凯基每日荐股- 2021年6月4日

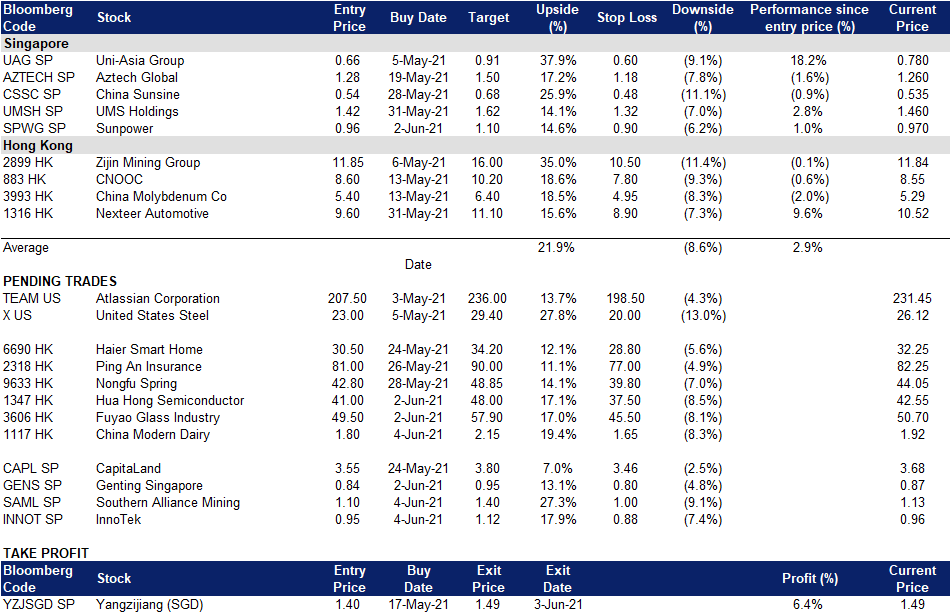

新加坡股票推荐

Southern Alliance Mining (SAML SP): Iron ore back to the moon

- BUY Entry – 1.10 Target – 1.40 Stop Loss – 1.00

- SAML is a high-grade iron ore miner and processor in Malaysia. The company sells iron ore of low levels of impurities with total Fe grade of between 62% to 65% to steel mills and trading companies mainly located in Malaysia and China. It also sells pipe coating materials that are crushed iron ore with a natural characteristic of a higher density for subsea pipes.

- SAML’s primary mining asset, the Chaah Mine, is an open mine pit consisting of two mining leases and covering an aggregate area of 225.7 hectares. The Chaah Mine is strategically located near existing road networks to ports. The company’s established supporting infrastructure and facilities consist of four fixed crushing plants, two lines of mobile crushers and two beneficiation plants both capable of operating on a 24-hour shift. The company has an approximate monthly production capacity of 60,000 tonnes of iron ore concentrates (not including pipe coating materials).

- SAML’s 1HFY2021 net profit surged 47% YoY to MYR 51mn from MYR 35mn in the prior year period, driven by higher average realised selling price (ARSP) of iron ore concentrate. While current valuations are expensive, we expect further upside to miners as iron ore prices remain elevated due to strong demand.

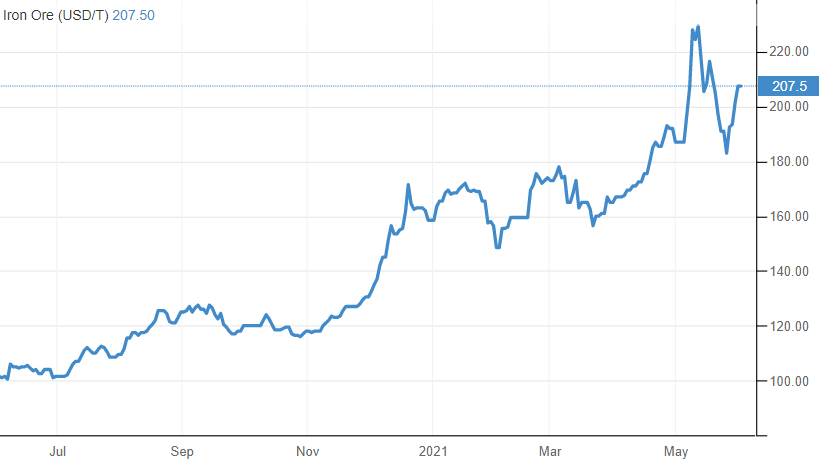

- Spot iron ore prices surged above US$200 for the second time this year on media reports that the Chinese steel hub of Tangshan may plan to ease requirements for production cuts at its mills. Earlier in May 2021, iron ore prices broke US$200/ton for the first time on record due to strong Chinese demand, but fell after the Chinese government stepped in to cool prices. However, steel demand, a key driver of iron ore prices, is surging as countries reopen, while large miners are hampered by operational issues, further tightening iron ore supply. The decarbonation trend in the US, Europe and China is also generating additional demand for metals.

- We expect a surge in China’s iron ore imports in around June or July 2021, which would help lift up prices. Read our industry report here.

Iron Ore Prices (1-Year), US$/ton

Iron Ore Prices (2008-2021), US$/ton

InnoTek (INNOT SP): EV fEVer

- RE-ITERATE BUY Entry – 0.95 Target – 1.12 Stop Loss – 0.88

- InnoTek is a precision metal components manufacturer serving the consumer electronics, office automation and mobility device industries. The company has a strong and diversified base of Japanese and European end-customers.

- Auto is the way. FY20 results was a show of resilience and InnoTek performed largely above our expectations. Through the annual report and annual general meeting, management has communicated strong expectations for the automotive division, led by a strong push for electric vehicles in China.

- 30% CAGR for EV in next 5 years. IHS Markit expects light vehicle sales to grow at 6% CAGR from 2020 to 2023, with electric vehicles (EV) to lead growth at over 30% CAGR in the next 5 years. In response, InnoTek has managed to secure customers in the EV space, and can reasonably expect the automotive division to become their largest division in subsequent years.

- 1Q21 unaudited results are promising. InnoTek provided 1QFY21 results during its Annual General Meeting, where sales of S$42.3mn are up 25% YoY with a net profit of S$2.47mn. We think these figures are within range of our improved FY21 estimates.

- Maintain OUTPERFORM with higher TP of S$1.12. We expect InnoTek’s strategy to drive a recovery in both the top and bottom line. Our 5.5x EV/EBITDA peg translates to around 14.3x FY22F P/E.

- Read our latest report here.

港股推荐

现代牧业 (1117 HK):同行的上市可能会产生连带效应

- Buy Entry – 1.8 Target –2.15 Stop Loss – 1.65

- 中国现代牧业控股有限公司是一家主要从事生产及销售牛奶业务的投资控股公司。该公司通过两个业务分部进行运营。奶牛养殖分部饲养奶牛以生产及销售原料奶。液态奶产品生产分部生产及销售加工液态奶。该公司也通过其子公司从事生产牧草及销售饲料业务。

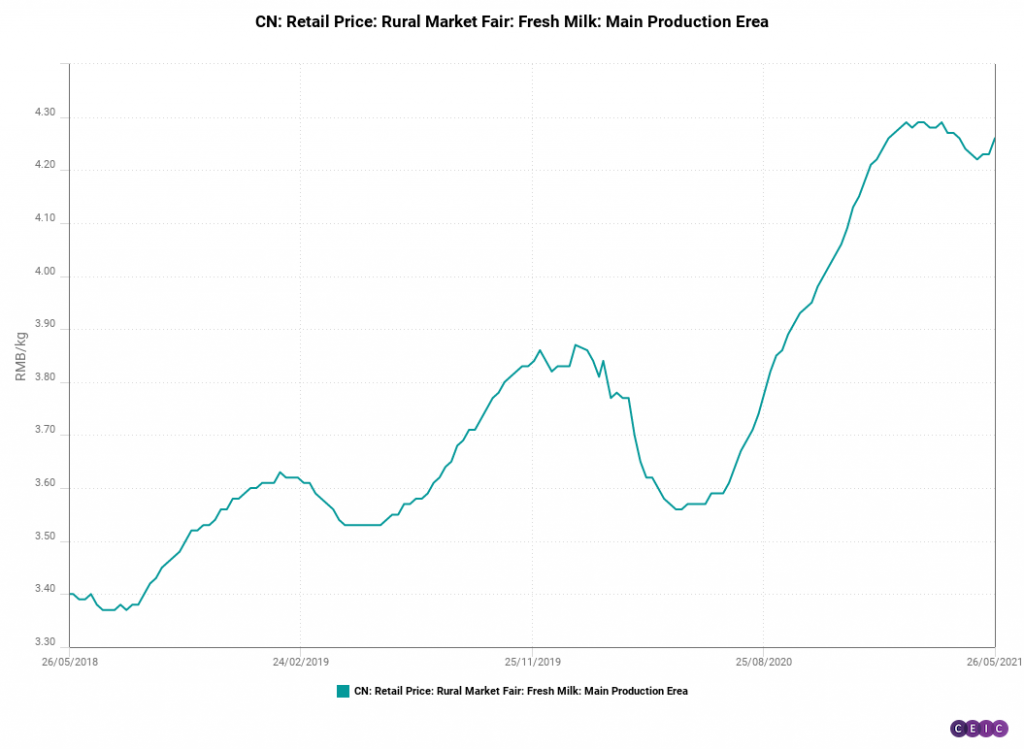

- 鲜奶价格从4.22元/公斤反弹至4.26元/公斤。年初至今高点为4.29元/公斤。

- 自3月底以来,该股一直在盘整,波动区间在1.8港元至2.0港元之间。

- 近期的催化剂是同行企业优然乳业的上市,这可能会提高投资者对该行业的兴趣,因为对优然的乐观情绪可能会提升其估值,而中国现代乳业可能会上演一场追赶戏。

- 更新后的市场共识是,预计21财年和22财年净利润增长分别为6.17%和38.8%,即12.3倍和8.8倍的预期市盈率。当前市盈率为13.1倍。彭博(Bloomberg) 未来12个月平均目标价为2.96港元。

海尔智家(6690 HK):家用电器打折销售

- 买入:买入价:30.5,目标价:34.2,止损价:28.8

- 海尔智家股份有限公司(原名:青岛海尔股份有限公司)是一家主要从事家用电器的研发、生产和销售业务的中国公司。该公司主要产品包括冰箱/冷柜、洗衣机、空调、热水器、厨电、小家电和U-home智能家居产品等。该公司还为顾客提供智能家电成套解决方案。该公司还从事提供渠道综合服务业务,包括物流以及家电与其他产品的分销业务。该公司的产品销往中国国内市场与海外市场。

- 自3月份以来,该公司股价一直在28港元至34港元之间波动。过去一个季度以及目前主要的利空主要是铜和钢等材料成本的上涨,这导致利润率受压。由于中国家电市场在经济上是典型的完全竞争市场,即使是像海尔这样的市场领导者也很难通过提高销售价格来将成本的增加转嫁给终端消费者。然而,材料价格不会长期维持在高位,因此,我们预计利润率的压缩是暂时的,盈利能力将在21年第三季度或第四季度恢复正常。

- 21财年第一季度业绩简要:

| (10亿人民币) | 21财年1季度 | 20财年1季度 | 同比(%) |

| 收入 | 54.8 | 43.1 | 27% |

| 毛利率 (%) | 28.5 | 27.5 | 1百分点 |

| 除税及少数股东权益利润 | 3.1 | 1.1 | 185.3% |

- 2021年第一季度国内家电销售额达1,640亿元,同比增长40%。物联网、智能家居、数字化转型和高端品牌发展是海尔持续发展的催化剂。

- 市场对21财年和22财年预期每股收益同比增长分别为2.51%和23.05%,即预期市盈率分别为19.6倍和15.9倍。当前市盈率为20.1倍。彭博(Bloomberg) 未来12个月平均目标价为41.6港元。

交易龙虎榜

Related Posts: