22 May 2023: Yangzijiang Shipbuilding (BS6 SP), CRRC Corporation Ltd. (1766 HK), Meta. (META US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Yangzijiang Shipbuilding (BS6 SP): Strong USD is a tailwind

- Entry – 1.25 Target – 1.37 Stop Loss – 1.19

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

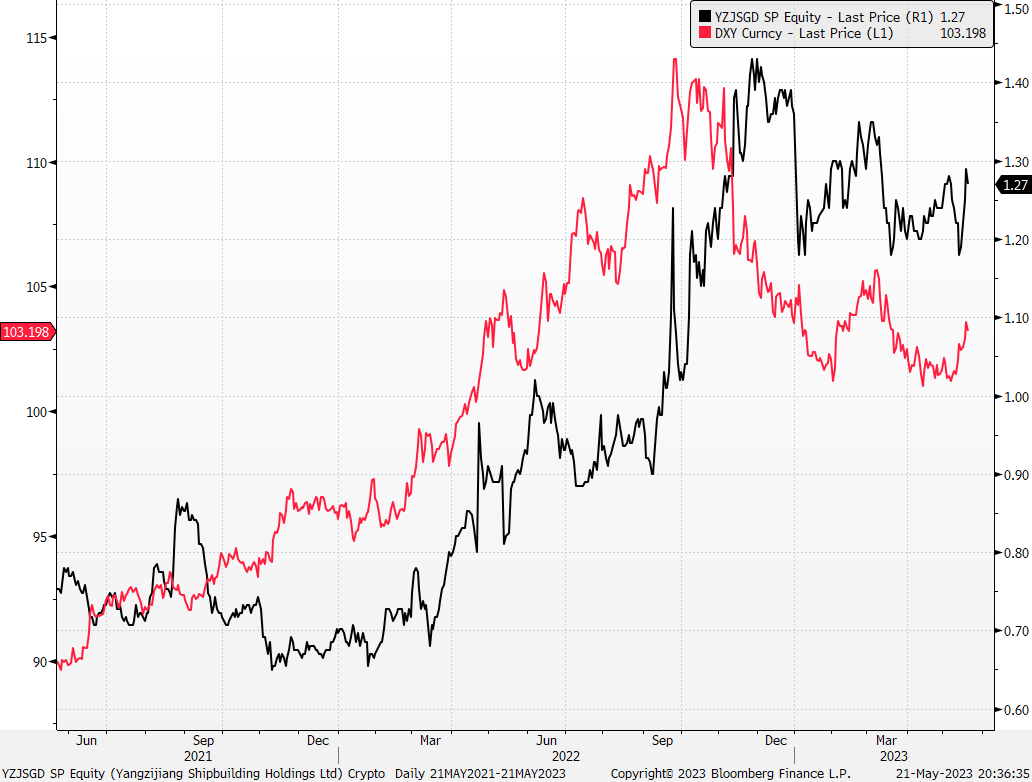

- US Dollar rebounding. Though the US inflation has tapered since 3Q22, the Fed maintains its stance to fight against inflation by keeping interest rates at high levels. Powell hinted that the Fed could pause the rate hike in June’s FOMC meeting. It is too early to project rate cuts, although the market expects so starting in 3Q23. The US dollar will remain strong in the near term.

Company share price (black) and Dollar index (red) comparison

(Source: Bloomberg)

(Source: Bloomberg)

- Falling iron ore and steel prices. China, the largest iron and steel consumer, shows weakness in its post-COVID recovery as the recent macro data was softer than expected. Accordingly, iron ore and steel prices reverse the previous uptrend and turn downward.

China iron ore (red) and hot rolled steel (black) prices

(Source: Bloomberg)

(Source: Bloomberg)

- Another record high order book. As of April, the company’s order book value climbed to another new high of US$10.98bn. Meanwhile, it secured US$1.18bn worth of new contracts, achieving 39% of the annual target of US$3bn.

- Company Outlook. The company’s outlook is positive in the upcoming months, with the rebound of the US dollar as economic pressure starts to ease. There is also clear visibility on the company’s revenue stream given that its order book is filled till mid-2025. The re-opening of China’s economy also allows the company to re-accelerate the production of its business. This suggests that the company’s performance is likely to continue to improve in the near future.

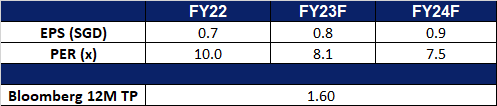

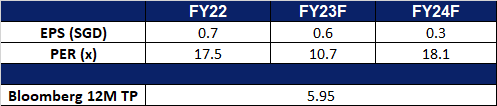

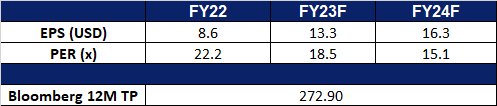

- Market consensus.

(Source: Bloomberg)

Singapore Airlines Ltd. (SIA SP): Recovering back to the pre-COVID level

- RE-ITERATE BUY Entry 6.05 – Target – 6.55 Stop Loss – 5.85

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

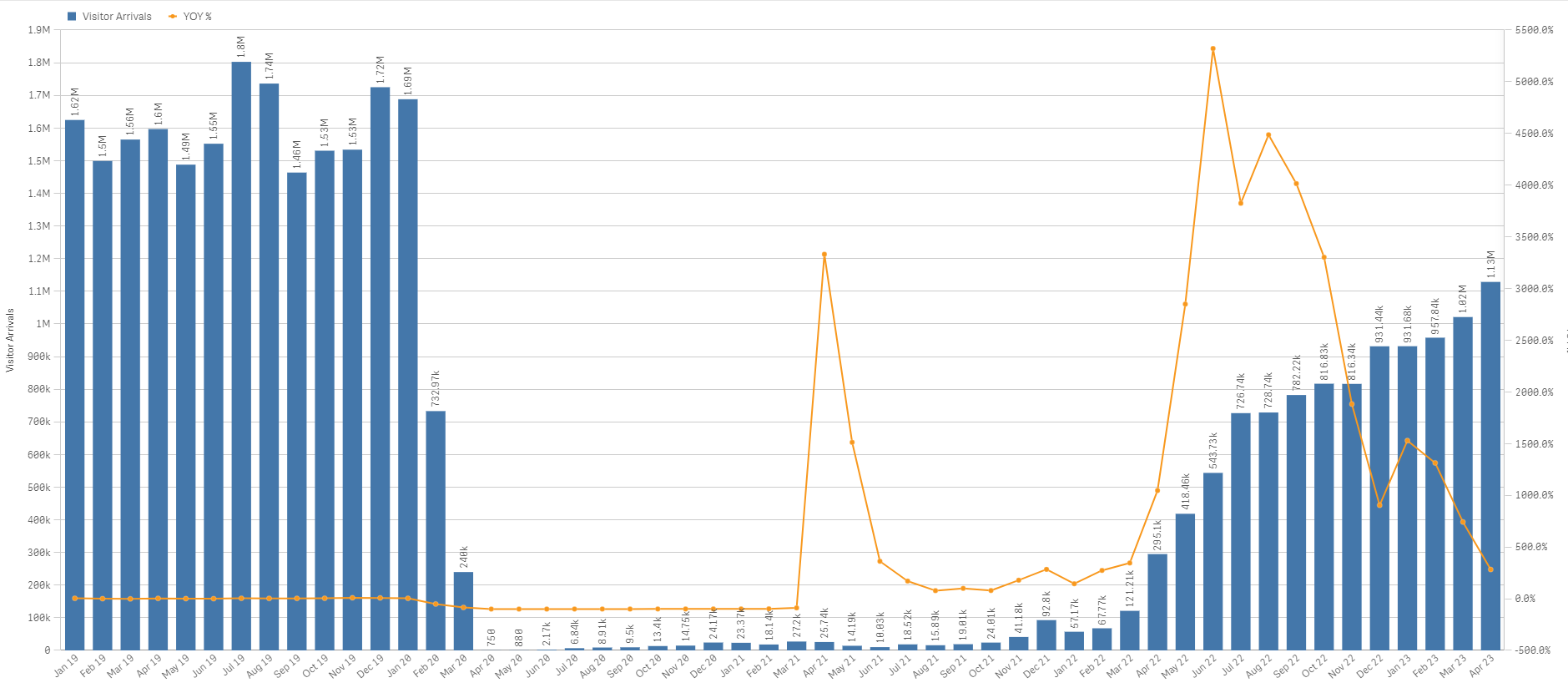

- Still more room for visitor arrivals recovery. In April, one year anniversary of Singapore’s full reopening of border, there were 1.13mn visitor arrivals to Singapore with 282.5% YoY growth. However, the number of arrivals is far below the pre-COVID level, compared to 1.69mn visitors in January 2020. The average monthly visitor arrivals in 2019 was above 1.5mn. Therefore, the normalisation of tourist visits is still on track.

Visitor arrivals trend

(Source: Singapore Tourism Analytics Network)

- To ride on the positive seasonality. The upcoming summer vacation (June to August) is the peak of the travelling season in a year. Meanwhile, this summer holiday is the first one after China’s full reopening. It is expected to see more visitors from China, as Singapore is a sweet spot of overseas traveling for families.

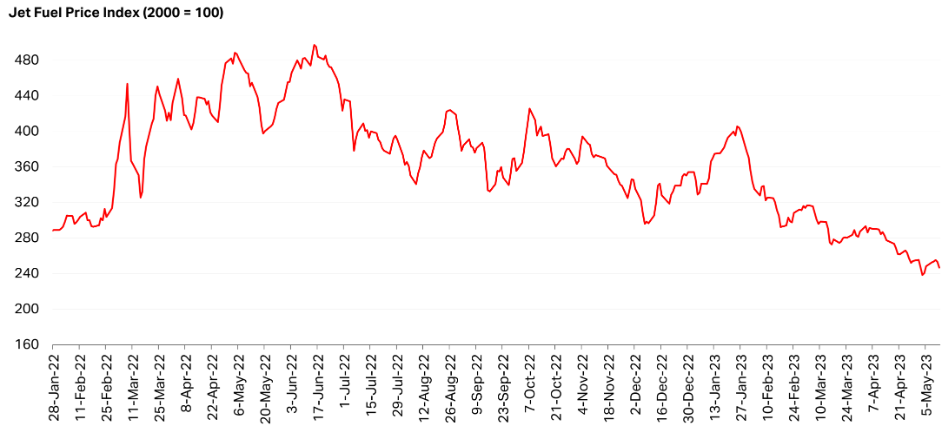

- Jet fuel prices trending down. Due to concerns over a slowdown of global economic growth and recession, international oil prices have been trending downward since mid-2022. Accordingly, prices of crude oil derivatives fall, benefiting airline companies as part of operating costs drops.

Jet fuel price trend

(Source: IATA, S&P Global)

- Record profit in FY23. Revenue more than doubled YoY from S$8.2bn to S$15.1bn as bookings soared and both SIA and Scoot substantially ramped up flights. The operating profit of S$2.7bn was a record for the group, reversing the S$610 mn operating loss in FY22. Net profit was S$2.16bn, the highest level achieved by the group since its inception 76 years ago in 1947.

- Market consensus.

(Source: Bloomberg)

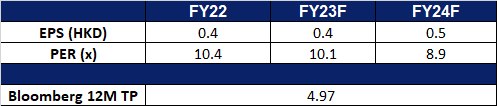

CRRC Corporation Ltd. (1766 HK): Several tailwinds to drive growth

- BUY Entry – 4.80 Target – 5.20 Stop Loss – 4.60

- CRRC Corp Ltd is a China-based company principally engaged in the manufacture and sale of rail transit equipment. The Company’s main businesses include railway equipment business, urban rail and urban infrastructure business, new industry business and modern service business. The railway equipment business mainly includes locomotive business, motor train unit and passenger car business, freight car business and rail construction machinery business. The urban rail and urban infrastructure business mainly includes urban rail vehicles, general contracting of urban rail projects and general contracting of other projects. The new industry business mainly includes electromechanical business and emerging industry business. The modern service business mainly includes financial business, logistics, trade business and other businesses.

- Hydrogen-powered city train. CRRC Corp. recently unveiled its latest hydrogen-powered city train at the exposition on China Brand amid the 2023 China Brand Day events. With a 600-km driving mileage, the train is equipped with automated start and stop technology and can reach zero emission while driving, of which CRRC Corp Ltd also holds full independent intellectual property rights for its latest hydrogen-powered city train.

- China Climate Action Plan. China’s pledge to reach carbon neutrality before 2060 and peaking Co2 emissions before 2030. By 2030, China aims to decrease its carbon intensity by over 65 % from the 2005 level and to reach over 1 200 GW of installed wind and solar power. CRRC Corp. latest hydrogen-powered city train supports China’s pledge to reach carbon neutrality.

- Tourism recovery to drive demand for transport. China recently worked with Central Asian countries to develop tourism based on intangible cultural resources along the ancient Silk Road in order to better reflect the region’s rich history. Trial opening of Shanghai Disneyland has also attracted thousands of Chinese. These efforts to promote tourism should drive the demand for transport, and CRRC Corporation would stand to benefit from this rise in demand.

- 1Q23 earnings reveiw. Revenue rose to RMB32.38bn, a 5.65% increase YoY. Net Profit rose to RMB615.3mn, up 180.01% YoY. Net profit margin rose to 1.9%, up 163.89% YoY and diluted EPS rose 100% to RMB0.02 YoY.

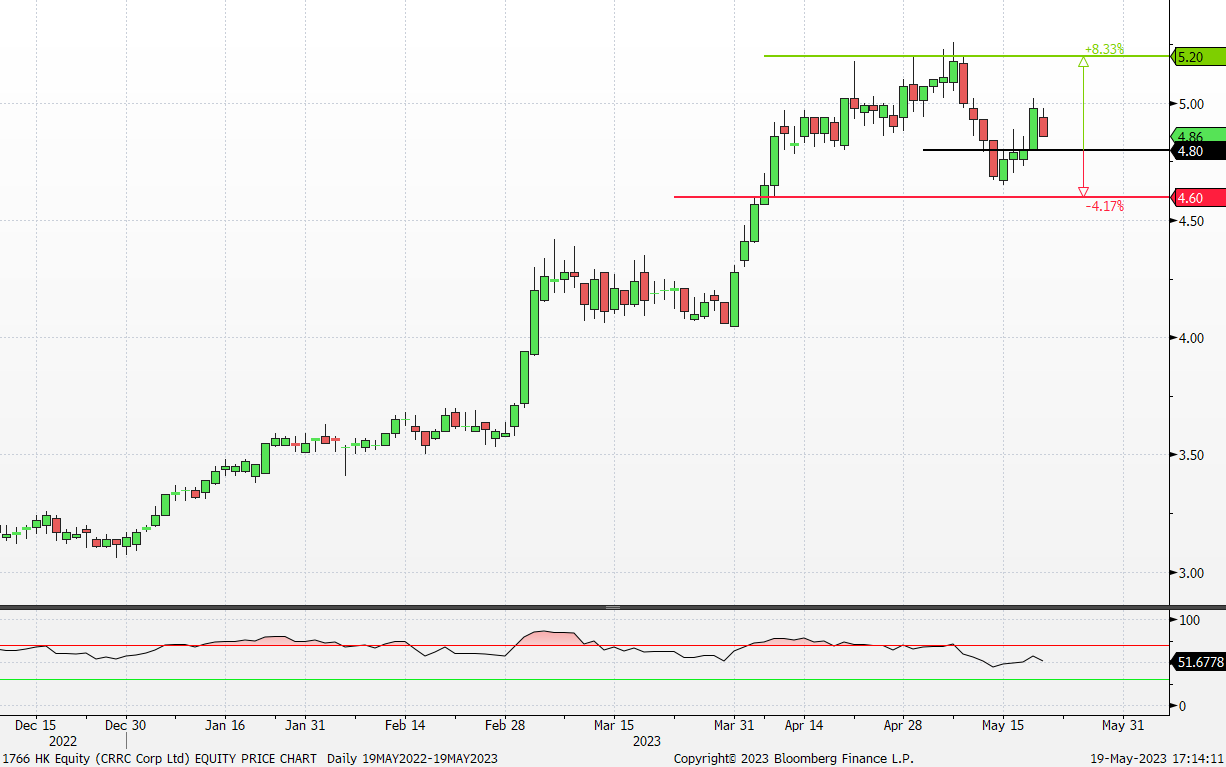

- Market Consensus

(Source: Bloomberg)

China Mobile Ltd. (941 HK): Theme of valuation system with Chinese characteristics

- RE-ITERATE BUY Entry – 65.0 Target – 70.0 Stop Loss – 62.5

- China Mobile Ltd is a China-based company mainly engaged in communication and information services. The Company’s businesses include personal market business, family market business, government enterprise market business and emerging market business. The personal market business mainly provides mobile communication services and Internet access services. The family market business mainly provides broadband access services. The government enterprise market business provides basic communication services, information application products and data, information, communication and technology (DICT) solutions. The emerging market businesses include emerging fields such as international business, digital content and mobile payment.

- Deepening State Owned Enterprises (SOEs) reforms. China has recently made an announcement regarding two special campaigns aimed at increasing the participation of market players in the reform of China’s State-owned Enterprises (SOEs). Investors in China’s stock market are showing a positive inclination towards State-owned enterprises listed in the A-share market due to the growing popularity of the “valuation system with Chinese characteristics” among market experts.

- Launch of first 5G cross-network trial service. Recently, China’s four major telecom operators made an announcement regarding their collaborative efforts to introduce the world’s inaugural trial commercial service for 5G cross-network roaming. This service will be launched in the Xinjiang Uygur autonomous region. It will allow users to access 5G networks of other telecom operators and continue utilizing 5G services even when their own network provider lacks coverage in that area. China Mobile Ltd., which has already established 1.55 million 5G base stations and provided gigabit broadband network coverage to 300 million households, is strategically positioned to reap the benefits of this 5G cross-network trial service launch.

- 1Q23 earnings reveiw. Operating revenue rose to RMB250.7bn, a 10.3% increase YoY. Net Income of RMB28.1bn was up 9.5% YoY. EBITDA rose to RMB79.9, up by 4.9% YoY. Mobile customers amounted to 983 mn, of which, 5G package customers amounted to 689mn. FY23F/24F dividend yield is 7.7%/8.5% respectively.

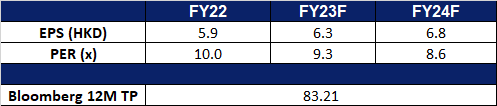

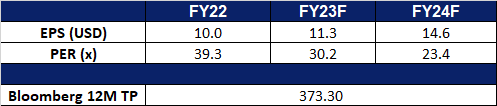

- Market Consensus

(Source: Bloomberg)

Meta. (META US): Pulling back the curtains

- BUY Entry – 240 Target – 260 Stop Loss – 230

- Meta Platforms, Inc. operates as a social technology company. The Company builds applications and technologies that help people connect, find communities, and grow businesses. Meta Platform is also involved in advertisements, augmented, and virtual reality.

- Unveil AI technology. As more mega caps are jumping on the AI bandwagon, Meta has also been developing its own cutting-edge AI chips. These chips will not only help Meta to improve the efficiency of its current operations but will also help to improve their AI capability further. In fact, the new inferencing chip that they have unveiled will be used to power some of Meta’s current recommendation algorithm. Furthermore, management has clearly stated that these chips are just the start and will eventually be used to power the metaverse. All of this, combined with the heavy cost-cutting policies that Meta has implemented to help improve profitability will undoubtedly lead to higher top and bottom lines for the firm in the coming quarters, and a high upside potential for the stock.

- Spinning out. Kustomer, an enterprise startup, which was purchased by Meta at the end 2020 for about US$1bn, has spun out and will operate as an independent company. Further supporting Meta’s intentions to reduce costs and its restructuring efforts.

- 1Q23 earnings review. 1Q23 revenue grew by 2.7% YoY to US$28.65bn, beating estimates by US$990mn. 1Q23 GAAP EPS was US$2.20, beating estimates by US$0.23. Average family daily active people grew by 5% YoY to US$3.02 bn for March 2023.

- Market consensus.

Netflix Inc. (NFLX US): Benefiting from new initiatives

Netflix Inc. (NFLX US): Benefiting from new initiatives

- RE-ITREATE BUY Entry – 360 Target – 390 Stop Loss – 345

- Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages. The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices.

- Increased market share from competitors. Netflix has recently been making strategic moves to solidify its position in the industry by increasing its market share in the media streaming industry. For instance, Netflix recently introduced an ad-supported tier at USD$7/mth, which has reached nearly 5mn active users per month, allowing it to tap into a new revenue stream while also attracting a wider audience. This move not only showcases Netflix’s adaptability and willingness to explore different avenues to maintain its competitive edge, but it will also enable it to generate additional advertising revenue when working with advertisers to create long-form commercials to be streamed on its digital platform. As a result, Netflix’s market dominance will continue to strengthen, making it a favorable choice for investors seeking long-term growth opportunities.

- Looming account-sharing crackdown. Netflix is preparing to implement another strategic initiative that will address the issue of account sharing. Under this new approach, subscribers who share their account passwords will be required to pay an additional fee for each additional member accessing the account. This initiative aims to encourage account borrowers to either activate their own subscriptions, pay to be added as an official member, or risk losing access to Netflix altogether. Considering Netflix’s substantial user base of 232.5mn paying subscribers globally as of March, we anticipate a potential increase in the number of paying subscribers once Netflix rolls out this account-sharing crackdown in conjunction with its ongoing ad-supported tier.

- Hollywood writer strike is a dip-buying opportunity. Hollywood writers voted to strike after six weeks of negotiating with major entertainment and filming companies including Netflix. This is a strike since 2007, and it cost billions of dollars in lost output and a quarter of prime-time programming for the network TV season back then. However, this is a buying opportunity as Netflix’s productions are more diversified. In recent years, Korean films and dramas which increasingly gains attraction, and previously the company was set to invest US$2.5bn in Korean content over the next 4 years. The strike has a limited impact on those productions. Besides, the main crowd of the strike is scriptwriters but actors, hence, productions are expected to continue even when the strike is on.

- 1Q23 earnings review. 1Q23 revenue grew by 3.7% YoY to US$8.16bn, missing estimates by US$20mn. 1Q23 GAAP EPS was US$2.88, beating estimates by US$0.01. Average paid memberships grew by 4% YoY to 1.75mn.

- Market consensus.

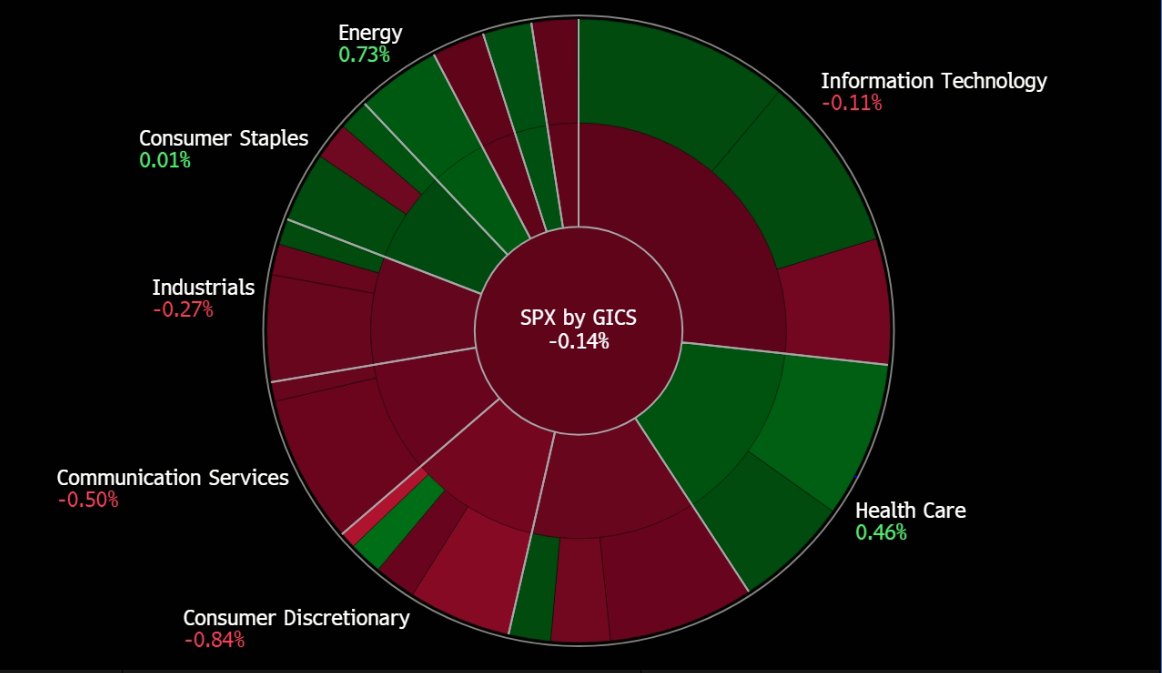

United States

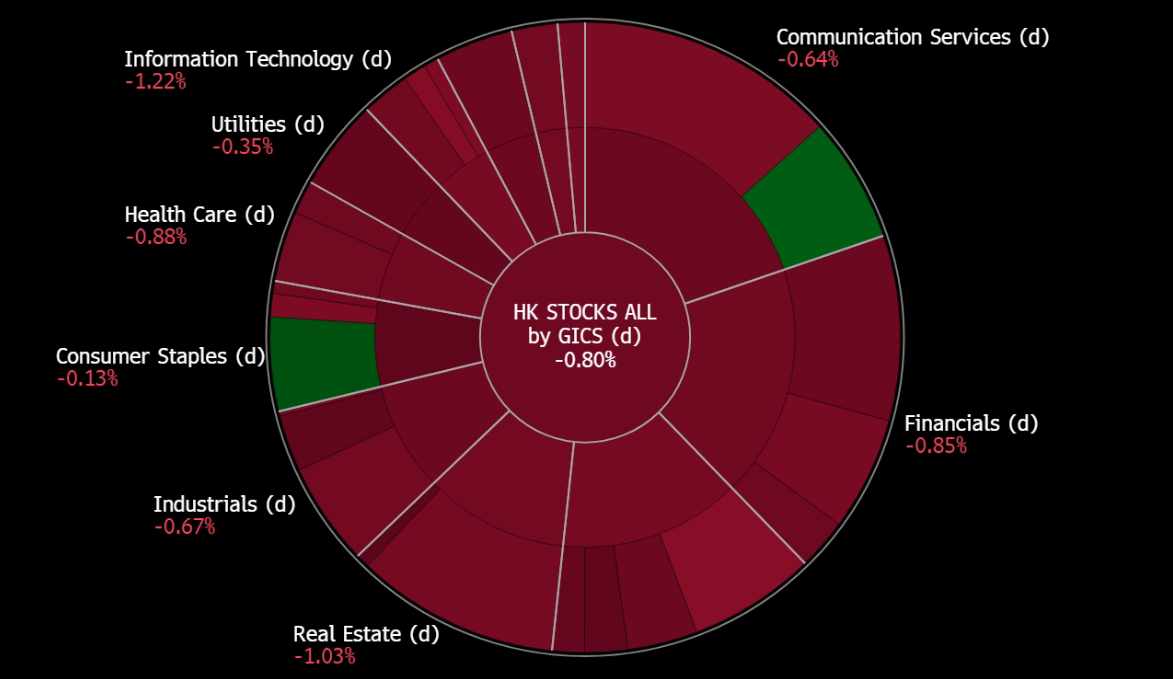

Hong Kong

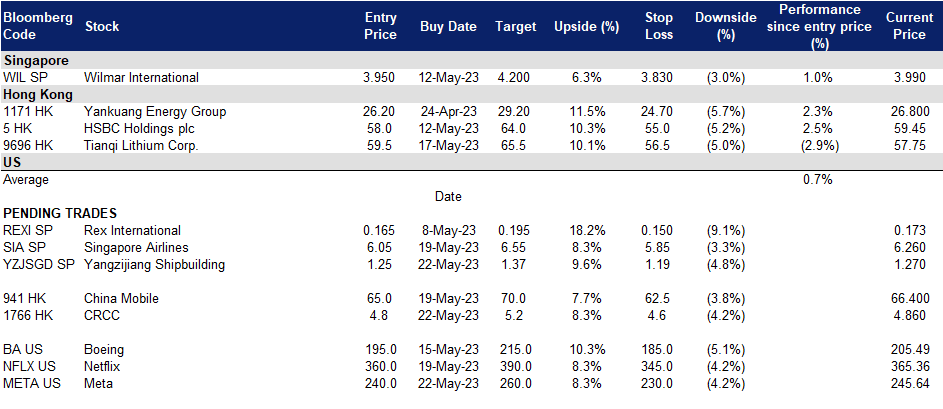

Trading Dashboard Update: Cut loss on China resource power (836 HK) at HK$17.6.

(Source: Bloomberg)

(Source: Bloomberg) (Source: Bloomberg)

(Source: Bloomberg)