SP)

- Shares closed above the 20dEMA with an incline in volume.

- Both RSI and MACD are constructive.

- Long – Entry 1.07, Target 1.15, Stop 1.03

ComfortDelGro Corp Ltd (CD SP)

- Shares closed above the 20dEMA with rising volume. The 5dEMA crossed the 50dEMA.

- RSI is constructive, while MACD is negative.

- Long – Entry 1.32, Target 1.38, Stop 1.29

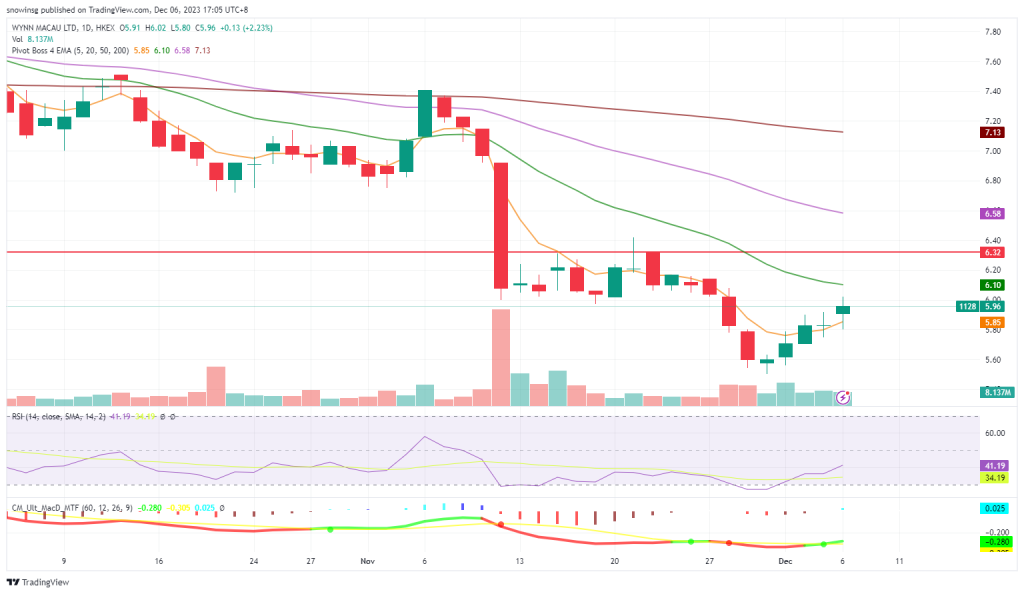

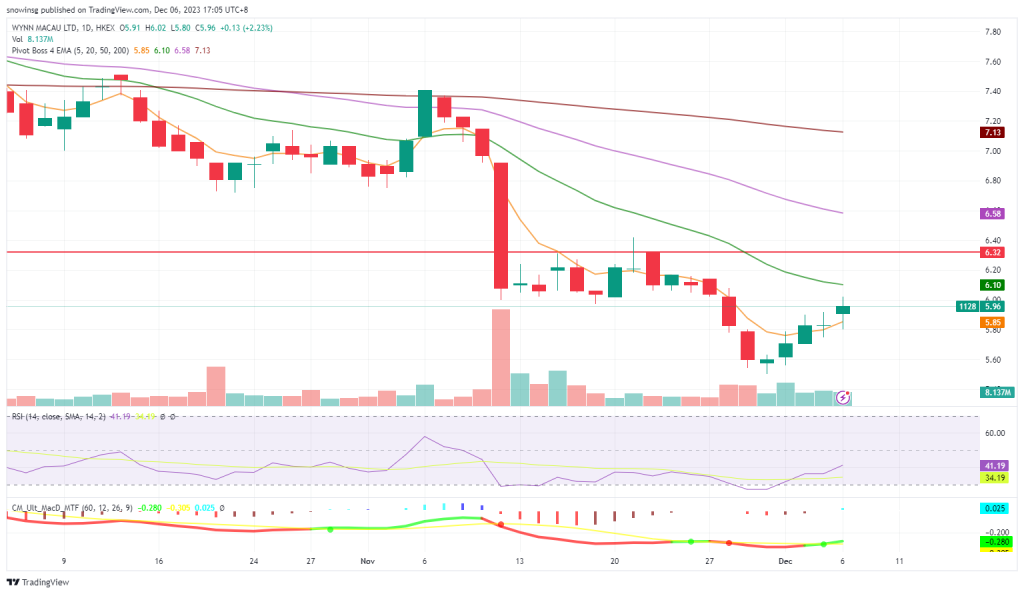

Wynn Macau Ltd (1128 HK)

- Shares closed above the 5dEMA.

- Both RSI and MACD are positive.

- Long – Entry 5.94, Target 6.32, Stop 5.75

Sands China Ltd (1928 HK)

- Shares closed above the 20dEMA with an incline in volume.

- RSI is constructive and MACD turned positive.

- Long – Entry 20.8, Target 22.2, Stop 20.1

C3.ai Inc (AI)

- 2Q24 Revenue: $73.23M, +17.3% YoY, miss estimates by $1.1M

- 2Q24 Non-GAAP EPS: –$0.13, beat estimates by $0.05

- 3Q24 Guidance: Total revenue $74.0M – $78.0M vs. consensus of $74.33M; Non-GAAP loss from operations $40.0M- $46.0M. FY24 Guidance: Total revenue $295.0M – $320.0M vs. consensus of $307.88M; Non-GAAP loss from operations $115.0M – $135.0M.

- Comment: C3.ai Inc reported quarterly revenue below analysts’ expectations. The company also adjusted its outlook for a wider fiscal-year operating loss, now projected to be up to $135mn, compared to the earlier forecast of up to $100mn. Subscription revenue for the quarter was $66.4mn, making up 91% of total revenue, an increase of 12% YoY, amounting to $59.5mn. Customer Engagement rose 81% to 404 compared to the previous 223. Despite a 17% increase in fiscal second-quarter sales to $73.2mn, the company faces challenges expanding its market share, as indicated by the steeper-than-expected loss forecast. C3.ai plans increased spending on generative AI products, impacting short-term profitability, with the CEO targeting positive cash flow by fiscal year 2025. The company closed 62 customer agreements in the quarter, but most were pilots or under $1mn in total contract value. The company also highlighted challenges in its European sales teams, implementing a reorganisation to address performance issues. In response to the challenges it has encountered, C3.ai has proactively implemented strategic measures which would partially mitigate the impact on its financial losses. 3Q24 recommended trading range: $23 to $30. Neutral Outlook.

C3.ai (AI)

- 24财年第二季营收:7,323万美元, 同比增幅17.3%,逊预期110万美元

- 24财年第二季Non-GAAP每股亏损:0.13美元,超预期0.05美元

- 24财年第三季指引:总营收7,400万至7,800万美元,市场预期为7,433万美元;Non-GAAP经营亏损4,000万至4,600万美元。24财年指引:总收入2.95亿至3.2亿美元,市场预期为3.0788亿美元;Non-GAAP经营亏损1.15亿至1.35亿美元。

- 短评:C3.ai公司公布的季度收入低于分析师预期。该公司还调整了对更广泛财年运营亏损的预期,目前预计将高达1.35亿美元,而此前的预测为高达1亿美元。本季度订阅收入为6,640万美元,占总收入的91%,同比增长12%,达到5,950万美元。客户参与度从之前的223个上升到404个,上升了81%。尽管第二财季销售额增长了17%,达到7,320万美元,但该公司面临着扩大市场份额的挑战,这从高于预期的亏损预测中可以看出。C3.ai计划增加对生成式人工智能产品的支出,影响短期盈利能力,首席执行官的目标是到2025财年实现正现金流。该公司在本季度完成了62项客户协议,但大多数是试点协议,或合同总价值低于100万美元。该公司还强调了其欧洲销售团队面临的挑战,实施了重组以解决业绩问题。为了应对所遇到的挑战,C3.ai已积极实施策略性措施,部分减轻对其财务损失的影响。24财年第三季度建议交易区间:23美元至30美元。中性前景。

GameStop Corp (GME)

- 3Q23 Revenue: $1.08B, -9.2% YoY, miss estimates by $100M

3Q23 Non-GAAP EPS: $0.00, beat estimates by $0.08

- 4Q23 Guidance: No guidance provided.

- Comment: GameStop Corp’s Q3 sales fell short of analysts’ estimates at $1.08bn, impacted by heightened competition and cautious consumer spending during its transition to an online-focused model. Sales declined across software, hardware, and collectibles. Despite the revenue miss, the company outperformed expectations for a loss of 7.7 cents, attributed to reduced expenses. The gaming industry has faced challenges due to sticky inflation and high borrowing costs, causing uneven spending. GameStop, adapting to the shift in video-game sales to digital marketplaces, closed over 1,000 stores. CEO Ryan Cohen, also the largest shareholder, took over in September, gaining authority over the investment portfolio. GameStop currently holds $909mn in cash and $300.5mn in marketable securities. The CEO’s strategy now combines brick-and-mortar stores with online orders, recognising market share losses to mass merchants and e-commerce giants. Looking ahead, as physical video game demand continues to wane, there is a need to speed up the process of transitioning towards an online model to ensure the continuity of GameStop’s business. 4Q23 recommended trading range: $11 to $16. Negative Outlook.

游戏驿站(GME)

- 23财年第三季营收:10.8亿美元, 同比跌幅9.2%,逊预期1.0亿美元

- 23财年第三季Non-GAAP每股盈利:0.00美元,超预期0.08美元

- 23财年第四季指引:不提供指引。

- 短评:游戏驿站第三季度销售额低于分析师的预期,为10.8亿美元,受竞争加剧和消费者支出谨慎的影响,该公司正在向以在线为中心的模式过渡。软件、硬件和收藏品的销售额都有所下降。尽管营收低于预期,但由于支出减少,该公司表现好于预期的亏损7.7美分。由于粘性通货膨胀和高借贷成本,导致支出不均,游戏行业面临挑战。为了适应电子游戏销售向数字市场的转变,公司关闭了1000多家商店。首席执行官瑞恩·科恩(Ryan Cohen)也是最大的股东,他于9月份接任,获得了对投资组合的控制权。公司目前持有9.09亿美元现金和3.005亿美元有价证券。这位首席执行官现在的战略是将实体店与在线订单结合起来,承认大众商家和电子商务巨头的市场份额损失。展望未来,随着实体视频游戏的需求持续减弱,有必要加快向在线模式过渡的进程,以确保公司业务的连续性。23财年第四季度建议交易区间:11美元至16美元。负面前景。

Campbell Soup Co (CPB)

- 1Q24 Revenue: $2.52B, -2.3% YoY, in-line with estimates

- 1Q24 Non-GAAP EPS: $0.91, beat estimates by $0.03

- FY24 Guidance: Reaffirms full-year FY24 guidance, expected to reflect volume declines in the first half of FY24 with sequential improvement leading to positive volume trends in the second half. Additionally, net sales growth is anticipated to reflect lower contribution from pricing and disciplined levels of promotion, continues to expect modest earnings and margin progress in FY24, weighted to the second half, reflecting a moderating inflationary environment and ongoing productivity improvements and continues to expect the acquisition of Sovos Brands, Inc. (Sovos Brands) to close in calendar year 2024.

- Comment: Campbell Soup exceeded Wall Street’s profit expectations for the quarter, driven by higher snacks and packaged food prices, countering reduced demand from cost-conscious consumers. The company affirmed its full-year 2024 outlook. Despite a 2% decline in net sales, Campbell surpassed profit estimates. The global trend of food makers raising prices to offset input and labour costs continued, with Campbell experiencing a 2% rise in average selling prices for meals and beverages and a 5% increase for snack brands. However, overall volumes declined by 5%, as consumers opted for cheaper alternatives amid ongoing inflation. The CEO noted pressure on the ready-to-serve and condensed soup businesses but highlighted improvement across all segments in the last four weeks, including the Thanksgiving holiday. Campbell has been increasing its promotional efforts to gain market share, evidenced by a 10% rise in marketing and selling expenses during the quarter. Even with fluctuating demand for its goods, the price increase has helped maintain its sales figures. 2Q24 recommended trading range: $40 to $48. Positive Outlook.

金宝汤(CPB)

- 24财年第一季营收:25.2亿美元, 同比跌幅2.3%,符合预期

- 24财年第一季Non-GAAP每股盈利:0.91美元,超预期0.03美元

- 24财年指引:重申24财年全年指导,预计将反映24财年上半年的销量下降,下半年的连续改善将带来积极的销量趋势。此外,预计净销售增长将反映价格和促销水平的贡献降低,预计24财年的盈利和利润率将继续适度增长,并加权至下半年,反映出通胀环境的缓和和生产率的持续提高,并继续预计对Sovos Brands, Inc. (Sovos Brands)的收购将在2024日历年完成。

- 短评:受零食和包装食品价格上涨的推动,金宝汤本季度的利润超出了华尔街的预期,抵消了注重成本的消费者需求减少的影响。该公司确认了其2024年全年展望。尽管净销售额下降了2%,但金宝汤的利润超出了预期。食品制造商提高价格以抵消投入和劳动力成本的全球趋势仍在继续,金宝汤的餐饮和饮料平均售价上涨了2%,零食品牌的平均售价上涨了5%。然而,由于消费者在持续的通货膨胀中选择了更便宜的替代品,整体销量下降了5%。这位首席执行官指出,即食和浓缩汤业务面临压力,但他强调,过去四周,包括感恩节假期在内的所有业务都有所改善。金宝汤一直在加大促销力度以获得市场份额,本季度营销和销售费用增长了10%就是明证。即使对其产品的需求波动,价格上涨也有助于维持其销售数字。24财年第二季度建议交易区间:40美元至48美元。积极前景。