15 February 2023: Sembcorp Marine (SMM SP), CNOOC LTD (883 HK), Northrop Grumman Corp (NOC US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Sembcorp Marine (SMM SP): Southeast-Asia’s re-opening play

- Entry – 0.135 Target – 0.145 Stop Loss – 0.130

- Sembcorp Marine (SMM) provides engineering solutions to the global offshore, marine and energy industries. The Group focuses on four key capabilities, mainly, Rigs & Floaters; Repairs & Upgrades; Offshore Platforms and Specialised Shipbuilding. The group operates shipyards in Singapore, Indonesia, the UK and Brazil. Its key clients include major energy companies, drilling contractors, shipping companies and owners/operators of floating production units.

- Possible acquisition. Sembcorp Marine (Sembmarine) will hold its extraordinary general meeting (EGM) at 11am on Feb 16 for shareholders to vote on its proposed $4.5 billion acquisition of Keppel Offshore & Marine (O&M). If the merger is approved by shareholders, Sembmarine will effectively buy the entire Keppel O&M stake from Keppel Corporation for about $4.5 billion, excluding legacy rigs and associated receivables. The new Sembcorp Marine will be headed by current Keppel Offshore & Marine chief executive Chris Ong Leng Yeow, and will tap into a pipeline of S$7.0Bn (US$5.3Bn) of new projects won in 2022.

- 3Q22 updates. From the start of FY2022, the Group had a total of 21 projects under execution with 12 projects scheduled for completion and delivery in FY2022. It reported that it has continued the smooth execution of projects with nine successful completions and deliveries to customers year-to-date. Despite these successes, the company expects losses in the second half of 2022 similar in range to the first half of 2022. In addition, the company reported that it has secured Year-to date new contracts in excess of S$6.71 billion, including S$0.42 billion of repairs & upgrades contracts, with the largest contract worth S$4.25 billion from Petrobras for the P-82 FPSO. Thus far, the group has a net order book of S$7.11 billion, with renewable wind energy and other cleaner and green solutions accounting for around 34% of it.

- Company Outlook. The company’s outlook is positive, as they are seeing an increase in orders due to a combination of factors such as high oil and gas prices, renewed focus on energy security due to geopolitical tensions, and a shift towards renewable energy sources. This suggests that the company’s performance is likely to continue to improve in the near future.

- Updated market consensus of the EPS in FY23/24 is -0.001/0.004 respectively,

(Source: Bloomberg)

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

- RE-ITERATE Entry – 1.20 Target – 1.37 Stop Loss – 1.15

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

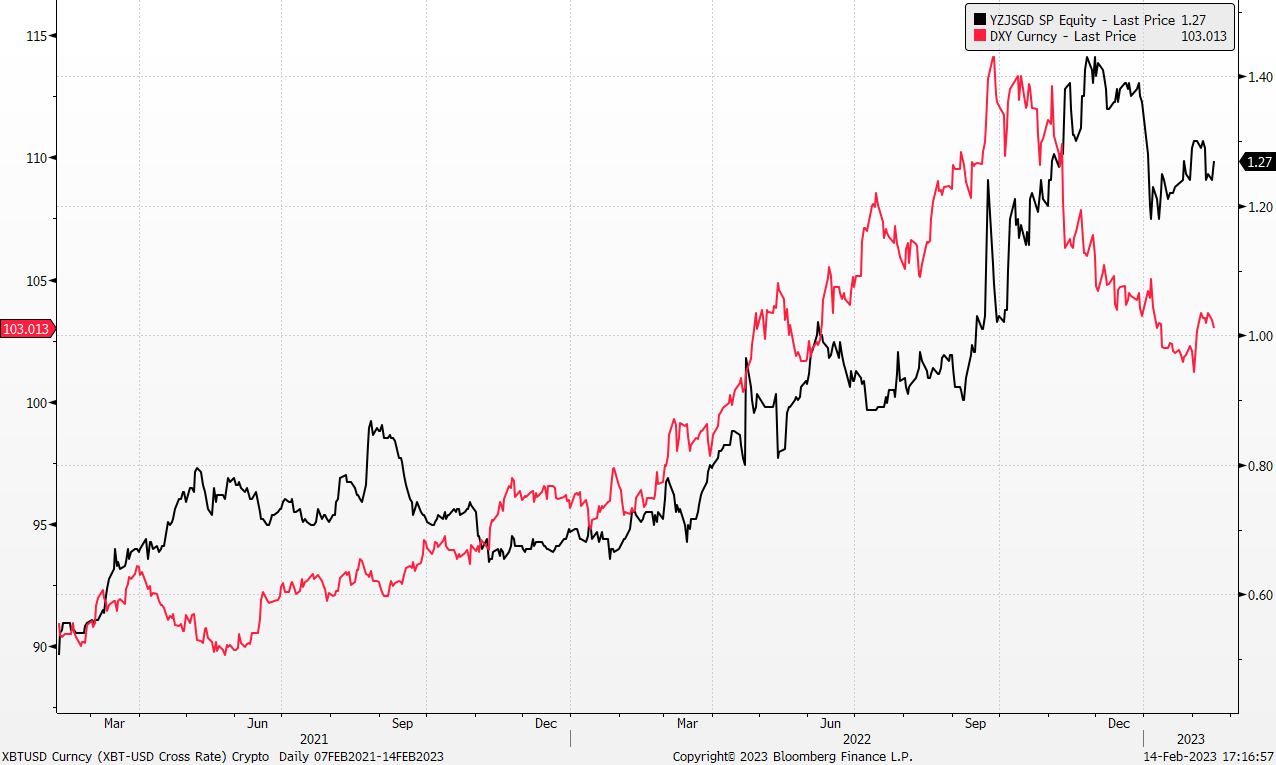

- Benefitting from a stronger US Dollar. Following the most recent US strong nonfarm payroll data for the month of January, the US dollar index saw a rebound with the positive results. Yangzijiang Shipbuilding Holdings Limited, whose financial results, as well as operations, which are mainly denominated in USD, can benefit from the appreciate of the US dollar in upcoming months.

Share price and dollar index comparison

(Source: Bloomberg)

- Dropping Iron Ore and Steel prices. Hard commodities, such as iron ore and steel, saw a price decline following the appreciation of the US dollar. This allows the company to find opportunities in lowering their cost of production, whereby iron ore and steel make up a key component of the production of a ship.

- Visibility on secured contracts. As of 3Q22, the company’s total order book value reached US$10.27bn which extended the company’s top line visibility to mid-2025. This allows the company to have a confirmed and visible stream of revenue for the upcoming years.

- Company Outlook. The company’s outlook is positive in the upcoming months, with the rebound of the U.S. dollars as economic pressure starts to ease. There is also clear visibility on the company’s revenue stream given that its’ order book are filled till mid-2025. The re-opening of China’s economy also allows the company to re-accelerate the production of its business. This suggests that the company’s performance is likely to continue to improve in the near future.

- The updated market consensus of the EPS growth in FY23/24 is 22.98%/4.72% YoY respectively, which translates to 8.1x/7.8x forward PE. Current PER is 8.0x. FY23F/24F dividend yield is 3.7%/3.8% respectively. Bloomberg consensus average 12-month target price is $1.46.

(Source: Bloomberg)

CNOOC LTD (883 HK): Defensive oil

- BUY Entry – 11.4 Target – 12.5 Stop Loss – 10.9

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Growing oil demand and curb in oil supply. Organization of the Petroleum Exporting Countries (OPEC) Secretary General predicts oil demand will surpass pre-pandemic levels, reaching almost 102 million barrels a day and demand is projected to further rise to 110 million barrels per day by 2025. On the other hand, Russia, the world’s third-largest oil producer, recently announced plans to cut crude production in March by 500,000 barrels per day (about 5% of output) in response to western curbs imposed on its exports due to the Ukraine conflict. With demand projected to increase and supply to decrease, oil prices will go up.

- China demand reccovery. Demand for both oil and gas has recovered following the removal of COVID-19 restrictions in December. China’s state-owned oil refiners have resumed imports of Russian crude oil, attracted by its affordability. This demand would also contribute to the rise in oil prices with supply being limited. Furthermore, import demand may rise further if China decides to replenish its stockpiles.

- LNG bid. The company has issued a tender to buy liquefied natural gas (LNG) cargoes for delivery from June 2023 to June 2024. It had previously issued a tender in December 2022 for LNG cargoes to be delivered between February and December 2023 as well.

- New joint project. Shell has signed a Joint Study Agreement with CNOOC, Guangdong Provincial Development and Reform Commission, and ExxonMobil for a carbon capture and storage (CCS) hub project in Daya Bay, China. The four parties aim to explore the development of the CCS hub to capture up to 10 million tonnes of CO2 a year, which could be China’s first offshore large-scale CCS hub. The project could help reduce significant CO2 emissions of the Daya Bay region, and the parties will assess the technical solution, develop the business model, and work with the government to develop enabling policies for the project. China has an estimated 2,400 gigatonnes of carbon storage capacity and over 40 CCUS pilot projects with a total capacity of 3 million tons.

- FY22 earnings guidance. Net profit attributable to equity shareholders estimated to have increased by 99% to 104% YoY in 2022 as compared with the same period last year, reaching between RMB139.6bn and RMB143.6bn. Net profit is estimated to be between RMB138.3bn and RMB142.3bn a YoY increase of 103% to 109%.

- The updated market consensus of the EPS growth in FY23/24 is -9.0%/-7.3% YoY respectively, which translates to 3.7x/4.0x forward PE. Current PER is 4.1x. FY23F/24F dividend yield is 10.8%/9.7% respectively. Bloomberg consensus average 12-month target price is HK$14.39.

(Source: Bloomberg)

Alibaba Group Holding Ltd (9988 HK): Make the elephant dance

Alibaba Group Holding Ltd (9988 HK): Make the elephant dance

- RE-ITERATE BUY Entry – 101.0 Target – 120.0 Stop Loss – 91.5

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- China’s economic recovery. China’s policymakers plan to step up support for domestic demand this year, with top policymakers repeatedly signalling their intention to harvest the spending power of China’s 1.4 billion people, after economic growth in 2022 slumped to one of its weakest levels in nearly half a century. Some chinese banks have launched promotions and lowered lending rates to encourage more consumer spending in China. Many leading banks have cut their consumer lending rates to below 4 percent, some have even offered certain consumer lending products at the minimum rate of 3.65 percent, the benchmark lending rate of China’s central bank. With China’s efforts to expand domestic demand and consumption alongside its reopening, which would stimulate increased spending and household consumption, the company should expect higher consumer demand this year.

- Cloud segment growth. Cloud infrastructure and services are becoming a prominent part of any business that uses the web for its operations. Total revenue from its Cloud segment, before inter-segment elimination, which includes revenue from services provided to other Alibaba businesses, was RMB50,698mn (US$7,127mn), an increase of 5% compared to RMB48,448mn in the same period of 2021. YoY growth reflected the strong revenue growth from non-Internet industries driven by financial services, public services and telecommunication industries. With cloud services being an integral part of the operations of all three of these areas, it could lead to long-term recurring revenue for Alibaba. Additionally, with the global cloud computing market projected to reach over $1.7 trillion by 2029, Alibaba’s share of the cloud segment is expected to expand as well.

- 1H23 results. Revenue was RMB412,731mn (US$58,021mn), an increase of 2% year-over-year. Net income attributable to ordinary shareholders was RMB2,178mn (US$306mn), and net loss was RMB2,169mn (US$305mn), compared to net income of RMB46,212mn in the same period of 2021.

- The updated market consensus of the EPS growth in FY24/25 is 0.1%/13.2% YoY respectively, which translates to 13.35x/13.34x forward PE. Bloomberg consensus average 12-month target price is HK$142.72.

(Source: Bloomberg)

Northrop Grumman Corp (NOC US): No Aliens, Just Humans

- BUY Entry – 460 Target – 510 Stop Loss – 435

- Northrop Grumman Corporation is a global security company. The Company provides systems, products, and solutions in aerospace, electronics, information systems, and technical services. Northrop Grumman serves government and commercial customers worldwide.

- UFO sightings. The United States (US) recently shot down 4 Unidentified Flying Objects (UFO) within their airspace. Their security forces are currently on high alert with the first UFO shot down suspected to be a Chinese surveillance balloon. Furthermore, the US has also accused China of operating a global surveillance programme covering more than 40 countries in five continents. China is also reportedly planning to take down a UFO flying over waters near the port city of Qingdao.

- Biden’s Defense Budget. President Joe Biden is expected to ask Congress for a U.S. defense budget exceeding $770 billion for the next fiscal year as the Pentagon seeks to modernize the military. The budget would benefit the biggest U.S. defense contractors including NOC.

- Common Infrared Countermeasures (CIRCM) systems achieved Initial Operational Capability (IOC). With NOC’s recent IOC, the U.S. Army demonstrated the ability to field, employ and maintain CIRCM in significant quantities on its rotary wing platforms. This milestone advances the accelerated fielding of CIRCM systems on more than 1,500 Army aircraft.

- 4Q22 earnings review. Revenue grew by 6.2% YoY to US$18.09bn, missing estimates by US$70mn. Non-GAAP EPS was US$1.27, missing estimates by US$0.02.

- The updated market consensus of the EPS growth in FY23/24 is 4.8%/15.8% YoY respectively, which translates to 20.1x/17.3x forward PE. Current PER is 18.4x. Bloomberg consensus average 12-month target price is US$504.71.

(Source: Bloomberg)

Enphase Energy Inc (ENPH US): Buy the dip amidst sell-down after earnings

- RE-ITERATE BUY Entry – 205 Target – 245 Stop Loss – 185

- Enphase Energy, Inc. manufactures solar energy equipment. The Company offers home and commercial solar and storage solutions. Enphase Energy serves clients in the United States.

- Favourable macro trend. Global investments in clean energy projects amount to US$1.1tn in 2022, this amount is sure to increase in FY2023 as governments transition towards a net-zero future.

- Growth drivers intact. The company plans to add a quarterly production capacity of 4.5mn microinverters in 2023 and reach a total of 10mn by the end of 2023. It is expected to increase its supply through a new domestic contract manufacturing partner in 2Q23 and two existing partners in 2H23. Another growth drivers are EV charging systems which bolster a holistic consumer ecosystem, benefiting from the increase in EV and solar adoptions in Europe and US markets.

- 4Q22 earnings beat but sell down afterwards. Revenue jumped by 75.6% YoY to US$724.65mn, beating estimates by US$21.59mn, Non-GAAP EPS was US$1.51, beating estimates by US$0.25. The sell-off is due mainly to the guidance of business is expected to slightly go down in 1Q23 compared to 4Q22, primarily driven by seasonality and the macroeconomic environment.

- The updated market consensus of the EPS growth in FY23/24 is 18.2%/30.0% YoY respectively, which translates to 38.8x/30.0x forward PE. Current PER is 76.2x. Bloomberg consensus average 12-month target price is US$296.82.

(Source: Bloomberg)

United States

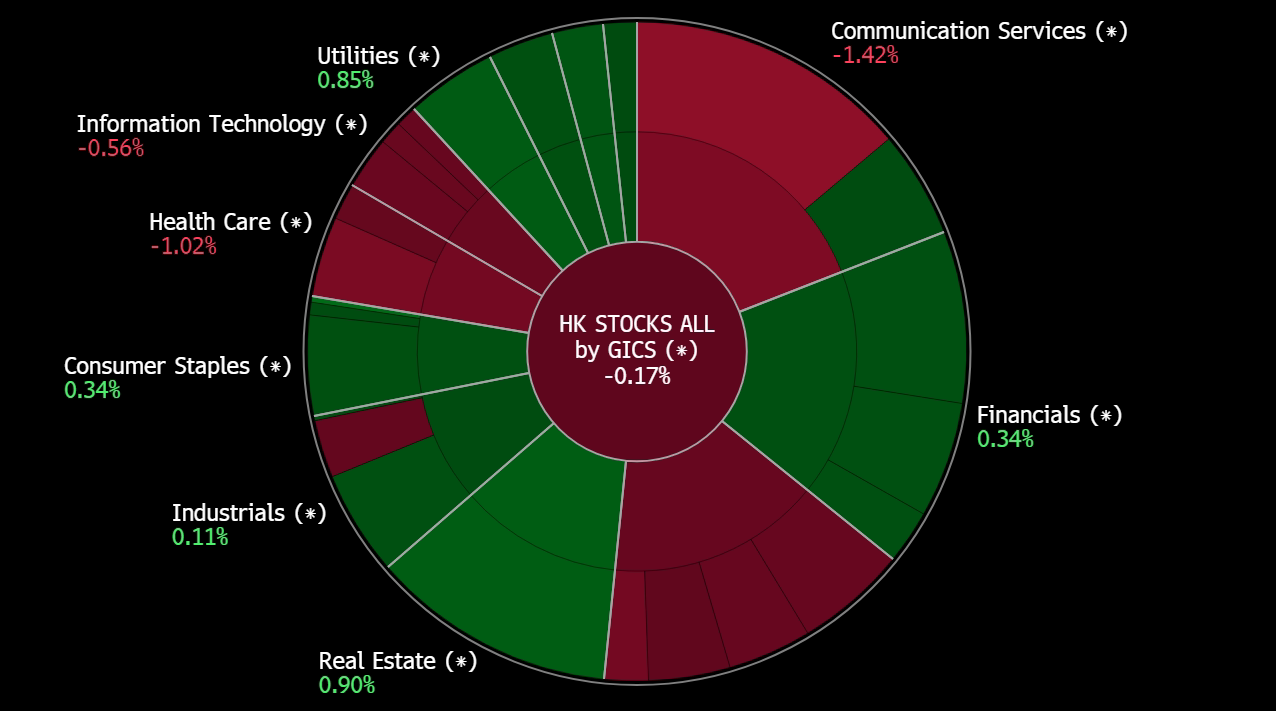

Hong Kong

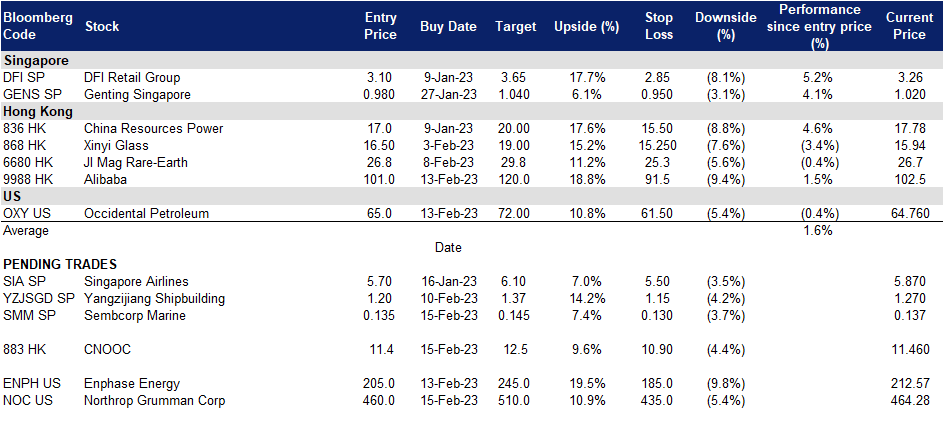

Trading Dashboard Update: Cut loss on SATS (SATS SP) at S$2.95 and Thaibev (THBEV SP) at S$0.665. Add Occidental Petroleum (OXY US) at US$65.0