凯基每日荐股- 2021年6月9日

新加坡股票推荐

莱佛士医疗 (RFMD SP):一箭双雕

- 买入:买入价:1.13,目标价:1.3,止损价:1.06

- 该股既是一只经济重开概念股,也是新冠疫情概念股。该医疗集团被指定为航空边境筛查的供应商,对外籍工人包括入境的航空旅客以及公共活动的客人进行拭子测试。此外,公司目前有四个专门的疫苗接种中心。

- 经济重开。当边境重新开放,允许更多的旅行时,该医疗组织将受益。它还可以扩展到其他补充服务,如血清相关测试。测试相关服务是一项利润相对较高的业务,可以对其利润做出有意义的贡献。

- 中国业务的增长。 公司的中国业务今年也有望加快步伐。该集团最近与中国人寿(China Life Insurance) 的一家子公司成为合作伙伴,以促进在中国医疗保健市场的业务。重庆莱佛士医院于2019年竣工,北京莱佛士医院于2021年竣工,预计今年将在上海开设另一家三级医院。

- 估值。 虽然该公司2021财年市盈率为35倍,2022财年市盈率为32倍,但我们预计,由于新加坡和中国业务的盈利增长强于预期,其估值仍有进一步上升潜力。市场评级有8个买入/ 2个持有/ 0个卖出,12个月的平均目标价为1.35新元 (17%的上升空间)。

快捷特环球 (AZTECH SP):低位交易

- 重申买入:买入价:1.28,目标价:1.5,止损价:1.18

- 基本面上强劲的利好。 最近几只新加坡科技股的下跌是一个买入机会,因为它们继续受益于物联网 (IoT) 和数据通信产品的结构性利好。

- 强劲的订单簿。截至21年第一季度末,公司的订单总额为4.89亿新元,其中大部分将在今年完成。该公司已经获得了来自韩国、瑞典、澳大利亚和美国的新客户。除此之外,它的主要客户是美国一家主要的电子商务公司。

- 乐观的市场估值。分析师对公司整体持积极评级,4个买入/ 0个持有/ 0个卖出,12个月平均目标价为1.87新元,这意味着在最近1.22新元的收盘价基础上,有53%的上升空间。与此同时,我们的短期交易目标价为1.50新元,意味着更保守的11倍2022财年市盈率,22财年每股收益预计为13.5新分。

- 技术性反弹。由于之情RSI低于40,这意味着其股价已短期触底,因此价格将出现技术性反弹。

HONG KONG

特步国际 (1368 HK):更便宜的奥运主题股

- 买入:买入价:8.5,目标价:10.5,止损价:7.5

- 特步国际控股有限公司主要从事体育用品包括鞋履、服装及配饰的设计、开发、制造、销售、市场推广及品牌管理业务。该公司主要以“特步”为品牌进行销售。该公司还通过其子公司从事投资控股活动。该公司的主要子公司包括特步国际发展有限公司、柯林(福建)服饰有限公司、特步体育用品有限公司及厦门特步投资有限公司。

- 运动服装行业无疑是今年以来表现最好的行业之一,因为在新冠肺炎期间,更多的人锻炼身体,也因为抵制外国运动品牌,国内品牌运动服饰需求激增。东京奥运会是自去年年初新冠肺炎大流行开始以来的首个大型国际体育赛事。被压抑的观看和参与该盛事的需求将会大大增加。由于比赛地点在日本,更多的中国观众将可以在亚洲时段观看现场直播。因此,对中国品牌运动服的热情有望转化为对国产运动服的更多消费。

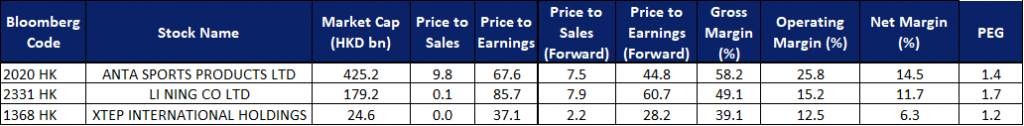

- 根据同行的比较,我们认为该公司仍有上行潜力,可以赶上安踏、李宁等市场领先者。

- 更新后的市场共识是,21和22财年的每股收益同比增长分别为31.3%和21.7%,即28.2倍和23.2倍的远期市盈率。当前市盈率为37.1倍。彭博(Bloomberg)未来12个月平均目标价为6.14港元。

现代牧业 (1117 HK):同行的上市可能会产生连带效应

- 重申买入:买入价:1.80,目标价:2.15,止损价:1.65

- 中国现代牧业控股有限公司是一家主要从事生产及销售牛奶业务的投资控股公司。该公司通过两个业务分部进行运营。奶牛养殖分部饲养奶牛以生产及销售原料奶。液态奶产品生产分部生产及销售加工液态奶。该公司也通过其子公司从事生产牧草及销售饲料业务。

- 鲜奶价格从4.22元/公斤反弹至4.26元/公斤。年初至今高点为4.29元/公斤。

- 自3月底以来,该股一直在盘整,波动区间在1.8港元至2.0港元之间。

- 近期的催化剂是同行企业优然乳业的上市,这可能会提高投资者对该行业的兴趣,因为对优然的乐观情绪可能会提升其估值,而中国现代乳业可能会上演一场追赶戏。

- 更新后的市场共识是,预计21财年和22财年净利润增长分别为6.17%和38.8%,即12.3倍和8.8倍的预期市盈率。当前市盈率为13.1倍。彭博(Bloomberg) 未来12个月平均目标价为2.96港元。

Market Movers

Singapore

- LHN (LHN SP) Shares rose to a record of S$0.39 after Phillip Securities initiated coverage on the stock with a BUY recommendation and a target price of S$0.54. The company provides property management services to industrial, commercial and residential properties.

- Environ-Hub (ENVH SP) Shares rose after it announced that its associate company Pastel Gloves has received regulatory clearance from the US Food and Drug Administration (FDA) for its nitrile medical-grade examination gloves. Pastel Gloves will be able to export the medical-grade gloves for sale in the US, where they typically command an average selling price of 10-15% higher than normal gloves.

- Propnex (PROP SP) and APAC Realty (APAC SP) Real estate agencies gained on the buoyant property market in Singapore and likely on news that Singapore’s online real estate firm, PropertyGuru, is eyeing a US$2bn SPAC deal. Bloomberg reported that Bridgetown 2 Holding Ltd, a blank check company backed by billionaires Richard Li and Peter Thiel, is in advanced talks to merge with PropertyGuru, which is backed by private equity firms KKR and TPG Capital.

- Wing Tai (WINGT SP) The company bought back a total of 1.1mn shares over the last two days, the first share buyback it has conducted since 2018. The company currently trades at attractive valuations of only 0.4x historical P/B, a discount to the 10-year P/B average of 0.5x. Consensus has 2 BUY recommendations on the stock and a 12-month average target price of S$2.04 (+13% upside potential).

- Sunpower Group (SPWG SP) Shares declined slightly ahead of its ex-dividend date on Wednesday, 9 June 2021. The company will be paying out a S$0.1406 special dividend. Read our full report on Sunpower Group here.

Hong Kong

- Simcere Pharmaceutical Group Ltd (2096 HK) Shares closed at an all-time high. The Center for Drug Evaluation of the China National Medical Products Administration showed the company submitted the application of generic drug Edoxaban,a type of medicine known as an anticoagulant or blood thinner. The company is the first in China to submit such a type of medicine.

- AviChina Industry & Technology Co Ltd (2357 HK) Shares closed at a three-month high. UBS upgraded TP to HK$7.1 from HK$4.5 and maintained a BUY rating. It forecasts net profit CAGR over 2021-2023 to be more than 20%.

- China Youzan Ltd (8083 HK) Shares jumped but still closed below yesterday’s open price. It could be due to a technical rebound as shares dropped by 13.21% on Monday with a jump in volume.

- Orient Overseas (International) Ltd (316 HK) Shipping and ports sector stayed strong as shortage of containers remained. The respective 20ft and 40ft container prices jumped to the record high of US$3,600 and US$5,950 recently. Meanwhile, China released foreign trade data on Monday. Exports from China grew by 27.9% YoY to US$263.92bn in May, easing from a 32.2% surge in April and compared with market consensus of 32.1%. This marked the eleventh straight month of increase in outbound shipments, as more countries reopened their economies although higher raw material costs, global chip shortage, logistics bottlenecks and lower capacity in Guangdong due to the coronavirus outbreak weighed on sales.

- Chinasoft International Ltd (354 HK) Shares closed at an all-time high. The strong upward momentum was due mainly to the positive outlook of Huawei’s HarmonyOS. Huawei is the largest customer of the company. Recently, the software sector gained attraction from investors.

- Trading dashboard: Ping An Insurance (2318 HK) was added at HK$81. Haier Smart Home (6690 HK) was added at HK$30.5. China Molybdenum (3993 HK) was cut at HK$4.95.

Trading Dashboard

Related Posts: