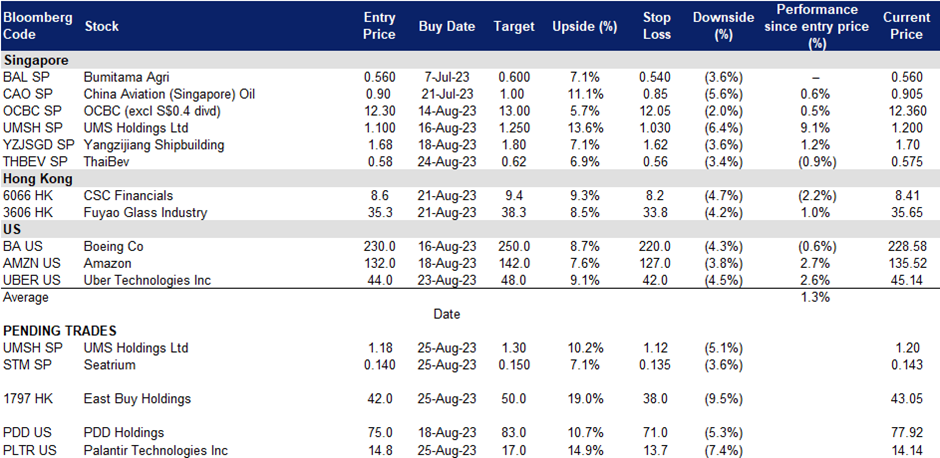

25 August 2023: UMS Holdings (UMSH SP), East Buy Holdings Ltd. (1797 HK), Palantir Technologies Inc (PLTR US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

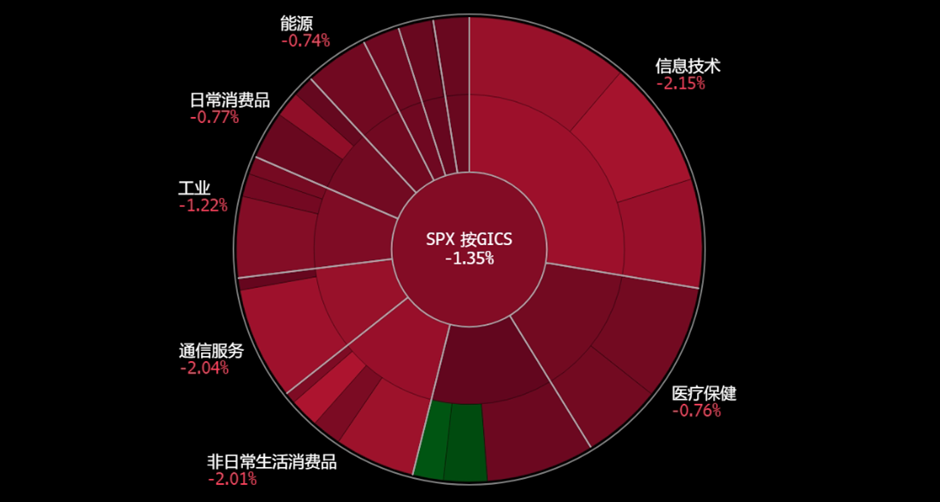

United States

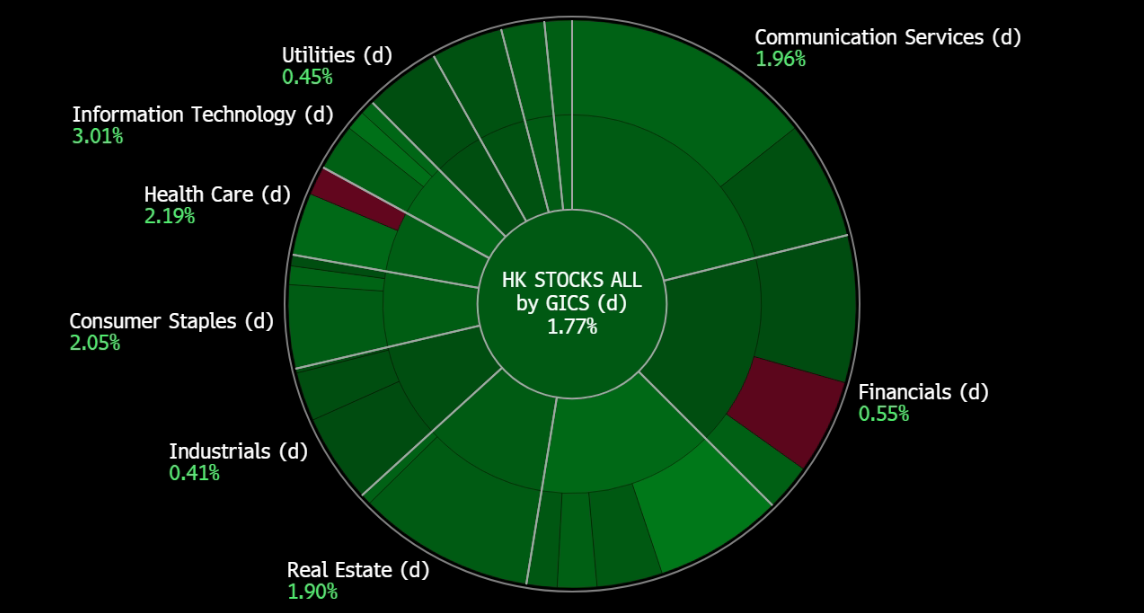

Hong Kong

UMS Holdings (UMSH SP): Better outlook moving forward

- BUY Entry 1.18 – Target – 1.30 Stop Loss –1.12

- UMS Holdings Limited provides equipment manufacturing and engineering services to Original Equipment Manufacturers (OEMs) of semiconductors and related products. The Company manufactures high precision components and complex electromechanical assembly and final testing services. UMS supports the electronic, machine tools and oil and gas industries.

- Semiconductor sector is bottoming out. The milestone development of artificial intelligence (AI) in 1H23 not only buffers the downcycle of the semiconductor sector but also kickstarts a new growth engine. The AI hype shadows the fall in demand for mobile/PC chips due to the normalisation of life and the drop in capex due to geopolitical factors. However, several market leaders projected that the sector will bottom out in 2H23 or 1H24 as both orders and capex will gradually recover. In the UMS’s 2Q23 press release, according to SEMI, global 300mm fab equipment spending for front-end facilities next year is expected to begin a growth streak to hit a US$119 billion record high in 2026 following a decline in 2023.

- Nvidia 2Q24 stellar results reinforce the AI revolution. Nvidia’s 2Q24 earnings smash market expectations again. Meanwhile, it also provides better-than-expected guidance for 3Q24. This marks the end of the technology and semiconductor sector correction since the end of July. The strong demand for AI chips and servers will uphold the bullish sentiment in the semiconductor sector.

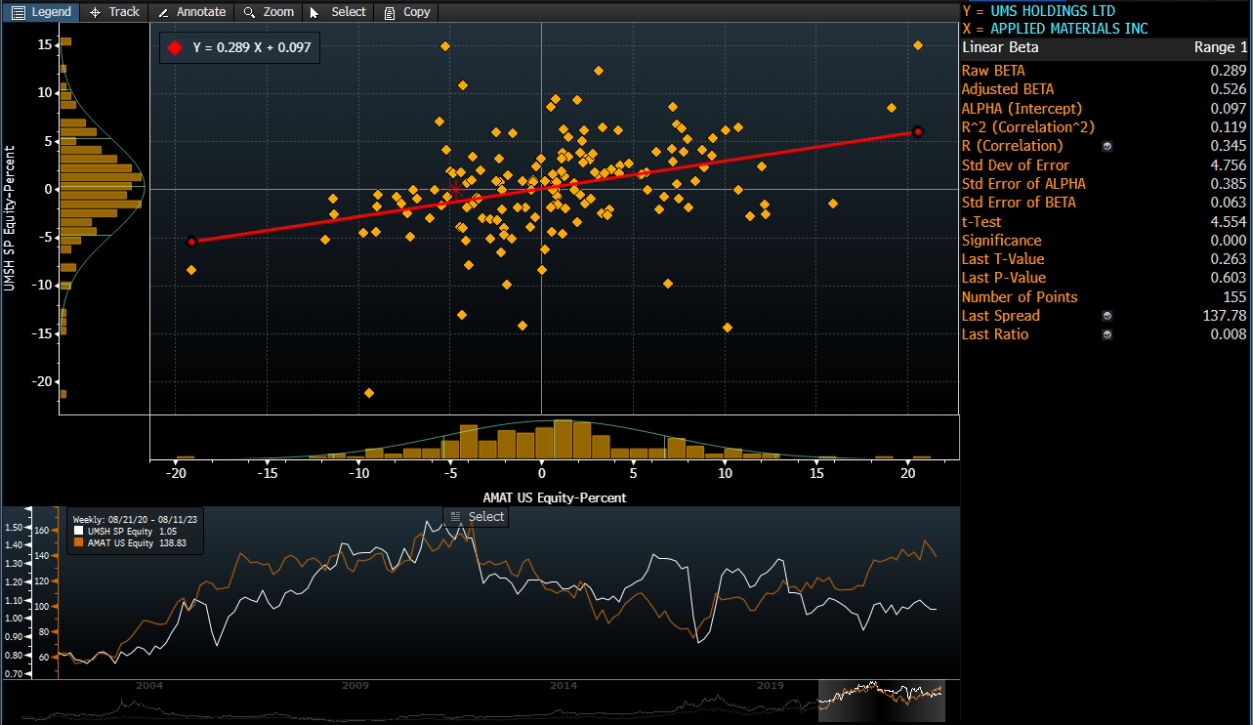

- Applied Materials 3Q23 review. Applied Materials (AMAT US) is a key customer to UMS. Its 3Q23 revenue dropped 1.4% YoY to US$6.3bn, beating estimates by US$250mn. 3Q23 Non-GAAP EPS was US$1.9, beating estimates by US$0.15. It expects 4Q23 net sales to be approximately US$6.51bn, plus or minus US$400 mn, compared to a consensus of US$5.87bn. 4Q23 Non-GAAP adjusted diluted EPS is expected to be in the range of US$1.82 to US$2.18, compared to a consensus of US$1.60.

Weekly return correlation between UMS and AMAT

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 results review. Revenue fell 14% YoY to S$74.4mn. Gross material margin decreased to 46.3% from 51.7%. PATMI plugged 42% YoY to S$11.6mn. Net margin fell to 15.4% from 23.2%. The new plant in Penang is expected to contribute at least US$30mn for FY24. The company declared an interim dividend of 1.2 SG cents.

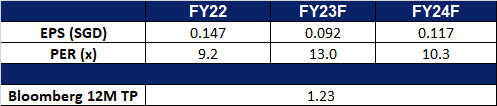

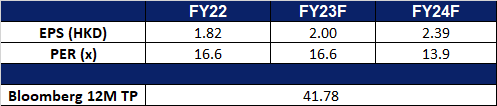

- Market consensus.

(Source: Bloomberg)

Seatrium Limited (STM SP): Resilient creude oil performance

Seatrium Limited (STM SP): Resilient creude oil performance

- BUY Entry 0.140 – Target – 0.150 Stop Loss – 0.135

- Seatrium Limited provides offshore and marine engineering solutions. It operates through two segments: Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding; and Ship Chartering.

- Order book remains strong. It secured new contract wins of S$4.3bn ytd with solid orders pipeline. It’s net order book of S$19.7bn with projects lined up to 2030, comprising 40% renewables and cleaner/green solutions. Additionally it showed strong operational performance with track record of projects delivered.

- Share buyback. Seatrium bought back shares for the second time. The company bought back 20mn shares on August 4 for 13.4 SG cents each. This follows its first buyback on June 12, when it bought 1.2mn shares for 12.4 SG cents each.

- Offshore market expected to strengthen. Seatrium is expected to benefit from the strengthening offshore market. The industry estimates that offshore oil and gas capital expenditure will continue to grow in 2023 and 2024, supported by data showing that day rates for latest generation drillships are now over $500,000 per day, and the number of active offshore rigs has increased by 8% YoY. The company has a strong order book, access to new markets, and the capacity to accept more projects and is looking to fill its 2028/29 production schedule. Furthermore, the normalisation of economic activity should also result in a greater volume of shipping activities, which will positively impact Seatrium’s repair/upgrade segment. These factors will help to drive Seatrium’s growth and share price in the future.

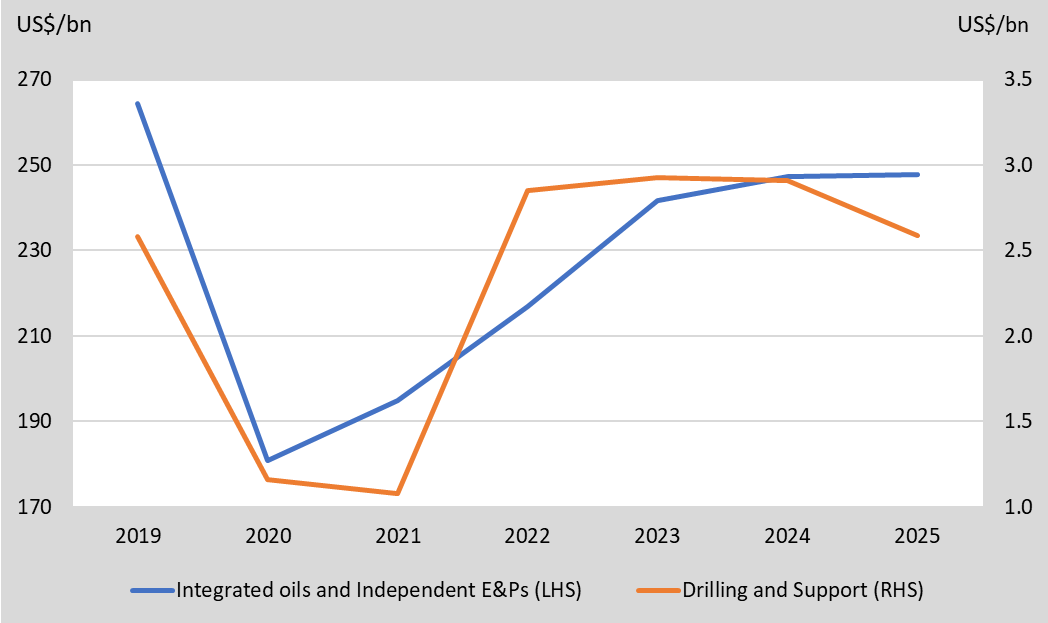

- Expecting mild growth in the upstream oil and gas capex. Oil prices have been showing signs of resilience despite a weakening economy, contribution by deflation in China. Yet, these concerns are offset by a steep drawdown in U.S. fuel stockpiles and Saudi and Russian output cuts, sending oil prices to a high since January 2023. The oil and gas upstream spending also continues. Oil majors accelerated to explore and develop oil resources outside Russia after the sanction. Hence, there still be mild growth in the upstream capex during 2023/2024.

Global upstream oil and gas capex

(Source: Bloomberg)

(Source: Bloomberg)

- 1H23 results review. Revenue rose 164% YoY to S$2.9bn from S$1.1bn the prior year. Net loss amounted to -S$264mn due to provision for contracts and merger expenses. The Group’s EBITDA of S$27mn in 1H2023 was higher than the negative S$19mn in the same period last year. EBITDA before provision for contracts and merger expenses amounted to a creditable S$258mn.

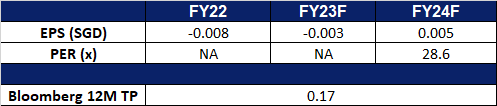

- Market consensus.

(Source: Bloomberg)

East Buy Holdings Ltd. (1797 HK): Going live streaming on Taobao

- BUY Entry – 42.0 Target – 50.0 Stop Loss – 38.0

- East Buy Holding Limited operates livestreaming platform businesses. The Company provides private label products including agricultural products, food, books, and household goods. East Buy Holding also conducts college education businesses.

- Live Streaming on Taobao. According to local reports, East Buy Holdings officially joined Taobao Live, with its first live-streaming session scheduled for next Tuesday, 29th August, hosted by the Founder and CEO of the company. This is bound to expand the company’s e-commerce exposure, driving the company brand name as well as sales.

- Increasing popularity of live-streaming. The online live-streaming shopping market in China is experiencing significant growth, reaching a total of $497 billion in 2022, as reported by Coresight Research. This upward trend can be attributed to consumers who are increasingly valuing their time and opting for the convenience of watching live stream shopping from anywhere, rather than simply browsing products online or visiting physical stores for purchases.

- Boosting domestic consumption. China recently pledged expansion in domestic consumption to boost growth within the China market. With poorer-than-expected economic indicators and signs that the China market is slowing down, the government has announced rate cuts to boost innovation, consumption as well as recovery, with the government lowering the loan prime rate by 10bps in June, as well as another 10bps in August, to a current loan prime rate of 3.45%. Going forward, more stimulus is expected to be released as well to boost the level of consumption.

- 1H23 results. 1H23 Revenue from continuing operations rose by 590.2% YoY to RMB2.08bn in 1H23 than compared to RMB301.4mn in 1H22. Net profit rose to RMB601mn in 1H23, compared to RMB27.0mn in 1H22. Basic EPS rose to RMB0.58, compared to -RMB0.11 in 1H22.

- Market Consensus.

(Source: Bloomberg)

Fuyao Glass Industry Group Co. Ltd. (3606 HK): Beneficial sectoral conditions

- RE-ITERATE BUY Entry – 35.3 Target – 38.3 Stop Loss – 33.8

- FUYAO GLASS INDUSTRY GROUP CO., LTD. is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The Company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The Company distributes its products within domestic markets and to overseas markets.

- Strong EV productions. With several EVs manufacturing companies in China hitting record sales in 1H2023, demand for EV is still expected to be strong for the rest of 2023. These companies have plans to increase their production capacity to capture the higher demand for EVs. China’s largest automaker, recently announced that it reached a total production of 5 million NEVs, just 9 months after it announced a production of 3 million NEVs. The increased level of production of EVs by these auto companies in China is expected to drive the demand for automobile glass produced by Fuyao Glass Industry Glass.

- Lower cost of production. China’s economy has slipped into deflation as consumer prices declined in July for the first time in more than two years. The official consumer price index, fell by 0.3% YoY in July. While this brings concerns to the performance of the China economy, it also lowers the cost of production for Fuyao Glass Industry as input materials become cheaper to purchase. The company would still be able to reap the benefits of a lower cost of production despite a faltering economy as EV production is still expected to remain strong.

- 1H23 results. Revenue improved to RMB15.0bn, +16.5% YoY, compared to RMB12.9bn in 1H22. Net profit rose to RMB2.8bn in HQ23, +19.08% YoY, compared to RMB2.4bn in 1H22. Basic and diluted EPS rose to RMB1.09 +19.8% YoY, compared to RMB0.91 in 1H22.

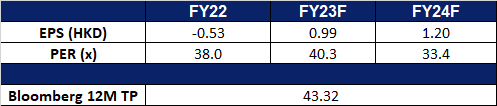

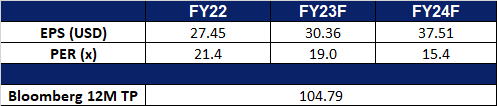

- Market Consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): AI in the spotlight again

- BUY Entry – 14.8 (Buy Stop) Target – 17.0 Stop Loss – 13.7

- Palantir Technologies Inc develops software to analyse information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- AI trend is back. Nvidia, the world’s most valuable chipmaker, is benefiting from the growing demand for artificial intelligence (AI). The company’s GPUs are essential for building and running AI applications, and its data center business is growing rapidly as cloud service providers and large consumer internet companies snap up next-generation processors. Nvidia’s growth forecast in its AI chip and database segment is a positive sign for the overall AI market. This is because it suggests that more companies are investing in AI, which is good for Palantir as it provides an opportunity to sell its AI software and services to these companies.

- Raised outlook. Palantir Technologies has raised its annual revenue forecast due to strong demand for its AI platform. The platform, launched just four months ago, already has users in over 100 organisations and discussions underway with 300 more. The platform offers an AI assistant to aid business decision-making. However, demand in Europe has been subdued, and the company’s commercial revenue was affected by investments in special purpose acquisition companies. The upcoming quarter will see increased expenses as Palantir focuses on expanding its AI platform and recruiting new technical talent.

- Garnering interest in its AI platform. Palantir Technologies’ AI platform, AIP, helps governments and businesses make better decisions by providing access to machine learning capabilities, commercial and open-source large language models, and industry-leading risk controls. The platform has been used by the U.S. military and other government organisations, as well as by companies like Novartis and Azule Energy. Palantir is well-positioned to continue to grow in the years to come, as more and more organisations adopt AI to improve their decision-making. The company’s most recent partnership is with Azule Energy, a 50/50 independent joint venture owned by BP and Eni, to deploy cutting edge software to optimise Azule Energy’s upstream production.

- 2Q23 earnings review. Revenue rose 12.8% year-over-year to US$533.32mn, in line with estimate. Non-GAAP EPS of $0.05 in line with expectations. The number of U.S. commercial customers count increased 35% YoY, from 119 customers in 2Q22 to 161 customers in 2Q23.

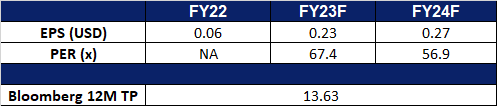

- Market consensus.

(Source: Bloomberg)

PDD Holdings Inc (PDD US): Goods for cheap

PDD Holdings Inc (PDD US): Goods for cheap

- RE-ITERATE BUY Entry – 75 Target – 83 Stop Loss –71

- PDD Holdings Inc. is a multinational commerce group that owns and operates a portfolio of businesses. The Company focuses on the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD Holdings has built a network of sourcing, logistics, and fulfilment capabilities for its underlying businesses.

- Defensive in the weak economic outlook. The economic outlook in China is looking bleak, with the country’s GDP growth forecast to slow down in 2023. Consumers will look towards purchasing cheaper substitutes. Chinese consumers, who have become more discerning, seek value for money and prioritise quality at reasonable prices. With attractive discounts and vouchers offered by domestic e-commerce platforms and brands, increased sales are expected, driven by pent-up demand and the preference for high-quality and new-generation products. The reported success of major Chinese e-commerce platforms during the last quarter further affirms the recovery in online consumer spending in China. PDD platform’s focus on fast-moving consumer goods (FMCG) and its unique approach of encouraging customers to join together in purchasing groups to maximise savings through bulk purchases will further contribute to its anticipated success ahead.

- Expanding its reach. Temu, PDD’s e-commerce platform, made its entry into the US market in September 2022. This Chinese-owned marketplace has expanded into around 27 countries, connecting predominantly Chinese merchants with customers in the US, Canada, Europe, and Australia; with recent expansions into Japan and South Korea. Temu distinguishes itself with its focus on ultra-low prices, achieved by reducing supply chain inefficiencies by sourcing products directly from manufacturers and cutting out middlemen; passing the savings to consumers. Its website and app heavily emphasise deals and discounts, allowing users to “shop like a billionaire”. This approach has led the platform to gain significant traction, surpassing popular platforms like Amazon, TikTok, and Instagram in download charts. Temu’s success is due to factors, including its appeal to budget-conscious customers, its focus on high-quality products, and its ability to offer competitive prices.

- Entrance to other Asian countries. Temu recently launched in South Korea. The app is offering coupons and discounts to attract new customers and is cooperating with third parties to provide logistics and delivery services. Temu is currently the No. 1 shopping app on Japan’s iOS store, and has not disclosed its next destination in Asia, but has sent out a survey to sellers asking about platforms in Japan, South Korea, and Southeast Asia. In South Korea, Temu will need to contend with other China-originated shopping apps such as Shein and AliExpress.

- 1Q23 earnings review. Revenue rose 58% year-over-year to US$5.48bn, beating estimates by US$920mn. Non-GAAP EPADS of $1.01 beat expectations by $0.38.

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Ross Stores (ROST US) at US$122 and Seatrium (STM SP) at S$0.144. Stop loss on Starbucks (SBUX US) at US$95. Add ThaiBev (THBEV SP) at S$0.58 and Uber (UBER US) at US$44.