19 July 2023: China Aviation Oil Singapore Corp. Ltd. (CAO SP), Anta Sports Products Ltd. (2020 HK), Coinbase Global Inc (COIN US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

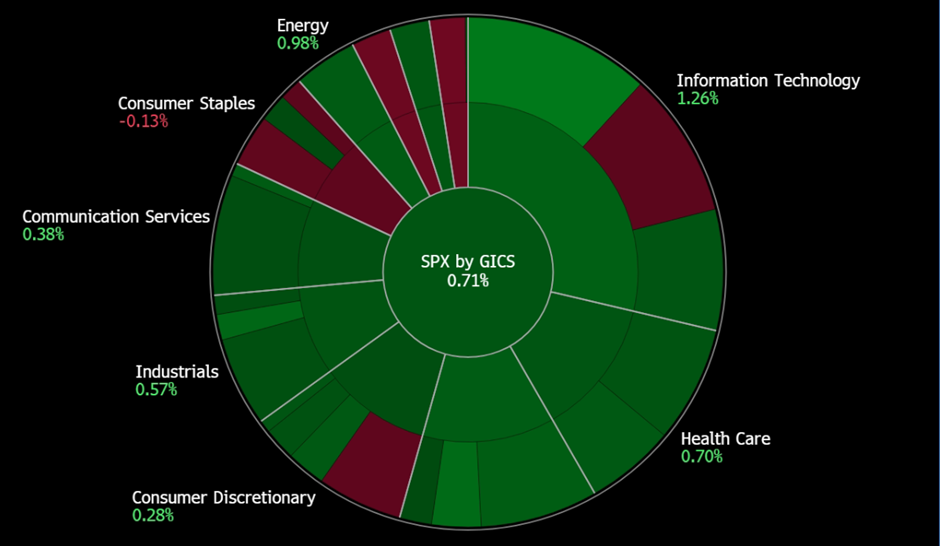

United States

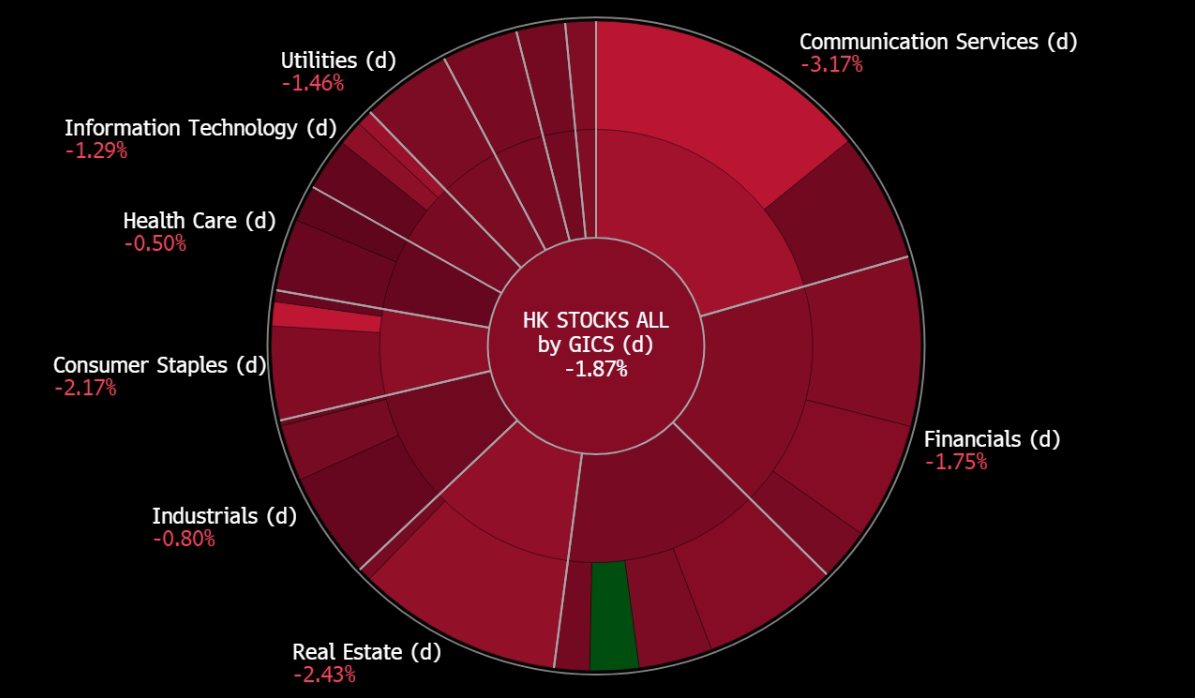

Hong Kong

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Ontrack recovery in flight demand

- RE-ITERATE BUY Entry 0.90 – Target – 1.00 Stop Loss – 0.85

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, and petrochemical products, including physical and paper swaps, and futures trading.

- Expecting travelling demand surge in the upcoming summer. The summer vacation is generally a travelling peak season as fresh graduates from primary/secondary/high schools and colleges go travelling with friends and families before they move to new schools in September. The upcoming summer is the first long holiday season after China’s full-blown reopening, and tourism is expected to brace a pent-up demand from fresh graduates and their families. Overseas travelling is poised to further recover due to the pent-up demand.

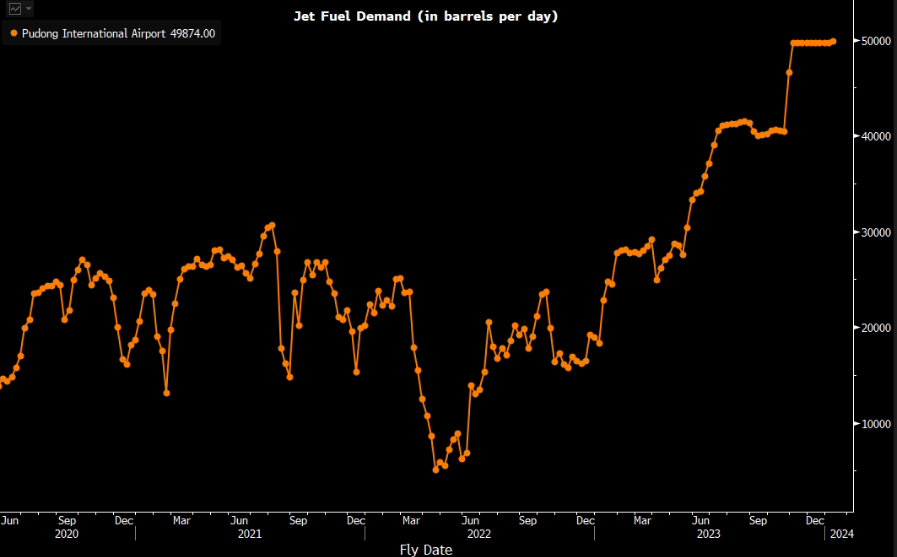

- Promising recovery in aircraft movement at Shanghai Pudong International Airport. According to the latest announcement, April aircraft movement at Pudong International Airport jumped by 726% YoY to 29074 flights. April passenger throughput jumped by 8155.9% YoY to 3.52mn. April freight throughput jumped by 145.8% YoY to 274.3 thousand tonnes.

- Promising recovery in aircraft movement at Shanghai Pudong International Airport. According to the latest announcement, June aircraft movement at Pudong International Airport jumped by 327.0% YoY to 36,702 flights. June passenger throughput jumped by 2,854.9% YoY to 4.77mn. June freight throughput jumped by 4.3% YoY to 276.7 thousand tonnes.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- FY22 results review. Revenue for FY22 fell by 6.65% to US$16.46bn. Gross profit rose by 15.29% YoY to US$35.39mn. Total supply and trading volume decreased by 40.60% YoY to 20.26mn tonnes. Net profit decreased by 17.75% YoY to US$33.19mn.

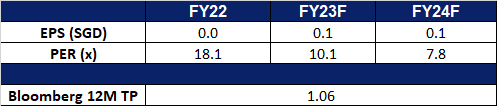

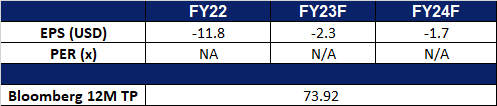

- Market consensus.

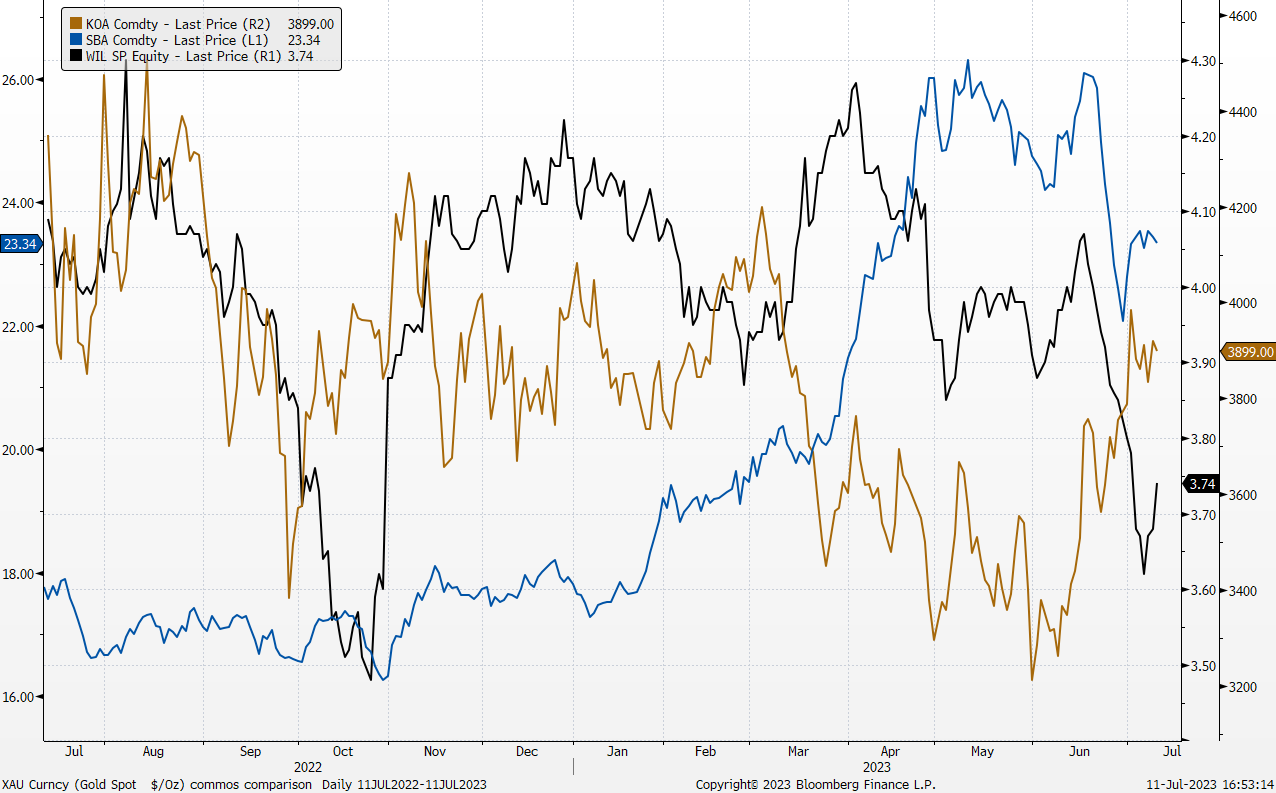

Wilmar International Ltd. (WIL SP): Sugar and Palm Oil productions decline

Wilmar International Ltd. (WIL SP): Sugar and Palm Oil productions decline

- RE-ITERATE BUY Entry 3.70 – Target – 4.00 Stop Loss – 3.59

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

- Less sugar output in India. Due to scanty rainfall, a possible heat wave could hit sugarcane production summer season. According to the weather department data, key cane-growing districts of Maharashtra have received up to 71% less-than-normal rainfall so far this monsoon season that started on June 1. In Karnataka, the third-biggest sugar producer, the rainfall deficit is as high as 55% in cane-growing districts. Sugar output in the current year is expected to fall more than 8% to 32.8mn tonnes from last year. The global production was estimated to be 187.9mn tonnes, and India is expected to account for 19.2% of the world supply in May, according to the US Department of Agriculture. Hence, the recovery in sugar production will tumble, upholding sugar prices.

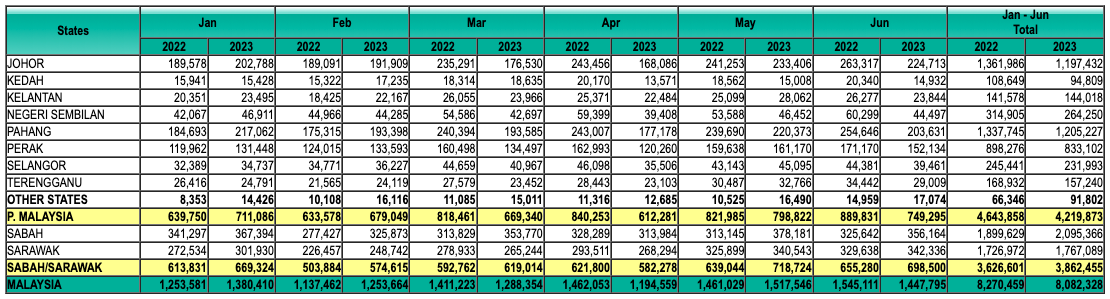

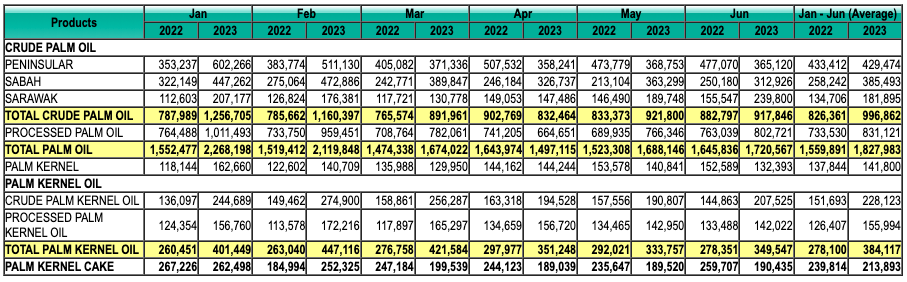

- Palm oil output fell in Malaysia in June. Crude palm oil output in June fell 4.6% MoM to 1.45mn tonnes. Exports rose 8.6% MoM to 1.17mn tonnes. Stockpiles gained 1.9% MoM to 1.72mn tonnes.

Monthly Crude Palm Oil Output

(Source: MPOB)

(Source: MPOB)

Monthly Closing Crude Palm Oil Inventory

(Source: MPOB)

(Source: MPOB)

- 1Q23 results review. Revenue dropped by 3.8% YoY to US$16.9bn. Net profit fell by 26.2% YoY to US$391.4mn. Food product sales volumes rose by 4.1% YoY to 7.2mn MT. Feed and Industrial Products sales volume jump by 15.2% YoY to 13.7mn MT.

Sugar Futures, Crude Palm Oil Futres, and Share price comparison

(Source: Bloomberg)

(Source: Bloomberg)

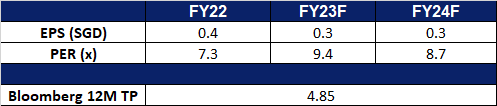

- Market consensus.

(Source: Bloomberg)

Anta Sports Products Ltd. (2020 HK): Dual stimuli

- BUY Entry – 84.0 Target – 91.0 Stop Loss – 80.5

- ANTA Sports Products Limited is principally engaged in the manufacture and trading of sporting goods, including footwear, apparel and accessories in the Mainland China. The Company focuses on sportswear market in China with a brand portfolio, including ANTA, ANTA KIDS, FILA, FILA KIDS and NBA. Through its subsidiaries, the Company is also engaged in the manufacture of shoe sole. The Company’s subsidiaries include Anta Enterprise Group Limited, Motive Force Sports Products Limited and REEDO Sports Products Limited

- Expected economic stimulus to boost domestic consumption. China’s continued economic recovery is still faced with insufficient demand, weak momentum, and weak confidence. The market expects a big economic stimulus with a focus on domestic consumption at China’s upcoming month-end politburo meeting, expecting policies to turn more positive by boosting infrastructure investment, rolling out some targeted consumption support, and easing property policies further. China’s Commerce Ministry also recently announced an 11-point plan to boost the domestic consumption of household consumer goods and services.

- Upcoming Asian Games. The Asian Games, initially delayed due to the rapid spread of COVID-19 in and around Hangzhou, China, have been rescheduled for September 23 to October 8, 2023. With athletes and spectators from across Asia converging in China to participate in or witness the event, the upcoming Asian Games are expected to have a positive impact on the sales of sports products. The heightened exposure that Anta, a sports brand, will gain from this sporting event is likely to considerably boost the sales of its products.

- New Partnership. Anta has recently entered into a 5-year partnership agreement with Kyrie Irving and is set to launch a new product line in the first quarter of 2024. Additionally, both parties will collaborate on the Anta x Kyrie youth basketball training camp in China, aiming to promote the sport and its culture through charitable initiatives. This partnership with Irving signifies a significant advancement in Anta’s international expansion efforts. By introducing their exclusive product line and leveraging Irving’s influential status, Anta is strategically positioning itself to expand its presence in the global market.

- FY22 earnings. Revenue rose to RMB53.7bn, up 8.8% YoY. Net profit fell 1.7% YoY to RMB7.59bn. Net Profit Margin fell by 2.0% to 14.0%, as a result of higher expenses.Diluted EPS is at RMB2.82, down from RMB2.87 in FY21.

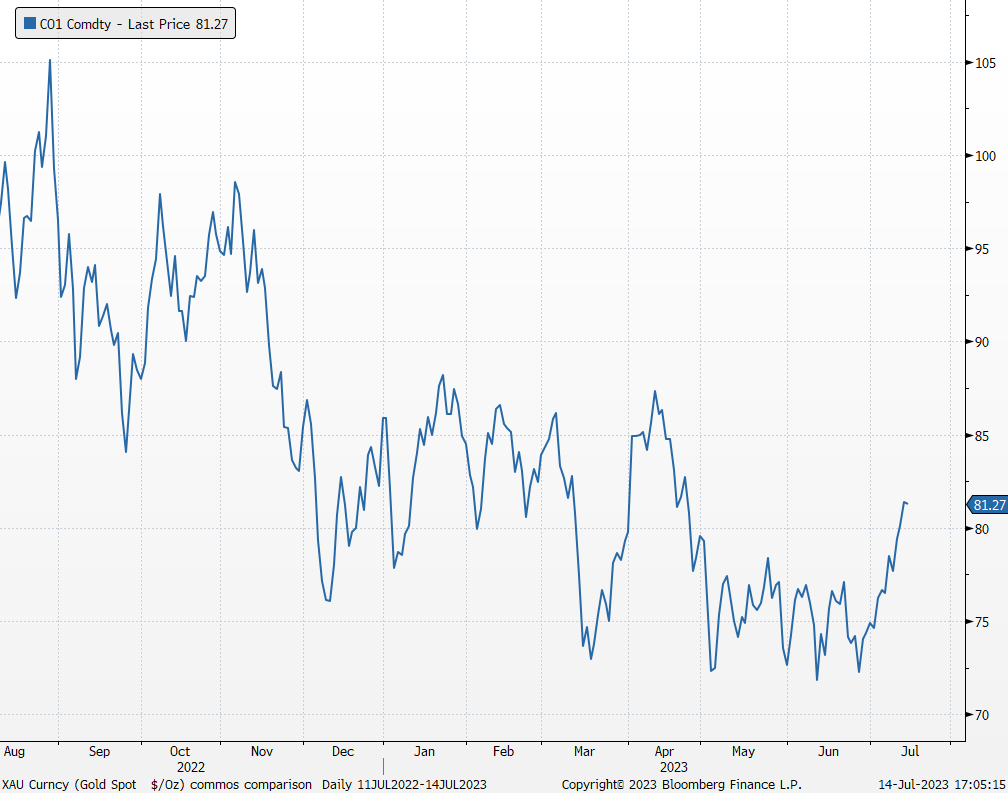

- Market Consensus.

(Source: Bloomberg)

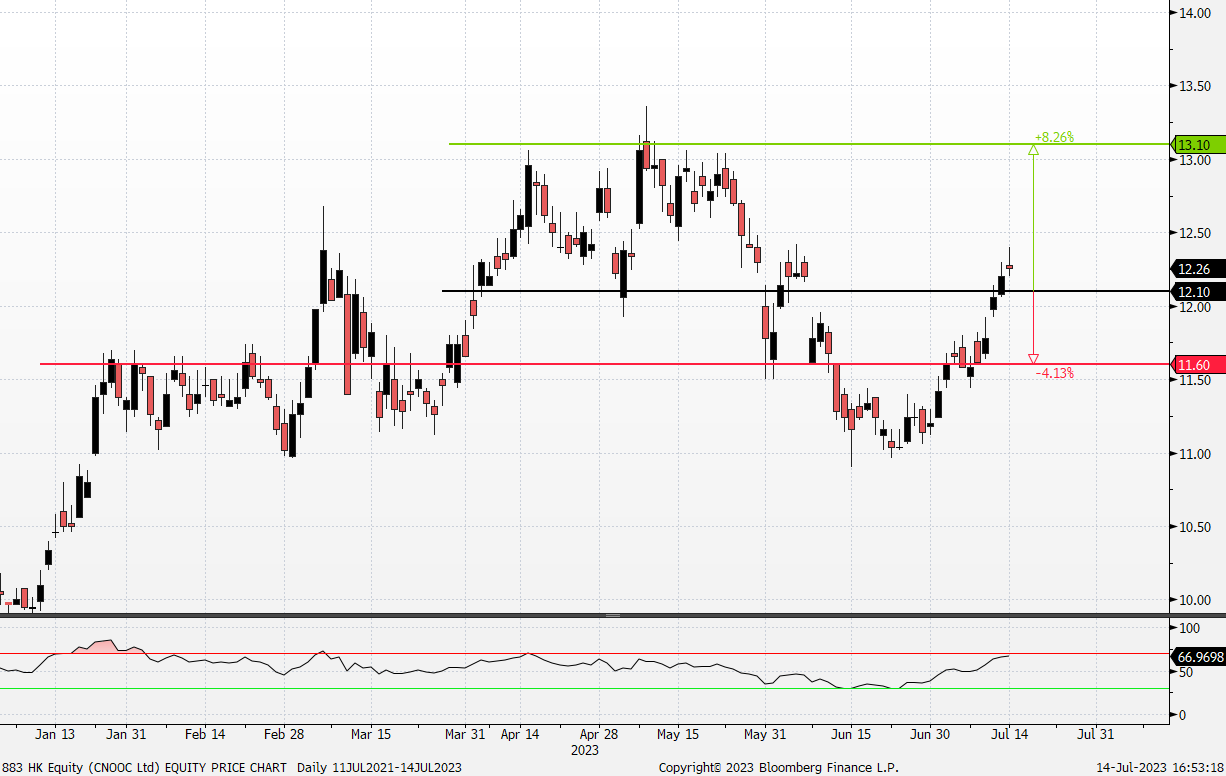

CNOOC Ltd. (883 HK): Rebounding Oil

CNOOC Ltd. (883 HK): Rebounding Oil

- RE-ITERATE BUY Entry – 12.1 Target – 13.1 Stop Loss – 11.6

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Demand for oil to outgrow supply. OPEC has revised its crude oil demand forecast for 2023, projecting an increase to 2.4 million barrels per day (bpd), a 100,000 bpd upward adjustment from the previous month’s forecast. As global economies recover and signs of inflation cooling off emerge in the second half of 2023, factory activities are expected to rise, leading to a higher demand for oil. Additionally, major oil-producing countries, including Saudi Arabia, have implemented significant oil production cuts, further driving up oil prices in the near future. Consequently, the cost of oil is anticipated to increase within the market.

- Uncovering more oil supply. CNOOC intends to initiate offshore exploration in Tanzania, as part of a recent plan. This plan arises from an agreement between CNOOC and the Tanzania Petroleum Development Corporation (TPDC). The collaboration between the two companies will involve conducting seismic studies in deep-sea blocks owned by TPDC. Tanzania is actively pursuing the development of its natural gas resources and has recently secured a partnership with major oil and gas firms to construct a large liquefied natural gas (LNG) export terminal. The purpose of establishing the LNG export terminal is to fulfil the growing demand for LNG in Europe, as the region aims to diversify its gas supplies away from Russian pipelines by 2027, which has been facing pressures from oil supply cuts recently.

- New Partnership. CNOOC Refining, a subsidiary of CNOOC, has recently inked a strategic cooperation framework agreement with Nio Energy in Anhui province. The primary objective is to jointly construct the electric vehicle charging and battery swapping infrastructure across China. This collaboration will enable CNOOC Refining to leverage its strengths and extensive experience, providing Nio with robust sites, cutting-edge technology, and comprehensive service support. By contributing to the rapid development of the charging and battery-swapping network, CNOOC Refining aims to bolster its position and actively support the country’s carbon neutrality and peak carbon goals.

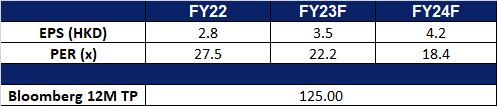

Brent Crude Oil Prices

- 1Q23 earnings. Revenue rose to RMB97.1bn, up 7.5% YoY. Net profit fell 6.38% YoY to RMB32.1bn. Diluted EPS is at RMB0.68, down 11.69% YoY.

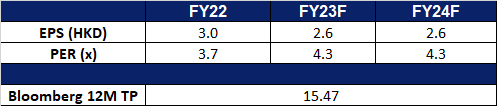

- Market Consensus.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Winning big

- RE-ITERATE BUY Entry – 98.0 Target – 115.0 Stop Loss – 89.5

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- Legal victory. The legal victory in the Ripple Labs case had a positive impact on stock prices in the cryptocurrency and blockchain industry. The ruling cleared Ripple Labs of violating federal securities law and led to a 74% surge in the XRP token’s value. Despite facing its own legal challenges with the SEC, Coinbase’s shares also surged by almost 25%. This marked the first time a U.S. judge ruled against the SEC, boosting optimism about the crypto market’s future. Other companies, including Riot Platforms, Marathon Digital Holdings, Microstrategy, and Hut 8 Mining, experienced significant stock price increases. Coinbase’s decision to relist the XRP token added to the positive market sentiment, signaling confidence in the industry’s growth potential. Overall, the Ripple Labs victory played a crucial role in driving up stock prices for crypto-related companies.

Bitcoin and Ethereum Price Chart

(Source: Bloomberg)

- Investors growing positive. Cryptocurrencies surged to new heights fueled by favorable regulatory developments and increased investment activity. Bitcoin achieved its highest price since June 2022, surpassing $31,818, with a year-to-date gain of over 90% and a monthly increase of nearly 30%. Ether and Ripple also experienced significant gains, supported by positive market shifts. The legal ruling allowing Ripple to be traded on public crypto exchanges played a key role in driving the market surge. Regulatory changes, combined with the participation of finance giants BlackRock and Fidelity, have sparked a positive shift in investor sentiment. Smaller cryptocurrencies also benefited from the rally, witnessing notable increases. The growing liquidity in Bitcoin and Ether indicates increased market activity, while Coinbase’s stock turnover reached a 14-month high. These developments mark a turnaround from the aftermath of the FTX exchange collapse in November 2022 and subsequent regulatory scrutiny. Although challenges and setbacks persist, the entry of traditional finance entities into the crypto market has infused optimism and momentum.

- 1Q23 earnings review. Revenue fell 33.4% YoY to $772.5mn, beating estimates by $119.2mn. GAAP earnings per share was -$0.34, $1.02 above expectations.

- Market consensus.

(Source: Bloomberg)

Caterpillar Inc (CAT US): Benefiting from recovery in the US construct and global mining activies

Caterpillar Inc (CAT US): Benefiting from recovery in the US construct and global mining activies

- RE-ITERATE BUY Entry – 251.5 Target – 265.0 Stop Loss – 244.8

- Caterpillar Inc. designs, manufactures, and markets construction, mining, and forestry machinery. The Company also manufactures engines and other related parts for its equipment, and offers financing and insurance. Caterpillar distributes its products through a worldwide organization of dealers.

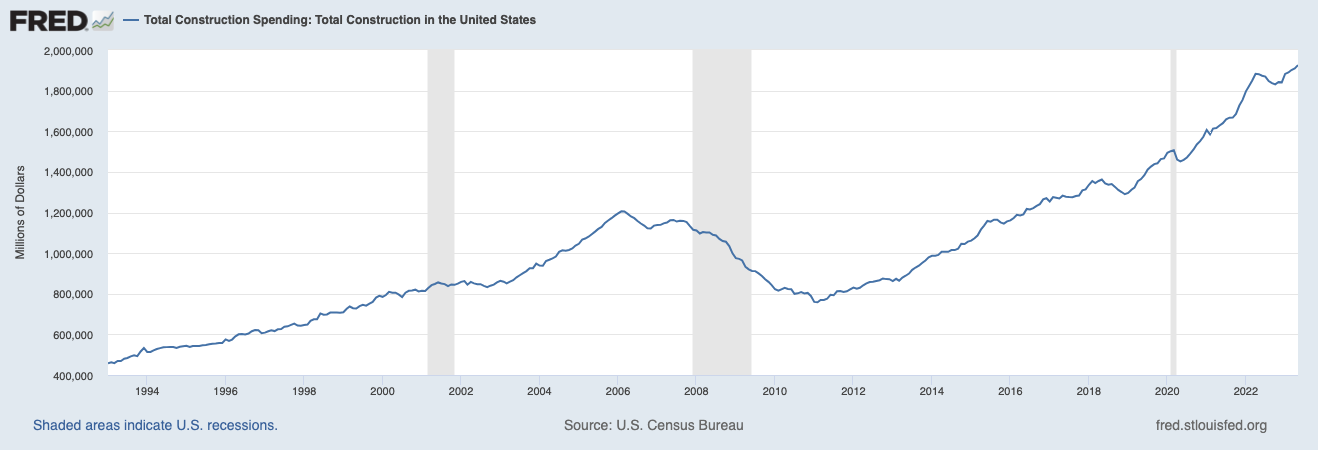

- U.S. construction spending hits record high. In May, construction spending in the United States experienced a 0.9% MoM rise, reaching a seasonally adjusted annual rate of $1,925.6bn. This growth followed a 0.4% increase in April and slightly exceeded market expectations of a 0.6% increase. Notably, this marked the most substantial increase in construction spending witnessed in the past four months.

US Total Construction Spending

(Source: Federal Reserve Economic Data)

(Source: Federal Reserve Economic Data)

- Global mining spending continues to grow. The global migration of supply chains and the growing adoption of electric vehicles have prompted countries to intensify their efforts in the mining industry. The latest findings from the World Energy Investment Report 2023, published by the International Energy Agency, indicate that capital expenditures on essential minerals rose by 30% YoY in 2022. Moreover, it is anticipated that the world’s leading mining companies will witness a 12.2% YoY increase in their capital expenditure for this year.

- 1Q23 earnings review. Revenue rose 16.9% YoY to $15.9bn, beating estimates by $630mn. Non-GAAP EPS of $4.91 beat estimates by $1.12.

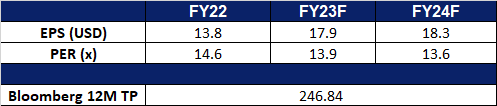

- Market consensus.

(Source: Bloomberg)

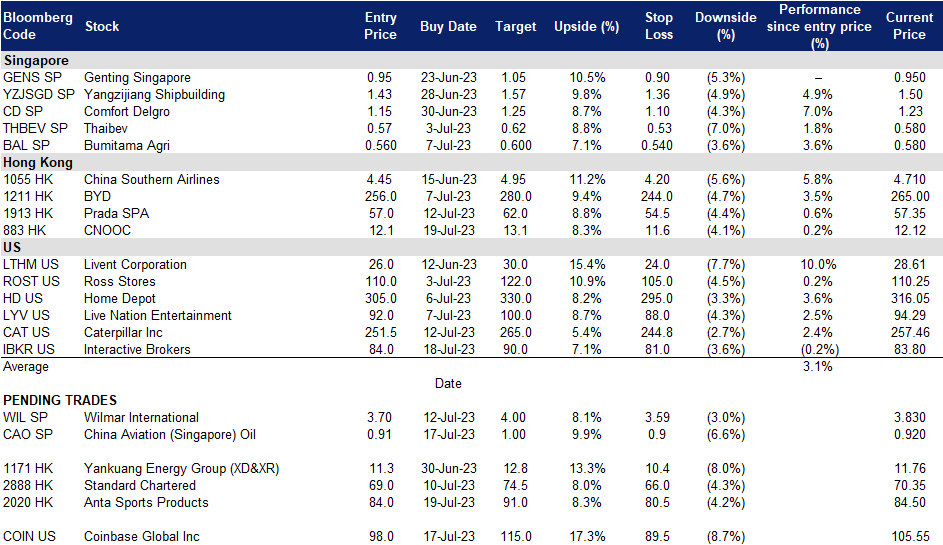

Trading Dashboard Update: Add CNOOC (883 HK) at HK$12.1 and Interactive Brokers (IBKR US) at US$84.

(Source: Bloomberg)

(Source: Bloomberg)