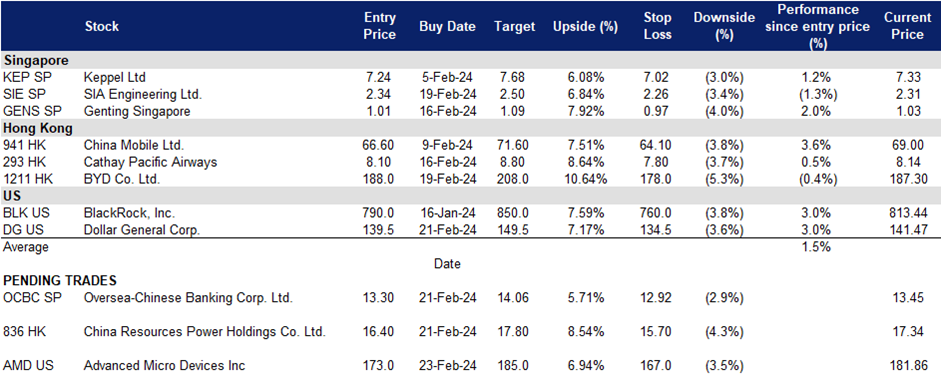

23 February 2024: Oversea-Chinese Banking Corp Ltd (OCBC SP), China Resources Power Holdings Co. Ltd. (836 HK), Dollar General Corp. (DG US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

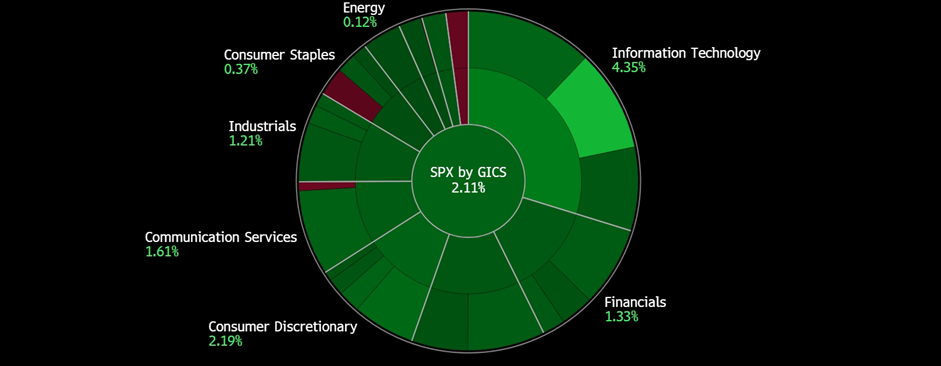

United States

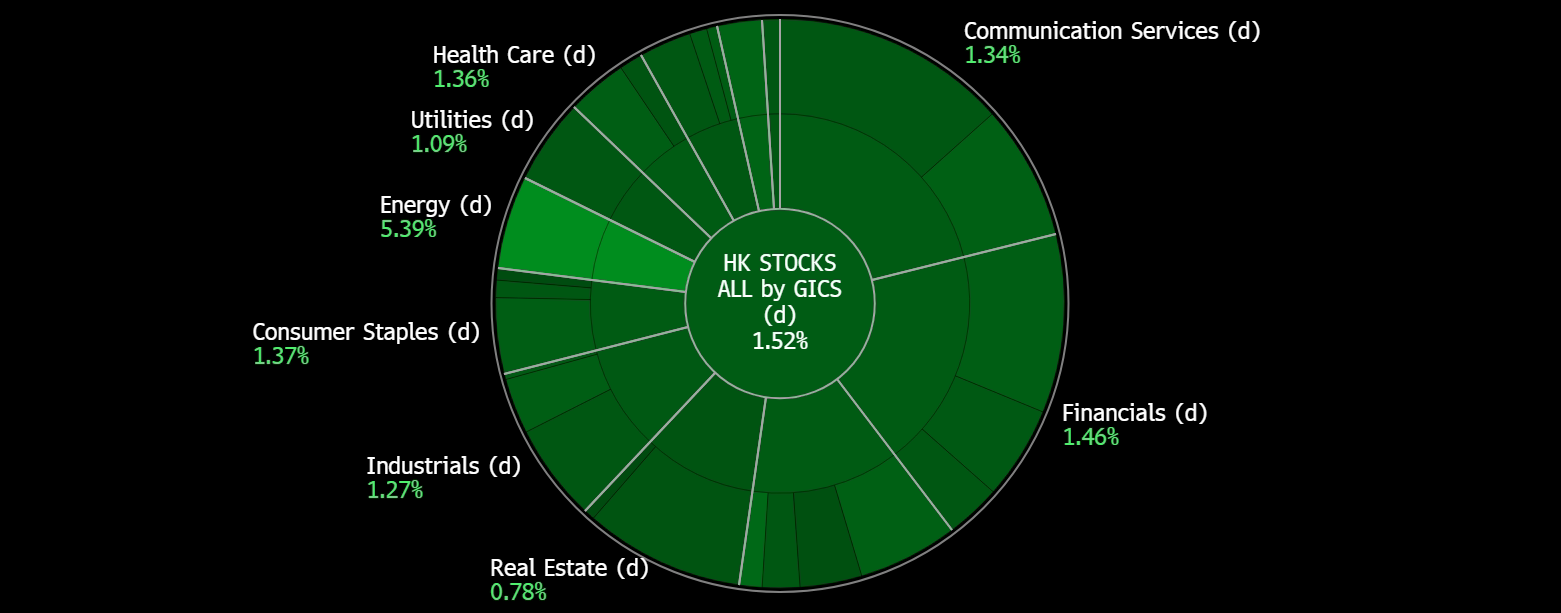

Hong Kong

Oversea-Chinese Banking Corp Ltd (OCBC SP): Seizing growth opportunities

- RE-ITEREATE Entry – 13.30 Target– 14.06 Stop Loss – 12.92

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Targeting regional growth. OCBC Bank plans to capitalise on China’s uncertain economic recovery by expanding its transaction banking business, particularly in Southeast Asia. The bank aims to increase its focus on Greater China and Asean markets, with Hong Kong and mainland China showing significant growth potential. To achieve this, OCBC plans to invest over S$50mn in its transaction banking capabilities in Greater China. Additionally, the bank aims to engage Chinese companies in Singapore and Hong Kong, facilitating their expansion into markets like Malaysia, Indonesia, Thailand, and Vietnam. OCBC also emphasized digital transformation, focusing on instant cross-border payments and exploring the use of digital currencies for payments and trade. The bank sees digitalization as crucial for capturing more business, as shown by the increasing adoption of digital solutions by trade finance customers and the growth of its OneCollect platform for QR code payments. OCBC has also been piloting the use of digital currencies, such as China’s central bank digital currency, and expanding its instant cross-border payment initiatives.

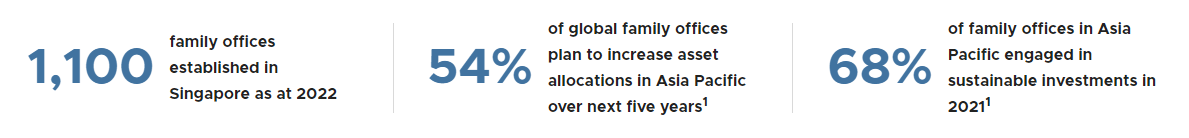

Singapore family office statistics

(Source: Singapore Economic Development Board)

- Attractive to multi-generational wealth. The Henley & Partners global ranking positions Singapore as the third most attractive destination for families seeking opportunities for the next generation, trailing only Switzerland and the United States. Singapore’s strong showing can be attributed to its robust economy, top-tier employment opportunities, and impressive economic mobility. The study emphasizes Singapore’s commitment to cutting-edge development across diverse sectors and its “skills-first” approach in the competitive job market, offering a significant advantage to recent graduates. While Switzerland takes the top spot due to its exceptional earning potential, career advancement opportunities, and low unemployment rate, the United States shines in terms of top-tier employment prospects and earning potential. Drawn by these advantages, affluent families have increasingly chosen Singapore as their new home, entrusting their wealth to established wealth management firms or setting up their own family offices here. This trend shows no signs of slowing down, and Singapore is well-positioned to continue attracting more affluent families seeking stability and growth for their futures. With more positive inflows of net new money in the country, OCBC will benefit from the continued influx of new clients under the group’s wealth management business unit.

- Doubled SME sustainable funding. OCBC Bank significantly increased its sustainable financing for small and medium-sized enterprises (SMEs) in 2023, doubling the amount from the previous year to over S$7bn provided to more than 1,200 companies across Southeast Asia. The bank’s SME Sustainable Finance Framework, initiated in 2020, aims to simplify and reduce the cost for SMEs to access sustainable financing. Over 80% of the SMEs that utilised the bank’s sustainable financing in 2023 were from sectors like built environment, clean transportation, energy efficiency, and renewable energy. OCBC also assisted larger and mid-sized corporates in manufacturing, logistics, and technology to become pioneers in sustainable transformation, hoping to inspire others. The motivation for SMEs to adopt sustainable financing is driven by the desire to future-proof their businesses and meet the increasing demand for sustainability from customers and stakeholders, rather than financial incentives. In 2024, OCBC aims to empower even more companies to become sustainability pioneers, offering them access to financing solutions while creating a positive impact on the environment. This approach benefits both borrowers through growth opportunities and the bank through sustainable practices and potential interest income.

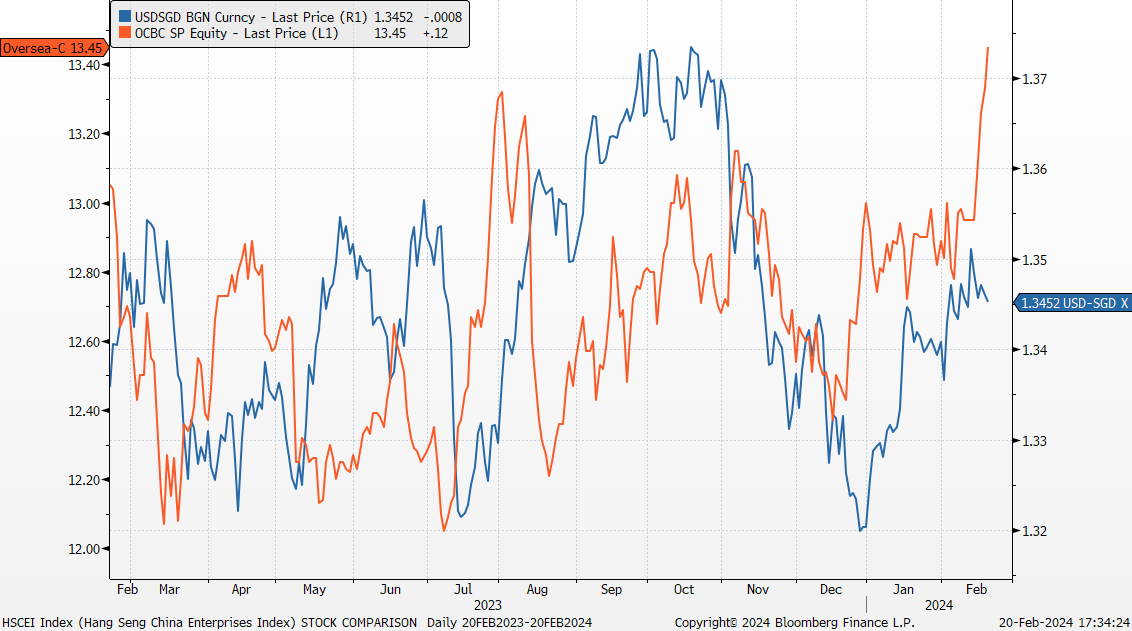

OCBC share price and USD/SGD comparison

- Benefit from rates staying higher for longer. Singapore banks are poised to benefit from the extended period of higher interest rates. The recent rise in Singapore’s T-bill yield to 3.66%, reflecting strong global economic signals, indicates a potential delay in Federal Reserve rate cuts. While demand for T-bills dipped slightly, it remained substantial, suggesting sustained upward pressure on rates. Although future rate cuts are expected, the current high yields suggest a longer period of elevated rates. This could lead to wider interest margins and potentially boost profitability for OCBC.

- 3Q23 earnings. The company’s total income for the period was S$3.43bn rising 13% YoY driven by higher net interest income and growth in non-interest income. The company’s net profit rose to S$1.81bn, +21% YoY compared to S$1.49bn in 3Q22. EPS rose to S$1.58 on an annualised basis. The group’s wealth management income grew 16% YoY to S$1.12bn, making up 33% of the Group’s income in 3Q23. Its wealth management assets under management increased 8% YoY to S$270bn, driven by positive inflows of net new money.

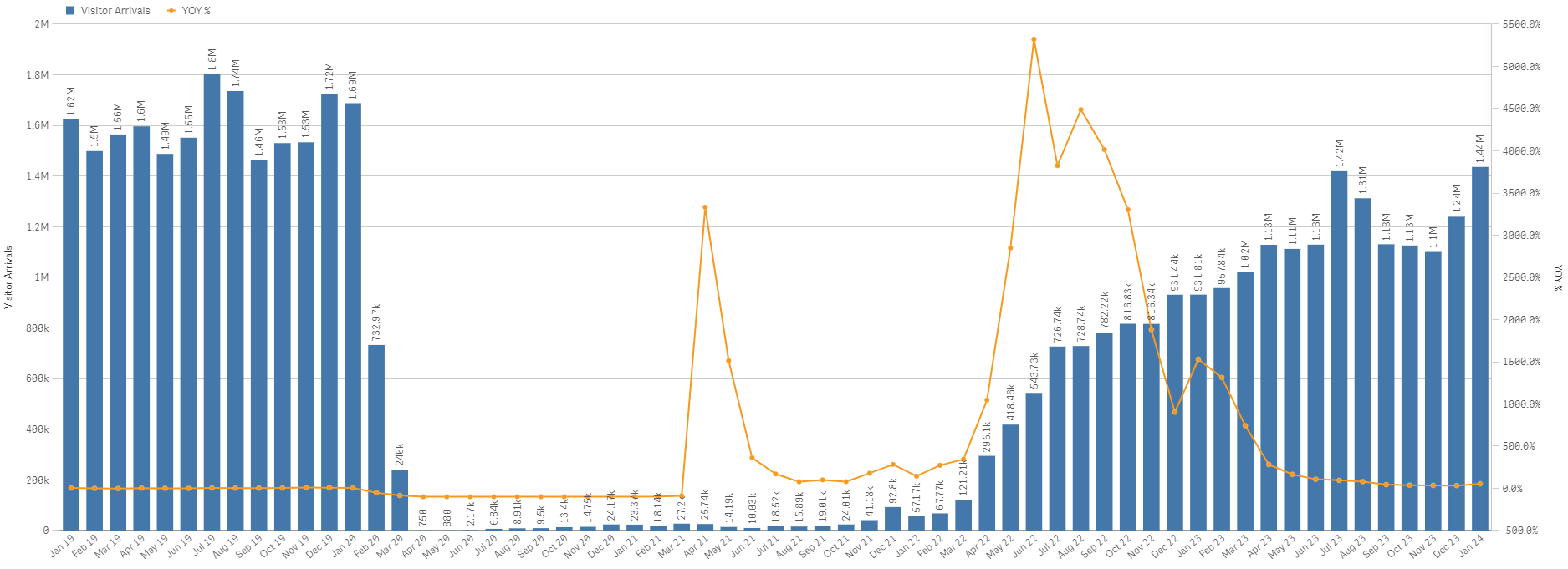

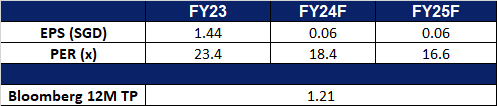

- Market Consensus.

(Source: Bloomberg)

Genting Singapore Ltd (GENS SP): Tourism on the rise

Genting Singapore Ltd (GENS SP): Tourism on the rise

- RE-ITEREATE Entry – 1.01 Target– 1.09 Stop Loss – 0.97

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- 30-day mutual visa exemption. The mutual 30-day visa-free arrangement between Singapore and China, effective from 9 February, has sparked increased interest in travel between the two countries. Tour agencies, booking websites, and airlines have reported rising inquiries and bookings, anticipating a surge in travel demand. The new scheme is expected to encourage more Chinese travellers to visit Singapore, complementing the already growing interest among Singaporeans in exploring Chinese cities. While challenges such as language barriers remain, the agreement is seen as a positive step in boosting tourism between the two nations. Despite the economic uncertainties, there is optimism in the potential for growth in travel activities, driven by enhanced connectivity, cultural exchanges, and more affordable fares.

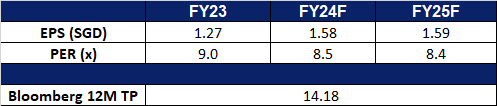

Monthly Visitor Arrivals from China – For the period between Jan 2019 to Dec 2023

(Source: Department of Statistics Singapore)

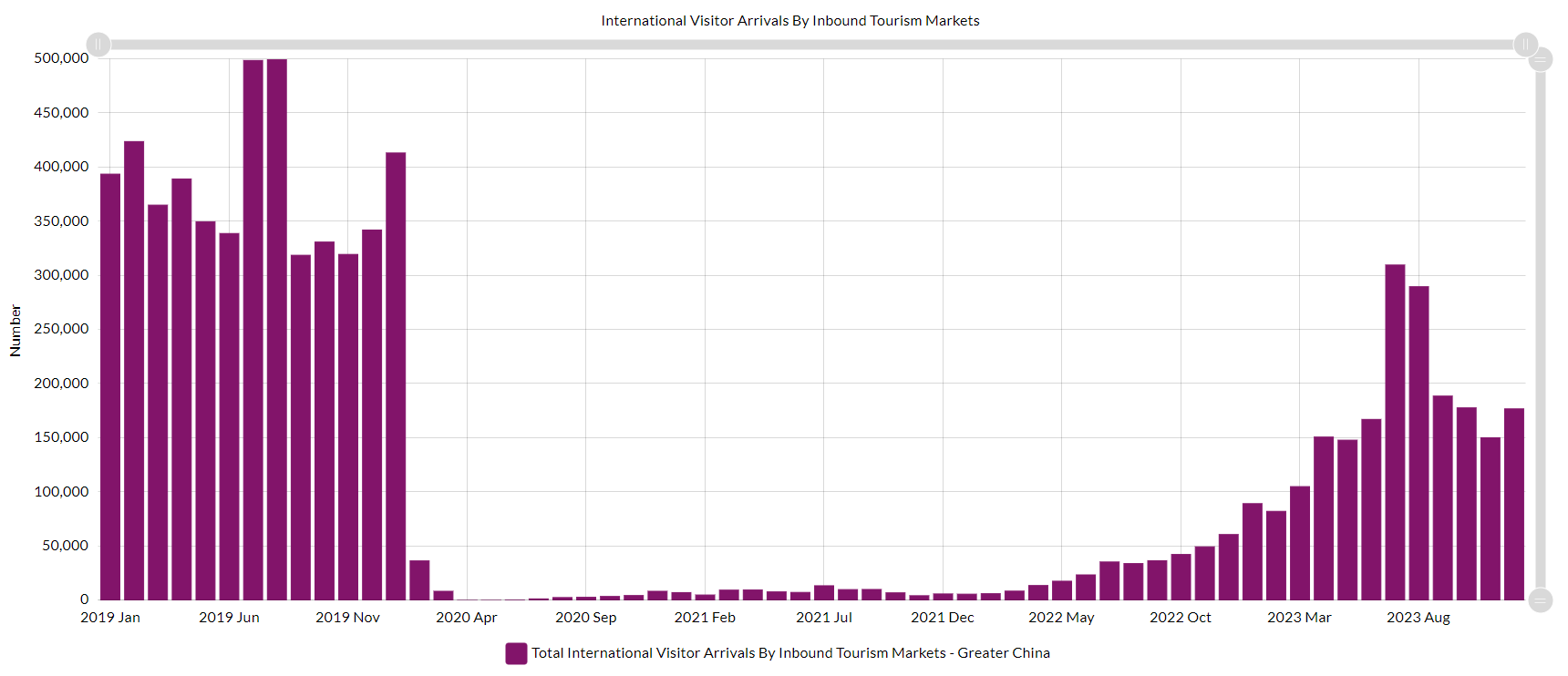

- More quality experiences for tourists. The Singapore Tourism Board (STB) projects continued tourism recovery in 2024, anticipating 15-16mn visitor arrivals and tourism receipts of S$26-27.5bn. Although pre-pandemic arrival numbers are not expected, tourist spending is anticipated to nearly match 2019 levels. In January, Singapore welcomed 1.44mn visitors, a 54.2% YoY increase and a 16.1% sequential rise, with 1.07mn being overnight visitors. The surge is credited to improved flight connectivity, factors like the mutual visa-free travel arrangement with China, and ongoing efforts to attract diverse visitors. The sector’s resilience is underscored by 2023’s strong performance, characterized by longer stays, expanded hotel capacity, and successful event hosting. STB’s strategy focuses on enhancing visitor experiences and prolonging stays to attract higher-spending tourists, prioritizing quality over quantity. This approach aligns with Singapore’s reputation for premium experiences and top-notch connectivity. Despite potential economic challenges, an emphasis on value-added experiences could help to sustain tourist spending, even if arrival numbers do not rebound to pre-pandemic levels until 2025.

Singapore monthly visitor arrivals trend – Jan 2019 to Jan 2024

(Source: Singapore Tourism Analytics Network)

- RWS expansion on track. On 2 March, the Hard Rock Hotel Singapore at Resorts World Sentosa will close to undergo renovations for the complex’s planned expansion. The 360-room hotel will receive a complete overhaul. This aligns with Genting Singapore’s previously announced plans to invest around S$6.8bn to revamp and enlarge the resort, which includes the development of a new luxury hotel and waterfront complex with 700 hotel rooms. Other ongoing projects include the transformation of The Forum shopping area, the development of a new Minion Land attraction, and the rebranding of SEA Aquarium to the Singapore Oceanarium, all of which are expected to partially open in early 2025.

- 3Q23 earnings. The company revenue for the period was S$689.9mn rising 33% YoY from the previous S$519.7mn. The company’s net profit rose to S$216.3mn, +59% YoY compared to S$135.8mn in 3Q22. Its gaming revenue rose 20% YoY to S$459.6mn and its non-gaming revenue jumping 68% to S$230.1mn.

- Market Consensus.

(Source: Bloomberg)

China Resources Power Holdings Co. Ltd. (836 HK): A freezing winter

- RE-ITEREATE BUY Entry – 16.40 Target – 17.80 Stop Loss – 15.70

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Incoming cold wave. China’s national observatory recently renewed an orange alert, the second-highest in the country’s four-tier weather warning system, for cold waves in various areas, forecasting plunging temperatures. The cold wave is set to bring a significant temperature decline to central and eastern China, progressing towards the east and south. Following the eight-day Spring Festival holiday, northern China witnessed strong winds, widespread sandstorms, dramatic temperature drops, and rainy and snowy conditions. Temperatures in the north plummeted, with certain areas experiencing declines exceeding 20 degrees Celsius. Throughout this week, central and eastern China can expect more widespread rainy, snowy, and freezing weather, coupled with noticeable temperature fluctuations. The imminent cold wave is likely to prompt increased electricity consumption as individuals opt to stay home, seeking warmth amid the freezing conditions.

- Long-Term green power purchase agreement with Merck. China Resources Power has revealed its intention to engage in a long-term power purchase agreement with Merck. Under this agreement, Merck China will substantially enhance its utilization of green electricity in production and operations, aiming to achieve a 60% usage and reduce Scope 2 carbon emissions by 185,000 tonnes. This initiative aligns with Merck’s broader objective of raising its global procurement of electricity from renewable sources to 80% by 2030 and achieving climate neutrality by 2040. The ten-year power purchase agreement with Merck guarantees life-cycle traceability of a total of 300 GWh of green power.

- Coal Prices. The decline in global coal prices is expected to have significant benefits for the company’s coal-fired power plants and gas-fired power plants. With prices at a 2-year low around $130 per tonne, lower fuel costs for coal-fired power plants translate into improved profitability and a competitive advantage in the market. While China Resources Powers does have its own coal production plants, energy consumption during the current winter period typically skyrockets for China, this means that the company will be required to buy coal from other suppliers to further supplement its energy production and will therefore benefit from the lower prices. The declining prices also create opportunities for the company’s gas-fired power plants, as natural gas becomes a more cost-effective alternative. This diversification and cost advantage contribute to improved financial performance, market competitiveness, and the ability to offer competitive electricity prices to consumers. Overall, the decline in coal prices presents favourable conditions for the company’s power generation operations, enhancing profitability and sustainability.

Thermal Coal Price

(Source: Bloomberg)

- 1H23 earnings. Revenue rose 2.13% YoY to HK$51.5bn in 1H23, compared with with HK$50.4bn in 1H22. Net profit rose 61.8% to HK$7,08bn in 1H23, compared to HK$4.37bn in 1H22. Basic earnings per share was HK$1.40 in 1H23, compared to HK$0.91 in 1H22.

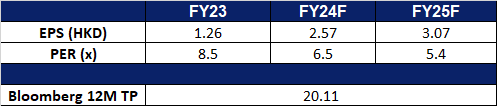

- Market consensus.

(Source: Bloomberg)

Cathay Pacific Airways Ltd. (293 HK): Resumption of key flights

- RE-ITEREATE BUY Entry – 8.10 Target – 8.80 Stop Loss – 7.80

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services and commercial laundry operations.

- Resuming more flights. Cathay Pacific Airways has recently declared its decision to recommence daily flights between Singapore and Bangkok from March 31, 2024, following a four-year hiatus prompted by the COVID-19 pandemic. Alongside its existing fifth freedom service, Cathay Pacific presently operates up to eight flights daily from Singapore to Hong Kong. The revival of the Singapore to Bangkok flight route, which was once one of the region’s most frequented paths, is anticipated to draw numerous passengers for the airline. This is particularly noteworthy given that Singapore Changi Airport and Suvarnabhumi Airport in Bangkok rank among the top airports with the highest passenger traffic in the Asia-Pacific region. The company also recently announced the resumption of other flight paths from Hong Kong to Perth, Sri Lanka, as well as Chennai.

- Lunar New Year travel rush. Anticipated to reach unprecedented heights, the Lunar New Year travel in China is poised to make history, with Chinese citizens joyously marking the festive season. In the initial four days of the Lunar New Year, Chinese travelers embarked on over 230 million “cross-regional” journeys, and a record-breaking nine billion domestic trips are projected to occur during the 40-day travel surge surrounding the Chinese New Year holidays. Additionally, there has been a notable increase in tourist numbers as individuals flock to renowned domestic tourist destinations to partake in the festive celebrations.

- High passenger traffic in Hong Kong. In 2023, Hong Kong’s airport secured the fourth position as the Asia-Pacific region’s busiest for international passengers. Anticipated to maintain its bustling status in 2024, Hong Kong continues to serve as the prominent financial hub in the region, with Singapore closely trailing. China has recently intensified its backing for Hong Kong’s role as a financial center for wealth products, bonds, and green finance, fostering increased business and investment in the city. Additionally, with China reopening post-pandemic, there is a projected surge in tourism to Hong Kong.

- 1H23 earnings. Revenue rose 135.0% YoY to HK$43.6bn in 1H23, compared with with HK$18.6bn in 1H22. Net profit was HK$4.3bn in 1H23, compared to net loss of HK$5.0bn in 1H22. Basic earnings per share was 61.5 HK cents in 1H23, compared to -82.3 HK cents in 1H22.

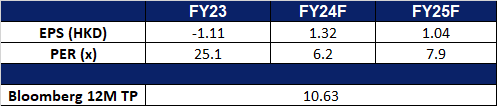

- Market consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): Riding the bull wave

- BUY Entry – 173 Target – 185 Stop Loss – 167

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- AI and semiconductors play follow the leader. Following Nvidia’s earnings beat, there was a surge in artificial intelligence and semiconductor stocks. Nvidia’s supplier, Taiwan Semiconductor Manufacturing Company and Super Micro Computer, a server component supplier, experienced an increase in share prices. ASML, which supplies critical equipment to TSMC, also saw a surge. Rivals like Advanced Micro Devices and Arm Holdings also experienced significant gains. Nvidia’s success is attributed to its custom AI chip designs, which have driven demand from tech giants like Amazon and Microsoft. South Korean memory chipmakers Samsung Electronics and SK Hynix also saw gains. Additionally, Taiwanese semiconductor firms Orient Semiconductor Electronics and MediaTek rose in value. US chip makers Intel, Broadcom, and Qualcomm also saw increases in share prices. Nvidia’s CEO expressed optimism about continued growth, especially fuelled by demand for GPUs in AI and industry-wide shifts toward accelerators. Nvidia’s strong performance has also positively impacted the shares of large computing companies such as Amazon, Microsoft, and Alphabet.

- Expanded AI offering for machine learning. AMD has announced the expansion of its ML development offering with ROCm 6.0, which will support its Radeon PRO W7800 and Radeon RX 7900 GRE GPUs. This expansion aims to broaden access to desktop graphics cards for AI researchers. Additionally, AMD has introduced ONNX Runtime support, enabling inference on a wider range of source data. Mixed precision with FP32/FP16 is brought to ML training workflows with PyTorch framework support. These advancements aim to make AI development more accessible and affordable, demonstrating AMD’s commitment to broadening hardware support and enhancing the Machine Learning Development solution stack.

- Stronger support for ROCm. AMD unveiled a new blog platform dedicated to ROCm software, designed to showcase achievements, improvements, and ecosystem updates. The platform aims to offer a centralized space for ROCm-related content, delivering exciting news and developments in the future. The establishment of a dedicated community focused solely on the benefits of the ROCm system will help AMD strengthen brand loyalty, encourage collaboration, and gather valuable feedback for further improvements and innovations in their products and services. This initiative would enhance AMD’s customer satisfaction as well as maintain its competitive edge in the market.

- Delivered strong full-year results. In FY23, AMD saw strong performance, particularly in its Data Center and Client segments, driven by increased sales despite mixed demand. Record revenue was achieved, with notable growth in Q4 attributed to Instinct AI accelerators and EPYC server CPUs. Despite a 4% annual revenue decline to $22.7bn, Data Center and Embedded segments grew significantly, comprising over 50% of total revenue. Data Center revenue surged by 38% YoY, fuelled by EPYC CPUs and GPUs. Cloud sales increased, while Enterprise sector sales accelerated. AMD’s upcoming Turin EPYC Processors are highly anticipated. Data Center GPU revenue surpassed expectations, driven by MI300X. Partnerships with cloud providers and server vendors are progressing well. In the PC market, Ryzen 8000 series processors and AI-driven G-series processors were launched. Gaming segment revenue declined, but Gaming Graphics revenue grew. The Embedded segment saw a revenue decrease due to inventory reductions. Looking ahead, AMD expects strong growth in Data Center and Client segments, with continued focus on expanding its AI capabilities.

- 4Q23 earnings review. Revenue rose by 10.7% YoY to US$6.2bn, beating estimates by US$60.0mn. Non-GAAP EPS was US$0.77 in-line with estimates. For 1Q24, AMD expects revenue to be approximately US$5.4bn vs consensus of US$5.7bn, plus or minus US$300mn. Non-GAAP gross margin expected to be approximately 52%.

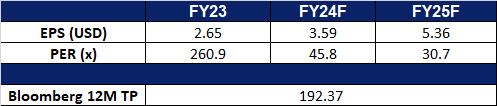

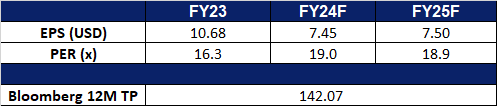

- Market consensus.

(Source: Bloomberg)

Dollar General Corp. (DG US): Shifting towards value

- RE-ITEREATE BUY Entry – 139.5 Target – 149.5 Stop Loss – 134.5

- Dollar General Corporation operates a chain of discount retail stores. The Company offer a broad selection of merchandise, including consumable products such as food, paper and cleaning products, health, beauty, pet supplies, and non-consumables such as seasonal merchandise. Dollar General serves customers in the United States.

- Turning towards more value. US consumption dipped slightly in January, but instead of cutting back, consumers are embracing value. Consumers are adapting their spending habits to prioritize affordability, demonstrating a shift in priorities rather than a reduction in purchasing power. The sticky core inflation rate of 3.9% YoY is keeping the Fed hawkish and interest rates high, prompting consumers to tighten their belts. This is evident in the unexpected 0.8% decline in January’s retail sales, particularly within the auto sector. However, spending continues in essential areas like restaurants and bars, and consumers are increasingly turning to more affordable alternatives like Dollar General for daily needs. Despite the harsh economic climate, a strong labour market and rising consumer confidence suggest a resilient future for consumption, albeit with a focus on value.

- Introduction of fresh produce. Dollar General achieved a significant milestone by offering fresh produce in over 5,000 stores nationwide, surpassing any other US mass retailer or grocer in individual points of produce distribution. These stores offer a curated assortment of fresh fruits and vegetables, covering approximately 80% of the produce categories typically found in grocery stores. By doing so, Dollar General aims to ensure communities have access to fresh, affordable, and convenient food options. The company also invested in a partnership with Shelf Engine, leveraging AI technology to improve perishable food forecasting and ordering. This optimizes in-stock produce levels and enhances operational efficiency, aligning with Dollar General’s commitment to providing healthy food options and convenience to customers across various communities. Furthermore, Dollar General expanded its 2023 “Food First” initiative based on customer feedback. This has resulted in the addition of over 100 new items to its private label brand, Clover Valley, encompassing a wide range of entrees, sides, sauces, condiments, snacks, and more, all at affordable price points. The increased product variety is likely to drive an increase in sales volume for the company, especially in the challenging macroeconomic environment.

- 3Q23 earnings review. Revenue rose by 2.4% YoY to US$9.69bn, beating estimates by US$10.0mn. Net profit fell 47.5% YoY to US$276.3mn in 3Q23 vs US$526.2mn in 3Q22. GAAP EPS was US$1.26 beating estimates by US$0.05. For FY23, it expects net sales growth in the range of 1.5% to 2.5%.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Frencken Group Ltd (FRKN SP) at S$1.6. Add Dollar General Corp (DG US) at US$139.5. Stop loss on Geo Energy Resources Ltd (GERL SP) at S$0.39.