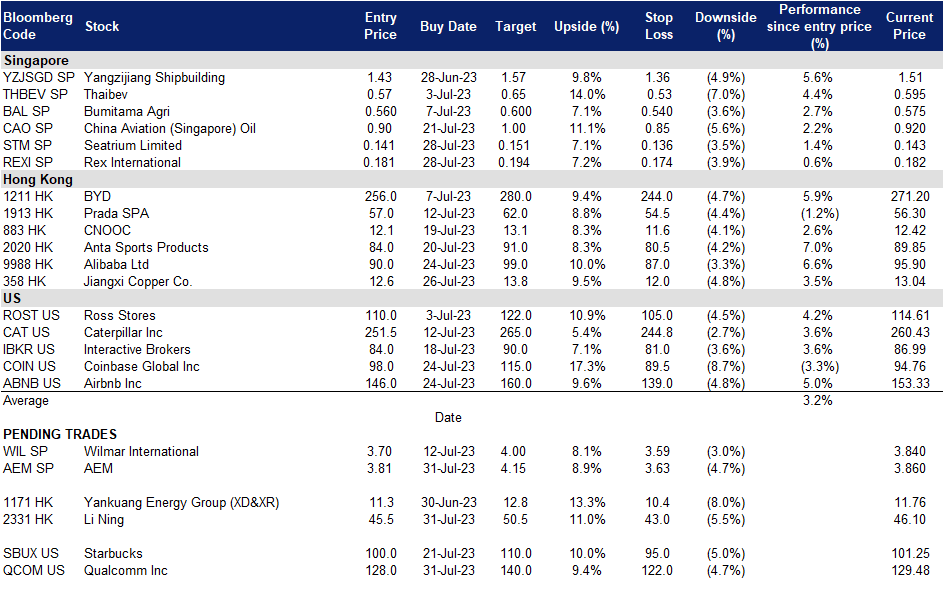

31 July 2023: AEM Holdings Ltd (AEM SP), Jiangxi Copper Co. (358 HK), Qualcomm Inc (QCOM US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

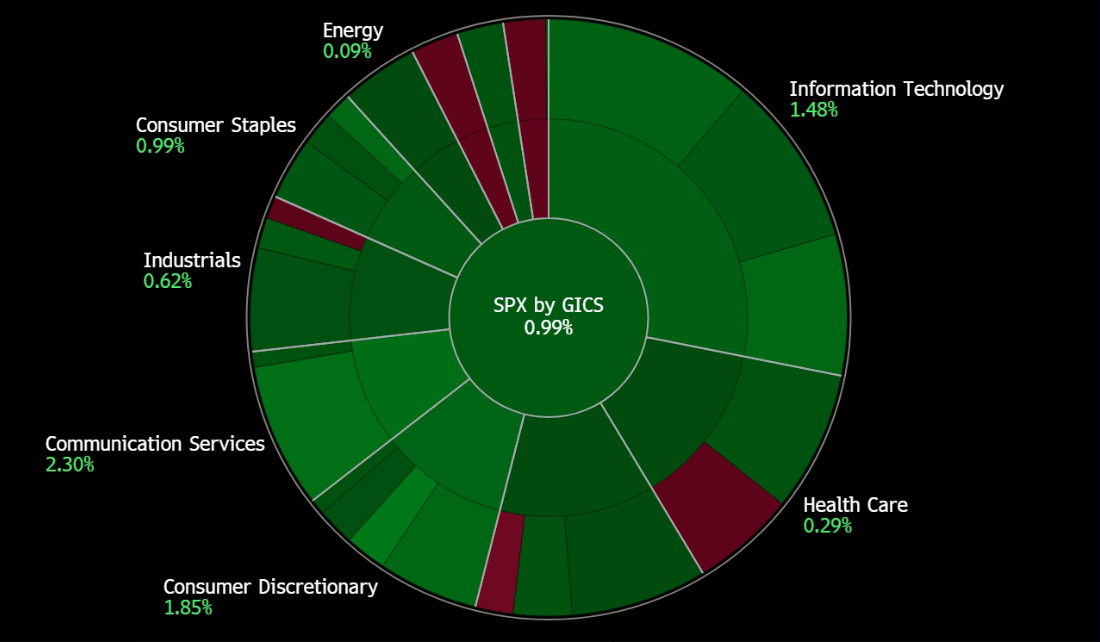

United States

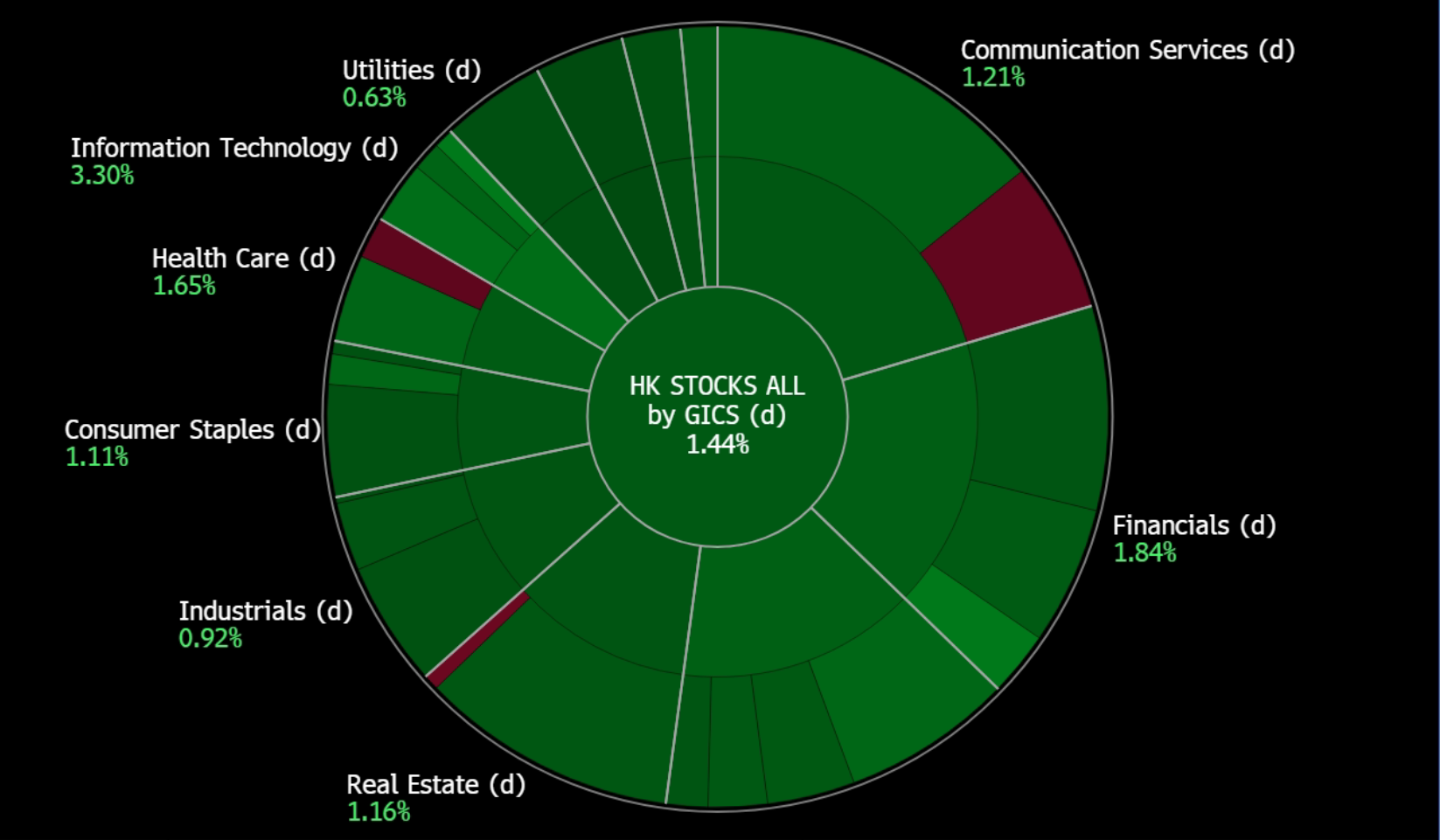

Hong Kong

AEM Holdings Ltd (AEM SP): Positive signs from Intel

- BUY Entry 3.81 – Target – 4.15 Stop Loss – 3.63

- AEM Holdings Limited is a Singapore-based company, which offers application specific-intelligent system test and handling solutions for semiconductor and electronics companies serving computing, fifth generation (5G) and artificial intelligence (AI) markets. Its segments include Equipment systems solutions (ESS), System Level Test & Inspection (SLT-i), Micro-Electro-Mechanical Systems (MEMS), Test and Measurement Solutions (TMS) and Others.

- Intel showed an early sign of recovery. Last week, Intel released better-than-expected 2Q23 earnings. Revenue beat estimates by US$760mn though it dropped by 15.7% YoY to US$12.9bn. Non-GAAP EPS was US$0.13, beating estimates by US$0.16. Intel turned profitable after two prior consecutive loss-making quarters. The company guided 3Q23 adjusted EPS to be US$0.2, topping estimates of US$0.13. Its Client Computing segment delivered 17.5% QoQ growth and arrived at US$6.78bn due mainly to strong demand for Chromebooks and high-end notebooks. Data center & AI segment grew by 26.0% QoQ to US$4.00bn. The company’s foundry unit revenue surged 96.6% QoQ to US$232M. The turnaround in 2Q23 showed an early sign that the PC cycle was bottoming out.

- Legal dispute settled. AEM announced that it has agreed to pay US$20mn to settle a legal dispute with two American companies, Advantest America and Advantest Test Solutions. US$9mn and US$11mn would be paid in 2Q23 and 3Q24 respectively with internal resources. It is expected that the payment has a minimal impact on its operations.

- 1Q23 earnings review. Revenue fell by 41.7% YoY to S$152.7mn. Profit before tax fell by 69.8% YoY to S$19mn. The company guided its full-year revenue target to be S$500mn.

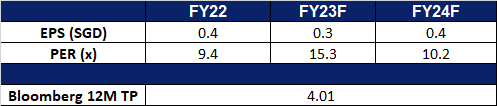

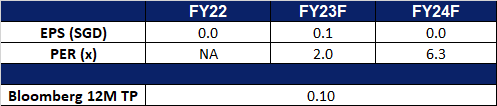

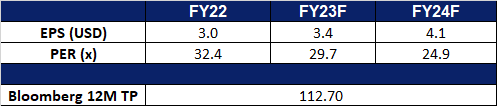

- Market Consensus.

(Source: Bloomberg)

Rex International Holding Ltd (REXI SP): Oil bottoming out

- RE-ITERATE BUY Entry 0.181 – Target – 0.194 Stop Loss – 0.174

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- OPEC+ cuts. Saudi Arabia and Russia, the world’s top oil exporters, have announced deeper oil cuts to support oil prices despite concerns over a global economic slowdown and potential interest rate increases from the U.S. Federal Reserve. Saudi Arabia will extend its voluntary oil output cut of one million barrels per day (bpd) for another month until August, and Russia will cut its oil exports by 500,000 bpd in August. These cuts amount to 1.5% of global supply and bring the total pledged by OPEC+ to 5.16mn bpd. Algeria will also make an extra 20,000-barrel cut in August to support market balance efforts. OPEC+ already has in place cuts of 3.66mn bpd. Oil prices have shown signs of increase as supplies tighten due to the oil cuts.

- China stimulus expectations. China’s leaders have pledged to step up policy support for the economy, focusing on boosting domestic demand, amid a post-COVID recovery. This includes expanding domestic demand, increasing residents’ incomes to drive consumption-led economic growth, and promoting investment in various sectors, including autos, electronics, household products, and tourism. The government will also adjust property policies to address changes in the property market and resolve local government debt risks. Chinese authority’s actions and focus on domestic demand could have an impact on oil demand as it is the world’s second-largest oil consumer. With the Chinese government planning to ramp up economic activity, oil demand is expected to rise, potentially leading to higher oil prices as demand outpaces supply.

- Russia lower export discount. Russia’s finance ministry intends to reduce the discount used to calculate taxes on crude oil exports from $25 to $20 per barrel. This decision comes in response to Western sanctions, including a $60 per barrel price cap on Russian crude exports and the EU’s import ban, affecting Russia’s oil sales. The discount is based on Russia’s dominant Urals blend of crude oil. The ministry is also exploring further measures to improve tax calculations on oil exports. As a result of the reduced discount, purchasers of Russian crude oil exports will face higher costs per barrel.

- Oman and Norway oil production. In June, Rex International Holding’s unit, Masirah Oil, reported an average oil production of 3,364 stock tank barrels per day from the Yumna Field in offshore Block 50 Oman. Rex International holds a 91.81% stake in Masirah Oil. Additionally, Rex International’s subsidiary, Lime Petroleum, recorded oil production of 4,370 barrels of oil equivalent per day from the Brage Field in Norway and 1,907 barrels of oil equivalent per day from the Yme Field in the same month. Lime Petroleum holds a 33.8% interest in the Brage Field and a 10% interest in the Yme Field.

- FY22 results review. Rex International posted a loss of US$1mn versus a net profit of US$67.2mn in 2021. Revenue for the financial year from crude oil sales was up 7% to US$170.3mn.

- Market Consensus.

(Source: Bloomberg)

Li Ning Co. Ltd. (2331 HK): Sport galas

- BUY Entry – 45.5 Target – 50.5 Stop Loss – 43.0

- Li Ning Company Limited is principally engaged in brand development, design, manufacture and sale of sport-related footwear, apparel, equipment and accessories in the People’s Republic of China (the PRC). The Company is also engaged in the manufacture, development, marketing, distribution and sales of sports products under several other brands, including Double Happiness (table tennis), AIGLE (outdoor sports) and Lotto (sports fashion). Through its subsidiaries, the Company is also engaged in the provision of information technology services.

- Upcoming sport galas. China will be hosting the 31st FISU Summer World University Games in Chengdu from 28th July 2023 to 8th August 2023. The event will bring together student-athletes from across the globe and allow them to showcase their skills, forge friendships and realize their dreams. China will also be hosting the 19th Asian Games in Hangzhou, from 23rd September 2023 to 8 October 2023. Increasing sporting activities is likely to drive the demand for sporting apparel and goods, and Li Ning would be able to ride on the demand for these goods to drive sales volume.

- Increase R&D efforts to strengthen its supply chain. The company is significantly boosting its investment in the construction of its inaugural self-built intelligent plant. This strategic move marks a departure from outsourcing practices and aims to enhance control over costs and product quality in the fiercely competitive market. The company plans to allocate RMB 3.3bn for establishing its factory in the southwestern Guangxi Zhuang Autonomous Region, a substantial increase from the earlier budget of RMB 1.5bn. By making this transition to in-house manufacturing, Li Ning anticipates strengthening its ability to manage costs and ensure superior product quality, ultimately bolstering its reputation in the industry.

- FY22 earnings. Revenue rose to RMB25.8bn, up 14.3% YoY from RMB22.6bn in FY21. Net profit increased slightly from RMB 4.01bn in FY21 to RMB4.06bn in FY22, remaining at a healthy level of 15.7%.

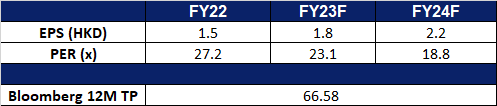

- Market Consensus.

(Source: Bloomberg)

Jiangxi Copper Co. (358 HK): Further easing property regulations

Jiangxi Copper Co. (358 HK): Further easing property regulations

- RE-ITERATE BUY Entry – 12.6 Target – 13.8 Stop Loss – 12.0

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- Support for the property sector. The latest Politburo meeting in China indicated increased backing for the struggling real estate sector while also committing to bolster consumption and address local government debt. President Xi Jinping is embracing a more supportive approach, emphasizing the idea that “housing is for living, not for speculation.” He also recognized a “significant” shift in the supply and demand dynamics of the property market. During the meeting, it was underscored that China could reconsider its stringent measures that had previously been implemented in first- and second-tier cities, with the aim of timely adjustments and optimizations of policies. An extension of the 16-item guideline which was implemented last year until December 31, 2024, will provide financial institutions with a boost to negotiate outstanding loans with real estate enterprises, promoting a market-friendly approach and protecting creditors’ rights. These policy support for the real estate economy in China is likely to drive the demand for construction materials including copper.

- Copper futures rebounded. Due to China’s favourable economic stimulus plan released on Monday, copper futures rebounded more than 1.8% on Tuesday.

Copper futures price trend

(Source: Bloomberg)

- 1Q23 earnings. Revenue rose to RMB127.7bn, up 4.57% YoY. Gross profit dropped by 7.5% to RMB3.3bn. Net profit was RMB 1.76bn, up 19.1% YoY.

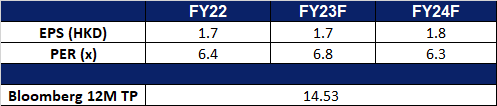

- Market Consensus.

(Source: Bloomberg)

Qualcomm Inc (QCOM US): AI on the go

- BUY Entry – 128 Target – 140 Stop Loss – 122

- Qualcomm Incorporated operates as a multinational semiconductor and telecommunications equipment company. The Company develops and delivers digital wireless communications products and services based on CDMA digital technology. Qualcomm serves customers worldwide.

- AI on mobile. Qualcomm has made significant breakthroughs in bringing AI out of the cloud and onto mobile devices. It demonstrated successfully optimised AI text-to-image rendering model, Stable Diffusion, running on an Android phone, making it possible to run generative AI services on smartphones efficiently without internet connectivity. The company achieved this by quantising the AI models from 32-bit floating point to 8-bit integer precision, maintaining nearly the same level of accuracy but with significantly better performance on low-power Snapdragon AI accelerators. Qualcomm’s AI model efficiency toolkit enabled accurate 8-bit integer quantisation, and it also pioneered the use of even less complex 4-bit integer operations (INT4) to further reduce computational resource requirements for on-device machine learning.

- Collab with Meta. Qualcomm and Meta Platforms are teaming up to bring AI-powered services to flagship Android devices in 2024, using Meta’s Llama 2 generative AI. The collaboration aims to enable on-device AI implementations, reducing the need for cloud services and allowing for private, reliable, and personalised XR experiences. Qualcomm plans to make the Llama 2-based AI available from 2024 and offers developers tools to optimise applications for on-device AI using the Qualcomm AI Stack. Resulting in potential implications for the augmented and virtual reality market, benefiting both companies and positioning Qualcomm well for future growth.

- 2Q23 earnings review. Revenue fell 16.9% YoY to $9.27bn, beating estimates by $151.04mn. GAAP earning per share was $1.52, $0.20 below expectations.

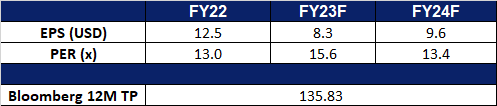

- Market consensus.

(Source: Bloomberg)

Starbucks Corp (SBUX US): BLACKPINK in your drink

Starbucks Corp (SBUX US): BLACKPINK in your drink

- RE-ITERATE BUY Entry – 100 Target – 110 Stop Loss – 95

- Starbucks Corporation is the premier roaster, marketer, and retailer of specialty coffee. The Company offers packaged and single-serve coffees and teas, beverage-related ingredients, and ready-to-drink beverages, as well as produces and sells bottled coffee drinks and a line of ice creams. Starbucks serves customers worldwide.

- Partnership with BLACKPINK. Starbucks recently unveiled an exclusive fan experience, exclusive to the Asia Pacific region, commencing on 25 July, featuring a BLACKPINK-themed Frappuccino and limited-edition merch collection. This collaboration with one of today’s biggest icons resonates with Starbucks’ dedication to uplifting customers and fans through meaningful connections, creating an unforgettable Starbucks Experience. The accompanying limited-edition merch collection boasts 11 drinkware styles and six lifestyle accessories in a striking pink and black color palette. The partnership, available at select Starbucks locations across Hong Kong, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan, Thailand, and Vietnam, aims to attract BLACKPINK fans, affectionately known as “Blinks,” capitalizing on the K-pop frenzy to potentially boost sales. Notably, this collaboration marks the first regional-scale partnership and menu item development for Starbucks, signifying their confidence in this collaboration with global icons.

- Expansion opportunity. Intense competition among global coffee chains like Starbucks and Costa, and local players such as Luckin Coffee and Manner Coffee, has driven a proliferation of coffee shops across countries, leading to a significant surge in coffee consumption. This trend is further fuelled by the growing demand for coffee makers and beans sourced internationally. Capitalising on immense growth prospects, Starbucks identifies substantial opportunities for expansion in China, where coffee consumption is on the rise due to increasing affluence and population. With rising coffee consumption in cities and a sizable middle-income consumer group, China remains a pivotal market for the coffee industry. Both global and domestic coffee chains are prioritising human connections, optimising performance, and investing in digital capabilities and innovation. In this pursuit, they are allocating more resources and manpower to penetrate smaller cities in China, aiming to tap into a larger consumer base while benefiting from lower costs in terms of management, labor, and rent compared to major cities. This strategic move enables large on-premise coffee brands to thrive and consolidate their presence in China’s rapidly evolving coffee landscape.

- Strength in its branding. Starbucks is poised to leverage the ongoing growth of the coffee industry and favorable customer preferences, ensuring continued success. Moreover, the company’s strong position is evident in its capacity to navigate potential economic downturns effectively. This resilience is attributed to its loyal membership program and a customer base that boasts relative affluence. These factors collectively fortify Starbucks’ market standing and reinforce its ability to thrive even in challenging economic conditions.

- 2Q23 earnings review. Revenue rose 14.5% YoY to $8.7bn, beating estimates by $270mn. Non-GAAP earnings per share was $0.74, $0.09 above expectations.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Live Nation Entertainment (LYV US) at US$100. Add Seatrium Ltd. (STM SP) at S$0.141 and Rex International (REX SP) at S$0.181.