16 February 2024: Genting Singapore Ltd (GENS SP), Cathay Pacific Airways Ltd. (293 HK), Zillow Group Inc (Z US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

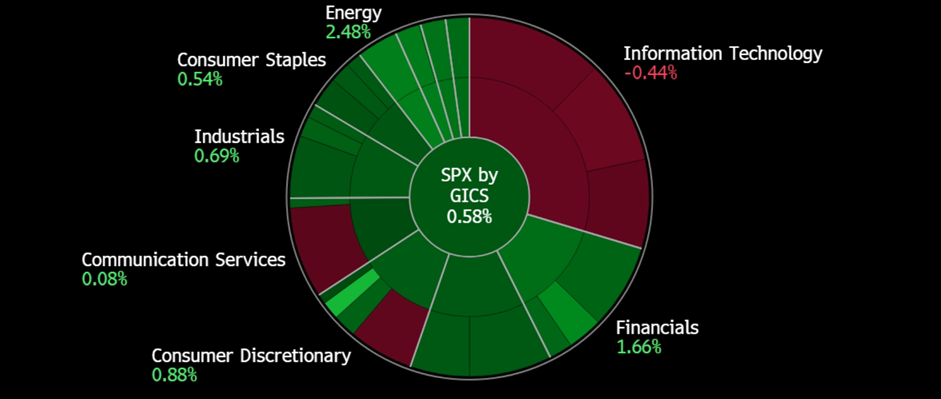

United States

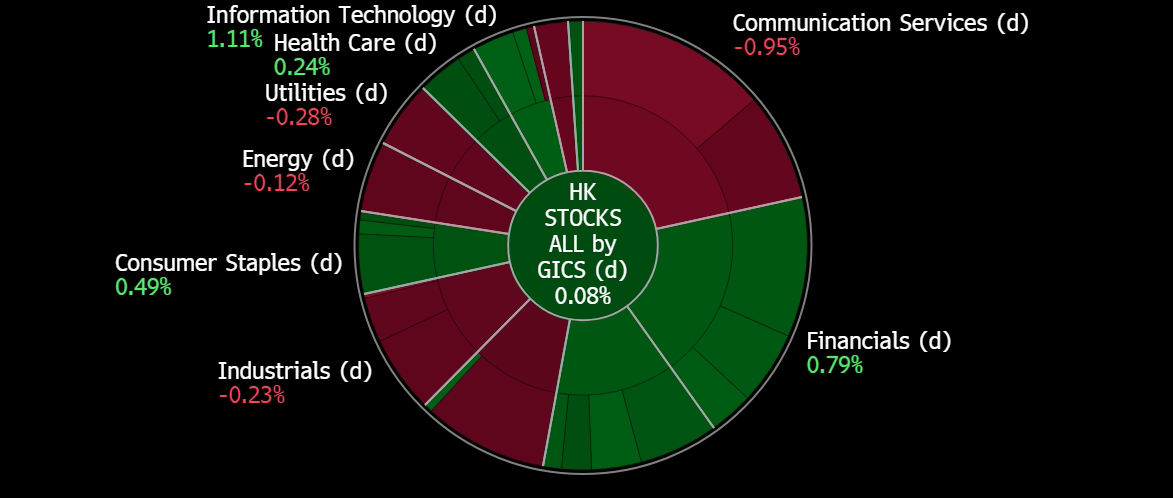

Hong Kong

Genting Singapore Ltd (GENS SP): Tourism on the rise

- Entry – 1.01 Target– 1.09 Stop Loss – 0.97

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- 30-day mutual visa exemption. The mutual 30-day visa-free arrangement between Singapore and China, effective from 9 February, has sparked increased interest in travel between the two countries. Tour agencies, booking websites, and airlines have reported rising inquiries and bookings, anticipating a surge in travel demand. The new scheme is expected to encourage more Chinese travellers to visit Singapore, complementing the already growing interest among Singaporeans in exploring Chinese cities. While challenges such as language barriers remain, the agreement is seen as a positive step in boosting tourism between the two nations. Despite the economic uncertainties, there is optimism in the potential for growth in travel activities, driven by enhanced connectivity, cultural exchanges, and more affordable fares.

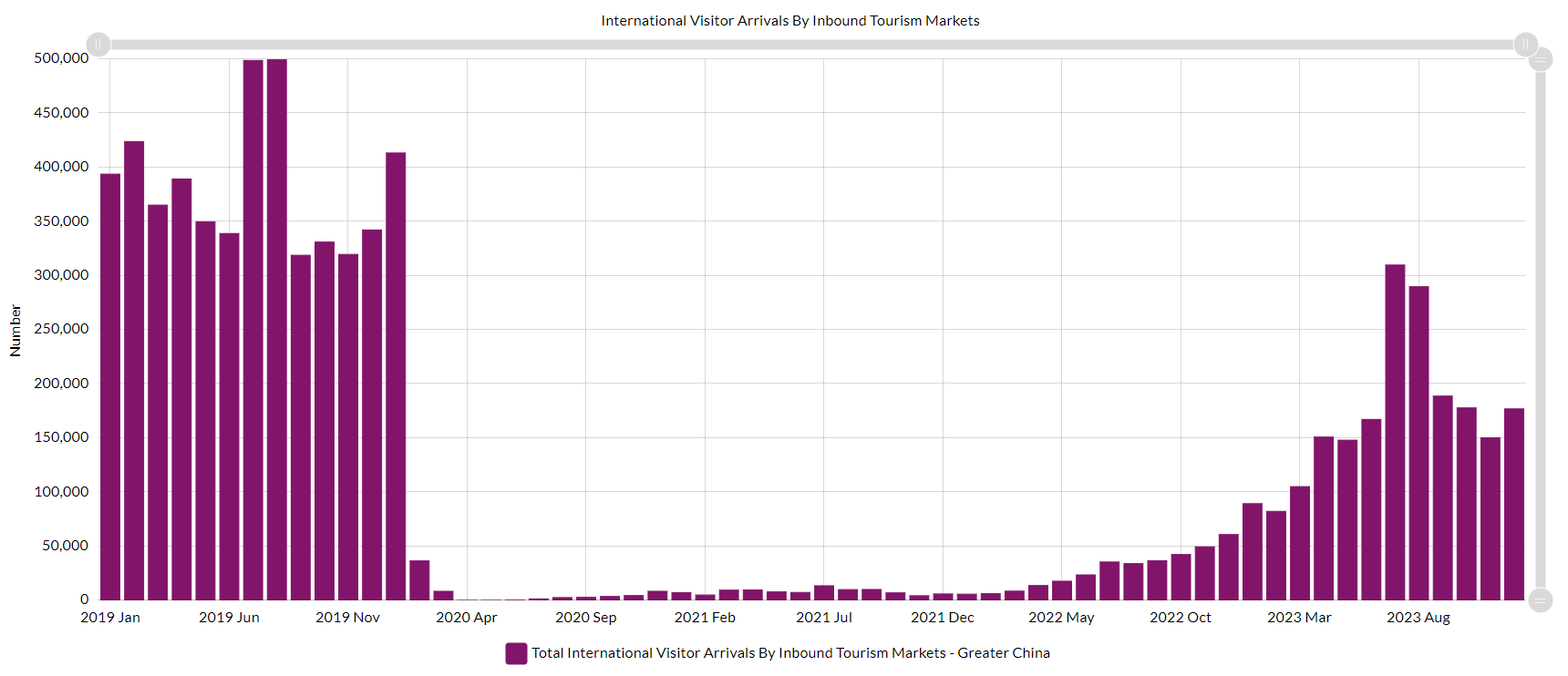

Monthly Visitor Arrivals from China – For the period between Jan 2019 to Dec 2023

(Source: Department of Statistics Singapore)

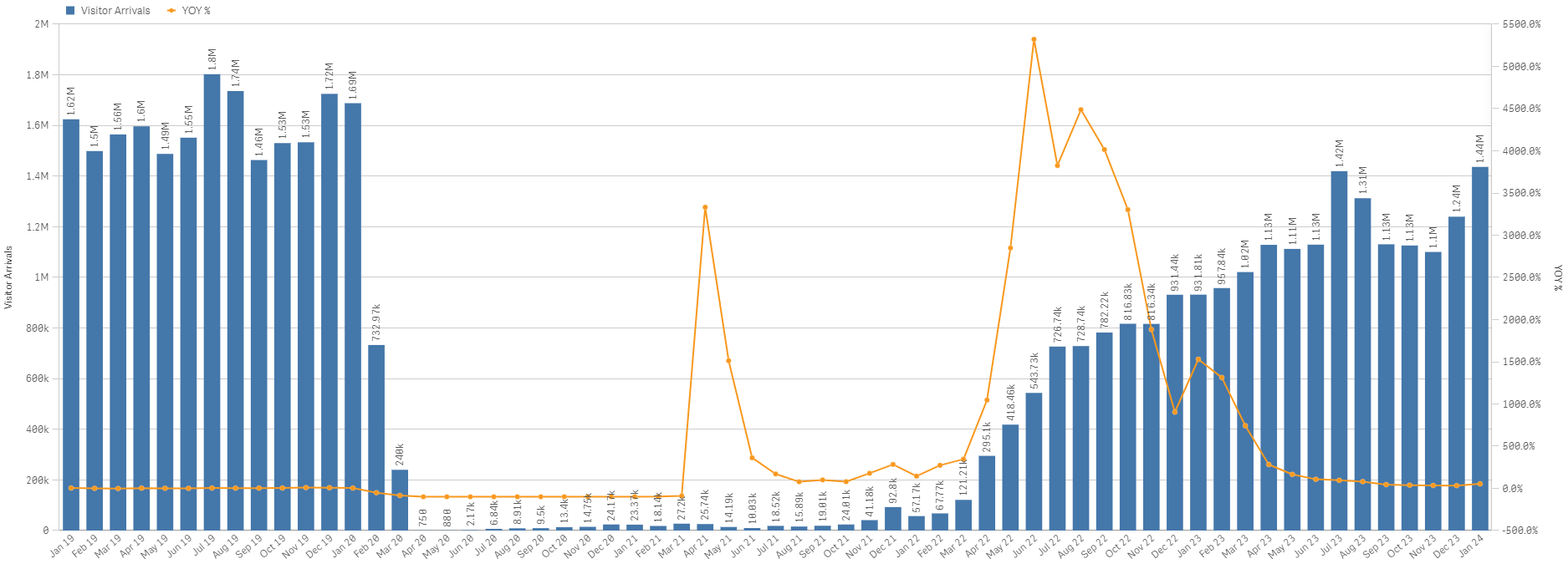

- More quality experiences for tourists. The Singapore Tourism Board (STB) projects continued tourism recovery in 2024, anticipating 15-16mn visitor arrivals and tourism receipts of S$26-27.5bn. Although pre-pandemic arrival numbers are not expected, tourist spending is anticipated to nearly match 2019 levels. In January, Singapore welcomed 1.44mn visitors, a 54.2% YoY increase and a 16.1% sequential rise, with 1.07mn being overnight visitors. The surge is credited to improved flight connectivity, factors like the mutual visa-free travel arrangement with China, and ongoing efforts to attract diverse visitors. The sector’s resilience is underscored by 2023’s strong performance, characterized by longer stays, expanded hotel capacity, and successful event hosting. STB’s strategy focuses on enhancing visitor experiences and prolonging stays to attract higher-spending tourists, prioritizing quality over quantity. This approach aligns with Singapore’s reputation for premium experiences and top-notch connectivity. Despite potential economic challenges, an emphasis on value-added experiences could help to sustain tourist spending, even if arrival numbers do not rebound to pre-pandemic levels until 2025.

Singapore monthly visitor arrivals trend – Jan 2019 to Jan 2024

(Source: Singapore Tourism Analytics Network)

- RWS expansion on track. On 2 March, the Hard Rock Hotel Singapore at Resorts World Sentosa will close to undergo renovations for the complex’s planned expansion. The 360-room hotel will receive a complete overhaul. This aligns with Genting Singapore’s previously announced plans to invest around S$6.8bn to revamp and enlarge the resort, which includes the development of a new luxury hotel and waterfront complex with 700 hotel rooms. Other ongoing projects include the transformation of The Forum shopping area, the development of a new Minion Land attraction, and the rebranding of SEA Aquarium to the Singapore Oceanarium, all of which are expected to partially open in early 2025.

- 3Q23 earnings. The company revenue for the period was S$689.9mn rising 33% YoY from the previous S$519.7mn. The company’s net profit rose to S$216.3mn, +59% YoY compared to S$135.8 in 3Q22. Its gaming revenue rose 20% YoY to S$459.6mn and its non-gaming revenue jumping 68% to S$230.1mn.

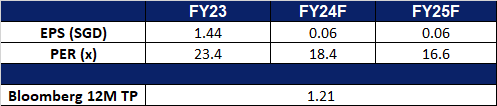

- Market Consensus.

(Source: Bloomberg)

Singapore Airlines Ltd. (SIA SP): Upbeat outlook in 2024

Singapore Airlines Ltd. (SIA SP): Upbeat outlook in 2024

- RE-ITEREATE Entry – 6.96 Target– 7.42 Stop Loss – 6.73

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

- Signed MoC to target travellers. Recently, the Singapore Tourism Board (STB) renewed its partnership with Traveloka, emphasizing collaboration beyond marketing campaigns to enhance visitor experiences. The memorandum of cooperation (MOC) aims to target consumers more effectively through data sharing and introduce new Singaporean products on the Traveloka platform. Aligned with STB’s “Made in Singapore” campaign, the partnership seeks to showcase unique experiences and attract more visitors from Indonesia and Southeast Asia. The collaboration also focuses on knowledge-sharing and developing tailored promotional campaigns to elevate visitor engagement.

- Singapore visitors expected to rise. In January, Singapore welcomed 1.44mn visitors, marking a 54.2% YoY increase and a 16.1% sequential rise, with 1.07mn being overnight visitors. Despite the growth, the average length of stay decreased by 20.1% YoY to 3.45 days. Indonesia remained the top source market, followed by mainland China, which saw the largest YoY growth of 644.2%. Australia ranked third in visitor numbers. Singapore’s tourism board projected international visitor arrivals to reach 15-16mn in 2024, generating approximately $26-27.5bn in tourism receipts, driven by improved flight connectivity and the implementation of mutual visa-free travel with China. While post-pandemic arrivals have not yet reached pre-pandemic levels, Singapore’s robust performance signals promising recovery, with longer visitor stays and diverse attractions contributing to growth. Hotels experienced strong expansion and performance, while meetings and events continue to drive tourism, with significant events lined up for 2024, including the Singapore Airshow, a variety of performances, MICE events, and the World Architecture Festival.

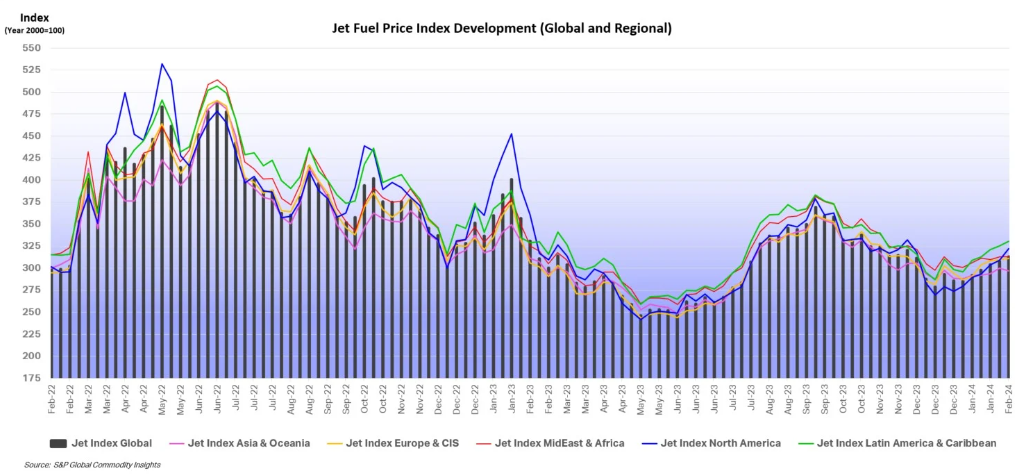

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Lower jet fuel prices in Asia. Oil prices have surged amid escalating geopolitical tensions and product shortages, particularly in Europe, stemming from disruptions in jet fuel and diesel supplies caused by the Red Sea crisis. In Europe, jet fuel stocks have dwindled as imports diverted to higher-priced markets in the USA and Latin America, driving up prices despite reduced demand during the off-peak air travel period. In the USA, jet fuel prices remained elevated due to low inventories resulting from refinery maintenance, unplanned outages, and severe winter weather. Meanwhile, the Asian market has weakened due to lower regional demand but has been supported by arbitrage opportunities in other regions. For the week ending 9 February, average jet fuel prices rose by 1.7% WoW to US$114.59/bbl, while the price in the Asia & Oceania segment declined by 1.0% WoW to US$103.96/bbl. The decrease in jet fuel prices in the Asian market is poised to benefit Singapore Airlines by bolstering its profit margins.

- KrisFlyer promotions. KrisFlyer, the rewards program of the Singapore Airlines Group, has evolved into a comprehensive lifestyle program offering rewards beyond just flights. To celebrate its 25th anniversary, KrisFlyer has presented enticing promotions for members, including bonus miles on flights, exclusive deals on the Kris+ app, and special offers on KrisShop and Pelago. These promotions are likely to attract new members to the KrisFlyer program, expanding its audience and benefiting Singapore Airlines in the long term.

- 1H24 earnings. The company revenue rose to S$9,162mn, +8.9% YoY compared to 1H23. The company’s net profit for the period was S$1,441mn, a 55.4% increase YoY. SIA and Scoot carried 17.4mn passengers in 1H24, an increase of 52.3% YoY. Passenger traffic grew 38.0% from a year before, outpacing the capacity expansion of 29.0%. As a result, the Group passenger load factor (PLF) improved by 5.8 percentage points to 88.8%, the highest ever half-yearly PLF. SIA and Scoot achieved record PLFs of 88.0% and 91.3% respectively. The Company declared an interim dividend of 10 cents per share, amounting to S$297mn, for 1H24 which will be paid on 22 December 2023 for shareholders as of 7 December 2023.

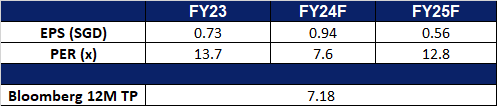

- Market Consensus.

(Source: Bloomberg)

Cathay Pacific Airways Ltd. (293 HK): Resumption of key flights

- BUY Entry – 8.10 Target – 8.80 Stop Loss – 7.80

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services and commercial laundry operations.

- Resuming more flights. Cathay Pacific Airways has recently declared its decision to recommence daily flights between Singapore and Bangkok from March 31, 2024, following a four-year hiatus prompted by the COVID-19 pandemic. Alongside its existing fifth freedom service, Cathay Pacific presently operates up to eight flights daily from Singapore to Hong Kong. The revival of the Singapore to Bangkok flight route, which was once one of the region’s most frequented paths, is anticipated to draw numerous passengers for the airline. This is particularly noteworthy given that Singapore Changi Airport and Suvarnabhumi Airport in Bangkok rank among the top airports with the highest passenger traffic in the Asia-Pacific region. The company also recently announced the resumption of other flight paths from Hong Kong to Perth, Sri Lanka, as well as Chennai.

- Lunar New Year travel rush. Anticipated to reach unprecedented heights, the Lunar New Year travel in China is poised to make history, with Chinese citizens joyously marking the festive season. In the initial four days of the Lunar New Year, Chinese travelers embarked on over 230 million “cross-regional” journeys, and a record-breaking nine billion domestic trips are projected to occur during the 40-day travel surge surrounding the Chinese New Year holidays. Additionally, there has been a notable increase in tourist numbers as individuals flock to renowned domestic tourist destinations to partake in the festive celebrations.

- High passenger traffic in Hong Kong. In 2023, Hong Kong’s airport secured the fourth position as the Asia-Pacific region’s busiest for international passengers. Anticipated to maintain its bustling status in 2024, Hong Kong continues to serve as the prominent financial hub in the region, with Singapore closely trailing. China has recently intensified its backing for Hong Kong’s role as a financial center for wealth products, bonds, and green finance, fostering increased business and investment in the city. Additionally, with China reopening post-pandemic, there is a projected surge in tourism to Hong Kong.

- 1H23 earnings. Revenue rose 135.0% YoY to HK$43.6bn in 1H23, compared with with HK$18.6bn in 1H22. Net profit was HK$4.3bn in 1H23, compared to net loss of HK$5.0bn in 1H22. Basic earnings per share was 61.5 HK cents in 1H23, compared to -82.3 HK cents in 1H22.

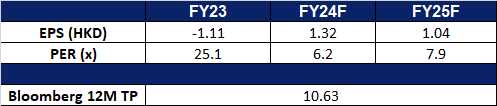

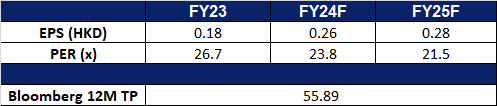

- Market consensus.

(Source: Bloomberg)

Prada S.P.A. (1913 HK): Topping the Lyst Index

- RE-ITEREATE BUY Entry – 50.5 Target – 54.5 Stop Loss – 48.5

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Partnership between Prada and L’Oreal. Prada has recently revealed a long-term licensing agreement with L’Oreal, marking a strategic partnership to globally create, develop, and distribute Miu Miu products. This collaboration aims to propel the brand’s growth, tapping into new markets and unlocking its full potential in the beauty industry. Utilizing this alliance, Miu Miu intends to enhance sales and broaden its footprint in the beauty market through the expertise of the renowned French cosmetic firm.

- Chinese New Year Campaign. Prada has recently launched its Chinese New Year campaign for the Year of the Dragon in 2024, drawing inspiration from the nostalgic charm of Wong Kar-wai’s iconic films. Infused with romanticism and vibrant red tones, the campaign features Du Juan, the latest muse prominently featured in Wong Kar-wai’s recently debuted TV series, Blossoms Shanghai. Notably, Zhao Lei, recognized as the face of Yang Fudong’s film, First Spring, is showcased at the Pradasphere II exhibition in Shanghai. The collection introduces Re-Nylon bucket hats, patent leather mini bags, and pouches in cherry red, as well as black leather wallets and belts. Additionally, Prada Home contributes to the ensemble with quirky porcelain cups, collectively capturing the essence of this thematic celebration. This well-curated selection provides consumers with several choices for wardrobe staples for the Year of the Dragon.

- Topping Lyst Index. Prada topped the Lyst Index in 4Q23, while Miu Miu, an Italian high fashion women’s clothing and accessory brand and a fully owned subsidiary of Prada, came in 2nd place in the Lyst Index in 4Q23. The Lyst Index is a quarterly ranking of fashion’s hottest brands and products. The formula behind The Lyst Index takes into account Lyst shoppers’ behaviour, including searches on and off the platform, product views, and sales. To track brand and product heat, the formula also incorporates social media mentions, activity and engagement statistics worldwide, over three months. Prada and Miu Miu topped the Lyst Index in 3Q23 as well, showcasing the strength of the company in staying relevant and up to date with consumers’ preferences.

- 9M23 earnings. Revenue rose by 10.3% YoY at constant exchange rates to €3.34bn in 9M2023, compared to €2.98bn in 9M22. Retail Sales rose 10.4% YoY at constant exchange rates to €298bn in 9M23, compared with €2.65bn in 9M22, driven by like-for-like and full-price sales.

- Market consensus.

(Source: Bloomberg)

Zillow Group Inc (Z US): Innovative market leader

- BUY Entry – 57.6 Target – 62.0 Stop Loss – 55.4

- Zillow Group, Inc. is a tech real-estate marketplace company. The Company provides information about homes, real estate listings, and mortgages through websites and mobile applications. Zillow Group serves homeowners, buyers, sellers, renters, and real estate professionals in the United States.

- Good results in a slowing housing market. Zillow Group Inc. exceeded analyst expectations in its fourth-quarter earnings report, with quarterly revenue reaching $474mn, surpassing the average estimate of $452mn, and delivered a conservative outlook for FY24. Despite challenges in the housing market, Zillow’s core residential business generated $349mn, marking a 3% YoY increase, supported by 2.2bn visits to its websites and apps. Rentals revenue of $93mn increased by 37% YoY, primarily driven by multifamily revenue growing 52% YoY in Q4. Mortgage revenue of $22mn increased by 22% YoY, mainly due to a 105% YoY increase in purchase loan origination volume to $487mn in Q4. Anticipated growth in home sales presents opportunities for the company, although it faces new challenges, including antitrust lawsuits and competition from rivals like CoStar Group Inc.’s Homes.com. Zillow continues to diversify its business by offering products for various segments of the real estate market. Despite ongoing housing headwinds, Zillow’s residential and rental segments continue to drive its performance, positioning the company for further growth in 2024. Furthermore, home sales are expected to increase this year, providing support for housing-related businesses, such as Zillow.

- Virtual reality tours. Zillow introduced Zillow Immerse, a virtual reality platform designed for Apple’s Vision Pro headset, aimed at revolutionizing the home shopping experience. The platform offers virtual walkthroughs and 3D floor plans, allowing potential buyers to explore properties virtually and gain a better understanding of their layout. Zillow’s research shows a strong preference for immersive tools among home buyers, with 3D tours providing a better sense of space compared to static photos. By using Apple’s Vision Pro headset, Zillow is poised to revolutionize the home shopping journey, offering potential buyers immersive technology experiences. This groundbreaking innovation is set to redefine the home shopping landscape, positioning Zillow as a standout among its competitors.

- US consumers are still consuming. In January, US retail sales declined more than expected, dropping by 0.8%, largely due to weak auto sales and lower gas prices. This unexpected decrease brought total sales to $700.3bn. The slowdown in spending may be attributed to factors such as higher loan rates and decreased pent-up demand following supply chain issues. Excluding the auto sector, retail sales fell by 0.6% from December. Despite this, spending at restaurants and bars remained steady, growing by 0.7%. Despite these challenges, the market remains optimistic due to a strong labour market and improving consumer confidence, suggesting a healthy outlook for overall consumption.

- 4Q23 earnings review. Revenue rose by 9.0% YoY to US$474mn, beating estimates by US$22.59mn. Residential revenue rose 3% YoY to US$349mn, rental revenue grew 37% YoY to US$93mn and mortgage revenue increased 22% YoY to US$22mn. Net loss amounted to US$73mn. For 1Q24, the company expects revenue to be between US$495mn to US$510mn, in-line with Wall Street consensus of US$499.9mn. Adjusted EBITDA is expected to be between US$95mn to US$105mn.

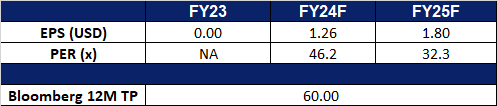

- Market consensus.

(Source: Bloomberg)

CrowdStrike Holdings Inc (CRWD US): Addressing cybersecurity demand

- RE-ITEREATE BUY Entry – 315 Target – 337 Stop Loss – 304

- CrowdStrike Holdings, Inc. provides cybersecurity products and services to stop breaches. The Company offers cloud-delivered protection across endpoints, cloud workloads, identity and data, and leading threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. CrowdStrike serves customers worldwide.

- Partnership opportunities. On 13 February, CrowdStrike announced its partnership with Ignition Technology in the United Kingdom (UK) to enhance access to the CrowdStrike XDR Falcon platform for businesses. This collaboration merges Ignition’s cybersecurity expertise with CrowdStrike’s innovative platform to address the UK’s growing cybersecurity demands. The partnership highlights CrowdStrike’s dedication to supporting its partners and fostering business expansion. Leveraging Ignition’s extensive network, the alliance aims to provide advanced cloud and SaaS cybersecurity solutions to customers while generating new market prospects. Through this collaboration, CrowdStrike and Ignition can effectively tackle customer challenges and develop unique market offerings. The partnership is poised to deliver value, seize opportunities, and achieve mutual success for CrowdStrike, Ignition Technology, and their partners.

- Growing in the AI cybersecurity sector. CrowdStrike, a leader in cybersecurity, is well-positioned to capitalize on the growing investments in artificial intelligence (AI). The company leverages advanced AI capabilities to offer superior threat protection through its endpoint security software. It’s cohesive platform integrates multiple security modules, simplifying workflows for customers and providing proactive threat detection using AI-powered indicators of attack (IoAs). CrowdStrike’s unique data advantage and innovative AI solutions position it as a market leader in preventing malware and other cyber threats. Additionally, the company is poised to benefit from the increasing frequency and sophistication of cyberattacks, the shortage of cybersecurity talent, and regulatory changes mandating disclosure of cybersecurity incidents. CrowdStrike’s strategic initiatives and powerful tailwinds underscore its potential for long-term growth and success in the cybersecurity industry.

- Higher than expected CPI data. In January, inflation exceeded expectations, with the consumer price index (CPI) rising by 0.3%, according to the Bureau of Labor Statistics. The 12-month CPI stood at 3.1%, down from December’s 3.4%. The increase was primarily driven by rising shelter prices, which accounted for more than two-thirds of the overall rise. Economists had forecasted a 0.2% monthly increase and a 2.9% annual gain. Excluding volatile food and energy prices, the core CPI accelerated by 0.4% in January and was up 3.9% from a year ago, matching December’s figures. Despite the rise in prices, inflation-adjusted earnings increased by 0.3% for the month. However, adjusted for the decline in the average workweek, real weekly earnings fell by 0.3%. The release could complicate the Federal Reserve’s plans for monetary policy adjustments as it anticipates inflation to return to its 2% target. This, in turn, may negatively affect expectations of interest rates declining. Lower interest rates would benefit corporations and stocks to a greater extent. However, with CrowdStrike being a cybersecurity company, it will not be as heavily impacted as other AI stocks since having a strong cybersecurity is a core part of businesses even during recessionary periods given the rising number of cyber threats.

- 3Q24 earnings review. Revenue rose by 35.3% YoY to US$786mn, beating estimates by US$8.62mn. Non-GAAP EPS was US$0.82, beating estimates by US$0.08. Its ending ARR surpassed the US$3bn milestone and grew 35% YoY to reach US$3.15bn. In 4Q24, it expects revenue to be between US$836.6-840mn vs consensus of US$836.81mn and non-GAAP EPS to be between US$0.81-0.82 vs consensus of US$0.78. FY24 revenue is expected to be between US$3.046-3.05bn vs US$3.04bn and non-GAAP EPS to be US$2.95-2.96 vs US$2.83 consensus.

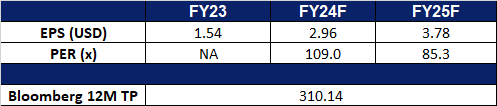

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Genting Singapore Ltd (GENS SP) at S$1.05. Add Singapore Airlines (SIA SP) at S$6.96, Prada S.P.A. (1913 HK) at HK$50.50 and Yankuang Energy Group (1171 HK) at HK$15.40.