Technical Analysis – 11 May 2022

United States | Singapore | Hong Kong

Visa Inc (V US)

- Shares are well supported around $190 at a double-bottom level.

- Both RSI and MACD are currently on a downtrend.

- Long – Entry 189.98, Target 207.75, Stop 180.68

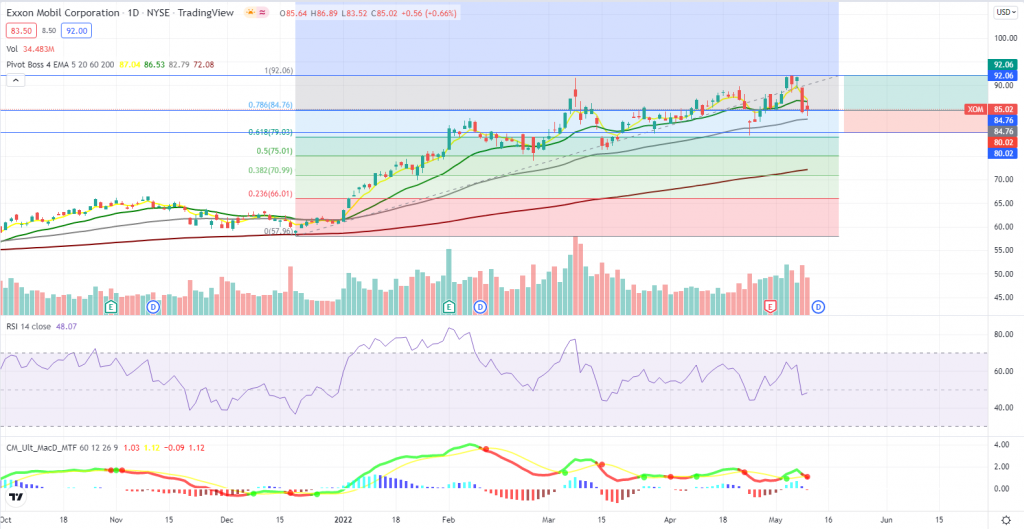

Exxon Mobil Corp (XOM US)

- Shares rebounded and closed above the fibbonaci trading range yesterday ($84.76 to $90.06).

- Both RSI and MACD are currently on a downtrend.

- Long – Entry 84.76, Target 92.06, Stop 80.02

ST Engineering (STE SP)

- Shares formed a triple bottom and rebounded from that level yesterday.

- RSI is moving sideways while MACD is on a downtrend.

- Long – Entry 3.99, Target 4.16, Stop 3.93

Jiutian Chemical (JIUC SP)

- Previous resistance level is now the short-term support level.

- RSI is constructive while MACD is converging towards the signal line.

- Long – Entry 0.096, Target 0.105, Stop 0.092

Tsingtao Brewery Co Ltd (168 HK)

- Shares retested the previous lows and closed near the intraday high with an increase in volume.

- MACD remains constructive, while RSI shows a sign of consolidation.

- Long – Entry: 59.0 Target: 65.0, Stop: 56.0

Sinopharm Group Co. Ltd (1099 HK)

- Shares formed a bullish engulfing pattern with a jump in volume.

- Both MACD and RSI are constructive.

- Long – Entry: 17.8, Target: 18.8, Stop: 17.3