Technical Analysis: 4 November 2021

United States | Singapore | Hong Kong

UNITED STATES

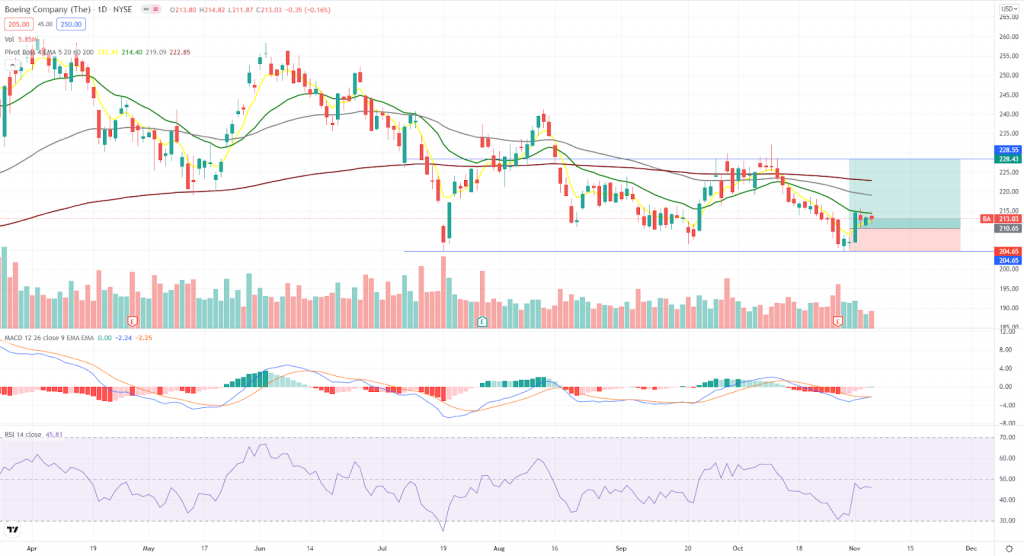

Boeing Company (The) (BA US)

- Range bound trade with strong support at 204.7, which formed a double bottom. Strong resistance level around 228.7, which over the last month was unable to break out. Shares near-term supported around the 5dMA.

- Convergence of MACD and signal line, showing positive signal for potential crossover, expected catalyst to be reopening themed plays in the upcoming fourth quarter

- Long – Entry: 210.7, Target: 228.7, Stop: 204.7

Meta Platforms Inc (FB US)

- Positive signal shown as 5dMA touched the 20dMA, while MACD line has crossed the signal line.

- Relatively strong volume over the last week after Facebook renamed itself to Meta Platforms. Positive momentum is expected to continue as a recent lawsuit case has been priced in. Limited exposure to supply chain headwinds moving into the fourth quarter being a software service provider.

- Long – Entry: 330.7, Target: 344.1, Stop: 324.2

SINGAPORE

Geo Energy (GERL SP)

- Clear downtrend after peaking on 15 October, with near term support at 50d MA at 0.305.

- Upcoming 3Q earnings likely on 12 Nov (Fri), which could provide a short term trading play if dividends announced are higher than expected.

- Long Entry 0.305 Target 0.35 Stop 0.28

Frencken (FRKN SP)

- Shares have been consolidating around 2.0-2.50 since 5 Aug, due to a lack of clear catalyst.

- Shares are trading along the 50d MA since the start of the year, and could provide an opportunity to accumulate. A better than expected 3Q business update next week could provide the much needed catalyst for shares to break out.

- Long Entry 2.30 Target 2.50 Stop 2.20

HONG KONG

Hua Hong Semiconductor Ltd (1347 HK)

- It is the 3rd time breaking out of the trading range between HK$37.5 and HK$44.5 after the February sell-off.

- Both MACD and RSI are constructive, pointing to a bullish momentum. 3Q21 results will be out on 11th November.

- Long – Entry: 46, Target: 52, Stop: 44

Nexteer Automotive Group Ltd (1316 HK)

- It formed a cup and handle pattern then broke out the handle, implying a bullish signal for the next movements.

- Both MACD and RSI showed a strong upward momentum. Short-term exponential moving average lines (5d, 20d, and 60d) are trending upward. Downside supports are 60dEMA of HK$9.1 and 120dEMA of HK$9.25.

- Long – Entry: 9.4, Target: 11.6, Stop: 8.8

Related Posts: