25 September 2023: Banyan Tree Holdings Ltd. (BTH SP), BYD Co. Ltd. (1211 HK), CrowdStrike Holdings, Inc. (CRWD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

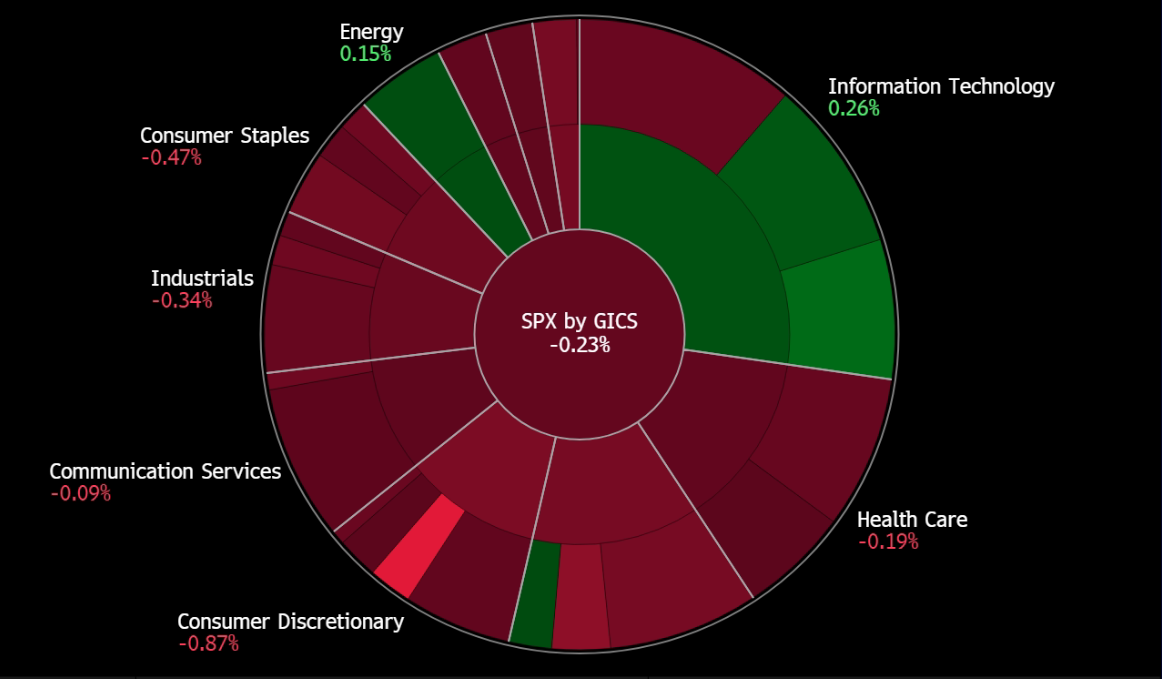

United States

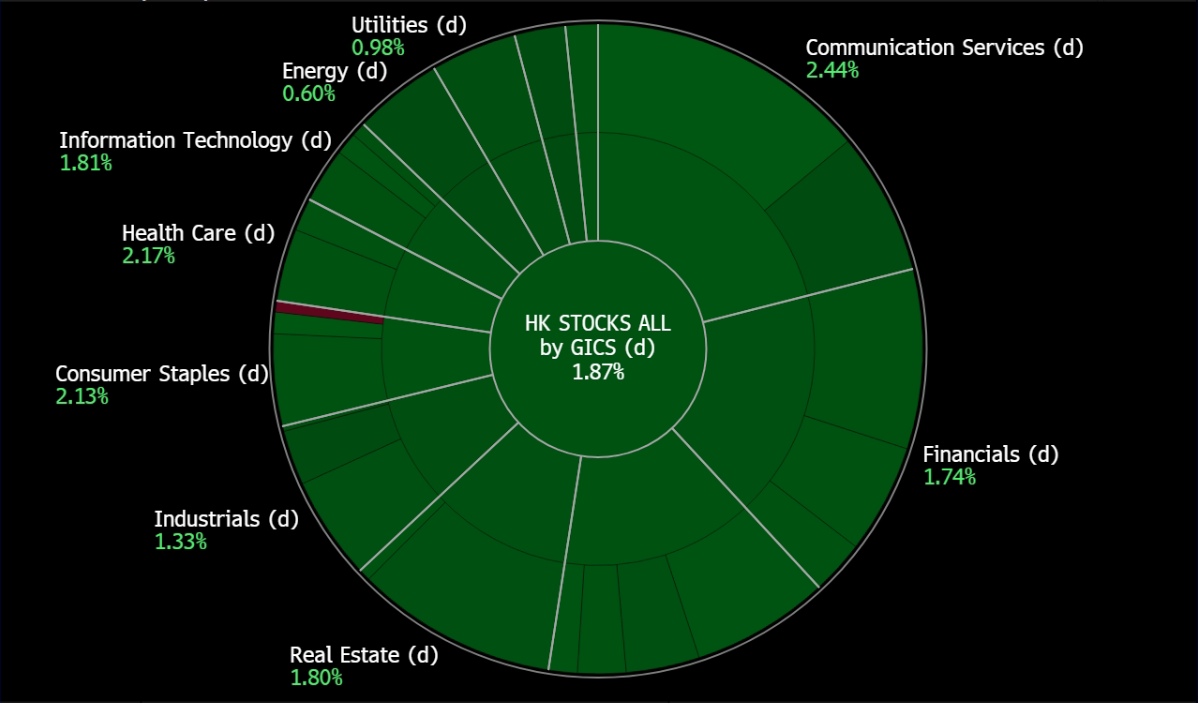

Hong Kong

Banyan Tree Holdings Ltd. (BTH SP): Fear not, tourism is here to stay

- RE-ITERATE BUY Entry 0.390 – Target – 0.415 Stop Loss – 0.378

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Visa-free travel. Thailand will temporarily waive tourist visa requirements for visitors from China and Kazakhstan from 25 September 2023 to 29 February 2024, in an effort to attract more tourists and spur spending during the year-end high season to stimulate the economy, which is slowing due to weak exports. The business sector has welcomed the government’s new policy, and airlines are preparing to increase flights and add more capacity to accommodate the expected increase in tourists. The tourism industry is optimistic that the visa-free scheme will be a success and boost tourism spending in Thailand. This would also benefit businesses such as Banyan Tree, which has multiple properties in the country. The visa-free scheme would make it easier and more convenient for Chinese tourists to visit Thailand, which could lead to an increase in bookings at Banyan Tree’s properties.

- Banyan Tree Dubai. Banyan Tree Group, Ennismore, and Dubai Holding have partnered to open a new Banyan Tree hotel in Dubai, replacing the existing Caesars Palace Dubai on Bluewaters Island. The new hotel will be co-operated by Banyan Tree Group and Ennismore and is scheduled to open in November 2023. It will have 179 rooms, including 30 suites and a brand-new four-bedroom villa, a Banyan Tree spa, a mini rainforest, five F&B outlets, and 96 private residences. This is the first of many hotel and brand development projects that Accor and Dubai Holding plan to collaborate on, to further develop and grow the hospitality sector in Dubai.

- Confidence in recovery. Ho Kwon Ping, founder of Banyan Tree Holdings, expects the tourism sector to benefit from the return of Chinese tourists, although the mass market is taking longer to recover. He is not worried about the lack of Chinese tourists, as Banyan Tree does not cater to mass market travellers. He is also confident that the Chinese real estate market will not collapse, as the banking system is strong. Additionally, he mentioned that Banyan Tree’s exposure to the Chinese real estate bubble is not large due to the sale of a few hotels in China before the bubble.

- 1H23 results review. Revenue for 1H23 increased 21% to S$143.7mn, from S$118.6mn a year ago. It achieved a 68% increase in core operating profit to S$18.7mn in 1H23 from S$11.1mn in 1H22. RevPAR rose 64% in 1H23 (on a same-store basis) vs 1H22.

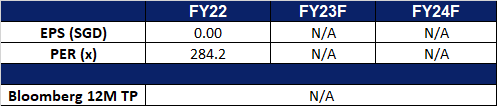

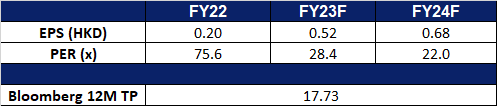

- Market consensus.

(Source: Bloomberg)

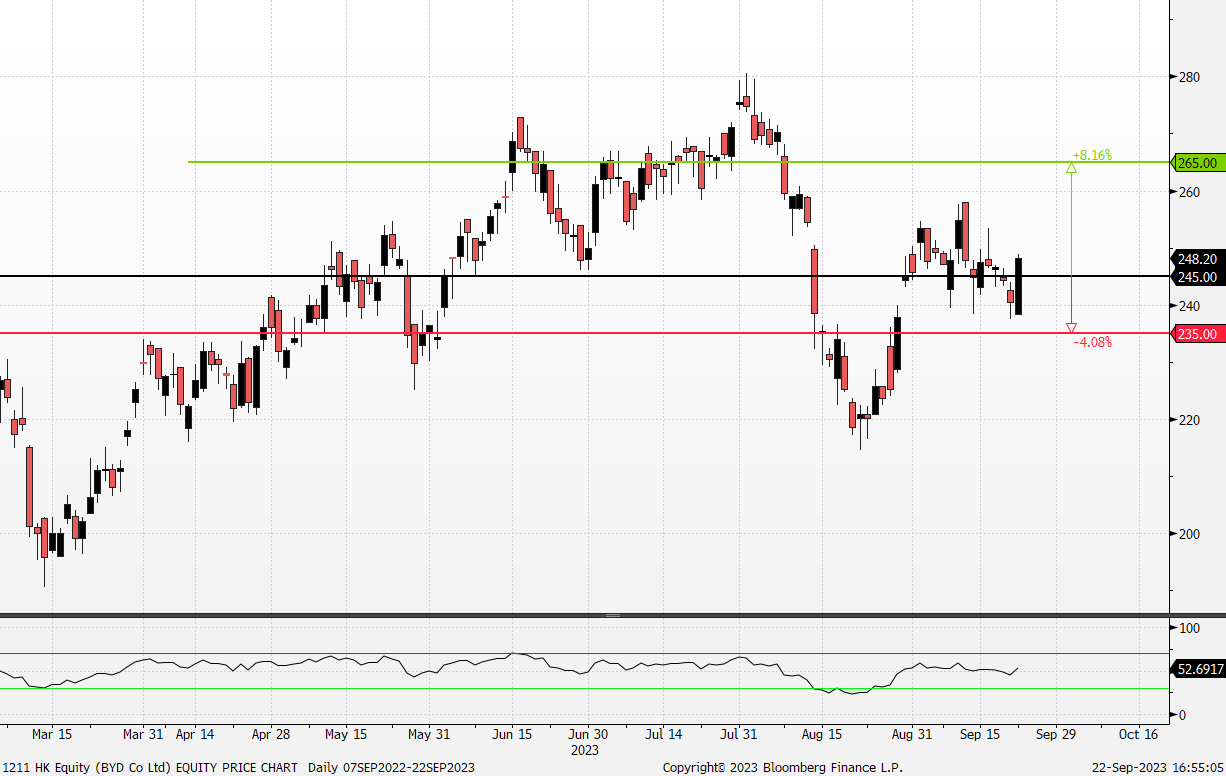

BYD Co. Ltd. (1211 HK): Accelerating Demand

- BUY Entry – 245 Target – 265 Stop Loss – 235

- BYD COMPANY LIMITED is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- Demand for EVs remains strong. The company continue to report good earnings and sales, reporting record monthly sales in July even after deliveries hit 700,244 vehicles in the second quarter. This comes to shows that demand for EVs still remains very strong amidst an uncertain economy. The company’s business strategy proved to be resilient, despite being in an environment of intensifying price wars and slowing demand.

- Launch of Dolphin EV into Japan’s market. The company recently launched its Dolphin EV into the Japanese market, with the intention to spearhead sales within the Japanese EV market using the company hatch design of the Dolphin EV. The Dolphin EV comes as the company’s second EV model in Japan, after launching a more expensive electric sports utility vehicle earlier this year. The company targets to sell 1,100 units of the Dolphin in Japan by March 2024.

- Extensive partnership network in Southeast Asia. The company has established its presence within Southeast Asia’s small but fast-growing EV market, on the back of several partnerships with large and local conglomerates in different countries. These partnerships has allow BYD to easily attain presence in different markets such as Singapore, Malaysia, Thailand, Indonesia, as well as the Phillipines. Its presence in each market has allowed the company to expand easily into other markets as well. In its Thailand market, the company invested nearly $500mn to build a new production facility, which aims to produce 150,000 EVs per year in Thailand.

- 1H23 results. Revenue rose to RMB260.1bn, up 72.7% YoY, compared to RMB150.6bn in 1H22. Net profit attributable to shareholders rose to RMB10.95bn in 1H23, up 204.7% YoY, compared to RMB3.60bn in 1H22. Basic EPS was RMB3.77 in 1H23, compared to RMB1.24 in 1H22.

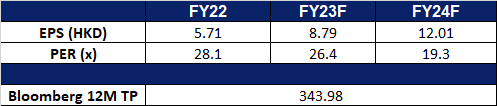

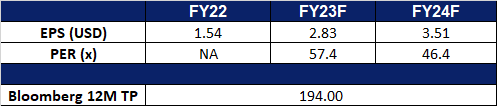

- Market Consensus.

(Source: Bloomberg)

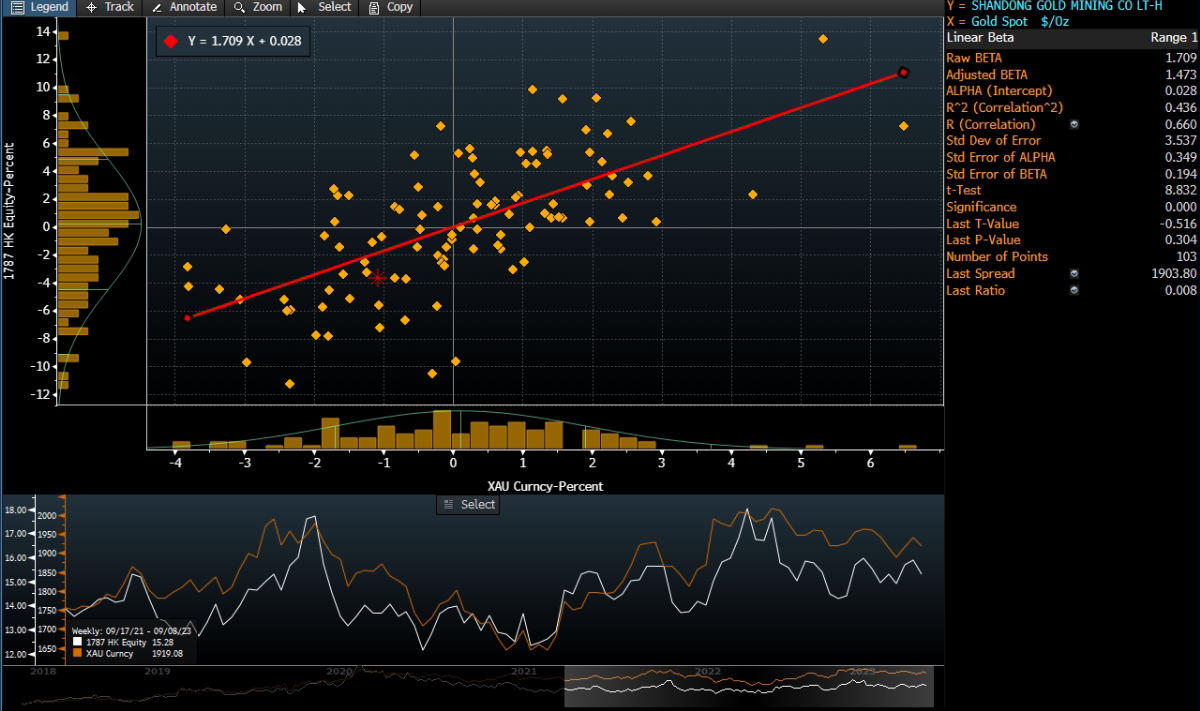

Shandong Gold Mining Co. Ltd. (1787 HK): Go for Gold

- RE-ITERATE BUY Entry – 15.8 Target – 17.0 Stop Loss – 15.2

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

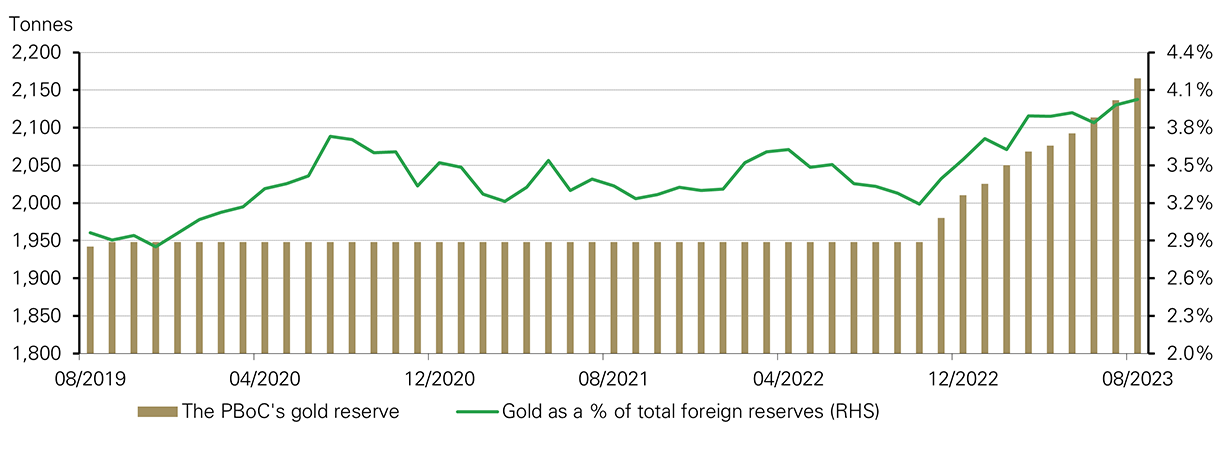

- China increasing its gold reserves. China has been buying gold for 10 consecutive months, increasing its already sizable holdings as part of a strategy to reduce its reliance on the US dollar. China’s central bank increased its gold holdings by 930,000 troy ounces, or around 29 tonnes in August, according to the bank’s statement recently. Gold now makes up 4.03% of China’s foreign exchange reserves in US dollars, the highest level ever recorded.

PBOC Gold Reserves

(Source: PBoC, World Gold Council)

- New discovery of Gold resources. Shandong Gold Group Co. announced that the estimated total gold reserves at the Xiling gold mine in Shandong province have increased to about 592.2 metric tons, up more than 200 tons from previous estimates. The gold reserves have a potential value of more than 200bn yuan (US$27.7 bn), making Xiling the largest single gold reserve mine in China. Accordingly to the company. the Xiling gold mine is also expected to maintain production for about 40 years, if its annual processing capacity is 3.3mn tons.

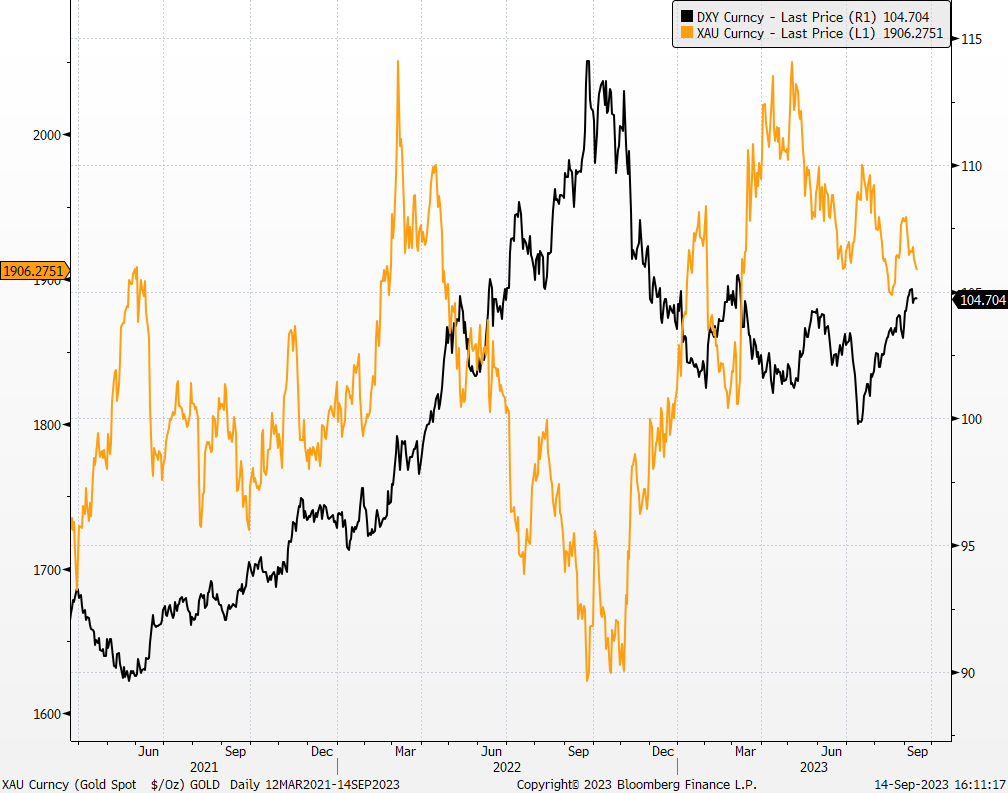

- Interest Rates expectations near its peak. Investors expects the Federal Reserve to leave Fed Fund Rate unchanged in September, and is only expected to start its rate cuts in 2Q2024 or later, with the current Fed Fund Rate atn 5.25% to 5.50%.With interest rates reaching its peak, the price of gold may see some positives, given that inflation continues to show signs of slowing down.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

- 1H23 results. Revenue fell slightly to RMB27.4bn, down 8.1% YoY, compared to RMB29.8bn in 1H22. Net profit rose to RMB979.8mn in 1H23, up 69.8% YoY, compared to RMB577.1mn in 1H22. Basic EPS was RMB0.14 cents in 1H23, compared to RMB0.09 in 1H22.

Shandong Gold vs Gold Price

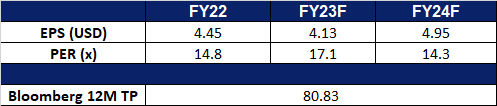

- Market Consensus.

(Source: Bloomberg)

CrowdStrike Holdings, Inc. (CRWD US): New products to drive sales

- BUY Entry – 161 Target – 171 Stop Loss – 156

- CrowdStrike Holdings, Inc. provides cybersecurity products and services to stop breaches. The Company offers cloud-delivered protection across endpoints, cloud workloads, identity and data, and leading threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. CrowdStrike serves customers worldwide.

- Acquisition of cyber startup Bionic. The company recently announced that it would be acquiring cyber startup Bioni, which is a startup offering technology in the emerging category of application security posture management, for US$350mn. The company aims to incorporate the startup’s capabilities into its fast-growing cloud-native application protection platform (CNAPP).

- New products unveiled. The company recently unveiled several new products at Fal. Con 2023, including CrowdStrike Raptor, Falcon Foundry, Falcon Data Protection, and several more. These products integrate the company’s current product with the addition of generative AI features and also aim to provide the company’s clients with a single agent, single console and single data backend.

- 2Q24 results. Revenue rose to US$731.6mn, up 37% YoY, compared to US$535.2bn in 2Q23. Net profit rose to US$8.5mn, compared to a loss of US$49.3mn in 2Q23. Non-GAAP EPS rose to US$0.74, compared to US$0.36 in 2Q23.

- Market consensus.

(Source: Bloomberg)

Hasbro Inc (HAS US): Passing GO

- RE-ITERATE BUY Entry – 70 Target – 80 Stop Loss – 65

- Hasbro, Inc. designs, manufactures, and markets toys, games, interactive software, puzzles, and infant products. The Company’s products include a variety of games, including traditional board, card, hand-held electronic, trading card, role-playing, and DVD games, as well as electronic learning aids and puzzles.

- Monopoly GO! success. The digital version of Monopoly GO!, launched in mid-April 2023, has generated $200mn in revenue and is the highest-grossing iOS app in the United States. It is expected to contribute to Hasbro’s profits and is ranked in the top five free mobile game charts in more than 100 countries based on downloads. The game is similar to the board game Monopoly but with some twists. It is a social game that can be played with players globally and is designed to be played anywhere and anytime, without having to commit a lot of time. Players can purchase dice, in-game currency, and stickers needed to complete challenges. These purchases will continue to contribute to its revenue as more players join the game and make in-app purchases.

- Realign focus on it’s priority brands. Hasbro has sold its eOne production studio to Lionsgate for $500mn. The deal is expected to close by the end of 2023. Hasbro will use the proceeds to pay down debt and focus on its toy and game businesses. The company will continue to licence its intellectual property to studios for film and TV projects, but will no longer be involved in production. It is also heavily investing in digital gaming, with successful releases such as Magic: The Gathering Arena and Baldur’s Gate 3. Hasbro believes that this will be a major growth driver for the future.

- 2Q23 earnings review. Revenue fell 9.7% year-over-year to US$1.21bn, beating estimates by US$90mn. Non-GAAP EPS of $0.49 miss expectations by $0.08.

- Market consensus.

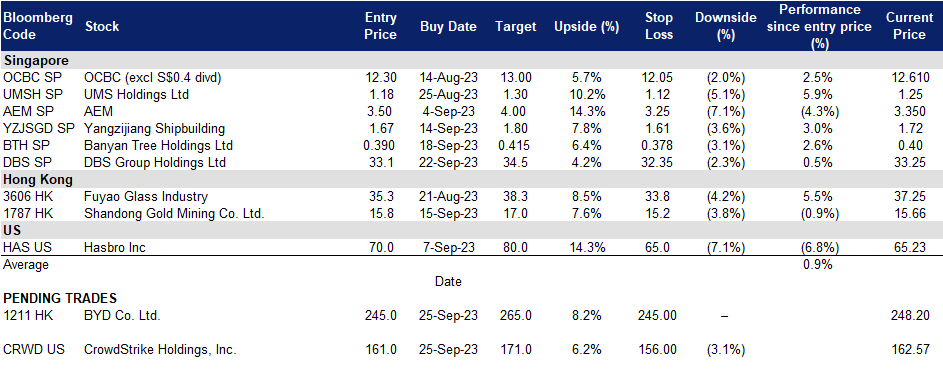

Trading Dashboard Update: Add DBS Group Holdings at S$33.1. Cut loss on Thaibev (THBEV SP) at S$0.56, China Oilfield Services (2883 HK) at HK$9.1, and Yankuang Energy Group (1711 HK) at HK$14.6.

(Source: Bloomberg)

(Source: Bloomberg)