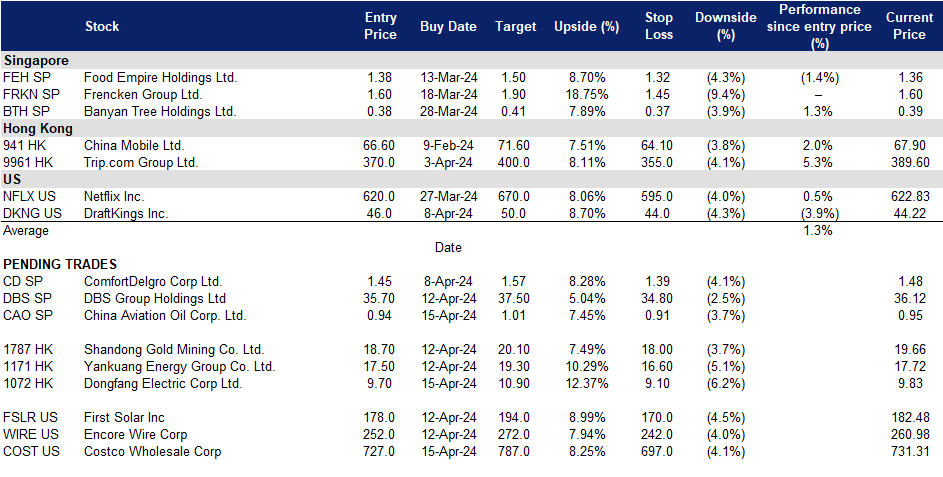

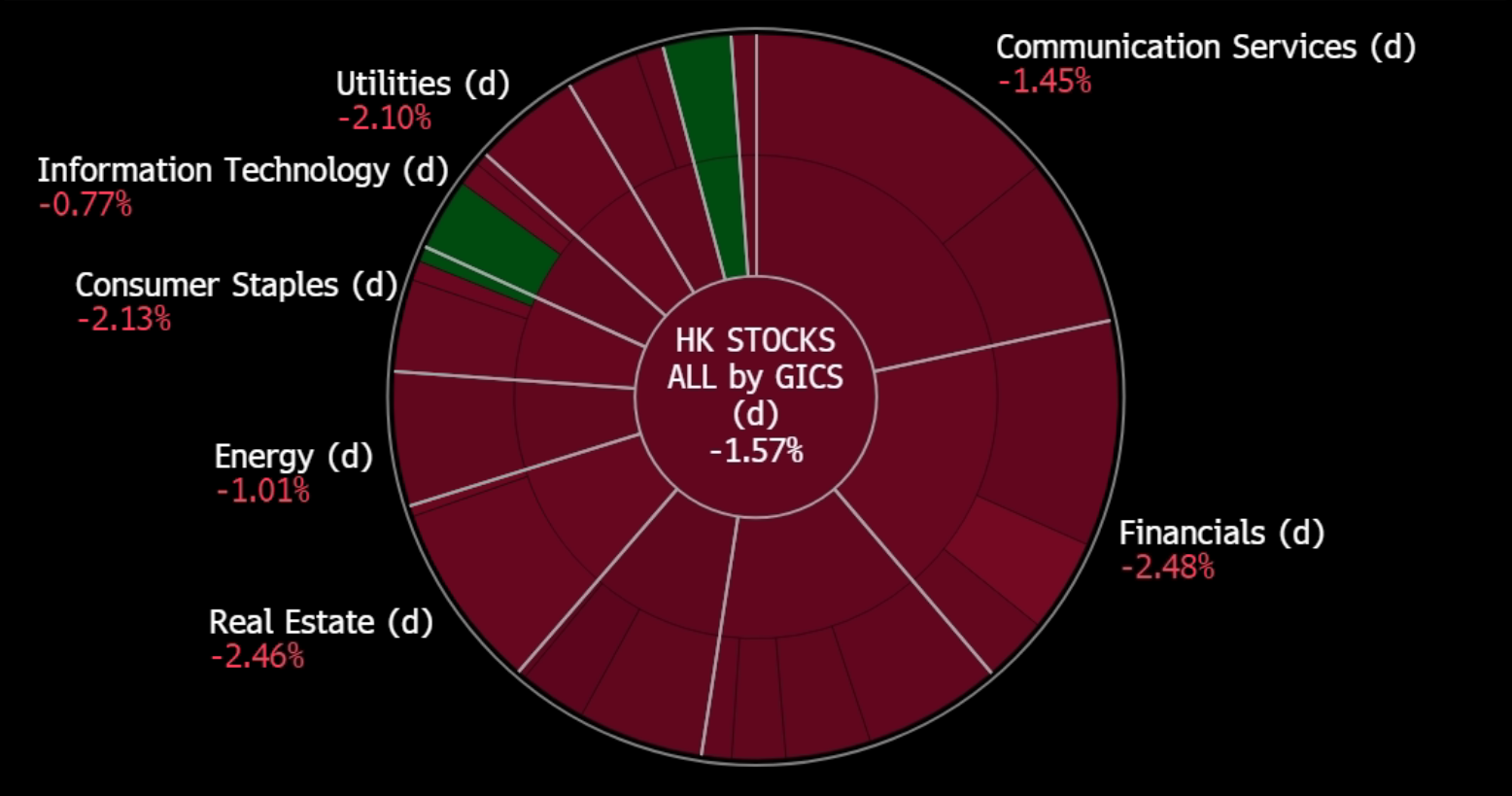

15 April 2024: China Aviation Oil Corp. Ltd. (CAO SP), Dongfang Electric Corp. Ltd. (1072 HK), Costco Wholesale Corp (COST US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

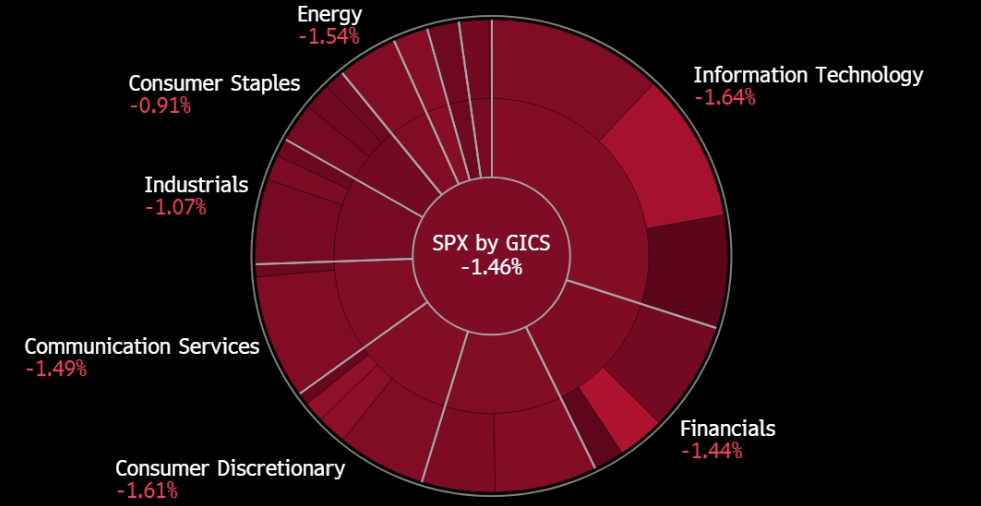

United States

Hong Kong

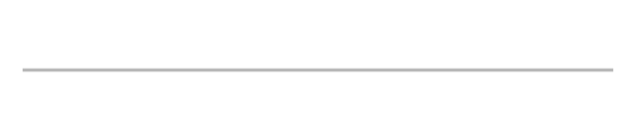

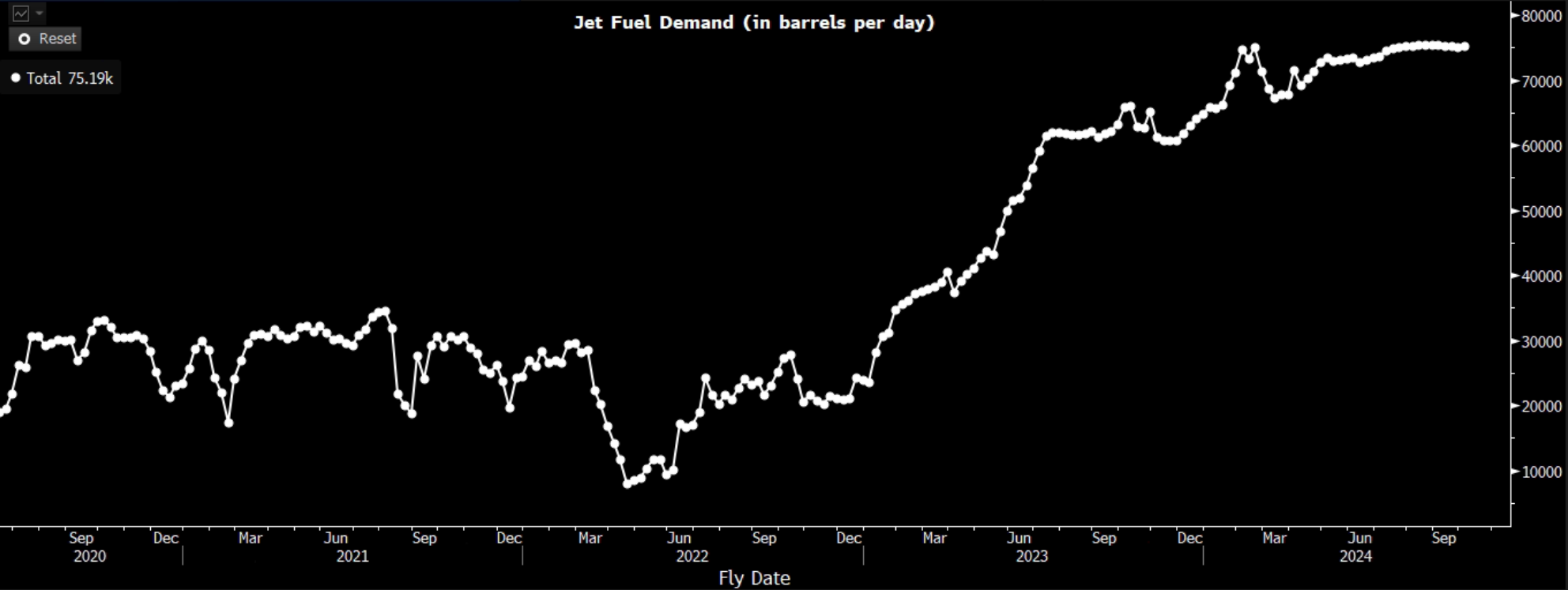

China Aviation Oil Corp. Ltd. (CAO SP): Favourable seasonality

- BUY Entry – 0.940 Target– 1.01 Stop Loss – 0.905

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, petrochemical products, including physical and paper swaps, and futures trading.

- More international flights for the summer season. China’s civil aviation sector is ramping up the reintroduction of international passenger flights to enhance connectivity as the summer season unfolds. From early April to October 26, more than 12,600 weekly international passenger flights will be operated by 122 Chinese and international airlines, spanning 66 countries—a notable expansion compared to previous periods. Additionally, over 4,600 weekly freight flights, operated by 67 airlines and connecting 46 countries, have been approved. The Civil Aviation Administration of China has announced the inclusion of one domestic airline and two foreign airlines to operate international passenger flights this summer. The recent relaxation of visa policies for travelers is poised to further stimulate demand for summer travel. This anticipated surge in flight activities is expected to positively impact China Aviation Oil.

- Flower viewing holiday escapes. As spring arrives and flowers starts to bloom around the country, the recent Tomb Sweeping Day holiday from April 4 to 6 saw many Chinese going for a walk and appreciating fields of flowers, both locally and internationally. Demand for outbound flower-viewing trips has been high this year, as prices of traveling abroad in spring are relatively low — a traditional off-season travel period in China. According to Trip.com, booking numbers of travel products to Japan in March and April, reserved in March, surged by 360% compared with bookings made in February.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- Increased aviation fuel consumption. China National Petroleum Corp. (CNPC) forecasts a 13.1% increase in China’s aviation fuel consumption this year, driven by a surge in passenger travel. It is anticipated that aviation fuel consumption will reach 39.3 million metric tons in 2024. Furthermore, there is widespread anticipation of continued growth in kerosene demand this year, particularly as China’s international air travel gradually rebounds in the post-COVID travel landscape. According to ETRI figures, China’s kerosene demand is projected to climb to 54 million tons by 2030, peaking in 2040.

- FY23 results review. FY23 revenue fell by 12.36% to US$14.43bn, compared to US$16.46bn in FY22. Net profit rose by 75.90% YoY to US$58.37mn, compared to US$33.19mn in FY23. Basic EPS rose by 75.48% to US6.84 cents in FY23, compared to US3.90 cents in FY22.

- Market Consensus.

(Source: Bloomberg)

DBS Group Holdings Ltd (DBS SP): Increase shareholders returns

- RE-ITERATE BUY Entry – 35.7 Target– 37.5 Stop Loss – 34.8

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Bonus share issuance. On 19 April, DBS will pay out its Q4 final dividend amounting to 54 Singapore cents per share. On 30 April, DBS is expected to issue one bonus share for every 10 shares held and these shares will qualify for dividends from 1Q24. The increase in dividend payout and issuance of bonus shares is to increase capital returns to its shareholders.

- Expectations of monetary policy to remain unchanged. The Monetary Authority of Singapore (MAS) is expected to maintain its current monetary policy in the upcoming review. Despite inflation showing some volatility, core inflation remains above the central bank’s target. MAS may consider easing monetary settings in the second half of the year if inflation stabilizes. While inflation in Singapore remains elevated, forecasts suggest moderation throughout the year. Global central banks are cautiously adjusting interest rates, and MAS is likely to follow suit gradually, balancing growth and inflation concerns. Analysts suggest MAS may not rush to relax policy, considering Singapore’s role as a bellwether for global growth and the ongoing export-driven economic recovery. Policy easing, if any, is anticipated in October at the earliest, with MAS managing monetary policy through adjustments to the Singapore dollar’s exchange rate against its main trading partners. With the monetary policy expected to remain unchanged, DBS will continue to benefit from the high net interest margins for the coming quarters, allowing it to maintain its FY23 net interest income levels.

- New sustainability initiative. On 3 April, DBS Bank and Enterprise Singapore launched a programme to support local companies in becoming more sustainable. The initiative offers training, guidance, and financing options to SMEs and mid-cap companies, with around 100 expected to join the first cohort. Companies will receive support from sustainability specialists and can choose basic or intermediate training levels. By the end of the programme, participating firms should have a clear sustainability action plan. Enterprise Singapore will finance 70% of eligible activities per company until March 2026. The initiative aims to help businesses future-proof themselves, cut costs, and meet growing demand for sustainability.

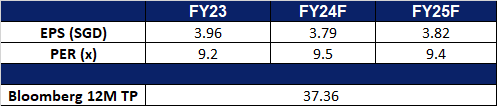

- FY23 results review. FY23 revenue rose by 22.2% YoY to S$20.1bn, compared to S$16.5bn in FY22. Net profit increased 25.5% YoY to S$10.3bn, compared to S$8.19bn in FY22. Basic EPS rose to S$3.87 in FY23 compared to S$3.15 in FY22. FY23 total dividend amounted to S$1.92 per share.

- Market Consensus

(Source: Bloomberg)

Dongfang Electric Corp. Ltd. (1072 HK): Riding the transition to renewables

- BUY Entry – 9.70 Target – 10.90 Stop Loss – 9.10

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. The Company distributes its products within the domestic market and to overseas market.

- Expectations of higher electricity demand. China is projected to experience accelerated growth in electricity demand this year, with an anticipated increase of 8.3%, according to the National Energy Administration (NEA). The NEA forecasts power consumption to reach 9.96 trillion kilowatt hours in 2024, compared to a growth rate of 6.7% in 2023. Notably, in the first two months of the year, power consumption surged by 11% year-on-year, driven by robust growth in industrial power generation. Furthermore, the NEA expects wind and solar energy to contribute at least 17% of China’s electricity in 2024, up from 12% in 2023, following significant expansion in renewable capacity the previous year.

- Renewable energy collaboration. The 2024 Hungary Renewable Energy Business Investment Summit, which convened industry leaders from Hungary and China, highlights promising prospects for collaboration in renewable energy initiatives. In 2023, Hungary attracted a record-breaking 13 billion euros (approximately 14.1 billion U.S. dollars) in foreign direct investment, with Chinese investors contributing 7.6 billion euros. Recognizing the significance of strong partnerships with China in advancing their energy and climate objectives, Hungary stands to gain substantial benefits. This alliance is poised to particularly benefit power generation equipment manufacturers like Dongfang Electric.

- Completion of hydro-floating solar hybrid power plant. Dongfang Electric has recently announced the commencement of commercial operations at the Ubolratana Dam hydro-floating solar hybrid power plant. Collaboratively constructed with Thai counterparts, this project signifies a significant step towards advancing Thailand’s clean energy agenda. Combining floating solar panels, clean hydropower, cutting-edge energy storage systems, and intelligent energy management solutions, the power plant epitomizes innovation in renewable energy infrastructure. Moreover, it represents a notable milestone in Chinese corporate investment within the region.

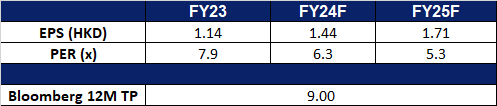

- FY23 earnings. Operating revenue rose by 9.60% YoY to RMB60.7bn in FY23, compared to RMB55.4bn in FY22. Net profit increased 24.2% YoY to RMB3.55bn in FY23, compared to RMB2.86bn in FY22. Basic EPS rose to RMB1.14 in FY23, compared to RMB0.92 in FY22.

- Market Consensus.

(Source: Bloomberg)

Yankuang Energy Group Co. Ltd. (1171 HK): Demand for coal surging

- RE-ITERATE BUY Entry – 17.50 Target – 19.30 Stop Loss – 16.60

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- Power demand is driving record-high thermal coal imports. In March, China significantly increased its imports of seaborne thermal coal to levels not seen in three months, capitalizing on lower international prices to meet surging domestic power needs. With power consumption soaring by 11% in January and February compared to the same period in 2023, and power generation growing by 6.9% in 2023—outpacing the overall economic growth of 5.2%—the demand for thermal coal surged. As the world’s largest coal producer and importer, China witnessed arrivals of seaborne thermal coal reaching 29.7mn metric tons in March, marking a notable increase from 23.03mn tons in February and surpassing the 28.62mn tons recorded in March 2023.

- Increased coal-fired power capacity. Despite its pledge to “strictly control” the use of coal, China spearheaded a worldwide surge in new coal-fired power plants last year, surpassing levels not seen in nearly a decade. According to the annual survey from Global Energy Monitor (GEM), China alone contributed two-thirds of the newly added coal-fired power capacity, installing 47.4 gigawatts (GW) out of the global total of 69.5GW. Furthermore, China initiated the construction of an additional 70.2GW of coal-power capacity in 2023, accounting for 95% of global construction starts and marking the country’s swiftest pace of groundbreaking since 2015. This uptick in coal-fired power capacity is expected to sustain heightened demand for coal in the foreseeable future.

- China reinstates coal tariffs. At the start of 2024, China has reinstated tariffs on coal imports. The reinstated tariffs include a 6% levy on coal for electricity and heating and a 3% tariff on coking coal used in steelmaking. Russia, South Africa, Mongolia, and the United States will be impacted by these tariffs, while Indonesia and Australia remain exempt due to free trade agreements with China. The implementation of these tariffs is likely to drive up domestic coal production and demand as there is less competition from foreign coal companies. This allows domestic producers like Yankuang Energy to extend their competitive edge in the Chinese market.

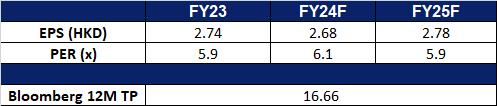

- FY23 earnings. Revenue fell by 23.4% YoY to RMB118.4bn in FY23, compared to RMB154.6bn in FY22. Net profit fell 41.3% YoY to RMB23.0bn in FY23, compared to RMB39.1bn in FY22. Basic EPS fell to RMB2.39 in FY23, compared to RMB4.10 in FY22.

- Market Consensus.

(Source: Bloomberg)

Costco Wholesale Corp (COST US): Boosting shareholder value

- BUY Entry – 727 Target – 787 Stop Loss – 697

- Costco Wholesale Corporation is a membership warehouse club The Company sells all kinds of food, automotive supplies, toys, hardware, sporting goods, jewelry, electronics, apparel, health, and beauty aids, as well as other goods. Costco Wholesale serves customers worldwide.

- Increase in sales and dividends. Costco Wholesale reported a 9.4% YoY increase in March net sales to US$23.48bn compared to the same period last year, attributing part of the growth to the Easter holiday. Year-to-date sales as of 7 April rose by 6.4% YoY to US$146.64bn. Additionally, Costco announced a nearly 14% increase in its quarterly dividend, raising it to US$1.16 per share from US$1.02.

- Limited access to food courts. Starting on 8 April, Costco will no longer allow non-members to dine at its food courts, including famous items like the US$1.50 hot dog. This decision comes as a response to increased crowding at outdoor locations, leading to member complaints. Non-members will need to purchase a membership, priced at US$60 annually, to continue enjoying Costco’s food court offerings like chicken bakes, pizza, and frozen yogurt. Costco generates a significant portion of its revenue from its members, with its FY23 annual report revealing that it made US$4.6 bn in revenue from its 128mn paying cardholders. This new restriction may lead to a rise in its members and in turn its top lines in FY24.

- Gold sales. Costco’s sales of gold bars, introduced last August, have become highly lucrative, with analysts estimating monthly revenue between US$100mn to US$200mn. The popularity of gold sales is attributed to competitive pricing and high customer trust. Despite the surge in revenue, the profit margin for Costco is limited due to low premiums and additional cash back benefits for members. However, gold remains an attractive investment amid inflation and geopolitical uncertainty, with central banks increasing purchases as a hedge against negative financial outcomes. This attractiveness of gold is expected to continue to attract Costco shoppers, contributing to the increase in its revenue.

- 2Q24 earnings review. Revenue was US$58.44bn, rising 5.7% YoY, missing expectations by US$690mn. Non-GAAP earnings per share were US$3.71, beating expectations by US$0.07.

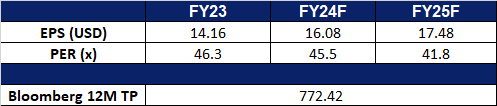

- Market consensus.

(Source: Bloomberg)

Encore Wire Corp (WIRE US): Continued growth of electrical demand

- RE-ITERATE BUY Entry – 252 Target – 272 Stop Loss – 242

- Encore Wire is a low-cost manufacturer of building copper wire and cable, producing NM-B cable (a sheathed cable used for wiring homes, apartments, and manufactured homes) and UF-B. Its stock units include THWN-2 cable, insulated feeders, circuits and branch wiring for commercial and industrial buildings, and other wires including SEU, SER, PV, URD, tray cable, metal clad and armoured cable. The company’s primary customers are electrical wholesale distributors who sell its products to electrical contractors.

- North America faces power shortages. According to a March report by the North American Electric Reliability Corporation (NERC), 300mn people in the United States and Canada will face power shortages in 2024. Current electricity demand is greater than at any time in the past 5 years. The North American economy is continuing to grow, and electricity demand is also growing. Driven by the wave of artificial intelligence, data centres will be built in large numbers in the next few years, so power consumption will expand rapidly. The popularity of new energy vehicles is also driving up electricity demand. The report warns that extreme weather events, such as heat waves and droughts, could further exacerbate power shortages. These events can damage power infrastructure and make it more difficult to generate electricity.

- 4Q23 earnings review. Revenue was US$634mn, falling 8.7% YoY, beating expectations by US$32.3mn. GAAP earnings per share were US$4.10, beating expectations by US$0.08. As of December 23, the company had no debt and US$560mn in cash and cash equivalents, representing approximately 14.3% of its market capitalisation.

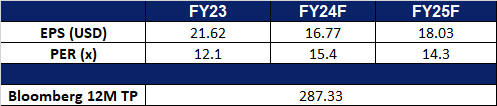

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Bumitama Agri Ltd. (BAL SP) at S$0.785 and Xiaomi Corp (1810 HK) at HK$16.7. Cut loss on Goldman Sachs Group Inc (GS US) at US$390.