KGI Daily Trading Ideas – 1 February 2021

IPO Watch

Overseas IPO subscription only for Accredited Investors (AI)

Week ahead – 5 major IPOs to grace the first week of February

The first week of February sees 5 major US IPOs, with Telus International (TIXT US), Atotech (ATC US), Sana Biotechnology (SANA US), ON24 (ONTF US) and loanDepot (LDI US) scheduled to price and trade for the week. We highlight ON24 amongst the IPOs.

ON24 (ONTF US) – Not just another Zoom

- ON24 provides a digital experience platform that helps with customer engagement through webinars and virtual events. Unlike other virtual conference software, ON24 focuses on the B2B market, with just over 2000 paying clients. ON24’s customer base are commonly large companies, with over 10% of clients paying over 100k per annum to ON24.

- ON24 differentiates from other teleconferencing software with the usage of AI and machine learning to assist an employee to draw valuable insight from their customers. It is designed to be used hand-in-hand with other Customer Relationship Management software. Sales grew ~75% year-on-year in 2020 and the company is expected to make their first yearly profit in 2020.

- ON24 is looking to raise US$409mn from the IPO, at an initial price range of US$45-50 per share.

- At the midpoint of the IPO price range, ON24 will have an initial market cap of ~US$2.7bn, and around 17x Price/Sales. Given Qualtric’s 30x P/S, and Zoom’s 50x+ P/S multiple, we expect ON24 to comfortably trade above 20x P/S (US$55, +16%).

IPO Performance Review

Kuaishou (1024 HK) – IPO priced at HK$115, the upper bound of the range

According to the International Financing Review, the amount raised from the IPO is estimated to be US$5.4bn. Initial valuation based on HK$115 per share is estimated at US$61bn (4.6x price to FY21F sales).

The total amount for the public subscription reached HK$1.28tn (US$164.8bn), equivalent to a 1,200x subscription rate.

Shares allocation will be announced on Thursday while trading starts this Friday 5th February 2021.

US Trading Ideas

Relx Technology (RLX US): 60x Price/Sales for a super-growth stock

- BUY Entry – 22.5 Target – 30.5 Stop Loss – 19

- We previously covered RLX’s IPO here, in which the IPO sentiment has cooled down and the shares have now consolidated at the US$22-26 range.

- We see the correction as a good chance to accumulate positions in a high growth stock. Despite the 60x Price/Sales price tag, RLX is expected to double its sales next year, and potentially grow 5x in the next 4 years as the Chinese market warms up to e-vapor products.

Digital Turbine (APPS US): Catch high growth stocks on their pullbacks

- BUY Entry – 51.5 Target – 72 Stop Loss – 46

- APPS operates as a middleman between mobile service operators (AT&T, Singtel) or OEMs (Samsung) and mobile app advertisers, earning a cut from apps that are installed on first boot.

- APPS currently has a presence in over 500 million devices, with 60 million coming in during the September 2020 quarter alone. Revenue growth has exceeded 100% in recent quarters while EBITDA has almost tripled year-on-year. The market has caught wind of APPS growth trend since August 2020, sending the share price up ~250% since.

- APPS is currently undergoing a healthy price retracement in line with major index movements. Should the market continue its correction in February, we recommend accumulation near the 60EMA support, roughly 10% below its current share price.

HK Trading Ideas

China Silver Group Limited (815): Ride on the hype of silver squeeze

- BUY Entry – 0.90 Target – 1.36 Stop Loss – 0.75

- China Silver Group Limited is a Hong Kong-based investment holding company principally engaged in the manufacture and sales of silver products. The Company operates through two segments. Manufacturing segment is engaged in the manufacture and sales of silver ingots and other non-ferrous metals in China. These products are used for industrial and commercial use.

- The company is one of the few pure silver plays listed in Hong Kong. The past 52 weeks high was HK$1.24 when silver prices just hit a 7 year high of US$26/oz. We believe the stock can shoot up to the previous high amid a full-blown silver squeeze in February.

- US retail investors’ short squeeze movements have widened to silver. One article on Reddit said silver is the biggest shorted asset class, and its inflation-adjusted value should be $1,000/oz instead of $25/oz. This post sparked the attention of the silver bet.

- iShares Silver Trust (SLV US) recorded an intraday inflow of US$1.18bn last Friday.

Blue Moon Group Holdings Ltd (6993 HK): The moon is waiting to shine

- BUY Entry – 14.6 Target – 18.5 Stop Loss – 13

- Blue Moon Group Holdings Limited operates as a household care company. The company produces liquid laundry detergents, liquid soaps, concentrated liquid laundry detergents, and other products. Blue Moon Group Holdings markets its products throughout China.

- The company has been a market leader in hand wash and laundry detergent in China with a respective market share of 17% and 24% in China as of 2019. Revenue and net profit CAGRs are 12% and 254% respectively from 2017 to 2019. According to Bloomberg, revenue growth in FY21 and FY22 is estimated to be 33.7%YoY and 24.4% YoY, and net profit growth in FY21 and FY22 is estimated to be 45.7% YoY and 21.9% YoY.

- Although the house cleaning products market is highly competitive, branding and pricing are the keys to maintain or even expand market share. Blue Moon has both competitive advantages. The company has been upgrading its product series targeting different groups of users and launching new products each year.

- The current valuation is relatively cheap as the 12-month forward price-to-earnings ratio (PER) recently dropped to 45x, the lowest since IPO. We believe the fair PER is around 55x to 60x because of its dominant market status.

SG Trading Ideas

Top Glove (TOPG SP): Trading the short squeeze

- BUY Entry – 2.18 Target – 2.38 Stop Loss – 2.07

- Malaysian listed glove makers Top Glove (TOPG MK / TOPG SP), Kossan Rubber (KRI MK) and Hartalega (HART MK) were the three most shorted stocks on Bursa Malaysia as of 27 January. However, only TOPG is dual listed both on Bursa and SGX while smaller glove maker, Riverstone (RSTON SP), is listed only on the SGX.

- On the SGX, TOPG is among the top five most shorted stocks. The others include Singapore Press Holdings (SPH SP), Best World (BEST SP), SATS (SATS SP) and REX International (REXI SP).

- Thus, we believe TOPG is likely the best Singapore-listed short-term bet to play the current short squeeze dynamics hitting US stocks such as Gamestop (GME US), AMC Entertainment (AMC US) and Express Inc (EXPR US).

ThaiBev (THBEV SP): Cheers to a potential spin-off

- RE-ITERATE BUY Entry – 0.83 Target – 0.93 Stop Loss – 0.75

- Bloomberg/Financial Times last week reported that THBEV plans to list its brewery business on the Singapore Exchange as soon as this week, with a valuation of around US$10bn. This would make it one of Singapore’s biggest IPO in almost a decade.

- THBEV produces the well-known Chang Beer. In 2017, its associate bought a controlling stake in Saigon Beer Alcohol Beverage, Vietnam’s largest brewer. THBEV’s other assets include a 28% stake in SGX-listed F&N.

- THBEV trades at favourable valuations when considering its market share and current P/E multiples below the 5-year average. We remain positive on THBEV’s longterm fundamentals and dominant market share in both Thailand and Vietnam. THBEV is well-positioned given that its key markets are ranked among the top alcohol consuming countries in Asia.

- We have an OUTPERFORM call with a target price of S$0.93. Read our full report here.

Market Movers – What’s Hot

Global / Macro

- Silver continued a blistering rally on Friday, taking its gains to around 10% since messages began to circulate on Reddit on Thursday morning urging retail investors to pile into the market and drive up prices.

- Tesla CEO Elon Musk changed his Twitter bio description to “Bitcoin”. That one word addition caused the price of bitcoin to spike to a 10-day high of $38,020 and sparked $387 million worth of short liquidations on major exchanges including Binance, Bitfinex, BitMEX, ByBit, Deribit, FTX, HuobiDM and OKEx.

United States

- Short squeeze stocks rebounded from Thursday lows as major brokerages partially lifted retail trading restrictions, with Gamestop (GME US) +67.9% at US$325 and AMC Entertainment (AMC US) +53.7% at US$13.26, albeit with lower trading volume and remaining below their Wednesday close prices. Major indices are down ~2%, wiping out most gains for the month of January.

- Moderna (MRNA US) +8.5%, closing at US$173.16 as the company’s COVID-19 vaccine mRNA-1273 proves to be effective in fending off newer variants of the virus. Novavax (NVAX US) +64.9%, closing at US$220.94 as a similar beneficiary, while Johnson & Johnson (JNJ US) -3.6%, closing at US$163.13 as investors digested news on their vaccine trial results, which is less efficient than peer coronavirus vaccine makers.

- Earnings watch: Amazon and Alphabet report earnings on Tuesday; Paypal report on Wednesday and Pfizer on Thursday.

Hong Kong

- Weichai Power Co., Ltd. (2338) +13.09%, closing at an all time high of HK$22.9. The company is expected to benefit from the domestic infrastructure expansion and replacement of vehicles due to the new domestic standard regarding safety requirements. Total domestic heavy truck sales grew by 37.7% YoY to 161,700 vehicles in 2020. The sector prospects is still high.

- Evergrande Property Services Group Limited (6666HK) +10.84%, closing at HK$61.95. The company announced to acquire 100% Ningbo Yatai Hotel Property Services Co., Ltd., a property service company that has 940 projects under management, serving over 2mn homeowners and has areas under management of over 80 mn square meters which includes residential buildings, office buildings, urban complexes, large industrial parks, etc.

- Jiangxi Ganfeng Lithium Co.,Ltd. (1772) -6.66%, closing at HK$109.3. The Company revised upward forecast for FY20 annual results, estimating that the range growth of net profit attributable to shareholders in FY20 was 154.14% to 198.82%; the range of net profit attributable to shareholders in FY20 was RMB910mn to RMB1.07bn.

- Prudential Public Limited Company (2378) -7.17%, closing at HK$129.5. The company has decided to pursue the separation of its US business, Jackson Financial Inc. from the Group in the second quarter of 2021 through a demerger, whereby shares in Jackson would be distributed to Prudential shareholders.

Singapore

- iFAST (IFAST SP) +9.3% to S$5.51. The company announced on 30 Jan that Hong Kong’s Mandatory Provident Fund Schemes Authority (MPFA) had awarded PCCW Solutions Limited the contract to standardise Hong Kong’s pension system. iFAST is part of the group led by Richard Li’s PCCW bidding for the project.

- Keppel Corp (KEP SP) -8.2% to S$5.01 after it announced a FY2020 loss of S$506mn, its biggest full-year loss since the Asian Financial crisis, due to S$952mn of impairments in its Offshore & Marine business.

- Earnings Watch: For the week ahead, Ascendas REIT (AREIT SP) reports its FY2020 on 2 Feb, SIA (SIA SP) reports 3Q 2021 on 4 Feb and iFAST (IFAST SP) reports its FY2020 earnings on 5 Feb.

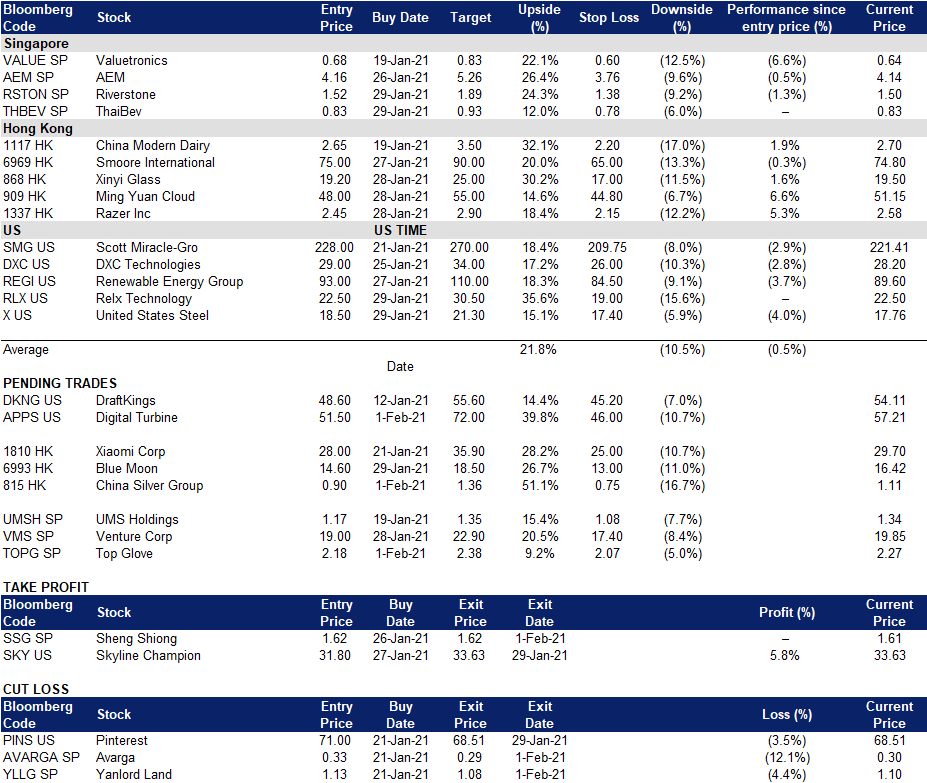

Trading Dashboard