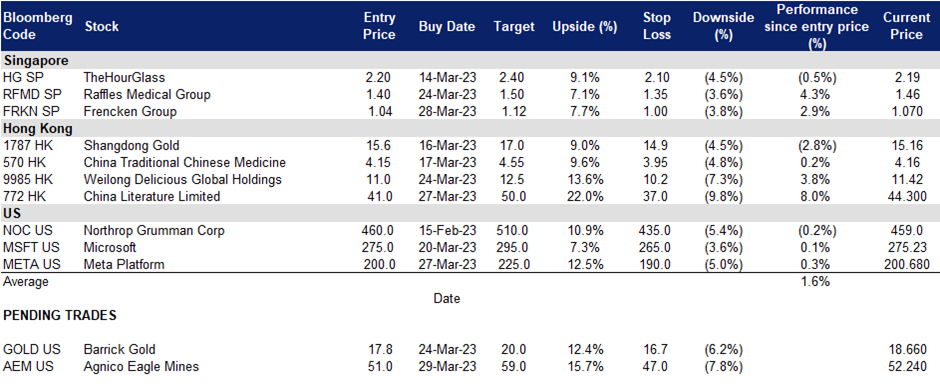

29 March 2023: Frencken Group Ltd (FRKN SP), China Literature Limited (772 HK), Meta Platforms Inc (META US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Frencken Group Ltd (FRKN SP): Ride on the AI bandwagon

- RE-ITERATE BUY Entry 1.04 – Target – 1.12 Stop Loss – 1.00

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial and semiconductor industries.

- Interest rates forecasted to decline. The US Federal Reserve recently raised interest rates by another 25 basis points in the March FOME meeting, which aligns with market expectations of a lower rate hike or no increment of interest rates. Market foresees the rate hike cycle to end in May, and there will be a 100bps cut in 2H23. Falling rates favour higher valuations of the semiconductor sector.

US Fed fund rate projection

(Source: Bloomberg)

- AI bandwagon. Artificial intelligence is gaining more attention with the release of new innovative AI technologies and more investors hopping onto the AI bandwagon. With the development of more AI systems, the production of newer and more powerful chips will be in demand. Frencken will need to be more innovative and increase existing production in order to meet the rise in demand for chips.

- FY22 results review. Revenue moderately rose 2.5% YoY to S$786.1mn from S$767.1mn. Gross profit declined by 7.7% YoY to S$119.0mn. Net profit attributable to shareholders of the company dropped by 11.7% to S$51.9mn.

- Updated market consensus of the EPS in FY24/25 is 8.7%/4.0% respectively, which translates to 8.5x/8.2x forward PE. Current PER is 8.7x. Bloomberg consensus average 12-month target price is S$1.09.

(Source: Bloomberg)

Raffles Medical Group Ltd (RFMD SP): A defensive stock amidst a market downturn

Raffles Medical Group Ltd (RFMD SP): A defensive stock amidst a market downturn

- RE-ITERATE BUY Entry 1.40 – Target – 1.50 Stop Loss – 1.35

- Raffles Medical Group is a leading integrated private healthcare provider in the region, operating medical facilities in thirteen cities in Singapore, China, Japan, Vietnam and Cambodia. The Group is the first Asian member of the Mayo Clinic Care Network. RafflesMedical clinics form one of the largest networks of private family medicine centres in Singapore. RafflesHospital, the flagship of Raffles Medical Group, is a private tertiary hospital located in the heart of Singapore offering a wide range of specialist medical and diagnostic services for both inpatients and outpatients.

- Post-COIVD era tailwinds. Singapore continues to see an increase in foreign demand in the healthcare sector, with many foreigners opting for treatment in Singapore. As Singapore opens up its borders, foreign patients return to seek treatment at Raffles Hospital. Singapore residents who postponed their elective surgeries also returned for treatment. Meanwhile, inflation is expected to taper this year, and hence decreasing operating costs will continue to improve its profitability.

- Defensive counter amidst market turmoil. The recent banking crisis in the US and Europe markets resulted in rising bearish sentiments which more or less spread to the Asia market. The sell-down in the healthcare services sector creates a buying opportunity as the fundamental remains sound.

- FY22 results review. Revenue moderately rose 5.9% YoY to S$766.5mn. Operating profit jumped by 61.4% YoY to S$195.8mn. PATMI jumped by 70.5% YoY to S$143.5mn.

- Updated market consensus of the EPS in FY24/25 is 1.9%/3.7% respectively, which translates to 20.0x/20.6x forward PE. Current PER is 17.9x. Bloomberg consensus average 12-month target price is S$1.72.

(Source: Bloomberg)

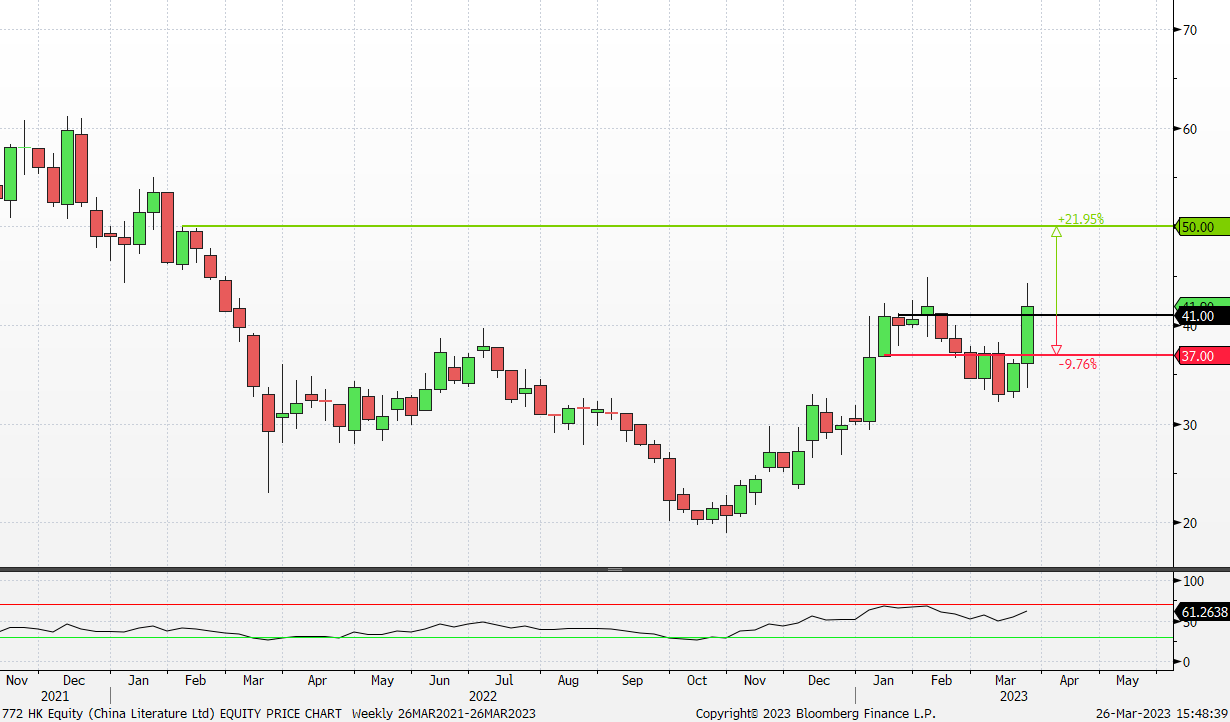

China Literature Limited (772 HK): Exploring AIGC-theme

- BUY Entry – 41.0 Target – 50.0 Stop Loss – 37.0

- CHINA LITERATURE LIMITED is a company principally engaged in the operation of online literature platform. The Company’s platform provides online readers with easy access to Company’s vast and diverse content library and enables a greater number of writers to create and publish original literary content online. Additionally, the Company able to extend the monetization lifecycle of Company’s content for our writers through Company’s intellectual property operation by managing and licensing Company’s content for adaptation into other entertainment formats.

- A new model to monetise digital content. The most disruptive technological product, ChatGPT created a new direction of artificial development. The AI generative content (AIGC) requires abundant content input for the AI engine to train. The intellectual properties (IPs) owned by the company is a gold mine for AI companies which are developing large language model engine. AIGC technology + IPs could be a new business model for the company to commercialize and monetize its assets.

- FY22 business review. The company’s online reading platform added approximately 540,000 writers, 950,000 literacy works and over 39bn Chinese characters. The number of online literary works that newly reached 3,000 average subscribers per chapter in 2022 increased by more than 50% YoY.

- FY22 earnings review. Revenue declined by 12% YoY to RMB7.6bn. Gross profit declined by 12.4% YoY to RMB4.0bn. Profit attributable to equity holders of the company dropped by 67.1% YoY to RMB608mn. Non-IFRS profit attributable to equity holders of the company grew by 9.6% YoY to RMB1.3bn.

- The updated market consensus of the EPS growth in FY23/24 is 152.9%/15.1% YoY respectively, which translates to 24.2x/21.0x forward PE. Current PER is 60.5x. Bloomberg consensus average 12-month target price is HK$45.01.

(Source: Bloomberg)

China Traditional Chinese Medicine Holdings Co. Ltd (570 HK): Health is Wealth

- RE-ITERATE BUY Entry – 4.15 Target – 4.55 Stop Loss – 3.95

- China Traditional Chinese Medicine Holdings Co. Limited is principally engaged in the manufacture and sales of traditional Chinese medicine (TCM) through its 12 subsidiaries.

- Reformed Healthcare insurance systems. Local governments recently announced reforming China’s healthcare system to improve the use of medical funds and help vulnerable populations like the elderly and those with chronic diseases, which is managed by the China authorities. The demand for and expenses associated with outpatient services are increasing as society develops. More individuals paying out of their pocket for common illnesses would be able to make use to these funds for treatment, hence increasing the demand for healthcare in China.

- Better medical and health systems. Chinese authorities has recently issued a set of guidelines to promote the sound development of the medical and health system in the country’s rural areas. The guideline highlighted the application of smart and digitalized technologies and the use of traditional Chinese medicine to allow residents to enjoy access to fairer and more systematical medical services in their vicinity.

- A defensive stock amidst a market downturn. The Hong Kong market has been hammered by both a slowdown in China’s economic recovery and banking crisis. Growth, value, and cyclical sectors, as well as other thematic stocks, have been sold off indiscriminately. However, this stock is relatively outperforming the rest as its business is largely immune to inflation and systemic risks. The business driver is the sales volume rather than profit margins.

- 1H22 earnings. Revenue rose by 41.9% YoY to RMB431.18mn. Gross profit increased by 108.2% YoY to RMB27.41mn. GPM was at 6.4% for 1H22 compared to 4.3% for 1H21.

- The updated market consensus of the EPS growth in FY23/24 is 67.7%/24.6% YoY respectively, which translates to 10.7x/8.6x forward PE. Current PER is 13.2x. Bloomberg consensus average 12-month target price is HK$5.07.

(Source: Bloomberg)

Meta Platforms Inc (META US): Benefit from indirect policy tailwinds

- RE-ITEREATE BUY Entry – 200 Target – 225 Stop Loss – 190

- Meta Platforms, Inc. engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs.

- Benefiting from the potential TikTok ban. The TikTok CEO’s congressional testimony last Thursday did not convince the US lawmakers that the short video platform has no threat to US national security. With the backdrop of deteriorating US-China relations, TikTok’s overseas operation will face more headwinds. However, other social media peers will take a big breath. Meta’s Reels as one of the benefactors is favoured indirectly by the policy tailwinds as Americans could be forced to switch from TikTok to Reels. In fact, Reels plays more than doubled in 2022.

- Back to the right direction. Meta has toned down the development of Metaverse which the market sees too ahead of the current trend. The company announced another round of layoff of 10,000 employees, following the previous round of 11,000 job cuts. The right-sizing accounts for 25% of the total employment. Meanwhile, Meta is one of a strong rivals to ChatGPT. It announced its latest AI language model, LLAMA, which is an open-source package that anyone in the AI community can request access to.

- 4Q22 earnings review. Revenue dropped by 4.5% YoY to US$32.2bn. GAAP EPS was US$1.76. 1Q23 revenue guidance ranges between US$26.0bn and US$28.5bn.

- The updated market consensus of the EPS growth in FY23/24 is 40.8%/23.1%, respectively, which translates to 20.7x/16.7x forward PE. Current PER is 18.7x. Bloomberg consensus average 12-month target price is US$225.63.

(Source: Bloomberg)

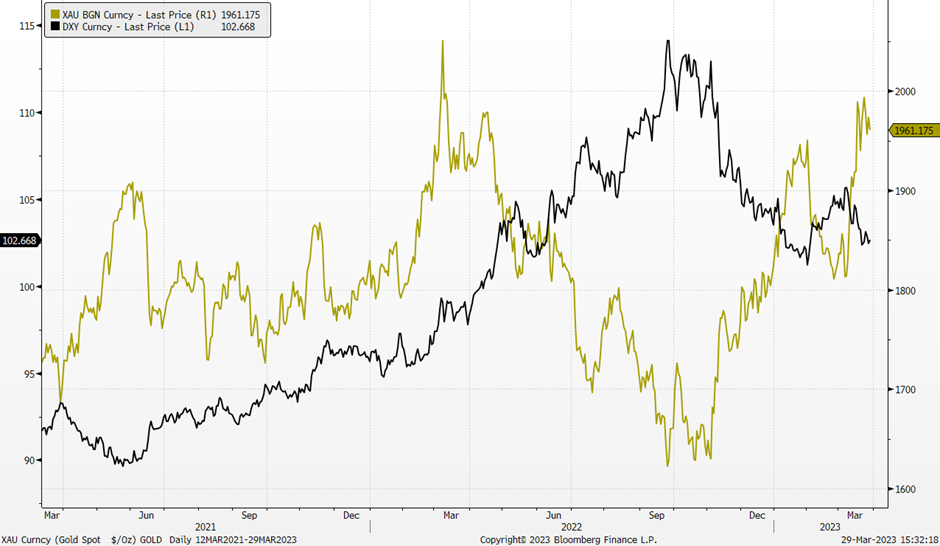

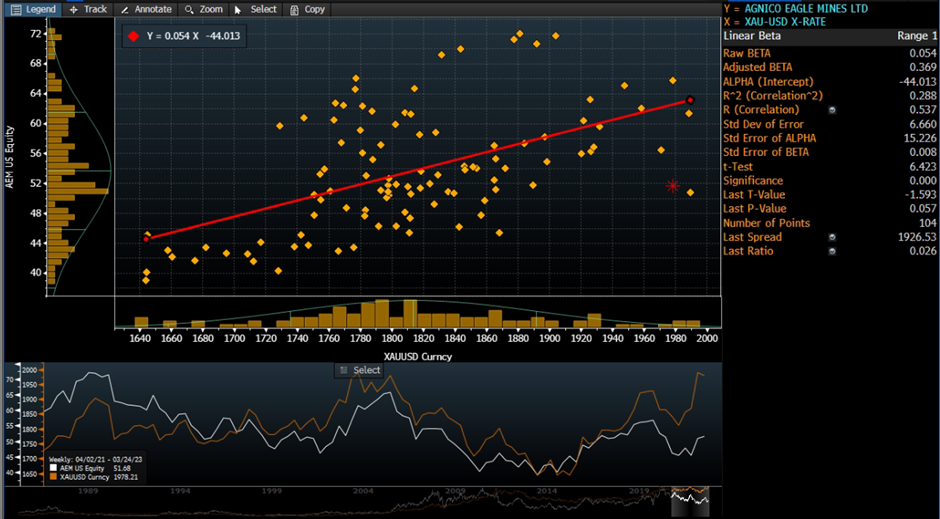

Agnico Eagle Mines Limited (AEM US): Gold back up

- BUY Entry – 51.0 Target – 59.0 Stop Loss – 47.0

- Agnico Eagle Mines Limited engages in the exploration, development, and production of mineral properties in Canada, Australia, Mexico, and Finland. The company primarily produces and sells gold deposits, as well as explores for silver, zinc, and copper deposits.

- Malfunction of the monetary system. The cent banking crisis in the US and Europe was due to liquidity concerns which led to a bank run. Though central banks reacted immediately to provide liquidity, the problem has not been resolved. Now, both the economy and markets are suffering from the backfire of decades of cheap credit. Central banks are confronting a dilemma between continual rate hikes to cool down inflation and pause/stop rate hikes from maintaining financial stability. The credibility of central banks is questioned, and investors’ confidence weakens gradually. Gold outshines on such a backdrop.

- Central banks are increasing gold reserves. According to Bloomberg, the People’s Bank of China raised its gold holdings by 30 tonnes in December 2022, and China’s central bank held a total amount of 2,010 tonnes of gold reserves as of January 2023. Russia increased its gold reserve by 1mn ounce to 74.9mn ounces as of February 2022. The Monetary Authority of Singapore’s bullion reserves rose to 6.4mn ounces at the end of January, up from 4.9mn ounces a month earlier.

- Better outlook for gold price in 2023. There are several factors that impact gold prices, and the key ones are the trend of the US dollar and global geopolitical risk. The broad market has expected that US dollars peaked last year as inflation has been on a downswing. Even though recent macro data such as CPI and core PCE prices showed overall prices were declining. The US job market started showing some weaknesses as the unemployment rate rose to 3.6% in February. The market expects Fed to cut rates in 2H23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold Price and Dollar Index Trend

- Mixed 4Q23 results. Revenue jumped by 45% YoY to US$1.38bn, missing estimates by US$40mn. Non-GAAP EPS was US$0.4, in line with estimates. The company guided gold production for 2023 to be 3.24mn to 3.44mn ounces, with total cash costs and all-in sustaining costs forecast at US$840-US$890/oz and US$1,140-US$1,190/oz, respectively.

- The updated market consensus of the EPS growth in FY23/24 is -8.9%/18.6%, respectively, which translates to 28.8x/24.3x forward PE. Bloomberg consensus average 12-month target price is US$59.83.

Agnico Eagle Mines VS Gold price

(Source: Bloomberg)

(Source: Bloomberg)

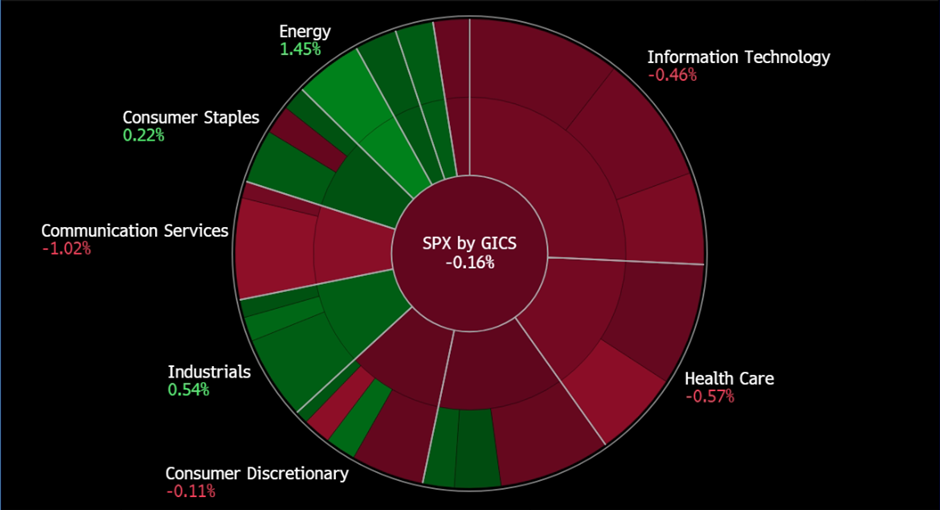

United States

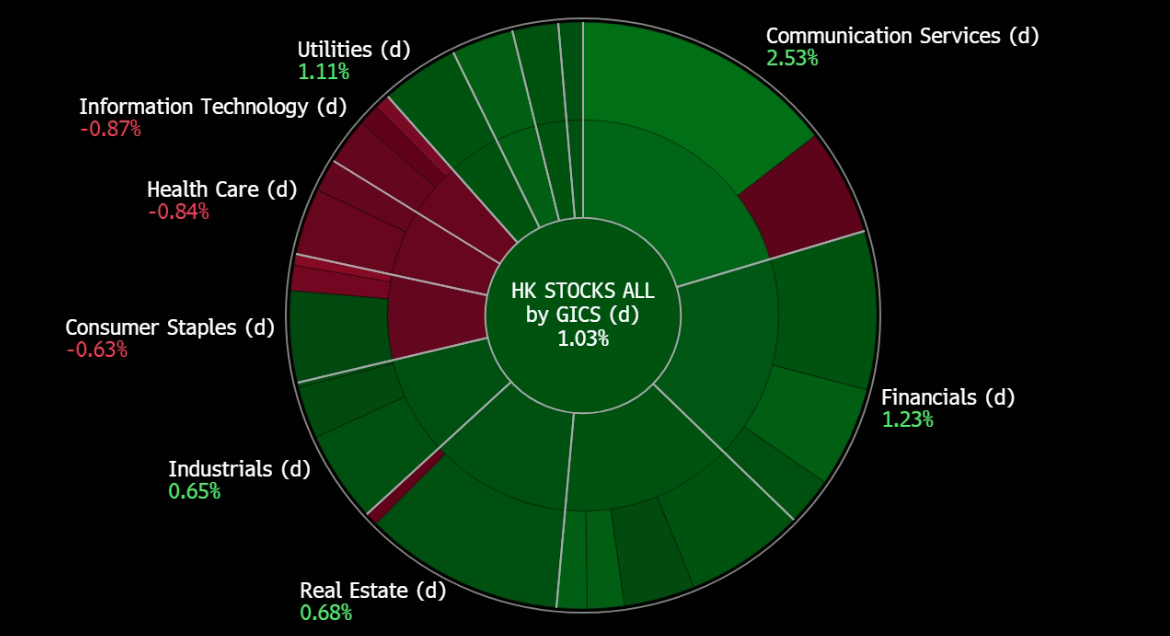

Hong Kong

Trading Dashboard Update: Add Frencken Group (FRKN SP) at S$1.04, China Literature (772 HK) at HK$41.0 and Meta Platform (META US) at US$200. Take profit on OCBC (OCBC SP) at S$12.45 and SenseTime (20 HK) at HK$2.70.