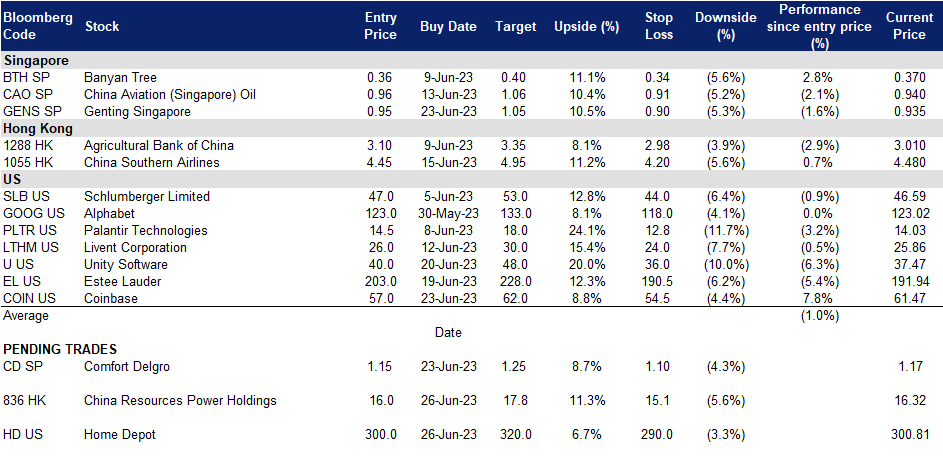

26 June 2023: Banyan Tree Holdings Ltd. (BTH SP), China Resources Power Holdings Co. Ltd. (836 HK), Home Depot Inc (HD US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Banyan Tree Holdings Ltd. (BTH SP): Summer vacation to drive further recovery

- RE-ITERATE BUY Entry 0.360 – Target – 0.400 Stop Loss – 0.340

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Summer vacation coming. As the summer season approaches, popular destinations in South East Asia and other parts of Asia such as Japan, anticipate a surge in tourist arrivals. This presents an opportunity for international travel and tourism businesses, like BTH, to attract visitors looking for high-quality experiences. By highlighting its enhanced offerings and service levels, BTH can position itself as a preferred choice for travellers seeking unique and tailored accommodation options. With a strong presence in Southeast Asia, particularly in Thailand, BTH is well-positioned to capitalise on the growing interest in the region and cater to the needs of discerning tourists.

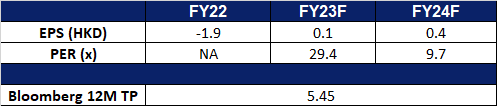

- Appeal to Chinese tourists. Thailand’s tourism industry has experienced a remarkable recovery in Chinese tourist arrivals since reopening its borders. In the first five months of the year, the country welcomed one million Chinese visitors, signalling a significant increase compared to the previous year. The Thai government has set a target of attracting five million Chinese tourists in 2023, with an expected expenditure of 446 billion baht (US$13.18 billion). This resurgence highlights the importance of the Chinese market and its contribution to Thailand’s overall tourism sector. With the approach of China’s summer holiday season and the majority of properties located in Southeast Asia, particularly in popular destinations like Thailand, the company is well-positioned to appeal to Chinese tourists seeking overseas trips.

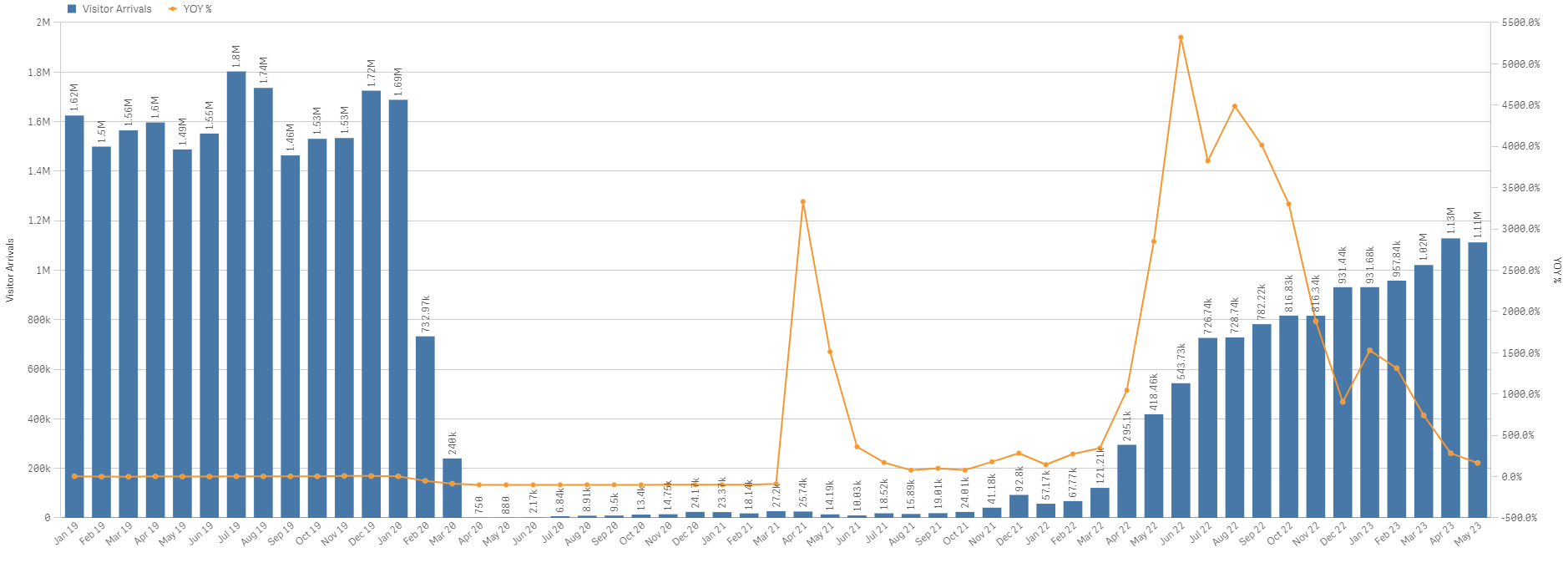

China outbound tourist growth – Thailand

(Source: Bloomberg)

- FY22 results review. Revenue for FY22 increased 23% to S$271.3mn, from S$221.2mn a year ago. Return to profitability in 2022, from the previous year’s loss after tax and minority interests of S$55.2mn to a profit of S$0.8mn.

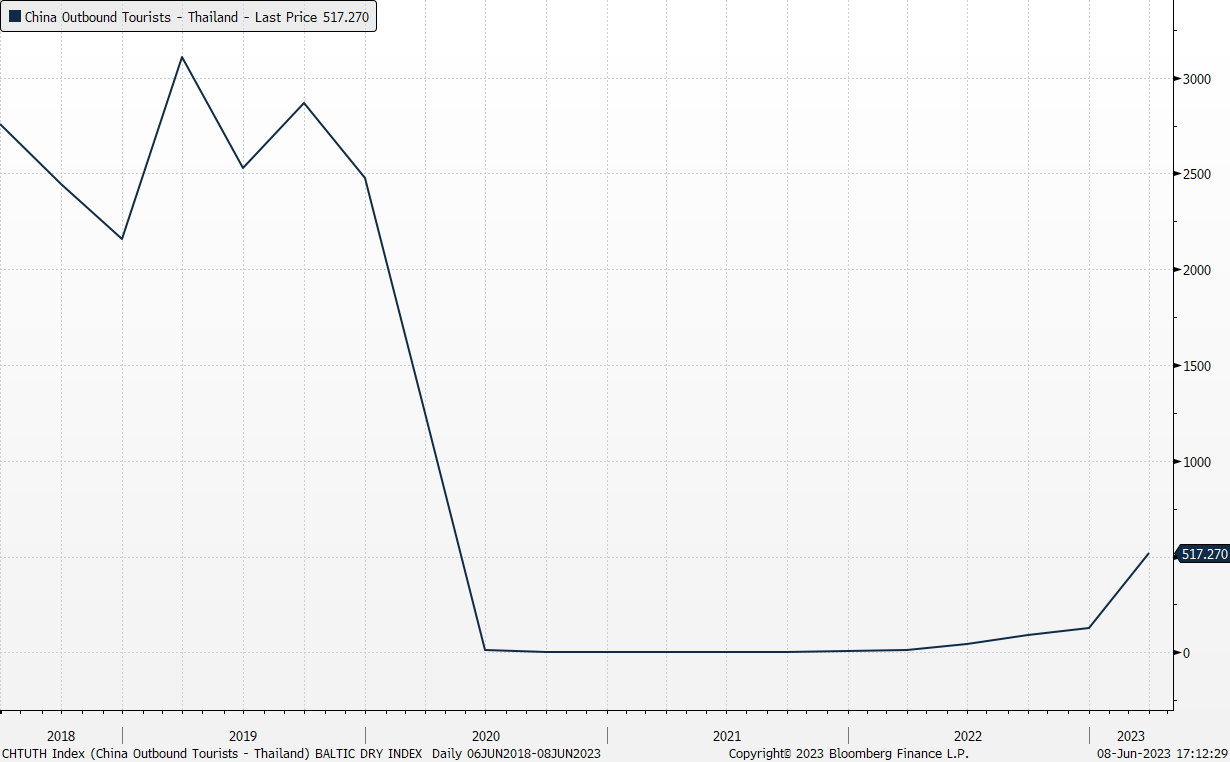

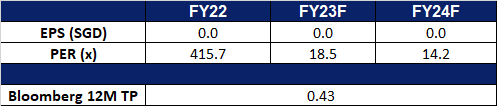

- Market consensus.

- Read the full fundamentals-based report here.

(Source: Bloomberg)

ComfortDelgro (CD SP): Peak Travel Season

- RE-ITERATE BUY Entry 1.15 – Target – 1.25 Stop Loss – 1.10

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

- Peak travel season drives demand for transportation. Longer waiting time were seen for taxis over peak travel season over the summer holidays. This boosted the demand for private transportation within Singapore, which was already recovering from the pandemic, as more employees return to the office. Supply of drivers has not been keeping up with the increase in demand for private transportation, as the supply of private drivers are only at around 80% of pre-pandemic levels, attributing to the long waiting time for ride-hailing passengers.

Comfort Delgro Seasonality Trend

(Source: Bloomberg)

Singapore Visitor Arrival Trend

(Source: Singapore Tourism Analytics Network)

(Source: Singapore Tourism Analytics Network)

- Platform fee to drive sales amidst higher demand. Comfort Delgro has recently made an announcement regarding their plans to implement a surcharge of 70 cents for taxi and private-hire car rides booked through their CDG Zig app starting from July 1, 2023. This platform fee has been introduced with the intention of further enhancing the quality of their point-to-point transport services. By implementing this additional fee, Comfort Delgro aims to leverage the increased demand for taxis during the peak travel period, ultimately boosting their sales.

- FY22 results review. Revenue rose by 7.94% YoY to S$3.708bn, compared to S$3.502bn in FY2021. Net profit rose by 40.7% YoY to S$173.1mn, compared to S$123.0mn in FY2021. EPS rose to 7.99 SG cents (+40.7% YoY) compared to 5.68 SG cents in FY2021.

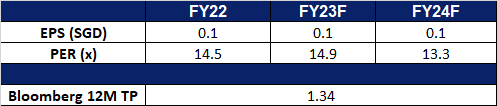

- Market consensus.

(Source: Bloomberg)

China Resources Power Holdings Co. Ltd. (836 HK): Heat wave strikes

- BUY Entry – 16.0 Target – 17.8 Stop Loss – 15.1

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Higher temperatures expected. Last Friday, the China Meteorological Administration took action in response to the prediction of scorching heat and heavy rains expected to affect large areas of the country in the upcoming days. Beijing, the capital, elevated its hot weather warning to the highest level, designated as red, marking the first instance of such an alert being issued since the adoption of the new classification system in June 2015. Additionally, notable weather stations in Tianjin, as well as Hebei and Shandong provinces, experienced unprecedented high temperatures on the preceding Thursday. According to the administration’s forecast, heatwaves are anticipated to persist for a duration of 10 days in Beijing, Tianjin, other parts of North China, and select regions in Henan and Anhui provinces.

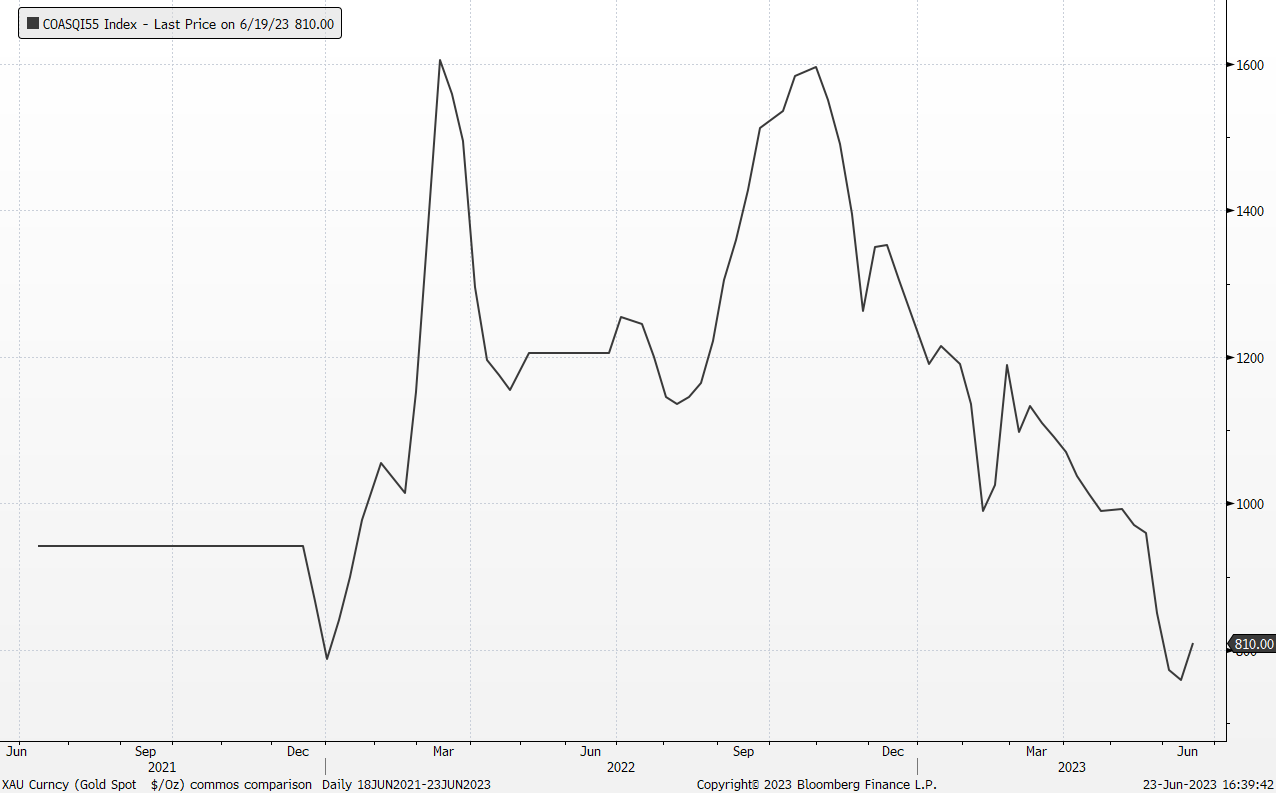

- Lower Coal Prices. The decline in global coal prices is expected to have significant benefits for the company’s coal-fired power plants and gas-fired power plants. With prices at a 2-year low around $130 per tonne, lower fuel costs for coal-fired power plants translate into improved profitability and a competitive advantage in the market. While China Resources Powers does have its own coal production plants, energy consumption during summer typically skyrockets for China, this means that the company will be required to buy coal from other suppliers to further supplement its energy production and will therefore benefit from the lower prices. Additionally, the predictability of prices enables better operational planning and mitigates risks associated with volatility. The declining prices also create opportunities for the company’s gas-fired power plants, as natural gas becomes a more cost-effective alternative. This diversification and cost advantage contribute to improved financial performance, market competitiveness, and the ability to offer competitive electricity prices to consumers. Overall, the decline in coal prices presents favourable conditions for the company’s power generation operations, enhancing profitability and sustainability.

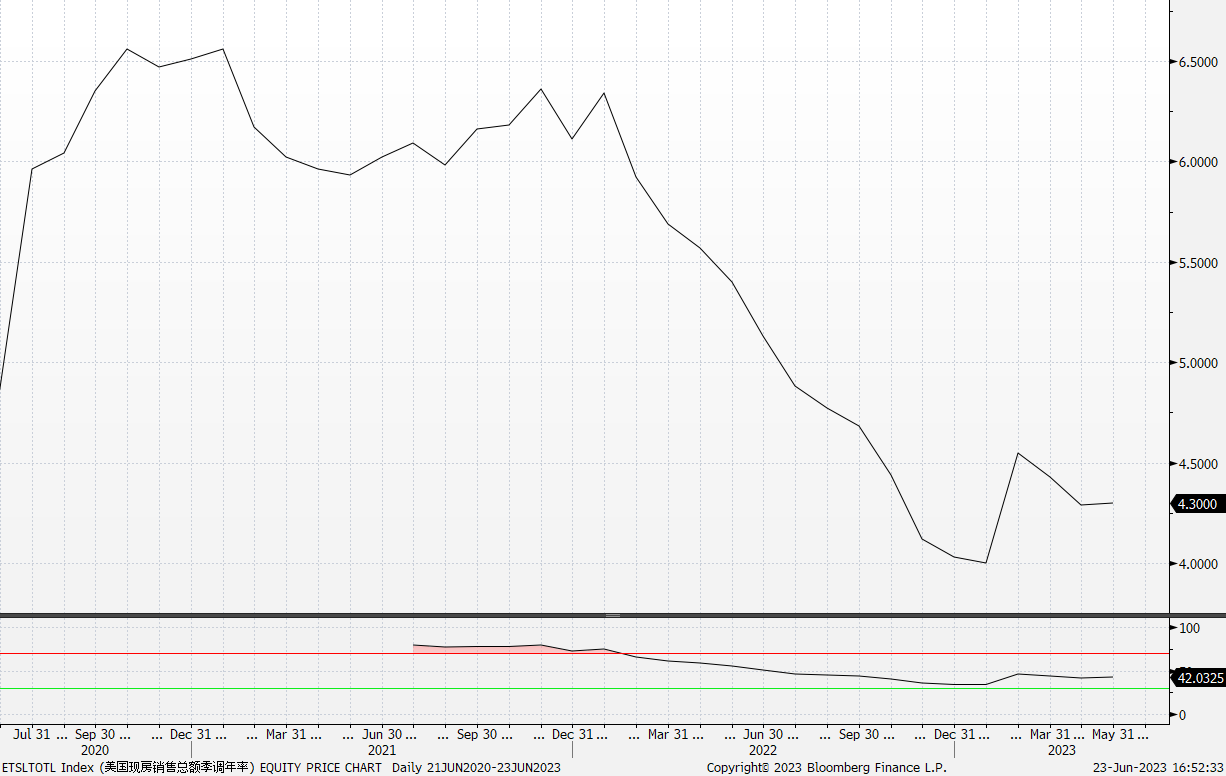

Thermal Coal Price

(Source: Bloomberg)

- Expansion of renewable projects. The city’s stock exchange has granted approval to China Resources Power (CRP) for the independent listing of its renewable energy division in Shenzhen. This decision enables CRP to generate additional funds that will be used to support the company’s ambitious growth plans in wind and solar power initiatives. Furthermore, the separate listing is expected to enhance the valuation of CRP’s assets, benefiting its shareholders.

- FY22 earnings. Revenue rose to HK$103.3bn, a 15.0% increase YoY. Net Income of HK$7.04bn was up 342% compared to FY2021.Net profit Margin rose to 6.8%, compared to 1.8% in FY2021

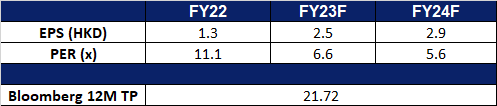

- Market Consensus.

(Source: Bloomberg)

China Southern Airlines Co. Ltd. (1055 HK): Incoming peak travelling season

China Southern Airlines Co. Ltd. (1055 HK): Incoming peak travelling season

- RE-ITERATE BUY Entry – 4.45 Target – 4.95 Stop Loss – 4.20

- China Southern Airlines Company Limited is principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery and other extended transportation services. The Company operates through two business segments, including Airline Transportation segment and Other segment. Airline Transportation segment consist of passenger and cargo and mail operations. Other segment includes hotel and tour operation, ground services, cargo handling and other miscellaneous services. . The Company also provides services of general aviation and aircraft maintenance. The Company acts as an agency of domestic and foreign airlines, and other aviation and related business, such as personal accident insurance and agency business.

- More International flights. China Southern Airlines has recently unveiled a new flight route that connects Beijing and London. This development is part of the Chinese airlines’ ongoing efforts to expand their overseas routes in the wake of the pandemic. Operating seven times a week, the route departs from Beijing Daxing International Airport and arrives at London Heathrow Airport. It marks the first direct route operated by a Chinese airline between these two airports and offers a travel time of approximately 10 hours to reach London. This signifies the growing international travel demand worldwide, driven by China’s recovering economy and the gradual relaxation of post-pandemic restrictions.

- Peak travelling season. As the summer season approaches, many popular destinations in South East Asia and other parts of Asia such as Japan, anticipate a surge in tourist arrivals. Bookings in China for trips abroad have surge as China’s economy re-opens and consumers release their pent-up demand for travelling, presenting a increased in demand for international flights.

- 1Q23 earnings. The company saw a rise in Revenue to RMB34.06mn (+58.61% YoY), compared to RMB21.47mn in 1Q2022. Net Income rose 57.8% You to -RMB1.9bn. Basic EPS eased to -RMB0.1 compared to -RMB0.27 a year ago.

- Market Consensus.

(Source: Bloomberg)

Home Depot Inc (HD US): Improving US housing market

- BUY Entry – 300 Target – 320 Stop Loss – 290

- The Home Depot, Inc. is a home improvement retailer. The Company offers wide range of building materials, home improvement, lawn, and garden products, as well as provides DYI ideas, installation, repair, and other services. Home Depot serves customers worldwide.

- Housing shortage. The tightening supply of available homes is exacerbated by the current high-interest rate environment. Although there was a slight increase in existing home sales in May, overall market activity remained subdued. The rate-sensitive nature of the housing market has been negatively affected by the central bank’s decision to raise the benchmark lending rate as a response to inflation concerns. Furthermore, the inventory of homes for sale is significantly lower compared to pre-pandemic levels, amplifying the scarcity of housing options. This limited supply, combined with a decline in mortgage applications following the rise in interest rates, indicates that sales are likely to remain subdued in the near future. These factors indicate a housing shortage, as the demand for homes surpasses the available supply, making it challenging for potential buyers to find suitable and affordable housing options.

- US housing market is showing signs of a potential turnaround. Housing starts in May rose to a seasonally adjusted annual rate of 1.631mn units, the highest since April 2022, indicating strong demand. This marked a significant increase from April’s rate of 1.34mn units. Permits for future construction also saw a positive growth of 5.2% to the highest level since October. The National Association of Home Builders/Wells Fargo Housing Market Index in June rose above the midpoint mark of 50 for the first time since July 2022, further reflecting an improved outlook. Moreover, the average rate on the popular 30-year fixed mortgage has come down from its high above 7% in November. These figures indicate positive momentum in the housing market, which is expected to contribute to US economic growth in the second half of the year. While these trends suggest a potential recovery, it’s important to acknowledge the volatility of the housing market, with no guarantees of sustained improvement. Nevertheless, these developments could positively impact Home Depot’s sales as it operates in the home improvement sector.

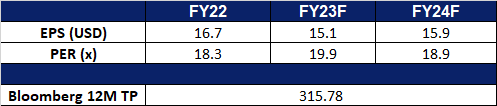

- Housing shortage. In May, sales of existing homes in the United States increased slightly despite limited demand caused by a shortage of supply and high-interest rates. The housing market, which is sensitive to interest rate changes, has been impacted by the central bank’s decision to raise lending rates in order to address persistent inflation. Additionally, the availability of homes for sale is significantly lower than it was before the pandemic. Analysts have observed a decline in mortgage applications following an increase in interest rates, suggesting that sales may remain subdued in the near future. The National Association of Realtors reported a 0.2% rise in existing home sales from April, reaching a seasonally adjusted rate of 4.3 million, but compared to the previous year, sales were down by 20.4%.

- Look to improve. The shortage in the housing market has led to skyrocketing prices, further exacerbated by high mortgage rates. As a result, many homeowners may opt to improve their existing homes rather than purchase new ones. This shift in consumer behaviour can be attributed to the limited availability and increased cost of housing options. Homeowners, faced with inflated prices and limited choices, may invest in renovations, remodelling, and home improvement projects to enhance their living spaces. This trend is expected to drive increased sales of products and services offered by companies like Home Depot, as homeowners seek to upgrade their properties rather than enter the competitive and expensive housing market. With limited supply and soaring prices in the housing market, the focus on home improvements presents an alternative for homeowners to create their desired living spaces and contribute to the growth of businesses specialising in home improvement products and services.

30Y U.S. Home Mortgage Rates

(Source: Bloomberg)

US National Association Realtors Total Existing Home Sales

(Source: Bloomberg)

(Source: Bloomberg)

- 1Q23 earnings review. Revenue fell 4.2% YoY to US$37.3bn, missing estimates by US$1.04bn. GAAP earning per share was US$3.82, $0.03 above expectations.

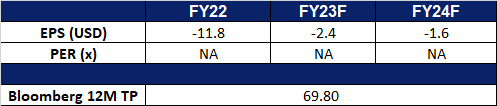

- Market consensus.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Up, up and away

Coinbase Global Inc (COIN US): Up, up and away

- RE-ITERATE BUY Entry – 57.0 Target – 62.0 Stop Loss – 54.5

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies.

- Bitcoin rallied to its highest level since April. Bitcoin experienced a three-day surge, driven by BlackRock’s recent filing for a bitcoin ETF and the launch of EDX Markets, a crypto exchange backed by Citadel Securities, Fidelity, and Schwab. Despite regulatory scrutiny, the global cryptocurrency industry remains optimistic. Bitcoin’s price rose by 5.5% to $29,881.00, with an 81% increase year-to-date. Traders are hopeful about institutional involvement, and Ether also saw a 4.8% increase. The market’s bullish sentiment is fueled by major institutions announcing spot Bitcoin ETF applications. Breaking key resistance levels could lead to further gains, with targets at $36,000 and potentially higher. The industry’s optimism is evident, with major players like BlackRock venturing into digital assets amid recent negative news and regulatory challenges.

Bitcoin and Ethereum Price Chart

(Source: Bloomberg)

- More issuers joining the race. BlackRock filed paperwork with the SEC to establish the iShares Bitcoin Trust, a proposed ETF that aims to offer investors a simplified means of gaining exposure to Bitcoin’s investment potential without the complexities of direct ownership. Coinbase will serve as the custodian for the ETF’s Bitcoin holdings. The filing emphasizes the ETF’s objective to remove obstacles associated with direct Bitcoin investment while reflecting the trust’s Bitcoin holdings’ value. If approved, this ETF would be the first dedicated to Bitcoin on the market. This filing has sparked a flurry of similar applications from other issuers, such as WisdomTree, Invesco, Valkyrie and Citadel, indicating growing demand for regulated investment vehicles in the crypto space. However, the impact of the SEC’s stance on Bitcoin ETF approval remains uncertain.

- Repurchase of Convertible Senior Notes. Coinbase recently repurchased around $45.5mn in cash of its 0.50% Convertible Senior Notes due 2026, at a discounted rate of 29% below par value. These repurchases were carried out through private negotiations with specific note holders and aimed to deploy capital and benefit shareholders strategically. The move reflects Coinbase’s confidence in its business and improved competitive position while aligning with its focus on reducing debt and optimizing capital structure. The transaction left approximately $1.373bn of the notes outstanding. Despite regulatory challenges, Coinbase remains dedicated to navigating the cryptocurrency industry and prioritising long-term shareholder value through effective capital deployment strategies.

- 1Q23 earnings review. Revenue fell 33.4% YoY to $772.5mn, beating estimates by $119.2mn. GAAP earnings per share was -$0.34, $1.02 above expectations.

- Market consensus.

(Source: Bloomberg)

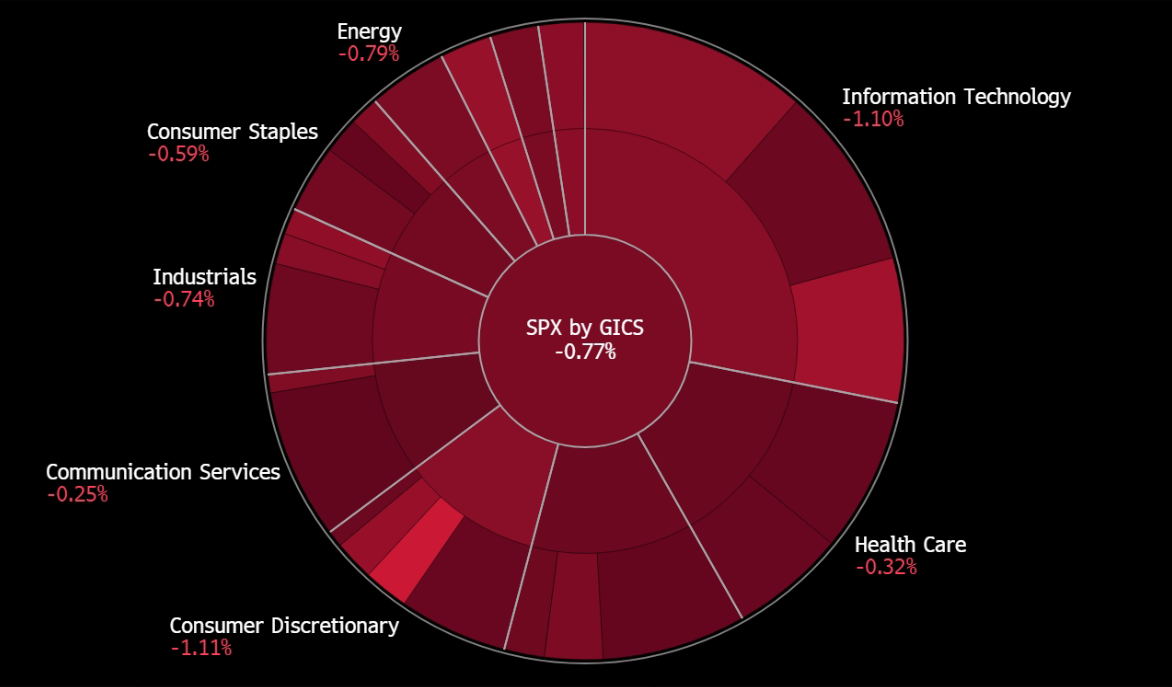

United States

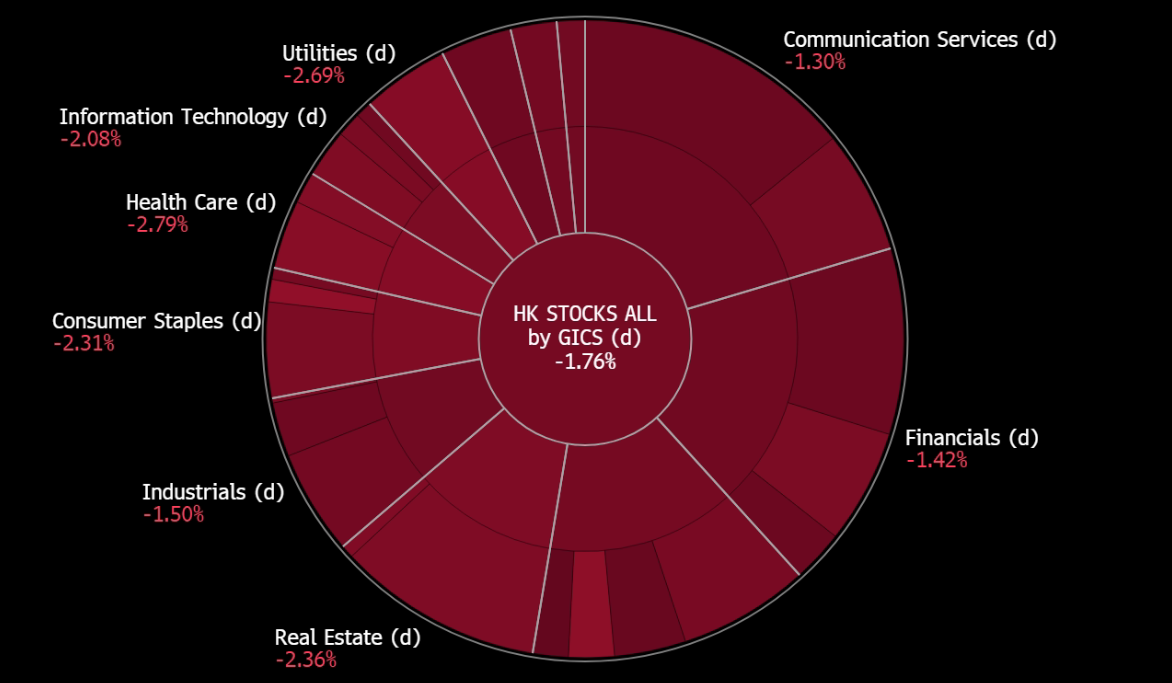

Hong Kong

Trading Dashboard Update: Add Coinbase (COIN US) at US$57.0 and Genting Singapore (GENS SP) at S$0.95. Cut loss on Rex International (REXI SP) at S$0.15, Wilmar International (WIL SP) at S$3.92, China Resources Power (836 HK) at HK$16.5, Budweiser Brewing Company APAC (1876 HK) at HK$20.7, and Pinduoduo (PDD US) at US$70.