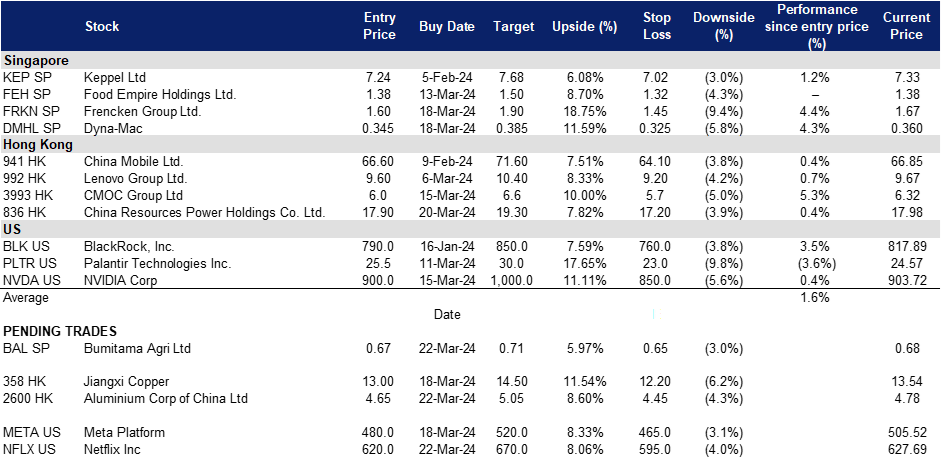

22 March 2024: Bumitama Agri Ltd (BAL SP), Aluminium Corp of China Ltd (2600 HK), Netflix Inc (NFLX US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

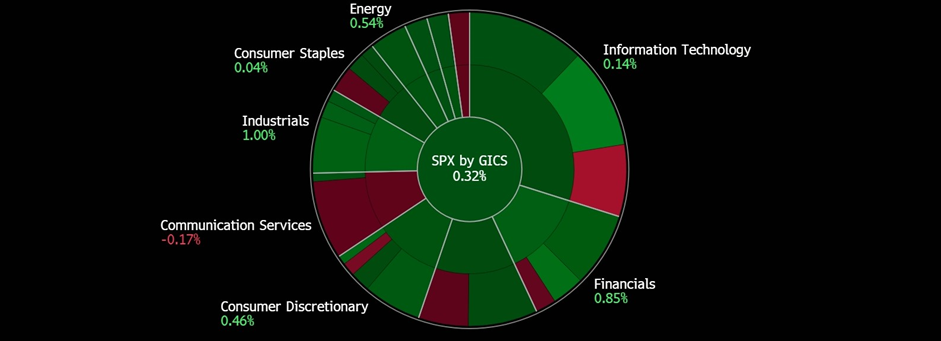

United States

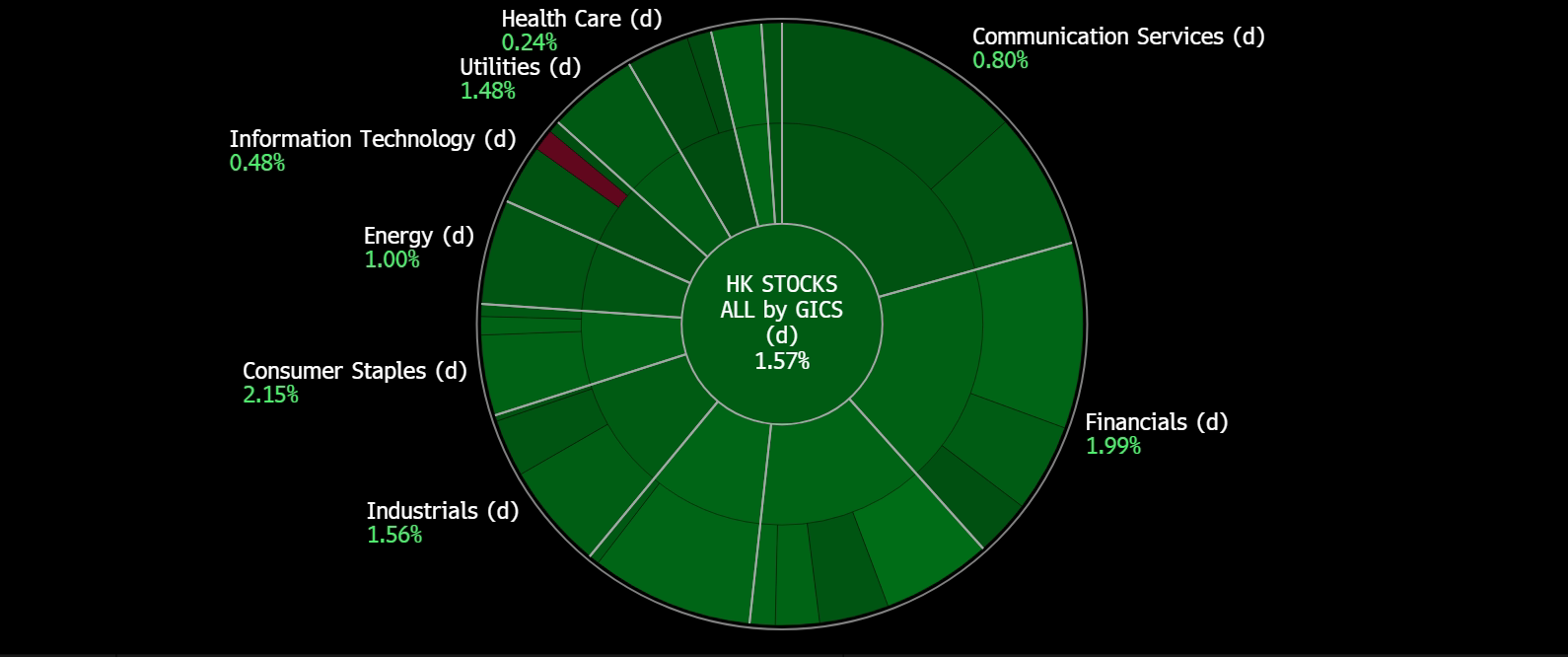

Hong Kong

Bumitama Agri Ltd (BAL SP): Palm oil rebounding

- Entry – 0.67 Target– 0.71 Stop Loss – 0.65

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK and selling CPO and PK in Indonesia.

- Palm oil prices on the rise. Malaysian palm oil futures rose to a 52-week high recently, from around MYR 3,700/T since Jan, to its current level of around MYR 4,250/ T, driven by current low stockpiles which led to a mini rally in palm oil prices. Palm oil inventory in Malaysia for February dropped to just over 1.9 mn tonnes from 2.0mn tonnes in January. Demand for palm oil also has remained strong, especially from the largest importer India, where inclement weather has prompted higher imports of edible oils.

- Expectation of strong demand for palm oil amidst stagnant supply. The outlook for the palm oil market in 2024 appears optimistic, as indicated by Malaysia’s Plantation and Commodities Minister. Strong demand is anticipated from key export destinations such as India, China, and the European Union. However, projections suggest that crude palm oil (CPO) production in Indonesia is likely to remain largely unchanged at 49 million tonnes in 2024 compared to the previous year. This stability is attributed to factors like adverse weather conditions and a slower pace of re-planting activities. As a result, palm oil supply is expected to remain constrained in the first quarter of 2024, primarily due to seasonally lower production levels and recent inclement weather hampering harvesting operations.

- Expected increased demand from Ramadan fasting period. The ongoing Ramadan fasting period and preparations for the Eid-al Fitr festival is likely to indirectly spur a higher demand for palm oil as families and communities gather for elaborate meals. This upsurge in food preparation naturally leads to a higher demand for cooking oil, and palm oil is a popular choice due to its versatility and affordability.

- FY23 results review. FY23 revenue declined by 2.4% to IDR15,442bn, compared to IDR15,829bn in FY22. Net profit declined 13.8% YoY to IDR2,931bn, compared to IDR3,398bn in FY22. Basic EPS fell to IDR 1,412 in FY23 compared to IDR1,618 in FY22.

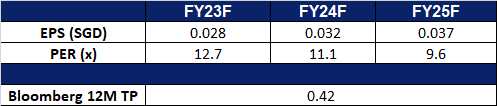

- Market Consensus

(Source: Bloomberg)

Dyna-Mac Holdings Ltd (DMHL SP): Oil prices on the rise

- RE-ITERATE Entry – 0.345 Target– 0.385 Stop Loss – 0.325

- Dyna-Mac Holdings Ltd. offers engineering, procurement and construction services to the offshore oil and natural gas, marine construction and other industries. The Company builds topside modules for floating production storage and offloading, semi-submersibles, manifolds, buoys, process piping, and tanks for petrochemical and pharmaceutical plants.

- Oil price rebounding. On 15 March, oil prices reached over US$85 a barrel for the first time since November, due to increased demand from US refiners completing planned maintenance. Brent crude futures decreased to US$85.33 a barrel, while US WTI crude dropped to US$81.09. Tightening supplies for motor fuels have driven concerns about potential price hikes. However, worries persist that the US Federal Reserve may be unable to cut interest rates due to inflation exceeding the central bank’s target. Despite recent fluctuations, oil demand is projected to increase, especially with disruptions in shipping caused by Houthi attacks. US energy firms have added a significant number of oil and gas rigs, indicating potential future output growth. Ukrainian strikes on Russian oil refineries have further supported prices. Additionally, unexpected declines in US crude oil stockpiles and gasoline inventories have contributed to price stability. While lower interest rates could stimulate economic growth and oil demand, signs of slowing economic activity in the US are not expected to prompt immediate rate cuts by the Federal Reserve.

- IEA forecasts in demand. The International Energy Agency (IEA) forecasts oil demand growth of 1.3mn barrels per day (bpd) for this year, a decrease of 1mn bpd from 2023 but up by 110,000 bpd from the previous month’s estimate due to Houthi attacks in the Red Sea delaying supplies. The IEA’s growth forecast is notably lower than OPEC’s, which is more optimistic about the economy by nearly 1mn bpd. Despite short-term shipping disruptions boosting demand, the post-pandemic slowdown and uncertain economic outlook will dampen oil demand, especially with improving vehicle efficiencies and expanding electric vehicle fleets. Oil demand growth will be primarily driven by non-OECD countries, with China’s dominance in demand growth expected to slow. If OPEC+ maintains voluntary cuts through 2024, the IEA anticipates the market to be in a slight deficit rather than a surplus. Supply growth from non-OPEC+ countries is expected to surpass oil demand expansion significantly.

- Order book and future plans. Dyna Mac had an order book totalling S$438.2mn as of December 2023, deliveries are scheduled into FY2025. To accommodate larger orders, Dyna-Mac is expanding its yard space to mitigate capacity constraints. Additionally, the company aims to diversify its revenue streams through mergers, acquisitions, and strategic partnerships with industry leaders.Top of Form

- FY23 results review. FY23 revenue increased by 32.1% to S$385.2mn, compared to S$291.5mn in FY22. This was due to higher progressive recognition from projects carried out in the year. Net profit rose 118% YoY to S$28.5mn from the previous S$13.1mn. EPS amounted to 2.75 cents for FY23 vs 1.27 cents in FY22. A final dividend of 0.83 Singapore cents per share was declared for FY23.

- Market Consensus

(Source: Bloomberg)

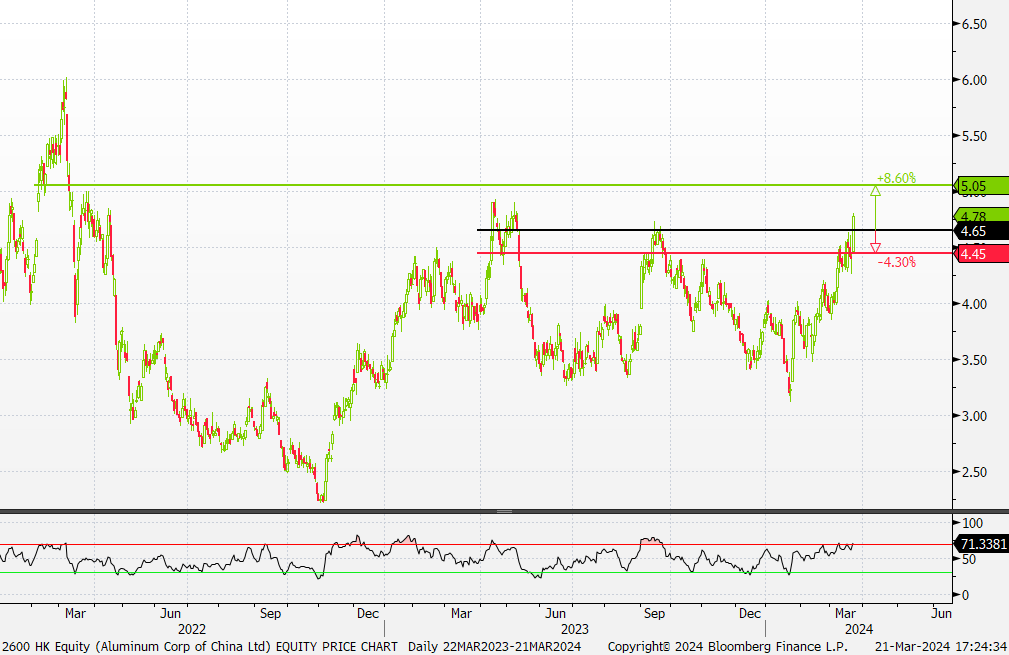

Aluminium Corp of China Ltd (2600 HK): Aluminium rebound

- BUY Entry – 4.65 Target – 5.05 Stop Loss – 4.45

- Aluminum Corp of China Ltd is a China-based company principally engaged in the production and sales of alumina, primary aluminum and aluminum alloy products. The Company operates businesses through five segments. The Alumina segment is engaged in the production and sales of alumina, fine alumina and aluminum ore. The Primary Aluminum segment is engaged in the production and sales of primary aluminum, carbon products, aluminum alloys and other electrolytic aluminum products. The Energy segment is mainly engaged in coal mining, thermal power generation, wind power generation, photovoltaic power generation and new energy equipment manufacturing. The Trading segment mainly provides alumina, primary aluminum, aluminum processed products and other non-ferrous metal products and coal and other raw materials, auxiliary materials trading and logistics services. The Headquarters and Other Operating segment is engaged in other research and development of aluminum business and other activities.

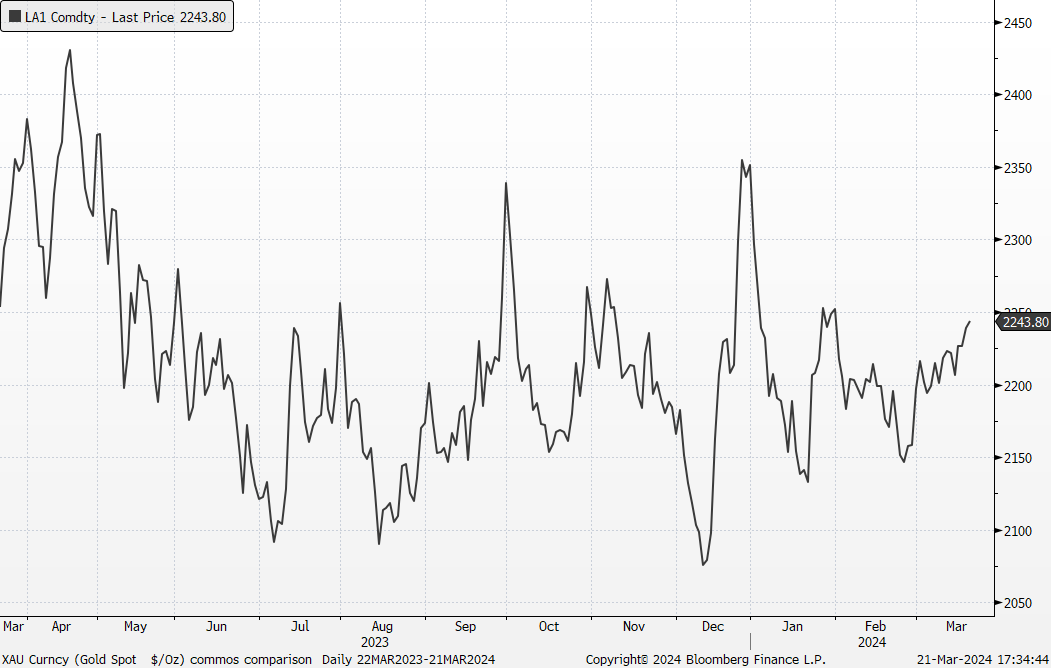

- Aluminium price rebound. The price of aluminum has surged to its highest level in three months, climbing from approximately US$2200 per metric ton at the end of February to its current rate of US$2300 per metric ton. This uptick is attributed to renewed indications of economic stimulus measures in China, specifically targeting demand stimulation. While there are apprehensions regarding escalating inventory levels in China, some suggest that this might follow a seasonal trend as the country readies itself for heightened consumption in the second quarter of the year.

Aluminium spot price (RMB/tonne)

(Source: Bloomberg)

- Record aluminium manufacturing activity. In January-February 2024, China’s industrial activity witnessed a remarkable 7% year-on-year surge, surpassing market projections of 5%. Notably, primary aluminum output experienced a notable 5.5% increase, reaching 7.1 million tonnes. This growth was propelled by heightened prices, incentivizing production as smelters sought to capitalize on improved profit margins. Furthermore, Yunnan’s aluminum output is anticipated to see growth in March, aided by enhanced power supply conditions. Additionally, China’s imports of unwrought aluminum and related products surged by an impressive 93.6% during the same period compared to the previous year, totaling 720,000 tons.

- Growing EV uses. Despite a year-on-year slowdown in overall electric vehicle (EV) sales during January-February, sales of battery-powered EVs surged by 18.2%, as reported by the China Passenger Car Association. Additionally, new energy vehicle (NEV) sales witnessed a significant 37.5% increase over the same period. The robust growth of the EV market surpassed the overall passenger vehicle market’s growth rate of 16.3%, fueled by widespread discounts that stimulated demand. This trend is anticipated to further bolster the demand for aluminum in China.

- 3Q23 earnings. Total revenue fell 20.85% YoY to RMB54.34bn in 3Q23, compared to RMB68.66bn in 3Q22. Net profit increased 105.35% YoY to RMB1.94bn in 3Q23, compared to RMB942mn in 3Q22. Basic earnings per share rose to RMB0.111 in 3Q23, compared to RMB0.052 in 3Q22.

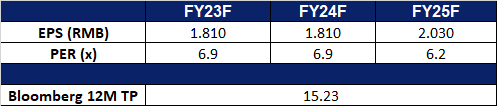

- Market consensus.

(Source: Bloomberg)

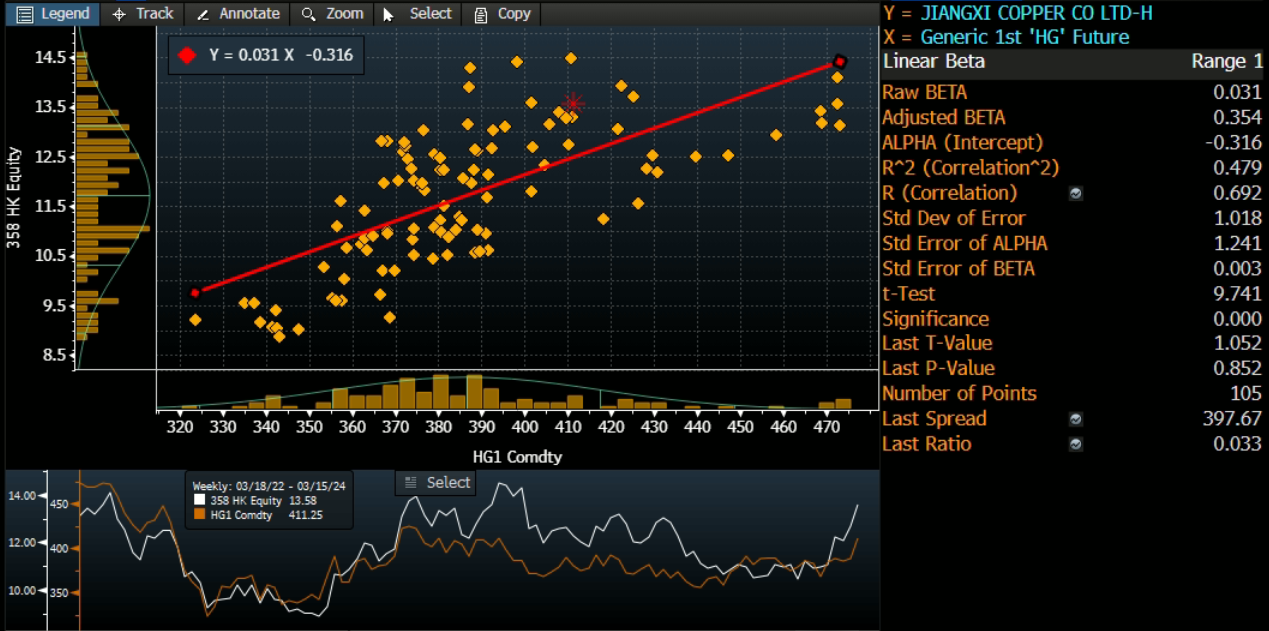

Jiangxi Copper Company Limited (358 HK): Copper breakout

- RE-ITERATE BUY Entry – 13.0 Target – 14.5 Stop Loss – 12.2

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- Copper price rally. Copper prices jumped to near 11-month highs due to potential supply tightness. News of Chinese smelters discussing production cuts, along with ongoing disruptions in major copper producers Peru and Chile, fuelled the rally. China’s top copper smelters, facing a shortage of raw materials due to global mine disruptions, agreed for the first time in a while to jointly cut production at some loss-making plants. Each smelter will determine the extent of the cuts, but the move comes after a significant drop in copper concentrate fees, a key material for copper production. This shortage is despite China’s rapidly expanding smelter capacity in anticipation of rising copper demand for green energy. However, concerns linger about the long-term outlook. The spike in copper prices will benefit CMOC’s revenue.

China Shanghai copper spot price (RMB/tonne)

(Source: Bloomberg)

- 3Q23 earnings. Revenue rose 16.9% YoY to RMB132.0bn in 3Q23. Net profit attributed to company shareholders rose 25.5 % to RMB1.6bn in 3Q23. Basic earnings per share was RMB0.46 in 3Q23.

- Market consensus.

Share price and copper price (US$/lb) correlation

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Netflix Inc (NFLX US): Signalling more price hikes

- BUY Entry – 620 Target – 670 Stop Loss – 595

- Netflix, Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

- Prices increasing once again. Netflix has warned investors and users of potential price hikes in 2024, aiming to reflect improvements and drive further investment in its service. Despite offering an ad tier at US$6.99 per month since 2022, uptake has been modest, with 23mn monthly active users reported. With over 260mn global subscribers, Netflix added 13.1mn in its recent fourth quarter, signalling satisfaction with current pricing. The company’s recent acquisition of WWE’s Raw for over US$5bn and plans to increase content investment suggest potential leverage for future price increases. While a specific timeline for hikes was not disclosed, Netflix’s pattern suggests it’s inevitable. While Netflix has not disclosed a specific timeline for price hikes, its historical pattern suggests they are inevitable. The company has experienced positive subscriber growth following its crackdown on password sharing and previous price increases. It is expected that price hikes will continue across countries as Netflix deems it has delivered sufficient additional entertainment value. Netflix Singapore recently announced a price hike across its tiers.

- Stepping into live sports action. Netflix is set to host a highly anticipated boxing match between Mike Tyson and Jake Paul, streaming exclusively on the platform on 20 July. This event marks Netflix’s ambitious venture into live sports and entertainment. Tyson, a former heavyweight champion known for his ferocity in the ring, will face off against Paul, a YouTuber-turned-fighter with a burgeoning boxing career. The match will take place at AT&T Stadium in Texas and signifies Netflix’s commitment to becoming a premier destination for at-home entertainment. This move follows Netflix’s recent acquisition of streaming rights to WWE’s “Raw” and highlights the platform’s growing presence in sports programming.

- 4Q23 earnings review. Revenue rose by 12.5% YoY to US$8.83bn, beating estimates by US$120mn. GAAP EPS was US$2.11, missing estimates by US$0.11. In 1Q24 revenue is expected to be US$9.24bn vs consensus of US$9.26bn, and EPS of US$4.49 vs US$4.14 consensus. Expect global average revenue per member (ARM) to be up YoY on a F/X neutral basis in Q1.

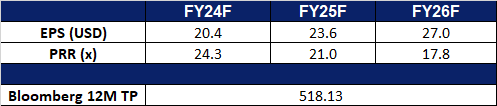

- Market consensus.

(Source: Bloomberg)

Meta Platform (META US): One man’s loss is another man’s gain

- RE-ITERATE BUY Entry – 480 Target – 520 Stop Loss –465

- Meta Platforms, Inc. operates as a social technology company. The Company builds applications and technologies that help people connect, find communities, and grow businesses. Meta Platform is also involved in advertisements, augmented, and virtual reality.

- TikTok ban. The House of Representatives passed a bill last Wednesday to urge ByteDance to divest TikTok from the company or ban the applications on the US app stores. The US has been hostile towards TikTok for the last few years, and it finally determinedly takes actions before the election day in November. It is expected that companies which put online advertisements on TikTok will reduce commercials or drop out from the application. Peers such as Meta platform, Google, or X (previous known as Twitter) could benefit from the bill, as they are the alternatives in the US market.

- Digital advertisements growth. According to Insider Intelligence, global digital AD spending is expected to grow 13.2% this year. In the backdrop of China’s sluggish domestic consumption, domestic e-commerce companies are actively exploring foreign markets, so they are increasing their advertising efforts on foreign social media. Meta is one of the major beneficiaries.

- LLaMA is one of the key contenders in the AI wave. At present, there are few mature large language models in the market. The training of the model requires a large amount of data support, and Meta has significant advantages in terms of individual and enterprise users, so LLaMA has the potential to compete with ChatGPT and increase market share.

- 4Q23 earnings review. Revenue grew by 24.7% YoY to US$40.11bn, beating estimates by US$940mn. GAAP EPS was US$5.33, beating estimates by US$0.39. 1Q24 total revenue is expected to be in the range of US$34.5bn-US$37.0bn vs US$33.87bn consensus. Meta’s board of directors declared a cash dividend of US$0.50 per share of our outstanding common stock.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add China Resources Power Holdings Co. Ltd. (836 HK) at HK$17.9.