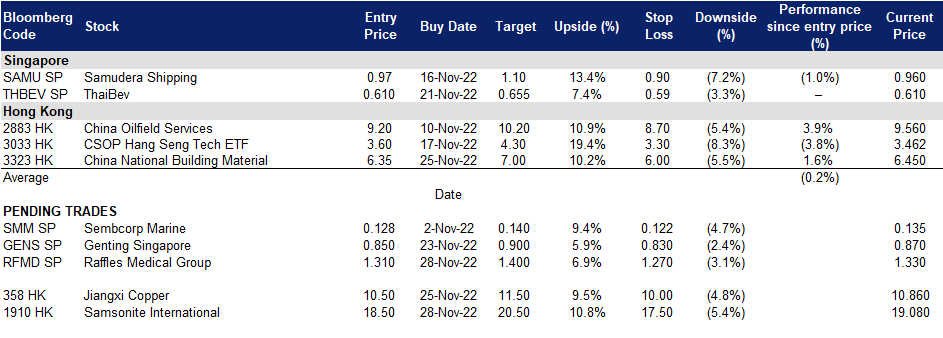

28 November 2022: Raffles Medical Group Ltd (RFMD SP), Samsonite International S.A. (1910 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Raffles Medical Group Ltd (RFMD SP): Travellers are back

- BUY Entry – 1.31 Target – 1.40 Stop Loss – 1.27

- Raffles Medical Group is a leading integrated private healthcare provider in the region, operating medical facilities in thirteen cities in Singapore, China, Japan, Vietnam and Cambodia. The Group is the first Asian member of the Mayo Clinic Care Network. RafflesMedical clinics form one of the largest networks of private family medicine centres in Singapore. RafflesHospital, the flagship of Raffles Medical Group, is a private tertiary hospital located in the heart of Singapore offering a wide range of specialist medical and diagnostic services for both inpatients and outpatients.

- Covid-19. Raffles Medical is still benefitting from being the largest Covid-19 service provider in Singapore. Even though the Covid-19 initiatives in the community have been reduced, they may still benefit from their partnership with the Ministry of Health on the Emergency Care Collaboration programme, with the recent bed crunch in public hospitals due to the Omicron XBB wave. Additionally, when China reopens, it will be able to serve more people in its medical facilities located in China.

- Pent-up demand. Singapore’s international visitor arrivals have been rising since the start of the pandemic, some of these tourists come to Singapore to receive treatment at Raffles Medical. The group will benefit from the recovery of elective procedures and the return of medical tourism, which will offset some tapering of Covid-19-related services. Furthermore, outpatient volumes at its general practitioner clinics have already surpassed pre-pandemic levels amid the ongoing wave of Covid-19 infections driven by the Omicron XBB sub-variant.

- 3Q22 results. Raffles Medical reported strong 3Q results ended in September, with a net profit growth of S$98.2 million, up 57.3% YoY. For the period, revenue grew 6.5% YoY to S$199.5 million while net profit surged by 62.1% YoY to S$38.3 million.

- Updated market consensus of the EPS growth in FY22/23 is 29.4%/-8.0% YoY respectively, which translates to 22.9x/25.1x forward PE. Current PER is 23.8x. Bloomberg consensus average 12-month target price is S$1.61.

(Source: Bloomberg)

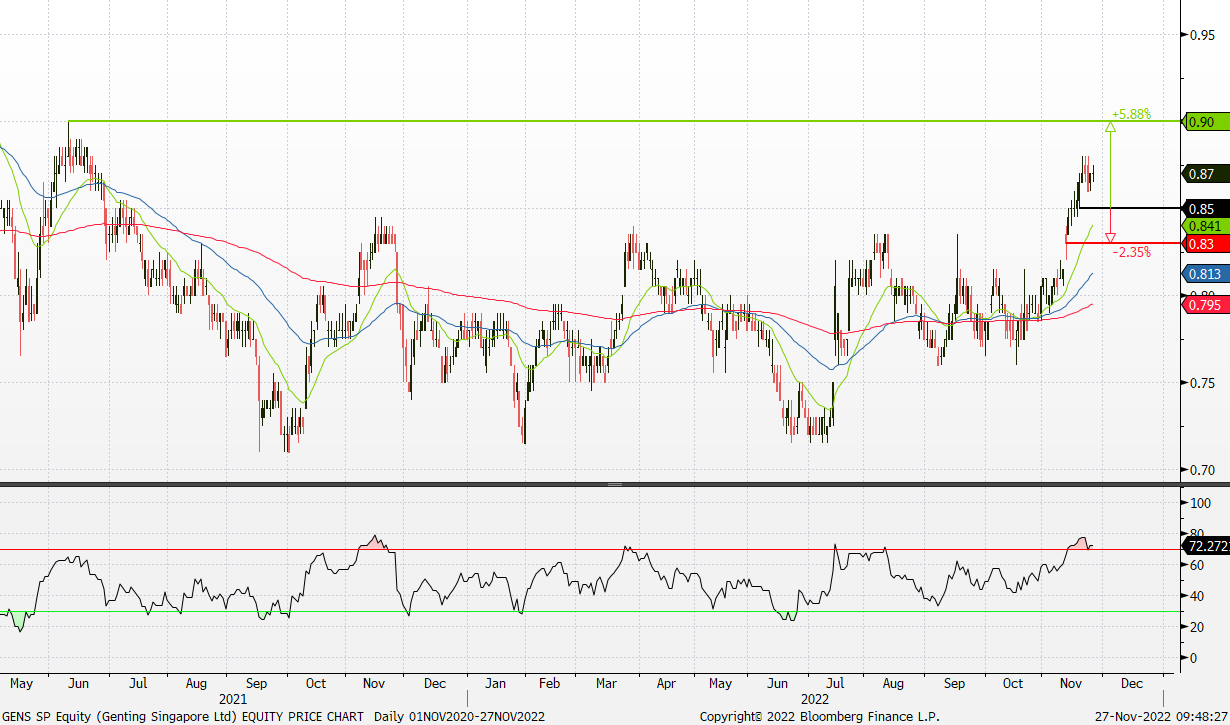

Genting Singapore Ltd (GENS SP): The year-end holiday season coming

- RE-ITERATE BUY Entry – 0.85 Target – 0.90 Stop Loss – 0.83

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index. The principal activities of Genting Singapore and its subsidiaries are in developing, managing and operating integrated resort destinations including gaming, hospitality, MICE, leisure and entertainment facilities.

- Pent-up demand for travel. Singapore’s international visitor arrivals rose for the ninth straight month, since the start of the pandemic, hitting a record of 816,758 tourists in October, according to the Singapore Tourism Board’s latest figures. Genting Singapore owns and operates Resorts World Sentosa (RWS) Integrated Resort which comprises six luxury hotels, a world-class convention centre, Universal Studios Singapore, a casino, and the S.E.A Aquarium and Adventure Cove waterpark. With more tourists coming to Singapore, RWS is a location that they are sure to visit as it consists of some main attractions in Singapore.

- Loosening of restrictions. Additionally, with the relaxation of Covid restrictions, more locals are able to visit RWS for a day of fun or even stay for a weekend. Furthermore, large-scale events such as international conferences and Halloween Horror Nights can once again be held with the loosened safe management measures and increased operating capacity.

- RWS 2.0 expansion. Genting Singapore’s $4.5 billion mega expansion of RWS is proceeding expeditiously as planned. RWS will add two new zones to Universal Studios Singapore – Minion Park and Super Nintendo World – as well as a new oceanarium. The Oceanarium will be three times the size of the SEA Aquarium and encompass a research and learning centre. RWS will also refurbish the Hard Rock Hotel Singapore, Hotel Michael and Festive Hotel, which have around 1,200 rooms in all, in phases from the second quarter of 2022 through 2023. Festive Hotel will be refashioned into a business-leisure and work-vacation hotel, while the Resorts World Convention Centre will be refurbished.

- 3Q22 results. Genting reported a significant improvement in its 3Q results ended in September. For the period, earnings reached $135.8 million, versus $60.7 million in the year-earlier; revenue in the same quarter was $519.7 million, more than double $251.5 million in 3QFY2021, led by increases in both gaming and non-gaming revenue. Non-gaming revenue soared 144.3% YoY to S$137.3 million.

- Updated market consensus of the EPS growth in FY22/23 is 92.9%/58.9% YoY respectively, which translates to 30.0x/18.5x forward PE. Current PER is 58.5x. Bloomberg consensus average 12-month target price is S$0.96.

(Source: Bloomberg)

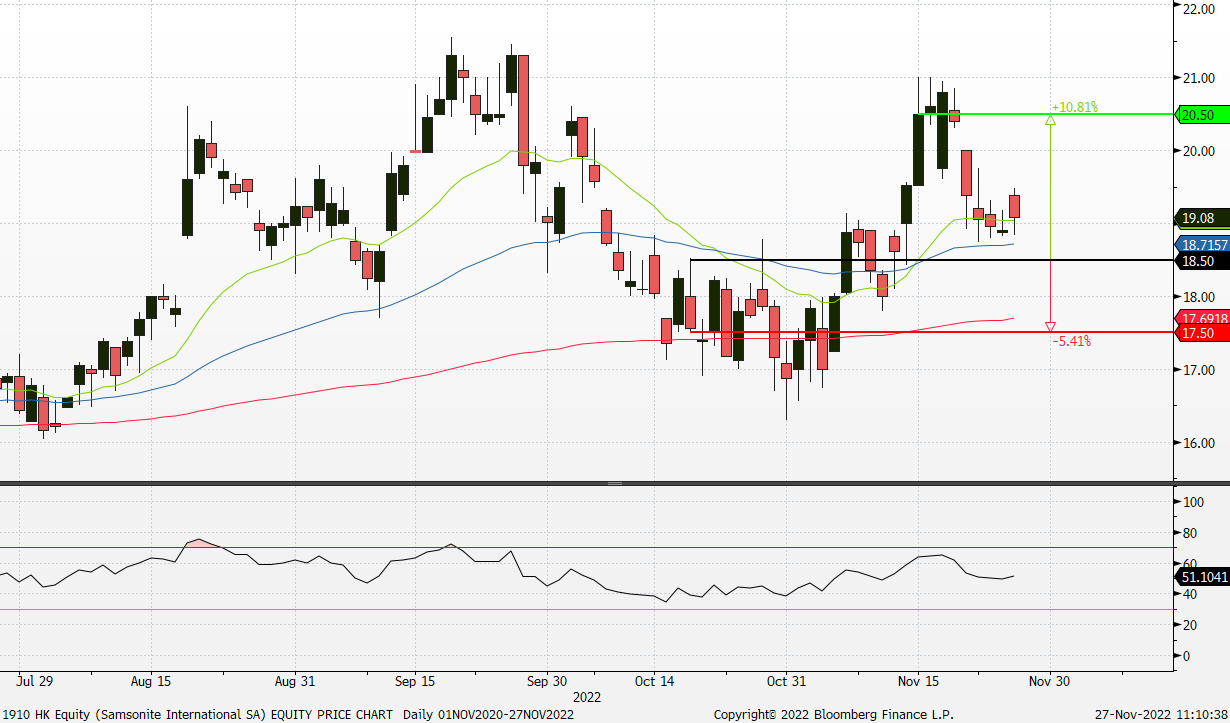

Samsonite International S.A. (1910 HK): Expecting a year-end rally during the holiday season

- Buy Entry – 18.5 Target – 20.5 Stop Loss – 17.5

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 3Q22 results review. Net sales jumped by 42.0% (+54.7% constant currency) YoY to US$790.9mn. Operating profit jumped by 140% YoY to US$121.8mn. Profit attributable to the equity shareholders arrived at US$58.2mn in 3Q22 compared to a loss of US$5.2mn in 3Q21. The turnaround of the business and financials was due mainly to the effects of the COVID-19 pandemic on demand for the Group’s products moderated in most countries due to the continued rollout and effectiveness of vaccines leading governments in many countries to further loosen socialdistancing, travel and other restrictions, which has led to the continuing recovery in travel. However, the Chinese government reinstated travel restrictions and social distancing measures in an effort to combat further outbreaks of COVID-19, which has slowed the Group’s net sales recovery in China.

- The updated market consensus of the EPS growth in FY22/23/24 is 1,300%/38.7%/18.5% YoY respectively, translating to 17.4×/12.6x/10.6x forward PE. The current PER is 10.5x. Bloomberg consensus average 12-month target price is HK$27.24.

(Source: Bloomberg)

China National Building Material Company Limited (3323 HK): Infrastructure expansion to revive growth

China National Building Material Company Limited (3323 HK): Infrastructure expansion to revive growth

- RE-ITERATE Buy Entry – 6.35 Target –7.00 Stop Loss – 6.00

- China National Building Material Company Limited is an investment holding company. The Company operates its business through four segments. The Cement segment is mainly engaged in the production and sale New Suspension Preheater (NSP) cement and commercial concrete. The Lightweight Building Materials segment is mainly engaged in the production and sale of dry wall and ceiling system. The Glass Fiber and Composite Materials segment is engaged in the production and sale of rotor blades, glass fiber and composite materials. The Engineering Services segment is engaged in the provision of engineering services to glass and cement manufacturers, as well as equipment procurement business.

- Resort to the most effective growth driver to restart China’s economic growth. China is suffering from another wave of Covid cases spike right now. Even though the central government relaxed some of the Zero Covid measures, the restrictive lockdowns are back in the high-risk regions. Accordingly, the slowdown in economic growth is expected to extend throughout 4Q22. The softness in domestic consumption, fixed asset investment, and exports will not turn in the near term, and the last resort is government spending. Previously, the authority had announced 16 measures to support the property market. Once the winter season is gone and the Covid outbreak tapers, construction projects will resume. In a nutshell, infrastructure is the main driver for China to revive economic growth.

- 3Q22 earnings review. 9M22 total operating revenue decreased by 13.1% YoY to RMB171.3bn. Net profit attributable to the owners of the company decreased by 48.5% YoY to RMB7.0bn. The fall of performance reflected the slowdown in infrastructure development due mainly to lock-down measures.

- The updated market consensus of the EPS growth in FY22/23 is -34.1%/22.9% YoY, respectively, translating to 4.4×/3.6x forward PE. FY22F/23F dividend yield is 7.4%/9.6% respectively. The current PER is 3.44x. Bloomberg consensus average 12-month target price is HK$9.18.

United States

Top Sector Gainers

Sector | Gain | Related News |

Managed Health Care | +1.38% | Sector Update: Health Care Stocks Advancing Ahead of Friday Close UnitedHealth Group Inc (UNH US) |

Home Improvement Chains | +1.05% | Dow closes more than 150 points higher. Stocks notch gains for holiday week Home Depot Inc (HD US) |

Insurance Brokers/Services | +0.98% | Wall St Week Ahead Stocks typically rally in December, investors have some caution this year Marsh & McLennan Companies Inc (MMC US) |

Top Sector Losers

Sector | Loss | Related News |

Telecommunications Equipment | -1.66% | Foxconn unrest risks iPhone shipments, weighs on Apple shares Apple Inc (AAPL US) |

Internet Retail | -1.37% | Nasdaq ends down as investors eye Black Friday sales, China infections Amazon.com Inc (AMZN US) |

Internet Software/Services | -1.13% | Nasdaq ends down as investors eye Black Friday sales, China infections Alphabet Inc (GOOGL US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Semiconductors | +4.39% | China Restrictions Kneecap U.S. Chipmakers Semiconductor Manufacturing International Corp (981 HK) |

Banks | +4.04% | ICBC Leads China Banks to Offer $179 Billion to Builders China Construction Bank Corp (939 HK) |

Telecomm. Services | +2.30% | China’s telecom sector registers stable growth in Jan-Oct China Mobile Ltd (941 HK) |

Top Sector Losers

Sector | Loss | Related News |

Alcoholic Drinks & Tobacco | -3.01% | Late night snacking by soccer fans lifts sector Budweiser Brewing Company APAC Ltd (1876 HK) |

Gamble | -2.51% | Macau’s Casino Operators Get New Licenses; Genting Loses Out Galaxy Entertainment Group Ltd (27 HK) |

Software | -1.22% | Hong Kong stocks complete weekly loss as record Covid cases, snap lockdowns in China jolt investors SenseTime Group Inc (20 HK) |

Trading Dashboard Update: Add China National Building Material (3323 HK) at HK$6.35.